EssilorLuxottica (EL) – This company has an unparalleled moat (A Deep Dive)

This is a must-own for long-term-oriented investors, but is it a buy today?

EssilorLuxottica is an absolutely brilliant business with a staggering moat and global market share, yet you have probably never heard of it.

However, it is one of those unique companies with an extremely durable business model and competitive position in an industry with incredible longevity and serious potential to remain a solid compounder for many more decades. As a result, EssilorLuxottica is one of the businesses you can buy today and hold practically forever without having to really worry about its longevity, losing its edge, or going bankrupt.

This puts it in an elite class with the likes of Coca-Cola, American Express, McDonald’s, and Universal Music Group. These are all businesses that practically can’t be disrupted, and the same goes for EssilorLuxottica.

With quite some confidence, I dare say it will still be here in a few decades, probably still flourishing and dominating. That is how dominant and indestructible its moat is.

This is one of those companies I need to own.

Let me show you why exactly!

This is EssilorLuxottica – All you need to know!

EssilorLuxottica, which I’ll refer to as just Essilor going forward, is a global leader in the design, manufacture, and distribution of ophthalmic lenses, optical equipment, and eyewear.

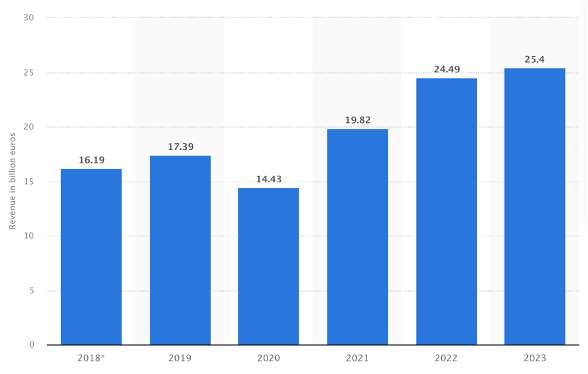

The company has a €95 billion market cap and generates over €25 billion in annual revenue, growing at a 10% CAGR since 2018. This translates into total revenue growth of 46% between 2019 and 2023, well ahead of the 27% growth from the peer average.

Formed through the 2018 merger of Essilor, a pioneer in lens technology, and Luxottica, a dominant player in eyewear retail and manufacturing, the company brings together expertise in vision care and premium fashion, which includes world-famous top-notch eyewear brands, including Ray-Ban, Oakley, and Persol, along with luxury licenses for brands like Chanel and Prada.

Indeed, while Essilor doesn't own prestigious luxury brands like Chanel, Burberry, Armani, Prada, Dolce & Gabbana, Michael Kors, Tiffany, Versace, and more, the company does own licenses to leverage its extensive eyewear network to design, manufacture, and distribute eyewear under these prestigious fashion labels. Every piece of eyewear by any of these brands is manufactured and designed by Essilor.

This probably already tells you a fair bit about its moat and dominance—ultimately, the company houses more than 150 eyewear brands, either directly or through licensing.

Furthermore, headquartered in Paris, France, and Milan, Italy, EssilorLuxottica operates in more than 150 countries and owns a vast network of retail locations, such as Sunglass Hut, LensCrafters, and Pearle Vision. In total, the company operates some 18,000 retail stores and leverages an additional 300,000 third-party locations to extend its global reach.

What stands out here is that Essilor adopts a model of both vertical and horizontal integration, involving itself in designing, manufacturing, distributing, and retailing its eyewear brands. In other words, the company simply owns the entire value chain.

Not only does it have an unparalleled portfolio of brands that already dominate the industry by itself, but it also owns everything from manufacturing to the stores distributing the products, giving it an incredible ability to dictate industry trends and set pricing standards.

From manufacturing to retail, Essilor has integrated vertically to an exceptional degree. The company simply owns the entire value chain, resulting in an astounding moat – one that only continues to grow with Essilor still actively looking for potential M&A deals to strengthen its portfolio and grip and competitors struggling to compete.

