Deutsche Telekom AG – Not exciting, but poised for 12% annual returns

Should you buy a boring telecom business? Yes, you should, but only this one!

Alright, I know this might not be the kind of business you want to read about. Deutsche Telekom isn’t an exciting technology stock with exposure to AI and isn’t bound for double-digit growth for eternity. It is not that exciting (safe to say, boring), not high-growth, not innovative, and operates in a harsh and historically poor-performing industry.

So, why even bother?

Well, don’t stop reading just yet. This is not the time to judge a book by its cover. In many aspects, DT is nothing like its peers and is actually a very compelling defensive investment. This company has absolutely left competitors in the dust over the last decade, mostly thanks to far superior execution and better strategic decision-making.

While it might not seem that way, we are actually going to discuss one of the most compelling long-term defensive investments today. Indeed, Deutsche Telekom is a defensive gem hiding in plain sight, thanks to its unique structure, dominant market position, healthy financials, and potential for significant earnings growth in the years ahead as capital intensity eases.

To me, this makes the company the perfect defensive cornerstone in any portfolio – an investment you can count on under any circumstances.

With the company having held its one-every-three-years investor event late last year, now is the perfect time to take a close look at this German giant, its financials, and its future. Let me tell you all about it and show you why this company has a special place in my own portfolio.

Telecom isn’t the most compelling market, I know

Now, before getting into the business, let’s address the elephant in the room: the telecom industry's unappealing nature.

I know the simple fact that the company operates in the telecom sector already puts it one step behind for investors, and understandably so. It has probably already led to a significant number of InvestInsights subscribers deleting this email before even getting to it.

Why would you want to invest in this industry at all?

It is safe to say that the telecom sector has not been among the greatest investments over the last decade—or, actually, over pretty much any time frame. Of six of the largest players in the business globally, only two have delivered positive returns over the last five or ten years (among which is DT), which is extremely poor, to say the least.

This can be blamed on a number of factors. First of all, there is the intense competition. Telecom companies often operate in saturated markets where most potential customers already have access to services like mobile connectivity and broadband. This saturation forces companies to compete primarily on price, leading to thin profit margins and limited pricing power.

In addition, there are the high capital requirements. Telecom providers must consistently invest in costly infrastructure upgrades to deploy new technologies like 4G, 5G, and fiber-optic networks. These upgrades take years to pay off and consume a significant portion of cash flow, leaving less available for dividends, share buybacks, or other shareholder returns.

So, thin margins and high capital requirements – not a great recipe for success.

Finally, you can add to this the fact that many of these telecom companies carry large amounts of debt (in part due to failed attempts to enter new markets like cable TV or streaming), regulatory challenges, and just simply the fact that this is a slow-growing industry.

For reference, the industry is expected to grow only in the low single digits through the end of the decade. In Europe, the market is projected to grow at a CAGR of 1.7% through the end of the decade, and in the U.S., it is projected to grow at a slightly better 3.7% CAGR.

Indeed, it’s not the most attractive outlook, I understand.

Nevertheless, I am here to argue that Deutsche Telekom is a compelling investment. Thanks to brilliant execution, a dominant market position, a superior business and network, and a healthy financial profile, it is positioned for long-term success and potentially market-beating returns at a risk profile well below average.

Again, don’t stop reading now. Let me explain!

Deutsche Telekom – the gem of the Telecom industry

Deutsche Telekom is a German telecommunications giant and one of the leading providers globally. It has a presence in over 50 countries, a €150 billion market cap, reports over €112 billion in annual revenue, and has more than 300 million customers globally.

The company offers a comprehensive range of services, including fixed-line and mobile communications, broadband internet, and digital television, catering to both individual and business customers.

This company has absolutely left competitors in the dust over the last decade, mostly thanks to far superior execution and better strategic decision-making. I mean, management has delivered on all its 2020 investor event promises over the last 4 years and over-delivered on most. As a result, it has been one of the few telecom giants to deliver positive returns to investors over the last decade.

Accentuating its quality, whereas Deutsche Telekom wasn’t even the largest telecom player in Europe in 2014, it is worth twice the combined value of its three closest competitors today. A big part of this success has also been driven by its ownership of T-Mobile US, which has rapidly taken over the U.S. market over the last decade, having grown to become the most valuable telecom business in the U.S.

