A deep dive into PayPal Holdings – Still a value opportunity or doomed to fail?

A PayPal deep dive

(This is probably one of my most extensive posts published here on Substack so far (Sorry!), so bear with me – it is worth it!)

PayPal PYPL 0.00%↑ is undoubtedly one of the most exciting stocks on Wall Street today. The digital payment processor was one of the most pronounced pandemic darlings on Wall Street, which led to shares putting down all-time highs in mid-2021 at ridiculous valuation multiples, which in no way were sustainable, as was the growth PayPal was experiencing at the time, in contrast to Wall Street’s believes. That didn’t end well.

However, I am not here to reflect on PayPal’s history—as making comments in hindsight is easy and completely useless—but rather to focus on where the company is today and what is ahead of it. PayPal shares have been pretty much flat over the last twelve months and YTD, right around the $60-65 mark, a whopping 80% below its all-time highs in 2021.

Notably, while PayPal remains one of the leaders in digital payment processing - which is a very profitable and lucrative market - a free cash flow (FCF) machine and is expected to grow solidly over the next few years as a result, shares trade at quite attractive valuation levels, as investors seem to have now turned overly skeptical in recent quarters.

Though, this seems to be at least partly justified as PayPal’s moat appears to be breaking down with the company’s pricing power (take rate) declining, and it losing grip of its market position in the face of growing competition. It certainly isn’t the strongest it has ever been, and serious doubts exist about its future.

So, what can we expect from this industry leader, with its new CEO and strategy shift, going forward? Is PayPal today indeed a value opportunity, as its valuation makes it seem, or is its situation only going to get worse?

Let’s find out by taking a closer look at… well, everything!

PayPal is still a clear industry leader

Let’s start with the basics for those unfamiliar with PayPal. With its $67 billion market cap and significant $1.5 trillion in annual payment volume running through its platform, PayPal Holdings is one of the leading and most recognized players in the digital payment industry, providing a seamless and secure way for individuals and businesses to conduct transactions online in various ways.

The company's operations revolve around enabling digital and mobile payments for consumers and merchants. PayPal provides a robust platform that supports various transactions, including peer-to-peer payments, online shopping, and business transactions. Its flagship product, the PayPal digital wallet, allows users to securely store and use their financial information for transactions with over 400 million active accounts worldwide.

Zooming in on its operations, the company's market focus is diverse and encompasses several key areas. In the consumer segment, PayPal aims to make online and mobile payments as simple and convenient as possible, enabling users to pay and get paid effortlessly across different platforms. This includes services like PayPal Credit, which provides a line of credit for purchases, and Venmo, a mobile payment service popular among younger demographics for its social payment capabilities.

One of PayPal's main selling points has always been a high level of transaction security, both in terms of privacy and fraud protection. For example, when you use PayPal for online checkout, your payment data is hidden and protected, increasing security. In addition, the company leverages machine learning, big data, and advanced analytics to enhance user experience, detect fraud, and ensure the safety of transactions.

PayPal’s risk management infrastructure is among the most sophisticated in the financial technology sector. It focuses on preventing fraud and maintaining trust among its users. In fact, 60% of consumers indicate they trust PayPal more than their bank for storing payment credentials, which gives it an important edge.

For businesses, PayPal offers a range of solutions designed to streamline operations and enhance sales. This includes the PayPal Commerce Platform, which supports payments in over 100 currencies and is tailored to meet the needs of merchants of all sizes, from small businesses to large enterprises. PayPal also offers payment processing services that integrate with various e-commerce platforms, providing businesses with the tools they need to manage and grow their online sales efficiently.

The company’s early presence in digital payment processing has allowed it to gain significant market share in the industry, eventually becoming the go-to for safe digital transactions worldwide. As of the most recent quarter, PayPal’s payment products are used by 426 million users and 36 million merchants across 165 countries. Yes, PayPal truly is a giant in the industry.

Due to its large user base and impressive acceptance by merchants worldwide, the company has been able to capture a 45% market share in the online payment processing industry as of February, which is still far ahead of any competitors, even as competition has been heating up over the last decade. Contrary to some beliefs, it is still the preferred digital payment provider for online, mobile, and peer-to-peer payments.

