American Express – A must-own for long-term investors (Deep Dive)

Time for a Deep Dive into this 175 year old business!

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

Shares of American Express, one of the top credit card issuers and payment processors globally, have been under pressure recently amid concerns over the U.S. economy following Trump’s blockbuster tariffs. Unsurprisingly, growing fears of a recession and economic slowdown aren’t seen as a good thing for this American poster child, which derives almost 80% of revenues from the U.S. and heavily depends on the health of the U.S. consumer (less spending on its network means fewer fees – makes sense).

A poor U.S. economy and weak consumers are ultimately bad for AmEx’s business. They would likely impact consumer spending, leading to fears over a slowdown in AmEx's volume growth and higher credit losses, as consumers might fail to pay their bills as unemployment rises. In response, AmEx shares have shed 22% of their value since their late January all-time high, dropping slightly more than the Nasdaq and S&P 500.

However, to me, these excessive fears and the overestimated impact a mild recession could have on AmEx’s business are nothing short of an opportunity to buy shares at a nice discount.

In my opinion, AmEx is one of the most brilliant and uniquely positioned businesses while also being one of the safest yet most promising investment opportunities for long-term investors, driven by the company’s unique approach and positioning in the incredibly compelling payments industry.

While many consider AmEx’s unique focus and approach (being both card issuer and payment processor) riskier than that of its peers, I believe it gives it significant long-term advantages that lead to higher customer satisfaction and retention and strong customer acquisition, especially in the younger demographic, which is already showing today.

In my view, AmEx is simply better positioned than its peers, which should allow it to outgrow the underlying industry and deliver considerable long-term returns. Also, this more personal approach and its focus on high-income individuals give it both incredible longevity – I assure you AmEx will be around stronger when we check in again in 20 years (this is one of the most durable models out there) – and a resilient business model.

All this makes me highly confident in its long-term potential for investors, especially considering its best-in-class financials.

Ultimately, I believe AmEx is pretty damn close to being a no-brainer right now. I mean, buying this gem at just 16x earnings – an 18% discount to the 5-year average – despite management targeting a bullish long-term 10% revenue CAGR and mid-teens EPS CAGR is just a gift.

Let me show you why I am so bullish on American Express in this Deep Dive, taking you through the business fundamentals, growth drivers, financial profile, overstated risks, and recent performance.

By the end, you’ll know all you need to know about American Express.

Let’s delve in!

All you need to know about American Express

The business and its unique approach

American Express is a globally recognized financial services company that specializes in credit cards, charge cards, and payment solutions, with a focus on premium cards for higher-income individuals. Founded in 1850, American Express has built a reputation for premium customer service, exclusive member benefits, and a strong presence in the payments industry.

As of 2023, AmEx is estimated to account for roughly 4% of all credit cards in use, which I know doesn’t sound impressive. However, in terms of payment volume, AmEx has a far higher market share, which is due to the simple fact that the company caters to a wealthier customer base that simply spends 3x more on average per year per card.

This results in the market share split below:

UnionPay credit: $6.9 trillion, 35%

Visa credit: $6.3 trillion, 32%

Mastercard credit: $4 trillion, 21%

American Express credit: $1.7 trillion, 9%

This percentage jumps even higher when we look at AmEx’s largest market – the U.S. – where it holds a very considerable 19% market share, only just trailing Mastercard’s 24% market share.

Furthermore, according to Interbrand, AmEx is now the 27th most valuable brand globally, so it is safe to say it doesn’t lack any brand recognition. Also, the company processes about $1.5 trillion in volume annually, has over 80 million proprietary cards in circulation, and has acceptance in 202 countries. Indeed, it has grown into a real payment powerhouse over its 175-year history and with a very differentiated approach compared to peers.

You see, the card (credit/debit) payments industry is practically dominated by three powerhouses (outside of China)—Visa, Mastercard, and American Express. Yet American Express is nothing like its peers and is truly unique in the industry, which makes it a real standout (in a compelling way, if you ask me).

The fundamental difference between AmEx and Mastercard/Visa is the business model. You see, unlike Visa and Mastercard, which operate as payment networks facilitating transactions between banks, with the banks issuing the branded cards and taking the credit risk, American Express functions as both the card issuer and the payment processor through its closed-loop network.

