Earnings Reviews – Monday.com, Coca-Cola & Adyen

Here's all you need to know about three of last week's most anticipated Q4 earnings reports.

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

While I try my best to cover as many earnings as possible during these busy months, I cannot cover every stock in my portfolio, on my watchlist, or in my coverage space in an extensive 4,000-word post each quarter.

Therefore, I want to introduce you to a new post format today named “Earnings Reviews." This format aims to provide as many key earnings insights as possible during these busy weeks in a shorter, more direct read.

Indeed, these will not be 4,000-word analyses of an earnings report and investment case, but rather a quick discussion of the company’s quarterly highlights, most important and telling financial numbers, earnings call insights, and an updated view on outlook and valuation.

In other words, I aim to give you a thorough understanding of the quarterly numbers and developments within 5-10 minutes read per business. This should give you guys a good sense of how the results impact an investment case and how the business is doing, and it allows me to cover more reports during earnings season.

Sound good? Let’s delve in; there is plenty to go over as we’re still in the midst of the earnings season.

Today, I’ll review the Monday.com, Coca-Cola, and Adyen results, all of which were well received last week!

(If you can save the time, please let me know in the comments whether this format was valuable to you and if you would like it to stay!)

Monday.com Ltd. – Delivered a brilliant quarter!

Earlier this week, Monday once more proved it is one of the highest-quality and most exciting upcoming players in the enterprise software space when it released its Q4 earnings report. The company blew past consensus estimates and issued bullish guidance for 2025, impressing Wall Street analysts and investors.

Subsequently, shares jumped by 26% during the following trading session, reaching an arguably well-deserved new all-time high of $327. Shares have held onto those gains reletively well since, mainly because nobody thought Monday could beat an already optimistic consensus and maintain this kind of growth.

So let me take you through these impressive numbers.

Q4 and FY24 results + highlights

Q4 revenue was $268 million, up 32% YoY and beating consensus estimates by $7 million (a solid 2.5% beat)

FY24 revenue was $972 million, up 33% YoY

This is a really impressive performance by Monday. The company kept its top-line growth steady in the low 30s, above expectations, and still barely showing any sort of slowdown in growth, even as the operating environment is still challenging amid pressured IT spending.

This really underscores the impressive demand Monday continues to see for its Work OS platform, which remains best in class.

For reference, the company’s platform receives a considerable 4.5-star rating on Gartner and leads the Gartner Magic Quadrant across three categories: Marketing Work Management Platforms, Adaptive Project Management and Reporting, and Collaborative Work Management. Thus, the Monday platform is seen as the best platform in each category and has a considerable lead.

Moreover, Monday’s focus on a high level of customizability makes it even more unique, favored, and well-positioned for the future. It aims to allow customers to create tailored workspaces that suit their specific needs and preferences instead of relying on standard off-the-shelf solutions, which limit efficiency and flexibility. This is what really sets Monday apart from the competition.

Also enabling this strong and steady growth for Monday are its strong cross-selling abilities and multi-product approach.

Q4 net retention rate (TTM) increased to 112%

This shows an uptick from prior quarters and the highest level since early 2023, suggesting Monday is seeing growing success in cross-selling its software stack and growing the number of seats per customer. For reference, Monday uses a seat-based pricing model, which means customers pay per user. So, as the number of users grows, this translates into additional growth.

This makes the Monday platform affordable to smaller businesses, where it has seen great success in recent years, but also easily scalable.

In 2024, Monday has shifted its focus to enterprises, and this has more than paid off. Notably, Monday’s largest customer now has 80,000 seats, which is considerably higher than its largest customer 1 year ago, suggesting customers are more than satisfied with the Monday.com platform, happily buying more software features and seats.

Thanks to its strategy shift, this company has succeeded among larger customers Q4, and the underlying numbers show it: its retention rate among large customers is above 115%, and customer growth is considerably higher here.

The number of paid customers with more than $50,000 in ARR was 3,201, up 39% YoY

The number of paid customers with more than $100,000 in ARR was 1,207, up 45% YoY

As mentioned before, Monday's multi-product strategy enables this growth in addition to growth in the number of seats. While Monday started as a Work Collaboration platform, it has expanded rapidly.

