Infineon Technologies AG – Still undervalued, with potential annual returns exceeding 13%.

Infineon is one of the most promising and best positioned semiconductor companies and in this post we show you why!

German semiconductor giant Infineon reported earnings last week, and let’s say Wall Street was quite happy with the report as shares ended last week almost 20% higher. Notably, this happened even as management cut its FY24 guidance quite significantly, which is interesting, to say the least.

Yet, most importantly, even after the 20% share price jump last week, shares remain pretty compelling and continue to present an excellent opportunity. It is about time Wall Street acknowledges the hidden value here.

On that note, let’s dive right into the results and once again point out why this company has a very bright future.

Infineon released its fiscal Q2 earnings report on Tuesday, reporting revenue of €3.63 billion, which was in line with prior guidance and down 12% YoY.

As announced at the start of the year, 2024 is a transition year for Infineon, as it is for many other leading semiconductor peers. It is essential to understand that with a transition year, Infineon refers to a down year in a multi-year upcycle.

The down years in the semiconductor industry are part of the regular dynamics. Semiconductor demand is highly cyclical and closely correlated with consumer spending and confidence. Even as Infineon is exposed to significant secular growth drivers, it is not immune to these industry dynamics.

We must understand that the company didn’t notice much from the downturn in semiconductor demand in 2023 as it is slightly late cyclical, but this is hurting the business this year.

Positively, management expects to have hit a bottom already this quarter as consumer-related parts of its business are bottoming. The backlog decline has stabilized a bit in the most recent quarter at $24 billion, flat from December and still very significant. The stabilization indicates that Infineon is probably seeing slightly better order intake than in previous quarters.

Still, management does indicate that visibility is limited and that a recovery will be gradual and shallow in the near term.

Meanwhile, Infineon remains exceptionally well positioned for the next upcycle with its leadership positions in analog and exposure to fast-growing industries such as automotive and decarbonization. Even as the company faces near-term cyclical headwinds, its structural growth drivers remain in place or are even getting stronger.

On the bottom line, this top-line weakness was also clearly visible as Infineon reported a segment result of €700 million, which was slightly better than expected. This resulted in a segment result margin of 19.5%, down 910 bps YoY due to the top-line decline and continuing growth in cost of goods, which pushed the gross margin down 800 bps.

While these margin declines might seem significant, they are 100% the result of cyclical weakness, which was already more than priced in. Still, the group segment result was down 40% YoY as Infineon chooses to undership the market to get through customer inventories more rapidly, taking the profitability pain right now. This also led to a 52% decline in net income to €394 million, even as operating costs declined, though not as strong as revenue.

Meanwhile, the company also continues to invest heavily in other parts of the business, including property and factory expansion, totaling €643 million in the quarter. Add to this some acquisition-related costs, and FCF was pretty depressed at just €82 million.

Nevertheless, despite cyclical weakness across the board, Infineon maintained a healthy balance sheet and even earned a rating upgrade to BBB+. At the end of the quarter, Infineon held €2.6 billion in cash on the balance sheet against €5.9 billion in debt, translating into a net debt position of €3.3 billion or a healthy net leverage of 0.7x.

Meanwhile, Infineon also continues to pay a respectable dividend, yielding 0.9%. The dividend is paid annually in Q1. Based on 2023 earnings, we are looking at a payout ratio of only 13%. Of course, in 2024, this will be elevated, but this should normalize in 2025 and 2026.

Meanwhile, on an FCF basis, the payout is slightly more elevated but well covered at 74%. Of course, in 2024, this will exceed 100%, as FCF will be around zero due to acquisitions and other investments. Again, this should normalize in future years.

With all of that out of the way, let’s take a closer look at how the company performed across its segments, also shedding some light on just how well Infineon is positioned for the future.

Automotive

Whereas weakness is very much visible in some of Infineon’s segments, automotive is showing strength. This is mainly due to secular tailwinds offsetting cyclical weakness coming from slowing EV growth in Western markets and customers reassessing inventory levels, although this is still a bit more severe than expected as well.

Automotive revenues in Q2 were €2.1 billion, or 58% of revenue, roughly flat YoY. The segment result was €512, reflecting a segment result margin of 24.6%, down 250 bps YoY, reflecting normalizing pricing due to demand normalization.

In previous years, Infineon couldn’t keep up with demand from automotive OEMs due to a chip shortage, which led to significant price growth. However, as demand normalizes and is even slightly down, pricing also comes down again, creating a temporary headwind for Infineon.

