DraftKings Inc. – A Deep Dive

This leading online gambling business might just be one of the most promising investments for the decade ahead. Time to find out all about it!

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

I must admit, until earlier this month, when I received the request to cover DraftKings through a paid subscriber pole, the company wasn’t on my radar. I had never really looked into it. Why? I honestly don’t know. Possibly because I tend to avoid unprofitable businesses… DraftKings was yet to turn an actual profit for long, although it is making solid progress today.

Anyway, I had my work cut out for me over these last few weeks researching the company, and I must say I was positively surprised. This is a really interesting, well-managed, and exciting business, definitely worth a deeper look.

Last week, February 13, online gambling and sports betting giant DraftKings released its fourth-quarter earnings report, impressing Wall Street. DKNG shares gained a sweet 15% during the following trading session on Friday, bringing its YTD returns to over 40%(!), propelling shares to their highest level since mid-2021, when the company’s online activities boomed thanks to COVID lockdowns.

Notably, after setting an all-time high in early 2021, at the peak of the COVID-19 pandemic, shares plummeted by a whopping 85% to an unavoidable low in late 2022, as COVID optimism, which had led to shares trading at insane multiples, slowly disappeared, and the world returned to normal.

However, since then, the company has continued on its March to the top of the online gambling and sports betting industry. This industry is definitely a very compelling market for long-term investors, thanks to easing regulation globally, a continued shift to digital, and growing enthusiasm for sports betting. This has led to double-digit industry growth projections through the end of the decade.

And DraftKings is perfectly positioned to benefit, as the industry leader.

As a result of the strong industry dynamics and DKNG’s good execution over the last few years, the company is still growing its active user base and revenues at a rapid and mightily impressive rate while also slowly but surely becoming more profitable. Thanks to this operational success, since that late 2022 low, shares have bounced back, gaining almost 400% in the span of about 26 months, though still trading 20% below that COVID-19-induced all-time high.

Crucially, this hasn’t been without reason. Here are some facts to consider:

Revenue has grown at an 87% CAGR from 2020 to 2024, reaching almost $5 billion in annual revenue.

Unique users have grown at a 40% CAGR over those same four years, going 4x in 4 years.

The EBITDA margin has improved from -64% in 2020 to -32% in 2022 and turned positive in 2024 at 3.8%.

SBC has declined from 15.2% in Q4 2022 to just 7.9% in Q4 2024, showing a steady decline and relatively low levels compared to growth.

And in the meantime, DraftKings has overtaken FanDual in the online gambling industry, capturing a 31% market share.

Indeed, this truly is a unique and high-quality business that is rapidly taking over a highly promising industry.

Looking at the last quarter, the 15% jump in share price doesn’t come as a surprise. DraftKings delivered a solid quarter, which showed continued strong growth in users and improved margins. Meanwhile, management was incredibly optimistic about 2025, raising guidance and pointing to another great year.

Today, following last week’s earnings report and shares jumping to a multi-year high, I want to walk you through this industry leader, showing you why it deserves to be on your watchlist or why now is possibly the time to pick up some shares, and taking a critical look at the Q4 earnings report and outlook for 2025.

Without further ado, let’s delve in!

This is DraftKings Inc.

So, let’s start at the basis. What is DraftKings?

DraftKings is a leading digital sports entertainment and gaming company that specializes in daily fantasy sports, sports betting, and online casino gaming. Thus, the company operates in the online gambling industry, with a heritage in sports betting, and solely operates in the U.S.

Headquartered in Boston, Massachusetts, DraftKings operates a robust sportsbook that allows users to place bets on a wide range of sporting events, including professional and college leagues in the U.S. and internationally. Founded in 2012, the company has grown into one of the most recognizable sports betting brands, offering users a seamless and engaging experience across multiple platforms.

However, today, the company has expanded beyond just betting on sports and is a rapidly growing player in the online casino market, which has really taken off post-COVID. It provides a variety of digital gaming options, including poker, blackjack, and roulette. This addition of features has made it one of the largest online gambling players globally.