In 2024, Monday CRM exceeded expectations in terms of growth. The company added a record number of new accounts for both CRM and Dev during the year, showing that customers are happy to adopt other Monday products and expand, driving healthy organic growth.

Driven by this impressive top-line performance, Monday also managed to deliver rapidly improving bottom line numbers, with record operating margins and FCF in 2024.

Q4 gross margin was 89%

R&D expense was 18% of revenue, up from 16% last year (17% for 2024)

Sales and marketing expense was 48% of revenue, down from 54% last year.

I am happy with this growth in R&D, as the company clearly doesn’t slow down on investments, even growing this as a percentage of revenue to keep its technological edge. Meanwhile, Sales and marketing continue to represent a significant portion of revenue amid a high need for promotional activity to grow its brand presence in this early sales phase.

This also reflects strong headcount growth, up 35% for 2024 to 2508. As management continues to invest in growth, it is again expected to be above 30% in 2025.

Q4 operating margin was 14%, up 600 bps YoY

Controlled cost growth amid a rapidly growing top line resulted in solid margin expansion in Q4 and 2024 as a whole. Safe to say Monday is very profitable and is able to combine impressive revenue growth with growing margins, which is quite unique and speaks to its quality.

Net income was $57.3 million in Q4, up 70% YoY.

Q4 EPS of $1.08 ($3.50 for FY24, up 89% YoY)

Q4 FCF of $72.7 million at a 27% FCF margin.

FY24 FCF was $296 million at an FCF margin of 30%

With revenue growth of 30%+ and an FCF margin of 30%, Monday remains a Rule of 60 business, which places it in a very small, high-quality group.

Meanwhile, these excellent cash flows also allow Monday to maintain a healthy balance sheet with $1.41 billion in cash and practically no debt.

Especially with cash flows growing rapidly, there is not much to complain about here.

Outlook & Valuation

Monday’s Q1 and FY25 outlook also didn’t disappoint and was nicely ahead of the consensus and way ahead of investor expectations. Here is what Keybanc analysts said:

"We felt that 24% on constant currency guidance would be good enough to lift the stock; 26.5% was hardly even on our radar."

Here is management’s guidance:

Q1 revenue to be in the range of $274 million to $276 million, representing growth of 26% to 27% year-over-year.

The operating margin is to be between 9% and 10%.

FY25 revenue is guided to be in the range of $1,208 million to $1,221 million, representing growth of 24% to 26% year-over-year (including a negative 100 to 200-bps impact from FX)

An operating income of $134 million to $142 million and an operating margin of 11% to 12%.

FCF to sit around $300 million to $308 million, with an FCF margin of 25%

Both Q1 and FY25 guidance were ahead of expectations, pointing to another year of solid growth. Meanwhile, profitability is expected to be less impressive, in line with expectations, amid continued investments in technology and sales, with the latter especially impacting the bottom line.

Nevertheless, this is excellent guidance, well ahead of expectations.

Following these results, I have slightly adjusted my financial projections to account for a year of lower profitability amid higher investments but a margin recovery in 2026 and 2027. Meanwhile, growth through the end of the decade should remain solid in the mid-twenties.

Moving to the valuation, it is safe to say Monday shares are still quite expensive after last week’s share price pop. At a current share price of $318, we are looking at an earnings multiple of 86x or 66x the current FY26 consensus, which is a very hefty multiple to pay. On a PEG basis, this is also still a multiple of over 3x.

However, due to changing profitability and fluctuating EPS, these arguably aren’t the best multiples to look at. For example, a 54x FCF multiple isn’t all that bad for a company still in its early growth stage. Also, we’re only looking at a sales multiple of 13x, which isn’t too bad when compared to the 16x multiple for SaaS peer ServiceNow or the 27x multiple for Crowdstrike.

Nevertheless, I do think MNDY shares are fully valued after last week’s pop, not making this an attractive entry price. Personally, I am not touching shares above $300 per share. Below this level would take some of the pressure off, but I’d prefer buying below $280 to optimize long-term returns.

