Booking Holdings – Shares are on sale once again!

Let's revisit Booking Holdings after it has underperformed YTD and reported Q2 earnings. Let me lay out my bullish thesis!

Let me just start by saying Booking is one of my favorite companies out there. Period.

No, but seriously, how can you not like this business? It is a terrific compounder with a brilliant and shareholder-friendly management team, an undisputed leadership position in a steadily growing market, industry-leading margins, it is a cash flow machine, is constantly gaining market share, and is successfully expanding its offering to create additional revenue opportunities.

Oh yes, it has also recently turned into one of the most attractive dividend growth opportunities after initiating a dividend and is in solid financial health, also to fund plenty of buybacks.

To support these claims, here are some important stats to consider:

Revenue growth at a 12% CAGR over the last decade.

EPS growth at a 15% CAGR over the last decade.

FCF margin of 33% in FY23.

Bought back 30% of its shares over the last six years alone.

ROIC of over 35%

And Booking’s business isn’t really slowing down either, with Wall Street analysts projecting the following:

Booking to grow revenue at an 8% CAGR through 2027.

And EPS to grow at an even more impressive 16% CAGR.

Indeed, whatever type of investor you are, this sounds compelling!

To give you some quick background information, Booking Holdings is a leading global provider of online travel and related services, known for its expansive portfolio that includes well-known brands like Booking.com, Priceline, Agoda, Kayak, and OpenTable. This makes Booking Holdings the leading global OTA or Online Travel Agency.

Headquartered in Norwalk, Connecticut, the company operates in over 220 countries, offering a wide range of services from hotel reservations and car rentals to airline tickets and restaurant bookings. Through its diverse platforms, the company connects travelers with accommodations and experiences, playing a pivotal role in the global travel ecosystem.

I would be surprised if you have never used any of its platforms, to be honest. I use them every time, even if it’s only for the great discounts I can get through the loyalty programs.

Crucially, nowadays, Booking is much more than just a company helping you to find the best travel accommodations; it is slowly becoming a complete one-stop-shop for all that is travel. This is a big driver in the bull-case for Booking, but I’ll get deeper into this later on. Let’s just say management is developing this business in all the right directions, making me extremely bullish on its prospects!

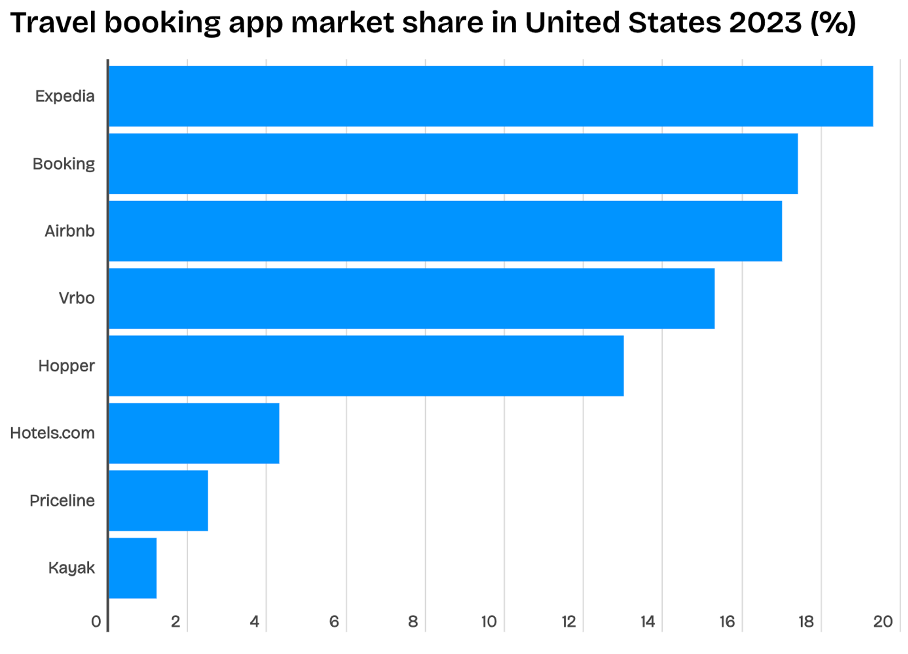

Anyway, as of January 2024, Booking holds a 21.1% market share in the U.S. OTA market, which is down a bit from 2022 - approximately 400 bps. However, with this, it still remains the number #2 travel company in the U.S., only trailing Expedia, which has been gaining quite some share.

