Delta Air Lines, Inc. – Sets the benchmark with decent Q1 results

Delta kicked off the earnings season last Thursday with excellent Q1 results, which were well received by investors. Yet, shares remain undervalued in our view.

The earnings season always kicks off with Delta Airlines setting the benchmark for global Airlines, followed by big banks on Friday. Whereas Delta shares fell by double digits in January on the Q4 results, investors seemed to be more pleased with the quarterly numbers this time.

Delta shares gained 3% last Thursday after the company reported its Q4 earnings, adding to the significant gains that followed the January sell-off. Since we covered the shares in mid-January, they have gained a very impressive 28%, getting quite close to our $52 price target quickly—and well deserved!

For those unfamiliar with the company, Delta is a major American airline that operates domestic and international flights. Headquartered in Atlanta, Georgia, Delta is one of the largest and oldest airlines globally, with a market cap of just under $30 billion. It flies to 352 destinations across 52 countries and operates over 5,400 flights daily using its fleet of 978 aircraft, operating one of the world’s largest fleets. It is definitely one of the most significant players in the industry.

In our January coverage (found here), we argued that Delta remains a standout in the industry and is by far the highest-quality player, deserving a premium over peers. The company showed it has an edge over the competition, is named one of the best employers in the U.S. by Fortune, can deliver substantial FCF, has a lot of growth ahead, and is able to outperform consistently.

We very much liked the company and its shares after the Q4 results, naming it the best pick in the industry. Not much has changed after the Q1 results, with the company continuing to outperform expectations.

Last Thursday, Delta reported record-high quarterly revenue of $13.75 billion for the quarter ending in March, up 8% YoY, beating the consensus by a pretty significant $890 million. Adjusted revenue was $12.6 billion, up 6% YoY.

This beat and the YoY gains were, first of all, driven by solid demand trends. Recent data showed that services spending surpassed goods for the first time post-COVID as we are seeing a continued normalization and return to long-term trends, which in this case favor Delta. This aligns with the demand trends management sees as consumers remain healthy and continue to view travel as a top purchase priority.

Particularly, business travel demand has been trending up strongly, growing by 14% in Q1, and high-margin revenue, in general, did quite well, generating 57% of total revenues. Premium revenue was up 10% YoY, driven by the expansion and significant adoption of premium options like premium seats. This is where Delta excels and has a strong customer base, from which it fully benefits.

In terms of regions, domestic revenue grew by 5% in Q1, driven by record unit (flight and passenger numbers) revenues, which were up 3% YoY. This improved by 7 points from one quarter ago, reflecting solid demand trends and an improvement in the industry backdrop due to some economic struggles and careful consumer spending.

Meanwhile, international revenues continued to do well, up 12% despite a 3% unit decline. This decline reflected capacity investments and developments in the Latin and Pacific franchises, which dragged on unit numbers. Still, this is an excellent performance, especially considering it lapped a very strong 1Q23.

Apart from solid demand trends, this outperformance is also helped by operational excellence. Just consider that the completion percentage was up by 100 bps YoY in Q1, which is an incredibly important number for customer satisfaction, and this is an area where Delta does exceptionally well.

This is largely thanks to its excellent employee base of over 100,000. Forbes named Delta the fifth-best large employer in America, which is an important indicator of long-term success and great management. Just consider that Delta issued $1.4 billion in bonuses to employees under the banner of “profit-sharing,” which is more than all its competitors combined. No wonder it's named one of the best employers and is able to reel in the best personnel.

This shows the company is excelling financially and operationally, increasing its long-term potential and positions it extremely favorably. Whether your experience with Delta is good or not, the numbers and statistics don’t lie. Delta is among the best.

This top-line success continues on the bottom line in the form of improving margins and cash flows. Going by numbers over recent quarters, Delta is significantly improving its operations and profitability and widening the gap to the competition further. ROIC was 14% on a trailing 5-quarter basis, up 390 bps from the prior period and truly industry-leading. Just consider that its closest peers – American Airlines and United Airlines – sit closer to the mid-single digits.

In Q1, operating income was $640 million, reflecting an operating margin of 5.1%, up 50 bps YoY, helped by 1.9% better fuel efficiency due to the continued renewal of the fleet. This led to a net income of $288 million or an EPS of $0.45, beating the consensus by $0.08 and up a significant 80% YoY as the operating environment has improved considerably. EPS was at the higher end of guidance as strong demand offset higher-than-expected fuel inflation.

Finally, Delta reported an FCF of $1.4 billion, down 26% YoY, but reflected higher investments of $1.1 billion and a higher profit-sharing of $1.4 billion. Overall, this is excellent and still reflects an FCF margin of over 10% in a very thin-margin industry.

This excellent cash flow generation positions the company well to further strengthen its balance sheet and deliver significant shareholder value.

Delta ended the quarter with a total cash position of $3.9 billion, up $1.1 billion from the end of Q4, and a total debt of $15.5 billion, down by approximately $400 million. This means the company still has a balance sheet with $11.6 billion in net debt, which is far from ideal but down meaningfully from a peak net debt of $18.2 billion at the end of 2020 as the company was forced to take on a lot of debt to stay afloat during covid.