Ultimately, for now, I am back on the sidelines, though happy to stick with my current position.

The Coca-Cola Company – Successfully navigating a minefield of challenges.

Coca-Cola (KO) really impressed with its financial results announced earlier this week, on February 2nd. They exceeded expectations and were significantly better than those reported by close peer PepsiCo a few weeks back, surprising Wall Street, which has already turned slightly skeptical.

The company delivered healthy organic revenue growth, driven by continued pricing benefits and positive volume growth, and was able to keep expanding margins further, which remain by far best-in-class. This also allowed for continued solid EPS growth.

In other words, KO nailed it. Clearly, KO is better able to navigate the minefield of challenges the industry is facing, including GLP-1 threats, tariffs, FX, and inflationary pressures.

As a result, investors rewarded the company with a 5% share price increase during Tuesday’s trading session, once more valuing it at the premium it deserves, with shares now up 11% over the last month.

This boring consumer staples giant proves it remains best in class.

Let’s delve into the Q4 numbers and put them into perspective!

Q4 and FY24 results + highlights

Q4 revenue was $11.5 billion, up 6.5% year over year and beating the consensus by an impressive $800 million, or 7.5%.

Organic revenue growth, a much better indicator of underlying health, was up 14% YoY (7.2% consensus)

Organic growth was driven by 9% pricing growth and 5% growth in volumes.

These are really impressive numbers. KO blew past consensus estimates for both reported revenue and organic growth, with the latter more than double the consensus estimate and remaining in double-digit territory, similar to the last two years, though this is in large part fueled by inflationary pricing measures.

Nevertheless, this shows that KO is well able to deal with its challenges and continues to see solid demand, even as prices continue to rise. Moreover, this growth is well ahead of the beverage industry, with close peer PepsiCo, for example, having reported only 2.1% organic growth in Q4.

KO really is outperforming.

A big contributor to this outperformance is its unique approach through its franchise system. This system gives it great local expertise and a sublime ability to immediately respond to local, changing consumer preferences. This gives it a big edge over the competition and allows it to gain market share across all beverage categories and regions.

“The franchise system Coca-Cola’s management refers to is its "Coca-Cola System," a decentralized business model where The Coca-Cola Company (KO) owns the brand, creates and markets its beverage formulas, while independent bottling partners handle production, distribution, and sales in local markets.”

Furthermore, the company remains a star in marketing, executing its campaigns to perfection and keeping consumers attached to the Coca-Cola brand. Its Christmas commercial was once more a massive hit.

For these reasons, most Coca-Cola brands continue to be named the world’s best and most liked brands in their respective categories.

Alright, back to the Q4 financials, in Q4, 9% pricing growth was evenly split between normal pricing actions and some remaining inflationary pressures, especially in LatAm. Excluding these temporary inflationary pressures, pricing growth was roughly in line with KO’s long-term algorithm in the low-single digits.

Meanwhile, despite elevated pricing, KO still saw positive volume growth of 5%, showing that despite pricing measures, consumers remain loyal and attached to KO brands, unlike what we have seen from its peers (PepsiCo volume growth was only 1% in Q4)

This speaks to brand strength. These are really healthy indicators.

Moving to the bottom line, KO also performed really well.

Comp gross margin was up 160 bps YoY

Comp operating margin was up 90 bps YoY to 24%

Similar to recent years, KO continues to show steady and impressive margin expansion across the board, accelerating cash flow growth. Last quarter’s performance is especially impressive, considering it included a four-percentage-point headwind from bottlers’ refranchising and quite a heavy FX headwind.

Reported EPS grew 12% YoY to $0.55, beating the consensus by $0.03.

Comp EPS was up 7% YoY.

FY24 FCF was $10.8 billion, up 11% YoY

EPS growth remained strong, especially amid nearly double-digit FX headwinds. This really is remarkably strong growth and a testimony to the sheer quality of the KO business.

I am impressed.

This strong bottom-line performance also translated into strong cash flows, with double-digit FCF growth, fully covering dividend obligations (dividends accounted for 73% of FCF) and allowing KO to maintain a healthy balance sheet, with a net debt leverage of 1.8x EBITDA, sitting below the 2-2.5x target.