No other company in the industry has the same economies of scale and distribution networks that Essilor commands, none even come close, making it challenging for new entrants to gain a foothold. This further results in a cycle where Essilor’s dominance perpetuates itself through barriers to entry.

Additionally, Essilor’s exclusive licensing agreements with high-end fashion houses like Chanel and Prada have limited the availability of these brands’ eyewear to Essilor-controlled distribution channels, thereby inhibiting competition and contributing significantly to its monopoly.

Finally, with its extensive network, patents, and advanced technology, Essilor is the partner of choice for any company looking to partner up, whether a luxury brand or technology company interested in the wearables market. This further strengthens Essilor's grip on the market.

For example, under the threat of Google approaching Essilor about putting its Gemini AI assistant in future smart glasses, potentially undercutting Meta, the latter is now considering spending multiple billions to secure a deal by acquiring a 5% stake in the company.

This is a beautiful illustration of the company’s global significance. For any of these technology companies, Essilor is the best way to bring eyewear products to market. Meta wants this deal, whatever it takes, but more on that in a bit!

Ultimately, by bottom line data, the company, with its vast network and collection of top-notch brands, currently holds a 36% market share in the European eyecare and eyewear market and an even more impressive 47% market share in North America. However, while harder to put down an exact number, looking at the company as a whole, its global market share in the entire eyewear market is often estimated to exceed 80%.

In other words, its dominance is unparalleled. The company is pretty much the standard for the eyewear and optical equipment industry.

There is more to like: A push for innovation, continued M&A, and a healthy revenue split.

As the title above says, apart from its dominance and favorable business model, there is even more to like here.

For starters, the company has a clear growth strategy and is executing it perfectly. To fuel growth, the company is focused on three specific factors: leveraging its iconic brands and pricing power (obviously), heavily investing in AI/wearables, and focusing on healthcare solutions.

With 11,000 patents, there also isn’t really a lack of innovation here. In fact, this stands at the center of the company’s ambitions. For reference, the company spends an average of 6% of its annual revenues on R&D, which, in this very mature sector, is pretty significant.

Meta x Ray-Ban – smart glasses could be the future

Starting with one of the company’s most significant growth opportunities and biggest headline maker, let’s discuss the company’s venture into the smart glasses industry in collaboration with Meta. Essilor, through its iconic Ray-Ban brand, has partnered with Meta to develop high-end smart glasses, blending fashion with advanced technology. The most recent product includes built-in cameras, audio, and voice control, as well as some mild AI features.

Obviously, smart glasses are a massive potential market and an incredible opportunity, and not only is Essilor best positioned, it already leads the market with its Meta x Ray-Ban smart glasses, which have been a big hit so far. In fact, it is the single real usable smart glasses product on the market that has actually turned into quite a success.

This venture into smart glasses represents a new frontier in eyewear, blending vision care, fashion, and technology and giving Essilor a foothold in the emerging AR and wearable tech markets. For reference, the smart glasses industry is currently valued at just $1.2 billion but will compound at a stellar 27% CAGR through 2030.

Indeed, this is a massive opportunity for Essilor, and with it already leading the market, this growth will massively benefit it. With its world-famous brands and Meta’s top technology, the setup here is great!

Further confirming this and solidifying the company’s potential in this market is the new long-term deal both companies recently signed, extending it “well into the next decade,” showing a serious commitment by both companies. On top of this, as I pointed out before, Meta is considering taking a 5% stake in Essilor, showing Meta is seeing a massive opportunity here.

I am really bullish on Essilor’s opportunity here and expect it to remain a long-term growth driver that might be broadly underestimated right now.

Healthcare is a growth driver for Essilor as well.

Besides smart glasses, exposure and demand for healthcare are also a growth drivers for Essilor

Crucially, in terms of healthcare solutions, the company isn’t just focused on finding solutions for eye diseases and loss of sight, which in itself is already a massive and rapidly growing market. However, it also focuses on other health issues, including hearing issues. While the company’s footprint here is very minimal right now, it has been making impressive steps in this industry, recently bringing products to market that include a completely invisible hearing aid integrated in eyewear, for example.

