Expedia Group – Please don't ignore this sell-off opportunity

Expedia seems to be completely misunderstood by the market, which results in it trading at a massive discount. Expedia is our top turnaround pick, and we doubled our investment.

Introduction

Expedia shares are being sold off by investors at the time of writing this post. Expedia shares are down 19% in Friday’s trading session in response to the Q4 earnings report and the announcement of a management switch. We believe this presents investors with a brilliant buying opportunity in this turnaround play.

The company has fallen behind the competition over the majority of the last decade and has been completely mismanaged. For example, the rental platform Vrbo was only properly migrated into the Expedia tech stack in Q3 of last year while it was acquired in 2015, which led to it missing out on years of synergies and efficiency gains. It's no surprise that Booking structurally has higher margins on every front.

Also, the company has been trailing its main competitor, Booking, for years in terms of technology, customer experience, and long-term growth initiatives as well. As I said in December in an SA post, “In the end, within the travel industry, the strongest platform attracts the most customers, making it hard for Expedia to fight Booking without significant changes.” Management has simply failed to steer this company in the right direction for most of the last decade. Add to this significant shareholder dilution over recent years, and we end up with stock that’s hard to recommend.

However, management has been working hard to turn this ship around, and as will become visible throughout this post, Expedia has made great strides over the last year or so, with the business fundamentally and operationally showing massive improvements, which should allow it to better compete with Booking and other peers in coming years.

As a result, we see Expedia as an excellent turnaround play, especially with shares now valued below 10x this year’s earnings, which is insane considering its outlook. In the end, Expedia is still a “prominent player in the international travel sector, commanding a varied collection of robust brands that have gained the confidence of countless global travelers, resulting in a market share of 26.4% in the international digital travel market, only trailing Booking Holdings, and a 42% market share in the US digital travel market,” as I wrote December.

Let’s dive into the results and discuss management’s commentary and guidance to find out why Expedia is one of the most attractive turnaround options in the market after this close to 20% drop in share price.

Top line growth accelerated in Q4 and looks solid

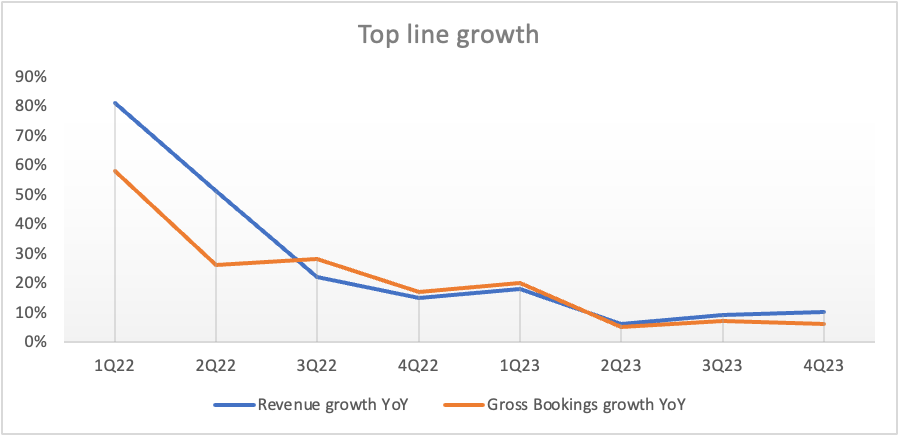

Expedia released its Q4 and FY23 results on February 9 aftermarket and delivered results roughly in line with the consensus and our expectations. It reported revenue of $2.89 billion, up 10.3% YoY, which is a growth acceleration of around 160 bps from 9% reported in the previous quarter and 6% growth reported in Q2. This was driven by both the B2C and B2B business with both reaching record-high Q4 revenues. B2B revenues even grew by a whopping 28% YoY in Q4 and 33% in FY23 as this market continues to recover.

However, Expedia did face some softness in gross bookings, with these up only 6% YoY, but this was mostly the result of air (flight tickets) gross bookings under pressure due to a reduction in average ticket prices. In this department, Expedia faced some signs of macro weakening.

Luckily, this is a small and low-margin part of Expedia, so the actual result of this weakness in revenue and profitability is limited. At the same time, it does have an outsized impact on gross bookings. As a result, this weakness in flight tickets also makes gross bookings appear less solid than it really is.

Obviously, 6% gross bookings growth is far from great, but if we actually look at the most important segments of Expedia in terms of revenue, growth, and profitability, we can see that gross bookings growth was actually quite solid with hotel gross bookings growing 13% YoY in Q4, and lodging growth of 14%. Crucially, Expedia was able to gain market share in all its key markets as well.

