Market Insight – TSMC and Synopsys

TSMC reported Q4 earnings last week and issued very bullish guidance for 2024, which caused a spurt in semiconductor stocks. Meanwhile, Synopsys announced it plans to acquire Ansys for $45 billion.

TSMC remains a strong buy after reporting Q4 results

Taiwan Semiconductor Manufacturing Company, or TSMC, reported its Q4 earnings last week. While the earnings itself only marginally beat the consensus, the guidance issued by management gave the entire semiconductor industry a massive boost, with the SOXX ETF gaining 8% in a single week.

For those unfamiliar with the company (although I highly doubt there are many), TSMC is the world’s largest semiconductor manufacturer (foundry). TSMC does not design semiconductors but entirely focuses on manufacturing these for its fabless clients like Nvidia, AMD, Qualcomm, and Apple, among many others.

As a result, the company plays a pivotal role in enabling innovation across various industries by providing cutting-edge semiconductor solutions and advanced manufacturing capabilities. Staggeringly, the company manufactured 12,689 different products, using 288 different technologies and servicing 532 different customers in 2022.

The company has built an incredible technological dominance over the last three decades, resulting in it accounting for 56% of global semiconductor manufacturing and generating close to $70 billion in annual revenue. In advanced node manufacturing, particularly in 3nm and 5nm nodes, TSMC dominates even more, being the only company with large-scale manufacturing. Crucially, this gives it an edge when it comes to AI, which requires these most advanced semiconductors for which the likes of Nvidia and AMD are forced to go to TSMC, positioning it exceptionally well. This is how management explained this during the Q4 earnings call:

“TSMC is a key enabler of AI applications. No matter which approach is taken, AI technology is evolving to use more complex AI models as the amount of computation required for training and influence is increasing. As a result, AI models need to be supported by more powerful semiconductor hardware, which requires the use of the most advanced semiconductor process technologies.”

This is precisely why TSMC’s Q4 results and 2024 guidance are crucial indicators for the entire semiconductor industry and why a single company’s results boosted share prices for tens of others. As the largest manufacturer of semiconductors, the company’s guidance gives us a good idea of the industry’s 2024 performance, which is why we want to pay some attention to management’s commentary, guidance, and the Q4 results. Luckily, this is all looking great for fabless semiconductor companies and semiconductor equipment manufacturers alike.

TSMC delivers once more in Q4

Before we get into the outlook and management’s 2024 commentary, let’s first quickly review TSMC’s Q4 results. The company beat the Q4 consensus by a slim margin as it saw demand improve and benefitted from demand for its advanced nodes.

Q4 revenue fell by 1.5% YoY to $19.62 billion, steadily improving sequentially as demand returns. Revenue was up 13.6% sequentially. On top of that, Q4 results were supported by the ramp-up of 3nm production and the strong demand for these new advanced nodes, particularly for AI-related purposes.

We all know that demand for Nvidia’s datacenter GPUs has been above supply and that Nvidia has been facing manufacturing limitations. With Nvidia using TSMC as its manufacturer, we can safely say that every single bit of the 3nm capacity TSMC builds is immediately booked, which is why it is able to rapidly boost revenue growth as it expands production capacity.