This exposes the company to the 1.6 billion people globally with hearing issues, translating into a massive opportunity. This way, the company is meaningfully growing its TAM, which is brilliant!

M&A remains crucial

M&A remains a critical growth strategy for EssilorLuxottica, playing a key role in shaping its market dominance and expanding its global footprint. The company has a long history of leveraging M&A to strengthen its position across the value chain, from lens innovation to retail distribution, and has used this strategy to enhance both its capabilities and geographical presence.

By leveraging M&A opportunities, Essilor expands its brand and product portfolio and strengthens its grip on the industry.

This is why the company remains very active on this front, acquiring another two businesses this year alone, including New York brand Supreme from VF Corporation for a total of €1.4 billion. While the market questioned the move, it further strengthened the company’s brand portfolio, especially among younger generations, where Supreme has a strong market position.

Whether always liked by shareholders and the market or not, the company has a strong M&A track record, and I am pleased to see the company executing its strategy.

No over-dependence. This is a beautiful global revenue split.

Finally, it is worth pointing out Essilor’s brilliant global exposure.

A big downside for many businesses is overdependence on a single region, sector, or customer. However, Essilor shareholders needn't worry about this, as the company has a nice and balanced global revenue exposure.

As highlighted below, the company isn’t dependent on a single region. It has a nice global split and not too much exposure to more volatile and uncertain regions, leaving it with a lot of room for growth in these same regions.

This simply translates into a lower risk profile.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. We appreciate you being here! Want to support our work a little bit more and show your appreciation? Consider upgrading to paid (only $5 monthly).

This allows me to push out even more content and gets you premium access to even more content, including my full insight into my personal portfolio!

The eyewear industry is tremendous and a solid foundation for growth

Cutting right to the chase, the eyewear industry shows impressive long-term potential driven by incredible longevity and some nice underlying growth drivers.

Over the last decade, the industry has compounded nicely, driven by factors like increasing visual impairments, fashion consciousness, and a rise in disposable income. It has become more and more of a fashion statement than ever before.

Going forward, this isn’t expected to change. As explained by Grand View Research, “the increasing prevalence of eye conditions such as myopia, hyperopia, astigmatism, and presbyopia is driving demand for corrective eyewear. The availability of a wide range of stylish and affordable eyewear options, including designer brands and customized lenses, has made eyewear more accessible to consumers. Moreover, the rising disposable incomes and the growing acceptance of eyewear as a fashion accessory have further fueled market growth.”

Furthermore, in emerging markets, where access to vision care is still limited, increasing awareness and economic growth are driving demand for corrective eyewear. As more people in these regions gain access to vision care services, the industry is expected to grow significantly.

As a result, the industry is expected to continue growing strongly through the end of the decade, with research firms projecting it to continue growing at a mid-single-digit to high single-digit CAGR.

A pretty solid foundation for growth indeed, especially for Essilor.

Meanwhile, the industry isn’t going anywhere, either. A combination of essential vision care needs and evolving consumer preferences toward fashion and technology has given the industry considerable longevity.

The rising demand for vision correction is a key factor sustaining the industry's growth. As populations around the world age, there is an increasing prevalence of vision issues such as presbyopia and cataracts. This aging demographic, especially in developed regions like Europe, North America, and parts of Asia, contributes to a steady demand for corrective eyewear.

With this development not going anywhere, I believe we can safely conclude that the industry will continue to flourish for many more decades.

And who is best positioned to benefit? Of course, EssilorLuxottica is with its vertically integrated business model and dominant position.

On that note, let’s move to the company’s financials before drawing our conclusion.

