Broadcom Inc. – Impressive but also heavily reliant on AI and hyperscaler CapEx

Great quarterly results, shares down 16%, AI remaining a brilliant tailwind. Is now the right time to pick up some $AVGO shares?

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

On March 6, Broadcom released its fiscal Q1 results, which were sublime. The company blew past consensus estimates as AI spending growth remained considerable, leading to some relief for Wall Street and investors alike, with the AI bull case still going strong.

Broadcom is still reaping the benefits from rapidly growing hyperscaler CapEx budgets to grow cloud capacity, which requires large amounts of Broadcom networking solutions. This is reflected in rapid AI-related revenue growth.

For Broadcom, which is definitely one of the best-managed and highest-performing businesses out there, this results in very solid double-digit growth and expanding margins, which were already best in class. I mean, how many businesses are able to consistently deliver an FCF margin of around 50%?

This is one of the highest quality businesses out there, or rather conglomerates, now boasting a market cap of just below $1 trillion and fully benefitting from the boom in AI demand and subsequent investments in data center capacity, leading to an incredible outlook.

However, at the same time, I have some growing concerns as well, as Broadcom’s bull case, leading to high expectations and premium multiples being awarded, seems to be built on just a handful of key hyperscaler customers, making Broadcom’s outlook and growing revenue stream extremely sensitive to disruption, in my view.

But I will get to all that in a bit. First, let’s delve into the excellent fiscal Q1 results!

Fiscal Q1 results + highlights

Q1 revenue was a record high $14.9 billion, up 25% YoY (includes the contribution from VMware)

Q1 semiconductor revenue was $8.2 billion, up 11% YoY

Q1 Infrastructure Software revenue was $6.7 billion, up 47% YoY (includes the contribution from VMware)

This was just another excellent quarter from Broadcom, with revenue surpassing the consensus by $330 million, or a solid 2.2%. YoY growth, even excluding VMware, remained solid despite one less operating week this year compared to Q1 last year.

Boosting growth was once more a big revenue contribution from AI-related revenue, which totaled $4.1 billion in Q1, up a whopping 77% YoY and well ahead of management’s own expectation for $3.8 billion in AI-related revenue, driven by stronger shipments of networking solutions to hyperscalers.

This reflects what management already indicated in prior quarters: hyperscalers continue to aggressively invest in data center capacity growth, which requires more of Broadcom’s most advanced networking solutions, able to connect massive amounts of GPUs. In this category, Broadcom leads the industry with unique solutions. Here is what management said during the earnings call:

“In the process of working with the hyperscalers, it has become very clear that while they [hyperscalers] are excellent in software, Broadcom is the best in hardware.”

In the coming years, Broadcom aims to be able to scale toward clusters of 500,000 accelerators, driven by significant innovation and considerable R&D investments. Hyperscalers in this AI arms race simply can’t afford to replace Broadcom’s best-in-class products with lower-quality alternatives, either in-house or from Broadcom peers.

This incredible AI-related demand offset weakness in other semiconductor verticals, with non-AI semiconductor revenue down 9% sequentially in Q1 to $4.1 billion due to a seasonal decline in wireless and a slow recovery elsewhere after considerable weakness in recent quarters, industry-wide.

Combined, this led to a solid 11% growth in semiconductor revenue.

Meanwhile, Infrastructure Software revenue was strong in Q1, in part thanks to some Q4 deals pushed out to Q1 and also thanks to Broadcom successfully converting VMware customers from a footprint of largely perpetual license to one of full subscription, of which now 60% is completed.

Broadcom shows steady progress here and a good integration of the VMware stack, which is now very close to being fully completed in under a year, which is nothing short of brilliant.

This strong top-line performance, driven by excellent execution and incredible AI demand, also benefited Broadcom’s bottom line.

Q4 adjusted EBITDA was a record high $10.1 billion, up 41% YoY and reflecting an EBITDA margin of 68%

The gross margin was 79.1%.

Operating income was $9.8 billion, up 44% YoY, at a 66% operating margin.

Q4 FCF as $6 billion at a 40% FCF margin.

When it comes to operating efficiency, Broadcom remains unmatched. Even after the massive VMware acquisition, Broadcom is able to deliver a best-in-class margin profile with terrific cash flows.

As for the details, the gross margin was better than expected, thanks to higher infrastructure software revenue and a more favorable semiconductor revenue mix. Meanwhile, operating expenses trended down nicely compared to last year, thanks to excellent efficiency gains made in the VMware operations, driving costs down 27% YoY, even as management continued to invest heavily in R&D.