The payment processing market is still a very compelling one

Everything so far sounds pretty damn good for PayPal. It is leading the industry with a significant 426 million users globally and a significant market share far ahead of its closest peer, Stripe. This significant market leadership and user base also make it a significant beneficiary of growth in the underlying industry, and this is also very much looking great.

In fact, the payment industry is one of my absolute favorites. The idea here is really simple: globally, consumers are increasingly adopting digital payment methods, replacing cash, due to growing smartphone penetration and internet adoption and availability. This leads to solid growth in the digital payment processing industry on top of the overall annual growth in total payment volume thanks to inflation and GDP growth.

No wonder Visa and Mastercard, the world’s largest digital payment processors, have compounded earnings by stellar double digits.

As of today, only 16% of payments are cash, with digital rapidly replacing it as a payment method. Now, it might seem like there isn’t much room left to grow, but one should note that this is still many billions, if not trillions of dollars in payment volume, and still, 67% of Americans use cash every month.

There is definitely still a lot of room to run here. According to Grand View Research, these dynamics should allow this industry, which PayPal leads, to grow at a CAGR of 14.5% through 2030.

In addition, the rapid adoption of digital wallets is a particularly interesting area to watch within this industry, especially when looking into PayPal. You see, the adoption of digital wallets is still rather low, with only 53% of Forbes survey participants indicating they used digital wallets more often than traditional payment methods, such as paying with cash or swiping a physical debit or credit card.

Meanwhile, Forrester’s most recent data shows that only 69% of U.S. adults used digital wallets, leaving this industry with a large runway of growth and leading players like PayPal with a large number of potential users to win over. Bank of America expects digital wallets to see more than 5.3 billion users by 2026, or more than half of the population, due to rapidly growing adoption, mainly due to growing digitalization and smartphone penetration.

This is also helped by growing merchant adoption. Today, only 57% of small businesses accept digital wallet payments, compared to 94% for credit and debit cards.

This is why Research and Markets expects this particular market to grow at a CAGR of 27% through 2028, which is very significant. I hope this explains my enthusiasm for this industry!

Remarkably and significantly, PayPal is still very much a leader here, even as it has been losing market share. Among consumers using digital wallets, PayPal is still the most used option with 40% and even 62% including Venmo, followed by Apple at 28%, and Cash App at 19%.

This makes PayPal, in a basic scenario, one of the largest beneficiaries of the growth potential discussed. Clearly, PayPal doesn’t lack a growth runway or any growth potential, as long as it manages to protect its market share and manages to fight off the competition.

Sadly, this is where it has been lacking, as its market share and moat are eroding. It is time to discuss some of the negatives, issues, and justified worries.

Despite its leading position, PayPal is struggling

PayPal has struggled in recent years to maintain its leading position, losing market share to new and upcoming competitors like Stripe, Apple, and Adyen, each attacking certain parts of PayPal’s market. As a result, the company has been bleeding users, losing market share and its grip on the crucial e-commerce checkout market.

Simply put, PayPal is seemingly losing its edge.

Most notably, while PayPal remains the industry leader by some margin, it has seen its market share trend down in recent years in the face of significant competition, especially in e-commerce checkout and P2P transactions.

Now, this might come as somewhat of a surprise, as PayPal has quite a solid moat at first glance. You see, PayPal is the largest in an industry where size matters, giving it significant competitive advantages.

Most notably, PayPal is one of the most broadly accepted digital wallets globally, with 36 million merchants, which also makes it a top choice for consumers, leading to more users joining the platform, which then again makes it more attractive for merchants to accept PayPal payments. It is a virtuous cycle that should protect its moat, at least up to a point.

In addition, PayPal is an established brand that has garnered consumer trust over the last two decades with its top-notch security and privacy policy. This is worth quite something in the payment industry.

Yet PayPal is failing to hold onto its market share and protect its moat as competition grows. It struggles to set itself apart from the often more convenient platforms of the competition, including Apple, Stripe, and Cash App.

PayPal's biggest issue is probably the rapid adoption and expansion of Apple Pay, which has more than doubled its adoption rate over the last three years while PayPal has been stagnant. Apple is rapidly gaining share, especially in e-commerce checkout, which has been one of PayPal’s strongest selling points.

And honestly, I am not surprised. Apple Pay is by far the most convenient checkout method for those using Apple devices, and it is seeing stellar merchant adoption thanks to the incredible Apple user base. Merchants simply don’t have a choice.

