ASML Holding N.V. – Significant growth ahead (A Q1 review)

In this post, we examine ASML's Q1 results and its longer-term positioning and outlook.

ASML ASML 0.00%↑ was the first large-cap semiconductor company to report Q1 earnings yesterday, and we can safely say the results weren’t very well received by the market. Shares ended trading on the Amsterdam exchange yesterday down almost 6.5% on what we would call an overreaction on very obvious short-term issues, which management already explained during the Q4 earnings call in January.

Though, we should add that shares had run up quite high YTD, gaining 20% even after yesterday's correction and close to 50% over the last 12 months prior to the results, propelling its valuation to new multi-year highs.

I mean, its P/E was approaching 50x, and across the board, its valuation metrics were more than 20% above 5-year averages. From this standpoint, the slight sell-off on a slightly disappointing earnings report made sense and has taken some pressure off the shares.

Meanwhile, ASML remains one of our absolute favorite long-term investments, and in this post, we hope to show you why.

What is ASML?

For those unfamiliar with the company, we are talking about one of the most important and advanced companies globally and a leader in the semiconductor industry. We can safely and without exaggerating say that the world would be quite different without ASML.

In a nutshell, ASML Holdings N.V. is a pioneer and a force in the semiconductor industry, commanding global recognition for its cutting-edge innovations and unparalleled precision technology.

At the center of ASML are its lithography systems, the cornerstone of semiconductor fabrication. Through relentless research and development efforts, ASML has crafted state-of-the-art machines capable of producing nanometer-scale features with utmost accuracy. These lithography systems, equipped with groundbreaking technologies such as extreme ultraviolet (EUV) lithography, enable semiconductor manufacturers to create smaller, more powerful chips vital for powering today's digital revolution.

ASML is the only company with the supply chain and technical knowledge to make these advanced machines, giving it an incredibly powerful monopoly. When we say the world would be different without ASML, we are saying that without the company’s EUV machines, we would simply not have been able to create the advanced chips we use in all our electronic devices today, like smartphones, cars, solar systems, and data centers.

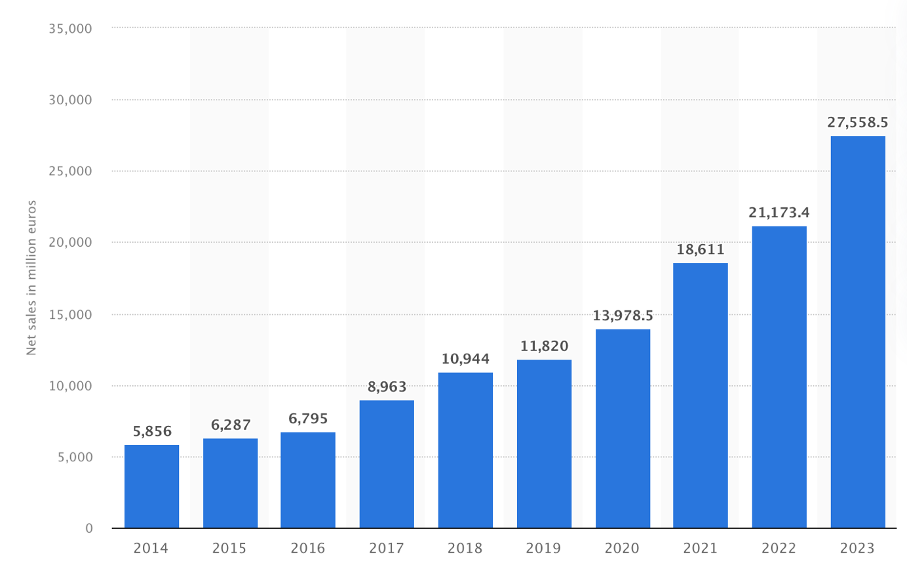

As the only one able to build these machines, it holds an unparalleled monopoly that has allowed it to become an amazing compounder over the last decade, growing revenues at a CAGR of nearly 19%.

So, in simple terms, ASML is the key to technological progress in the semiconductor industry, producing the most advanced semiconductor equipment used by the likes of TSMC, Intel, GlobalFoundries, and Samsung. As demand for semiconductors grows, demand for ASML’s machines will grow even faster, giving it one of the best outlooks you will find.

