Broadcom – An AI Powerhouse With 20%+ Growth and a 44% FCF Margin

From explosive AI growth to unmatched cash generation, Broadcom is simply built differently - a best-in-class technology conglomerate!

On September 4th, networking semiconductor and enterprise software giant Broadcom released its fiscal Q3 results, once again delivering strong quarterly results and surpassing consensus estimates for the 15th consecutive quarter.

Though it wasn’t the quarterly results that impressed investors. In fact, the actual results likely didn’t even impress investors in the slightest, considering shares trade at 45 times earnings, so such a minor beat was already well priced in, potentially even disappointing considering Broadcom’s track record of blowing past consensus estimates.

No, what really impressed investors and pushed shares up 10% in the following trading session, despite their already insanely high price, were three things: An absolutely brilliant outlook combined with very bullish commentary, CEO Hock Tan extending his tenure as CEO, and Broadcom’s very bullish commentary on a massive hyperscaler contract.

In other words, it is the medium- to long-term commentary and underlying developments that impressed. No matter how high expectations for Broadcom already were, these have to be revised upward as the company is truly firing on all cylinders, fully benefitting from the AI revolution like no other.

Simply put, Broadcom is proving once more that it more than deserves the premium it’s awarded – there is just no other business like it, and its outlook is mind-blowing.

Let me take you through it all – its Q3 results, AI growth drivers, fundamental positioning, and exceptional outlook – before updating my investment thesis and valuation estimates by reviewing its fiscal Q3 numbers, developments, and revising my medium-term projections.

However, first, in this introduction, let me provide you with some background information in case you are not familiar with this one-of-a-kind conglomerate and the reason it’s one of the biggest beneficiaries of exploding AI demand.

You see, Broadcom is one of the most strategically essential companies in global technology today. What began as a mid-sized semiconductor supplier has, under the leadership of CEO Hock Tan, transformed into a $1.5 trillion infrastructure powerhouse that combines two worlds: high-performance semiconductors and enterprise software.

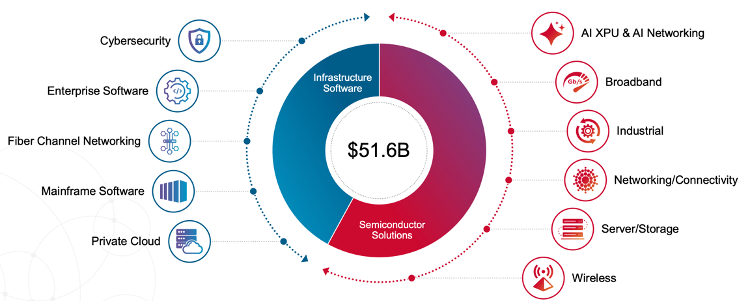

In very simple terms, on the semiconductor side, Broadcom dominates networking chips that power hyperscale data centers, cloud infrastructure, and AI clusters, with products like its Tomahawk and Jericho switch silicon serving as the backbone of modern internet traffic.

Broadcom’s semiconductors are essentially the highways inside AI data centers. Training and running AI models isn’t just about powerful GPUs; it’s about connecting tens of thousands of them so they can work together. That requires ultra-fast, reliable networking chips that move enormous amounts of data between processors with as little delay as possible.

This is where Broadcom comes in: its networking silicon (like the Tomahawk and Jericho families) makes sure data can flow seamlessly across massive GPU clusters. Without this “plumbing,” GPUs would sit idle, bottlenecked by slow connections. In other words, Broadcom’s chips don’t do the math of AI, but they make sure the math can be done at scale, which is why they are indispensable to every hyperscaler building out AI infrastructure.

It’s no surprise then that Broadcom is experiencing an explosion in demand, as hyperscalers spend billions to expand their AI capacity and rely heavily on Broadcom’s networking solutions to make it possible.

Also, beyond semiconductors, Broadcom has built a formidable enterprise software business, which today generates roughly 46% of its revenues. Through acquisitions such as CA Technologies, Symantec Enterprise, and most recently VMware, Broadcom has assembled a portfolio of mission-critical software that enterprises depend on to run, secure, and virtualize their operations.

