Infineon Technologies AG – Remains one of our rare “strong buys” after earnings

Infineon reported Q1 results earlier this week, which led to an 8% drop in the share price. However, the lowered outlook did not come as a surprise, and we remain bullish.

Earlier this week, Infineon presented its Q1 earnings. While these still hit the Wall Street consensus and our estimates, the Q2 guidance and that for the remainder of 2024 highlighted a weakening in the company’s end markets as well as some macroeconomic and currency headwinds, which turned out to be far more widespread than anticipated. In fact, Infineon is seeing relative strength in the automotive market in spite of inventory corrections but is seeing a much more severe slowdown in other end markets, forcing it to lower its outlook.

In response to the lowered FY24 outlook, Infineon shares lost close to 8%, which stands in sharp contrast with the 9% share price jump that followed after the Q4 results. Nevertheless, we remain bullish on Infineon and continue to view the company as one of the most attractive in the semiconductor industry due to a complete mis-valuation and underestimation of its long-term growth potential, even in the face of the current slowdown. In fact, we believe this weakness could present investors with even more favorable entry points. As will become clear throughout this earnings review, investors able to look through the near-term weakness could be in for stellar long-term returns.

Before we get into the Q1 results, management’s commentary, and the FY24 outlook, I want to quickly repeat my bullish thesis on Infineon. This is what I wrote previously on Seeking Alpha:

“Infineon is a leading analog semiconductor manufacturer with a de-risked revenue stream, strong in-house manufacturing mainly located in Europe, a strong market share in its key end-markets, and exposure to high-growth secular trends that drive above-industry growth through the cycles. Meanwhile, it trades at a significant discount to peers and historical averages. This company is a bargain today and presents an opportunity to investors with a long-term investment horizon and a stomach for some volatility. Shares have underdelivered over the last year but are poised to outperform over the next 5+ years.”

Worth mentioning as well is that Infineon continues to target 10% annual revenue growth through the cycles, a 25% segment result margin (not to fall below a high-teens range in downcycles), and an adjusted free cash flow margin of 10% to 15% of revenue. These optimistic targets are supported by the company’s exposure and strong foothold in fast-growing sectors like automotive, cybersecurity, and sustainability. This exposes it to secular growth drivers like digitalization and decarbonization.

Add to this the company’s significant investments and market share of over 30% in silicon carbide technologies – one of the fastest growing semiconductor technologies projected to grow at a CAGR of over 20% through the end of the decade – and we have quite a strong investment case. In our view, Infineon is one of the better-positioned analog semiconductor companies, and yet it trades at a discount. We saw a 47% upside in November, and shares are down another 8% since.

On that note, let’s dive into the Q1 results, which weren’t as great due to the earlier-mentioned cyclical downturn. The company faced a number of headwinds in its fiscal Q1, including cyclical market dynamics and adverse effects from currency. While management is seeing strength in areas like automotive due to the secular drivers in place, other end markets like industrial and consumer computing saw significant weakness as Infineon now sees a prolonged period of inventory digestion at customers. As a result, revenue was down 6% YoY to €3.7 billion in Q1.

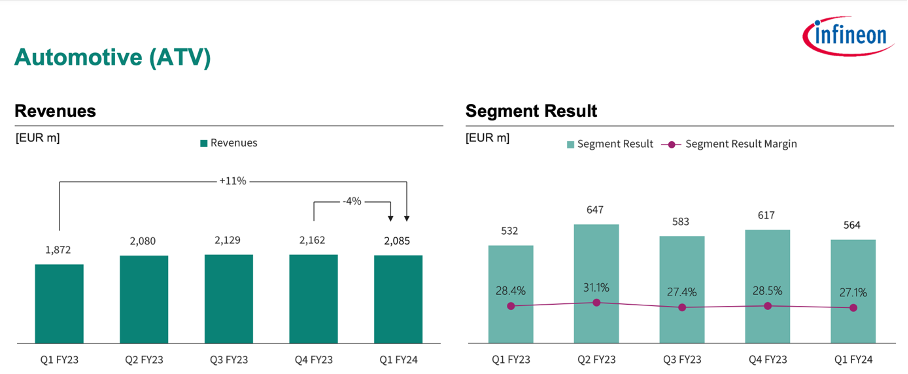

Looking at the individual segments, automotive once more outperformed as it saw revenues grow by 11% YoY, although this was also down 4% sequentially. Growth has been slowing down in this department as Infineon isn’t entirely isolated from the short-term inventory correction and macroeconomic pressures.

