Copart, Inc. – A one-of-a-kind business with a killer business model (Deep Dive)

Let me take you through everything you need to know about this excellent compounder with one of the best business models you'll come across!

Looking for a top compounder with a strong track record, healthy financials, a great moat, and great organic long-term growth prospects? In other words, are you looking for a gem to buy and forget about for the next 10 years?

Copart, the undisputed global leader in online vehicle auctions and remarketing services, should be on your list of considerations, without a doubt. This company is truly exceptional and tends to fly under the radar, not creating flashy headlines but delivering strong, anti-cyclical compounding results year after year, driven by a compelling underlying market that benefits from strong secular organic growth drivers.

Most importantly, the company has a formidable moat that makes it nearly impossible to disrupt, ensuring the durability of its business model and minimal competition. Additionally, it has a pristine balance sheet, delivers strong margins from a capital-light business model, and consistently achieves strong reinvestment metrics.

This really is a one-of-a-kind business and an investor’s dream.

Sadly, that is also exactly how it tends to be priced by investors. Copart rarely trades at a discount, with its high-quality business consistently earning it a premium. Notably, Copart shares have faced pressure recently, reaching a fresh 12-month low, driven by the company's near-term headwinds and an elevated investment cycle.

Now, even at a 12-month low and after losing some 15% YTD, shares still trade at over 30x this year’s earnings, which isn’t cheap, but recent weakness might just give us an opportunity to pick up some shares in this brilliant business at a fair price, or does it?

To find out, in this article, I will take a deep dive into Copart, discussing its fundamentals, business model, moat, growth prospects, finances, recent performance, and medium- to long-term outlook.

In other words, this article will provide investors with all they need to know about Copart. Let’s delve in!

A one-of-a-kind business with a killer business model

Company fundamentals + business model

As always, let’s start from the beginning: What is Copart?

Founded in 1982 and headquartered in Dallas, Texas, Copart, Inc. is a global leader in online vehicle auctions and remarketing services, specializing in the resale and remarketing of salvage and clean title vehicles. What this means exactly is that Copart operates an online auction platform, selling mostly damaged or unwanted vehicles (or parts), most often on behalf of insurance companies, dealers, and fleets.

The company sells these vehicles through its proprietary online auction platform, VB3, connecting sellers and buyers worldwide. It sells these vehicles and parts to a diverse base of buyers, including licensed dealers, dismantlers, rebuilders, exporters, and end-users.

In terms of global exposure, the company operates across 11 countries and has buyers in over 190 countries. Copart's global footprint spans across North America, Europe, the Middle East, and parts of Asia, enabling it to serve a broad and growing international customer base. At the same time, the company remains U.S.-heavy, generating 80% of its revenues in the United States.

The company sources vehicles primarily from insurance companies (75-80% of inventory), which supply damaged or totaled cars following accidents, natural disasters, or theft recoveries. In addition to insurers, Copart also works with banks, financial institutions, fleet operators, car dealerships, and individual sellers to expand its inventory. As a result, the company has over 265,000 vehicles available online on any given day and sells more than 3 million per year.

Notably, in most situations, Copart only functions as a middleman between the insurance companies and buyers, earning fees every time a car is sold. In these situations, Copart doesn’t own the cars. Instead, it acts like a marketplace or service provider, running the auction, finding buyers, handling paperwork, and charging fees to both the seller and the buyer for facilitating the sale. This is the core of Copart’s business — it’s stable, scalable, and highly profitable because Copart doesn’t carry the financial risk of owning inventory.

This business model keeps it capital-light, highly profitable, and insulated from the cyclical swings in demand and car prices the broader industry is subject to. These “fee cars,” as Copart calls them, are roughly 80% of its business.

Through its extensive network of storage facilities and logistics services, Copart offers a comprehensive solution that includes vehicle transportation, title processing, appraisal services, and international shipping assistance. Its ability to manage the entire lifecycle of a vehicle, from intake to sale and post-sale services, allows it to provide a seamless experience for both sellers and buyers.

Additionally, there are instances where Copart purchases vehicles outright and resells them. These are called purchase units. Copart steps in to purchase certain vehicles when it believes it makes sense, often in situations where there isn’t a seller directly looking to auction. However, because Copart then owns these cars temporarily, this side of the business involves more risk and is much more sensitive to changes in used car prices or overall demand.