This resulted in a multi-year high EBITDA margin of 67.6%, up 780 bps YoY but also up 290 bps compared to last quarter and up 390 bps from a pre-acquisition Q1 2023 level of 63.7%, showing very impressive margin progress with room for further improvement.

Due to efficiency gains in the VMware operation, improvement in the software segment, in particular, was strong. Here, the gross margin improved 450 bps YoY to 92.5%, and the operating margin hit 76%, up 17 percentage points YoY. That is an absolutely blinding improvement, far ahead of expectations.

This shows that Hock Tan led Broadcom continues to be an acquisition beast.

Further down the line, this led to excellent cash flows, with a 40% FCF margin and $6 billion in FCF, which is pretty great, even as this number is heavily impacted by cash interest expense from debt related to the VMware acquisition and cash taxes due to the mix of U.S. taxable income. You can safely assume this will improve in the year ahead to around 50% again, at the very least.

As for the balance sheet, this remains far from ideal. The acquisition of VMware considerably worsened Broadcom’s balance sheet, with it largely paid through debt. As a result, Broadcom now carries a gross debt load of roughly $69 billion, offset only marginally by $9 billion in cash on the balance sheet, leaving the company with roughly $60 billion in net debt.

However, whereas I would normally try to avoid companies with this kind of net debt, I am willing to give Broadcom a break. With the amounts of FCF Broadcom generates, it could pay off all this debt in 2-3 years, so ultimately, I don’t view it as a massive problem.

For reference, last quarter, Broadcom lowered its net debt by $1.1 billion, even as it still handsomely rewarded shareholders through $2.8 billion in dividends and $2 billion in buybacks. As a result, the weighted average coupon rate and years to maturity of the debt are 3.8% and 7.3 years, respectively, which is rather okay.

Considering the rate at which Broadcom could pay off this debt if it chooses to, I don’t view it as a massive risk or drag on the business.

Meanwhile, Broadcom continues to pay a decent dividend of 1.2%, supported by a healthy 42% payout ratio and growing rapidly at a 14% CAGR (5-year).

Ultimately, yes, the debt load is far from ideal, but Broadcom seems to have it covered just fine, especially with cash flows expected to grow at a blinding rate. Ultimately, this is a business that should be able to generate at least $20-$30 billion per year in FCF, of which about $10 billion per year could be easily assigned to debt repayment.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe if you like our content! Want to receive even more of our investment insights and show even more appreciation? Please consider upgrading to our paid tier (only $7.50 monthly or just $70 annually).

In addition to all the free stuff, this also gets you access to even more premium analyses (a total of 3 per month), full access to my own (outperforming) portfolio, immediate trade alerts in the subscriber chat, and a full overview of all my price targets and rating, and even more!

Outlook & Valuation

This excellent quarter came together with a great outlook that was once more above expectations amid significant demand for AI-related products.

Q2 group revenue to be up 19% YoY to $14.9 billion

Q2 semiconductor revenue to grow 17% YoY to $8.4 billion.

Q2 software revenue to be up 23% YoY to $6.5 billion.

Q2 EBITDA is expected to be roughly 66%.

This guidance includes the expectation for AI-related revenue growth in Q2 of 44% YoY to $4.4 billion. Meanwhile, non-AI semiconductor revenue is expected to be flattish sequentially as inventories continue to be brought down and demand returns.

Ultimately, this leads to management guiding for Q2 semiconductor revenue of $8.4 billion, up 17% YoY, accelerating from 11% in Q1, driven by continued rapid AI revenue growth and a stabilization in non-AI revenue.

Meanwhile, software revenue is anticipated to reach $6.5 billion in Q2, growing 23% YoY, which leads to the projection for another quarter of record-high revenue and solid 19% YoY growth.

Finally, margins are expected to decline mildly compared to Q1, mainly due to an increase in R&D expenses. This results in a 20 bps decline in gross margin and an EBITDA margin of roughly 66%.

As I said, this is excellent guidance ahead of expectations.

Furthermore, longer-term, Broadcom management reaffirmed what it said last quarter and believes its SAM (Serviceable Addressable Market) to be in the range of $60 billion to $90 billion in fiscal 2027.

This remains an incredibly bullish prospect. Also, note that this is based on only three hyperscaler customers Broadcom now serves on a high-volume basis. Yet, the company is already “deeply engaged” with two other hyperscalers, helping them create their own customized AI accelerator, with production likely to start later this year, and it has two more in the waiting room.