Nevertheless, Infineon continues to be a prime beneficiary of several secular growth trends in automotive, like e-mobility and ADAS, which allow Infineon to keep growing revenue, even as the number of cars expected to be produced in 2024 is expected to be flat to slightly down. Simply put, more semiconductors are required in each of these cars produced, driving growth for Infineon.

Furthermore, the company is best positioned to benefit from electrification through its leading share in automotive power semiconductors. And yes, this market is weakening in Western markets, but the electrification push in China is still firing on all cylinders, growing by 22% in calendar Q4. This was able to offset some Western weakness for Infineon.

Of course, Infineon still felt the impact of a short-term inventory correction, but these demand drivers were able to offset this and keep growth positive. Revenue for this segment came in at €2.85 billion, now accounting for a very significant 77% of revenue due to the downturn in other operating segments. The top-line resilience in this segment also led to a relatively resilient bottom line with a segment result margin of 27.1%, which was down 130 bps YoY as a result of weakening pricing power.

However, this is pretty much where the good news, or at least short-term good news, ends. In all of its other segments, Infineon experienced significantly more cyclical weakness. In the Green Industrial Power segment, revenue was down 3% YoY and 16% sequentially as a result of high inventory levels at customers and typical seasonality.

Core industrial applications like factory automation experienced significant weaknesses. According to Infineon, these are closely correlated with economic health and usually late cycle, which is why we should expect this weakness to persist and broaden.

Meanwhile, Infineon also faced weakness in one of its growth drivers – green energy – as “increased inventories in the photovoltaic value chain will temporarily slow down semiconductor demand for PV inverters, even in the face of continuous growth of installations,” as explained by management. While this is a massive growth driver for Infineon in the long run, the current weakness is a drag on financial growth.

Meanwhile, the company is making solid progress in its silicon carbide plans as it hit its $500 million SiC revenue target in 2023. It still plans to grow this by 50% in 2024, even amid a tough operating environment. Moreover, the company’s Malaysia expansion plans are well underway, giving the company a long runway of growth in SiC.

Finally, weakness in the Power & Sensor Systems and Connected Secure Systems segments also remained significant, with revenue down 27% YoY and 31% YoY, respectively. Again, this resulted from an expected downswing in the end markets, high inventory levels, and the corresponding need for a depletion period.

This is why management expects this weakness to persist in the near term in both volumes and margins while seeing a high likelihood for a recovery in the second half of the year. Positively, management does expect such a recovery to be steep due to the combination of depleted inventories and lower interest rates, which should support a strong demand rebound.

In the meantime, Infineon remains bullish on the long-term prospects of each of these segments. The company sees excellent structural opportunities in the adoption of IoT technologies, especially with AI now moving to the edge.

And this perfectly highlights one of the key takeaways from this earnings report, which is the fact that this is a temporary slowdown. We believe looking through this near-term cyclical weakness is crucial as the company’s exposure to secular drivers and leading market positions in decarbonization and automotive electrification will be significant long-term growth drivers.

Therefore, this is not the moment to turn bearish on this company; instead, see the current weakness as an opportunity. According to management, 2024 will be a transition year, but it maintains its growth targets. Therefore, so far, there is nothing that justifies the 8% sell-off of the shares.

On the bottom line, the company also performed relatively well, beating its own margin guidance of 22% with a segment result margin of 22.4%. Infineon was able to use stable pricing and slightly favorable development of some input costs and government funding receipts to offset some of the top-line weaknesses.

Of course, the top-line pressure led to somewhat lower margins, but these sat at record-high levels, so this should not come as a surprise. As a result, the gross margin came in at 43.2%, down 400 bps YoY. On top of this, FCF was down due to the acquisition of GaN, which slightly weakened the balance sheet. Still, with a cash position of €2.7 billion and debt of €5.4 billion, the company remains in excellent financial health with a net debt of €2.7 billion and a net leverage ratio of 0.5x.