You see, Deutsche Telekom operates through a global network with a strong presence in many European countries, including its home market of Germany. However, what makes Deutsche Telekom especially compelling, unique, and interesting is its presence in the U.S. through its majority ownership of T-Mobile U.S. (50%+ ownership worth $122 billion). T-Mobile U.S. has been by far one of the most exciting growth stories in the telecom industry in recent years, rapidly taking market share from industry giants AT&T and Verizon and emerging as a real disruptor.

This has provided Deutsche Telekom with a great growth engine, and it makes it one of the more unique telecom players with a significant presence and leading market position in both Europe and the U.S.

This, in combination with continuous market share gain in Europe thanks to a superior network and execution, has helped it perform extremely well over recent years, outpacing most peers and growing to become the #1 telecom brand globally, with its brand value having grown 84% since 2020.

In fact, the Deutsche Telekom/T-Mobile brand is currently the 9th most valuable globally and #1 most valuable European brand.

Indeed, Deutsche Telekom isn’t your average telecom company but a far higher-quality alternative to its more popular American peers. Without any doubt, I feel safe to say Deutsche Telekom is by far the best telecom business globally.

Its great success in recent years is also largely due to its excellent mobile and broadband network. Regarding network strength, in Germany, the Deutsche Telekom 5G network covers 98% of the population and 78% of Europe. These are unequaled numbers, and in addition to offering the best coverage, the company also offers the fastest 5G speeds. Today, the company is the leader in 5G connectivity in all its respective markets.

In this industry, network quality, coverage, and customer satisfaction go a long way in ensuring your success, and this is where DT once more excels. As a result, the company claims a strong market share across Europe and the U.S.:

35% mobile market share in Germany (gaining share)

40% broadband market share in Germany (gaining share)

31% mobile market share in Europe (gaining share)

26% broadband market share in Europe (gaining share)

30% mobile market share in the U.S. (gaining share)

Of course, despite all this quality and success, telecom will always be a mature and slow-growing market, so Deutsche Telekom isn’t reporting ‘appealing’ numbers. I mean, don’t expect this business to grow earnings at anything more significant than a mid-single-digit rate at any time.

Nevertheless, I am here to argue that it doesn’t have to and that it is still an appealing investment, just for different reasons.

Instead of being a high-growth, high-risk, high-volatility, and potentially high-return investment, Deutsche Telekom has the potential to outperform the market under any circumstances, in both bull and bear markets, thanks to its defensive, anti-cyclical, and inflation-resistant nature.

Indeed, Deutsche Telekom is the kind of business you can count on when times get rough to keep growing and deliver positive returns while performing in line during a bull market. In other words, this is a stable force, a quality which, to me, is just as important as a fast grower.

Even amid the COVID-19 crisis and record-high inflation levels in Europe and the U.S., Deutsche Telekom performed well and consistently.

As it offers internet and mobile services, which are nowadays a basic necessity of life, the company doesn’t depend on economic health (up to a degree, of course). People will continue to use its services no matter the circumstances. In fact, as the world around us becomes increasingly digital, demand still grows.

As a result, Deutsche Telekom has been reporting revenue growth at a low single-digit CAGR in recent years, still outpacing the underlying industry as it takes market share but not really exciting investors. Service revenue (or contract revenue excluding handset sales) has grown at a 3.6% organic CAGR over the last four years.

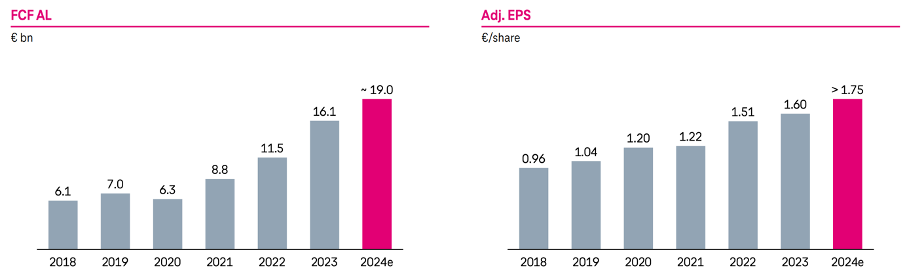

While this is decent and as much as you can expect from it, the real appeal here is the bottom-line performance track record and promise. Thanks to rapidly expanding margins as capital intensity eases, especially in the U.S., cash flows and margins are, in fact, growing at an impressive rate. FCF has grown at a 30% CAGR from 2020 to 2024, now exceeding €18 billion annually, and EPS has grown at a 10% CAGR in recent years.