Healthy financials and stable growth

Since the 2018 merger, Essilor has grown revenue at a pretty impressive 10% CAGR, hitting $25.4 billion in annual revenue in 2023. Considering this includes a COVID-19 pandemic, which forced it to close many of its 18,000 retail locations, this is not too bad at all

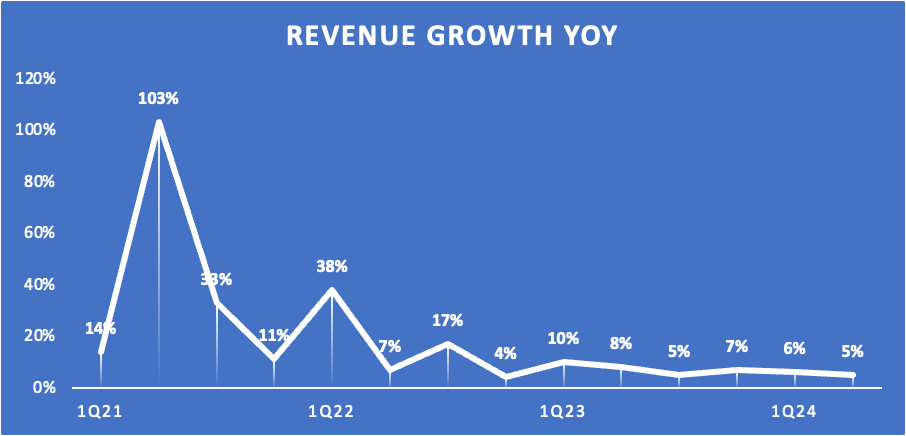

Now, growth has been slowing, or rather normalizing in recent quarters, back to the low to mid-single digits, but I believe this is still more than enough to please investors. Growth is healthy and stable despite everything that is going on around the world.

The company reported its latest financial results back in July, which were well received by investors. Essilor reported a solid 5.2% top-line growth, which sat roughly in line with the growth reported in prior quarters. This brought the first-half revenue growth to 5.3%, still outpacing the underlying industry.

Growth has clearly stabilized in the mid-single digits in recent quarters, in line with management’s long-term guidance despite a challenging operating environment and uncertainty in the U.S. market. This is more than a decent performance; I expect it to persist.

Notably, growth was similar for both the professional and DTC segments, and the company saw revenue grow in every single operating region, both quarterly and for the first half of the year, indicating solid business health across the board.

Looking at the H1 numbers, the U.S., the company’s largest market, continued to show most weakness, only growing 1.5% for Essilor. Growth did remain positive across the board, but some consumer weakness is impacting Essilor. Positively, the economy seems to be heading for a soft landing, and with interest rates being cut, we could see demand improve here in coming quarters, heading into 2025, which should significantly affect growth.

No real worries here for now.

Meanwhile, growth in the EMEA region was straight-up impressive in the first half of the year, growing 8.2% YoY, even as poor weather in Europe impacted demand for sunglasses. Still, 7.9% growth in Q2 market is the 13th consecutive quarter of growth in the EMEA region, which is impressive. I expect growth to remain solid here.

Moving to the third reporting region, growth in the Asia Pacific was once again stellar, coming in at 9% YoY. It showed an acceleration in Q2 to 9.8% as demand improved, even as it lapped the best quarter of 2023 with 24% growth. Growth was especially strong in Mainland China and Japan, with double-digit growth.

Finally, growth in Latin America, the smallest of the four, was solid as well at 9.7% YoY for the first half, making it the fastest-growing segment. Of course, this isn’t too surprising, considering this also is the segment where there remains the longest runway of growth for Essilor due to the poor availability of eye care. This should remain one of the fastest-growing regions going forward as Essilor grows its presence.

Ultimately, we can conclude that growth remains pretty solid and healthy across the board. I am definitely pleased.