Meanwhile, Booking also remains ahead of Airbnb, which has seen its market share flatten at 17% over the last two years. Indeed, despite Airbnb being seen as the disrupter of the travel industry, it is no longer gaining as much ground. It turns out all three can operate just fine together, and Airbnb isn’t eating up Booking and Expedia’s business at all, in contrast to what was feared.

As I have stated before, Booking’s moat is stronger than it might seem. You see, within the online travel industry, the platform with the largest and broadest offering is the most interesting to the consumer. This is an important part of its moat as it creates a virtuous cycle. Its current leadership position attracts a large number of consumers who are likely to stick with the platform for the simple reason of convenience and competitive pricing. This is what I added last time out:

“Thanks to its leadership position and massive user base, accommodations, rental companies, and airlines are also inclined to use the booking platform as it gets them exposed to the largest number of consumers, which then further grows Booking’s offering and also gives Booking a strong negotiating position to keep prices competitive. The platform is simply too important for hotel chains and other accommodation formats.

I hope you can see where I am going here. Booking's current leadership position puts it in the perfect spot for both consumers and accommodations, leading to further market share gains. This makes Bookis ’s leadership position hard to beat and creates quite a strong moat, which shouldn’t be underestimated.

Notably, while its tech stack (which is also best-in-class) might not be too hard to replicate and its business model seemingly not too hard to disrupt (in the end, the Expedia offering isn’t much different), the popularity of its platform and brand, and the way consumers trust the platform, is.”

As a result, I am not too concerned about competition coming from Airbnb and Expedia, which is trying to reinvent itself.

Also, while a market share of 21% in the U.S. might not sound overly impressive, Booking’s strength has never been the U.S. market, but its leading position in Europe and Asia, which brings its global market share to over 40% and growing!

For reference, Airbnb is only looking at a market share of 23%, and Expedia is only in the high teens. Crucially, neither has been able to take market share from Booking in recent years as its competitive position in Europe and Asia is unparalleled, allowing it to outgrow its smaller peers.

As a result, Booking Holdings, through all its travel platforms, remains the undisputed leader in the OTA (Online Travel Agency Market) market, gaining market share and building on its current success, expanding its offering.

With this market expected to keep growing at a 9% CAGR, Booking has a pretty bright future, as it should allow it to keep growing its top line by high-single digits.

However, the company hasn’t been among the best investments so far this year, with Booking shares underperforming significantly YTD, returning a negative 3% against a 12% positive return from the S&P500. Shares have lost a staggering 14% in the last months alone through a combination of the general and post-earnings sell-off.

As a result, since my last coverage of Booking shares, the company has also underperformed, losing another 4.5%.

In my view, this underperformance is entirely unjustified. I have been buying quite a few shares in recent weeks, and as long as Booking trades at a discount to fair value, I plan to keep adding as I am happy to grow my position in this compounder.

In its latest quarterly results, Booking once more outperformed peers and delivered very respectable financial results, easily surpassing the consensus. Despite a somewhat weakening economy, the business is still firing on all cylinders, even as growth is slowing, though not unexpected.

Let me take you through the numbers before updating my financial projections and fair value estimate!

Growth slows down, but still a solid quarter

Booking Holdings reported earnings on August 1st (yes, I am a bit late with this update) and delivered just excellent financial results, even as shares got sold off by roughly 9% in the following trading session, mostly due to poor sentiment and an (expected) slowdown in growth, in my opinion.

Looking at the top-line numbers, however, Booking did very well, beating on both top and bottom lines. For reference, it beat the revenue consensus by a minor but solid 2%, but EPS by a more impressive 8%. Definitely a solid beat across the board as Booking continues to impress Wall Street with its numbers, which came in above the high-end of management’s guidance.

As expected, the travel industry continued to normalize in the latest quarter after a rapid recovery coming out of the COVID-19 pandemic in recent years, which allowed Booking to reach new highs in terms of revenue rapidly. However, this recovery is now largely behind it, resulting in a normalization in growth rates as well.