This dual model—a rapidly growing semiconductor engine paired with a highly profitable, recurring software business—makes Broadcom a unique conglomerate and one of the most strategically essential companies in the entire tech ecosystem.

Alright, with that background now established, let’s delve into the results!

Welcome to InvestInsights — an independent equity research publication rooted in long-term, buy-and-hold investing, publishing actionable stock/equity research reports weekly!

📈 You’re reading my latest [FREE] stock analysis. If you like this analysis, make sure to like & subscribe to receive much more like this!

If you’d like full portfolio access (14% CAGR since 2022) & additional exclusive reports, consider becoming a paid subscriber!

Broadcom delivers another sublime quarter

Broadcom once again delivered in its fiscal Q3. As it has done for 15 consecutive quarters now, it comfortably beat consensus estimates. It set record highs across the board, primarily driven by remarkable AI-related demand, which is fueling exceptional top-line growth. In the meantime, Broadcom continues to deliver best-in-class and improving margins and cash flows, as operating leverage grows.

Really, there isn’t much negative to say about this report. Let me show you!

Broadcom reported a record Q3 revenue of $16 billion, up 22% YoY, which is very similar to the growth in the last two quarters and better than both management’s own guidance and Wall Street’s estimates, beating the consensus by $130 million.

This excellent growth and beat were driven by better-than-expected strength in AI semiconductors and healthy progress in its software operations, particularly strong growth in VMware.

Furthermore, management indicated bookings traction remained very strong, particularly related to large AI-related networking semiconductor orders, as highlighted by a record backlog of $110 billion, which is truly exceptional, accounting for almost two full years of revenue!

Breaking down this growth by segment, the real standout, of course, remains semiconductor solutions. Segment revenue growth accelerated to 26% YoY and $9.2 billion, which was driven almost entirely by AI-related demand. For reference, AI semiconductor revenue was $5.2 billion, with growth accelerating further to a very impressive 63% YoY, as demand for its highest-end datacenter networking products remains quite incredible.

Supporting this growth is Broadcom’s top-notch innovation and best-in-class products. As compute loads and AI clusters continue to grow to keep up with demand, Broadcom’s networking solutions become increasingly important.

For reference, (without getting too technical) Broadcom’s highest-end Jericho4 Ethernet fabric router can handle clusters beyond 200,000 compute nodes crossing multiple data centers. Additionally, its Tomahawk 6 switch is capable of providing 102.4 Terabits per second of switching capacity in a single chip – double the bandwidth of any Ethernet switch currently available on the market.

In this market, Broadcom remains unequaled.

Meanwhile, its decades of expertise in networking and its best-in-class technologies are giving it an especially strong position in XPUs.

Broadcom’s XPU business (custom AI accelerators) is firing on all cylinders, growing to 65% of AI revenue, and quickly becoming its primary growth driver. Interestingly, this surge in custom AI accelerators is rooted in the needs of hyperscalers.

Companies like Google, Meta, Microsoft, Amazon, and OpenAI increasingly want their own silicon tailored to their workloads rather than relying exclusively on Nvidia. Owning the chip design lets them optimize performance, reduce costs, and avoid vendor lock-in. This is why XPU is likely to be the future and a massive growth market, projected to grow by at least a high-teens CAGR through 2030.

Yet, designing and manufacturing those chips at scale is no small feat. That’s where Broadcom comes in. Broadcom has decades of expertise in application-specific integrated circuits (ASICs), enabling it to take a hyperscaler’s specifications and transform them into silicon that’s highly optimized for their data centers.

This is the same playbook Broadcom has long used in networking and storage chips, now applied to AI. The company acts as a co-developer, supplying design expertise, IP blocks, and advanced packaging to bring these custom accelerators from concept to production far faster than a hyperscaler could alone.

