Chipotle Is a Best-in-Class Compounder With a Bright Future (Deep Dive)

What a business! But is it worth its steep price tag?

Today, I am going to be focusing on Chipotle, one of the hottest and highest-rated fast-casual food chains in the U.S., known for its flavorful yet incredibly fresh Mexican cuisine-inspired food offerings, which have set it apart from the competition and rapidly made it one of the most popular chains in the U.S.

Getting right to the point, I will argue that Chipotle remains one of the most promising companies in the restaurant industry, deserving of its premium valuation, which seems to be somewhat of a contrarian view these days. Recent struggles have eroded investor trust in the company's future, unrightfully so.

Granted, a significant recent slowdown in growth, combined with the loss of its rockstar CEO and the company’s exposure to tariffs and weakening consumer spending, does not look promising and is a reason for concern, at least in the near term. Combine that with Chipotle’s consistently high premium valuation, as highlighted by a current P/E of 42x – that’s a tough pill to swallow.

It’s not hard to see why Wall Street is no longer so enthusiastic. However, at the same time, I believe Chipotle’s fundamentals remain excellent. I admire the company’s positioning within the fast-casual dining industry, which is perfectly aligned with secular shifts in consumer demand that are leading to rapid growth in its underlying market. Additionally, the company’s room for expansion remains massive, both in the U.S. and internationally, likely fueling solid growth well into the next decade.

On top of this, the company’s financial profile is brilliant. Chipotle’s margins are best in class, cash-on-cash returns are far ahead of peers, and the company’s ROIC and ROE are showing brilliant progress. And it does this all with not a single dollar in debt on the balance sheet.

In other words, the company stands out from its peers and remains a compelling choice in the industry. Although it may face near-term headwinds, its long-term prospects remain excellent, as I will thoroughly outline and discuss throughout this article.

However, does it fully justify Chipotle’s premium valuation at this time, especially considering the near-term headwinds, risks, and uncertainty it’s facing? Are shares a good buy today, or should we aim for a lower entry price?

In this Deep Dive, I will attempt to answer this question by examining all the details that matter to investors, providing a clear view of Chipotle’s prospects and appeal.

But first off, let me tell you a bit more about the company, its positioning, and brand.

This is all you should know about Chipotle, its positioning, and unique approach.

Starting with the basics to ensure we understand all aspects of this business, Chipotle Mexican Grill is a fast-casual restaurant chain founded in 1993 and headquartered in Newport Beach, California. It is one of the hottest franchises in the U.S. today, thanks to its unique positioning and approach, which play into growing needs and preferences.

Crucially, Chipotle, unlike most competitors, doesn’t use a franchise model; it owns and operates all of its own stores, which gives it far tighter control over operations and cost structures. This control helps maintain consistent standards and profit margins across locations. This represents a significant difference compared to most of its peers.

Now, just to avoid some instant confusion: fast food and fast casual aren’t entirely the same concepts. Fast-casual dining sits between fast food and full-service restaurants. It aims to provide the speed and convenience of fast food, along with the quality and dining experience of a sit-down restaurant, often appealing to more health-conscious and discerning consumers.

It is important to note that recent secular shifts in consumer preferences are enabling the fast-casual dining market to grow significantly faster than the fast-food industry.

Moving our focus back to Chipotle, the company sets itself apart from the competition through its emphasis on serving high-quality Mexican-inspired food made from responsibly sourced ingredients, which include antibiotic-free meats, organic beans, and a variety of toppings.

Additionally, unlike most restaurants in the fast-food industry, Chipotle operates on a model that prioritizes sustainability, transparency, and food integrity. Its "Food with Integrity" philosophy guides decisions around sourcing, animal welfare, and environmentally conscious operations.

Hopefully, you can see how this strategic focus by Chipotle aligns perfectly with current consumer preference trends, offering healthier and sustainably responsible food options. This is what has made the chain such a popular choice for U.S. consumers and what has given it a significant edge over its larger peers, even eroding the market share of the established order, despite its higher price point.

Chipotle maintains the easy access of fast food while offering far higher-quality products.