In the latest quarter, Booking saw room nights booked across its platforms grow 7% YoY to 287 million, which is very healthy growth and better than expected, but also a further slowdown from prior quarters, as expected, but also absolutely nothing to complain about!

Looking at regions, Booking saw the best performance in Asia due to a late recovery in the region, growing by mid-teens. Meanwhile, Europe grew by mid-single digits, as did the U.S. This shows a mild growth moderation in Europe and somewhat of a growth recovery in the U.S., again in line with expectations.

As a result of the 7% growth in nights booked, gross bookings grew 4% YoY. This was three percentage points lower than room nights growth due to a two percentage points headwind from changes in FX and about 1% lower constant currency accommodation ADRs.

Nevertheless, revenue grew 7% YoY to $5.9 billion, partly thanks to a slight improvement in the take rate to 14.1%. This includes a two percentage points headwind from the change in Easter timing and two percentage points from changes in FX. Adjusting for this, which is entirely outside of Booking’s control, revenue was up 11%, better representing current operating health.

Overall, despite growth slowing down in response to a normalization in the travel industry, Booking’s underlying performance remains solid. Crucially, it is all ahead of expectations.

On the bottom line, Booking also performed well, as marketing expenses were up only 8% YoY, growing slightly as a percentage of revenue. Still, this allowed Booking to deliver $1.9 billion in adjusted EBITDA, driven by higher revenue and lower fixed expenses. This represents 7% YoY growth, even as there were a five percentage points of pressure from Easter timing and two percentage points from changes in FX.

A very respectable performance indeed, especially considering that when adjusted for these items, EBITDA grew 14% YoY. In terms of margins, it is better to look at the H1 result to exclude the easter impact. Positively, we can see that in the first half of the year, the EBITDA margin expanded by 160 bps YoY, which is impressive amid slowing top-line growth.

This solid performance also translated into EPS growth of 11% YoY, which was in big part thanks to a 7% lower share count compared to last year after significant buyback in the last 12 months. For reference, net income itself was only up 3% YoY due to higher income tax expenses.

Finally, FCF was an impressive $2.4 billion, representing a staggering 41% FCF margin. This allowed Booking to strengthen its balance sheet, now holding $16.8 billion in cash against $13.4 billion in debt, leaving it in a healthy net cash position.

This solid cash generation in Q2 also allowed Booking to return significant amounts of cash to shareholders. In the quarter, Booking returned $1.9 billion through repurchases and dividends, further lowering the share count.

As for the dividend, Booking initiated this recently, indicating a further focus on rewarding shareholders. Shares currently yield a very respectable 1% based on a payout ratio of only 10%, which is a brilliant setup for long-term dividend growth.

Considering the earlier mentioned mid-teens expected EPS growth and the meager 10% payout ratio, Booking is most definitely one of the most exciting and promising dividend growth stocks out there today.

Booking is positioning itself for long-term success

I already touched on this very shortly before, but a big part of this solid performance, which is ahead of the industry and mostly in line with peers, despite the fact Booking is much bigger than, say, Airbnb and Expedia, is thanks to management’s excellent efforts to continue improving and differentiating its platform.

Booking management is steering this company in all the right directions, focusing on creating a one-stop-shop for all that is travel, growing its platform offering, improving its loyalty program, and focusing on growing its presence in alternative accommodations.

Management’s most important focus here is its connected trip vision, which is all about allowing travelers to book all their travel aspects through the Booking platforms, including accommodation, flights, experiences, rentals, transfers, etc., with the end goal of improving the user experience and growing traveler retention and booking frequency.

Booking believes that by providing a better overall booking experience, travelers may choose to book more trips with them with a higher likelihood of booking directly in the future.

Today, Booking is no longer a business focused on just accommodations as it once was, but it is becoming an actual online travel agency supplying all travel aspects. Ultimately, it should deliver greater user value, keeping these away from competing platforms and generating higher value per user as each user on the platform can book many more aspects of his or her trip.

Booking is making great progress on this front already, seeing connected transactions (booking multiple travel aspects) grow by 45% in Q2, although still only accounting for a high-single-digit percentage, leaving it with plenty of room to grow!