As a result, revenue growth came in at a slightly higher 10% in Q4. This led to FY23 revenue of $12.8 billion on gross bookings of $104 billion, both up 10% YoY. Lodging bookings grew slightly faster at 11%, and growth in all departments apart from air accelerated in H2. So far, there is little negative to say about the performance of Expedia as growth is steady, accelerating, and in line with expectations.

However, we are even more enthusiastic about the fundamental and operational improvements management realized in 2023, which drives our enthusiasm. This includes launching One Key, completing the Vrbo migration, introducing machine learning and AI functionalities, and massive technological and platform improvements.

Significant operational improvements drive our bullcase

First of all, Expedia finally fully completed its front-end migration of Vrbo in Q4, which was a big temporary drag on the platform’s results. Luckily, with the migration now completed, the platform is better positioned than ever. Expedia plans to grow its marketing efforts significantly and, in the words of management, punch its main competitors squarely on the nose. Management plans to be aggressive with Vrbo to bring the fight to Airbnb, and I believe it has a good shot and could be a growth driver, especially with the platform now included in the one key rewards program.

The one key rewards program was introduced by Expedia earlier this year and might be the most important development of 2023 and the most important growth driver as well. It is designed to increase the attractiveness of its platforms, increase cross-selling between its brands, and increase customer loyalty. With this program, Expedia wants to bring the fight to Booking, which has had reward programs within its app for years, leading to terrific customer retention.

The program unifies all of Expedia’s key brands (Expedia, Vrbo, Hotels.com, etc.) under a single loyalty program. It allows customers to earn points earned through earlier bookings, which can be used (and earned) across its platforms. This should lead to customers staying with Expedia and using its different travel platforms for their different travel needs. Simply put, with this rewards program, Expedia allows customers to achieve savings by staying with Expedia.

This might sound like a small development, but generally, these loyal customers drive higher profits per transaction and higher repeat rates, ultimately leading to higher lifetime value, which drives growth. I believe this is key to the growth prospects of Expedia and success in this industry.

Positively, the company’s rewards program already has over 100 million members, up from 75 million at the end of Q3, and is far from done growing as management will expand it into many more international regions over the next couple of years. This has also led to great adoption of its app, with it generating a record high percentage of revenues from the app in 2023, up 600 basis points as a percentage of all business.

All in all, I really like the introduction of one key and believe it will drive growth and customer loyalty for Expedia, allowing it to better compete with Booking. So far, the company has seen great adoption and success, as highlighted by this quote from management during the earnings call:

“We will also drive more cross-brand and cross-product engagement through One Key, which enables cross-earn and redemption across all our key brands and encourages consumers to stay in our ecosystem for all their travel needs. We are already seeing early signs of this with an increasing number of customers who cross-shop our brands in the U.S. since the launch of One Key.”

Besides the introduction of one key and the migration of Vrbo, the company also significantly improved and streamlined its operations and tech stack by, for example, eliminating the 76 different agencies around the globe it used for marketing and generating an entire full-service marketing, creative, and media buying team internally. This not only cut away a bunch of costs but also allowed it to “optimize across brands and bring programmatic approaches to everything [it does] in meta-search, social, SEO, and everywhere else.

It also decommissioned 17 CRM systems and built one universal messaging platform linking all its brands, which includes one key through which it went from seven to one loyalty stack; consolidated from 13 machine learning platforms and four experimentation platforms to one, meaningfully reducing the number of developer tools and optimized its IT footprint; and migrated all brands to a single front-end stack with a unified test-to-learn platform, which allows it to rapidly launch tests and features across brands, platforms, and geographies.

Clearly, management had changed a big part of the company’s operational infrastructure, making it much leaner and straightforward. This is how management put it:

“We are just at a completely different place technologically, and the effects we have seen so far are only just scratching the surface of what is possible.”

A big part of this technological transformation involves the introduction of AI and ML features like the travel AI assistant for customers to improve their experiences and reduce effort while also cutting away customer support roles. This also includes an AI and ML program to predict “a consumer's best next action in order to sell complimentary items, be it in the booking flow, post-booking, and in CRM communications,” through which it drives up a consumer’s baskets.

Taking all this into consideration, the company is looking very strong technologically and well-positioned for future growth. It is in a better position than ever before.

Meanwhile, this also allows the company to once more focus on international expansion. During COVID-19, the company exited a number of markets as its tech and marketing model weren’t well suited in those regions. However, now that the company is in a much better place technologically and operates much leaner and improved operationally, management wants to re-enter some of these markets and go back on offense.