This unique positioning is a significant growth driver for Chipotle, as it exposes the company to a rapidly growing market. For reference, the U.S. health and wellness food sector is expected to double in size from 2023 through 2030, while the global healthy foods market is projected to grow at a 10% compound annual growth rate (CAGR), driven by heightened consumer awareness of nutrition and a desire to prevent lifestyle-related diseases.

This significantly outpaces the respective markets of fast food peers. The U.S. fast food market is only expected to deliver a 3.4% CAGR over the same time frame. So, clearly, Chipotle has secular demand shifts on its side, which should support growth, as it has over the past decade.

Particularly among the younger generation, this trend is strong, making Chipotle even more popular among Gen Z, which bodes well for its future, with these generations growing in wealth.

This already all looks pretty great – Chipotle is excellently positioned.

However, this is not the only factor that has contributed to Chipotle's success over the last decade, making it a household name in the U.S. Other factors contributing to its success and appeal include its simple menu, robust digital ecosystem, strong branding, and food innovation.

The strengths of Chipotle’s menu, which is highly regarded and has made it a consumer favorite, are its simplicity, with a menu that focuses solely on burritos, bowls, tacos, and salads, and its high level of customizability, allowing customers to tailor their meals with a selection of freshly prepared ingredients and toppings.

Simple but strong, with enough for customers to choose from. This enables Chipotle to maintain competitive prices, keep ingredients fresh, and minimize complications for customers. At the same time, the company changes its menu choices enough to keep customers engaged and interested. For example, over the years, Chipotle has introduced new items, such as brisket, cauliflower rice, and lifestyle bowls tailored to specific diets (e.g., keto, Whole30), without complicating its operations. These limited-time offerings keep the menu fresh and drive customer trial, while the core menu remains simple and efficient.

Additionally, the company has developed a robust digital ecosystem over the years, featuring effective digital ordering and delivery options, as well as a robust loyalty program.

All these factors combined have led to considerable success for Chipotle over the last decade, resulting in a strong approximate 10% market share in the U.S. fast-casual dining market. This is impressive, considering the market's fragmentation with thousands of restaurant chains to choose from.

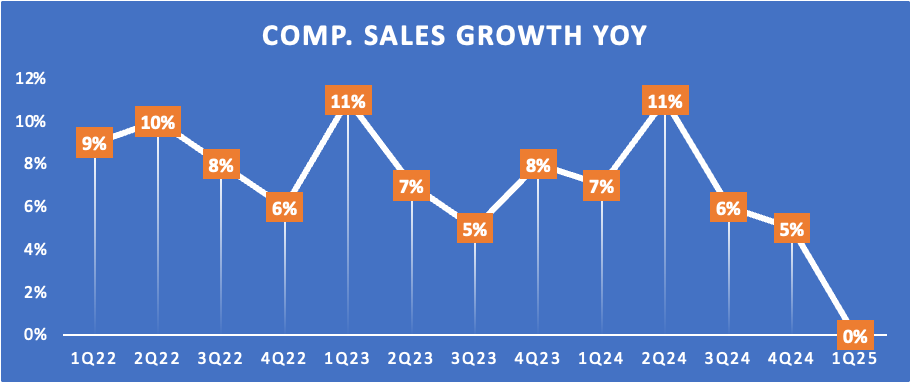

This growing demand for healthy and sustainable food options, combined with the company’s strong strategy, has enabled it to deliver a high-single-digit comparable store sales CAGR. This represents the growth in sales from existing stores, suggesting strong growth in traffic for Chipotle.

Meanwhile, this market is expected to grow at a 13.7% CAGR through 2029, which Chipotle is expected to continue fully benefiting from.

However, Chipotle has even more levers to pull, with the most important one being the expansion growth lever. Besides solid comparable store sales growth, Chipotle has been rapidly expanding its presence across the U.S. over the last decade, growing its store count at a steady 10% CAGR, from just 700 in 2007 to over 3,000 today.

Today, the company continues to aim for 300-350 new stores per year, growing its store count at a high single-digit rate. Crucially, this now also includes entering new markets, which could prove to be a solid growth driver over the years to come. For example, the company has plans to open its first international restaurants in Mexico and the Middle East in the coming years, expanding beyond the U.S. border. This global expansion aims to tap into new customer bases and diversify revenue streams, presenting a significant growth opportunity.