This means Amex directly issues many of its own cards, manages customer relationships, and processes transactions. This means it takes on more risk, as it takes on the credit and lending risk, but it also allows it to capture a far larger share of each transaction’s fees and gives it much closer customer relationships and control.

A focus on a premium customer base

Meanwhile, this greater control and the closer customer relationship also allow AmEx to decide who it wants as its customers, and AmEx has historically focused on high-income individuals, which is another fundamental positive. Unlike Visa and Mastercard, which cater to a broad range of consumers through various banks, AmEx positions itself as a provider of premium financial services. Many of its flagship cards, such as The Platinum Card® and the Centurion Card® (Black Card), require high annual fees and are designed to attract affluent cardholders who prioritize luxury, travel, and exclusive perks.

This focus leads to several fundamental benefits for AmEx. For example, high-income cardholders tend to spend more per transaction and carry higher balances, which allows AmEx to generate more revenue through both merchant fees and interest on balances for those who use its lending products.

For reference, AmEx users have a 2x higher annual income compared to the U.S. average and spend 2x more on flight tickets and accommodation on an annual basis. The difference in customer spending is further highlighted perfectly below in the average credit card transaction per network:

America Express: $150

Mastercard: $94

Visa: $91

Discover: $58

This shows AmEx customers are simply spending way more per average transaction.

These higher spend per transaction are also precisely why AmEx can charge far higher fees to merchants while not hurting acceptance as much.

Yes, American Express is still accepted in far fewer places than its larger competitors – Visa and Mastercard – due to the higher fees it charges merchants, but acceptance is growing as merchants increasingly want optimal acceptance as digital payments grow, and these don’t want to miss out on AmEx’s premium customer base.

For reference, American Express charges 50-100% higher merchant fees per transaction, so some merchant reluctance makes sense. However, ultimately, they can’t afford to miss out on the 140 million AmEx cards out there, especially considering the much larger average transaction value.

Ultimately, for AmEx, being able to charge higher fees to merchants simply results in far higher revenue per user.

On top of this, these wealthier customers also don’t usually change their spending habits much, even during tough times, making AmEx’s volumes a bit more resilient in a downturn.

Finally, also worth pointing out is the fact that the delinquency rate for AmEx customers is very low at just 1.3%. For reference, Capital One has a rate of 3.89%, showing AmEx really is in a different customer league that is simply far more likely to pay their bills and manage risk, but more on that later.

A unique revenue structure.

Due to its full control over the payment process, close relationship with the user, and its focus on higher income consumers, the company’s product offering is also very different from Visa and Mastercard and looks more like that of a bank, which is most often the card issuer. This then also leads to a unique revenue structure, which is like a mix between both, though its transaction fees are still the biggest revenue contributor.

As of 2024, AmEx derives roughly 53% of revenue from merchant fees, which are the fees charged to the merchant for each transaction made (roughly 3%). These are the same revenues generated by Visa and Mastercard.

However, AmEx also generates over $8 billion a year, or roughly 13% of 2024 revenue, from card fees, which are subscription-like fees charged to card owners in exchange for great benefits. You see, through this entire control over the payment flow and the direct relationship with the customer, AmEx is able to offer more generous card benefits and rewards programs, such as Membership Rewards points, travel credits, and luxury perks. This is why most AmEx cards come with a fee for the consumer, a bit like a subscription.

This is a rapidly growing revenue stream for AmEx as more and more users opt for these premium cards to reap the benefits, creating a very steady recurring revenue stream for the company, which is excellent!

These fees, which account for almost 70% of annual revenue, are exactly why American Express, unlike other card issuers like most banks, is far lower risk and less volatile. These are generally steady and reliable revenues.

However, the company is a little like a bank as well, deriving another 24% of 2024 revenue from NII (net interest income), which is simply the revenue derived from consumer loans, which is a less reliable and constant revenue stream, though accounting for a not-to-large share of revenue. For reference, the average card issuer derives a whopping 85% of its revenues from NII.

This once more proves just how uniquely positioned AmEx is. It is nothing like Visa and Mastercard but also nothing like other card issuers.

Meanwhile, despite being its own issuer/lender, which is very often deemed risky, AmEx faces very little lending risk purely thanks to its premium business model focused on high-income individuals. With these lenders/users much more likely to pay their bills than the average consumer, AmEx’s lending delinquency rate is far lower than industry averages by as much as 160 bps at a 2023 level of 1.9%, which today still remains well below pre-COVID levels.