Really, this is a worrying trend for PayPal as apparently its moat isn’t strong enough to fight Apple and Stripe. Data from investment firm Mizuho indicates that PayPal has been losing significant market share against Apple and is struggling to compete.

This also expands beyond just e-commerce checkout. While, as pointed out before, PayPal is still the most used digital payment form, it has already been overtaken among more active consumers. As pointed out here, Apple Pay is the most popular among consumers who pay for a purchase using a wallet at least five times a month, which isn’t a great indication for the future of PayPal.

Another serious issue for PayPal is the fact that it is losing traction among younger generations. A recent survey highlighted that Apple Pay is by far the most popular among younger consumers, while the older generations tend to go with PayPal, which is telling.

In 2013, PayPal acquired Venmo, a popular P2P payment service among new generations. However, growth has been lackluster in recent years, and PayPal has failed to connect the service to its leading PayPal platform properly. The company has completely failed to fully monetize Venmo and is now losing market share to Zelle and other competitors. This will not help the company improve its position among new generations, and with these supposed to drive the next wave of growth, especially in digital wallets, I am concerned about PayPal’s positioning.

Considering all of this, it shouldn’t come as a surprise that PayPal has seen its active user numbers trend down for several quarters. This has been one of the leading reasons for the company's poor share price performance in recent quarters.

After significantly growing user numbers in 2020 and 2021, growth has come down considerably since, turning negative in the last four quarters, with total active users declining from a peak of 433 million to 426 million as of the most recent quarter. While these are no incredible declines, this number declining at all for a company like PayPal with all the underlying trends discussed before sure doesn’t look great. If PayPal can’t revitalize this growth, it will have trouble growing its payment volume and, therefore, revenues. So yes, these concerns from Wall Street are valid, considering the data.

However, it isn’t as bad as it looks. You see, during the COVID-19 pandemic, many consumers were forced to buy things online, which led to significant growth in PayPal users. However, as this normalized, many of these occasional buyers went to physical stores again, making their PayPal account unnecessary. Positively, these losses aren’t too bad as these aren’t the type of consumers that drive growth.

The graph below perfectly highlights this. While user growth definitely hasn’t been great after the pandemic and PayPal is struggling here, monthly active users, which I see as the real PayPal users, have kept growing throughout these last four quarters. While I am not saying concerns here are overblown, it also isn’t as bad as it looks – but it's still far from great, and PayPal is struggling to attract users, unlike its competitors.

Over the last two years, with lackluster user growth, PayPal has been working hard to offset this by increasing the number of transactions from its active accounts. This has been working rather well, with this number continuously growing by double digits as PayPal improves the user experience. This has helped it maintain acceptable TPV growth, as shown below.

However, this isn’t a viable long-term growth strategy, especially if most of these users consist of older generations, as we pointed out before. Also, the majority of this growth was driven by Braintree (roughly half) and Venmo, which comes with the additional downside of lower take rates, which is another concern.

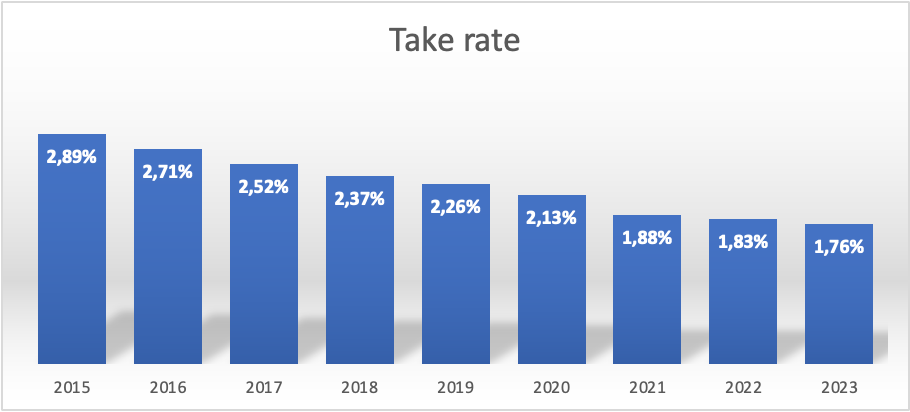

Shockingly, PayPal's take rate has declined every year since it was spun off by eBay in 2015. This is due to a number of reasons, including a higher dependence on lower margin transactions from Braintree and Venmo and a gradual loss of higher take rate eBay transactions (which have moved to Adyen).