Over the years, DraftKings' innovative gaming approach and commitment to technology-driven solutions have positioned it as a major player in the evolving landscape of online gambling and fantasy sports.

Today, DraftKings leads the U.S. online gambling industry with an impressive 31% market share, overtaking Fandual in 2023 with a 30% market share. Interestingly, Fandual was the leading player in the U.S. for many years, but in recent years, DraftKings has rapidly overtaken the leader, taking a significant market share.

DraftKings’ rapid market share gains are even better visualized when looking at the sports betting industry. Here, the company has grown its market position considerably, as shown below:

2022 -> DraftKings has a 25% market share (versus 43% for Fandual)

2023 -> DraftKings grows to a 34% market share (versus 39% for Fandual)

2024 -> DraftKings grows to a 38% market share (versus 36.5% for Fandual)

That is an impressive development, a testimony to and perfect visualization of the company’s success in the industry in recent years. It is simply outpacing competitors on all fronts.

Of course, you are wondering why. What gives DraftKings such a big edge over the competition in these recent years?

Well, there are several factors at play here, but it all boils down to the same thing: great management, a good understanding of the industry, and perfect execution.

DraftKings is still led by its co-founder Jason Robins, the current CEO and chairman of the board. Robins founded the company with Matt Kalish and Paul Liberman in 2012. For me, the fact that this business continues to be founder-led is a big plus, and this is also reflected in its performance over recent years.

You see, since its inception in 2012, management has been fully focused on gaining market share, consumer trust, and building its user base, all at the cost of initial profitability—a risky strategy, but one that paid off massively.

Over the last decade, DraftKings has been fully focused on bringing superior technology to market and scaling rapidly through very aggressive marketing.

Starting with the latter, DraftKings has been by far the most aggressive on marketing of any player in the industry. The company has been willing to outspend competitors on promotions and customer acquisition, investing heavily in promotional offers like risk-free bets and deposit matches, particularly in newly legalized states where gaining early market share is critical.

This also included important strategic partnerships. DraftKings has aligned itself with major sports leagues, media companies, and influencers, expanding its brand presence and credibility. By securing key partnerships with ESPN, the NFL, and other major entities, it has built stronger brand equity, making it the go-to sportsbook for casual and serious bettors.

For reference, in 2021, the company spent a whopping 76% of revenue on sales and marketing alone, amounting to $1 billion. This investment paid off massively, leading to the incredible market share gains above.

In addition, DraftKings has been superior in product innovation. The company has built a more comprehensive in-app experience with better live betting options, more micro-markets, and a smoother overall interface. It has also integrated a more engaging loyalty program, which keeps bettors within its ecosystem for longer. The company’s deep focus on in-game betting, which is becoming a larger share of overall betting volume, has also helped it capture a more engaged audience.

All in all, the company has just been outplaying the competition on all fronts and continues to do so, leading to constant market share gains in an already rapidly growing market.

Unsurprisingly, this leads to a pretty great outlook, but also a risky one. While online gambling is an up-and-coming and fast-growing market, it comes with significant risks outside of DraftKings’ control.

The digital gambling industry – High growth goes hand in hand with high risk.

As I said, the digital gambling market has two sides. On the one hand, the industry is incredibly promising, thanks to the rapid adoption of online gambling apps and steady progress in its legalization. However, considerable risks must also be considered, such as higher sports betting and gambling taxes, changing gambling laws, advertising restrictions, and low margins due to the need for high promotional spending.

Let me discuss both the negatives and the positives in greater detail, starting with the positives (I’ll focus on the U.S. market only since DKNG solely operates in the U.S.).

