ASML Holding N.V. – Please, ignore this short-term noise

Time to review the ASML Q1 results and update my investment thesis - this might just become a so-called generational opportunity.

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

Last Wednesday, ASML was among the first companies to release its Q1 earnings report. While its quarterly headline numbers met expectations, shares sold off by 5% during the following trading session and ended the week 9% lower, entirely driven by a somewhat lighter-than-expected order intake and management not showing enough “confidence” to reassure Wall Street and alleviate concerns over tariffs and the near-term outlook, which I think is absolute bull.

ASML delivered excellent quarterly results, is seeing solid demand (orders tend to fluctuate strongly from quarter to quarter), and remains in great financial health. Management reaffirmed its 2025 and 2030 guidance, still pointing to solid growth through the end of the decade, even as it is at the low end of the guided range.

This is not a bad quarter in my book, and the medium-term outlook remains excellent. Yet, current poor sentiment weighs heavily, and just performing well isn’t enough to please investors.

On that note, let me review the Q1 numbers and put them in a bit more perspective. Let me show you why ASML shares are a no-brainer at current prices. They are now well oversold and on the brink of deep value territory.

Q1 results + highlights

Q1 revenue totaled €7.7 billion, up 45% YoY.

ASML delivered very solid Q1 results, which came in nicely at the midpoint of management’s guided range and roughly in line with consensus estimates for €7.75 billion. Revenue of €7.7 billion reflects a rapid 45% year-over-year growth.

As visible below, growth for ASML has been recovering nicely since bottoming in early 2024, following a cyclical demand dip coming from a cocktail of headwinds, including lower electronics demand and fab construction delays. However, these headwinds have steadily eased off, and the market for ASML is quickly recovering as Capex budgets at large customers like TSMC and Samsung are growing again, especially amid booming demand for leading-edge nodes thanks to AI.

Consistent with ASML management’s views in previous quarters, growth in AI demand remains a massive growth driver for the semiconductor industry. Suppose current demand persists and hyperscaler Capex budgets remain high. In that case, ASML expects its customers to keep working hard on bringing more advanced node capacity online in the years ahead to support this demand, which should allow ASML to keep growing revenue strongly in the years ahead.

Ultimately, this was a solid top-line result for ASML in Q1, which was in line with expectations and showed a continued return in demand.

Of the reported €7.7 billion, ASML derived €2 billion from contract-based and recurring services revenues and €5.7 billion from system sales, comprised of €3.2 billion in EUV sales and €2.5 billion in non-EUV sales. This shows solid growth in the installation of EUV systems, while DUV is slowing down a bit, reflecting a decline in Chinese demand following U.S. export restrictions.

This is also all very much in line with expectations.

Revenue derived from China sat at 27% in Q1, which is in line with Q4, but down considerably from 49% in the same quarter last year. This was mainly driven by U.S. export restrictions. Positively, the loss of Chinese revenue was easily offset by demand elsewhere, with Western demand improving rapidly. For reference, Korea now accounts for 40% of revenue (up from 19% in Q1 2024), and both the U.S. and Taiwan jumped from 6% to 16%, showing good demand improvements here.

However, the less positive last quarter was the order intake reported by ASML:

Net order intake in Q1 was €3.9 billion, comprised of €1.2 billion in EUV orders and €2.8 billion in non-EUV orders.

This was a bit shy of expectations, with a consensus for €4.8 billion in orders. However, it is very important to consider that these order intake numbers are highly volatile due to timing changes, and rarely anywhere near analyst projections, as these are impossible to predict, making the consensus entirely useless. Last quarter, orders were more than €4 billion above the consensus. This time, it’s shy by about €1 billion.

I believe the more significant issue with these quarterly order intake numbers and subsequent disappointment probably originates from short-term demand concerns, which weren’t quite taken away by these numbers missing estimates.

