Applied Materials, Inc. – This company is of exceptional quality

Applied Materials (AMAT) reported Q1 results last week and impressed Wall Street with incredible resiliency and a very optimistic long-term outlook.

Applied Materials released its fiscal Q1 results last week and impressed Wall Street with the results and management’s Q2 guidance coming in above the consensus as the company is benefitting from the AI boom, growing demand for chips, and recovery in the equipment industry. Ultimately, shares jumped over 8% on the results, which means shares are now up more than 25% YTD.

Before we get into the results, for reference, Applied Materials is a global leader in the semiconductor manufacturing equipment sector, in which it is one of the leading companies. With a strong market position and a comprehensive product portfolio, with which it caters to most of the world’s largest semiconductor manufacturers like Intel, TSMC, and Samsung, the company caters to the demand for faster and more efficient chips, supporting innovative technologies like AI, 5G, and autonomous vehicles.

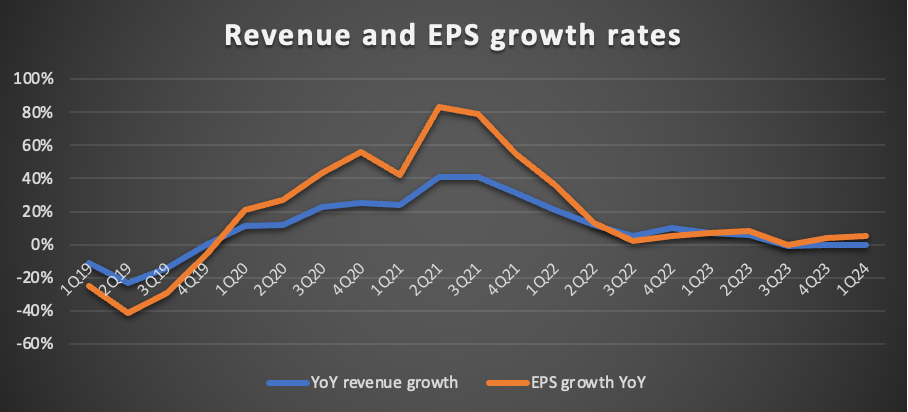

The company reported revenue of $6.71 billion, which was roughly flat YoY and in line with the flat YoY growth it reported in the previous quarter. Remarkably, the company has avoided real revenue contractions so far despite the significant downturn we have seen for the semiconductor and equipment markets in 2023. For reference, peers Lam and KLA both reported much more significant revenue contractions of over 30% and down 16%, respectively. Furthermore, the equipment industry was down by high-single digits in 2023.

Meanwhile, AMAT was still able to report positive growth and record revenue levels in 2023, which perfectly highlights the resilience and extremely favorable positioning of AMAT, which allowed it to keep outperforming, and which is exactly why we pulled the trigger on AMAT a couple of months ago, making it a key holding in our portfolio and one of our top picks in the industry. One does not need to buy Nvidia or AMD shares in order to fully benefit from the AI boom.

Moving back to the Q1 results and looking at its operating segments, systems sales came in at $4.91 billion, down 4.9%. This included record high DRAM and edge system sales, which was able to offset weakness in other end markets. The AGS segment – AMAT’s services segment – was once again strong in Q1, with revenue up 8% YoY to $1.8 billion, as this segment is much less sensitive to the economic climate due to the majority of these contracts being subscription-based.

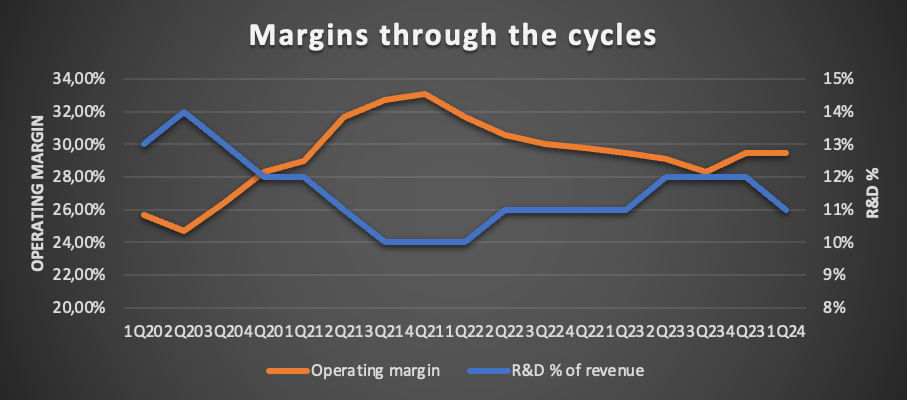

On the bottom line, the company also performed exceptionally well, with the gross margin improving by 110 bps YoY to 47.9%. This led to an operating margin of 29.5%, in line with the previous quarter and the same quarter last year. AMAT has seen its margins drop from a 2021 high of 33.1% as a result of the slowdown or downturn in the underlying industry, which led to slower growth. Margins are now recovering from a bottom, as highlighted below, and we expect margins to improve further as 2024 progresses and demand improves.