Positively, management is fully committed to bringing down its debt to healthier levels and continues to see this as a top priority. In 2024 alone, management aims to repay at least $4 billion of debt (it repaid $700 million in Q1) and will continue working to lower its debt opportunistically while rewarding shareholders through a recently reinstated dividend.

At the moment, shares yield only 0.65%, which is based on a payout ratio of only 5%. We should expect this to grow rapidly in the coming years as the company continues to grow cash flows and improves its balance sheet, leaving more room to return cash to shareholders. This makes the dividend quite exciting, and considering the strong debt reduction trajectory management is on, we do not view the current leveraged balance sheet as a huge issue.

During the quarter, Fitch and S&P raised Delta's financial outlook to positive, combined with a BB+ rating, which is great and an essential indicator of improving financial health!

Outlook & Valuation

Moving to the outlook, obviously, the company is not operating in one of the most exciting or popular industries, but it has positioned itself extremely well within the industry. The airline industry is projected to grow at a CAGR of roughly 3.2% from 2023 to 2030, which is no incredible growth in any way but enough to make it interesting, especially as Delta has plenty of potential to outperform.

Most importantly, however, in the short term, management reaffirmed its outlook after the Q1 results. Management was satisfied with its first quarter and has good visibility into the strength of summer travel demand, which allows it to remain confident in its full-year outlook.

Management continues to guide for FY24 EPS of $6 to $7 per share and an FCF of $3 to $4 billion. This includes the expectation for Q2 revenue growth of 5% to 7%, based on 6% to 7% capacity growth and flat unit growth.

Furthermore, the Q2 operating margin is expected to be between 14% and 15%, down quite a bit from 17.1% in the same quarter last year. This includes the expectation for 10% higher fuel prices and 2% growth in non-fuel costs. This translates into an EPS guidance of $2.20 to $2.50, down 12% YoY. It is not the most impressive guidance, but it is roughly in line with the consensus.

Across the board, management indicates consumer demand remains robust, and the outlook for corporate travel is optimistic. In the second half of the year, management expects quite an improvement in demand, while the summer should be another record period. Looking forward, management expects progressive improvement through 2025, driven by asset utilization and improving profitability.

Longer-term, Latin America and the Pacific should be solid growth drivers as supply and demand come back into balance from the second half of this year. Management is focusing on rapidly growing capacity in these regions and is poised to benefit from a multi-year restructuring program.

Meanwhile, on a slightly negative note, we do have to consider the Boeing scrutiny for Delta, as it will likely lead to plane delivery delays. In January, we already pointed out that Delta had orders for 100 Max 10 planes worth over $13.5 billion, for which the increased regulatory scrutiny would most likely lead to delays through 2027, according to Delta management.

This will lead to capacity expansion and fleet renewal delays, which management hopes to partially offset with Airbus aircraft deliveries, particularly the A321NEO aircraft. Still, to be conservative, we anticipate some headwinds in terms of efficiency and capacity gains in 2025, 2026, and 2027.

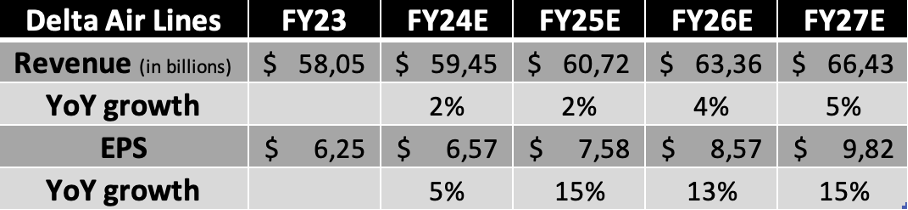

Considering all of this, Wall Street analysts now expect the following financial results through FY27. These have trended up a bit over recent months, reflecting an improving outlook.

In terms of valuation, however, there is no denying that shares aren’t as favorably priced as they were a couple of months ago after some significant share price gains and mostly unchanged guidance.

However, the upside is still significant. As explained earlier, Delta is a standout in the industry and, therefore, continues to earn quite a premium and remains quite favorably valued. Shares now trade at only just over 7x earnings, which still is a 23% discount to its 5-year average. Meanwhile, the company is in a much better financial position and has a very promising outlook, as laid out above. As a result, we believe it might even deserve to trade at a premium to its own historical multiples.

However, we remain conservative here and believe an 8x multiple is the very least one should be willing to pay for this industry leader, offering enough downside protection. Based on this multiple and the FY25 Wall Street consensus, we calculate a target price of $61, which reflects annual returns of roughly 17%, which is nothing short of excellent.

In our view, Delta remains a high-quality pick in a relatively low-quality industry and a real standout performer. The company has a promising outlook, is rapidly improving its financial position, and offers a promising dividend. Across the board, we believe Delta continues to be an interesting investment opportunity at current prices and rate shares a buy.

Let us know your thoughts in the comments! Also, please leave a like if this post was of value to you!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

Great write up. Lot to like about Delta