Industry growth is expected to be considerable thanks to high adoption and additional legalization

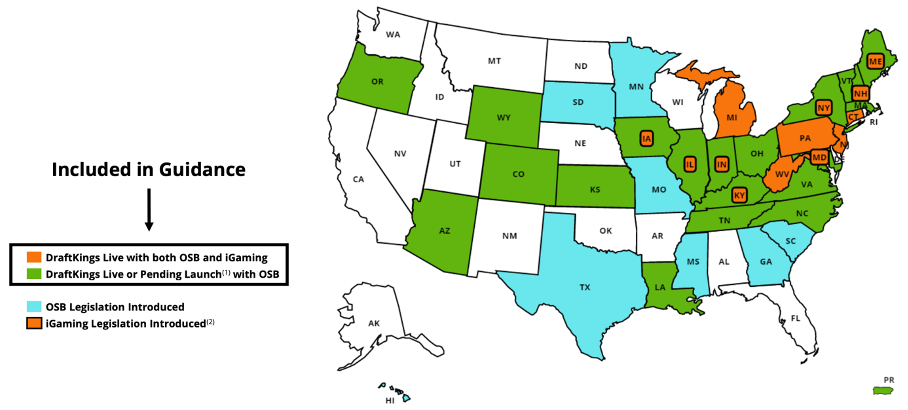

For starters, it is worth pointing out that, despite the already significant revenues, the U.S. digital gambling market is still in its very early innings. This is especially true for iGaming (digital casinos), which is extremely profitable (40% to 50% margins) and has yet to be legalized in many states.

For reference, as of February 2025, only seven U.S. states (out of 50) had legalized online casino gaming. This number has been gradually increasing, with Rhode Island being the most recent state to do so. The trend is ongoing, with several other states considering similar legislation. For instance, in February 2025, Illinois lawmakers introduced bills aiming to legalize and regulate online casino gaming within the state.

Many more are expected to join in the years ahead, which will drive considerable but highly uncertain growth.

Meanwhile, the sports betting industry is already a bit more mature. It is accepted in over 25 states, most of which have overturned bans since 2018, and is growing.

In sports betting, margins are much thinner (roughly between 5% and 10%) due to a much higher win ratio for users. However, the business is much more sticky, as gamblers tend to return regularly, in large part due to the relatively high win rate. Low margins are offset by high volumes.

Ultimately, both of these industries are solid growers with significant potential. Their growth is mostly driven by the growing adoption of digital gambling, which is being legalized in more and more U.S. states.

However, even without additional legalization, DraftKings is optimistic about market growth, purely due to higher engagement rates, customer retention, and monetization from improved and expanded product offerings. In existing states only, DraftKings foresees TAM growth at an 8.5% CAGR, which is far from bad.

Meanwhile, the additional expected legislation, although unpredictable, is expected to push growth well into the double digits for both the online casino and sports betting industries. The combined market is expected to grow at a low-to-mid double-digit rate well into the next decade.

Obviously, this is a great market backdrop for DraftKings, the industry leader. Through continued market share gains, the company should be able to outpace the underlying industry, leading to revenue growth of at least a mid-to-high teens CAGR through the end of the decade, with plenty of upside.

Regulatory risks can’t be overlooked

While the outlook above sounds great, the online gambling industry also has above-average risk, mostly regulatory.

Most importantly, gambling laws are subject to frequent changes. While they have been positive in recent years, thanks to additional legalization, companies like DraftKings and Fandual can be hit very hard when stricter regulations are imposed, ranging from higher taxes to outright bans.

Ultimately, gambling is addictive, and making it more accessible through apps isn’t really something regulators are enthusiastic about.

For example, in the U.K., regulators have banned gambling ads on TV, hurting customer acquisition efforts, something that is also possible in the U.S.

Higher taxes on sports betting and online casinos are also a much-discussed subject. In Maryland, the 2025 Budget Announcement included a proposed increase in the online sports betting tax rate to 30% from 15%. The budget also proposed raising the land-based table game tax rate to 25% from 20%.

This raise alone in a relatively small state is, when implemented, expected to create a $25 million to $30 million headwind for DraftKings’ 2025 adj. EBITDA. More such tax hikes could significantly impact profitability.