Let’s get into some more detail

Technologically, it is also worth pointing out that ASML remains far ahead of any competition and continues to develop its machines rapidly, protecting its monopoly in EUV technology. Explaining EUV in very short and simple terms was done well by CNBC (make sure to read this article as it is fascinating):

“EUV stands for extreme ultraviolet, an incredibly short wavelength of light that ASML generates in large quantities to print small, complex designs on microchips. The EUV light is created with tiny explosions of molten tin happening at extreme speeds and then bounced off unique Zeiss mirrors that ASML says are the flattest surface in the world. A small percentage of the EUV light particles reach the surface of a silicon wafer, where they print the minuscule designs that determine what each chip will do.”

Now, it might be hard to comprehend just how strong its monopoly is. Of course, the first question to ask here is how easily competitors can catch up and disrupt ASML’s business. Well, just consider that ASML has been building and delivering EUV machines and its technology for over a decade (since 2013), and in this time frame, not a single company has been able to replicate its machines, not even its first generation.

The main reasons for this are the insane complexity and materials needed. Each of these machines costs up to €300 million and consists of thousands of components derived from nearly 800 specialized suppliers, some of which ASML owns or has a minority position in to gain greater control of its supply chain and ensure it.

To further highlight this insane supply chain, ASML manufactures the different modules in 60 different locations and then ships these to Veldhoven for assembly and testing. After that, it disassembles the device again and uses a whopping 20 trucks and three fully loaded Boeing 747s to ship a single device to the customer.

I mean, considering the sheer complexity of its supply chain and the many years it has taken ASML to build it to be able to manufacture hundreds of machines annually (including DUV), in addition to the technological insanity of EUV technology, it is not hard to see why no other company has been able to compete here. As Chris Miller, assistant professor at the Fletcher School at Tufts University, puts it:

“The machines that they produce, each one of them is among the most complicated devices ever made.”

And ASML is not just pushing out these advanced machines and calling it a day, but it is also rapidly developing these. A great example of its technological progress is the new low NA configuration (Entry-level EUV in terms) it is currently shipping. It has realized a 37.5% productivity improvement through a higher wafer-per-hour capacity, increasing the value for the customer and the gross margin for ASML due to a higher price tag. Management expects this new configuration to be the go-to for customers in the second half of this year and into 2025.

Meanwhile, the company is also working hard on the next generation of EUV technology – High NA EUV – which puts it another step ahead of any competitor thinking of competing and strengthening its moat. Just to put this into perspective, ASML already manufacturers the highest-end semiconductor equipment with its low NA EUV tools, which are required to manufacture the most advanced semiconductors, but this new High NA machine is able to “provide a transistor density that actually is 3x of the transistor density that you will have with a low NA tool,” according to management.

Obviously, ASML has seen a lot of customer interest in these tools as they enable further progress in semiconductor development. Simply put, without ASML’s machines and expertise, current Nvidia GPUs driving the AI revolution would be impossible to manufacture, or at least at scale.

This should tell you how vital ASML is for the entire semiconductor supply chain, how high demand is for its tools, and how strong its moat is. Yes, the company is navigating a challenging year due to a combination of headwinds, but it remains as strong as it gets in the long term.

ASML is well-positioned to fully benefit from the growing need for highly advanced semiconductors for AI, IoT, and cloud computing functions. These factors are expected to propel the semiconductor industry to a total value easily exceeding $1 trillion by 2030, growing at a double-digit CAGR through the end of the decade. Meanwhile, the semiconductor equipment market should be a faster-growing vertical as manufacturers try to keep up with insane demand.

As a result, with its incredible monopoly and importance, ASML is well positioned to fully benefit and keep growing sales at a mid-teens CAGR, with earnings growing even faster due to improving margins. I can’t express enough how vital and promising this company is.

ASML faces short-term headwinds in 2024

However, in the short term, everything is not looking as straightforward. It is safe to say expectations weren’t set very high for ASML for 2024 after it reported its Q4 results earlier this year, as the company is going through a so-called “transition year.” After many years of tremendous growth, driven by growth in the semiconductor industry, the company is now facing several headwinds, which lead to the expectation for a flat year in terms of revenue growth.

Most significantly, after facing lackluster demand over the last year, many large semiconductor manufacturers have scaled down their investments or at least haven’t grown their Capex budget for 2024 as they wait for demand to fully return. As a result, ASML is facing a somewhat weak demand environment.

In addition, many leading manufacturers like TSMC and Intel have been dealing with a shortage of specialized personnel in addition to demand issues, which has led to fab completion delays. As a result, these big ASML customers have temporarily postponed the delivery of ASML equipment, and as ASML only realizes revenue after delivery and installation, this is also a temporary headwind on growth.