As for dividends, here is a quick update:

Forward yield of 2.87%

EPS payout ratio of 67%

FCF payout ratio of 73%

5-year growth CAGR of 4%

62 years of consecutive dividend hikes.

Yeah, this is just great! Albeit slowly growing, it is a sweet, consistent, and well-covered dividend.

Outlook & Valuation

FY25 organic revenue growth to be between 5% and 6%.

FY25 comp EPS growth to be between 8% and 10%.

FY25 reported EPS growth to be between 2% and 3% (FY25 EPS of $2.95 at the midpoint)

Adjusted FCF to come in around $9.5 billion

This guidance also came in well above expectations.

2025 organic revenue growth is expected to normalize to long-term averages amid an easing contribution from pricing and steady volumes. Meanwhile, thanks to expanding margins, organic EPS growth is expected to remain at the high end of management’s long-term algorithm.

This 2025 guidance includes the expectation for a 3-point to 4-point currency headwind to comparable net revenues and an approximate 6-point to 7-point currency headwind to comparable EPS, explaining the big gap between organic and reported growth guidance.

This is as good as one can expect from KO.

Following this guidance, Wall Street now projects the following results, still pointing to solid top-line growth and really decent EPS growth in the mid to high single digits, better than previously expected.

That then brings us to valuation.

After last week’s share price pop and the 11% gain over the last month, KO shares are now only 6.5% away from their September 2024 all-time high and back trading at rather rich multiples, though arguably much deserved.

KO is still an all-weather business and stock. It can perform under any circumstances, grow its top and bottom line consistently, and outperform peers. It is definitely worth a premium multiple.

Therefore, valuing KO at its historical average P/E of 23/24x isn’t all that ridiculous – much deserved, actually. No doubt about that after this quarter.

Currently, at a current share price of $68, shares trade at roughly 23x this year’s earnings, roughly in line with historical multiples. At the same time, the current 2.87% yield is a minor 6% discount to the 5-year average.

All in all, I would say KO shares look fairly valued, possibly trading at a mild discount.

For reference, using a 23x long-term multiple and the current FY27 EPS consensus, we would end up at a target price of $79 per share. This translates into potential annual returns (CAGR) of 5% or closer to 8% when including the dividends. These are decent returns from a defensive cornerstone but not quite enough of a cushion for me to pull the trigger.

Personally, I would like a bit more of a margin of safety. I aim for a share price below $64 per share, ideally closer to $60. For now, I am on the sidelines.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe if you like our content! Want to receive even more of our investment insights and show even more appreciation? Please consider upgrading to our paid tier (only $7.50 monthly or just $70 annually).

In addition to all the free stuff, this also gets you access to even more premium analyses (a total of 3 per month), full access to my own (outperforming) portfolio, immediate trade alerts in the subscriber chat, and a full overview of all my price targets and rating, and even more!

Adyen N.V. – Brilliant but expensive

On Thursday, November 13, Adyen released its Q4 earnings report and managed to impress, with shares gaining 14% in the following trading session, surging to their highest level since August 2022.

The price jump was driven by a good earnings report, which showed healthy growth across the board and expanding margins amid tighter cost control. Meanwhile, the Dutch payment technology company continues to outpace the underlying industry and take market share across all categories and regions, thanks to its highly valued payment solutions.

In other words, Adyen is nailing it on all fronts and remains one of the most exciting stocks in the payment technology industry, thanks to its differentiated single-platform approach.

Its latest results only confirm my bullish stance on the company.

Let’s delve into the H2 numbers and put them into perspective before moving to the updated outlook and valuation.