Finally, another negative to consider is the need for aggressive spending on promotions to acquire customers. While this is seen trending down industry-wide, as competition eases due to acquisitions and consolidation, the market remains price sensitive. High spending on promotions will keep margins under pressure.

Ultimately, I think it is fair to say the sports betting and iGaming industries have huge long-term potential, especially as more U.S. states legalize online casinos. However, the industry is highly competitive, subject to regulatory risks, and has thin margins in sports betting. These are important risks to any thesis to consider.

Yet, I believe the positives outweigh the negatives. The industry is likely to experience significant growth, and DraftKings is perfectly positioned to benefit, with its size also offsetting some of these headwinds.

On that note, let’s examine the fourth-quarter results to get a good sense of current growth, financial health, and margin development!

Q4 earnings and financials review

DraftKings released its fourth-quarter earnings report on Thursday, February 13, and, as mentioned before, it impressed. However, I will say the outlook did the job.

As for the quarterly numbers, DraftKings reported total Q4 revenue of $1.4 billion, up 13% year over year and roughly in line with consensus estimates. At first glance, this 13% growth might seem rather disappointing for a high-growth stock, but it is worth pointing out that growth for DraftKings fluctuates strongly due to the influence of the timing from sporting events or regulatory action, like the approval of new regulation.

This time, Q4 was quite dull in terms of sports activities, but the company had a strong Q4 2023. Ultimately, I wouldn’t look too closely at the quarterly growth numbers and differences.

The FY24 numbers are much more useful and impressive! DraftKings delivered 30% year-over-year growth in FY24, reporting a total revenue of $4.8 billion.

Alright, yes, as visualized below, growth is slowing down considerably, but this is in line with expectations coming out of a period with a lot of new legislation working in its favor and the COVID-19 pandemic accelerating the transition to online gambling. By now, these headwinds are easing, but I am pleased to see the company still grow its top line this quickly.

However, unique customers/users are even more impressive and important for the long-term thesis. Revenue growth numbers are important in the short term, but in the long term, it is all about growing the number of consumers using the DraftKings platform.

Positively, this growth remains even more impressive. Last quarter, the company added a whopping 800,000 new unique customers, reflecting 36% YoY growth and bringing the FY24 number to a whopping 3 million new customers, up 42% YoY to 10.1 million.

To me, these are absolutely mind-blowing numbers, as DraftKings doesn’t seem to be struggling with the rule of large numbers. Despite its significant size, customer growth remains incredible.

The difference between user and revenue growth is explained by a drop in ARPU (Average Revenue Per User), which was driven by lower betting activity amid fewer sporting events compared to last year and prior quarters. Again, this number fluctuates highly.

Again, despite a drop in ARPU, underlying structural trends remain positive and continue to improve. In Q4, the SB hold percentage improved 80 bps year over year to 11.2%, which is quite impressive.

For reference, a sportsbook's hold percentage (or just "hold") refers to the percentage of total wagers that the sportsbook keeps as revenue after paying out winning bets. It essentially represents the book's profit margin.

In other words, DraftKings is seeing its sports betting net income margin increase further. It is well above the industry average and is already much higher than management's long-term forecast.

Ultimately, while the Q4 revenue numbers weren’t impressive, at first glance the annual numbers are, and structural underlying trends remain strong and positive.

Moving to the bottom line, DraftKings performed quite a bit better than expected.

The company delivered a Q4 gross margin of 45%, reflecting the structural improvements in SB hold percentage and the optimization of promotional offers despite a headwind from customer-friendly outcomes.

Further down the line, this resulted in an EBITDA of $89 million, reflecting an EBITDA margin of 6.4%. This brought the FY24 EBITDA number to $332 million. As shown below, DraftKings has been rapidly improving its EBITDA numbers over recent years.

