adidas AG – A turnaround in the making (A Deep Dive)

A Deep Dive in this German apparel and footwear leader!

It has been a while since I wrote a real business deep dive here on Substack, but after adidas popped up on my radar recently, I felt forced to take a close look at this apparel leader, which has taken a fall from grace post-COVID.

We can safely say that, coming out of the COVID-19 pandemic -although it had it coming after quite a few years of mismanagement in the years prior – the company has been going through the most challenging period in its 75-year history. It reported its first operating loss in over 30 years, lost market share across the board, and failed to revitalize its brand image, particularly among younger generations.

In response, adidas shares had dropped 69% in value from an August 2021 high of €319 per share to a low of just €99 a little over a year later, in October 2022. Even today, after shares have bounced back quite strongly, doubling in value again, these still trade 33% below their all-time high, translating into a negative 16% return over the last five years.

(Check out StocksGuide, my preferred analysis tool for graphs and data, using this link)

Luckily, the company has been slowly turning things around in recent quarters, showing improving operations across the board and rapidly improving financials as a result, in part thanks to a new CEO, who has been working hard on solving issues and getting this business to fire on all cylinders once more.

Meanwhile, adidas remains pretty well positioned in a compelling industry, with a solid market share in the apparel and footwear markets and one of the most recognizable fashion and apparel brands out there, though with a lot of room for improvement and potential market share gains, especially as its most prominent and historically superior peer, Nike, has been lacking as well in recent times.

Overall, the setup here looks pretty favorable, and Adidas looks ripe for a real turnaround in its business, even as it’s not out of the woods yet. With many issues still hanging over this business and competing with Nike and up-and-coming brands like Lululemon not an easy task, this is far from a no-brainer.

Nevertheless, I believe it is at least worth checking out for long-term-oriented investors, including myself. Therefore, in this deep dive, I want to get a better sense of where this company is at today and what its prospects are.

Is it worth your (and my) money today or not? Let’s find out!

Mismanagement, a damaged brand, a lack of innovation, and blow after blow – adidas experienced the worst period in its 75-year history.

I don’t doubt any of you has ever heard of adidas, seen its commercials, or worn its apparel and incredibly popular footwear. Nowadays, this German company remains a leader in the global sportswear and footwear market. The brand's distinctive three-stripe logo is recognized worldwide, symbolizing quality, durability, and sportiness.

Adidas specializes in the design, manufacturing, and marketing of sports footwear, apparel, and accessories. Its product range caters to a wide array of sports, including soccer, running, basketball, and training, as well as lifestyle segments that blend athletic performance with street-style fashion.

Founded in 1949 by Adolf "Adi" Dassler in Herzogenaurach, Germany, Adidas has grown from a small, family-owned business into one of the world’s most iconic sports brands. For reference, Interbrand ranks adidas as the 42nd most valuable brand globally, with a $16 billion brand value, and the #5 in the apparel and fashion industry, only trailing brands such as Nike and Louis Vuitton.

Today, the company operates in over 160 countries and employs over 60,000 people. Adidas continues to drive the future of sports and fashion by staying true to its mission: to be the best sports company in the world.

However, let’s be honest. It hasn’t been anywhere close for quite some time as it has been desperately losing to its close peers, Nike and Lululemon, and even to German competitor Puma and smaller brands like New Balance.

Across all segments, adidas has been losing market share in recent years. In footwear, which is Adidas’ most significant segment, it is nowhere near Nike in terms of size and market share - Nike is over 2x as big in terms of revenue after years of market share losses by adidas.

Today, the company holds a market share in the footwear industry of roughly 10.9%, and while this still leaves it as the second largest globally, this is down a whopping 300 bps since 2019, which is an extremely poor performance.

In apparel, the company hasn’t fared much better. Whereas back in 2011, adidas was the largest apparel brand in market share, capturing 11.2% of the market, ahead of Nike’s 9.9%, this has been trending down ever since, with Nike blowing past and newer brands like Lululemon and Under Armour taking market share as well.

Despite being one of the most recognized brands globally and the industry’s #2, it simply hasn’t been able to compete for years.

