After a chaotic August, this is my 24-stock portfolio - Portfolio update Sept. 2024

August was a great month, with the portfolio up close to 7%, double the return from the S&P500.

Welcome back to our monthly portfolio update!

As always, at the start of the new month, we will share our current portfolio, its performance over the last month, and any changes and additional commentary.

But before we get to that, let me show you the planning for September so you know what to expect in terms of research from us!

This is what you can expect from us in September!

Current September content release planning:

Lowe’s Companies, Inc. ($LOW) → Deep Dive (Free)

“These are the top 3 stocks I am buying today.” → new post format! (Premium)

Synopsys, Inc. ($SNPS) → Deep Dive (Free)

Universal Music Group N.V. → Deep Dive (Free)

FedEx Corporation → Quarterly update (Free)

Texas Instruments Incorporated → Deep Dive (Free)

And potentially even more…

Note this planning is prone to changes and is mostly an indication of what to expect as a subscriber!

Do you miss anything? Are there any stocks you’d like us to cover? Specific information you are missing? Or any tips, tricks, or other comments?

Share them with us!

You can do so with the link below! We are open to any suggestions to make our content fit your preferences!

On that note, let’s delve into last months performance and my portfolio!

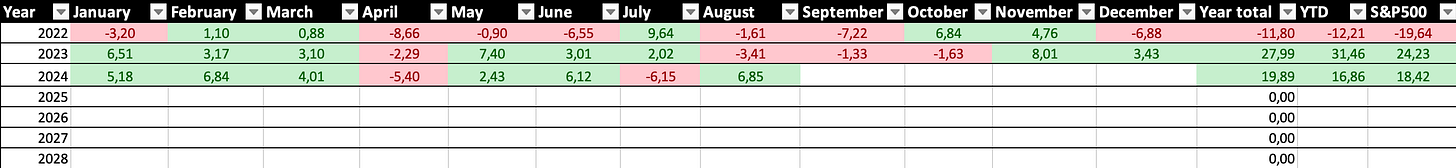

My portfolio gained 6.85% in August.

Moving to last month’s performance, I can safely say I was very pleased with my portfolio’s performance, especially after a very poor July, which was close to my worst month in over two years(!).

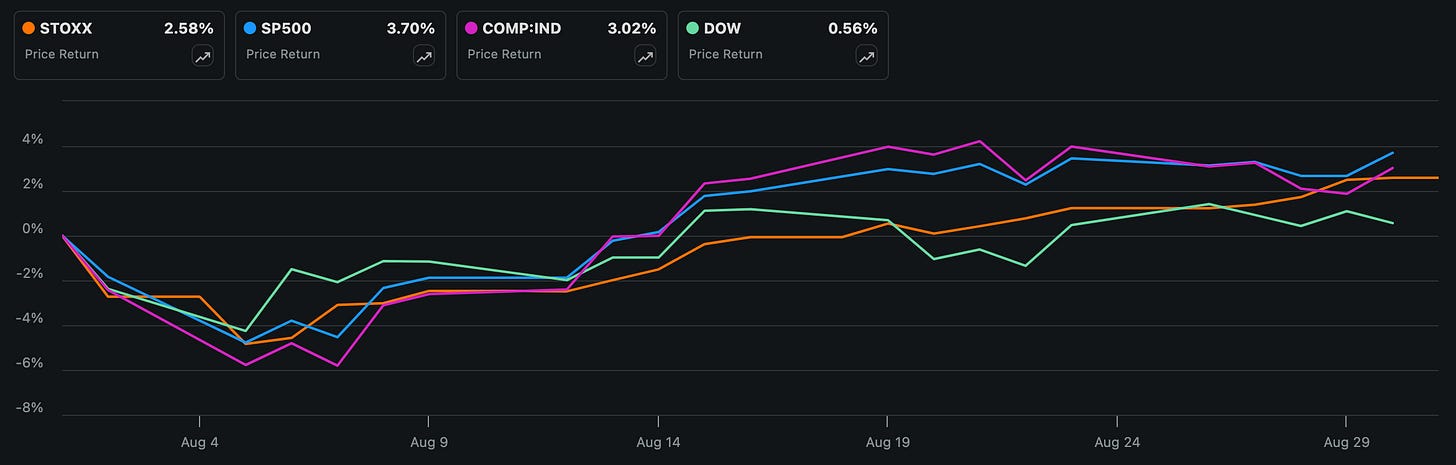

Positively, we bounced back in August, with my portfolio returning 6.85%, corrected for FX fluctuations. With this performance, I comfortably outpaced global benchmarks. Check out the performance from some benchmarks below.

