With 132 million active buyers, over $10 billion in revenue, and more than $2 billion of FCF generated annually, eBay is in no way small. Though, in the massive e-commerce market, its $26 billion market cap only allows it to capture a market share of below 3.5%, so maybe it is rather small after all - It’s all about perspective.

Anyway, the company’s marketplace is still used by over 132 million consumers in over 190 markets worldwide, so the company definitely deserves some attention, especially with shares trading at very low levels. This is the primary reason we have had shares on our watchlist for a while, and it is about time we took a closer look at them.

Remarkably, eBay shares have rallied over the last month following some positive news headlines, gaining over 20% since mid-February. However, despite recent gains, eBay hasn’t really been a Wall Street darling in recent years, underperforming benchmarks over both a 5-year and 10-year period.

eBay has faced criticism from investors for several reasons. One major concern is the company's perceived lack of innovation and slow adaptation to changing market dynamics, particularly in comparison to competitors like Amazon. eBay's growth has also been relatively modest compared to e-commerce peers, leading some investors to question its long-term potential for expansion and profitability. These factors, combined with shifts in consumer behavior and the competitive landscape, have contributed to investor skepticism about eBay's ability to deliver strong returns in the future.

One thing is for sure: eBay has been massively disappointing over the last ten years when it comes to growth. The company has grown revenue at a CAGR of just over 2%, which is simply disappointing. Meanwhile, EPS growth hasn’t been much better, at a CAGR of just below 7%, which simply hasn’t been enough for market-beating returns. However, we should note that this includes a number of divestures in recent years.

In response to this lackluster performance over the last decade and the falling user numbers, the company’s valuation has also fallen, with shares now trading at just 11x this year’s earnings, which is a 17% discount to their own 5-year average and a 30% discount to the sector median.

With shares trading at such a discount, one could wonder if we are looking at a value opportunity in an arguably heated market. Therefore, in this post, we hope to find out whether eBay shares are a bargain today or whether the company is not worth an investment, as it could be bound to deteriorate further.

Understanding eBay, its business model, and its potential

In order to determine whether eBay might be a promising investment, it is critical to first fully understand the business model and where the company is at precisely. In the case of eBay, it has been going and still is very much transitioning after a decade of underperformance and disappointments.

eBay’s legacy and main business is quite straightforward: it manages a platform connecting buyers and sellers, primarily of secondhand/non-new items. It is a global leader in online marketplaces and e-commerce and operates the well-known eBay online marketplace, where individuals and businesses can buy and sell a wide variety of goods. eBay offers both auction-style and fixed-price formats, providing users with flexibility.

Founded in 1995 by Pierre Omidyar, eBay has since evolved into a multifaceted platform connecting millions of buyers and sellers worldwide. With its headquarters in San Jose, California, eBay operates in over 190 markets, facilitating transactions in a vast array of categories, ranging from electronics and fashion to collectibles and automobiles.

With its distinct business model, the company saw great success in the early 2000s, reporting rapid growth. However, over the last decade, the company has been less successful, mainly attributable to several failed strategic choices. The biggest was the move away from non-new products and its auction format to brand-new products and fixed prices in 2007/08.

With this move, the company started moving away from its core format and competing with e-commerce giants like Amazon. By 2015, 80% of the company’s listings were fixed-price and brand-new items. Yet, sellers on the platform quickly noticed that Amazon offered a far better platform in this category with faster shipping times and better product selections. As a result, eBay saw a massive out-stream of sellers and was losing to Amazon, which explains the majority of its underperformance over the last decade. The company simply couldn’t compete with Amazon in the highly capital-intensive e-commerce industry.

However, there is room for positivity today. Since 2020, the company has appointed a new CEO who has shifted the company’s focus back to its core and legacy business of focusing on the C2C market or individuals selling non-new products.

As a result, eBay today certainly isn’t the same business it was four years ago and is now much closer to its early 2000s success days in terms of operations and strategic focus. The company has an almost entirely new management team, built for the future and consisting of eBay veterans and new talent. Remarkably, over 70% of current leadership is new to eBay and has joined over the last four years, which is exactly what the company needed as it almost had to start over.

With this also came a completely new strategy. One of the most important changes in strategy implemented by the new management team is the focus shift back to the core marketplace, focusing on the areas where the platform excels and divesting subsidiaries that weren’t worth the investments and that stood far away from the core business. Really, this is restructuring 101, but it is critical.