The result is a sweet spot: hyperscalers get bespoke chips tailored to their AI models and infrastructure, while Broadcom earns long-term, high-margin revenue streams. Demand is particularly strong right now because AI workloads are scaling explosively, hyperscalers are desperate to diversify beyond Nvidia, and custom silicon is one of the few levers that can deliver both performance advantages and cost savings at scale.

So, Broadcom’s strength in this area isn’t just about supplying chips—it’s about being the trusted enabler for the most prominent AI players who want differentiated silicon but don’t have the in-house manufacturing or ASIC design muscle to pull it off alone.

Currently, Broadcom’s XPU revenue is primarily derived from just three large hyperscaler customers, which raises concerns about extreme revenue dependency. With so few customers, any slowdown in spending, shift in strategy, or move to another supplier could have a significant impact on growth.

This concentration urges some caution when looking further ahead, as visibility on hyperscaler spending cycles remains limited, and even minor adjustments by a single customer could ripple meaningfully through results.

That said, the long-term picture remains very encouraging. AI demand shows no signs of abating, with hyperscaler capital expenditure projections continuing to rise as workloads scale and models become increasingly compute-intensive. Broadcom is not just riding this wave—it is steadily gaining wallet share as hyperscalers expand their reliance on its custom accelerators and networking solutions. Importantly, the bespoke nature of Broadcom’s silicon creates considerable customer lock-in, making switching costs high and relationships sticky.

You see, when a hyperscaler partners with Broadcom to build a custom AI accelerator, the process isn’t just ordering a chip—it’s a multi-year collaboration. Broadcom integrates its proprietary IP blocks, advanced packaging, and networking interfaces into a hyperscaler’s architecture, and then co-optimizes the design to fit seamlessly with that customer’s data center fabric, software stack, and workloads. Once a design is in production, it becomes deeply embedded in the hyperscaler’s infrastructure. Switching to another partner wouldn’t just mean designing a new chip; it would require overhauling the systems surrounding it, rewriting parts of the software environment, and risking performance or compatibility issues on a massive scale.

Hyperscalers may experiment with bringing more design work in-house. However, they still rely on Broadcom for physical design, verification, and advanced manufacturing support, especially when timing to market is critical. In short, the switching costs here are both technical and organizational—hyperscalers would have to spend years and billions of dollars to entirely displace Broadcom, with no guarantee of achieving the same level of efficiency.

Together, these factors suggest that while customer concentration warrants some caution, Broadcom is exceptionally well-positioned to benefit from sustained AI infrastructure spending for years to come.

And there was more good news last quarter, as Broadcom was able to close a deal with a fourth hyperscaler customer for XPUs, signing a massive $10 billion of orders already from this one new customer, which is highly beneficial, with none of these revenues accounted for in prior projections, which is why management expects fiscal FY26 AI revenue to come in considerably higher than previously anticipated.

This is a significant positive and a win, likely prompting us to substantially increase our medium-term revenue estimates. But more on this outlook in a bit.

First, focusing on the fiscal Q3 results, Broadcom reported non-AI semiconductor revenue of $4 billion, flat sequentially. These revenues continue to recover slowly, as demand remains suppressed amid macro concerns.

Meanwhile, Broadcom did execute well within infrastructure software operations, with revenue growing 17% YoY to $6.8 billion, surpassing its $6.7 billion guidance. Contract bookings also remained very strong at $8.4 billion in Q3, driven primarily by strong growth in VMware, which Broadcom has been able to integrate seamlessly within two years; the operations are now growing faster and more profitably than before the acquisition.

In other words, Broadcom’s Q3 execution was excellent, with incredible AI growth and strong software traction driving a robust top-line performance.

Moving to the bottom line results, Broadcom’s execution was once again excellent, as rapid revenue growth and controlled cost growth allowed for growing leverage and expanding margins.

The company reported a gross margin of 78.4% for its fiscal Q3, better than guidance, driven by higher high-margin software revenues and a favorable product mix.