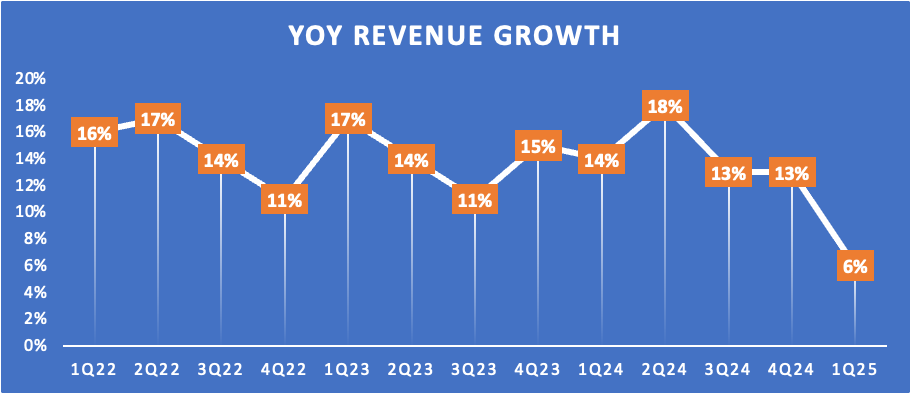

Nonetheless, this expansion strategy has already proven to be a significant growth driver over recent years, building upon strong high-single-digit comp. store sales growth. The result?

Chipotle has grown revenues at an 11% CAGR from 2014 through 2024, reaching $11.3 billion in FY24 revenue.

EPS grew from $0.35 in 2014 to $1.11 in 2024, resulting in a 10-year CAGR of approximately 12.5%.

Free cash flow rose from $0.5 billion in 2014 to $1.5 billion in 2024, indicating a 10-year CAGR of around 11.6%.

Strong growth, which it has delivered consistently, as shown below.

Meanwhile, despite the company’s significant size today, with revenue exceeding $11 billion and a market capitalization of nearly $70 billion, I believe the company’s fundamentally compelling positioning and approach should enable solid growth through the end of the decade. Chipotle’s underlying market, where it continues to capture market share, is expected to grow at a healthy low-double-digit rate, and the company is well-positioned to continue benefiting from its winning strategy, as long as it stays true to this.

Therefore, I see no reason why Chipotle shouldn’t be able to maintain at least high-single-digit comparable sales growth. In addition, management remains committed to its expansion strategy, now also looking to enter new international markets. Meanwhile, room for expansion in the U.S. also remains plentiful. Therefore, I see room for Chipotle to continue growing its store numbers by mid to high single digits for at least another decade, especially considering the significant potential of the international market, particularly in countries like Mexico or Spain.

All things considered, I continue to believe in Chipotle’s differentiated approach and believe the company is nicely positioned for the future. Combining healthy demand growth and its expansion strategy, I believe low-double-digit growth is likely through 2030.

Without a doubt, this is one of the most promising picks in the restaurant sector, deserving of its premium valuation.

Does Chipotle have a moat?

One of the big issues in the restaurant industry is the lack of a moat for most businesses. These restaurant chains operate in a commoditized, low-margin, labor- and capital-intensive environment, with fickle consumers and intense competition. Even dominant players rarely enjoy the kind of durable, structural advantages seen in industries like software or pharmaceuticals, making them relatively sensitive to disruption.

Take switching costs. Well, there are virtually none. People can easily try a different restaurant for any reason. This makes customer loyalty fragile and heavily dependent on continuous marketing, promotions, and consistency in quality. In an industry where brand loyalty can be undermined by a $1 price difference or a new menu item from a competitor, it’s hard to sustain long-term competitive advantages.

Second, much of what restaurants offer can be easily replicated. While a strong brand and unique menu items are helpful, they’re rarely enough to create a moat, as competitors can quickly copy popular innovations.

A big brand name? Yes, it helps a lot and is a powerful lever. The massive yellow “M” of McDonald's is recognized worldwide. Brand is probably one of the few factors in this industry that actually creates a real moat. However, even this strong brand can be broken down in a few days.