This represents a significantly smaller portion of total sales and revenue, but it reduces the company's dependence on external suppliers, such as insurers, which is a valuable aspect of diversification. This now accounts for the remaining 20% of revenues.

So, just to take a step back now: How does Copart generate revenues?

Buyer Fees: Fees charged to buyers for each winning bid (typically scaled based on sale price).

Seller Fees: Fees charged to insurance companies and other sellers for processing and selling vehicles.

Auction Listing Fees: Charges for listing, handling, and processing vehicles.

Title Processing Fees: Handling of title transfer, lien resolution, and paperwork.

Transportation & Logistics Services: Towing, storage, and vehicle movement for insurers and sellers.

These together account for roughly 80% of revenue. The remaining 20% is generated through vehicle sales. In this category, Copart takes temporary ownership of inventory and recognizes full vehicle sale proceeds as revenue, unlike fee-based service revenue.

Non-insurance sellers (dealers, fleet operators, rental companies, finance companies, repo agencies).

Purchased Inventory: Occasionally, Copart acquires and resells vehicles directly (still asset-light, but different accounting treatment).

International Sales: Some vehicle export sales may fall into this category.

As previously noted, while these revenues carry a higher risk, they provide valuable supply diversification. This also includes international revenues and the recent acquisition of Purple Wave. For reference, Purple Wave is a business Copart acquired to expand beyond its core insurance salvage auctions. While Copart primarily deals with damaged cars and light trucks, Purple Wave focuses on auctioning heavy equipment, construction machinery, agricultural equipment, trucks, trailers, and industrial assets. These are typically sold by businesses, municipalities, farms, or construction companies rather than by insurance companies.

By acquiring Purple Wave, Copart has diversified its auction business beyond vehicles, giving it access to a new group of sellers and buyers, and adding another growth lever that isn’t directly tied to auto salvage or insurance claims. Quite valuable and further strengthening its moat.

Ultimately, Copart’s business model is highly scalable and asset-light, which, combined with its technology-driven platform and massive network effects, has enabled Copart to become a dominant player in the industry. It holds a market share of approximately 65% in both the U.S. and internationally, and together with IAA, controls approximately 80% of the market.

Yes, Copart practically operates a monopoly.

Most importantly, its market share is growing as well, as Copart is well outpacing the competition, fully benefiting from network effects. The competition simply cannot keep up with its superior technology, scale advantage, breadth of inventory, and massive user base; more on this (its moat) later.

Through these subsequent network effects, operational efficiency, and the healthy growth in the underlying market, driven by growing demand for used vehicles across multiple markets, Copart has delivered excellent financial results over the last decade.

Averaged a 15% revenue CAGR over the last 10 years

Averaged a 16% revenue CAGR over the last 5 years.

Averaged a 28% EPS CAGR over the last 5 years.

Averaged a 22% EPS CAGR over the last 10 years.

These are absolutely blinding numbers and massively impressive.

However, potentially even more impressive, the company consistently delivers these strong results. This is driven by its highly predictable and economically insensitive revenues. The majority of Copart’s business comes from insurance companies auctioning total-loss vehicles. Total-loss events (accidents, thefts, floods, hurricanes, fires, etc.) happen regardless of macroeconomic conditions. People don’t stop having accidents in recessions, and so Copart’s business keeps running at any time.

Additionally, demand for salvage vehicles — whether for parts, repairs, or resale — remains strong in almost all environments. International buyers (Copart’s largest growth area) are often purchasing lower-cost vehicles for markets where new cars are prohibitively expensive.

And finally, Copart doesn’t own the inventory it sells (most often); it acts as a service provider. This keeps gross margins stable, as revenue is tied to auction fees, rather than vehicle prices or holding costs.

As a result, even in 2008-09 (GFC), Copart delivered positive revenue growth, and over the last 10 years, it has delivered only six quarters of negative growth (including 2 during COVID), with its deepest drop just -4%. This is truly a testament to the quality of this business and its brilliant, fee-based, asset-light model.

Long story short, Copart is a brilliant one-of-a-kind business. It has a capital-light, highly scalable, and anti-cyclical business model and has grown into a dominant force in the relevant markets, practically operating a monopoly. With the same industry also experiencing steadily growing organic demand, Copart is able to deliver strong compounding results year after year, facing barely any cyclicality.