This is driven by improvements in costs and efficiency. For reference, while revenue grew 30% year over year in 2024, operating expenses increased only 5% year over year as acquisition-related costs normalized after a heavy spending period.

Especially with competition easing due to acquisitions and some industry consolidation, the reliance on heavy marketing and promotional activity eases a bit, allowing DraftKings to improve its cost profile and bottom line. From 2021 onward, cost per acquired customer has trended down rapidly, declining by some 20% per year.

As a result, management now anticipates rapid improvement in EBITDA in the years ahead, already guiding for roughly $1 billion in 2025, $1.4 billion by 2026, and $2.1 billion by 2028. These numbers are based on existing markets only. In other words, additional legalization in states could significantly increase this number by roughly $6.2 billion, according to management estimates.

This shows a rapid increase in cash flows and incredible improvement in margins.

Furthermore, while 2024 was the first year in which DKNG delivered a positive FCF, this is now expected to grow exponentially in the years ahead, with management already guiding for almost $1 billion in FCF in 2025.

It seems like the company has hit a tipping point and is now rapidly turning profitable across the board.

As a result, the “unprofitable” argument can go out of the window. The company is expected to rapidly turn into a cash flow machine with solid margins.

Finally, the company also maintains a healthy balance sheet. The company now holds $788 million in cash and $1.3 billion in long-term debt. While not ideal, with cash flows improving rapidly in the years ahead, this leaves the company in a good spot.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe if you like our content! Want to receive even more of our investment insights and show even more appreciation? Please consider upgrading to our paid tier (only $7.50 monthly or just $70 annually).

In addition to all the free stuff, this also gets you access to even more premium analyses (a total of 3 per month), full access to my own (outperforming) portfolio, immediate trade alerts in the subscriber chat, and a full overview of all my price targets and rating, and even more!

Outlook & Valuation

I have already touched on the long-term outlook, stating that the company is likely to grow its top line at a mid- to high teens rate, but let’s get into a bit more detail now.

Management indicated that after the first two months of the year, it’s off to an excellent start in 2025, which gives it confidence in its 2025 guidance, even raising it slightly.

In January, revenue and EBITDA exceeded expectations, with an SB hold percentage of a really impressive 13%. Furthermore, acquisition, retention, and engagement continue to be strong, helped by the Super Bowl, which resulted in a record day for DraftKings in terms of acquisition and engagement. For reference, the app reached #1 in the App Store in the sports category and #3 across all apps.

As a result of this strong start to the year, management was confident enough to raise the low end of its guided range for FY24 revenue, now guiding for revenue to be between $6.4 billion and $6.6 billion, representing YoY growth of 32% to 38%, guiding for a solid growth acceleration compared to 2024, which is incredibly impressive and well ahead of expectations.

DraftKings just continues to impress and surprise Wall Street.

To put things into a bit of perspective, as recent as the 2023 investor day, management guided for 2026 revenue of $6.2 billion, which was already bullish at the time. However, it will now already exceed this number in 2025.

As for the bottom line guidance, management reaffirmed its prior guidance, pointing to a gross margin of between 46% and 47%, and an EBITDA in the range of $900 million to $1 billion, a significant step up from just $330 million in 2024, and guiding for a roughly 14.6% EBITDA margin.

Also, stock-based compensation is expected to remain well within control, especially considering this is a high-growth stock. Management is guiding SBC to trend down further as a percentage of revenue to around 6%.

Finally, management expects an FCF conversion of roughly 90% of EBITDA, guiding for an FCF of approximately $850 million, showing a significant improvement in cash flows.

Interestingly, this guidance doesn’t even yet include any benefit of favorable year-to-date support outcomes nor the company launching mobile sports betting in Missouri, leaving some upside to guidance.

Ultimately, this is some really impressive 2025 guidance.

As for the medium-term outlook, there is also plenty to like. Within existing states, management sees room to keep compounding revenues at a CAGR of at least 10%, with additional legalization coming on top of this double-digit growth.