Nevertheless, I am still underperforming the S&P 500 this year, although now only by a few percentages. YTD, my portfolio is now up just shy of 17% compared to an 18.5% return from the S&P 500.

Still, I am quite pleased with this performance, especially considering how much semiconductors and Crowdstrike, easily accounting for over 20% of my portfolio, have been bleeding over recent months.

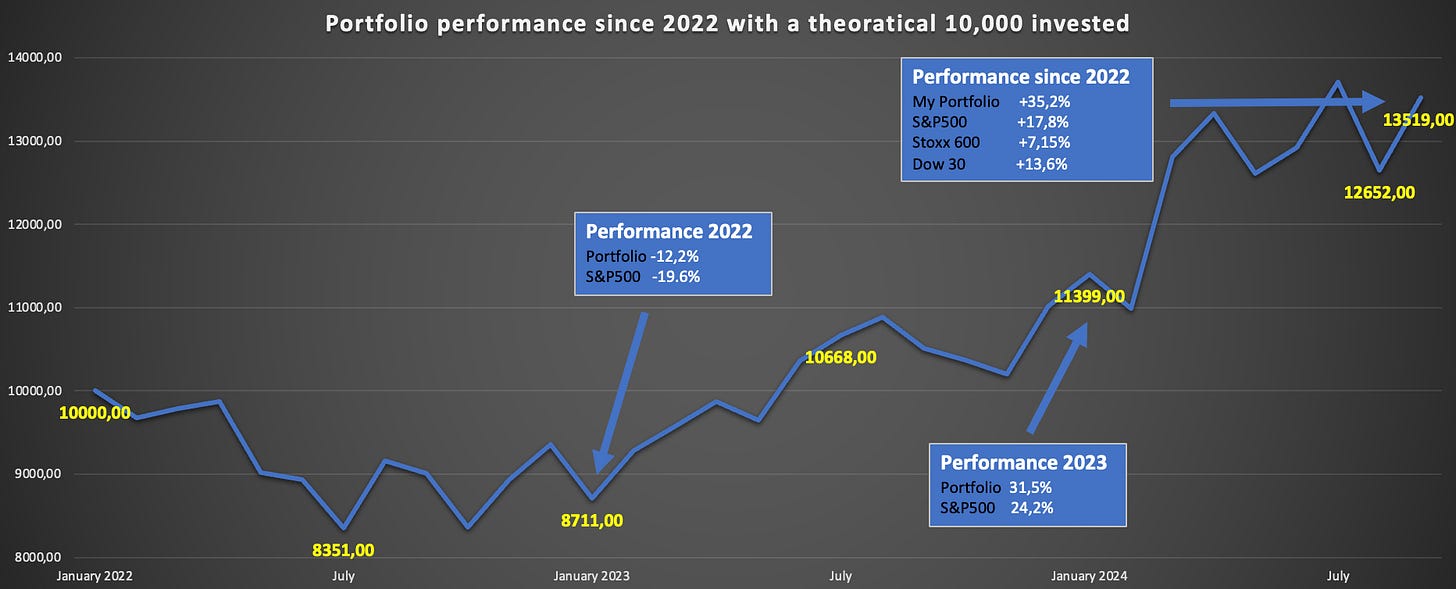

Check out my full three-year performance below.

Furthermore, since I started this portfolio, it has still easily outperformed the U.S. and European benchmarks, returning 35.2% starting January 2022, compared to a 17.8% return from the S&P 500. Remarkably, this outperformance has been realized at a below-average risk profile and with a strategy focused on diversification.

You see, I am a buy-and-hold investor, not a trader. I work hard on picking out the long-term winners and the highest quality businesses with promising long-term prospects - I am buying with the idea to hold shares for at least 5-10 years and ideally forever.

Furthermore, I try to balance value and growth as well as geographies and sectors to perform well under all circumstances.

In other words, I work on building an all-weather portfolio of high-quality businesses with great long-term prospects that should outperform in the long haul.