You see, amid current concerns over economic growth, a potential U.S. recession, and the impact of a global trade war, investors are on edge, and with the semiconductor industry highly cyclical, there are some concerns over short-term demand for semiconductors. Subsequently, this also impacts CapEx budgets at ASML customers and demand for its machines, which is pressuring sentiment.

And this lower-than-expected order intake didn’t take these concerns away, like at all.

Yet, I will happily argue that this should be of zero concern to investors. These are just short-term sentiment issues, nothing fundamental. Unless the order intake suddenly comes under pressure for multiple quarters, all these concerns are massively overblown just because of order intake timing.

You see what I am getting at? If the order intake is strong again next quarter, concerns will disappear and prove overblown. That is how it works.

Ultimately, I believe an order intake of €4 billion is still quite solid, especially with ASML management optimistic about the quarters ahead. Management expects to see a good inflow of orders for its High-NA EUV machines in Q2 and Q3, which should boost its backlog and confidence in its medium-term goals.

As for this High-NA demand, this is showing to be a big technological jump in semiconductor production, showing massive benefits in terms of process simplification, cost, and cycle time reduction compared to previous technologies, as shown by initial customer use numbers.

The technology allows for fewer process steps, shorter cycle time, lower cost, and better yield, which management says is translating into great demand, with customers really liking this new technology. For reference, Intel reported the number of process steps declining from over 40 to less than 10 on a given layer, which comes paired with significant time improvements. For reference, Samsung reported a 60% improvement in cycle time.

This is a game changer, and customers are eager to order this new, leading-edge EUV equipment, which will likely show next quarter.

Alright, let’s finally move to the bottom-line results:

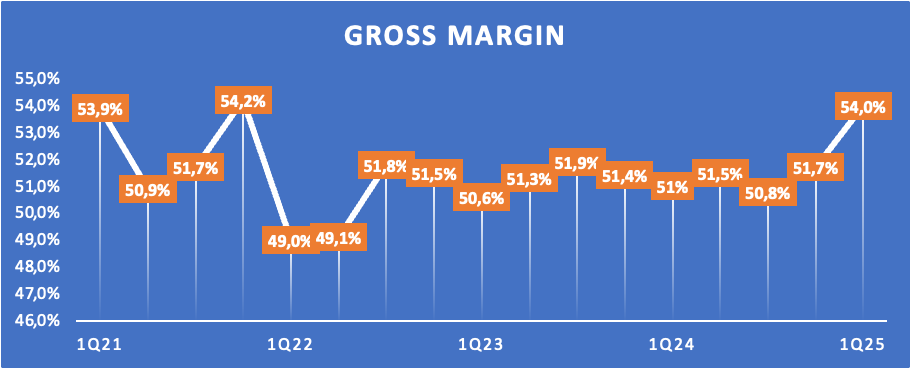

Q1 gross margin was 54%, beating guidance and the consensus

Q1 operating margin was 35.4%.

Q1 net income margin was 30.4%.

This was an especially strong margin performance. ASML has guided for a gross margin of between 52% and 53%, and the consensus expected a 52% gross margin, yet ASML actually delivered a 54% gross margin, thanks to early achieved customer productivity milestones and a favorable EUV product mix.

Thanks to this strong performance, the operating margin was also strong at 35.4%, with operating expenses well under control, despite ASML still heavily investing in R&D, which sat at 15% of revenue. Further down the line, this resulted in a €2.4 billion net income and an EPS of €6, which was stronger than expected.

Despite these strong margin results, FCF in Q1 was a negative €475 million due to a combination of “customer payment and down payment dynamics and continued investments in fixed assets for future capacity.” ASML’s FCF numbers are always volatile on a quarter-to-quarter basis thanks to these exact dynamics, so these should only be reviewed on an annual basis.

Nevertheless, despite a negative FCF, ASML maintained a very healthy balance sheet with €9.1 billion in cash and only €3.5 billion in total debt, even as ASML also repurchased €2.7 billion worth of its own shares to grow shareholder value.