McDonald’s, for instance, has faced reputation challenges around nutrition and health for years. Chipotle’s 2015 food safety crisis shows how quickly trust can erode. One incident can damage years of brand-building and send customers fleeing to competitors.

So, yes, not a great backdrop for Chipotle. So, does Chipotle have any sort of moat?

Well, yes, though it's relatively narrow and depends heavily on execution rather than impenetrable structural advantages. Its moat is a combination of brand strength, operational efficiency, and cultural relevance, rather than traditional forms like patents or network effects.

One of the most important elements — and arguably the primary one —of Chipotle’s moat is its brand. Over the years, the company has established itself as a leader in the fast-casual sector by aligning with consumer values centered on health, sustainability, and food quality. Its “Food with Integrity” ethos resonates especially well with Millennials and Gen Z, who tend to prefer food that is fresh, ethically sourced, and customizable. This brand equity doesn’t just help attract customers—it creates emotional loyalty, which can be difficult for competitors to replicate.

This brand equity translates to high repeat business and pricing power, which are key competitive advantages. Additionally, the company benefits from efficient operations, strong unit economics, and digital integration, collectively giving it a durable—if execution sensitive—edge in the fast-casual landscape.

All in all, while its moat is thin, for the restaurant industry, Chipotle looks relatively strong. Due to the nature of the industry, the company lacks the same network effects or IP protection as companies like Coca-Cola or Apple. It also operates in a competitive industry with low switching costs and emerging fast-casual challengers. However, its execution, innovation, and brand trust have made it unusually defensible for a restaurant chain.

While not ideal, it doesn’t look too bad and is at least somewhat resilient, although it is dependent on execution risk.

Chipotle is plagued by external headwinds but continues to show promising development

All right, it is time to review Chipotle’s recent performance and financials, which truly are best in class.

Starting with performance, as I pointed out before, Chipotle has delivered excellent financial results over the last decade, and it has done so pretty consistently. Since the 2016 food safety incident, the company has delivered at least 7% year-over-year sales growth in every quarter (excluding Q1 2020, when COVID-19 hit).

However, this was right up until the most recent quarter, when Chipotle reported a considerable slowdown in growth to just 6%. It is safe to say this has spooked investors a bit, with shares now down 12% YTD and 18% over the last year.

However, crucially, this isn’t the result of any fundamental weakening for Chipotle. Instead, we’re simply seeing the results of challenging macroeconomics combined with the impact of consistently high inflation and tariffs.

As a result, Chipotle witnessed a considerable slowdown in consumer spending in Q1, not helped by poor weather conditions keeping people inside. According to management, the company began to notice some initial weakness in consumer spending habits in February, with concerns over economic health leading to a reduction in restaurant visit frequency. This trend continued in April, with Chipotle experiencing some improvement toward the end of the month, thanks to the success of its limited-edition variations.

Nevertheless, this weakness caused Chipotle’s comparable sales to drop into negative territory, declining 0.4% YoY. As shown below, this represents a considerable weakening from the growth delivered by Chipotle over recent years, which has rightfully led to some concerns.

Positively, in Q1, Chipotle was able to offset some of this weakness in demand through rapid expansion, still resulting in sales growth of 6% YoY to $2.9 billion, although this is still down considerably from what we have gotten used to from Chipotle. These numbers clearly reflect the macro headwinds the company is facing.

Positively, I expect these numbers to improve significantly once macro conditions improve.

On a very positive note, in Q1, Chipotle opened 57 new restaurants in the U.S. and Canada. This means the company remains on track to open between 315 and 345 new restaurants this year, reflecting a strong 8-10% growth.

This includes two new stores in the Middle East in partnership with Alshaya Group, bringing the region’s total to five. Management is pleased with the results and remains committed to accelerating international growth. This also includes expansion into other regions, with Chipotle having signed a partnership agreement with Alsea, a leading operator in Latin America and Europe. Through this partnership, Chipotle will enter the Mexican market, anticipating opening its first restaurant here in early 2026.

As far as I can tell, international growth remains well on track, though in the very early stages.