That is impressive, and, positively, this bottom-line growth is even expected to keep accelerating in the years ahead as Deutsche Telekom has positioned itself extremely well to further expand margins as it drives down costs and continues to grow steadily in both Europe and the U.S.

Despite being a boring and defensive business in a tough industry, Deutsche Telekom is exceptionally well-positioned to continue outperforming and delivering significant earnings growth.

This is as good as an ultra-defensive investment will get.

On that note, let me take you through its financials by looking at the recent financial reports before getting deeper into the outlook and valuation.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe if you like our content! Want to receive even more of our investment insights and show even more appreciation? Please consider upgrading to our paid tier (only $7.50 monthly or just $70 annually).

In addition to all the free stuff, this also gets you access to even more premium analyses (a total of 3 per month), full access to my own (outperforming) portfolio, immediate trade alerts in the subscriber chat, and a full overview of all my price targets and rating, and even more!

Want to try our paid tier for free? Simply get three of your friends and family to join Rijnberk InvestInsights and receive one free month!

Deutsche Telekom reports steady growth and healthy financials

Now, of course, telecom businesses aren’t known for their excellent financial health. This is primarily due to the capital-intensive nature of the industry, with these companies requiring significant upfront investment in infrastructure, such as building and maintaining networks, laying fiber-optic cables, and upgrading technology to support advancements like 5G.

Add to this the highly competitive nature of the industry and thin margins, and you can imagine it takes some time to earn back these investments, resulting in ugly balance sheets across the board. Here are some examples:

AT&T -> $148 billion in debt (Market cap $168 billion)

Verizon -> $178 billion in debt (Market cap $178 billion)

Vodafone -> $64 billion in debt (Market cap $23 billion)

Orange -> $46 billion in debt (Market cap $27 billion)

Yeah, that isn’t a pretty picture (there aren’t tens of billions in cash, either), especially given very thin margins and slow growth.

This slow growth in itself is another reason why the financials of these companies are rarely exciting. I mean, most of these businesses haven’t averaged a revenue CAGR above 2% over the last decade. In fact, the four businesses above have averaged a revenue CAGR of -1% since 2015, in part due to mergers and spinoffs across the board.

Still, this is extremely poor.

For Deutsche Telekom, I wouldn’t say the situation is very different (it holds a lot of debt as well and operates in the same industry after all), but I will argue it is in a considerably better and healthier position than most of its peers, mostly thanks to its better growth profile and outlook thanks to superior execution, and rapidly growing cash flows, allowing it to lower its debt and improve its financial health.

I wouldn’t even consider investing in any of the others, but Deutsche Telekom stands out from the pack.

I already alluded to some numbers before, but here are some more: Deutsche Telekom has grown revenues at a 6% CAGR since 2015 and a 3.5% CAGR since 2020, well outperforming all its peers. Furthermore, service revenue has grown at a 3.6% organic CAGR over the last four years, well ahead of most of its peers.

In many aspects, DT is nothing like its peers and a far superior business and investment, which was once more confirmed with its most recent quarterly earnings report, with the company showing solid and even accelerating growth across the board.

Let’s take a look at these numbers to get a better sense of its performance and health.

Deutsche Telekom delivered a good third-quarter earnings report, showing growth in line with medium-term targets and stable compared to prior quarters. Nevertheless, profit growth was slightly better than expected, allowing management to slightly raise its FY24 profit guidance.

The company reported group service revenue growth of 4% YTD, resulting in revenue growth of 3.6% YoY. This growth was due to resilient growth in its European business and accelerating growth in North America. The company has also reported strong customer growth YTD, with net increases from last year across the board.

In the U.S., service revenues grew 5.2% YoY, accelerating from previous quarters, thanks to this strong customer growth performance. T-Mobile U.S. added 1.6 million postpaid customers, including 865k phone net additions, both of which are industry-leading.

For reference, these postpaid numbers are more than double those reported by AT&T and Verizon combined, highlighting that T-Mobile U.S. continues to rapidly gain market share. Overall, this business is doing extremely well.

