Adobe Inc. – An opportunity amid AI fears or getting disrupted?

An 80%+ market share, A+ credit rating, double-digit growth, a massive moat. In other words, it is a brilliant business. Yet, its business is threatened by the rise of AI...

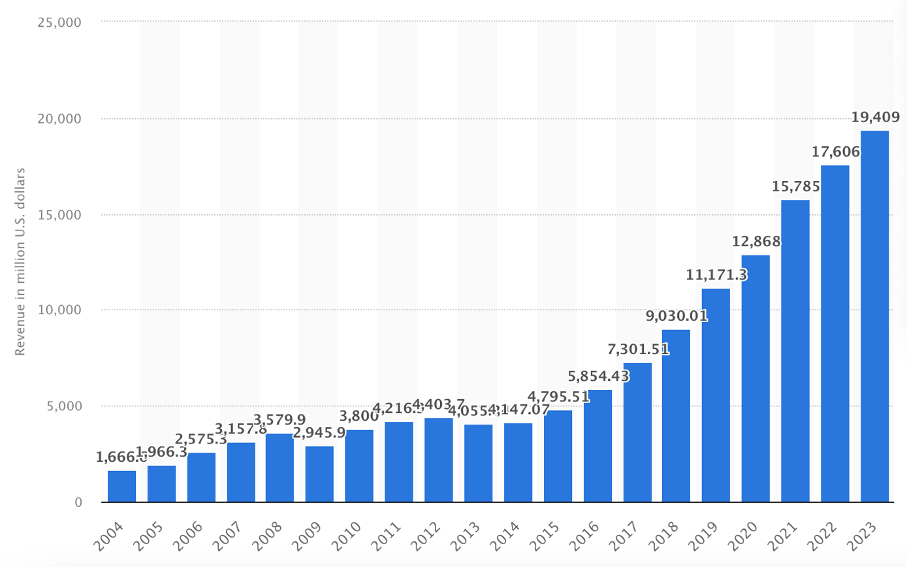

Adobe is a business that is on and off my watchlist all the time, mainly because it is a company that is hard to read, at least for me. On the one hand, the company has an impressive revenue growth track record and is an undisputed industry leader in a compelling industry.

At the same time, shares are far from cheap; it is tough to know how strong its moat is compared to upcoming competitors like Canva and whether AI is going to turn into a tailwind or a massive disruptor. Also, growth has been slowing recently.

As a result, up until this point, I have never been entirely certain about whether this is a must-own stock or one to avoid, and I have stayed on the sidelines.

However, after shares sold off by 8.5% following the release of its Q3 results, shares popped back up on my radar again. In part because of the sell-off, Adobe shares have been among the underperformers so far this year, with shares down 12% YTD.

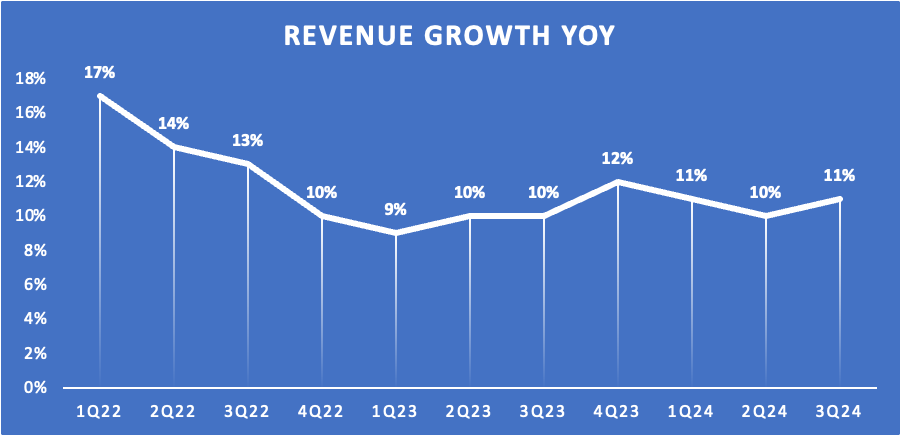

Furthermore, Adobe shares are now down 19% over the last three years, making them quite a poor investment. This can partly be explained by struggling profits, but revenue has grown at a 15% CAGR over these same three years, outpacing the 14% CAGR at which revenue had grown in the decade before. There really isn’t a lack of growth here.