Further highlighting this low risk is a remarkably strong CCAR Fed modeling, where AmEx consistently performs among the best.

So, whereas I understand AmEx is a higher risk pick than Visa and Mastercard as it takes on the credit risk itself, this argument is often blown up way too far because, in reality, this risk is extremely limited and nowhere near its bank peers. As a result, the discount often awarded to AmEx shares is not entirely justified.

In fact, I believe this approach offers far more benefits than it does risk.

AmEx sees strong traction in younger demographics

Another important factor worth pointing out for AmEx is its strong traction among younger demographics like Millennials and Gen Z. With these generations, the company is doing far better than anyone else, which is a big long-term positive, likely fueling long-term market share gains.

Impressively, management indicates that a whopping 75% of Platinum and Gold card members are Millenials and Gen Z, up from 40% in 2016. Furthermore, roughly 70% of new customers are currently from this younger demographic, showing strong traction for AmEx.

Granted, as younger generations pull more toward spending on experiences instead of physical goods, AXP looks excellently positioned better than its larger peers, with its card benefits like travel perks.

Crucially, these younger generations offer the company a considerable lifetime value, with roughly 55% of these customers below 35 years old. Thanks to this, and considering AmEx delivers a 98% retention rate, the company is undoubtedly in for many more decades of growth.

Moreover, this considerable exposure to younger generations should prove a solid tailwind over time and an advantage over the competition, as Millennial and Gen Z spending is growing way faster than all other generations as their wealth grows. These generations already account for over 50% of U.S. consumer spending, but this is only expected to increase over the next decade.

This will prove a great tailwind, and AmEx is leading the competition.

International expansion remains a massive opportunity.

As already pointed out before, AmEx is still heavily U.S.-focused, with the country accounting for roughly 77% of revenue, which is a bit too much exposure to a single region for my taste.

Now, considering that AmEx shouldn’t be too sensitive to economic fluctuations (though it is far from immune), it doesn’t concern me too much. Moreover, it does leave AmEx with significant room for international expansion. With a market share below 5% in most countries outside of the U.S., the growth runway remains considerable, and management acknowledges this, investing considerably in this since 2017.

A critical part of these investments and international efforts went into boosting merchant acceptance, which, historically, is rather low outside of the U.S.

However, AmEx has been making good strides and continues to invest. By now, its merchant network has actually reached 80% acceptance across its top international markets. International acceptance locations have grown 50% between 2021 and 2023 to 72 million locations and have tripled since 2017, now including 96% of top e-commerce websites, 90% of top tourist attractions, and 82% of transportation agencies, all of which are up considerably from 2021.

Unsurprisingly, higher acceptance has proven critical to international user growth, and we can see this accelerating in recent quarters as management’s efforts pay off.

Driven by these international investments since 2017, international growth since has been solid and an overall growth driver, growing at a high teens CAGR, outpacing the underlying (international) industry, which grew at just a 7% rate, showing solid market share gains.

Meanwhile, international revenues are actually also more compelling in terms of quality, with 89% of international revenues coming from merchant and card fees, showing even less exposure to lending, which I favor.

Ultimately, I expect management’s efforts to keep paying off and AmEx to continue gaining market share outside of the U.S. with its top-notch offering and growing acceptance.

I anticipate this will remain a solid growth driver while also lowering dependence on the U.S. consumer.

Meanwhile, don’t think AmEx is done growing in the U.S. AmEx still only accounts for 5% of U.S. accounts and has a 25% market share in fee-based accounts, leaving it with plenty of room to grow.

Pretty neat overall, I would say! A very good backdrop for prolonged long-term growth.

On that note, let’s move to the company’s recent performance and let’s take a closer look at its financials.

Assessing AmEx’s financials and recent performance

2024 was a pretty great year for AmEx, as it continued to see a stable spending environment, even registering a minor improvement toward the end of the year.

The company delivered record revenues and cash flows, saw a record inflow of card members, record high processed volumes, and record high card fees. Meanwhile, the company carefully managed expenses, growing operating leverage further, and retention remained very strong and best-in-class, as did AmEx’s credit performance, showing no consumer weakness.

Top-line growth is strong and very healthy across the board

For the full year, AmEx delivered 10% YoY revenue growth to $66 billion, aligning with its long-term aspiration.