This is also clearly visible in the graph below, which shows that in terms of revenue growth, adidas has been trailing its two closest peers, with Nike showing by far the best growth despite its size. However, even Puma has been outgrowing adidas.

What is the reason for Adidas' extremely poor performance across the board? Well, quite a few factors have contributed to Adidas’ poor performance over the last decade, but in my eyes, many of these market share losses can be attributed to years of mismanagement, operational flaws, and, most notably, a lack of innovation and a poor design team.

Granted, the company has faced a toxic mix of headwinds and operational setbacks in recent years, often outside of its own control, but nevertheless, adidas has also been falling short operationally for most of the last 5-10 years, facing competitive pressure from Nike, Puma, and New Balance, among others, and has been struggling to keep up with competitors in terms of product innovation, particularly in performance sportswear and athleisure. Nike has been out-innovating adidas in all areas, including in materials and design, affecting adidas’ appeal to consumers.

As a result, coming out of the covid-19 pandemic, but also in the years prior, adidas has been struggling with maintaining brand relevance, especially among younger generations like Gen Z.

In addition, the company has also struggled to reboot its business after the COVID-19 pandemic, dealing with significant supply chain disruptions, including shipping delays and raw material shortages.

Add to this significant consumer weakness in its most important market, China, and an exit from Russia, which was also one of its larger markets, and you can see how adidas has been struggling, forcing it to cut its outlook multiple times in 2021 and 2022.

However, the most significant blow to Adidas and its shareholders was the Kanye West partnership, which turned into a complete disaster. In 2022, Adidas faced a lot of controversy and losses over its partnership with Kanye West due to his antisemitic statements.

Obviously, that partnership and the production of the Yeezy sneaker was quickly canceled, as Adidas wanted to distance themselves from the famous rapper. Still, it left adidas in a vulnerable position, losing one of its most famous brand ambassadors and best-selling sneakers, hurting its brand image, and the whole drama left it with billions worth of Yeezy stock.

You see, before the incident, the Yeezy brand was by far the biggest growth driver for adidas and a big popularity driver. It accounted for roughly 5% of its annual revenue and more than a quarter of its operating profits.

Obviously, losing this overnight was massive, and with still millions of pairs of Yeezy shoes ordered, adidas was left with billions in inventories, being a massive additional blow to its balance sheet.

All these factors combined to create a challenging environment for adidas post-pandemic, leading to significant underperformance in key markets and financial metrics, even leading to adidas reporting its first operating loss in over 30 years, primarily due to the loss of the Yeezy brand, perfectly accentuating how much this company and beautiful brand have been struggling.

As a result, adidas shares turned out to be an absolutely terrible investment over the last five years, with negative returns and massive sell-offs, and for good reasons. Just looking at the financial numbers already tells you most of the story. Here are a few to consider:

Adidas’ FY23 revenue was down 2% from FY18 levels and down 9% from a 2019 all-time high.

Its FY23 operating profit was down 90% from a 2019, or pre-covid, high.

Net income even turned negative in 2023…

The balance sheet has worsened from a net cash position of €700 million in 2019 to a net debt position of €1 billion by the end of 2023.

In the end, across the board, adidas has seen its financials, fundamentals, and market position weaken considerably as a result of all this, leaving it in a pretty bad spot.

There is light at the end of this very dark tunnel for adidas, thanks to a new CEO

Luckily, not all is negative for adidas. The big positive is that today's adidas brand is still relatively strong and globally recognized. Therefore, while still challenging, a turnaround isn’t hard to realize if executed well. In other words, the foundation is rather strong.

Probably the biggest, and maybe only real positive for adidas shareholders in recent years, has been the CEO change. Kasper Rørsted, adidas CEO from 2016, left the company in 2023 to be replaced by then-acting Puma CEO and previous adidas employee Bjorn Gulden.

Just how happy were shareholders with this news? Shares gained over 30% in the few trading days following the news. It's pretty insane, but understandably so.

If there was one thing adidas needed after years of mismanagement and operational flaws, it was a fresh C-suite, and a new CEO was the most important change to make. And Bjorn Gulden isn’t just any CEO, but the 2019 Fortune Businessperson of the Year has an incredibly successful track record at close German peer Puma.