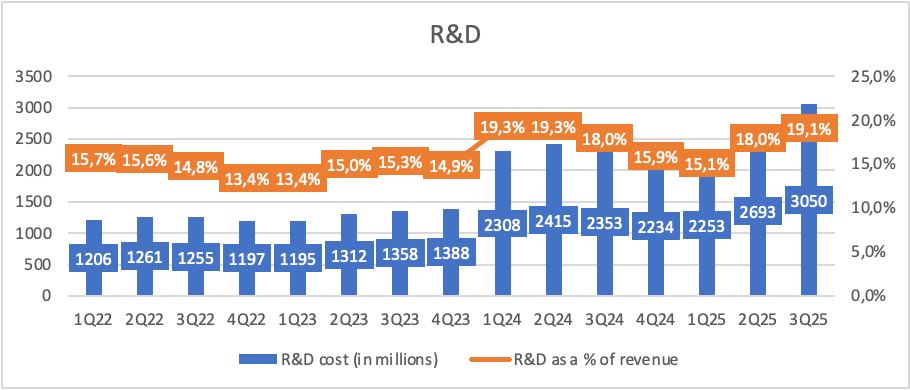

Operating expenses totaled $4.8 billion, primarily comprising $3.1 billion in R&D expenses (the highest ever spent), accounting for 19.1% of revenue, which is the highest level in just over a year and up 110 bps YoY, as Broadcom remains fully committed to innovation to maintain its leadership position.

This resulted in an operating income of $10.5 billion, up 32% YoY, reflecting an operating margin of 65.5%. For reference, even as the gross margin was down sequentially by 100 bps due to higher revenue from higher cost XPUs, the operating margin still expanded by 20 bps YoY due to excellent cost management and growing operating leverage, outweighing this headwind.

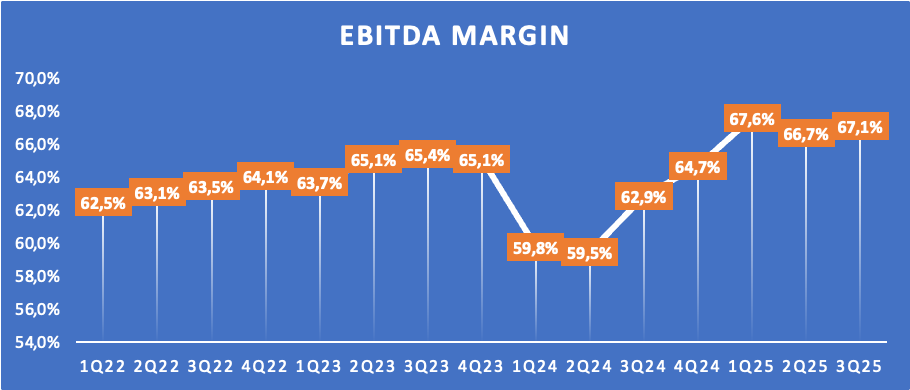

This also resulted in an EBITDA of $10.7 billion, representing a 67.1% EBITDA margin, up 420 bps YoY.

Finally, Broadcom reported a free cash flow of $7 billion for the quarter, reflecting a 44% margin, which remains excellent. Broadcom has firmly established itself as one of the market’s true FCF machines, consistently converting between 40% and 50% of revenue into free cash flow. That level of efficiency is almost unheard of at this scale, highlighting the strength of its operating model, the discipline with which it integrates acquisitions, and the stickiness of both its semiconductor and software franchises.

On an annualized basis, Broadcom is now generating more than $20 billion in free cash flow, providing enormous optionality. It can return large sums to shareholders through dividends and buybacks while also preserving ample dry powder for strategic M&A—something that has been central to the company’s growth story under Hock Tan.

Perhaps most importantly, this consistency gives investors rare confidence. Even in an industry known for its cyclical swings, Broadcom’s diversified portfolio and relentless focus on costs enable it to continue generating cash at a level that few other tech companies can match.

That then brings me to financial health. At the end of Q3, Broadcom held $10.7 billion in cash on its balance sheet, leaving it with ample liquidity. However, this does stack up against a considerable $66.3 billion in debt following the blockbuster acquisition of VMware.