I mean, what is there not to like about this business model?

And yet, the even more impressive and important quality of this business is its massive moat.

Competitive edge (moat)

One of the most important questions in the building of any investment thesis to ask yourself is: Does this business have a moat/competitive advantage that ensures durability and should make it a long-term winner?

For Copart, the answer to this question is a convincing “Yes.” Copart has a very strong moat, and arguably one of the widest in the vehicle remarketing industry. Its competitive advantage is built on multiple durable pillars that are very hard for competitors to replicate.

For starters, there are the strong network effects, which I referred to earlier. At its core, Copart runs a two-sided marketplace with buyers and sellers. The more inventory Copart has, the more attractive it becomes to buyers. The more buyers it has, the more valuable it is to sellers. This flywheel is self-reinforcing.

Furthermore, with over 300,000 registered buyers across 190 countries, Copart has significantly deeper liquidity than its competitors, enabling it to secure better pricing for sellers and achieve higher conversion rates. This size only continues to attract more users and buyers, as both parties favor Copart over competitors due to its size on either side of the transaction. This is a massive competitive advantage.

Closely tied to this, Copart’s long-standing relationships (often decades) with suppliers, mostly insurers, also give it an advantage and add to its moat. You see, Copart has long-term relationships with most major U.S. insurance companies, which provide the bulk of its vehicle supply. Switching to a competitor like IAA would entail disruption, potentially lower realized prices, and a less liquid buyer base — creating high switching costs for sellers. These relationships are more than simple vendor contracts—they involve integrated systems, data sharing, and tailored auction solutions.

To provide further background on the importance of these relationships, Copart’s insurance partners are crucial to its business model and competitive advantage, forming the backbone of its vehicle supply and revenue streams. Insurance partners include major U.S. carriers like GEICO, Progressive, Allstate, State Farm, and Nationwide, among others. These relationships deliver a steady, high-volume, and relatively predictable flow of salvage vehicles.

Knowing that these insurance partners will not go anywhere else and will only use Copart for decades to come creates a significant moat on the supply side.

At the same time, Copart’s brand is also highly trusted. International buyers often prefer Copart for quality, reliability, logistics, and title management. This strengthens its position as the default auction platform on both the buy and sell sides.

And there is more. Another competitive advantage worth pointing out is real estate and technology.

Copart owns most of its yards outright — over 250 locations globally — which creates enormous scale advantages. Acquiring, permitting, and developing this land takes years and often faces regulatory hurdles. Many competitors lease land, which leaves them vulnerable to rising costs or losing capacity. Copart’s real estate footprint gives it unmatched storage capacity, flexibility during volume spikes (such as catastrophes), and lower long-term costs.

Additionally, Copart’s technology investments, such as its VB3 auction platform and the Title Express service, are powerful differentiators. Title Express now processes around one million titles per year, improving cycle times and seller satisfaction. Meanwhile, its proprietary VB3 online auction platform is widely regarded as the best in the industry. Copart was among the first to fully embrace online-only auctions and now benefits from years of data, optimization, and customer familiarity.

Due to its size, technology platform, and owned infrastructure, Copart operates at a lower cost per vehicle compared to its smaller peers. This allows it to reinvest aggressively in growth while maintaining high margins and returns on capital.

Pretty neat, right? These factors create a massive moat for Copart. It is wide, diversified, and still widening. It would be extraordinarily difficult and expensive for any new entrant to replicate its combination of technology, land assets, global buyer base, insurer relationships, and brand trust.

This is exactly why Copart is consistently outgrowing IAA, its closest peer, and widening the competitive gap, not facing stiff competition from them. One can simply compare growth. Even though Copart is the larger of the two, it is still outgrowing its closest peer.

Over the past 5 years, Copart has grown revenue at a 16% CAGR.

Before being acquired by Ritchie Bros in 2023, IAA’s growth was much more modest, generally low- to mid-single digits.

This widening reflects Copart’s stronger insurance partner retention and new account wins. Major insurers, such as GEICO, Progressive, and Allstate, are deeply integrated with Copart.

Copart really is a power in the industry, and it is fully benefiting.

Organic growth drivers

So, we have a favorable business model, a dominant market position, and a massive moat allowing it to keep gaining market share and neglecting any risk of disruption.

The only question remaining, then, is how fast its addressable market is growing. Once again, this looks brilliant for Copart, as trends driving growth over the last decade remain in place and become even more powerful.