In his years there, Gulden had turned Puma into one of the fastest-growing sporting goods companies in the world, outgrowing adidas and, at times, Nike. During his tenure at the company, revenue almost tripled, as did the company’s market cap and share price. For reference, in his eight years at the company, revenue grew at a 14% CAGR, and footwear revenue more than tripled.

So, yes, we can safely say Gulden knew what he was doing, and I can see where enthusiasm following his announcement as the new adidas CEO came from. Since Gulden joined the company, adidas shares have outperformed Puma and Nike by quite some margin. How is that for a positive catalyst?

Under Gulden, the culture insight adidas has quickly shifted to a far less bureaucratic place, allowing it to operate better. Gulden has already been making significant changes within the company in a little over a year there, most importantly abandoning the strategy of prioritizing DTC (Direct to Consumer) sales in adidas own physical and digital stores, but instead has started to embrace independent retailers again, similar to his focus at Puma, which proved successful. In fact, Nike recently also once again committed to wholesale partners, proving the DTC strategy isn’t the way to go, at least not entirely.

Of course, the idea behind a DTC focus is evident as it cuts out the middle man, giving adidas greater control over product pricing and showcasing, and it allows it to keep the full profits to itself.

However, there is a big downside to this: it not only limits consumers' access to Adidas products and brand visibility but also forces popular retailers to start promoting smaller brands, increasing competition, something Gulden already argued a couple of years back.

So yes, you report improving margins and profits, but sales growth stagnates, and market share losses follow quickly. Gulden avoided this at Puma and outperformed both Nike and Adidas in recent years.

Therefore, since he arrived at adidas, he has been rebuilding relationships with wholesale partners, focusing on growth over control and margins.

On top of this, he has also been introducing new footwear and apparel lines and has invested significantly in new partnerships with celebrities and top athletes, similar to Nike.

Overall, I believe Gulden is the best thing that could happen to adidas in arguably its most challenging time ever. The new CEO has a brilliant track record and obviously a thorough understanding of the market and its dynamics. He has proven to understand consumer preferences and trends well, which adidas desperately needed.

As a result of his efforts and improving market dynamics, adidas has slowly but surely been starting to improve its performance and financials. Indeed, a turnaround seems to be in the making.

Adidas is navigating headwinds and focusing on the right areas.

Before turning to the financials and recent results, I also want to discuss some of the headwinds discussed before as adidas is finally able to navigate these headwinds and slowly improve its business.

Most notably, one of the first actions by new CEO Gulden was to slowly offload Adidas Yeezy inventory following the break up with Kanye West (or rapper Ye, as I believe I should call him), selling the shoes and donating parts of the proceeds to charities fighting hate speech. This allowed adidas to lower inventories and avoid a big financial hit while doing “the right thing.” As a result, Adidas inventories have been falling by double digits for a few quarters, and the overall financial hit has been limited, at least in the long term.

Meanwhile, Adidas has also made significant efforts to bring its brand forward and improve its product line, particularly toward Gen Z. In order to attack the Gen Z market, adidas has been getting a lot of famous brand ambassadors on board, including Lionel Messi, David Beckham, James Harden, Kylie Jenner, and Jenna Ortega, getting its brand more visible on social media.

In football or soccer, in particular, adidas has been gaining quite a bit of ground, turning out as the real winner of the Euros and Olympics, with its brand on the most popular jerseys, as both the Euro winner (Spain) and Copa América champion (Argentina) are outfitted by the company.

Also, in recent years, adidas added a third label to its product lineup, sportswear, which is a fashion-forward line aimed at Gen Z. With this, adidas attacks the growing market in between daily wear and performance wear. You see, 70% of Gen Z state that comfort is a top priority. Especially coming out of the COVID-19 pandemic, comfortable athletic wear with a more casual look has turned much more popular, which adidas is now trying to benefit from.

While developments like these might seem small or irrelevant to investors, these are the kinds of things Adidas failed to act upon in prior years, but they can result in market share gains. Another example is recent efforts in the basketball market, traditionally dominated by Nike. However, adidas now has the hottest product on the market with the Anthony Edwards signature shoe, which Foot Locker Inc. has highlighted as a top seller. Again, these small developments indicate a shift in focus at adidas.