Notably, this debt load is trending downward as Broadcom works diligently to pay off this debt while still rewarding shareholders. Additionally, its weighted average coupon rate and years to maturity are 3.9% and 6.9 years, respectively, so this isn’t too bad.

And, most importantly, I am not overly concerned about this debt load, considering Broadcom’s strong history of capital allocation and its healthy, growing cash flows, which should enable it to manage debt effectively.

Hock Tan to remain on as CEO through 2030

Probably even more important than these excellent numbers just discussed was the announcement made during the earnings call that CEO Hock Tan will remain as Broadcom’s CEO through at least 2030.

Why is this so important?

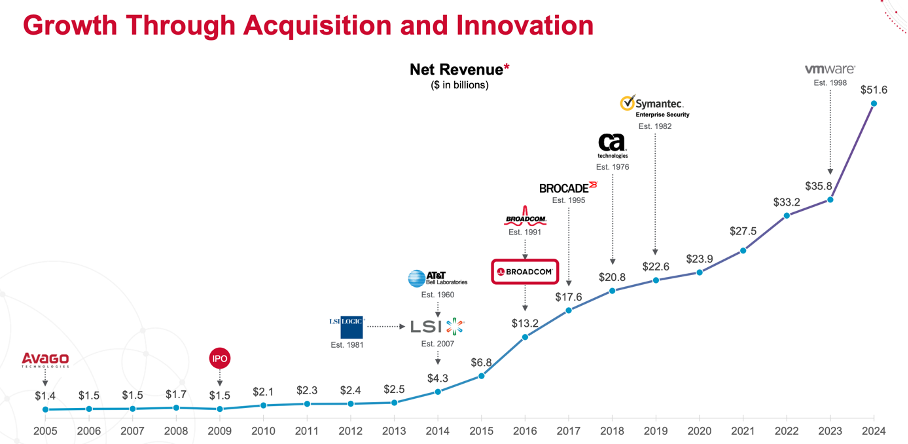

Well, one could practically see Tan as the founder of Broadcom and one of the best CEOs in the world. Hock Tan has served as the President and Chief Executive Officer of Broadcom since March 2006, a tenure now approaching two decades.

When Tan took over what was then Avago in 2006, it was a small chipmaker spun out of HP with about $2 billion in annual revenue. Fast-forward to today, and Broadcom is a $1.6 billion market cap giant with diversified hardware and software franchises.

Tan has been such a dominant and long-lasting force at the helm that many investors and industry observers treat him almost like a founder. He didn’t create the original Broadcom, but under his leadership, Avago transformed into a semiconductor powerhouse. Through the merger, acquisitions, and strategic pivots, he effectively “refounded” the company into the Broadcom we know today. The stock’s meteoric rise, diversification into infrastructure software, and now the rapid ascent in AI semiconductors are all closely tied to his vision.

Broadcom is Hock Tan; there is no way around it, and this visionary staying on is excellent news.

This continuity in leadership during a critical expansion phase for Broadcom is invaluable. Since becoming CEO in 2006, Tan has overseen an astonishing stock surge—up an extraordinary 26,750% after accounting for splits and dividends. That level of growth reflects sustained strategic execution, and maintaining his leadership intact provides confidence that Broadcom will continue to navigate AI and semiconductor markets with purpose and precision.

Additionally, Tan’s track record of bold acquisitions and transformation—from steering Broadcom through major mergers, building its software and hardware portfolios, to reshaping networking and AI infrastructure offerings—adds weight to the argument that continuity matters. His leadership isn’t just administrative; it’s the engine behind Broadcom’s profound evolution.

Also, Hock Tan’s acquisition record is almost unrivaled in the semiconductor and infrastructure space, and what makes it “insane” isn’t just the size or frequency of the deals, but his uncanny ability to integrate them into Broadcom’s machine-like operating model and extract enormous value. He has spent more than $120 billion on M&A over his tenure, but unlike many serial acquirers who stumble, Tan has a near-perfect track record of making those deals accretive.