More importantly, Chipotle’s new restaurant economics remain absolutely best in class and worth a highlight. Despite rapid expansion, the company is still realizing year two cash-on-cash returns around 60%. This means a new Chipotle location typically generates a return of 60% on the initial cash investment. In other words, If Chipotle spends $1 million to open a restaurant, it expects to earn $600,000 in profit or cash flow from that location in year two.

For reference, many operators would consider a 25–30% return excellent, so this remains extremely impressive and very promising in the long run, as these excellent numbers allow it to self-fund expansion, allowing them to open more locations without relying heavily on debt or equity issuance (hence Chipotle’s clean balance sheet, but more on that later).

Even more impressive, Chipotle’s overall cash-on-cash return sits in the low 80% range, which implies that Chipotle is earning 80 cents in profit for every dollar originally invested across its mature store base. These are absolutely mind-blowing numbers and an incredible feat at a 3,000+ store count.

To put this into perspective, fast-food chains like McDonald’s or Wendy’s target a 20-30% number, while for fast-casual peers like Panera or Shake-Shack, a 25-40% number is considered strong. Yes, Chipotle delivers 80% across all its restaurants, which is an extremely promising long-term sign and a massive competitive edge.

And there are more positives to point out in the face of near-term external headwinds. Chipotle is still showing strong results underneath, with successful limited edition product launches and equipment innovation.

For starters, Chipotle continues to nail it with its limited-time offers. Chipotle Honey Chicken has seen incredible traction since its launch in March, far surpassing expectations and leading to incremental transactions.

Besides this, management is not easing its investments in next-generation equipment. Here is some valuable commentary:

“We remain on track to have the produce slicer in all restaurants by this summer, which will improve the speed of prep and improve the culinary by ensuring consistent cut sizes for onions, bell peppers and jalapenos. We are also expanding the rollout of the equipment package, which includes the dual-sided plancha, three-pan rice cooker, and the high-capacity fryer.

In addition to new restaurant openings that will begin in Q4 of this year, we are now in the process of rolling out the equipment package to an additional 100 existing restaurants over the next few months. Based on the results, we can accelerate the rollout to all restaurants, which we believe we can complete over the next several years.”

Management anticipates that these investments will yield significant efficiency gains, enabling restaurants to meet peak demand and deliver improved customer satisfaction. While maybe not the most exciting announcements to discuss, these are long-term growth enablers and drivers of healthy margin gains over time.

On that note, let’s move to the bottom-line numbers, where Chipotle continues to impress. Let’s review the company’s financial profile.

Chipotle’s financials are in a league of their own

Let me start by saying that Chipotle’s numbers are sublime, both in terms of development and progress, and in actual numbers compared to peer averages. Similar to its cash-on-cash returns, Chipotle seems to be in a league of its own.

Let’s just start by looking at Chipotle’s restaurant-level margins, which are well ahead of peers and still steadily growing. As visible below, these have been consistently in the 25-30% range, which is extremely remarkable and in part driven by the fact that Chipotle doesn’t use a franchising model, giving it tighter control over execution and customer experience.

For reference, even fast-casual peers like Panera or Shake Shack generally only manage restaurant-level margins of 15-20%, yet Chipotle consistently sits over 25%. Meanwhile, massive and established fast-food chains like McDonald’s generally still only deliver 20-22% margins, further highlighting Chipotle’s excellence.

Driving these considerably better margins are a number of factors. Let me name two of the most considerable.

First of all, there is Chipotle’s relatively simple, focused menu centered on customizable Mexican-inspired items. This simplicity reduces kitchen complexity, minimizes food waste, and streamlines training and labor requirements. Fewer ingredients and standardized preparation processes enable faster service with lower overhead.

Additionally, using premium ingredients—like responsibly raised meats and organic produce—Chipotle commands higher price points. However, customers are willing to pay a premium for perceived value, freshness, and sustainability, allowing the company to maintain healthy gross margins.

Somehow, Chipotle has positioned itself as a sort of premium choice, but it’s not hurting demand thanks to strong consumer preferences for healthier but still convenient options.