With the company in a much better position, management wants to accelerate growth and take more market share. With the right management team, I believe it has a good chance as it remains very well positioned with its strong and globally recognized and trusted travel platforms.

That brings me to the management shift announced by Expedia.

Expedia announced a CEO change

Possibly the biggest shocker of the earnings report was the added announcement that CEO Peter Kirn would step down as CEO of Expedia in May and will be replaced by Ariane Gorin, currently president of Expedia for Business and part of the company since 2013 when she joined the company after a decade-long stint with Microsoft.

The CEO switch came as a massive surprise for pretty much everybody, but the choice for Gorin is not a surprising one, given her high-profile role at the company. Looking at her experience, she seems to be a solid choice by the Expedia board.

And yet, Expedia shares sold off quite significantly following the news. Of course, this is likely not entirely based on this news, but Wall Street clearly responded with some shock. And honestly, I am also still not sure how I feel about it.

I have been very negative about Expedia management over the last year due to the years of mismanagement, but current CEO Peter Kirn has transformed the company since 2021 with a clear vision, as discussed above. Especially considering this, the step down comes as a surprise and a disappointment.

Additionally, such a CEO change always comes with its fair share of challenges, although these are relatively limited in this situation. Gorin has many years of experience leading parts of Expedia, making her a perfect fit for the company. Also, Kern will continue as the company’s vice chairman and remain on its board, which he has been on since 2005, so he will stay involved.

Overall, I do not view this CEO change as very significant for investors, and while somewhat disappointing, the bull case remains intact, and Gorin should be able to lead this company to success. Of course, her first earnings call will be an important one to watch.

On that note, let’s return to the Q4 earnings.

The bottom line is slowly and steadily improving

On the bottom line, Expedia also performed well in Q4 and FY23, with profitability improving strongly. Obviously, all the operational improvements mentioned above have positively affected margins and led to the closure of 100 office locations and a 30% reduction in employees from a peak level in 2019. However, much of these gains will only be realized in future years, giving Expedia a long runway of margin gains ahead. On top of this, the company still sees significant opportunities to run even more efficiently by eliminating more redundant systems, optimizing its cloud usage, and utilizing AI to cut more costs.

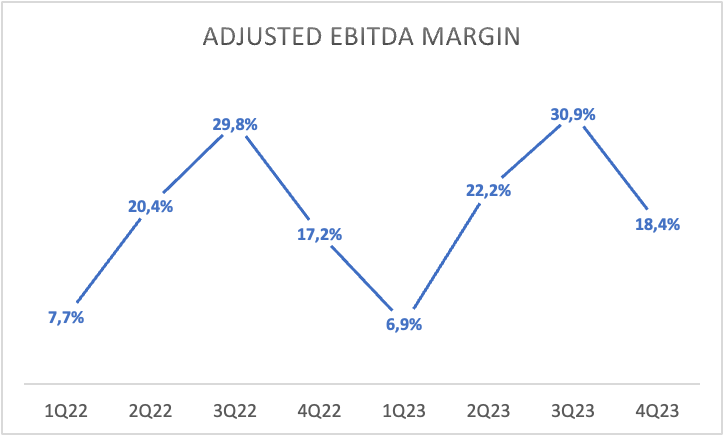

Nevertheless, the EBITDA margin now already sits at the highest level in over a decade and is up over 300 bps from 2019. Driven by the solid revenue performance and moderated cost growth, Q4 EBITDA was at a record high of $532 million, up 19% YoY at an EBITDA margin of 18.5%, up 130 bps YoY. Positively, both EBITDA and margin expansion also accelerated from the previous quarter as efficiency gains kicked in.

As a result, Expedia generated $2.7 billion of EBITDA in FY23, up 14% YoY with an EBITDA margin of 21%, up 75 bps YoY. These margin gains also led to a very robust FCF of $1.8 billion in FY23, which allowed management to complete the most significant annual share repurchases in its history of $2 billion or 19 million shares, bringing the share count back to 2015 levels and offsetting years of dilution. Again, management is showing strong signs of a successful turnaround with significant cash flows and shareholder returns.

Even after these share repurchases, Expedia still ended the year with a solid balance sheet with $6.8 billion in cash and $6.3 billion in debt. This translated into a gross leverage ratio of 2.3x, which should go down to the target range of below 2x in 2024, driven by early debt repayments and EBITDA growth. This leaves Expedia in a tremendous financial position with plenty of cash to invest and return to shareholders.

In the previous quarter, management announced a new $5 billion buyback program, which should allow it to reduce the share count by a whopping 20% after a 10% reduction in 2023. Management plans to keep buying back shares opportunistically in 2024. Safe to say investors are in for significant returns, boosting EPS.