Most importantly, whereas the company was focusing on growing its new-products offering for many years, management has now shifted the focus back to non-new products. Instead of competing with buyers and sellers, management now focuses on giving them the tools to grow. As a result of this shift, 90% of GMV now comes from non-new products (compared to 20% in 2015), and this category has been outgrowing new product GMV by a mile.

The company strongly believes it still has a long growth runway in this category and looking at the growth expectations for the non-new product market, it is definitely on the right track here.

Resale is big, growing, and relevant. The secondhand market alone is expected to nearly double by 2027, reaching a market value of $350 billion, while the U.S. will reach a market size of $70 billion, clearly leaving enough on the table for eBay as well. According to the company itself, its TAM should continue to grow by high-single digits in the foreseeable future, giving it a solid runway for growth.

Much of this is driven by the younger generation, who are increasingly focused on sustainability and have a different view on pre-owned. According to recent research, 83% of correspondents consistently sell secondhand goods, and 32% of Gen-Z started last year. In fact, Gen-Z’ers are leading the market when it comes to buying pre-owned stuff, with 80% stating they bought pre-owned goods over the last year, which is tremendous.

Furthermore, more and more people are also selling goods, fueling market growth. Simply put, more and more people are selling and buying pre-owned goods to boost their income, save money, and live sustainably, which positions eBay quite favorably.

If the company can manage to improve its position in the industry and gain buyer and seller trust, things it can achieve by increasing the customer experience and improving security and reliability, I am quite optimistic about its potential.

Luckily, the company has been working hard on these factors and has been doing well in developing the platform. Take the authenticity guarantee feature, a system to verify the authenticity of products sold on the platform, which has already meaningfully strengthened its position in non-new luxury items.

Furthermore, management has divested non-core assets like StubHub, eBay Classifieds, and the South Korean business, converting 20% of earnings into $20 billion of value. As a result, management can focus resources on the parts of the business where it is a leader and a winner, which is a far superior and capital-light long-term strategy.

Despite these divestitures, the company has been able to grow operating income by $1 billion on an apples-to-apples basis, more than offsetting the sale of these assets by growth in its core business. Meanwhile, management has used the $20 billion from the divestitures to invest in its core business, launching features that complement it and add value for its users, like the advertising business and a payments platform.

The company has fully transformed its advertising business over the last few years, retiring legacy ad products and replacing these with tools for sellers while streamlining the experience for buyers, resulting in far higher advertising value. Furthermore, they scaled promoted listings and focused on ad products that add incremental sales for sellers. As a result, ad revenue has more than doubled in recent years and continues to grow strongly at almost a $1.5 billion run rate as of 2023.

Regarding payments, the company launched its own payment system on its platform a couple of years ago to manage this in-house fully. By doing this, eBay further improved the customer experience and smoothed out the buying and selling process while adding $2 billion in incremental revenue.

We are seeing a trend across the board that eBay is leveraging technological advances, including AI, to make the whole user experience much more seamless and make the platform relevant to the next generation of customers. By doing this, buyer and seller retention should improve while also increasing buying frequency.

Another strategic priority for management is focusing on high-value buyers who are highly engaged and purchase items frequently and actively across multiple categories. These high-value buyers account for 75% of global GMV, making them incredibly important to eBay.

Around 20% of buyers fall in this category, translating into around 28 million buyers. eBay hopes to drive growth without growing user numbers by focusing on this group. Though, whether this is the right strategy, I am not entirely convinced.

Nevertheless, judging by their commentary and actions, this new management team seems to know exactly what they are doing, targeting mostly the right areas. By managing more parts of the experience, like payments, communication, and shipping, they are able to add new revenue streams and streamline the customer experience. Also, this gives the company more control, allowing it to reduce friction and facilitate trust between sellers and buyers, improving the platform.

Doing this, combined with focusing on the right customer groups, allows the company to extract the most value from its capital-light business and its highly engaged community. Therefore, we view the current strategy as favorable and the right one. According to management during its 2022 investor event, these efforts have already stopped market share losses and allowed key categories to return to double-digit growth.

So far, so good, right? Management has been able to turn this business around in terms of strategic priorities, and it seems to be focused on the right areas. As I said before, the platform still holds the potential for solid long-term growth and returns if management continues to execute.