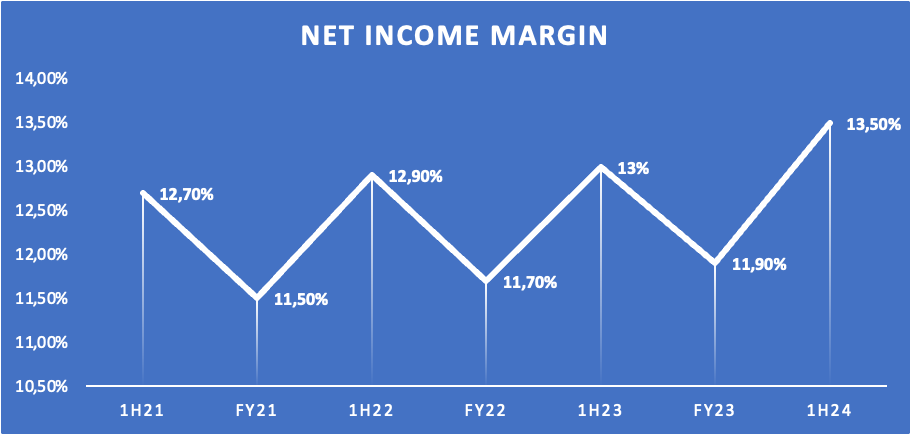

The same can be said about the bottom-line performance, with Essilor showing expanding margins across the board. For the first half of 2024, the gross margin was up 30 bps YoY to 64.5%. This was driven by price increases across the product portfolio in 2023 and the first half of 2024 to offset inflationary pressures. However, many of these price/mix tailwinds were offset by strategic investments in manufacturing infrastructure.

Still, considering the circumstances, this is a pretty solid performance. The same cannot really be said in the long run. You see, since 2019, which was the first year after the merger and the only pre-COVID year, the gross margin has only expanded by 130 bps, which isn’t really as impressive. We should keep in mind that this included the impact of COVID-19 and the challenging inflationary pressures the company dealt with in recent years.

Therefore, I am not overly worried, and we should expect margins to climb higher in coming years as cost efficiencies kick in and the company enters a more normalized operating environment.

For the operating margin, the story is very similar, with a solid performance so far this year but limited expansion since the merger. In the first half of 2024, Essilor reported a solid operating margin expansion of 30 bps YoY to 18.8%. The operating margin has been fluctuating around the 18.5% mark over the last three years but has shown only little expansion since 2019, recording 130 bps of margin expansion.

A big reason for this was costs rising just as quickly as revenue. Selling expenses, or the cost of operating all stores and channels, were one of the fastest-growing costs, growing at a 13% CAGR from 2019. Accounting for 63% of operating costs at over €7.5 billion annually, this has had a pretty big impact.

Positively, all other expenses have grown slower than total revenue. However, total operating expenses have still outgrown top-line growth over the last four years, which has been weighing on bottom-line growth.

As a result, net income margin expansion has also been limited. In the first half of 2024, the net income margin hit 13.5%, up 50 bps YoY and 80 bps from H1 2021. However, this is up only 100 bps from H1 2019, when this sat at 12.5%.

Moving further down the line, FCF remained solid in H1 2024, coming in just shy of €1 billion, up roughly 2% YoY. FCF annually exceeds €2.4 billion.

This solid FCF also allowed Essilor to maintain a healthy balance sheet. It currently holds €2.16 billion in cash and cash equivalents and ended the second quarter with just below €10 billion in net debt (including €3.51 billion in lease liabilities) and a net debt/TTM EBITDA of 1.5x.

This is perfectly healthy, giving the company plenty of room to keep focusing on M&A. In terms of financial health, shareholders have little to complain about. Essilor gets an A credit rating from S&P Global, perfectly highlighting its top financial health.

This also allows Essilor to pay a nice dividend to investors and a rapidly growing one as well. The annual payout has more than doubled since 2019. Furthermore, since the start of the century, Essilor has grown its dividend at a 15% CAGR, accelerating further over the last ten years to an 18% CAGR and, finally, a 19.4% CAGR over the last five years, which is rather insane growth!

Last year, the company raised the dividend by 22%.

Shares now yield just below 2%, which, thanks to the significant growth mentioned, is above the 10-year average of 1.4% and a really nice starting yield.

Now, while the company isn’t the dividend growth investors’ dream, with consistency not at the top of management’s agenda, as highlighted by a few dividend cuts in its history or even some years in which it was skipped in its entirety, on a long-term basis the dividend does still look very compelling.