Remarkably enough, AXP has actually been able to accelerate revenue from the GFC onwards. For example, from 2010 through 2014, revenue grew at a 6% CAGR, which accelerated to a 9% CAGR through 2019. Post-pandemic, this accelerated further to a 19% CAGR, although arguably reflecting some delayed and heightened travel activity, which is where AmEx excels with its benefits.

Nevertheless, the numbers still show that AXP management is well able to identify the right consumer and payment trends and act on them.

Focusing on the most recent quarter, AmEx delivered growth in line with the rest of the year, growing revenues by 10% YoY or 9% in dollar terms. This is up slightly from the growth we saw in prior quarters but overall remains in the high-single digits to low-teens range, which is healthy.

This Q4 growth was driven by an 8% growth in discount (transaction) revenue and an impressive 19% growth in card fees.

Starting with AmEx’s payment processing business, notably, spending momentum improved toward the end of the year, as shown below, as billings growth (payment volume processed) accelerated from a 6% range in prior quarters to 8% in Q4, driven by robust holiday spending and growing engagement. Transaction growth was also a strong 10%.

Most importantly, this once more shows that the U.S. consumer remains in great health, not slowing down spending and even accelerating spending a little for AmEx. Of course, this could be a bit more AmEx-specific as its premium customer base is not as impacted by economic headwinds.

Crucially, this growth acceleration was broad-based, driven by all customer categories, sectors, and geographies.

In a bit more detail, U.S. consumer spending was up a solid 9%, which is healthy. Furthermore, Millennial and Gen-Z spending remained strong and continues to outpace all other categories, growing 16% YoY in Q4. Finally, international growth also remained solid at 15% YoY, showing continued share gains and accelerating from the 13% range in prior quarters.

This all looks pretty good for AmEx, with no signs of weakness.

However, throughout 2024, the real highlight was the underlying growth AmEx recorded, especially in accounts and card fees.

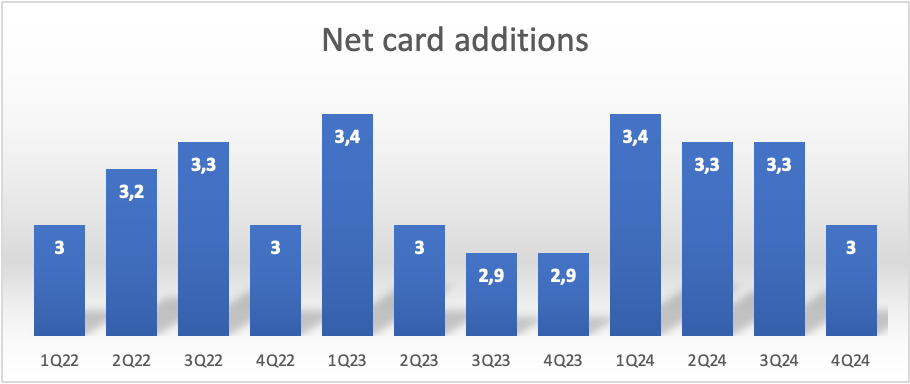

As of the start of 2024, American Express had over 80 million proprietary cards in circulation and is seeing impressive and steady growth. For reference, the company issued over 3 million new cards per quarter over the last year, adding a total of 13 million in 2024, surpassing the 12.2 million issued in 2023. As a result, total accounts have grown 20% from 2019 through 2023.

First of all, this shows that American Express's growth is stable and more than solid; it is also accelerating as the company’s approach is working, reeling in large amounts of young customers, with Gen Z and Millennials accounting for 70% of these new accounts.

Ultimately, adding more cards to its network is the best indicator of current and future growth, and this is what fuels very impressive subscription revenue growth, growing far faster than any of its other revenue streams. Also, AmEx boasts a 98% retention rate among its premium cardholders, whereas the industry average is approximately 85%. This shows incredible customer retention, another indicator of long-term success.

This means the company is not only rapidly adding new cards but is also seeing limited outflow and high customer satisfaction (#1 among credit cards) despite the often steep pricing of its cards. In fact, AmEx is able to raise card fees considerably without losing customers. For reference, Gold card fees have grown 28% since 2018, yet Gold card members have grown 2.2x, showing no weakness at all, with high satisfaction and great benefits more than weighing up.