Though, I should add growth has been slowing aggressively in recent quarters.

Furthermore, GAAP EPS is down 9% in the last three years… obviously, that isn’t great. As a result, despite the share price underperformance, shares haven’t even actually become that much cheaper compared to historical multiples amid slowing growth and AI concerns.

So, where does that leave us today? Are Adobe shares worth the consideration, even amid slowing growth and AI concerns, or is the margin of safety too slim here?

Let’s take a close look at the Q3 results, management’s commentary, and recent developments to make up the balance!

However, let’s start by introducing the company and addressing the elephant in the room—AI concerns.

Adobe Inc. – A remarkable company!

For those not so familiar with Adobe, it is a global leader in digital media and creative software solutions, known for its innovative products that allow individuals and businesses to create, edit, and share content.

Founded in 1982, Adobe has revolutionized industries such as graphic design, video editing, photography, and web development with its software suite, including popular tools like Photoshop, Illustrator, Premiere Pro, and Acrobat.

The company's cloud-based platform, Adobe Creative Cloud, offers a comprehensive range of applications that cater to creatives, marketers, and professionals, enabling seamless collaboration and workflow management. Also, this subscription-based offering means Adobe has a very high-quality recurring revenue stream, which is brilliant!

Today, its products are widely used by professionals across various industries, from advertising and filmmaking to publishing and education. The company’s software has become the go-to for graphic designers and digital marketing purposes.

In fact, graphic designers are taught the craft in school using Adobe software. By now, many of its software tools have become verbs, like “photoshopping,” and tools like Adobe Acrobat and file formats like ‘PDFs’ have become industry standards.

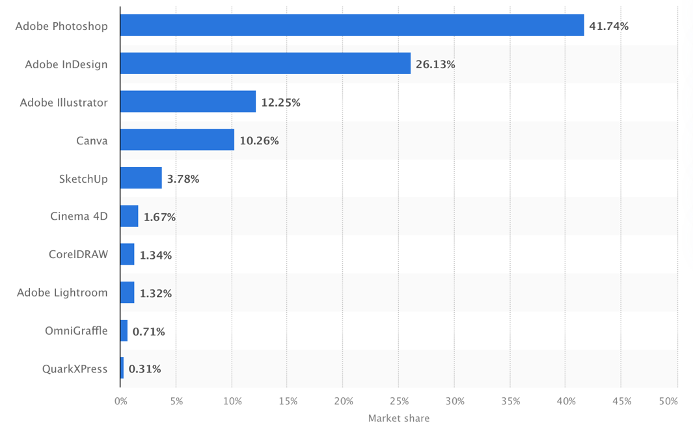

As a result, today, the company holds a commanding market share of over 80% in the graphic design industry, which is absolutely whopping! Through its years of product development and reliable brand, the company has built a massive moat, ranking its brand as the 14th most valuable globally at $35 billion, according to Interbrand.

So, yes, overall, Adobe is an absolutely brilliant business with a massive moat, dominating the graphic design and marketing industry. There certainly isn’t a lack of a moat here.

However, in recent years, investors haven’t been jumping on top of Adobe shares as growth has been slowing down and the company is facing the threat of AI, which has caused fears of Adobe’s software being replaced by AI tools such as image generators, and understandably so.

Is the rise of AI a game-changer for Adobe? A threat to its dominance?

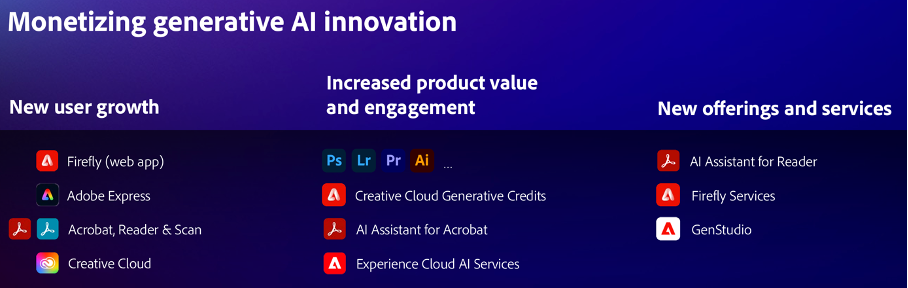

AI presents both opportunities and potential challenges for a company like Adobe. On the one hand, the emergence of AI is an opportunity for Adobe as it allows it to improve its product offering with easy-to-use AI features in graphic design and photo editing, which should improve the user experience and the value of its products. This is pretty straightforward, and Adobe is in the right industry to benefit.