Air tickets are a big part of this connected trip vision and a travel vertical where Booking has been expanding rapidly over recent years through its Booking.com and Agoda platforms. Air tickets booked grew 28% in Q2, as Booking is seeing a healthy number of customers try out this new offering. Also, Booking indicates that the flight offering attracts new users to its platforms, which then also book their accommodation with Booking, generating additional revenues and driving growth.

This all sounds promising, and I firmly believe this is the right strategy to focus on!

In close relation to the connected trip vision and to get customers to stick with Booking, the company is also heavily focused on continuesly improving and promoting its Genius loyalty program, through which users can earn significant discounts, which is one of the best ways to gain customer loyalty in this industry.

You see, if a traveler has reached Genius level 2 or 3, discounts on Booking’s offering get so high that these travelers have no reason to look elsewhere, increasing long-term value for Booking. Positively, 30% of Booking users already sit in either level 2 or 3, meaning Booking sees quite a bit of loyalty already. Also, these customers tend to book much more frequently, which drives additional growth.

Finally, I want to highlight Booking’s solid progress in alternative accommodations, which refers to other types apart from its traditional hotel offering. In this industry, it competes much closer with Airbnb.

Positively, Booking has seen this offering grow very nicely over recent years, with listings growing 11% in Q2 and reaching a new high of 7.8 million, which only marginally trails Airbnb’s 8 million listings.

This is also a faster growing vertical for Booking today, with room nights booked up 12% in Q2 and reaching 36% of revenue, up 200 bps YoY. With this offering expected to keep growing in the years ahead and remaining popular, especially among younger generations, I expect this to remain a growth driver for Booking and to potentially grow to over 50% of revenue.

Overall, with all these efforts, Booking aims to deliver a better planning, booking, and travel experience over time, which should lead to travelers choosing to book directly through Booking’s platforms and more frequently. In other words, it should grow user loyalty and engagement.

Positively, this seems to be working well for the business as it continues to see both user numbers and booking frequency grow steadily. Also, it is indeed seeing a growing percentage of travelers book through the platform’s direct channels, including its mobile app.

For reference, over the last four quarters, 53% of all room nights booked came from its mobile app, up six percentage points YoY, which is terrific.

Overall, I am very happy with these developments and management’s focus. I firmly believe this positions the business favorably for long-term success.

Booking is well able to fight off competition from Airbnb

Coming back to the threat from Airbnb, which I touched upon earlier, I just want to briefly elaborate on why I am not overly concerned here.

Most importantly, as I already pointed out before, Airbnb hasn’t been taking market share from Booking over the last two years, with Booking outgrowing its smaller peer and gaining global market share. In contrast, Airbnb has seen its market share stabilize, indicating Airbnb is not eating up Booking’s lunch. As I have stated in prior coverage, the two companies can operate side by side just fine, operating in their own niche – Airbnb isn’t disrupting Booking’s business as much as once feared.

In fact, data tells me Booking is seeing its competitive position strengthen a bit across the board. You see, one of Airbnb’s real strengths is its popularity among younger generations, which is somewhat of a worry for Booking as Gen Z is expected to account for the majority of travel spend in coming years.

As of earlier this year, global data still shows that hotels remain the most popular accommodation for travelers, with 68% indicating they prefer a hotel. However, this differs across age groups, with younger generations like Gen Z choosing Airbnb, while Gen X prefers hotels. From this standpoint, Airbnb does look favorably positioned to take more market share.

Yet, I don’t expect this trend to persist as Booking is gaining share in this category and positioning itself better to compete. One of the things helping Booking gain share among younger generations is its best-in-class loyalty program, growing alternative accomodations offering, and complete offering, which is far more compelling than Airbnb’s offering.

Just how important loyalty programs are was highlighted in a recent survey, with 58% of Gen Z travelers indicating they actively look for loyalty programs when booking accommodations, which is higher than 50% of all travelers. These loyalty programs are becoming especially important when it comes to brand loyalty, with only 9% of Gen Z travelers stating they trust a single brand and a whopping 71% stating that loyalty programs are an extremely important factor when it comes to brand loyalty.