As for net card fee growth, or its card subscription revenue, this consistently sits in the mid-to-high teens, coming in at 19% in Q4 and accelerating again.

As already pointed out earlier, enabling this success – accelerating growth, strong customer additions, and high retention – are, critically, AmEx’s significant efforts in growing acceptance, especially internationally. In 2024 alone, AmEx added millions of new merchant locations, reaching an average of 80% coverage across its top 12 international countries, up 8 points from three years ago.

Under the hood, AmEx is doing really well, and these numbers show it. This is what should matter most to investors, as this is what enables long-term success.

Shifting our focus to the company’s loan portfolio, investors can also be very pleased, with delinquency rates and write-offs stable from prior quarters, showing no consumer credit weakness, and still remaining below pre-COVID levels.

As of Q4, the 30-day past due rate was still low at 1.3%, and net write-off rates were low at 1.9%, nicely below a pre-COVID level of 1.5% and 2.2%, respectively. These numbers also remain far below that of other issuers/lenders, reflecting AmEx’s premium customer base and great risk management.

As a result, Q4 total loans and Card Member receivables grew 9% YoY, showing some growth moderation as expected. However, this is expected to stabilize here and grow faster than spending in 2025.

Q4 NII was up 13% on an FX-adjusted basis, driven by increases in revolving loan balances and net yield versus the prior year.

Meanwhile, with the consumer still healthy, AmEx could afford to build fewer reserves, which led to a decline in provision expense by about $100 million per quarter. Total provisions were nice and stable at 2.9% of total loans and receivables.

Constant operating leverage gains drive results on the bottom line

Moving to the bottom line, it is safe to say investors have little more to wish for, with AmEx consistently delivering a great cost profile with very healthy margins. The company consistently achieves solid operating leverage gains year after year. As a result, over the years, operating costs have been trending down nicely as a percentage of revenue, from 30% of revenue in 2017 to just 25% in 2023 and 22% in 2024.

Looking at the most recent quarter, the company once more showed solid operating leverage gains. Operating expenses in Q4 were down 1% YoY to $4.2 billion, leading to steadily improving margins. Operating expenses were down 2% for FY24, despite high marketing expenses of $6 billion, up 16% YoY. These are expected to moderate in 2025, meaning we should expect further margin gains in the current year.

Furthermore, the VCE to revenue ratio, which refers to Variable Customer Engagement expenses that are not included in operating expenses, which include cardholder rewards, cash-back incentives, and certain other benefits tied to customer spending and engagement with AmEx products, came in at 43% in Q4, which is slightly elevated.

Reward expenses, in particular, grew strongly in Q4, up 15% YoY, although this is compared to a slow Q4 in 2023. Furthermore, AmEx has “made some small changes to the program that are good for both customers and the overall economics of the program,” to use management’s own words, but these are a slight drag on costs in the short term.

Overall, there is nothing too crazy there.

Ultimately, this strong bottom-line performance, along with efficiency and subsequent margin gains across the board, helped AmEx achieve a record net income of $10 billion in FY24, reflecting an FY24 EPS of $14.01, up an impressive 25% YoY.

Also, it is worth pointing out that ROE hit 35% in 2025 and has consistently been over 30% in recent years, showing the company knows how to use the capital it generates.

Interestingly, a good portion of this is actually used to reward shareholders. AmEx both pays a rapidly growing dividend and uses excess cash flow to repurchase its own shares.

As for dividends, AmEx shares currently yield a solid 1.2%, which is based on a conservative 21% payout ratio. However, the most compelling factor here is growth. Over the last 10 years, AmEx has grown its dividend at a sweet 10% CAGR, and it has no plans to slow this down.

Long-term management aims to grow its dividend in line with earnings growth to maintain a payout ratio of between 20% and 25%. Considering management aims for EPS growth at a mid-teens rate, we can expect similar dividend growth. We already got a small taste of this when management announced a 17% dividend hike for 2025.

And as if that weren’t compelling enough yet, AmEx has also bought back a large number of its own shares, retiring a whopping 32% of its outstanding shares over the last decade, significantly increasing shareholder value and boosting EPS growth.

What is there to complain about?

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe if you like our content! Want to receive even more of our investment insights and show even more appreciation? Please consider upgrading to our paid tier (only $7.50 monthly or just $70 annually).