The eBay brand is strong in key markets like the U.S., UK, and Germany, and growth in the underlying market is promising. Of course, we do need to consider that the competition in the e-commerce market is intense, but in the non-new products category, eBay is looking really solid, and with more and more consumers looking for cheaper alternatives, it seems well positioned.

And yet, the total number of active buyers on the eBay platform does not entirely reflect the fundamentals and operational improvements. Up until the end of 2018, buyer growth was tremendous. However, buyer numbers have been falling rapidly ever since, from a high of 179 million to 132 million as of the most recent quarter.

Obviously, this isn’t great. As the number of buyers on the platform drops, this will most likely also impact the number of sales, sellers, and GMV. A healthy platform needs enough buyers and sellers to keep going, so from that perspective, buyer losses are critical.

Positively, while GMV did peak in 2018, this has not been as much impacted by the decline in buyers due to strength in enthusiast buyers and inflation.

Now, part of the buyer losses can be attributed to a number of factors like post-covid normalization and divestitures. During COVID, the number of buyers saw a slight uptick as people sat at home and started selling and buying more things. Coming out of the pandemic, this growth driver disappeared, and this impacted buyer numbers. So, at least some of these buyer losses can be explained by factors outside eBay’s control.

However, the losses still lead to investor skepticism, and really, to gain more confidence in management’s success and the company’s future, we need to see a stabilization or even a slight uptick in buyer numbers with these outside factors now out of the picture.

Of course, management now refers to a tough macroeconomic environment as a reason for lackluster growth. Still, with an improvement in macroeconomics expected by the second half of 2024 as the Fed will start cutting rates, eBay will need to prove its business is in a better place.

On a positive note, we have already seen a slight stabilization in 2023, with buyer numbers stable at 132 million for the last three quarters, which is a minor positive. With the improvement in macroeconomics mentioned earlier, we could expect some growth in these numbers by the end of 2024.

However, it will be critical to monitor this closely as further losses in coming quarters could be a negative indicator that the business is still deteriorating. For now, management is also not shining much light on the issue or giving clarity or expectations.

Management was asked quite bluntly during the recent Morgan Stanley Technology, Media & Telecom Conference about whether they believe the decline in buyers and sellers is now bottoming, which might be one of the most important questions investors would like answered. However, management largely avoided the question, immediately shifting the focus to their “enthusiast buyers” as a focus area.

This answer by management did raise some questions and worries. While we understand the focus on high-value customers, the company still needs to keep growing in total numbers.

Ultimately, while we do believe in management’s turnaround plan and are slightly bullish on the business, we do need to see proven positive growth in buyers. Once this occurs, there is quite a bit of upside here through valuation multiple expansion, as it would relieve investor concerns.

Overall, we are slowly turning more bullish on the business and can see the potential and trust in this management team.

eBay financials

On to the second part of this analysis, where we take a closer look at the company’s financials, starting with its most recent quarter.

eBay reported its Q4/FY23 results not so long ago, on February 27, and managed to beat expectations on both top and bottom lines. The company once more indicated that it is still feeling the impact of macro pressures on the business, which is driving down discretionary spending and leading to less buying activity on eBay.

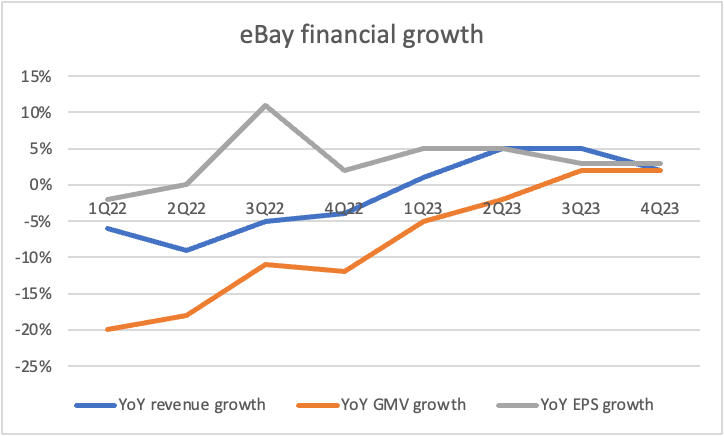

As a result, Q4 GMV growth was up 2% YoY at $18.6 billion, leading to revenue growth of 2% YoY to $2.6 billion, even as the take rate was down roughly 10 bps sequentially and flat YoY at 13.8%. Considering the headwinds eBay faces right now, this is okay.