Overall, the company remains exceptionally well-positioned, both operationally and financially. While it is navigating some cyclical weakness, it remains one of the best-positioned analog semiconductor manufacturers globally.

Nevertheless, the combination of FX headwinds, a cyclical slowdown, and high customer inventories resulted in management lowering their FY24 outlook, spooking investors despite it not coming in any way as a surprise. Managed lowered its FY24 revenue guidance from a midpoint of $17 billion to $16 billion. This is primarily driven by all non-automotive segments as management confirmed its guidance for low double-digit growth in automotive revenues, which is still quite impressive.

For margins, management now points to a gross margin in the low to mid-40s from a prior 45%. This should also bring the segment result margin down to the low to mid-20s, which is still relatively robust considering the lower top-line expectations.

Furthermore, while management still has limited visibility into the time frame and shape of a recovery, the dynamic of interest rates expected to be cut and inventory digestion points to a steeper recovery than usual. Also, management now uses a U.S. dollar euro exchange rate assumption of 1.10 from a prior 1.05, which could leave some additional upside. As a result, we view management’s current guidance as quite conservative, leaving quite a bit of upside.

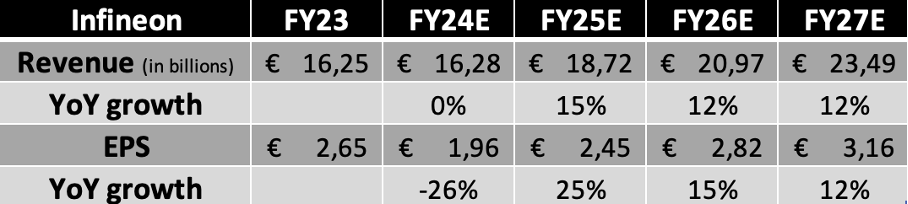

At this point, looking at market dynamics and the demand environment, we expect Infineon to report roughly flat revenue levels for FY24 compared to the prior year. However, as highlighted by the approximate 500 basis point decrease in the segment result margin in management’s guidance, profitability will most likely be impacted much more severely than previously expected as Infineon is seeing far less demand, faces a flat top line against increasing costs, and has far less pricing power compared to previous years. As a result, we now project EPS to be down 26% YoY for FY24.

Meanwhile, we remain bullish on the company’s long-term growth potential and believe it should be able to meet its goal of growing revenue at a CAGR of 10% through the cycles. However, we do not see margins returning to the all-time highs achieved in 2023 but sit closer to management’s long-term targets with a segment result margin of around 25% compared to 27% in 2023. These expectations translate into the following financial estimates.

Now, even as we have downward revised our medium-term financial estimates due to near-term headwinds, shares have also retracted further, meaning shares remain in bargain territory. At a current share price of €32, shares are valued at just 16x this year’s depressed earnings. Moreover, these trade at just 13x next year’s earnings, both of which sit far below its 5-year average valuation of over 20x earnings, which is a much fairer multiple for one of the leaders in analog semiconductors growing revenue and EPS by double digits.

Even if we go with a fair value multiple of 18x, which might offer some more downside protection and compare more favorably to peers, we still end up with an FY25 price target of €44 per share, which leaves us with 38% upside from current levels, even after incorporating lower earnings for the next two years. As a result, we believe that Infineon shares remain unfairly discounted by investors, presenting a significant upside.

Therefore, Infineon remains one of our most highly regarded investment ideas for long-term investors. We continue to view this company as an industry leader in a very promising industry, fully benefitting from multiple secular growth drivers with significant potential for growth and multiple expansions.

We remain active buyers of Infineon shares and put a “strong-buy” rating on the shares. The 8% share price drop that came in response to the lowered outlook, presents another excellent buying opportunity, in our view.

Thank you for reading this post. Enjoyed it? Please leave a like to let us know!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which I hope will be insightful!

Please make sure to like, restack, and share this post to increase our reach and support our work. Thank you!

Not subscribed yet? What are you waiting for?!

Disclosure: I/we do have a beneficial long position in the shares of Infineon, either through stock ownership, options, or other derivatives. This article expresses my own opinions, and we are not receiving any sort of compensation for it.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.