Surprisingly (at least, I thought so), the online salvage auctions market is a highly attractive and rapidly growing one, benefiting from secular growth drivers that aren’t going anywhere.

First and foremost, rising total-loss frequency has been a powerful secular force for Copart’s business. Simply put, as modern vehicles become more complex and safer, thanks to advanced sensors and chips, repair costs have escalated. All these technological parts are incredibly expensive and complex to replace and repair.

Consequently, insurance companies increasingly declare vehicles as total losses. Copart’s leadership notes that total-loss frequency “has grown more than fourfold since 1990” and remains above pre-pandemic levels. This trend underpins much of its organic growth in volume. More total losses mean more business for Copart, and this trend continues to grow.

Additionally, population growth and increased vehicle miles traveled (VMT) also contribute. The U.S. population has roughly doubled since 1960, and VMT has quadrupled. Even though crash frequency per mile has declined (due to increased safety), the aggregate level of total losses remains strong, creating a steady supply for Copart’s auctions. So, even though people crash less, the higher mile count still leads to growth in total losses, growing Copart’s supply.

As a result of these secular developments, which show no signs of weakness, the North American online salvage auctions market is expected to continue growing at a robust 14% CAGR through 2030, which should provide Copart with ample growth opportunities. Meanwhile, Copart is expanding its international presence, with growth expected to be even more considerable outside of North America, projected to grow at a 24% CAGR.

In short, Copart’s addressable market is expanding rapidly, and its strong positioning suggests it’s well-positioned to capture a substantial share of this multi-billion-dollar growth opportunity.

All things considered so far, you won’t be surprised to hear that Wall Street’s expectations for Copart over the next 5 years are optimistic. Although it is facing some near-term weakness (about which more will be discussed in a moment), expectations are for Copart to continue growing sales at a double-digit rate. Personally, I believe a low double-digit CAGR (10-12%) over the next 5 years is very likely, possibly even conservative, and with limited economic sensitivity, that is a very strong prospect.

On that note, let’s delve deeper into the company’s recent performance, developments, and financials.

Copart faces some cyclical headwinds, but remains in great health

While Copart’s CAGR results over the last 5 and 10 years are mighty, as pointed out earlier, Copart has seen growth moderate a bit (to roughly a 10% CAGR) in the post-COVID years. Why?

In 2021-2022, vehicle prices (both retail and salvage) spiked due to tight supply, low new car inventories, and COVID disruptions, which fully benefited Copart. However, as new car production normalized in the years that followed, used vehicle and salvage values have declined from peak levels, reducing Copart's fee-per-vehicle growth. This has created tough comps even if volumes remain stable or grow.

In most industries, revenue softness would be a cyclical contraction. For Copart, this is more like a return to steady-state growth after an unusual multi-year tailwind. Nothing to worry about – growth remains healthy enough.

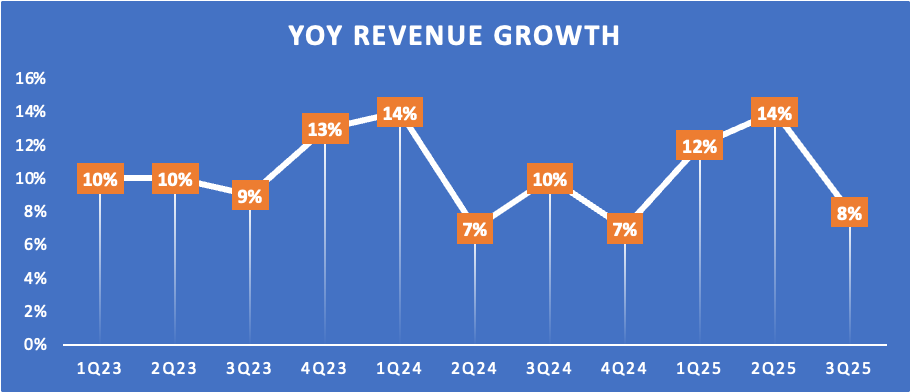

Looking at the latest quarter, for which Copart reported results in late May, Copart reported total fiscal Q3 revenue of $1.2 billion, up “just” 8% YoY and sitting roughly in line with consensus estimates. As you can see below, revenue growth tends to fluctuate as neither demand nor supply is constant.