Moreover, GMV growth has been improving throughout the year, going from a 5% decline in Q1 to growth of 2% in Q4, which was the best result since the end of 2021.

Yes, the company has only reported two-quarters of positive GMV growth over the last two years due to a tough comparison, post-COVID normalization in 2022, and significant headwinds in 2023.

However, this now finally seems to be improving and stabilizing in the low single digits and should accelerate by the second half of 2024 as the macroeconomic environment improves and the Fed starts cutting interest rates.

However, the top-line pressures are also reflected in the bottom-line results and are more significant here. Q4 operating margin was 26.7%, up 30 bps sequentially but down 320 bps YoY. This included an FX headwind of approximately 150 bps. However, after taking this into account, the operating margin was still down by 170 bps, and this was due to continued investments in product development and the margin impact of recent M&A, according to management.

Furthermore, the net income margin came in at 21.9%, down 200 bps YoY, reflecting the decline in the operating margin. This led to a non-GAAP EPS of $1.07, roughly flat YoY. Meanwhile, the GAAP EPS came in much higher at $1.40, driven by unrealized gains in its equity portfolio, partly offset by SBC, which sat at 5.7% of revenue in 2023, which we view as healthy.

Across the board, margins have come down quite a bit from COVID highs, with the operating margin falling from the mid-30s range to the mid-20s. Positively, margins seem to be stabilizing over the last couple of quarters, showing some sequential improvements. We expect margins to improve towards the high 20s range once top-line growth accelerates by the second half of 2024 and gets to keep up with cost growth, which should moderate slightly in 2024.

This will be helped by eBay's restructuring, which was announced last month. The company is implementing organizational changes focused on removing layers and simplifying execution. As a result, the company will reduce the workforce by 1,000 roles, translating into 9% of the workforce, and begin scaling back alternative workforce contracts. The news was cheered on by investors as it should give the company a margin boost in 2024 and 2025.

Summarizing some of the 2023 numbers:

Revenue grew 3% to over $10 billion in 2023, driven by strong growth in its first-party advertising business and the expansion of its financial services offering.

GMV was $73.2 billion, down 1%. Growth in eBay’s focus categories came in better, with GMV up 4%, against a 3% decline in the remainder of the business.

eBay’s advertising business continues to grow strongly, even in the face of macroeconomic headwinds. Advertising revenue was up 20% to $393 million in Q4, bringing the 2023 total to $1.4 billion, up 25% YoY or more than double the 2019 number.

2023 operating margin of 27.4%, down 260 bps YoY.

2023 non-GAAP net income was $2.3 billion, or $4.24 per share, up 3% thanks to significant share repurchases in 2023, amounting to $1.4 billion or around 6% of shares outstanding, more than offsetting a 2% decline in net income.

Operating expenses in 2023 were up 12% YoY, outpacing revenue and GMV growth. This was driven primarily by a 16% growth in product development costs and a 24% growth in G&A.

The company did still manage to report $2.4 billion of operating cash flow and $2.0 billion of free cash flow in 2023.

Balance sheet & shareholder returns

As of December 31st, eBay maintained a healthy balance sheet with a total cash position of $2 billion, short-term investments worth $7 billion, and a long-term debt of $7 billion. Really, there is nothing bad to say about this. Yes, debt could be a bit lower, giving it some more financial room, but management chooses to deploy this cash elsewhere.

This healthy balance sheet is what allows the company to return significant amounts of cash to shareholders, and this is what it has been doing over the last couple of years. As mentioned before, in 2023 alone, eBay repurchased $1.4 billion worth of its own shares, representing around 6% of its outstanding shares, which is significant.

Since the start of 2022, the company has returned a total of $5.6 billion to shareholders through dividends and repurchases, representing 134% of its generated FCF in those two years. As a result, since 2014, the company has repurchased a staggering 60% of its outstanding shares, and the company is not planning on stopping with shares valued at bottom prices.

Management still has $3.4 billion left under its authorization after adding an additional $2 billion recently. This gives the company plenty of cash to deploy. With this cash, it can retire another 13% of currently outstanding shares, and it plans to deploy at least $2 billion in 2024 alone or buy back 7.5% of outstanding shares based on current prices.

Add to this a dividend, which currently yields 2.1%, and shareholders are looking at a total 2024 yield of 9.6% without any share price appreciation.