Meanwhile, PayPal has also been reliant on its branded payments business with higher volume merchants, which is also a lower margin business, and it has seen international transactions with FX benefits decline. Add to this significant competition, which hurts PayPal’s pricing power and stops it from increasing take rates, and you are looking at quite a challenging operating environment and rapidly declining take rates. In this respect, PayPal has been struggling much more than its peers.

Overall, PayPal’s prospects aren’t great. Its underlying business trends are poor, and it is losing market share across all business areas to growing peers. Based on this, the current depressed earnings multiple seems justified, and I can’t see much value here, at least not until these underlying trends improve, of which I am not convinced it will ever happen.

Management is doing everything it can, but is it enough?

In order to resolve and offset many of these issues and headwinds, PayPal appointed a new, carefully picked-out CEO and started a multiyear efficiency journey in 2023, including layoffs and restructuring efforts.

However, so far, the company and the new CEO have mostly been unable to impress Wall Street. Announced innovations so far were seen as falling short or being hyped up while barely offering any differentiation from other platforms. In this fast-moving industry, seemingly innovative new features are expected to be adopted by peers by the end of 2024 already.

The company still fails to differentiate itself and is unable to gain enthusiasm. Also, PayPal has indicated that seeing the results of these innovations will take time, which is something it doesn’t really have a lot of.

Nevertheless, let’s examine some of these innovations, as there are some that I quite like. Let’s start by briefly introducing the new CEO. Alex Chriss was appointed PayPal CEO in 2023 after being very successful at Intuit as the Executive Vice President and General Manager of the company’s Small Business and Self-Employed Group.

I must say I was quite pleased with this announcement, as Chriss seems like a good match for the position. During his time at Intuit, he drove significant growth in the small business segment, increasing customers and revenues at impressive rates. Within PayPal, he will aim to do the same and improve relations with small and medium-sized businesses, with which he has a lot of experience.

So far at PayPal, Chriss’ statements have led to mixed reactions. Little value was provided in the first earnings calls, but he appeared more confident in the latest call. He is committed to focusing on growth and profitability, with clear priorities focusing on streamlining operations, optimizing costs, and aligning investments with growth initiatives. Eventually, he aims to make PayPal leaner and more efficient. It will be crucial to follow his commentary closely, but so far, I view Chriss as a big positive within PayPal.

Shifting our focus to announced innovations, features, and cost management efforts, Chriss and PayPal have focused on seeking profitable growth by developing better features for small and mid-sized business customers and introducing a range of features that should improve the user experience for consumers.

First, PayPal introduced “Complete Payments” for small and medium-sized businesses. This solution enables businesses to accept various payment forms, including PayPal, BNPL, Apple Pay, Google Pay, and credit and debit cards. It also includes advanced fraud and seller protection. Obviously, this will make it much easier and more convenient for small businesses to offer a range of payment solutions, which sounds great!

I am a big fan of this solution. As pointed out by PayPal, data shows that consumers are 43% more likely to complete checkout rather than abandon their cart if the retailer offers their preferred payment method. Through this offering from PayPal, this becomes very accessible for smaller businesses, which is great.

I firmly believe this will give it a stronger foothold in this business segment. Chriss is the perfect candidate to complete this vision thanks to his many years of experience offering solutions to these kinds of businesses.

Furthermore, if PayPal can win over solid numbers of small and medium-sized businesses with this solution and payment platform, it could very well boost its payment volume and the acceptance rate of its own PayPal and Venmo payment services, which increases the attractiveness of the platforms.

As for the PayPal Complete Payments platform or PPCP, as of Q1, it has rolled out to 34 countries and has seen a very positive response. As of the end of the first quarter, 7% of PayPal’s SMB volume is already running through PPCP.

While the real success of this effort is still unclear, I do like the shifting focus and platform offering and the progress PayPal is making so far. It sure isn’t messing around.

Meanwhile, on the consumer end, PayPal has also been introducing a range of technological developments that should improve its payment platforms. This includes the following:

An upgraded checkout experience using AI to remove friction by working around password prompts. This should increase convenience.