Finally, as I said before, I am quite optimistic about Adidas’ prospects because of the expected growth in the underlying industry, combined with potential market share gains, which I am anticipating under Gulden.

In fact, recent data already shows adidas is now outperforming peers, including Nike, taking market share. It is rare for Nike to underperform and fail to act on consumer trends, but Nike is struggling today, failing to innovate and offering an opportunity to adidas, which it is taking with both hands.

Contrary to Nike’s woes, adidas’ resilient performance has been strong in product releases and popularity. Especially its new multi-colored Samba and Gazelle sneakers are flying off the shelves, aiding the company’s recovery and outperformance. In fact, Google Trends shows “Adidas Samba” searches surpassing “Nike Air Force 1” searches, which is a rare occasion.

According to Simon Irwin, retail and sporting goods analyst at Tanyard Advisory, “Nike, in terms of product and message, is very much off its game, and Adidas is having a bit of a moment.” As a result, even in the face of competition from smaller competitors, adidas seems to be doing quite well, taking market share, something I think won’t be a standout with adidas turning things around.

As a result, I expect it to be well-positioned to outperform growth in its underlying markets in the coming year. Even though these aren’t the most exciting markets, growing by mid-single digits, I think that for Adidas, this could translate into high-single-digit revenue growth consistently.

Add to this a significant margin recovery as current financial headwinds ease and disappear, and you end up with quite a compelling case.

On that note, let’s turn to the latest financial results and adidas’ financial health, but first….

We try to keep all our analysis free for all of you to enjoy and benefit from! Want to support our work a little bit more and show your appreciation? Consider upgrading to paid ($5 monthly).

This allows us to push out even more content and gets you access to our exceptionally performing portfolio and premium subscriber chat!

Financially, adidas is clearly showing progress

Roughly a month ago, adidas announced its Q2 and first-half results, and they did not disappoint. Profits more than doubled, the top line grew strongly and much faster than peers, and adidas reported promising signs of a recovery in its business and, crucially, market share gains.

After years of disappointing results, the company finally seems to be somewhat back on track, developing in the right direction, strengthening its financials, and reporting solid growth across segments and regions.

Meanwhile, peers are struggling, with Nike reporting declining sales and Puma and Lululemon a slowdown in growth. Adidas seems to be gaining market share for the first time in a long time.

What also should be pointed out and complimented before I get to the results is management’s incredible transparency, not making numbers look prettier than they are and getting investor’s hopes up. Management is honest, transparent, and open about the state of the company and it is working. As a potential shareholder, this is what I very much like to see – a capable and reliable management team.

Getting to the numbers, adidas reported excellent top-line growth for its second quarter, with a growth of 11% in currency-neutral sales to €5.8 billion. Moreover, underlying growth, which excludes Yeezy sales and therefore better represents the actual growth of the core business, was up an even more impressive 16%, which is pretty great.

Adidas management indicated that it is seeing growing interest in the brand and its products, possibly partly fueled by a greater wholesale presence and exciting new product releases.

In Q2, the wholesale business, for the first time in a long time, turned positive as adidas has been restoring its wholesale relationships under Gulden. Last quarter, wholesale revenue grew by a very strong 17% YoY, far ahead of expectations, fueled by renewed interest in the brand and stellar demand for new products.