The only real negative is the payout ratio, which is somewhat elevated at 77% as of 2023. Now, quite a bit of profit growth is anticipated in the years ahead, so this shouldn’t be too much of an issue, but it does indicate there won’t be as much dividend growth ahead. Also, if we were to enter a recession, the dividend would almost certainly be cut.

Positively, the current dividend comfortably remains fully covered by FCF, with annual obligations now sitting right around €1.5 billion.

In the long run, I do view it as a sweet dividend investment, even though it doesn’t offer as much reliability or safety.

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Many of its features are free. (Note: this is an affiliate link)

Outlook & Valuation

As for the forward projections here, there really is a lot to like!

Obviously, looking at everything discussed and pointed out so far, it is pretty clear this company has a long road of growth ahead of it, and in the medium term, current projections by Wall Street analysts look pretty favorable.

As for top-line growth, Wall Street expects growth to remain stable and in line with recent quarters, pointing to mid to high single-digit growth roughly in line with the underlying industry. Personally, I see some upside to these estimates as I feel like analysts aren’t properly taking into account the company’s growth opportunity in smart glasses, but, nevertheless, this already looks rather solid.

However, in terms of bottom-line growth, Wall Street is even more bullish, pointing to EPS growth at a mid-teens CAGR in the medium term, which is significant. Now, I do take this with a grain of salt as projections aren’t as reliable here, but the safe conclusion is that EPS should easily outgrow top-line growth thanks to notable margin expansion expected as inflationary pressures ease and the company gets to fully leverage its investments in its brands and innovative product lines.

Ultimately, this results in a very compelling medium-term outlook. Below, you’ll find the current analyst consensus, which, in my view, leaves room for further upside.

Since the merger, Essilor shares haven’t quite been an outperformer. Shares returned 68% over the last six years, against a 98% return for the S&P 500.

YTD, shares have also not quite been able to match the gains made by the S&P500, returning a solid 15% but falling short of the 20% + gains from the S&P 500. However, compared to the French index, shares have done well, with the index flat YTD.

Nevertheless, shares are quite expensive. Based on current projections, Essilor shares trade at 30x next year’s earnings, which is just straight-up expensive. Taking into account its current net debt, which better illustrates the actual value of the business, an EV/E (Enterprise Value/Earnings) of 36x is an even more significant multiple to pay. This makes it more expensive than the likes of Oracle, Microsoft, or Visa.

Of course, the moat, dominance, and longevity here deserve a higher multiple. Businesses of this kind of quality rarely come cheap, but still. There is a limit to what one should be willing to pay. Even a wonderful business should only be bought at a fair price.

Of course, the medium-term profit outlook is pretty impressive, and on a PEG basis, shares trade at a multiple of 2x, which isn’t too crazy for a business as high-quality as this. So, the medium-term profit growth might at least somewhat warrant the current multiple.

Still, it is hard to determine whether the current multiple is too rich due to a lack of reliable historical data and the promise of medium-term outperformance.

However, I am slightly more conservative today due to global geopolitical tensions and a continued risk of poor economic data and a hard landing, so I am a bit more conservative in paying these high multiples. Therefore, I am currently staying on the sidelines, aiming to buy shares on a dip below €200 per share, ideally closer to €190, as this should offer some more downside protection and potential for long-term outperformance.

For reference, using a 30x P/E multiple, which I believe is relatively fair, I calculate an end-of-2026 target price of €239, which translates into annual returns (CAGR) of just 4.5%, which simply does not justify a buy rating.

Meanwhile, buying at a share price of €195, you would be in for annual returns of 8.5% or over 10%, including dividends, which are far more compelling returns.

In conclusion, for now, I remain on the sidelines and aim to start a position at a share price closer to €195. Ultimately, this is a must-own.

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

I understand the moat. But why isn't it reflected in their return ratios (e.g. ROIC 6.4%, RoE 6.2%) and margins (e.g. Net income margin 8.9%)?