In addition to all the free stuff, this also gets you access to even more premium analyses (a total of 3 per month), full access to my own (outperforming) portfolio, immediate trade alerts in the subscriber chat, and a full overview of all my price targets and rating, and even more!

Outlook & Valuation

Overall, it is safe to say that in terms of positioning, long-term growth potential, and financial execution, AmEx looks terrific. The company is uniquely positioned in a steadily compounding industry, and with a focus on younger demographics, high-income individuals, premium card offerings, strong customer relationships, retention and benefits, and international expansion, it seems very well positioned to outpace the industry and deliver very solid growth for a few more decades, also considering the longevity of the business model.

And this is exactly what management expects.

The credit card payment industry is expected to grow at an 8-9% CAGR through 2034, according to both market research firms and AmEx management.

However, long-term AmEx management is confident that, thanks to its favorable positioning, it will be able to grow revenue at a double-digit rate and outgrow the underlying industry.

Meanwhile, management expects bottom-line growth to be even more impressive, driven by strict expense management, growing operating leverage, and rapidly growing high-margin card fees and discount revenues.

As a result, AmEx management is confident it will be able to deliver not only 10%+ revenue growth but also mid-teens EPS growth on a sustainable basis, which results in a very compelling long-term outlook.

Meanwhile, looking a bit more short-term at 2025, AmEx’s guidance didn’t disappoint either. For the full year, it now guides for a slight slowdown in growth, and this to be between 8% and 10%. However, this is based on the assumption that billings growth will be similar to 2024 overall, even as we saw a healthy uptick in spending in Q4. If this trends pushes into 2025, which it has through the first two months, 2025 revenue growth should be at least at the high end of the guided range.

Also, the guidance still assumes a pretty heavy FX headwind from the strengthening of the dollar, which has lost a lot of steam since, benefitting AmEx’s revenue performance further.

This guidance also assumes card fee growth to start the year in the high teens and growth to moderate throughout the year. Also, NII growth is expected to outpace the growth in total loans and receivables, which is supported by growth in revolving balances. This guidance faces very little exposure to potential Fed rate cuts.

As for the bottom line, management guides for EPS of $15 to $15.50 or a 12% to 16% increase YoY. VCE expenses are expected to outgrow revenue in 2025 due to continued investments in card member engagement, but this should be offset by lower operating expense growth, including slower growth in marketing costs.

Ultimately, this leads to a very solid 2025 outlook, with room for upside. In fact, I believe management’s guidance might prove conservative. Anyway, all things considered, I expect the following growth through 2028, which assumes some economic weakness in 2026 and a slow recovery into 2027. These estimates might turn out conservative.

Based on these projections and the 18% drop in AXP shares over the last 1.5 months, AXP shares are back trading at just 16x this year’s EPS consensus, which is an 18% discount to the company’s 5-year average multiple, which I believe is still more than justified right now, even as the outlook is slightly cloudy due to some economic uncertainty.

Nevertheless, this multiple seems to be a solid discount to fair value. For reference, this means we are now looking at a PEG of just 1x, which is right around bargain territory and a whopping 40% discount to the company’s 5-year average.

At this point, I believe broader-based concerns over the U.S. economy and the subsequent sell-off have unrightfully punished AXP shares to the point where these have returned to trading at a really compelling level, with risks to the business overestimated.

For reference, even if we assume a very conservative 18x long-term P/E multiple as fair, more than accounting for potential economic headwinds, I end up with an end-of-2027 target price of $367 per share. This reflects potential returns of 16% annually (CAGR), which already should be enough to beat most global benchmarks, even as you are reeling in one of the best businesses you can buy and one that will remain a solid grower for a few more decades, at the very least.

Moreover, suppose we use a 20x long-term multiple, which aligns with the 5-year average and, in my opinion, reflects quality and growth prospects much better. In that case, these potential annual returns jump up to 20%, which are sublime returns.

My conclusion? AmEx will be a no-brainer investment for the next two decades, and its shares are absolutely terrific value right now at around $245.

I am a buyer at these levels, no doubt.

Using 5yr avg multiple isn’t always useful given odd multiples during Covid - if you strip out 2020 & 2021 it’s trading more in line with historical

Great article! I bought this last year when you recommended at $225 and was considering adding last week but was concerned about a recession. Is this still a good buy price if a recession looms?