PayPal introduced CashPass, a reward program. The feature will give users access to hundreds of cash-back merchant offers personalized using AI. PayPal already has large partners on board, such as eBay, Ticketmaster, Walmart, and Uber, which is excellent. The feature should improve the platform's attractiveness.

In addition to these, PayPal introduced a number of other AI-powered features with a similar goal, but one other I want to highlight in more detail is Fastlane, which I find fascinating.

PayPal recognizes that many merchants lose out on sales because of an annoying and time-consuming guest checkout process—I am sure many of you recognize this. PayPal designed Fastlane to mitigate this problem. Fastlane is a one-click checkout experience that merchants can offer, removing the need for a username or password when entering personal information.

Simply put, customers can save their information in Fastlane and can easily checkout with a merchant offering PayPal with a single click, without sharing credit card information with the merchant.

Personally, I feel like this offers significant convenience if adopted widely, both for the consumer and merchant. Again, I am a big fan of this feature, and if PayPal rolls it out well and gets merchants on board, it will once more improve and differentiate the PayPal offering.

As of Q1, PayPal has seen solid progress in the early testing. Data shows that returning Fastlane users are converting at nearly 80%. This is giving PayPal confidence that it can create a double-digit increase in guest checkout conversion for participating merchants, which is incredibly promising. As a result, PayPal is seeing solid demand for the product and expects to roll it out in the U.S. in the second half of the year. So far, I am positive.

Looking at this, I don’t agree with Wall Street’s skepticism and “disappointment” as I am pretty pleased with these developments. I think PayPal is focusing on the right areas to differentiate itself.

For reference, Forbes indicates that “when asked to identify the primary reason for using a digital wallet to make purchases, respondents cited convenience (41%), followed by the availability of rewards and loyalty programs (22%).” Damn, PayPal took that survey seriously. They are acting on all the right areas, which gives me confidence in its future.

Of course, whether these efforts are going to pay off will depend on execution and competition. That is probably the biggest risk to my optimism here, but if PayPal executes this will, it could at least help it fight off the competition, slowing the pace of market share losses.

Finally, it is worth pointing out that PayPal could benefit from Apple’s recent compliance with EU law, which requires it to open its iPhone’s tap-to-pay functionality to competitors, including PayPal, in the European Union. This should allow PayPal to offer tap-to-pay applications on iPhones in certain markets, removing a significant headwind and advantage for Apple.

On that note, let’s examine the company's most recent financials to understand its financial position and recent performance before proceeding to the financial projections and valuation.

PayPal’s most recent Q1 results show a solid performance

PayPal released its latest earnings report on April 30 and delivered quite solid results that beat the consensus on both the top and bottom lines, coming in stronger than management expected at the start of the year. 2024 was always going to be a transition year for PayPal as it positions itself for a new period of sustainable and profitable growth, but Q1 actually looked pretty solid.

PayPal reported revenue of $7.7 billion, up 9% YoY and beating the consensus by $180 million. Revenue growth has been stable in recent quarters in the high single-digits as consumer spending remains relatively resilient and PayPal is able to offset stagnant user growth with growing transactions per user.

TPV came in at $404 billion, up 14% YoY and roughly in line with the growth we saw in prior quarters. This growth was driven by transactions per active account growing by 13% YoY and some slight ticket growth. This was able to offset a slight decline in active users, though this number did grow by 2 million sequentially, which is a first positive sign of stabilization for PayPal.

In terms of regions, the U.S. TPV grew by a very solid 12%, which was better than expected, and international TPV grew by 17% thanks to a stronger performance in Europe and Asia.

Branded checkout growth accelerated to 7%, up from 5% in Q4. For reference, you often hear me mention branded and unbranded checkout. Branded checkout refers to checkout pages where you see the PayPal brand, logo, and button, whereas unbranded checkout all happens behind the scenes. Large enterprises more often use this method, while unbranded is mostly used by small—to medium-sized businesses.

PSP processing, which is PayPal’s unbranded checkout, saw solid growth in Q1, growing volume by 26% YoY, driven by momentum in Braintree, which is a full-stack payment platform that provides businesses with the tools they need to accept, process, and split payments in their mobile apps or online storefronts.