Though, positively, the company is seeing no cancellations due to the sheer importance and waiting list for its machines. It has a backlog of multiple years, so its customers can’t afford to cancel an order only to get back in line one year later. As a result, this revenue is pushed forward to future quarters, so it is only a temporary headwind.

Finally, Chinese export restrictions that kicked in as of January 1st also have not made things easier for the company, as Chinese orders were largely able to offset Western weakness. These restrictions are still only expected to impact 15% of revenue from China, so the impact is minimal, but they still aren’t helping the company in a somewhat challenging operating environment, making things even harder for ASML in 2024 on a YoY basis.

All these things combined led to rather low expectations for 2024, and we can clearly see the weakness reflected in its Q1 results. However, the outlook for the latter half of the year and into 2025 is looking better, but more on that later.

Let’s first take a closer look at the Q1 results.

The Q1 earnings report was a bit mixed

ASML released its Q1 earnings report yesterday and reported revenue of €5.3 billion, which fell within its guidance range of €5-5.5 billion. ASML has historically always managed to deliver on its guidance, thanks partly to strong relationships with customers, which give it good visibility.

Still, this is a roughly 18.5% decrease YoY, clearly reflecting the headwinds that ASML is facing in the near term, with pushed-out deliveries weighing heavily. While this is a solid performance considering the circumstances, we must admit we expected more from the company, and revenue fell short of our expectations by roughly €200 million.

On the bottom line, we can clearly see the top-line weakness reflected. Positively, ASML reported a gross margin of 51%, which was once more far ahead of expectations due to several one-off tailwinds and a favorable mix. For reference, ASML previously guided for only a 48-49% gross margin. Still, this was down 60 bps YoY, reflecting the lower sales.

Furthermore, continued investments in the business also led to 8% growth in R&D and SG&A costs, which, in combination with sales weakness, drove down the operating income by 37% YoY to €1.4 billion.

Further down the line, this also impacted net income, which was €1.2 billion, reflecting a net income margin of 23.1%. This came in quite a bit lower than hoped and down 590 bps YoY, again due to higher costs from continued investments in the business and a lower top line.

This resulted in an EPS of €3.11, down 40% YoY, missing the consensus and our expectations despite a lower share count after €400 million worth of repurchases in Q1. The financials clearly reflect ASML's challenging operating environment.

Lower margins have also led to lower FCF, which ASML doesn’t divine in its earnings report. However, we can see that the total cash on the balance sheet has fallen by €1.6 billion from last quarter to €5.4 billion. Meanwhile, long-term debt was flat at €4.6 billion, leaving ASML with a net cash position of €800 million. Regarding financial health, ASML is looking fine, and we can safely assume this will improve rapidly in H2 and into 2025.

Now, across the board, ASML’s results aren’t really surprising in any way. Management managed to deliver on its guidance and report solid results considering the circumstances. While the results did not impress, they certainly were no reason for the sell-off.

The order intake was seen as the bigger issue

The biggest issue in the Q1 earnings report and the leading reason for the post-earnings sell-off was the order intake, which fell well short of expectations. ASML reported an order intake of only €3.6 billion, which was way short of the €5 billion consensus and sitting far below a record order intake in Q4 of €9.2 billion, though roughly in line with last year.

Now, this slightly disappointing order intake may not be a massive surprise considering the record Q4 orders. Over the last six months or two quarters, management has registered nearly €13 billion in orders, which is still impressive and ahead of realized revenue. In hindsight, we might have seen some pulled-forward demand in Q4 as a response to an improving semiconductor industry and some final Capex budgets for the calendar year, leading to a disappointing Q1 order intake. The company has seen this number be quite lumpy over the years.

Considering these dynamics, the order intake is no reason for concern. ASML still has a backlog of right around the €40 billion mark, and we expect orders to bounce back in the second half of 2024 and tick up slightly next quarter.

Furthermore, according to management, it only needs to register orders of just over €4 billion in the remaining three quarters of this year to be fully booked for 2025 to meet the midpoint of its guidance range, sitting at €35 billion in revenue. Therefore, let’s not stress out over a quarter of lower orders, as ASML remains in an exceptional position to grow rapidly once demand improves in the second half of this year and heading into 2025.

While order intake will remain lumpy and hard to predict, we now incorporate the following estimates into our financial models – to give you somewhat of an indication. This is based on the underlying semiconductor industry and Capex budgets from leading customers:

Q2 orders of roughly €3.8 billion

Q3 orders of roughly €5.5 billion

Q4 orders of roughly €8 billion

China remains an important subject for ASML

Regarding geographies, China remains one of the largest markets currently for ASML, accounting for the majority of revenues at 49% last quarter, up from 39% in Q4. Now, this is not the moment to start freaking out about dependence on China and export restrictions, as the current revenue split is very much influenced by headwinds in Western countries and fab completion delays.