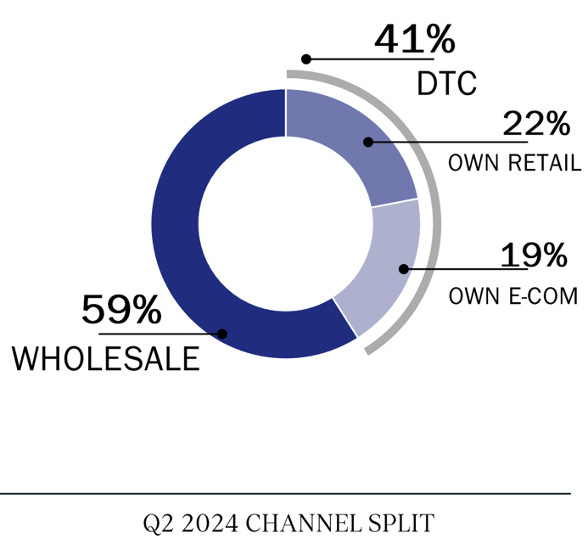

Furthermore, sales from its own retail stores were also up a solid 15%. The only negative standout was e-commerce, for which sales were down 6% YoY, although this was due to many of these sales moving to wholesale and a lot of online Yeezy sales last year. You can find the latest revenue split below, which shows a nice balance between wholesale and DTC again. I expect wholesale to strengthen further in the coming quarters, which is in line with Adidas’ strategy shift.

Also, helping this performance and most likely next quarter’s sales as well was a sports-heavy summer with the Euros, Copa America, and Olympics, which led to a lot of attention for adidas as one of the most prominent brands. Notably, both the winners of the Euros and Copa wore Adidas-branded jerseys.

This led to much higher jersey sales, hitting 3 million, fueling 14% growth in adidas’ performance segment.

Furthermore, growth across segments and regions has been accelerating compared to Q1, which is great! Looking at the regions, we can see that weakness in the U.S. persisted, with sales down 8% YoY, although underlying growth was a much more healthy and positive 2%, showing improvement from Q1.

The U.S. remains a large opportunity for adidas as its market share is still the lowest and far below that of its American peers. However, the company has been focusing on its efforts here, expanding its offering to focus on American sports as well. For example, it recently signed a deal with College Football team Texas Tech and a personal branding deal with star Quarterback Patrick Mahomes.

Meanwhile, Europe remained one of the brand’s strengths, with sales up 19% YoY (underlying growth of 24%). Furthermore, LatAm sales were up 33%, emerging markets 25%, and China 9%. The latter remains a key market for adidas and one of its biggest underperformers in recent years. However, the tide seems to be turning positively as adidas has been taking market share every single month in 2024, showing improvements in the underlying business.

Overall, I think we can clearly see improving trends and financials in adidas’ top-line results. The shift in focus to wholesale is working well already, and adidas is seeing metrics improve across the board. In fact, in part thanks to the demand for its latest sneakers, Adidas is currently unable to fully satisfy this demand.

That's quite a difference compared to one year ago, indeed, and ahead of expectations and targets. Adidas seems to be reinventing itself, and successfully.

Profits recover, and financial health improves.

On the bottom line, we can clearly see the top-line recovery and wrap-up of the Yeezy debacle reflected, with margins and cash flows improving.

The gross margin in Q2 hit 50.8%, which, adjusted for Yeezy profits and one-offs, was up 150 bps YoY thanks to reduced discounting and lower source costs. As a result, the operating profit skyrocketed by 97% to €346 million, which included a €50 million contribution from Yeezy still, but this is far lower than last year, so on a comparative basis, this is still a big improvement.

Further down the line, this resulted in a net income of €211 million, up 119% YoY.

These improved cash flows allowed adidas to improve its financial health, with its total cash position up 67% YoY to a much better €1.7 billion and ahead of management’s targeted €1.5 billion. With €2.5 billion in debt, this still leaves it in a net debt position, but considering where it came from and how quickly cash flows are improving, I am more than happy with this.

Even more impressive is the company’s current inventory level, which is down €1 billion from last year, or roughly 17%, to a much healthier €4.5 billion. This now only contains €150 million of Yeezy inventories, which should all be gone by the end of the year, according to management. This leaves it with healthy inventory levels ready to grow a bit again.

This is absolutely terrific and a massive improvement from just 1.5 years ago when inventory sat at €6 billion. This is an enormous improvement in terms of financial health.

Finally, ROIC is also slowly recovering again, although still far away from pre-covid highs of 11%, leaving adidas with plenty of room for improvement.

Overall, I am positively surprised by these results and the pace of improvement here. Honestly, there isn’t much to complain about.

On that note, let’s look at what’s ahead.

Outlook & Valuation

After a very strong first half of the year, with financials far ahead of expectations and targets, adidas management once more updated its FY24 outlook, now guiding for high-single-digit growth, up from mid-single digits before.