Each integration has driven margins higher, strengthened cash flow, and made the company more diversified—without the cultural or operational implosions that often plague large acquisitions. Investors have come to trust that when Tan announces a deal, he won’t overpay, and he’ll make it work.

That’s why many on Wall Street think of him not just as a dealmaker, but as a refounder-CEO who uses M&A as a core competency, much like Warren Buffett uses capital allocation at Berkshire. The compounded effect is staggering: from a niche chip supplier to one of the most strategically important infrastructure companies in the world.

I believe it’s safe to say it’s fantastic news that he will stay on for at least another 5 years – it gives me a load of confidence in Broadcom’s forward trajectory.

Want more out of your subscription? Even more content like this weekly?

Consider InvestInsights PRO - $7.50/month ($70/annually)

This gets you:

A guaranteed 6+ stock analyses every month (roughly 2-4 paid-exclusive).

Full insight into my own portfolio (14% return CAGR since 2022).

Instant transaction alerts anytime I make a move (Fully transparent).

A complete overview of all my target prices and ratings (online available).

Exclusive access to the PRO subscribers Discord channel.

You will get immediate access to these recent analyses of Netflix, American Express, PayPal, Uber, and Meta!

Outlook & Valuation

Finally, time to address Broadcom’s outlook, and as I already alluded to before, its outlook has considerably improved even more after last quarter, in particular thanks to the massive fourth hyperscaler deal signed by Broadcom, adding $10 billion in revenue in the medium-term, but with potential to be an enormous contributor well into the future.

Crucially, this entire contribution wasn’t accounted for in prior estimates, so a long-term projection hike is unavoidable. Its outlook already was brilliant, but it’s only getting better.

Starting with the short-term guidance, management now projects AI semiconductor revenue of $6.2 billion in Q4, up 66% year-over-year, accelerating further from last year’s 63% growth and increasing by $1 billion sequentially. That is some incredible growth.

Additionally, non-AI semiconductor revenue is expected to continue showing weakness, with seasonality likely leading to flat sequential growth to roughly $4.6 billion. Broadband, server storage, and wireless are expected to improve, while enterprise networking remains down quarter-on-quarter.

Finally, software revenue is expected to grow 15% YoY to $6.7 billion.

Taken together, Broadcom now guides for Q4 revenue of $17.4 billion, up 24% YoY, as momentum remains strong. This is well ahead of a pre-earnings consensus of $17 billion. Additionally, management guides for healthy EBITDA expansion, guiding for a 67% EBITDA margin. And the gross margin is expected to decline 70 basis points sequentially due to a higher mix of XPUs and wireless revenue, which carry lower margins.

Ultimately, this is very robust guidance.

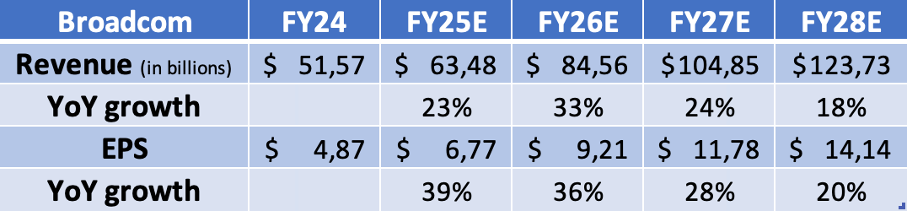

As for my projections, I have considerably raised my fiscal FY25 projections for both revenue and EPS to reflect the Q3 outperformance and better-than-expected Q4 guidance.

However, more importantly, I am raising my medium-term guidance by a lot. Broadcom continues to demonstrate excellent demand for its AI-related products within its existing customer base, and this fourth customer agreement is a significant growth catalyst. As a result, I am raising my FY26 revenue guidance by a whopping $11 billion, my 2027 estimate by almost $20 billion, and my 2028 revenue estimate by $25 billion.