Q4 and FY24 results + highlights

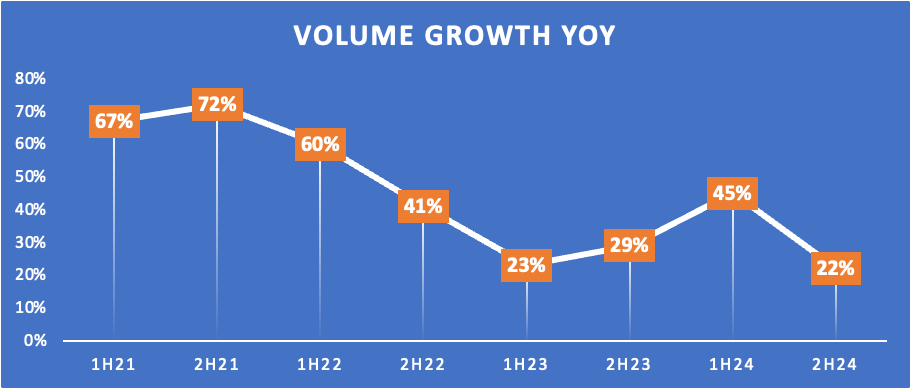

2H24 revenue was €1.08 billion, up 22% YoY (versus a 20% consensus).

2H24 processed volume was €666 billion, up 22% YoY (28% consensus)

FY24 revenue was €2 billion, up 23% YoY.

FY24 processed volume was €1.3 billion, up 33% YoY.

Starting with volumes, FY24 volumes were still excellent, but during H2, we did see some volume weakness, although this was reportedly driven by a “single large customer,” which we know is Cash App. As a result, H2 volume growth missed the consensus by 800 bps, which was a mild disappointment, especially since volume growth is the main growth indicator.

At the same time, though, a better-than-expected and remarkably high take rate of 16.9% (15.3% expected) meant revenue still beat expectations by 200 bps, pleasing investors nonetheless. Also, we know these numbers can fluctuate for Adyen, so there's no reason for concern.

Revenue growth remained stable in the low twenties, similar to recent quarters. Ultimately, there is not much to complain about.

Getting into a bit more detail, the second-half revenue growth was mostly driven by Adyen’s existing customer base, thanks to wallet share gains. In other words, existing customers are giving Adyen more of their business, pointing to customers being happy with the Adyen platform and urging them to move away from other platforms and bet bigger on Adyen.

This is driving this significant continued growth. It suggests that Adyen isn’t fully relying on customer acquisition but can still derive much more business from existing customers who are growing their use of the Adyen platform. I believe this a great indicator of customer satisfaction, and I like this organic low-cost growth. This is a great long-term setup.

For reference, Adyen’s user base already includes giants across all industries like H&M, Zara, eBay, Spotify, Microsoft, Uber, Booking.com, Airbnb, McDonald’s, Subway, Meta, and Netflix.

In terms of customer satisfaction, efficiency and features, which lead to lower costs and reliability, are big factors.

For example, according to Adyen management, this customer satisfaction results from its single-platform approach, which makes it efficient and easier to process transactions and manage data, and resulted from new product innovation. Features like Intelligent Payment Routing or Uplift received a positive response and added value to the platform.

For example, within its early pilot of the Payment Routing feature, 20 early-adoption customers saw a drop of 26% in processing cost and a 22 base points increase in conversion.

These features create significant value for Adyen customers, who move a larger share of their transaction wallets to Adyen.

Meanwhile, Adyen has no trouble scaling with its customers and meeting their needs. For example, its processing downtime is among the best, and during the Black Friday Weekend last year, it processed 160,000 transactions per minute without issues.

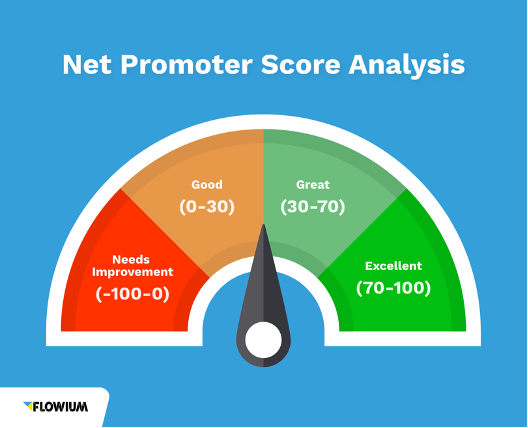

What more can an Adyen customer wish for? This customer satisfaction is highlighted by an NPS (Net Promoter Score) of 66 in H2. As shown below, this score is well within the ‘great’ range and approaches ‘excellent,’ which says a great deal about satisfaction.