Furthermore, regarding profitability, management has also updated its expectations. Previously, it guided for a €500 million operating profit, upgrading this to €700 million in April, but now expects to report an operating profit of around €1 billion, which is more than double what was guided for initially. This includes the expectation to sell the remaining Yeezy stock at cost, taking into account no profits.

Ultimately, this is brilliant guidance, highlighting that adidas is realizing its turnaround much faster than expected. Still, management was still somewhat tempering expectations, claiming it wasn’t expecting further accelerating growth in the second half of the year due to industry dynamics. However, with adidas still unable to fully satisfy demand, management might also be a little conservative, not wanting to underdeliver.

Looking ahead even further, management remains upbeat on its prospects, expecting consistent performance and operational improvements to boost growth and financial health well into 2026. This should translate into double-digit top-line growth through the end of 2026 and a 50-52% gross margin, which is plenty of reason for enthusiasm.

Clearly, management is quite confident, and I see no reason not to trust this management team at this point.

So, what does this mean in terms of medium-term growth expectations? According to data from StocksGuide, Wall Street analysts now expect the following financial results through 2027.

Obviously, this looks extremely promising, with very solid top-line growth and absolutely brilliant bottom-line growth. With this, it is among the fastest-growing fashion brands, easily outgrowing Nike.

However, based on these projections, adidas shares now trade at roughly 29x next year’s earnings, which is everything but cheap. It seems like a turnaround is already pretty much priced into the shares by now. It certainly looks demanding at first sight.

Yet, while shares are absolutely not cheap anymore, these also do not look overly expensive considering the EPS growth that’s ahead for adidas in a base case scenario that doesn’t even fully incorporate long-term success for this brand, which I don’t deem unlikely. I believe adidas could be well able to keep growing its top line by high-single digits to low-teens until at least the end of the decade and EPS by mid-teens past 2027.

Considering this, paying 16x 2027 EPS estimates isn’t too crazy. It translates into a PEG of just below 2x. For comparison, both Nike and Lululemon tend to trade at a PEG of closer to 2.5x, so from this perspective the growth ahead might not even be fully priced in yet.

Granted, adidas isn’t quite up to the quality of those– not yet, at least – but I still think there is more upside here.

For example, using a 28x multiple, which is a little below Nike’s longer-term average and what I feel is relatively fair for adidas today considering the projected growth ahead, room for further upside, but also execution risks, I end up with an end-of-2026 target price of €300 per share.

This translates into potential annual returns of roughly 13.5% annually, which is more than enough to beat the market at a pretty favorable risk-reward, in my view.

Therefore, all things considered, I don’t think adidas shares are fully priced yet, but it does require some conviction and trust in this management team and brand to deliver.

Wall Street analysts tend to agree with this. Currently, 53% of 27 analysts covering adidas rate it a Buy, with an average price target of €243, leaving an upside of just over 10% over the next 12 months, according to data from StocksGuide.

In the end, I believe there is enough here to like. I view adidas as a brilliant turnaround candidate, and even as investors have already recognized this with the adidas share price up more than 100% from a 2022 low, I still believe there is enough upside potential here to justify picking up some shares.

Therefore, I rate adidas a Buy. I plan on adding some shares to my some of my portfolios next week.

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

If you enjoy Rijnberk InvestInsights, it would mean the world to me if you invited friends to subscribe and read with us. If you refer friends, you will receive benefits that give you special access to Rijnberk InvestInsights.

Who doesn’t like some free premium content, right?

How to participate

1. Share Rijnberk InvestInsights. When you use the referral link below or the “Share” button on any post, you'll get credit for any new subscribers. Simply send the link in a text, email, or share it on social media with friends.

2. Earn benefits. When more friends use your referral link to subscribe (free or paid), you’ll receive special benefits.

Get a 1-month FREE premium subscription for 3 referrals

Get a 3-month FREE premium subscription for 8 referrals

Get a 12-month FREE premium subscription for 20 referrals

Thank you for helping get the word out about Rijnberk InvestInsights!

Cheers!

What a job!!! Great! Thanks

Great post! Really like your thorough yet easy to understand explanation