Overall, PayPal's top-line performance was very solid, and investors should be pleased with the results. While user growth remains disappointing, it is slowly stabilizing, which is a big positive. Meanwhile, PayPal continues to grow volumes strongly, fueled by growth in transactions made by existing users.

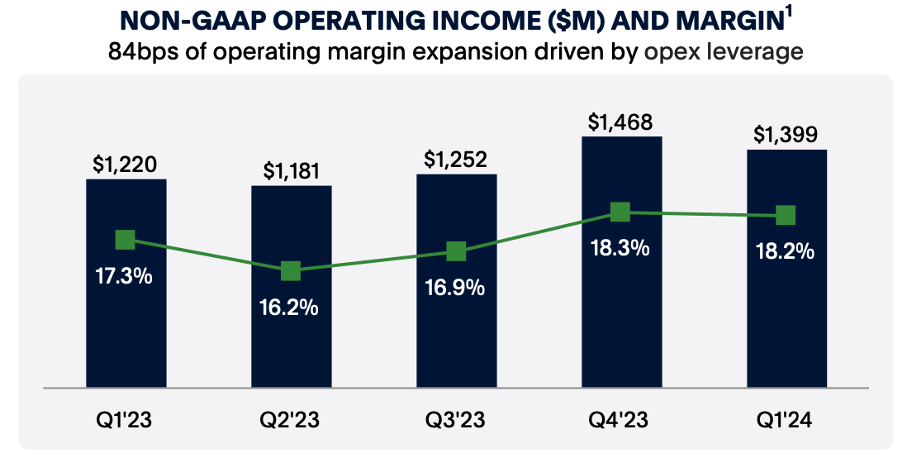

This solid top-line performance also helped the company deliver on the bottom line, with operating income growing by 15% to $1.4 billion, driven by an 84 bps of margin expansion to 18.2%.

PayPal’s operating margin has fluctuated slightly in recent years due to a shifting operating environment. However, as normalization kicks in in the coming years and management shifts its focus back to profitability, I expect PayPal to slowly expand its operating margin again in the coming years back to its recently adjusted highs. This seems very much possible.

However, it is worth pointing out here that PayPal has changed its reporting method as of Q1, now including SBC expenses in the non-GAAP results. I find this incredibly positive, as it indicates management is not looking to hide expenses but wants to be transparent. Though, it also creates some tough comparisons to past years.

Meanwhile, in Q1, the improvement in the operating margin also translated into solid EPS growth, with this up 27% YoY to $1.08 or up 20% under the old reporting method excluding SBC. This solidly beat the consensus as PayPal has been well able to improve operating leverage through ongoing expense discipline, the timing of certain investments, and solid interest income.

Finally, this improved leverage also translated into a solid FCF of $1.8 billion in Q1, which fully covered $1.5 billion worth of share repurchases. PayPal is a real FCF machine, consistently reporting an annual FCF of between $4 billion and $5.5 billion over the last five years.

This has allowed PayPal to remain in excellent financial health. Its stellar balance sheet holds $17.7 billion in cash, cash equivalents, and investments against just $11 billion in debt, leaving it in a very solid financial position with plenty of cash to invest in the business.

Across the board, PayPal just delivered very solid financial results containing few surprises. The business is performing well financially, and while there is no denying that it is showing some weakness here and there, it is also performing far from bad. There really isn’t that much to complain about financially.

That then brings us to the outlook.

Outlook & Valuation

Starting with management’s short-term guidance, it now guides for Q2 revenue growth of roughly 6.5% to around $7.8 billion. Management expects several tailwinds it saw in Q1 to disappear as the year progresses, including the YoY benefit from interest on customer balances and lower YoY improvement on transaction and loan loss performance.

Still, EPS is expected to grow by low double digits.

For the full year, management has turned slightly more positive thanks to the Q1 outperformance. It now expects to report EPS growth of mid to high single digits on an adjusted basis, helped by the inclusion of SBC in these numbers, which is a three percentage points tailwind. This is up from a previous expectation for flat growth.

Also, management continues to expect $5 billion in FCF for FY24 and to spend at least this amount on buybacks to make good use of its significant cash position. This means PayPal aims to lower its share count by roughly 7.5% this year, which is tremendous.