These margin improvements are partly helped by AMAT somewhat flattening its R&D growth in recent quarters after growing this consistently over the last few years. Management is still focusing its investments on R&D to invest in emerging technology programs but is also investing heavily in expanding and diversifying its manufacturing logistics and supply chain.

Nevertheless, the margin improvements in Q1 allowed AMAT to grow net income by 3% and EPS by 5% to $2.13. Furthermore, FCF was $2.1 billion, which is still very solid and easily covered shareholder returns of a little below $1 billion. Shares now yield just 0.7% after the run-up in shares over recent weeks, but at a payout ratio of just 15% and annual growth comfortably in the double digits, this is still very attractive from a dividend growth perspective.

Overall, it was an excellent quarter for AMAT, with financial results exceeding expectations. Making up the balance, AMAT has delivered excellent financial results over the last decade, with it growing revenue at a CAGR of 13%, EPS at a CAGR of 30%, FCF at 33%, and dividends at a 12% CAGR, which really is all investors can wish for and which are industry-leading results. Moreover, the ROIC improved from 8% to 35%, and the company also reduced its outstanding shares by over 30%. Simply sublime!

Meanwhile, the company is also exceptionally well positioned for the future and the new semiconductor boom. AMAT has outperformed markets over the last five years and is in a great position to benefit from its customers moving to new chip innovations and high-volume manufacturing over the next few years. The industry is entering a new bull cycle, and AMAT is there to benefit.

AMAT has been adjusting and expanding its portfolio over recent years, which enables it to better service customers looking to manufacture “next-generation transistors, new interconnect schemes, including backside power delivery, high-performance DRAM including high bandwidth memory, and specialty applications in the ICAPS market,” as explained by management.

Management argues that it has the broadest and deepest portfolio of capabilities and products, which helps it bring advances faster to market and drive deeper partnerships with its customers and partners. This is what management said during the earnings call:

“We have a unique ability to combine, co-optimize, and integrate our technologies to develop highly differentiated solutions for our customers.”

This has also helped the company gain market share in critical markets like DRAM, where it gained 10 percentage points of market share over the last decade. As a result, AMAT now reports DRAM revenues larger than its two closest peers combined.

Crucially, its exposure to advanced technologies and its role in the transition to high-volume manufacturing also makes it a prime beneficiary of the AI boom and a great AI play outside of headline-grabbing names like Nvidia and AMD.

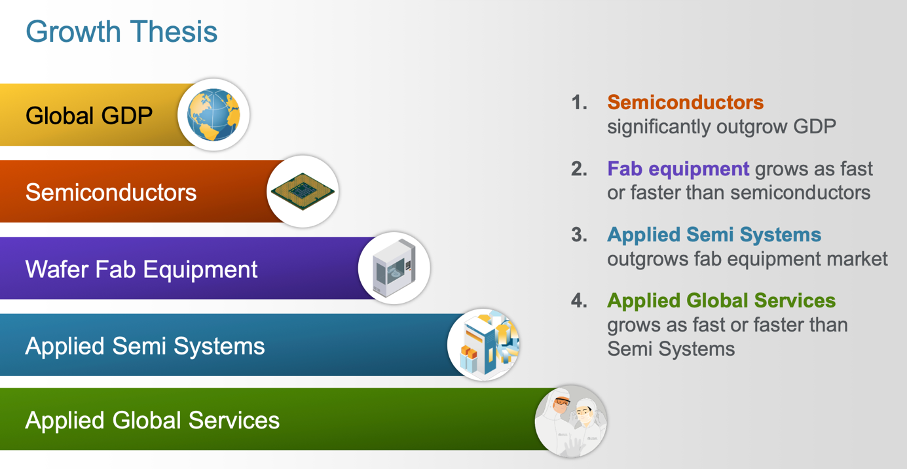

Furthermore, a significant growth driver for AMAT is the semiconductor industry’s growing complexity, which requires AMAT customers to buy more machines, but it also makes its advanced services much more important, especially when it comes to scaling new technologies to high-volume manufacturing.

This is precisely why AMAT has already been able to grow its services segment through the downturn for 18 consecutive quarters. AMAT does not expect this trend to reverse any time soon and believes it should be able to keep growing these service revenues by double digits in 2024 and keep up this same growth in the following years as services become more important to customers and AMAT tools under service grows.

For reference, this already sits at 17,000 as of today, up 8% YoY, and these services contracts also have an extremely high renewal rate of over 90%, making it a very reliable and recurring revenue stream as well, which protects AMAT’s revenues in a downturn like the one we are going through right now. As a result, this segment alone already provides AMAT with sufficient cash flows to fund its growing dividend.

Crucially, due to these dynamics, AMAT expects that its equipment business should be able to outgrow an already rapidly growing market. According to management, the equipment market should grow as fast or faster than the overall semiconductor industry, driven by the earlier mentioned increasing complexity of the industry and semiconductor processes.