So far, my strategy to diversify and keep a low-risk profile has worked well. You see, contrary to what many believe, you don’t need to pick out multi-baggers or the ultimate winners to outperform global benchmarks.

Often, you can achieve something similar at a far lower risk profile by picking out businesses with steady cash flows, profitability, and just decent growth.

Just try looking for those with a superior business model, industry-leading position, operating in a promising industry with a great management team, and with a product that is unmissable in society or to other critical industries.

If I can find those at a fair price, I generally pull the trigger.

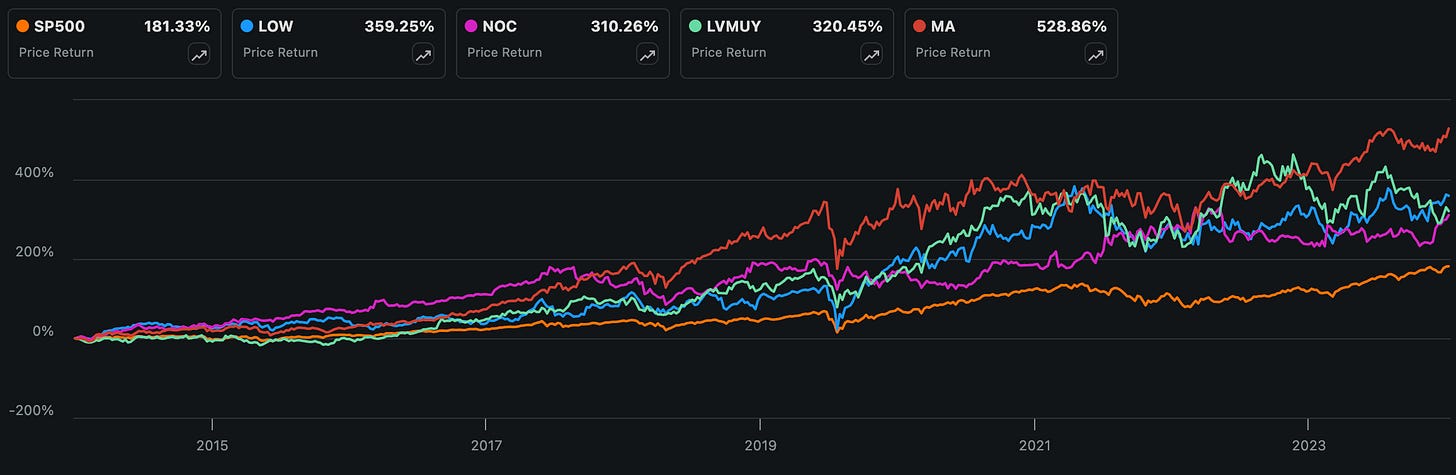

Crucially, outperformance doesn’t always come in the form of blinding growth but often through brilliant execution and high quality. Take Mastercard, LVMH, Northrop Grumman, and Lowe’s as examples - no rapid growth, but just brilliant execution and a strong market position in a great industry, which resulted in an outperformance at low risk.

Each outperformed global benchmarks over the last decade, while many high-growth darlings turned into a bust…. Low risk doesn’t need to translate into underperformance!

All in all, I believe that having a well-balanced portfolio is the best way to go, and that is the strategy I implement in my portfolio, with a combination of growth and value, as well as exposure to various sectors and geographies.

With a portfolio capped at 24 stocks and 2 ETFs, I can achieve all of this, and I feel it gives me a sweet balance in terms of diversification and concentration.

Finally, let me clarify that, in my view, there’s no need to time the market or to constantly adjust your portfolio after or during any (big) event. Just think carefully before you act, stay true to your strategy, and stick to the plan!

If you have done your research and picked out the right companies, you’ll rarely have to be concerned about anything.

On that note, here is my current 24-stock portfolio…

Our full portfolio allocation below is part of our premium content. To get full access to my entire personal portfolio and the monthly updates in terms of transactions and changes, consider upgrading to paid. ($5 monthly).

This also gets you access to our monthly “Top 3 Stocks to Buy” post, a brand new format launching later this month, putting some terrific bargains on your radar!

Not interested? No worries! Most of our stock analysis and Deep Dives will always remain FREE!

Check out my most recent [FREE] post and Deep Dive on adidas below!