By region, growth was driven by 18% growth in international sales and 8% sales growth in the U.S., or 7% excluding cat units. As explained previously, Copart deals with fee units (only middleman fees) and purchase units (own inventory). Additionally, there are cat units, which are vehicles that come from natural disasters such as hurricanes, floods, hailstorms, and wildfires. These are still fee units, but Copart sometimes separates them out to highlight abnormal volume spikes during catastrophe seasons. So, excluding these one-offs, U.S. growth was 7%.

Examining the underlying dynamics, let’s start with insurance, as this is Copart’s primary supplier. For fiscal Q3, Copart reported that global insurance volume remained relatively flat year-over-year, with a nominal decline of 0.3% globally in unit sales and 0.9% in the United States. In other words, Copart sold about the same number of insurance cars as it did a year ago. However, if we adjust for the fact that 2024 had an extra business day (because it was a leap year), then volumes were actually up slightly — 1.3% globally and 0.6% in the U.S.

Meanwhile, total loss frequency continues to rise YoY, hitting 22.8% in fiscal Q3, up a strong 100 bps YoY, which indicates this underlying trend remains strong. What this number means exactly is that 22.8% of all insurance auto claims (accidents, damage, thefts, etc.) resulted in the car being declared a total loss rather than being repaired, which fuels Copart’s business.

However, this means we have a strongly rising total loss rate but flat volumes. According to Copart, this difference has two reasons:

The numbers aren’t perfectly precise. The way “total loss frequency” is measured can change after the fact, because some claims are reclassified later. So, there’s a bit of noise and delay in the data.

There are some macro headwinds. For example, there’s a rise in the number of uninsured or underinsured drivers, which can reduce the number of cars funneled through insurance channels — and therefore through Copart.

Over time, these cyclical forces will reverse, but in this specific quarter, this posed a headwind in the company’s largest channel.

Nevertheless, correcting for the leap year, total unit sales increased by 2% year-over-year, which is healthy enough. By region, U.S. unit sales were flat, driven by a 1% decrease in insurance units, offset partially by 14% growth in non-insurance units. Internationally, unit growth was 6% YoY, with 9% growth in fee units but a 13% decline in purchase units due to a shift in preference from large insurers outside of the U.S.

Overall, this slower supply led to a global 10% decline in inventory YoY, or quite literally fewer cars on its auction. According to management, the inventory currently reflects the cyclical impacts associated with an increasing share of underinsured and uninsured motorists, as well as varying growth trajectories among insurance carriers.

The number of vehicles coming into their auctions is being affected by two things right now. First, there are more drivers who don’t have enough insurance or no insurance at all, which means fewer of their cars end up being processed through insurance companies and sent to Copart. Second, not all insurance companies are growing at the same pace, so some insurers are sending in fewer cars while others may be sending in more. These two factors are influencing the overall number of cars Copart has in its system at the moment, though this number tends to fluctuate.

Overall. I believe Copart’s business remains fundamentally strong, but current growth is being held back by temporary supply-side pressures. Total loss frequency, which drives long-term supply, continues to rise, showing the structural health of the model. However, more uninsured and underinsured drivers, along with uneven growth across insurance carriers, limited the number of vehicles flowing into Copart’s auctions this quarter.

Adjusted for the leap year, unit volumes still grew modestly, helped by strength in non-insurance and international sales. While inventory levels are temporarily lower, these are cyclical factors, not a sign of weakening demand or market position. Copart remains well-positioned for long-term growth once these short-term headwinds ease.

Moving to the bottom line, it hasn’t been all plain sailing for Copart in recent quarters. If we look at Copart’s gross margin, we can see considerable weakness over the last four quarters, which can be attributed to a mix shift and some inflationary cost pressures, but none to actual operational weakness.

First, Copart has been seeing stronger growth in non-insurance and international units, which generally carry slightly lower margins compared to its core U.S. insurance fee business. International operations, especially as they scale up, often involve higher costs per unit sold due to logistics, regulation, and market development. Similarly, non-insurance sales sometimes include more lower-margin vehicles or seller types that don’t generate the same fee structure as insurance consignments.

Additionally, cost inflation is playing a role. Higher labor, towing, yard operations, transportation, and facility costs have been modestly pressuring margins. Copart has done a good job managing these increases, but the cumulative effect is still evident in gross margin compression.