On top of this, management is convinced it should be able to outgrow the already rapidly growing semiconductor equipment market, which should translate into high-single-digit to low-double-digit growth through the end of the decade, also fueled by the services segment outgrowing its equipment sales. The company is simply best positioned in terms of product portfolio, innovation, and relationships with customers. This is what management added to this:

“The reason is that our technologies enable the key semiconductor advances needed to drive growth in AI, IoT, and renewable energy. Looking ahead to the semiconductor process inflections that will play out over the next several years, the company is extremely well positioned.”

Ultimately, the reasons we discussed above made us add AMAT to our portfolio.

And that brings me to the outlook. According to management, discussions with customers point to improving overall market dynamics, which could bode well for the semiconductor equipment industry in 2024. We have already heard the likes of KLA and Lam guiding for the overall industry potentially growing by high-single digits in 2024, which is fueled by a reacceleration in capital investments by cloud companies and improving fab utilization.

Specifically for AMAT’s business, management is also optimistic about 2024, with leading-edge foundry/logic customers looking stronger YoY even in the face of some delayed projects due to the much-discussed shortage of specialized personnel to complete fab construction. Still, this market should be up in 2024 with accelerating growth as the year progresses.

Meanwhile, management also projects NAND revenues to be up YoY but to remain below 10% of total equipment spending. Also, DRAM growth is expected to rebound strongly in 2024, fueling accelerating demand for AMAT’s equipment.

Ultimately, these expectations result in management guiding for Q2 revenue of $6.5 billion, plus or minus $400 million. At the midpoint, this means revenue would be down 2% YoY. Besides revenue, management also guides for non-GAAP EPS of $1.97, plus or minus $0.18, which is down 1.5%. Also, management expects a non-GAAP gross margin of around 47.3%, which is down slightly from the previous quarter but up 50 bps YoY.

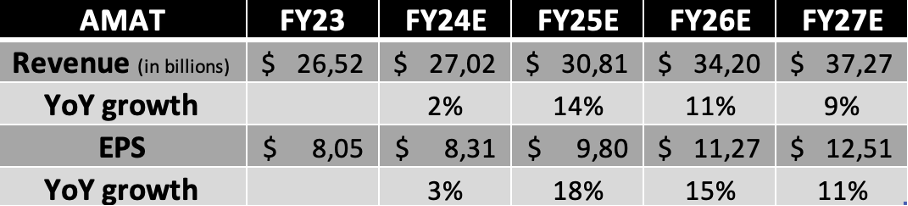

Overall, this guidance reflects a relatively weak Q2 regarding demand, but this should improve by the second half of the 2024 calendar year. Therefore, we now update our estimates from a previous 2% revenue decline to a 1.9% increase, which should drive EPS of just over 3% for fiscal FY24. Long-term, I have also turned more bullish on the company, and considering its growth outlook, exceptional good positioning, and the simple fact that this company is one of the highest quality picks in the industry, the company should fully benefit from the upcoming semiconductor boom.

We now project the following results through the company’s fiscal FY27.

Based on these projections, which are slightly more bullish than the Wall Street consensus, shares now trade at just below 23x this year’s earnings after a 63% run-up in the shares over the last year. However, we argue that this relative premium might be justified. As mentioned plenty of times throughout this post, AMAT is one of the highest-quality picks in the industry and a prime beneficiary of the upcoming semiconductor upcycle. As visualized above, this should result in excellent top and bottom-line growth.

Also, the company has proven over recent quarters that it is at the same time also one of the most stable and anti-cyclical picks in the industry, with top and bottom line growth barely turning negative, whereas peers are reporting double digit YoY revenue contractions. This should only become more pronounced in future down cycles as the rapidly growing services segment adds additional revenue stability and predictability.

Overall, there is very little negative to say about this company, and with industry-leading metrics like an ROI or ROIC of comfortably above 30% and a WACC of just 14%, this company really has very promising prospects. This really is one of our favorite companies.

As a result, we are very much willing to pay a premium for this company. All things considered, a 22x multiple might be fair right now, which is still a roughly 10% discount to the sector. This translates into a target price of $216, leaving an upside of 14.3%. This translates into annual returns of approximately 8% from a current share price of $189, which might not offer enough downside to warrant a buy rating here, including the dividend and our bullish thesis.

At this time, we are no active buyers of AMAT shares and would prefer these to fall to below $184 per share before considering adding to our position. As a result, despite our bullish theses, we rate shares a “Hold.”

Please let us know your thoughts in the comments! Also, please leave a like if this post was of value to you!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which I hope will be insightful!

Disclosure: I/we do have a beneficial long position in the shares of AMAT, either through stock ownership, options, or other derivatives. This article expresses my own opinions, and we are not receiving any sort of compensation for it.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.

Owned AMAT for a while in my fund - starting to bleed out of it now