Over the last four years, TMUS has grown service revenues at an organic 4% CAGR, and judging by its current performance and traction, there is no reason to anticipate a slowdown here.

Meanwhile, DT’s German business also continues to do really well, continuing its trend from the last four years of stable low-single-digit growth and gaining market share, with 2.1% mobile revenue growth in Q3. This segment has grown mobile revenues at a solid 2.3% CAGR since 2020 and broadband revenues at a 4.9% CAGR as it expands its presence and availability.

Notably, both of these numbers are ahead of the target and the competition. For reference, competition grew mobile revenues at only a 1-2% CAGR. This outperformance was driven by continued market share gains thanks to a best-in-class network.

Moving to the European part of the business (excluding Germany, obviously), the company is currently firing on all cylinders. It reported 4.2% organic service revenue growth in Q3, once more the result of solid customer additions and the expansion of broadband networks across Europe.

This segment has also performed well over the last four years, gaining market share in all product categories. Consistency is also worth pointing out here, with DT having grown EBITDA in Europe for 27 straight quarters, showing little impact from the COVID-19 pandemic and record-high inflation levels in recent years.

Stable as she goes, right? I know it isn’t mind-blowing growth, but it is considerable, above its peers, and, above all, stable and reliable.

However, while this is all great and steady, Deutsche Telekom’s bottom-line growth and rapidly improving financial health are the real excitement drivers for investors.

For reference, the company has grown its EBITDA at a 6.9% organic CAGR over the last four years and its FCF has grown at a 32% CAGR over the last four years, both of which are still accelerating as well!

In 2024, so far through the first nine months, DT has grown EBITDA by 7% YoY, FCF has grown 28% YoY, and EPS has grown by 16% YoY. Those are pretty impressive numbers.

This was helped by a solid Q3 performance, with the company reporting a 9% growth in EBITDA and EPS growth of 4% YoY, in large part thanks to a cash capex decline of 10% YoY.

This led to FCF growth of 32% YoY and allowed management to strengthen the balance sheet, as it looks to report a record FCF of €19 billion this year. Last quarter alone, the company was able to lower its net debt (excl. leases) by 5% YoY to €92.5 billion.

Now, while this is still considerable, the rapidly improving cash flows make it somewhat more manageable. You see, this means we’re now looking at a 2.18x net debt/EBITDA ratio, which is really not that bad. Meanwhile, analysts anticipate DT to grow its FCF to over €23 billion by FY28, reporting over €20 billion a year from 2025 onward.

This means the debt is very manageable, and management knows this. In fact, after lowering its debt significantly in recent years, management is happy with its current balance sheet and BBB+ credit rating. Therefore, management aims to maintain its current balance sheet ratios and use its additional cash flows to invest in next-gen technologies and to reward investors.

For reference, management targets an EPS payout ratio of between 40% to 60%. With a projected 2027 EPS of €2.50, a 50% payout ratio would translate into a dividend of €1.25 or a 12% CAGR through 2027, so investors have great dividend growth prospects ahead.

Meanwhile, you already receive a sweet 2.6% dividend today based on a conservative 35% payout ratio, so I would say Deutsche Telekom is a rather compelling dividend growth investment for the years ahead.

Finally, management plans to use additional funds to buy more TMUS shares and reward investors through additional share buybacks.

So, ultimately, we are looking at a business in good financial health, reporting solid top-line growth and rapidly growing cash flows that will be used to reward investors. Really, what is there to complain about?

Let’s finally take a look at the growth ahead here, which management gave great insight into during its recent investor event.

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

Outlook & Valuation (CMD 2024 in detail)

In early October, Deutsche Telekom held its Capital Markets Day, an investor event held every three years. The company provided investors with a detailed look at the last three years and new targets and projections for the years ahead.

And after delivering on most of its 2020 targets, it has once more set ambitious targets for the next four years, pointing to stable top-line growth compared to previous years and significant earnings and FCF growth, impressing investors.

So, looking ahead, first of all, and similar to the last four years, management aims to keep growing its fiber coverage across Germany, Europe, and the U.S. and leverage its strong market position in mobile to grow fiber customers, while also still taking away market share in mobile.

DT has done excellently on this front over the last four years, with its best-in-class network and offering, and management believes it will be able to keep gaining market across all three regions, translating into the aim to grow customer numbers in excess of 4% annually.