China is not facing these similar headwinds, which means it has grown as a percentage of revenue in recent quarters for ASML, partially offsetting this Western weakness. However, in a more normalized environment, such as in 2022, China accounts for only a mid-teens percentage of revenue. We should expect this percentage to drop in the coming quarters to the 20s and the teens in 2025. Eventually, including the restrictions, China's percentage of revenue should fall below the 14% reported for 2022 relatively quickly.

Meanwhile, there could be more restrictions incoming. The US government is reportedly looking to talk to the Dutch government to further impose restrictions on ASML, this time focused on servicing equipment.

For reference, for many, many years, ASML has not been allowed to ship its most advanced equipment to China. It has never shipped its most high-end EUV equipment to China. As of January 1st of this year, ASML also is no longer allowed to ship its most advanced DUV equipment to China, further limiting its Chinese operations and shipments.

These latest reports now indicate the company would potentially also no longer be allowed to service machines in China, or at least up to a point, with the goal of limiting China’s progress in chip development. For ASML, this would impact their service revenue from China. While rather limited in terms of actual revenue, considering its installed base business accounts for only 25% of revenue and China for only a low-single digits of this, it still is not great as it would put further restrictions on ASML and its revenue potential.

Though, overall, we do not view China as a big risk to an investment here.

The near-term outlook remains challenging, but long-term it is poised for growth

This most definitely is the key part of this post and what ASML investors should focus on.

Positive for ASML, the underlying semiconductor industry is improving rapidly after the low in 2023. The best indicator of this is the monthly sales from TSMC, the largest semiconductor manufacturer globally and ASML’s largest customer. Its monthly sales data show a very strongly improving trend, starting the year with 7.9% growth in January and a whopping 34% growth in March, showing a strong improvement in semiconductor demand.

This reflects an improvement in the industry, reflecting global resilient consumer spending, normalized inventory levels, and growing demand for electronics, also helped by the insane demand for AI GPUs.

This recovery in the underlying industry should bode well for expansion and equipment budgets, which will benefit ASML later this year. During the earnings call, management said it is seeing downstream inventory normalize nicely, creating a more favorable environment for its customers.

Most importantly, management reaffirmed its FY24 guidance, naming it a transition year and guiding revenue to be flat YoY around €27.5 billion. This means management is expecting a strong recovery in the second half of the year to compensate for the double-digit decline in the first half of the year.

As for margins, management still expects a gross margin down slightly from last year due to flat revenue levels but growing costs, reflecting investments in production capacity and specialized personnel. Despite the downturn, ASML is still hiring at a significant pace to prepare for the recovery in the second half of this year.

Furthermore, management continues to see a strong uptick in 2025 driven by healthier inventories, secular growth drivers like AI, and many fab openings by its customers. Management expects these factors to come together in 2025 to create a very favorable operating environment, allowing it to recover rapidly.

The company is preparing for this boom through increased capacity. During the earnings call, management indicated that it is continuing to build production capacity to meet demand through the decade's end. In the midterm, it wants to expand to an annual production of 90 EUV tools of low NA, 600 DUV tools, and 20 High NA tools.