Meanwhile, the dividend is well covered by a payout ratio of just 23.5%, even after growing this at a CAGR of close to 50% since the introduction of a dividend in 2019. However, this is not a rate we should expect going forward. Rather, this will be roughly in line with the latest increase of 8%. We expect the dividend to grow roughly in line with earnings growth in the high single digits.

Still, combining the significant amount of shareholder returns and a steadily growing dividend, investors really have little to complain about. Again, a 9.6% total yield in 2024 is insane!

eBay outlook & valuation

That brings us to the final two questions: what can we expect from eBay going forward, and does this make shares attractively priced today?

Regarding the outlook, this is still very much uncertain due to an unclear rate cut trajectory for the Fed and economic growth expected to slow down. So far in 2023, management indicated that it had seen very uneven demand across markets, with negative GDP growth in the UK and weaker-than-expected retail sales in the US, both of which affected eBay.

As a result, management now guides for Q1 GMV of between $18.2 billion and $18.5 billion, representing an FX-neutral decline of 1% at the midpoint. This should translate into revenue of $2.5 billion to $2.54 billion, up 1% at the midpoint, which is all far from impressive.

Furthermore, the operating margin is expected to improve slightly YoY to between 29.6% and 30%, up by 20 bps YoY at the midpoint. This results in the expectation for an EPS of between $1.19 and $1.23, up 9% at the midpoint, driven by some slight revenue growth, improving margins, and continued share repurchases.

Positively, management expects a slight improvement in the macroeconomic environment in H2, leading to positive GMV growth expectations and revenue outpacing this by around 2 percentage points, which could lead to revenue growth of 2-3% in 2023 as a whole.

Furthermore, management expects the operating margin to expand by 60 to 100 bps in 2024 due to a slowdown in technology and tech investments and improved operational efficiencies. This should lead to EPS growth of 8% to 10% YoY in 2024. However, FCF is expected to decline YoY to under $2 billion due to several one-off headwinds.

This all sounds solid enough and largely unsurprising. However, what we will focus on with the Q1 and Q2 results will be management’s commentary for H2 and the underlying macroeconomic improvements and, of course, the buyer numbers, which should remain at a level of around 132 million. Ideally, we would like to see a slight uptick in these numbers to confirm that management is progressing on this front, but we might have to wait until H2.

All things considered, we now expect eBay to report revenue growth of 2.3% in 2024 to $10.34 billion and growth to accelerate in 2025 and 2026 as the underlying operating environment improves. Meanwhile, we expect EPS growth to come in at 9.4% in 2024 to $4.64.

In the long term, we are quite bullish on the changes management has implemented over recent years, and we do believe the business is developing in all the right directions in a promising industry. However, to be fully confident in this turnaround, we will need to see some positive GMV and buyer number trends. Ultimately, we now expect the following results through FY27.

Based on these financial projections, shares now trade at just over 11x this year’s earnings, which definitely is far from expensive. This means shares now trade at a 30% discount to the sector median and a 17% discount to their own 5-year average. While the shares arguably deserved such a discount over recent years, we believe that the positive fundamental changes that occurred over the last two years warrant a slightly higher multiple.

Again, we aren’t entirely convinced of a successful turnaround of this business yet, but we do believe it is going in the right direction. Therefore, we believe a multiple closer to its 5-year average is warranted, with the business arguably in a better place fundamentally. Also, financial metrics point to solid value creation with an ROCE of just below 30% against a WACC of 8.6%.

Using a 13x multiple and our FY25 financial estimates, we calculate a target price of $65 per share, which represents annual returns of just over 11% over the next two years or over 13%, including the dividend.

While an investment in eBay is definitely higher risk than many others out there, we do believe this one has a high chance of paying off. We believe the risk-reward right now is rather attractive, and with the potential for total annual returns of over 13% from current prices of around $52 per share, we believe shares deserve a “buy” rating.

Let us know your thoughts in the comments! Also, please leave a like if this post was of value to you!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which I hope will be insightful!

Disclosure: I/we do not have a beneficial long position in the shares of EBAY, either through stock ownership, options, or other derivatives. This article expresses my own opinions, and we are not receiving any sort of compensation for it.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.

Now this is a DEEP dive. Great article man.

Ebay has it's issues but there's little argument against it being at a relatively cheap valuation now. Whether it can build momentum up again is a big question.

It’s true that people see eBay as somewhat of an “old” and “boring” company. It leaves the company vulnerable to competitors who are willing to innovate.