For reference, globally available customers in these regions grow at less than 1% annually, so if the company can realize 4% annually, it will take a significant market share from the competition.

Crucially, management isn’t known for guiding or setting too ambitious targets. It is generally quite conservative, so this is a bullish backdrop speaking to management’s confidence.

Meanwhile, broadband upgrades to higher speeds and the growing usage of mobile internet should also drive higher contract value, creating an additional growth driver besides customer growth. As a result, management now targets the following through 2027:

A 4% revenue CAGR (2.5-3% in Europe, with the U.S. still the growth driver here)

EBITDA to grow at a 4-6% CAGR thanks to cash capex trending lower.

This should result in EPS growth at an 11%+ CAGR through 2027 -> hit €2.50 by 2027.

FCF to exceed €21 billion in 2027, reflecting a minimum CAGR of 7%

ROCE should improve to over 9%, higher than WACC.

These are really bullish targets set by management, increasing my confidence in the quality of this business and its ability to outperform.

After reorganizing the business over the last decade, it is now truly a best-in-class telecom company, with #1 positions across the board and no “weak links” after selling certain business parts, such as GD Towers and T-Mobile Netherlands.

It is safe to say this industry giant is in the best position it has ever been in, well-positioned to deliver impressive growth through the end of the decade.

Looking short-term, the picture also isn’t too bad, with management raising its EBITDA and FCF guidance post Q3 earnings, now projecting an FY24 EBITDA of €43 billion, resulting in an EPS of over €1.75, and FCF to be around €19 billion.

Ultimately, this results in the following financial projections

Over the last year or so, Deutsche Telekom shares, similar to the company itself, have performed rather well, delivering a 27% return (excluding dividends) roughly in line with the S&P500 and well ahead of the German DAX index. Also, shares now sit at their highest level since 2001 and no longer trade at the bargain levels these traded on in recent years.

However, I will argue that shares remain attractively priced nonetheless. You can now buy Deutsche Telekom shares at just below $30 per share, which reflects a 15x earnings multiple, which isn’t too bad for a business of this size, with this kind of revenue stability and growing earnings at double digits.

At the same time, this is a 10% premium to the sector median and its 5-year average multiple, but this seems more than deserved, given that the company is growing at about twice the pace of most of its peers and is arguably in the best fundamental position in its history.

Furthermore, on a PEG basis, which takes into account future growth, we are looking at a multiple of only 1.25x, which is an 11% discount to the sector median.

Indeed, I will argue that the growth ahead for Deutsche Telekom is not entirely priced in yet.

Consider this: Considering the current market cap of TMUS and DT’s 50.4% ownership, investors currently price DT’s ex-US business at a market cap of only €18 billion, which is obviously ridiculous. This reflects a 4x EV/EBITDA multiple, compared to a 6x multiple for European peers, offering far less quality.

For example, DT’s ex-US business is expected to grow EBITDA at a 3-4% CAGR, compared to only a 1.6% growth expectation for its European peers. So, if we were to value DT’s ex-US business at a multiple only 25% above that of its European peers, there would be another 10% upside here based on this alone.

Ultimately, whatever calculation we use or multiple we deem fair, I believe DT still trades at a discount to its fair value, considering its best-in-class network and management team and its accelerating EPS and FCF growth.

Meanwhile, the business trades at roughly the same multiple as back in 2010, not at all reflecting the much improved financial and fundamental position of the business and the double-digit EPS growth expected, likely through the end of the decade.

Currently, I believe fair value is about 15% higher at €34.50 per share, which is closer to a PEG of 1.5x and P/E of 17x.

Using a slightly discounted 16x multiple and my FY27 EPS projection, which is in line with management’s target, I calculate an end-of-2027 target price of €40. This reflects annual returns of about 9.5%, which, including the current 2.5% dividend, brings us to potential annual returns of 12%, which is still only based on management’s targets, which tend to be somewhat conservative.

Personally, as long as shares trade below €31 per share, I am happy to keep buying shares of this defensive telecom giant.

For all of you reading this through e-mail, did you know we also have an active subscriber chat [FREE]?

In this chat, we post regular updates throughout the week, like standout news items, with plenty of room for discussion and questions from all of you!

Definitely go check it out, and feel free to ask me anything there! Don’t miss out on these daily subscriber features!

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

Amazing write-up, thanks for highlighting this company.