While this so far is all pretty clear and realistic, in terms of medium and long-term growth, a lot is uncertain with PayPal fully in the process of a fundamental transition under its new CEO in an effort to distinguish itself and fight off the competition.

Crucially, Chriss’ and the management team’s efforts so far have given me some confidence that they will be able to steer this business in the right direction and remain a go-to platform for both consumers and businesses in the financial sector, something I didn’t expect to say halfway through my research.

Suppose PayPal can maintain at least most of its market share and strengthen its foothold in certain business areas, such as small and medium-sized businesses. In that case, it should be a significant beneficiary of the projected growth in the underlying digital payment processing industry, which is very much looking bullish!

Based on my current, slightly conservative (as I want to leave some margin of safety here) expectations and projections, I expect PayPal to report medium-term top-line growth at a CAGR of high single to low double digits, depending on its execution success and timeline. It surely has potential.

Still, it might take some time to all fully materialize, which is somewhat of an uncertainty and makes me more conservative in my estimates. Also, within these estimates, I assume a normal operating environment with some economic weakness in the remainder of 2024 and into 2025.

Meanwhile, through continued margin expansion efforts, EPS should outgrow revenue, though I am not expecting too much margin expansion as significant investment will be required in the coming years. Therefore, I am projecting EPS growth at a low-teens CAGR.

Based on these projections, PayPal shares now trade at just below 15x this year’s earnings, which is in no way expensive for an industry leader and a company expected to keep growing earnings and revenue quite strongly in the medium term. This translates into a PEG of 1.25x, which is roughly in line with the far slower-growing financial services industry.

Without a doubt, PayPal is trading at a discounted multiple, which is justified up to a point due to the severe headwinds and struggles it has been dealing with in recent years. However, it seems like all the negativity is fully priced in, as are conservative growth estimates, which makes me believe that there is quite a bit of room for upside surprises.

Based on PayPal’s fundamentals, growth potential, and leading position, as well as the room for upside thanks to management’s recent efforts and my confidence in Alex Chriss, I believe it still deserves to trade at a higher multiple of closer to 18x, even as it is still struggling with competition.

It seems that Wall Street and the investor community don’t appreciate management’s recent efforts and the potential for them to be at least somewhat successful. While PayPal is facing significant headwinds, there are also plenty of positives.

Based on an 18x multiple and my FY26 EPS, I calculate a three-year target price of $92, which reflects potential returns exceeding 15% annually, which should easily beat most benchmarks.

While PayPal is most definitely not the lowest-risk investment out there, with plenty of execution risks, I believe the current risk-reward ratio is skewed in favor of the positive, which makes PayPal an attractive long-term investment.

Some large capital managers seem to feel the same way. The most recent quarterly data shows that Billionaire investor Philippe Laffont's Coatue Management significantly grew its PayPal position in Q1, as did Tudor Investment Corp., the hedge fund founded by billionaire investor Paul Tudor Jones, which took a brand new stake in PayPal of 888k shares.

However, on a slightly negative note, insider transaction activity has been disappointing, with net activity negative over the last three and twelve months.

All things considered, I put a Buy rating on the shares and have added the company to my portfolio at a cost basis of $62.

Let us know your thoughts in the comments! Also, please leave a like if this post was of value to you!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

Nice write up. Your thoughts are similar to mine. A few points - I think the focus on account growth or decline is a bit overblown - PayPal has over 430 million active accounts. That’s a huge number. To put it into perspective, that’s equal to every adult in the United States, Canada, Germany, the UK, and Australia. To expect a lot of growth from this point isn't realistic in my view. Transaction growth is the more important metric.

I also think that while PayPal's moat with consumers is getting a bit weaker, the moat with merchants is getting significnatly stronger. Between PayPal's excellent fraud protection, ability to offer buy now pay later, innovations like complete payments and fastlane, they're the only payment provider that can go to a business and say "use us for your payments and you'll make more money." They have plenty of data to back up that kind of claim.

A Neilsen survey showed

- 28% higher conversion with PayPal checkout

- a 19% increase in unplanned purchases

- a 13% increase in repeat purchases

- and an 8 point gain in NPS

With that kind of advantage, PayPal should be able to raise margins on Braintree. Chriss has said he plans to do just that. There are still execution risks of course, but I think the sentiment around PayPal is way too negative.

Their Advertising idea is a good one.