Looking at the latest quarter, we do see some of this top-line weakness reflected further down the line. The restaurant level margin was down 130 bps YoY due to a combination of top-line weakness and rising costs. As a result, the cost of sales in Q1 was up to 29.2% of revenue, an increase of 40 bps. The small menu price hikes were fully offset by inflationary impacts, most notably in the prices of avocados, dairy, and chicken.

Additionally, labor costs for the quarter were 25% of revenue, up approximately 60 basis points, primarily driven by lower volumes and wage inflation. Finally, other operating costs (including utilities) and marketing costs were both up 10 bps YoY, ultimately leading to a lower operating margin.

Positively, Chipotle can easily suffer some of this cash flow and margin weakness thanks to its pristine balance sheet. At the end of Q1, Chipotle held $2.1 billion in cash and investments and no debt, primarily thanks to its ability to self-finance expansion.

This also allowed management to repurchase some of its own shares, returning about $550 million to shareholders in Q1. As of the end of Q1, management still had $875 million remaining under its authorization.

Meanwhile, Chipotle has also shown a good ability to generate healthy free cash flow. Its FCF margin has steadily grown since 2018, reaching 13.5% in 2024 or over $1.5 billion in FY24 FCF.

Finally, I want to once again highlight Chipotle’s remarkable ability and track record of investing in its own business, as evidenced by its ROIC, which is a textbook example of perfection. Not only are the company’s ROIC and ROE really healthy, but they are also steadily growing YoY, which is precisely what investors like us want to see.

Now, for those who aren’t entirely familiar, ROIC assesses how effectively a company utilizes its capital to generate profits. Chipotle's ROIC has shown a consistent upward trajectory:

2019: 7.48%

2020: 6.79%

2021: 11.12%

2022: 14.48%

2023: 16.60%

2024: 21.24%

Just perfect.

Then here is Chipotle’s ROE, which measures a company's profitability relative to shareholders' equity. Chipotle's ROE has also experienced significant growth:

2019: 20.81%

2020: 17.61%

2021: 28.42%

2022: 37.97%

2023: 40.13%

These are brilliant numbers across the board, showing Chipotle knows how to use its cash flow to deliver excellent long-term returns and value to shareholders. This is a great sign for future growth and financial health.

Ultimately, I believe this confirms my fundamental conclusion that Chipotle is truly best-in-class.

On that note, let’s move to the outlook and valuation part of this analysis.

Before we move on, just a quick word…

Want more out of your subscription?

InvestInsights PRO - $7.50/month ($70/annually)

An additional 2-5 premium stock analysis monthly.

Full insight into my own portfolio (15% return CAGR since 2022).

Monthly portfolio updates + Instant transaction alerts (Fully transparent)

A complete overview of all my target prices and ratings (Excel file).

Exclusive access to the PRO subscribers Discord channel

Instant access to earlier premium analysis on, for example, Adobe, Thermo Fisher, Spotify, and The Trade Desk.

Outlook & Valuation

Earlier, I had already laid out a fairly optimistic long-term expectation for sales growth. Based on the company’s fundamentally strong positioning toward secular trends and its excellent expansion efforts, I remain confident that Chipotle will be able to deliver low-double-digit sales growth through 2030, and likely beyond. For reference, management still targets 7,000 stores in the U.S. and Canada in the future, which is approximately double the current number.

Meanwhile, going by Chipotle’s excellent expansion track record, I expect restaurant-level margins to slowly expand further, driving healthy cash flow growth, which is likely to stay in the high-teens range, driven by productivity gains, economies of scale, equipment innovation, and rapidly growing sales.

Indeed, I believe Chipotle will continue to deliver outsized growth. Honestly, I see no reason why Chipotle won’t be able to deliver these sorts of growth numbers, apart from the obvious execution and economic risks, going by all the business fundamentals discussed and management’s excellent execution. Chipotle really stands out on all fronts, giving me confidence in its long-term outlook and resulting in strong projections.

However, the short-term outlook is not looking as bright. For Q2, management expects significant headwinds to hurt YoY growth. The company is facing a challenging comparison due to 11.2% comp growth in Q2 last year, including a high teens comp in April. Additionally, there is the easter timing shift, which creates an additional 100 bps headwind, plus there is a 90 bps headwind as last year’s price increases are lapped.