Outlook & Valuation – Expedia shares are tremendous value

Looking at 2024, Expedia management now points to relatively healthy demand. Still, it expects growth rates to decelerate globally, especially in the first half of the year, which may have spooked investors somewhat. This includes the expectation for international growth outside of North America and Western Europe to remain much stronger but with this gap to close in H2.

However, management believes it remains well positioned, and with it now going back on offense, it strongly believes it should be able to gain market share in key regions in 2024 and keep growing the top and bottom lines at respectable rates.

Nevertheless, for Q1, management does not guide very strong YoY growth due to tough comps and the pressure in air operations persisting. As a result, management now guides for low to mid-single-digit growth in gross bookings and mid-single-digit revenue growth, which could be perceived as slightly disappointing. However, management does expect growth rates to increase throughout the year due to gains from product improvements and a healthier demand environment.

On the bottom line, management sees plenty of room to optimize the cost structure further and keep up margin expansion. As a result, management guides for another year of record EBITDA levels with margin expansion similar to 2023, so within a range of 100-150 bps. On top of this, FCF should grow even faster due to the EBITDA margin expansion and CapEx efficiencies.

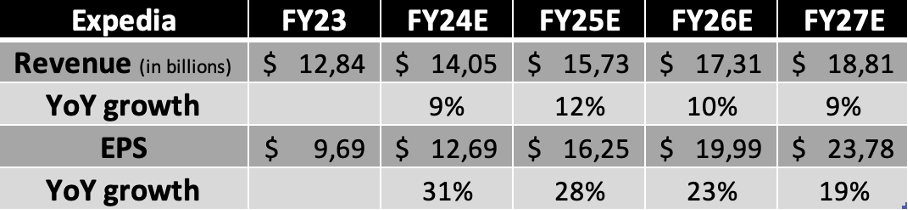

Considering management’s guidance, we now expect Expedia to deliver revenue growth of 9% in 2024. However, this could end up slightly higher depending on the pace of interest rate cuts and the growth acceleration in H2. Meanwhile, Expedia should continue to expand margins steadily. We now project 120 bps of EBITDA margin expansion, leading to an EPS of $12.69, up 31% YoY. This leads to the following expectations through 2027.

Based on the estimates above, shares are now, after a 20% drop, trading at a PEG ratio of below 0.5x and around just 10x this year’s earnings, which is a massive 40% discount to the sector median. This is also a massive discount to peers Booking and Airbnb, which currently trade at 21.5 and 34x FY24 earnings, respectively.

Now, I understand that this company trades at a discount to peers with it still having to prove itself, the real gains of operational improvements still having to fully materialize, and the CEO change bringing additional risks. Clearly, risks for Expedia are slightly higher, but still, at 10x earnings and a PEG of 0.5x, investors are pricing in absolutely no growth for Expedia, while the company has a pretty clear runway of growth ahead of it.

As a result, we believe Expedia shares now trade at a ridiculous discount, which does not at all reflect any sort of turnaround or fundamental improvements, or any growth for that matter. Meanwhile, the company has already shown that it is well on its way to getting the business turned around and is ready to go back on offense and take market share aggressively. The company is simply in a much better place than ever before.

Even if we award shares a very conservative 15x multiple, which is still a significant discount to peers, I end up with a 12-month price target of $187 or almost 43% upside. Meanwhile, if Expedia can show investors that its operational improvements materialize in market share gains and margin improvements, a higher multiple closer to 18-20x is highly likely over the next two years, which could make Expedia a multi-bagger. Of course, this is more speculative, but we view this as a highly likely scenario. For reference, an 18x multiple on the current FY25 EPS projections leads to a target price of $292 or an upside of 123%.

Therefore, we remain extremely bullish on Expedia and view it as the top turnaround option in the market, especially after the massive overreaction by the market after the Q4 results. In fact, we doubled down on Expedia and doubled our investment after this 20% share price drop.

We are strong buy rated on Expedia.

Thank you for reading this post. Enjoyed it? Please leave a like to let us know!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which I hope will be insightful!

Please make sure to like, restack, and share this post to increase our reach and support our work. Thank you!

Not subscribed yet? What are you waiting for?!

Disclosure: I/we do have a beneficial long position in the shares of EXPE, either through stock ownership, options, or other derivatives. This article expresses my own opinions, and we are not receiving any sort of compensation for it.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.

5 years ago the stock was at $125 - today it is at $136 - AWFUL! I have been buying VALE and PFE - good upside and very good dividend