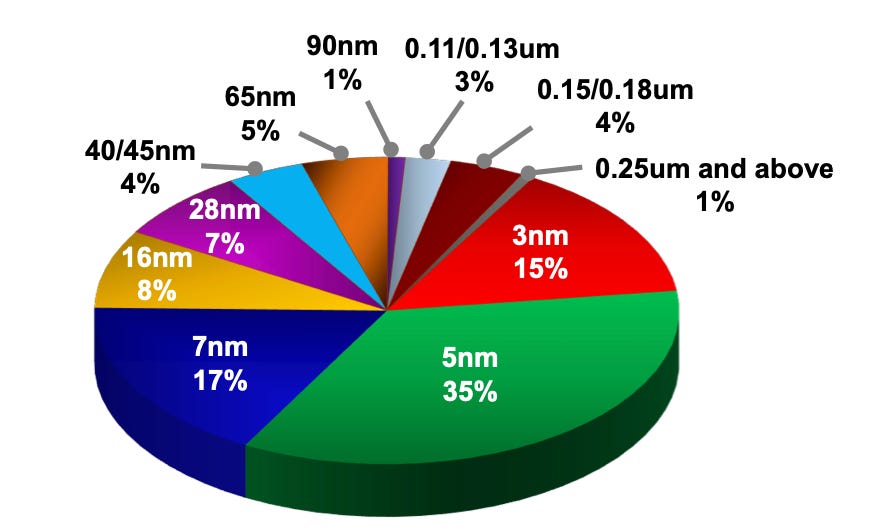

This is also reflected in its revenue split, with advanced nodes now accounting for 67% of total revenue, driven by growth in 3nm and 5nm revenue. The 5nm node accounted for 35% of revenue in Q4, up from 32% one year ago, and the 3nm node contributed 15% of revenue, up from just 6% one quarter ago, which is a terrific acceleration driven by the supply and demand dynamic.

Moving to the bottom line, the story gets somewhat more complicated. The gross margin was down 130 bps sequentially to 53% as the company is fully ramping up 3nm production, which increases costs. Moreover, this is down 920 bps YoY. Though, this looks much worse than it really is. This is simply the result of TSMC keeping up investments and focusing on technological progress even as the top line weakens. Furthermore, this is compared to very strong margins one year ago, which will not return any time soon as the company continues to invest heavily in new nodes.

The operating margin was also down sequentially by 10 bps to 41.6%, which is also down 10.4 percentage points YoY due to a combination of a weaker gross margin and growing operating expenses in the face of a falling top line. Again, don’t award too much value to these comparisons. The operating margin was still strong and ahead of expectations.

As a result of these weaker margins, EPS was $1.44, down from $1.82 one year ago.

Following this decent Q4, we can make up the FY23 balance, and I can say it does not disappoint. Yes, revenue was down 8.7% YoY to $69 billion, but considering the downturn we have seen, this is far from bad. Furthermore, according to TSMC management, the semiconductor industry contracted by 2% in 2023, while foundry fell by 13% YoY, indicating the company delivered an outperformance once again and continues to gain market share.

For the entire year, the gross margin fell by 520 bps to 54.4%, reflecting lower demand and the 3nm and 4nm ramp. This focus on continued investments in advanced technologies also dragged on the operating margin, which was down 690 bps in FY23 to 42.6%, which is still industry-leading by a significant distance, even as the company continues to invest over $30 billion in CapEx annually.

Furthermore, TSMC ended the quarter with a total cash position of close to $48 billion and debt of just below $30 billion, leaving it in a tremendous financial position. For reference, even after the revenue decline in 2023 and the significant amounts of CapEx spend, TSMC still generated over $9 billion in FCF at an FCF margin of around 13%. This company is a freaking cash flow machine, and this puts it in a significantly advantageous position against its closest competitors, Samsung and potentially Intel, which aren’t anywhere close in terms of cash flows, giving TSMC superior financial strength, which should help it maintain its technological and capacity edge.

In the end, even in the face of significant headwinds, this company remains one of the most impressive businesses in the world and one of the most important ones as well.

2024 guidance is incredible

Now, moving to the highlight of the Q4 earnings release, it is time to take a look at management’s 2024 guidance and commentary, which inspired a very bullish stance from investors toward close to all semiconductor stocks.

TSMC now guides for FY24 revenue to grow by the low- to mid-20 percentages in US dollar terms as it is poised to take full advantage of the boom in demand for AI chips as it grows production capacity of 3nm nodes. This leads to the expectation for revenue from 3nm technology to triple and account for a mid-teens percentage of total revenue in 2024, which is staggering.

For Q1, management now guides for revenue to be between $18 billion and $18.8 billion, ahead of the consensus of $18.23 billion prior to the release. This includes the impact of smartphone seasonality. At the midpoint, this represents an increase of 10% YoY. Meanwhile, the gross margin is expected to be flat at 52% to 54%, and similarly, the operating margin is projected to be between 40% and 42%.

Meanwhile, TSMC management now guides the semiconductor industry to rebound in 2024 by double digits of around 10%, while the foundry industry should rebound more strongly by approximately 20%, which means TSMC expects to outperform the underlying industry once more.