Similarly, I have considerably raised my EPS estimates for 2026-2028 by an average of 30-40%. EPS will continue to outgrow top-line growth, driven by growing operating leverage.

Yet, we must acknowledge that the one significant downside risk I still see here is extreme customer concentration. To me, this still urges some caution. Ultimately, when a substantial portion of the revenue stream comes from only a handful of buyers, Broadcom’s fortunes are closely tied to their spending cycles, strategic priorities, and willingness to continue outsourcing chip design. If even one of these hyperscalers slows investment, pivots to a different in-house design strategy, or shifts more work to another partner, Broadcom could experience a significant impact on growth.

This will remain very important to monitor, but at this time, I am not yet seeing any indications of any slowdown, especially as Broadcom continues to gain wallet share with these three customers, has just signed a fourth, and is not too far away from a potential deal with a fifth, which isn’t even accounted for in these projections yet.

So, yes, these projections do carry some risk, but also offer considerable room for upside.

You can see my full projections below.

Honestly, considering just how much we were able to raise financial projections following last quarter’s results and developments, I can’t argue against the post-earnings 10% pop at all. However, it has also not made Broadcom shares any more affordable.

Following its price gains since earnings, shares now trade near their all-time high share price at $344 or an almost $1.6 trillion market cap, up 113% over the last twelve months and 47% YTD. As a result, shares now trade at:

51x this year’s earnings and 37x next year’s earnings.

A growth-adjusted PEG of 1.8x

60x this year’s FCF or 42x next year’s FCF.

Looking at these multiples on a headline basis, this looks expensive in any way – there is no denying it.

But when viewed through the lens of free cash flow generation and sustained growth in AI-driven demand, the premium looks more justified. In other words, investors are not just paying for today’s numbers—they are paying for a business that throws off extraordinary amounts of cash while still compounding at double-digit rates, underpinned by structural demand trends that show no signs of slowing.

Ultimately, we are looking at a PEG of just 1.8x, which isn’t too bad. For reference, numerous companies deliver similar growth, but nowhere near Broadcom’s cash generation, trading at a PEG of at least 2-3x. I believe this valuation is rather fair, especially considering there is plenty of upside to these estimates. Additionally, 36x earnings for a 28% EPS CAGR through fiscal FY28 isn’t ridiculous in any way.

It's all about perspective.

Now, of course, there is also the customer concentration to consider, as well as the risk of a slowdown in customer spending, which could significantly impact these estimates. However, this is broadly offset by the potential upside from new hyperscaler deals. So, ultimately, a mild discount or some caution is justified, but no more than that.

Ultimately, all things considered, Broadcom is definitely worth the premium. Despite the customer concentration, this is one of the best-managed businesses globally, a FCF machine, and poised to keep benefitting from the AI revolution through its very tight custom semiconductor relationships with these hyperscalers.

So, I believe it’s fair to assume a fiscal FY27 exit multiple of 35x, as I expect Broadcom to keep delivering at least mid-teens growth as we head into the next decade. Taking this multiple and my FY27 estimate, I calculate an end-of-2027 target price of $412. Based on current prices, this reflects potential annualized returns of approximately 8.5% (including dividends).

Personally, I believe this doesn’t reflect a good risk-reward balance, with shares priced just a little too high at the moment, leaving limited room for outperformance without revenue upside.

Therefore, I am still not inclined to buy shares after the surge in recent weeks. While I would love to own shares, I need a better risk-reward balance to make the move. Currently, I am aiming for a share price of $310-$315 to pull the trigger.

For now, I am on the sidelines, hoping for a minor pullback!

Rating: Hold - Accumulate below $310 - $315

2027 Target Price: $412

Implied CAGR from the current price: ~8.5%

AVGO is certainly firing on all cylinders. All the numbers look great apart from the debt (but manageable given great FCF). But .... it's priced for perfection. Too heavy for me. Is want to see sub $300 before considering.

PS. Great analysis!

Great one! Just subscribed to you, feel free to check my channel!