Ultimately, I believe this was just a very solid quarter delivered by ASML with little to fundamentally complain about.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe if you like our content! Want to receive even more of our investment insights and show even more appreciation? Please consider upgrading to our paid tier (only $7.50 monthly or just $70 annually).

In addition to all the free stuff, this also gets you access to even more premium analyses (a total of 3 per month), full access to my own (outperforming) portfolio, immediate trade alerts in the subscriber chat, and a full overview of all my price targets and rating, and even more!

Outlook & Valuation

Q2 revenue to be between €7.2 billion and €7.7 billion, falling short of a €7.77 billion consensus.

Q2 gross margin to be between 50% and 53%, which is roughly in line with a 52.3% consensus.

As already pointed out above, ASML’s Q2 guidance wasn’t quite on par with the consensus estimates, coming in a little light. I believe this is mainly due to ASML management taking a much more conservative view of the market amid heightened global uncertainty, mostly due to the potential impact from announced tariffs and the subsequent risk of an economic slowdown.

Regarding tariffs, management noted that the situation remains very dynamic, which results in quite a bit of uncertainty, with the impact on customers and suppliers still very much unknown. As of now, we do know that the global 10% tariff from the U.S. impacts ASML on three main fronts:

System sales and upgrades for U.S. customers. Obviously, ASML faces a 10% U.S. tariff when importing equipment into the country, which will likely be partially absorbed by the ASML customer and also by ASML itself to avoid hurting demand, especially amid short-term pressures.

The import of materials into the U.S. for ASML facilities in the country. Positively, ASML doesn’t have too much exposure to U.S. facilities, so I expect this impact to be limited.

The import of parts from the U.S. into other countries. Retaliatory tariffs will also hurt ASML due to the import of certain components from the U.S. into Europe. Price increases by ASML suppliers will hurt its margins slightly.

Ultimately, ASML is working to alleviate the impact and concerns from these tariffs, but the company isn’t entirely isolated from the problem, although it is also not overly exposed, as its strong supply chain and dominant market position help it offset some of these headwinds.

However, uncertainty remains, and this is putting pressure on sentiment, especially with management being quite straightforward about it, which didn’t take away investor concerns. To quote management, “The tariff discussion is still very dynamic. The potential indirect impact on end-market demand is even more complex and impossible to determine at this stage.”

Yeah… this isn’t what Wall Street likes to hear.

Of course, in addition to margin issues, a potential economic slowdown could also impact the semiconductor industry, which remains highly cyclical, which is why ASML management is turning somewhat more cautious, and rightfully so.

On the margin front, the guided bandwidth is also a bit larger than usual due to the uncertainty management is facing regarding tariffs and their value chain absorption. Also, management expects the H2 gross margin to be lower than the first half due to “the expected margin-dilutive effect of the revenue recognition of High NA systems in the second half of the year, lower upgrade revenue, as well as any potential impact of tariffs.”

Still, the FY25 gross margin is guided to be between 51% and 53%, which isn’t that much lower, in part thanks to the Q1 outperformance.

Also, crucially, management still reaffirmed its quite wide FY25 guidance, despite the significant potential headwinds. Management still guides for revenue between €30 billion and €35 billion, and for 2026 to be another growth year, even as demand may face some short-term headwinds.

For now, management’s view of the market remains unchanged. AI remains a massive demand growth driver as it pushes ASML customers to create more capacity, requiring more ASML EUV equipment. If this demand doesn’t weaken, management still expects revenue to come in at the upper end of the guided range. However, there is a lot of uncertainty, so a sharp drop in demand later this year could push revenue to the lower end of the range.

Furthermore, ASML reaffirmed 2030 guidance, pointing to revenue of between €44 billion and €60 billion, together with a gross margin between 56% and 60%, driven by higher service revenue and a better product mix.