However, more importantly, this also indicates that better times are ahead for most players in the semiconductor industry, which led to significant optimism toward these stocks.

Furthermore, management guides for CapEx spend between $28 billion and $32 billion, which is roughly flat YoY. During the earnings call, management indeed indicated that it looks to level off the rate of increase in capital spending as it looks to capture and harvest the growth it has invested in.

As CapEx growth is going to be flat, we could potentially see management grow FCF more rapidly, leaving it with more room to return cash to shareholders through dividends and repurchases.

Most importantly, this also fuels a bullish outlook for semiconductor equipment manufacturers like ASML, AMAT, KLA, and Lam, which are poised to benefit from these investments made by TSMC and its peers. Clearly, 2024 will be a rebound year for these stocks, as well as the entire industry returning to growth mode after a dip in 2023, making the increased optimism last week fully justified.

We remain extremely bullish on most of the semiconductor industry, highlighted by the fact that 20% of our portfolio is focused on this particular industry. Especially the semiconductor equipment manufacturers mentioned above are well-positioned to benefit from this new upcycle and the growing demand for semiconductors, being positioned as the so-called “picks and shovels.” These will be great plays to benefit from AI and semiconductor demand growth.

Finally, despite the headwinds it has faced and the significant investments ahead, TSMC management sticks to its long-term growth goals laid out in 2022, guiding for revenue growth of between 15% and 20% through the cycles and a gross margin of above 53%, which is still very much a promising outlook.

Crucial to this growth outlook is advanced node production capacity expansion, and positively, the company is well on track with 4nm process technology production about to start off in the first half of 2025 in its Nevada facility, which should allow it to service its Western customers better and reduce geopolitical risks, while of course also adding to its capacity.

However, the second Arizona facility is now expected to start operations by 2027 or 2028, from a prior 2026, which is not great but also far from horrible. On top of this, TSMC has also decided to further expand its 3nm manufacturing capacity in Taiwan with a new expansion in Taiwan Science Park.

Meanwhile, TSMC is also already focusing on the next generation of semiconductor technology. It is on track with its N2 technology for volume production in 2025. Management believes this will extend its technology leadership and allow it to capture even more of the future AI-related opportunities.

Overall, we believe TSMC is one of the mightiest companies in the world. While geopolitical risks are often a subject of discussion, their global importance also protects them. I mean, Washington would rather go to war with China than lose control of Taiwan. Therefore, we believe geopolitical risks are often overstated, and with TSMC still trading at a discounted multiple of just 18x this year’s profits, it presents an excellent opportunity.

Where do you find a company growing revenue by 15-20% through the cycles while also being one of the world’s most powerful and important companies? After its Q4 results and an 8.5% jump in share price YTD, TSMC remains a no-brainer in our view, and we can only rate this company a strong buy at its current price of $113.

Synopsys plans to acquire Ansys

Over the last couple of weeks, rumors emerged on Synopsys's possible acquisition of Ansys. The rumors caused Synopsys stock to fall below $500 per share, 20% below its end-of-2023 high. Clearly, investors weren’t sure what to think of the acquisition of multiple tens of billions, which would most likely cause some dilution and the balance sheet worsening.

However, we at InvestInsights are big fans of Synopsys's acquisition and aggressive approach and viewed the share price correction as a massive buying opportunity. We laid out our complete investment thesis and analysis in one of our very first articles on this platform. For more information on Synopsys and the investment thesis, we recommend reading that article, which can be found here.

Last week, Synopsys officially announced it is moving forward with the deal, with the terms close to being finalized. Synopsys will be paying roughly $390 per share or about $45 billion for Ansys, comprised of $19 billion in cash and $16 billion in Synopsys stock, making it one of the largest technology deals in recent years.

The deal represents a 29% premium over Ansys’ stock price prior to the rumors, and we can see how this might seem like a very hefty price tag for a company reporting only $2.2 billion in revenue and expected to grow this at around 10%, which is slower than what analysts expect Synopsys to report through 2027.