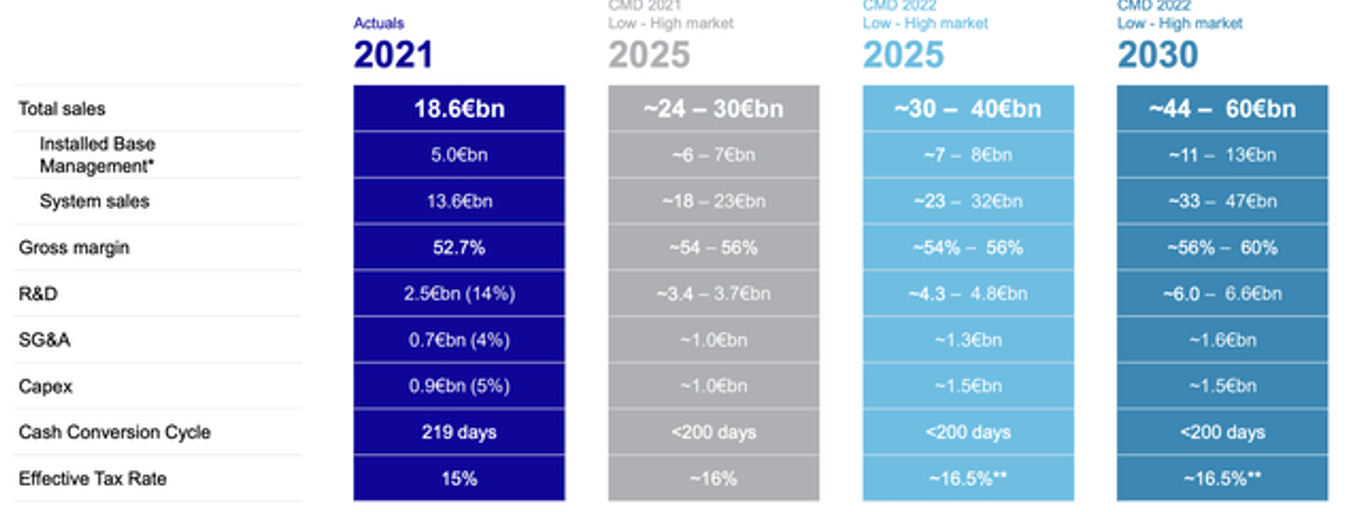

As discussed earlier, the company remains tremendously well positioned in the long term. Also, there is plenty of room for growth in terms of margins. Its 2025 gross margin target was reaffirmed, guiding for a 54% to 56% gross margin. An improved mix, leaning toward higher-margin machines and growing service revenues, which also carry higher margins, will help the margin in 2025.

All in all, management sticks to its 2025 and long-term targets it set 1.5 years ago (visible below), meaning its long-term outlook remains unchanged, even when incorporating this current weakness. This company remains poised for tremendous growth, and investors should focus on the long-term thesis here.

However, Q2 looks to be another challenging one for ASML. Management now guides for revenue of €5.7 billion to €6.2 billion in Q2, reflecting an 11% YoY revenue decline as demand slowly improves, highlighting we saw a bottom in Q1. Furthermore, management expects a gross margin of 50% to 51%.

Considering all of this, we have lowered our FY24 projections. We now expect revenue to be down 1% for the full year and EPS to contract by 8%, based on a net income estimate of 26.5%, driven by a recovery in H2.

However, we have upgraded our longer-term projections to account for the strong expected recovery in demand in 2025, 2026, and 2027. We now expect 2025 revenue to be right around the midpoint of management’s guidance and growth to remain strong in the following years. Furthermore, gross margin improvements and revenue outgrowing costs should lead to margin expansion on the bottom line, with the net income hitting 31.4% in 2025 and growing to 33.8% in 2027, according to our financial projections.

This leads to the following financial projections through 2027.

Based on these projections, ASML shares now trade at 46.5x this year’s earnings and 30x next year’s earnings, with the latter painting a more realistic picture. Obviously, FY24 multiples are based on depressed earnings.

Still, 30x next year’s earnings is far from cheap, but considering its forward growth potential (a 28% CAGR over the next three years), it only translates into a PEG of 1.6x, which sits below its 5-year average of 1.8x, indicating shares aren’t that expensive after this small correction taking some heat off the shares.

However, shares might still be slightly too expensive to buy enthusiastically. Based on our FY26 EPS and a fair value multiple of 32x, which we believe leaves plenty of downside risk here, we calculate a target price of €1065. From a current share price of €854.50 on the Amsterdam Stock Exchange (AEX), this translates into returns of only 8.3% annually, which isn’t quite enough for us.

We do acknowledge that we are working with a relatively discounted multiple compared to its 5-year average of 35x. However, we have to take into account that the company is maturing and is facing the rule of large numbers. We expect the growth rate after 2026 to remain closer to the low teens compared to 18% over the last decade. Therefore, a lower multiple is necessary.

Furthermore, we could see some more analyst downgrades come out in the coming weeks, and some headwinds from sticky inflation and a lack of interest rate cuts to be a headwind for the entire market, which is why we can see some more downside for ASML shares in coming weeks, making us even more hesitant to buy shares at current levels.

For now, we rate shares a hold. We believe shares offer just better value below €820 per share, positioning you for annual returns of over 10%, including an attractive and growing dividend, currently yielding 0.7%.

In the long term, this company remains amazing, so if shares drop below our target price, we will definitely buy opportunistically.

Let us know your thoughts in the comments! Also, please leave a like if this post was of value to you!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

Great recap. With valuation at that level, that leaves little room for error.

Insightful read, thanks for the work, Daan!

The valuation makes it a tough one for me...