Overall, it’s not a sign of underlying weakness in the model — it’s mostly a function of sales mix shifting toward newer segments, some inflationary cost growth, and the normal volatility that comes when volumes and unit types fluctuate in the short term. The core fee-based, high-margin U.S. insurance business remains very healthy, and Copart’s gross margin is best-in-class.

In addition to some weaknesses, Copart has also been heavily investing in facility capacity, its towing and real-time tech tools, and doubling the size of its specialized sales teams, particularly for Purple Wave. These investments put additional pressure on near-term margins, which, combined, have been spooking investors over recent quarters, though Copart’s bottom line remains strong overall.

Looking at the latest quarter, Copart reported a gross profit of $552 million, up roughly 5% YoY. This translates into a gross margin of 46%, down 50 bps YoY, as we can clearly see margins recover after a deep drop in fiscal Q4 2024, as inflationary pressures ease.

Further down the line, this resulted in a net income of $407 million, up 6% YoY, or $0.42 per share, in line with consensus estimates. This also includes $7 million from interest income, as Copart has invested a portion of its cash pile into treasury securities.

This translates into a really strong fiscal Q3 net income margin of 33.9%, which is up 10 bps YoY. Thanks to strict cost control, Copart’s gross margin weakness hasn’t shown too much of an impact on the company’s net income margins, apart from limited expansion compared to prior years.

Finally, in terms of financial health, Copart appears to be in excellent shape. The company ended the latest quarter with $5.6 billion in liquidity, comprising $4.4 billion in cash and $ 1.2 billion in capacity under a revolving credit facility. Meanwhile, Copart holds virtually no debt on its balance sheet, leaving it in a pristine financial position with ample liquidity, especially considering the business now also generates almost $1 billion in FCF annually.

This is really impressive.

And crucially, Copart management has shown a great ability to reinvest all these cash flows into the business to fuel long-term growth, as proven by an excellent ROE and ROCE.

Copart’s ROE has remained strong, though it has moderated from its earlier peak:

2024 TTM (as of July 31, 2024): 20%

2023 average: 23%

2022 average: 27%

5‑year average (2019–2024): 26%

Copart consistently delivers excellent returns on invested capital:

2021 = ROIC of 21%

2022 = ROIC of 24%

2023 = ROIC of 20%

2024 = ROIC of 17%

TTM (as of early 2025) = ROIC of 16%

What does stand out across both numbers is that they have declined from peak levels in recent years. Generally, falling ROIC is a big negative, as it shows the company is no longer able to use its cash as efficiently as it grows. At least, that’s what it means in most circumstances. However, Copart is an exception.

Crucially, the drop in Copart’s ROIC over the past couple of years doesn’t reflect operational weakness but rather changes in the capital base driven by deliberate, long-term strategic investments.

One of Copart’s biggest competitive advantages is its network of owned storage yards. Over the past few years, the company has made significant capital investments to acquire additional land and expand existing storage capacity. Because these real estate investments are capitalized on the balance sheet, they increase invested capital immediately, while the revenue and profits tied to these yards are only realized gradually over time as volumes build. This creates a short-term ROIC compression — invested capital rises faster than operating profit.

Copart has also invested heavily in technology (e.g., VB3 platform, Title Express), international operations, logistics infrastructure, and towing capacity. These investments are designed to scale the business for higher volumes, but again, the returns come with a lag. This kind of "build it before you need it" strategy temporarily lowers ROIC because you're deploying capital ahead of the corresponding profit growth.

Meanwhile, the core business remains extremely profitable and capital-efficient — management is simply playing a long game to support much larger volumes down the road. Still, these numbers remain healthy today, and I expect them to improve as the rate of investments eases off and earlier investments start paying off as volumes build.

In the meantime, Copart continues to deliver excellent results, showing a strong ability to reinvest and maintain a pristine balance sheet in the meantime.

Regarding the recent performance and margin compression, I am not overly concerned. Despite facing some near-term pressure over recent quarters, the company remains in excellent financial health and exhibits no fundamental or operational weaknesses. While these cyclical sales and margin pressures have impacted consumer sentiment, I am convinced these are only temporary. I remain confident in Copart’s ability to consistently deliver double-digit growth and steadily expanding margins.

Fundamentally, Copart is showing brilliant numbers all around.

Before we move on, just a quick word…

Want more out of your subscription?