So, while the company only serves and ships customer XPUs in volume to two hyperscale customers, there are now four more looking to use Broadcom’s best-in-class products.

Crucially, these additional four customers aren’t included in the TAM projection above, suggesting a massive potential upside to these estimates, which is more than enough to spur additional investor enthusiasm.

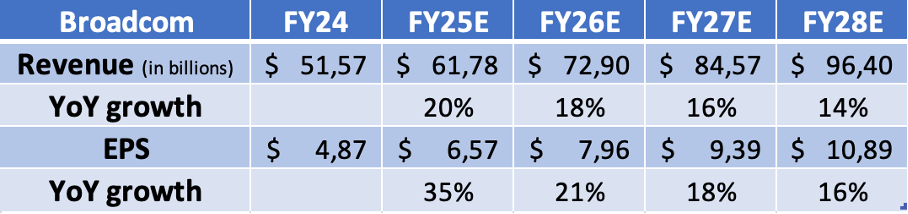

Ultimately, this excellent quarter and guidance, as well as the report of even more hyperscaler interest in Broadcom’s networking solutions, have urged me to raise both my near-term and medium-term estimates. Broadcom is simply doing much better than already expected.

Here are my updated projections.

That then brings us to valuation, and here, there really is some room to be more positive compared to December 2024, as revenue and EPS projections have gone up, but Broadcom’s share price has come down amid broader market pressure.

Even as Broadcom shares gained 8.5% last Friday after delivering its great earnings report, they remain down considerably from three months ago. They have lost 16% since my late-2024 coverage and are dropping below my targeted buying range of roughly $200 to $210 per share.

This has made shares quite a bit more affordable and more attractively priced.

However, at the same time, Broadcom’s heavy dependence on AI to drive growth, as was clearly visible last quarter, does raise some concerns as well that I didn’t see as much back in December.

Yes, I believe Broadcom is best positioned to benefit from rising hyperscaler CapEx budgets, but to match current growth projections and estimates, lower CapEx growth by this handful of customers can be detrimental, and not all signs point to this trajectory continuing.

Some initial signs are pointing to hyperscalers easing investments as actual demand for cloud computing capacity might be weaker than expected, with a ramp-up slower than anticipated. Microsoft is reportedly cancelling some of its data center leases, and the initial demand for AI features at companies like ServiceNow and Salesforce isn’t that blinding yet.

This has led to some doubt over these cloud investments by the likes of Microsoft, Oracle, Amazon, and Google, which might prove less aggressive in the years ahead as demand needs to pick up. In this situation, the demand for Broadcom’s networking solutions would also drop.

Now, at the same time, Broadcom is in close contact with each of these hyperscalers, so I would assume they have pretty good visibility on demand, and they continue to guide for blinding demand through the end of the decade, contradicting reports of easing hyperscaler CapEx growth.

Based on this, I am not overly worried yet, but my point remains the same: Broadcom is heavily reliant on AI and a handful of customers to drive growth at levels that justify current multiples. If cloud investments drop or a single large customer moves to a different networking provider, this would be a big hit for Broadcom.

This raises risk considerably and, in my opinion, requires somewhat of a discount.

At a share price of just below $200 right now, Broadcom shares trade at roughly 30x the fiscal FY25 consensus, down from 34x back in December. While still expensive, this makes shares quite a bit more appealing. However, more interesting is that this lower multiple comes with higher growth expectations, translating into a growth-adjusted PEG of only 1.3x, which is a considerable 20% discount to the semiconductor median, meaning investors are currently not fully pricing in Broadcom’s projected growth and counting in quite a discount.

Ultimately, considering Broadcom’s incredible track record, excellent leadership team, and best-in-class operations and margins, I believe shares are now much more compelling, even when factoring in the revenue risk I just discussed.

If Broadcom delivers on its current projections and AI growth doesn’t slow, it is a tremendous opportunity from these levels, with mid-teens revenue growth and a 22% EPS CAGR over the next four years. That is quite incredible, and there is still a lot of room for upside amid additional hyperscaler demand.

Ultimately, I believe a 1.5x PEG and 28x earnings multiple are more than reasonable here, accounting for additional upside and risk. Based on this and my current fiscal FY27 EPS projection, I calculate a target price of $263, representing potential returns of about 11.5% annually (CAGR) or around 13%, including dividends.

I believe this represents an excellent risk-reward profile, with plenty of room for outperformance. I believe Broadcom is likely to outpace global benchmarks in a base case scenario.

Therefore, I believe shares are now a solid buy.

Quite attractive Q2 growth figures!

who are the hyperscalers working with broadcom?