Furthermore, with Synopsys using both a significant amount of debt and shares to pay for the acquisition, the proposition gets even more concerning for Synopsys shareholders. Not only will these face quite some dilution, with Ansys shareholders owning 16.5% of the combined company following the proposed acquisition, but Synopsys’ splendid balance sheet with absolutely no debt at the moment will also take quite a hit.

The company plans to fund the deal by taking on $16 billion in debt, with the remaining $3 billion in equity coming from its cash balance, which should easily cover the remainder by the time the deal has received antitrust clearance, which is estimated to take at least 24 months. However, this still means the company will end up with $16 billion in debt.

However, what could partially offset this financial impact and help Synopsys keep its cash levels at healthy levels is the potential sale of its Software Integrity Group, which accounts for 9% of revenue and slightly falls outside of both Synopsys’ and Ansys’ focus areas. It is well-known that the segment has been under review by management. With it now looking to acquire Ansys, we expect Synopsys to sell this segment to, most likely, private equity to raise some more cash and create a more streamlined company.

So, why do we still favor this deal despite the financial burden?

As explained in my prior article, Synopsys is already the world’s leader in electronic design and engineering software, making it a crucial factor in the semiconductor industry, working together with all major players in their chip design process. However, through this acquisition, it will become an even more formidable player in the industry, offering customers everything they might need in their design process and validation.

The step makes a lot of sense despite the significant price tag. For reference, ANSYS is a global engineering simulation software company that provides solutions for product design and development. They specialize in offering simulation tools that enable engineers to analyze and optimize the performance of their products across various industries. ANSYS's software helps in simulating physical phenomena, such as fluid dynamics, structural mechanics, and electromagnetic fields, allowing engineers to make informed decisions and enhance the efficiency and reliability of their designs.

Crucially and most importantly, the deal will merge Synopsys’ EDA technology, which is already adopted by most global semiconductor giants, and Ansys’ broad lineup of electronic simulation and analysis tools, potentially creating a superior, holistic, powerful, and seamlessly integrated silicon to systems approach and product, better serving customers’ evolving needs.

Especially when considering the increasing complexity of today’s systems and designs, it makes a lot of sense for Synopsys to enhance its product offering, keeping it more than relevant and even further ahead of the competition. This is how TheNextPlatform explained the significance and effects of the deal:

“No matter what, it is clear that the ability to simulate a complete system, not just a chip, is the wave of the future. This is the only way to wring every possible efficiency out of a design. And with AI helping with that simulation, we strongly suspect that the time to design completion and the start of manufacturing can be brought down for all kinds of systems.”

Apart from creating a superior product offering, the deal also opens Synopsys up to new industries in which Ansys already has a strong foothold, including aerospace, defense, automotive, energy, and industrial, massively expanding its TAM. According to Synopsys management, the deal will grow its TAM by a staggering 50% to about $28 billion, while total revenue based on today’s numbers will grow to over $8 billion.

Nevertheless, according to Synopsys CFO Shelagh Glaser, the deal won’t immediately be accretive until at least a year after closing. However, management believes it can cut around $400 million in costs over three years and increase revenue by cross-selling both offerings by $400 million in four years. Add to this the long-term advantages of the deal and everything discussed above, and we believe the combination of both companies results in a very impressive market leader poised for even faster growth.

While the short-term financial impact might be significant, the long-term benefits are apparent, and we believe it positions the company for more substantial growth by offering better solutions and products as well as penetrating new industries, resulting in market share gains.

Furthermore, Synopsys and Ansys already have over half a decade of experience working together through a close partnership, which gives me some additional confidence that Synopsys management knows what this deal brings them and how it can be very accretive.

All in all, we view the deal as significantly accretive and expect it to have a significant positive impact on the company’s long-term growth and strength. Furthermore, whether the deal gets approved or not, we continue to view shares as a buying opportunity, even after shares have rebounded by 12% from a low of $484 in January.

Thank you for reading this newsletter. Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which I hope will be insightful!

Please make sure to like, restack, and share this post to increase our reach and support our work. Thank you!

Not subscribed yet? What are you waiting for?!

Disclosure: I/we do have a beneficial long position in the shares of SNPS and TSM either through stock ownership, options, or other derivatives. This article expresses my own opinions and we are not receiving any sort of compensation for it.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.