Finally, here are the numbers by region.

EMEA revenue was up 27% YoY

North America revenue was up 21% YoY

APAC revenue was up 12%

LatAm revenue was up 12% (in constant currency)

Europe, despite being Adyen’s largest market, was once more the fastest-growing region in H2. This shows that even in its most mature markets, Adyen still sees plenty of room to grow, and this growth reflects continued market share gains.

Meanwhile, growth in the U.S. was also strong at 21%, also reflecting continued market share gains and success in this tough market full of more established competitors.

Growth in APAC and LatAm was also solid, as expected. There is still a lot of room for Adyen to expand its presence here.

Moving to the bottom line, there is also enough to like.

H2 EBITDA was €569 million, up 35% YoY and beating expectations by a solid 6%.

The H2 EBITDA margin was only expected to be 50.3% versus a reported 52.6%

The FY24 EBITDA was €992 million, up 34% YoY

The FY24 EBITDA margin was 50%, up 400 bps YoY

Strong revenue growth and slower cost growth due to slower hiring compared to previous years led to solid bottom-line expansion for Adyen, with the EBITDA margin in 2024 gaining 400 bps to an impressive 50%.

The biggest standout from a cost perspective was Adyen's slower hiring in 2024, which kept cost growth to a minimum. Instead of hiring new talent, Adyen focused on making sure people hired in recent years were more efficient. As a result, growth wasn’t too impacted. This was a good execution and, again, a sound basis from which to work.

Outlook & Valuation

Adyen’s outlook was mainly in line with expectations and its medium-term guidance issued earlier.

Revenue growth is expected to continue accelerating year over year in 2025, likely in the mid-twenties, and to accelerate further in 2026, likely toward the mid-to-high-twenties. This growth is expected to still largely come from wallet share growth.

Meanwhile, management expects to ramp up investments. North America is still its core growth market, considering its low market share and significant potential. In addition, Adyen expects to accelerate hiring again in 2025 to fuel and enable growth.

Nevertheless, Adyen anticipates more margin expansion in 2025, although not at the same level as in 2024, due to these more aggressive growth investments.

This translates into a pretty neat outlook for 2025, as shown below, roughly in line with expectations. Meanwhile, I remain optimistic about Adyen’s medium-term prospects. Growth will likely accelerate further in 2027, in line with management’s medium-term targets, and the EBITDA margin will expand further.

Beyond, I anticipate growth to normalize a bit in the low-twenties, while I expect a slowdown in growth and continued investments to put some more pressure on margins as well, translating into minimal margin expansion in FY27 and FY28.

This translates into the projections below.

Moving to valuation, we can safely say Adyen isn’t among the cheapest stocks, especially after this week’s pop, which pushed shares to their highest levels in a while.

Granted, the company continues to execute and projects accelerating growth in the years ahead. This, combined with a likely great long-term outlook, significant growth runway, and great execution success, makes me incredibly bullish on this company long-term.

I still believe Adyen is one of the more exciting investments in the payments industry.

However, can all this warrant a current 45x EBITDA and 23x sales multiple?

I don’t think so. After last week’s pop, I believe shares are fully valued. For reference, when using a more reasonable 35x EBITDA multiple and my FY27 EPS, I calculate a €2259 end-of-2027 price target. This reflects a potential annual return (CAGR) of roughly 7%, which is insufficient.

Meanwhile, when using a 40x multiple, which would be the absolute maximum I could be willing to pay for this business, I end up with an end-of-2027 price target of €2582, representing potential annual returns (CAGR) of just under 12%. While likely market-beating, this still doesn’t represent an acceptable risk-reward balance, with no sufficient safety cushion.

Ultimately, I believe investors are best off waiting for some of this enthusiasm to wane and benefiting from a dip in share price, which would take some pressure off these multiples.

Personally, I am aiming for a share price of €1600 to €1650 to buy.

Great format and insight into these companies! I'm with you on $KO and its valuation!

This new "Earnings Reviews" format is a great idea—concise but still packed with valuable insights! Definitely worth keeping, especially during busy earnings seasons.