Yet, at the same time, AI also poses competitive threats as emerging AI tools, especially those in the fields of design, content creation, and automation, could potentially reduce the demand for Adobe’s traditional software by offering quicker, often more cost-effective alternatives. I mean, image generators are already getting quite advanced, and if such a program can generate the image you need for free or at least low cost at the same quality, then why pay hundreds per year per user for an Adobe software stack?

Today, AI-driven design tools can generate graphics, edit images, or even produce video content with minimal human input, diminishing the reliance on Adobe's products like Photoshop, Premiere Pro, and Illustrator, which have traditionally required specialized skills.

Not great and definitely reason for concern.

You can see the problem here for Adobe. So, how big is this issue? Is this something Adobe can offset by adding similar AI features on top of its already stacked software suite? Only time will tell for sure, but from what we can see today, I highly doubt Adobe’s stack will actually be replaced entirely.

Among amateurs looking for a quick picture, AI might be a great, cheap, and easy solution. However, for the professionals out there, these upcoming AI tools are unlikely to fully replace Adobe’s software suite. Adobe’s tools, such as Photoshop, Illustrator, Premiere Pro, and After Effects, have become industry standards because they offer deep, feature-rich capabilities that cater to the nuanced and highly specialized needs of creative professionals. AI tools, although improving rapidly, still face limitations in terms of delivering the precision, control, and creative freedom that professionals require for complex projects.

So, while transformative, AI tools remain limited, and they might be for much longer.

Moreover, Adobe's suite is deeply integrated across various creative disciplines, enabling seamless workflows for professionals who may be working on projects that span multiple media types. This level of integration and flexibility is difficult for standalone AI tools to replicate.

Additionally, as Adobe is rapidly integrating top-notch AI features into its own software programs, it might be offsetting some of the attractiveness of upcoming AI tools as well. This includes AI integrations into photoshop, illustrator, Premiere pro, and more. So far, these features have impressed.

So, overall, I firmly believe Adobe has more than enough to offer to offset these threats.

Therefore, it isn’t a game changer or reason for concern, at least not yet. If anything, the company is an AI beneficiary today, even as its shares have missed out on the whole AI hype so far this year.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. We appreciate you being here! Want to support our work a little bit more and show your appreciation? Consider upgrading to paid (only $5 monthly).

This allows me to push out even more content and gets you premium access to even more content, including my full insight into my personal portfolio!

Adobe delivered excellent Q3 results

On Thursday, 12 September, Adobe released its Q3 results, and even though the company delivered pretty solid results, shares plummeted by 8.5% in response and lost a total of 11% in the week that followed, mainly due to slightly weak guidance raising some questions and concerns.

However, looking at the actual quarterly numbers, the company performed really quite well. Adobe beat on both top and bottom lines, although only marginally, with a 1% revenue beat and a 2% EPS beat. Still, it’s safe to say top-line numbers didn’t disappoint.

Adobe reported a total revenue of $5.41 billion, which represented a YoY increase of 11% as the company saw strength across its product portfolio. As visible below, revenue growth for Adobe has, for some quarters now, stabilized in the low teens after growth slowed down significantly coming out of the COVID-19 pandemic.

Honestly, I am pretty happy with this as it shows pretty exceptional strength. We shouldn’t forget that we are currently living in a tricky operating environment where most software companies are seeing some caution among customers and their spending/budgets.

However, Adobe flexes its muscles and moat, showing little sensitivity to the current cycle, growing steadily. If it maintains this growth, I believe investors have very little to complain about. Especially considering the market share the company already has. I mean, the industry isn’t growing by high teens, so we shouldn’t expect something similar from Adobe with limited room to capture more market share.

This low teens growth, at least for now, is absolutely brilliant.

Diving deeper, the Digital Media segment grew revenue by 12% YoY to $4 billion, with net new Digital Media ARR, one of the most important metrics to monitor here, coming in at $504 million, which was ahead of expectations.

You see, ARR or Annual Recurring Revenue reflects the company's ability to grow its subscription business. It shows how much recurring revenue Adobe adds through new customers or by expanding sales to existing ones. In a subscription model like Adobe's, strong net new ARR is key to maintaining predictable, long-term revenue - It is a great demand and product success indicator, which is why investors are heavily focused on these metrics. For reference, for Adobe, 94% of its revenues are subscription-based.