With Booking being a one-stop-shop for travelers, it looks much more attractive as a place to score rewards and improve customer loyalty. It's these factors that are helping Booking gain some share among younger travelers. At this point, I do not see Airbnb continuing to gain market share like it did over the last decade, if at all.

Airbnb simply doesn't have enough to offer any more or to differentiate it, and Booking is the more attractive platform overall, which is visible in performance and market share gains. I expect this to benefit it going forward, as it has done in recent years already.

Therefore, I do not view Airbnb as a massive disrupter to Booking’s business, and I expect both to show steady growth. Still, Booking will continue dominating the industry with its more complete offering, platform, and brand strength.

Recent data only confirms my confidence here.

(I am planning a deep dive data comparison between Airbnb and Booking soon, so stay tuned for that!)

We try to keep all our analysis free for all of you to enjoy and benefit from! Want to support our work a little bit more and show your appreciation? Consider upgrading to paid ($5 monthly).

This allows us to push out even more content and gets you access to our exceptionally performing portfolio and premium subscriber chat!

We appreciate you all!!

Outlook & Valuation

Finally, let’s talk about the outlook and growth expectations in the medium term.

For the current quarter, Booking expects growth to decelerate further as the industry normalizes and might experience some weakness from cautious consumer spending. Therefore, management now guides for room night growth of 3-5%, gross bookings growth of 2-4%, and revenue growth of 2-4%.

This laps 21% revenue growth last year and translates into revenue of roughly $7.5 billion at the midpoint. Furthermore, management expects adjusted EBITDA of between about $3.25 billion and $3.35 billion, flat YoY due to deleveraging from sales and other expenses and from growth in IT expenses.

For the full year, management has made quite a few changes to its outlook after a better-than-expected first half. However, it did lower its gross bookings growth forecast for FY24 to around 6%, which is due to less growth in flights than expected previously.

However, this doesn’t impact revenue as much, allowing management to upwardly revise its revenue growth estimate to over 7% and its adjusted EBITDA growth expectation to the high-single digits as the FY EBITDA margin should still expand solidly.

In the end, this translates into adjusted EPS growth of over 15%, also up from prior expectations.

It's pretty solid overall!

For my financial projections, it doesn’t change an awful lot, as I already counted on somewhat of a guidance update. However, I have slightly lowered my FY25 and FY26 expectations as I am counting on a bit more economic weakness for a prolonged period. You can find my updated estimates below!

Based on these updated projections, Booking shares now trade at 20x this year’s earnings, roughly similar to when I last discussed the company in May and translating into a PEG of 1.25, which is a roughly 50% discount to its 5-year average. Also, on an earnings basis, Booking trades at a 30% discount to Airbnb, which is in no way justified, in my view. Crucially, growth expectations are mostly similar.

Ultimately, my conclusion remains the same as last time: Booking shares trade at an unjustified discount as it continues to be underappreciated. Even when assuming a conservative 20x earnings multiple, which is more than deserved, looking at its global market position, financial health, shareholder returns, and growth potential, I calculate an end-of-2026 target price of $4711. This translates into potential annual returns of nearly 13%, including dividends.

Considering this leaves us with plenty of downside protection and a lot of room for further upside, I continue to view Booking as a great investment opportunity after its YTD underperformance.

This company is a real industry stalwart with significant growth ahead. I am happy to buy Booking shares at any price below $3700 per share.

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

If you enjoy Rijnberk InvestInsights, it would mean the world to me if you invited friends to subscribe and read with us. If you refer friends, you will receive benefits that give you special access to Rijnberk InvestInsights.

Who doesn’t like some free premium content, right?

How to participate

1. Share Rijnberk InvestInsights. When you use the referral link below or the “Share” button on any post, you'll get credit for any new subscribers. Simply send the link in a text, email, or share it on social media with friends.

2. Earn benefits. When more friends use your referral link to subscribe (free or paid), you’ll receive special benefits.

Get a 1-month FREE premium subscription for 3 referrals

Get a 3-month FREE premium subscription for 8 referrals

Get a 12-month FREE premium subscription for 20 referrals

Thank you for helping get the word out about Rijnberk InvestInsights!

Cheers!

Awesome write-up. I like both Booking and Airbnb and agree the industry is big enough for both! 🙌

Very impressive company, thank you for sharing Daan.