This is still very bullish. Based on this guidance, I now expect the following financial results through fiscal 2028, which assumes a solid tariff impact in H2 and a demand slowdown in 2026, before growth accelerates again toward the end of the decade. This is still a very good outlook, even amid short-term pressure.

And yet, shares sold off on this outlook in the following trading sessions, purely because of heightened uncertainty and management simply not sugarcoating it.

As a result, ASML shares are now down 15% for the year and down a whopping 37% over the last 12 months, putting shares at a TTM P/E of sub-30x, a level we have only seen on two other occasions over the last six years. Furthermore, this translates into a forward P/E of just 24x, which leaves its PEG at just above 1 and on the brink of deep value territory.

Honestly, those are just insanely low levels for a business with a pristine monopoly position in a mission-critical part of the semiconductor industry, and poised for rapid growth in the decade ahead. ASML is still one of the best-positioned businesses out there, yet now completely misvalued over short-term uncertainty.

And, yes, I know, despite operating a monopoly and having a €39 billion non-cancellable backlog, ASML isn’t enjoying the standard benefits from either due to the unique nature of the industry and ASML’s positioning. ASML practically only serves a handful of customers, primarily TSMC, Intel, and Samsung, which doesn’t give it a lot of pricing power and makes it fully dependent on the capex budgets of these few customers. So, it’s not quite that straightforward of a monopoly and mega backlog.

At the same time, the company still enjoys a monopoly, a perfect 100% market share, in the most critical type of equipment for the manufacturing of high-end semiconductors, EUV technology. This technology is only expected to become more critical as requirements for energy efficiency and capacity grow (without ASML equipment, there are no sub-7nm chips, simple as that).

Currently, we are on the brink of a massive new investment cycle for the semiconductor industry, as TSMC, Intel, and Samsung are all working very hard to bring more leading-edge (3nm and below) manufacturing capacity online to meet the growing demand (coming from AI, edge computing, and high-end electronics).

All these new fabs require a lot of ASML EUV technology, so the outlook for ASML is great—there is no denying it.

However, the one big sidenote to all of this is that the exact timing and curve of investments is somewhat uncertain, increasingly so as global trade and economic health come under pressure. Ultimately, the semiconductor industry is highly cyclical, and ASML isn’t immune. If the industry comes under pressure, Capex budgets at its customers will drop, and ASML equipment deliveries will be postponed again, dragging on ASML’s near-term growth, potentially.

This is the big sentiment overhang we are seeing right now, and what is putting pressure on its price.

Yet, I will happily argue that ASML shareholders shouldn’t care a single bit about these short-term fluctuations. The simple fact is that this investment cycle will come at some point, one way or another, as the growing need for high-end semiconductors is unavoidable as the world continues to digitalize further. This means that ASML will realize all this EUV revenue at some point.

It is important to understand that if the near-term outlook worsens, which it hasn’t yet, with ASML still maintaining guidance and guiding for growth in 2025 and 2026, this will only result in demand and orders being postponed, not demand being wiped out. ASML equipment will remain mission-critical.

So, I would advise you not to blindly focus on near-term developments, but to keep a long-term view.

Being able to pick up ASML shares below €600, at a P/E below 24x, and a PEG of 1x is just ridiculous and an opportunity I am not passing on. Short-term concerns and poor sentiment have pushed ASML shares into oversold and deep value territory. At this point, I believe short-term concerns are more than priced in.

For reference, using a still more than fair 28x long-term multiple (just look at this outlook, fundamentals, and its longevity), and my FY27 EPS projections (which is below the street estimate), I calculate an end-of-2027 target price of €930. From a current share price of €564 (on the Amsterdam Exchange), this translates into potential returns of 20% annually (CAGR) or a return of almost 100% in less than three years.

This is a risk-reward I absolutely love. Therefore, I am very actively growing my ASML position at these levels.

Impressive write up Daan! And couldn’t agree more with your conclusion! Also wrote a deep dive last month and concluded that this is a very very attractive opportunity right now!

Very cool, Daan! congrats on the write-up.