Last quarter, the solid net new ARR number was driven by a strong performance in both the Creative and Document business. For example, Document Cloud ARR was up 24% YoY, in part fueled by the introduction of the AI Assistant in Adobe Acrobat, among other new features.

Finally, Digital Experience revenue of $1.35 billion, also up 12% YoY.

Overall, the top-line performance for Adobe remained pretty solid last quarter, with stable growth across all businesses and net new ARR coming in above expectations, at least in part driven by continued innovation. The integration of new AI features is said to have contributed, but there isn’t really any sort of uptick or growth acceleration visible, so this is hard to measure.

Nevertheless, investors had little to complain about. This business is firing on all cylinders.

On the bottom line, the story wasn’t any different. Adobe reported a 40 bps operating margin expansion and $2 billion in operating income. Margin expansion was driven by a 13% growth in gross profit and limited growth in operating expenses of 10%, even as R&D was up 16% YoY as management continued to invest heavily in product innovation.

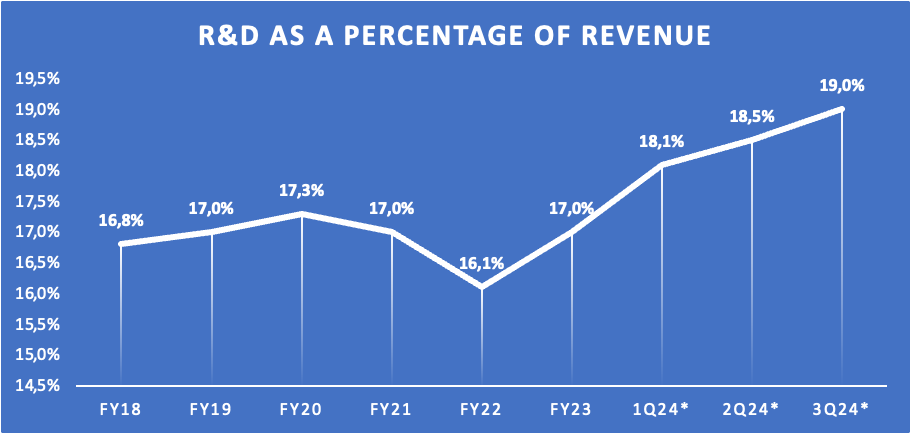

I mean, I like margin expansion, but not at the cost of growth investments, which needs to fuel growth, so I am really glad to see Adobe heavily investing in R&D. Over recent years, Adobe’s R&D as a percentage of revenue has been stable in the mid-to-high-teens, which is already pretty high in itself.

However, so far this year, management has been picking up the pace of investment, significantly growing R&D investments. Last quarter, this number was up 100 bps YoY, which is significant considering the solid underlying revenue growth.

This is what allows it to stay ahead, protect its moat, and fuel long-term growth.

Moving further down the line, Adobe reported an EPS of $4.65, up 14% YoY. As a result of these solid bottom-line results, Adobe was also able to maintain a very healthy balance sheet. The company ended the quarter with $7.52 billion in total cash on the balance sheet against just $4.13 billion in long-term debt.

This is absolutely brilliant, especially considering Adobe is able to push out $7+ billion in FCF annually and has tremendous financial metrics with both ROE and ROCE consistently above 30%.

This has earned the company a sublime A+ credit rating, putting it in the top bracket when it comes to financial health. Pretty tremendous overall!

This excellent financial health also allows the company to reward shareholders and offset dilution by repurchasing its own shares, currently executing a $25 billion share repurchase program running through 2028, allowing it to retire 10% of the currently outstanding shares.

Meanwhile, management has repurchased $15 billion worth of shares over the last four years alone, bringing the share count down 10% already. This gives EPS a nice boost, and it’s a good use of management’s sufficient cash pile for now.

Of course, many would wish for a dividend to be introduced here, but I am not expecting this to happen anytime soon, especially as the company is entering a new growth and investment cycle with the rise of AI, so shareholders might have to wait for that a few more years.

Luckily, there is plenty to like here! When it comes to financial health and the current performance, I am quite pleased.