Therefore, assuming no change in consumer spending trends, management anticipates Q1 weakness to carry through to Q2, likely resulting in overall negative comps for the quarter, but an improvement to positive territory toward the end.

Meanwhile, thanks to this lower sales growth and management's continued commitment to its investment plans, costs across the board are expected to further increase as a percentage of revenue, likely putting additional pressure on margins in Q2. This also reflects the impact of tariffs on aluminum and the broader 10% tariff on all products. These alone are expected to be a 20 bps margin headwind in Q2, assuming no new reciprocal tariffs.

In other words, Q2 won’t be great, though also not much worse compared to Q1, likely.

Positively, management does expect an improvement in demand in the second half of the year, still guiding for low single-digit comparable sales growth in 2025, with a return to positive transaction growth in the second half of the year. This is a positive indicator, also showing some confidence from management.

All things considered, I keep a conservative view for 2025, as I anticipate economic weakness to persist through the first half of 2026. As a result, both my FY25 revenue and EPS projections are toward the low end of the Wall Street consensus, assuming high-single-digit growth for both.

As I mentioned, I anticipate weakness in early 2026 to persist; however, consumer confidence and spending are expected to improve in the second half, as interest rates drop and economic growth picks up. This should drive a return to double-digit sales growth for Chipotle and a strong margin recovery. This same trend is expected to persist in 2027 and 2028.

This results in the following projections.

So, earlier, we already established that the recent weakness shown in the Chipotle quarterly results isn’t any form of fundamental weakness, so does that make the recent sell-off, with shares down 18% over the last 12 months, an overreaction?

Honestly, the sell-off seems more than justified. Chipotle shares were priced for perfection, and its Q1 results no longer showed this perfection, with the company facing considerable near-term headwinds. As a result, expectations and multiple resets were unavoidable and justified.

And even now, shares still aren’t cheap by any measure. At a current share price of $53, shares now trade at roughly 45x this year’s earnings and 29x EV/EBITDA, which remains highly demanding. While this is far below its 5- and 10-year average multiples, this is undeniably rich compared to industry peers.

However, the question of whether it's justified depends on several factors, including growth prospects, profitability, return on capital, brand strength, and industry positioning. Positively, in each of these catagories, as discussed, Chipotle is also miles ahead of its peers, rightfully earning a big premium.

Ultimately, considering the sheer quality of this business and its quite amazing growth prospects, I believe Chipotle’s current valuation can be justified — but only if its growth story continues to deliver with little room for error. It’s trading like a top-tier, wide-moat consumer brand with scalable economics, and so far, it’s living up to that promise. But any disruption could put downward pressure on the multiple.

Do you believe Chipotle can actually continue compounding earnings at a mid-teens clip, which I do; then the current premium doesn’t seem entirely unreasonable. However, it requires operational excellence and leaves very little downside protection.

For reference, assuming some multiple compression in the year ahead, going with a 38x medium-term earnings multiple, I calculate an end-of-2027 target price of $65. From a current price of $53 this represents potential annual returns of roughly 8% per year (CAGR). Notably, this is still well short of my 12% minimum target.

Therefore, all things considered, I believe Chipotle remains an extremely compelling growth story, but its current premium is just too high to offer sufficient downside protection, especially amid near-term economic risks and uncertainty. Additionally, other risks to consider are the execution under a new CEO and the risk of food safety issues.

Without a doubt, Chipotle is one of the highest-quality compounders you will find, but the risk-reward just isn’t attractive enough. Therefore, based on my projections, I would argue against buying shares at this time.

Personally, I will only consider buying if the share price dips below $47, which it actually did in early April. However, for now, I am watching from the sidelines, but I am eager to to buy when the price is right.

It's interesting to show the increasing Roic, but it would be more interesting to know why. (Inflation?, efficiency?, customer sss?) Many compounders had trends like this and ultimately customer slow downs changes these numbers big.

Unit economics businesses like retailers and restaurants can be so interesting. If the blueprint works, which it does for Chipotle, then the only task is expanding and duplicating what already works in different places.