Also, DraftKings is still gaining market share across all states and has yet to expand outside the U.S. and Canada, leaving it with plenty of growth levers to increase this CAGR further through the end of the decade.

Ultimately, I think there is more than enough to support a bullish medium-term outlook. As I said earlier, I expect DraftKings to grow its top line at a mid-to-high teens CAGR through the end of the decade, with significant room for upside.

Meanwhile, I anticipate rapid margin expansion due to size benefits and a further decline in promotional spending per acquisition. This could lead to EBITDA and EPS growth at 2x the top-line growth rate, with a CAGR between 30% and 40%.

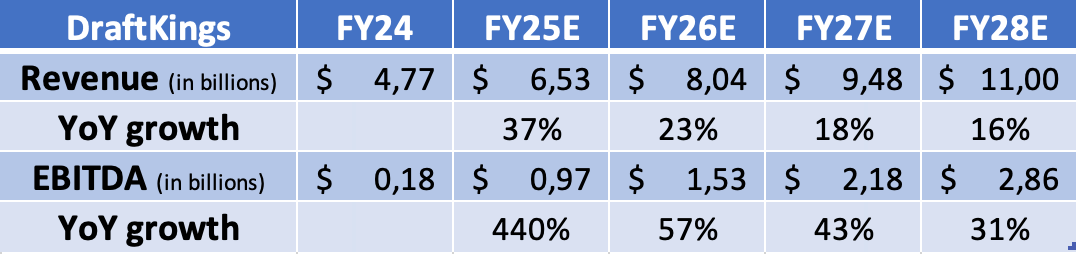

All things considered, I have calculated the following financial projections through FY28.

In terms of valuation, it won’t surprise anyone that DKNG shares don’t trade cheaply and for good reasons. However, considering the quality, track record, and outlook of this business, I will argue that shares are also far from expensive, even after last week’s pop.

Since that 15% pop, shares have retreated a few percentage points and are now trading at around $50. This reflects an EBITDA multiple of 26.5x the current 2025 consensus, which I don’t think is that expensive. Neither is a 3.5x sales multiple.

Considering DraftKings’ high growth, significant long-term growth potential, and room to outperform current estimates thanks to additional legalization in U.S. states, as well as the regulatory risks involved with an online gambling business and all the scrutiny that comes with it, I would say a current multiple of around 25x EBITDA is rather fair. This suggests that shares currently trade around fair value.

To be conservative and create a bit more of a margin of safety, I will use a long-term 18x EBITDA multiple in my medium-term calculations, already accounting for a possible slowdown in growth toward the end of the decade.

Using this and my FY27 EBITDA projection, I calculate a conservative end-of-2027 target price of $80 per share. This price reflects potential annual returns (CAGR) of 17%. These are absolutely great returns, especially considering we’re using a very conservative multiple and have not accounted for any additional states legalizing online gambling.

In other words, I don’t feel like forward growth and rapid profitability gains are fully priced in currently, making DKNG shares an attractive buy. DraftKings is a great long-term investment opportunity and a great business, with a management team that has a strong track record of superior execution, sticking to its promises, and outperforming financial projections. Meanwhile, secular tailwinds for online gambling and DraftKings’ ability to outperform peers make it a great pick, in my opinion.

At current prices of around $50 per share, DraftKings is especially compelling.

I am bullish!

I have not initiated a position yet, but I am likely to do so in the weeks/days ahead.

Disappointed you covered this name, though I understand the investment opportunity. For myself I steer clear of companies whose business model is causing clear harm to others, such as through the addictive nature of gambling. I follow a few other analysts who also cover this name and know it's just part of looking for the most profitable companies, but speaking for myself and only myself, this one is in a no fly zone along with tobacco companies and others of that ilk.

Great write, Daan. I've listened to their calls for a while and agree with your optimism. My reluctance has been due to state regulation hurdles, which have really made it difficult for the company to maintain economies of scale. My fund has flirted with the idea of initiating a position. Thanks again.