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Many of its features are free. (Note: this is an affiliate link)

Outlook & Valuation

Then, to the somewhat less great part of the Q3 earnings report – the outlook. Indeed, this is what caused the drop in share price, as investors got concerned over demand and Adobe’s ability to keep up growth.

However, let me cut it short here: this was a complete overreaction.

Taking a close look at the numbers, management is now guiding for Q4 revenue of $5.50 billion to $5.55 billion, representing YoY growth of just 9.3%, which is indeed quite a bit of a slowdown from prior quarters as growth is expected to drop into the single digits. Meanwhile, EPS growth is expected to be around 9% YoY.

Furthermore, Digital Media net new ARR is expected to be around $550 million, falling short of the consensus by $21 million, which was taken pretty badly by Wall Street analysts and the market.

Obviously, this isn’t great, but it is also no reason for panic. Most importantly, management’s guidance seems incredibly conservative, but moreover, expectations for 2025 are already much more bullish as Wall Street generally expects the AI tailwind to kick in for Adobe, “as new users buy higher-priced plans, existing users upgrade, enterprises buy Firefly Services, and new products such as Acrobat AI Assistant get adopted.”

For longer-term investors, there really isn’t too much to worry about for now.

First of all, growth in the underlying market is expected to remain solid. The global graphic designing software market is expected to keep growing strongly at a 10% CAGR through the end of the decade. With an 80% market share for Adobe, it is well positioned to benefit from this.

Meanwhile, there is, of course, the proliferation of AI, which is expected to set the stage for a new leg of growth for Adobe. During its most recent presentation, Adobe management indicated that its addressable market should grow to $293 billion by 2027, representing a CAGR of 12%, which is pretty brilliant.

I believe it is realistic to assume Adobe to lose some market share to upcoming AI tools through 2027, but it should still be a dominant force and, therefore, a massive beneficiary of this expected growth.

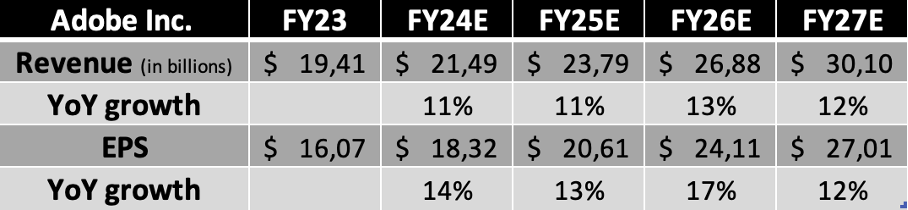

All in all, this presents a pretty compelling outlook, and I am quite optimistic about Adobe’s longer-term growth opportunity. You can find my full financial estimates below.

Based on these estimates and after last week’s sell-off, Adobe shares now trade at 28x this year’s earnings and 25x next year’s earnings. I know this might sound quite expensive and it surely isn’t cheap, but it is a 30% discount to its 5-year average and only a 5% premium to the sector.

Also, with a PEG of 1.8x, shares look pretty attractive as well, again at a 30%+ discount to its own 5-year average but also in line with the sector.

Considering we are talking about a company growing double digits, being a big AI beneficiary, with sublime financial health and metrics, and with a massive moat, it really isn’t that expensive, is it?

A company such as Adobe isn’t going to trade at low multiples at any time, not even as Wall Street is worried about AI and its growth prospects.

Long story short, on current weakness, I believe Adobe shares look really attractively priced when taking into account its sheer quality and growth prospects.

To put things into perspective, using a long-term 28x earnings multiple, which should provide us with a sufficient margin of safety when compared to sector, historical, and peer averages, I calculate a target price of $675 for the end of fiscal FY26, which translates into annual returns of 13%, which is compelling.

In the end, at a current share price of just over $500 per share, I believe Adobe shares are an extremely compelling investment with plenty of room to outperform the market by a sweet margin. Meanwhile, you own a company with a staggering moat and sublime financial health and metrics.

I am a buyer at current levels and intend to initiate a position at current levels.

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

Great thought process and detail went into your thesis for Adobe. Definitely like your style of presenting your thoughts too. As a fellow writer in the same niche, I’m happy I get to learn from yourself. After quitting my job 8 months ago to invest full time (going into my 10th year of investing)- I’m always trying to look for different angles to keep the blades sharp and learning. Accumulation of experiences from writers like yourself is great! Keep the great work!