InvestInsights PRO - $7.50/month ($70/annually)

An additional 2-5 premium stock analysis monthly.

Full insight into my own portfolio (15% return CAGR since 2022).

Monthly portfolio updates + Instant transaction alerts (Fully transparent)

A complete overview of all my target prices and ratings (Excel file).

Exclusive access to the PRO subscribers Discord channel

Instant access to earlier premium analysis on, for example, Adobe, Thermo Fisher, Spotify, and The Trade Desk.

Outlook & Valuation

As for Coparts’ outlook, a lot has already been touched upon so far in this analysis. As pointed out earlier, looking at the fundamentals of its business and the expected growth in the underlying industry, I strongly believe Copart should be able to keep delivering double-digit sales growth in the medium-to-long term, fueled by secular trends, market share gains, and excellent execution.

Meanwhile, growing operating leverage, the easing of near-term headwinds, and a slowing rate of investments should allow for solid margin expansion in the years ahead, which I expect to result in low-teens EPS growth.

These estimates indicate somewhat slower growth than we have seen from the company over the last decade, but we should acknowledge that the company has grown significantly in size, making it challenging to maintain this level of growth organically.

Ultimately, considering all factors, I now expect the following results from Copart through fiscal year 2028. This accounts for some macroeconomic headwinds that are expected to persist into FY26 and ease in the years after.

So, where does this leave us in terms of valuation? As I mentioned earlier, Copart shares generally trade at a premium, and rightfully so. Interestingly, shares have faced significant weakness over the last year or so, as investors have become more cautious in the face of near-term macroeconomic weakness, inflationary pressures, and higher investments, leading to somewhat slower revenue growth and some margin pressure.

However, as discussed, long-term trends remain intact, and the company shows no operational weakness. Nevertheless, Copart shares now trade at a 12-month low of $48 per share, which is down 11% over the last 12 months and 16% YTD. As a result, Copart shares now trade at roughly 31x this year’s earnings, and while still quite a demanding multiple, this is well below its 5-year average of 35x and roughly in line with its 10-year average of 30x, so I would say that, based on historical numbers, this looks relatively fair.

Meanwhile, an EV/EBITDA of 23x suggests a slight discount to its 10-year average of 25x, and a FCF multiple of 40x is well down from a 10-year average of 66x. So, adjusting for a strong balance sheet or using real cash flows, Copart shares don’t look too expensive on a relative basis at all.

Of course, paying 40x FCF or 31x earnings is in no way cheap, but we should consider the sheer quality of this business and the premium it deserves. Copart has a brilliant, capital-light, anti-cyclical, highly scalable business model, a mighty market position (practically no competition), a very strong moat, healthy double-digit organic growth in its underlying market, industry-leading and growing margins, and consistently strong reinvestment metrics… can we (investors) ask for much more?

The result? A company growing both sales and profits at a very strong rate and with plenty of room to keep delivering double-digit sales growth and low-teens profit growth for at least another decade.

No wonder this company is awarded a premium multiple – companies like these simply don’t come on sale. Historically, any sort of discount or considerable share price weakness has proven a great buying opportunity.

I don’t think this time is any different. Paying 31x earnings for a company growing at such a strong clip, with no risk of disruption and barely any exposure to macroeconomics or cyclicality, seems quite fair.

Using a 32x multiple on my fiscal FY27 EPS estimate, which is closer to historical multiples, I calculate an end-of-fiscal FY27 target price of $62.40. From a current share price of $48, this suggests potential annualized returns of roughly 12%, which I deem really healthy returns.

So, does this make Copart shares a buy today? My answer is Yes! I believe the risk-reward and potential returns here are compelling enough to start a small position in this brilliant compounder.

However, I would prefer a bit more downside protection before buying more aggressively. If shares drop further to below $45 per share, I believe the risk-reward ratio becomes much more compelling, and the shares become a no-brainer.

For now, DCAing into a position appears to be a solid strategy.

Great article 👍 Any opinions on the potential impact of Autonomous vehicle growth to CPRT future business?

Nice writeup on $CPRT as I feel you hit the nail on the head regarding its advantages. Obviously, at > 30X earnings, the stock is not cheap in an absolute sense. If there's nothing wrong with the moat, this could provide a nice setup to take advantage of weakness in the stock price where there is nothing wrong with the business.