Positively, even as it is now also seeing demand in automotive weaken a bit, its competitors are even worse off, which is what investors should focus on. This highlights that Infineon is still gaining market share at quite an impressive pace, which helps it further offset weakness from normalizing prices and inventory corrections.

Clearly, in times when customers are cutting costs, they are opting to stick with Infineon, which is an incredibly promising sign and a testimony to the quality and importance of its automotive products.

In 2023, Infineon grew automotive revenues by 26.2% against industry growth of 16.5%. So far this year, while data is still limited, Infineon seems to be experiencing less weakness, driven by even more market share gains.

Today, Infineon is the #1 supplier of automotive semiconductors, driven by its #1 position in Asia, #2 position in Europe, and #3 position in the U.S. It now holds a market share of 13.7%, up 130 bps YoY and 290 bps ahead of second place NXP.

Whether we are in a bull or bear market, Infineon shows it can outperform peers, gaining market share quite significantly thanks to its superior products and strong product development. Investors can’t wish for much more.

The company is doing tremendously well, especially in automotive microcontrollers. In just the last 12 months, it gained 510 bps in market share to an incredible 28.5%, allowing it to jump to the #1 position. Meanwhile, it also remains the undisputed leader in automotive power semiconductors with a market share of 30.8%, over 10 percentage points ahead of its closest competitor.

Worth pointing out is that Infineon is making most of these gains in one of the largest automotive markets in the world – China. In 2023, Infineon grew its business here by 25% against industry growth of just 15.4%, which tells you all you need to know, really.

The company made significant design wins with EV leaders in the country, most notably Xiaomi very recently, and as these upcoming EV leaders expand to Western countries, the company is bound to win share here as well!

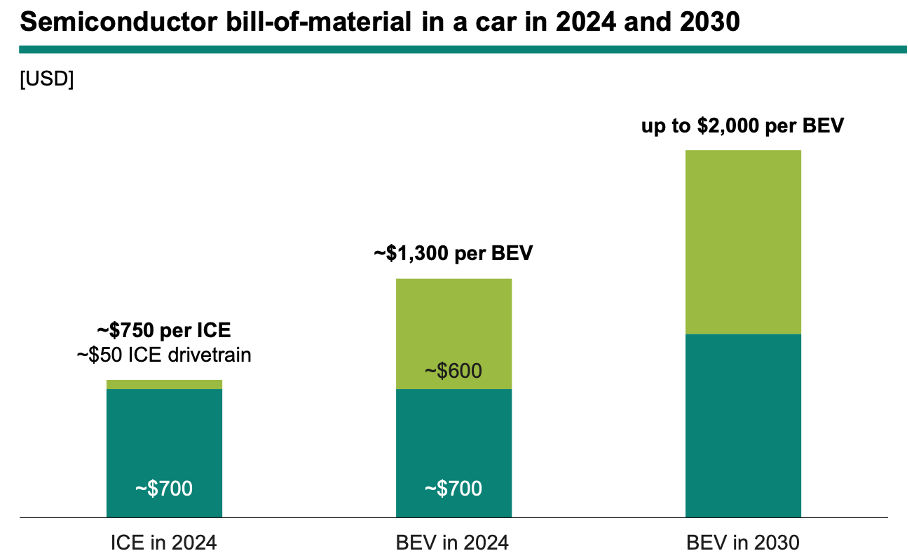

This positions the company exceptionally well long-term. As more and more cars become EVs and include advanced technologies such as autonomous driving, the number of semiconductors needed per car also grows significantly. According to data from Infineon, a traditional ICE car in 2024 required $750 worth of semiconductors while a BEV already needed almost twice that much at $1300.

However, this is expected to grow rapidly through the end of the decade to over $2,000 per car, which is a massive tailwind for Infineon and an important driver of its automotive bull case.

Green Industrial Power (Decarbonization)

Another exciting segment is green industrial power, where Infineon fully benefits from the shift to green energy or decarbonization. This is another area where Infineon is an industry leader, partly thanks to its dominance in power semiconductors.

This allows it to capture top positions across the industry, as visualized below. Further highlighting its leadership position in decarbonization, Infineon’s power semiconductors are present in a staggering 50% of currently installed solar and wind capacity. Also, Infineon power solutions are also used for 2/3 of the electricity grid infrastructure, including electric charging, making it a beneficiary of growth in the entire supply chain.

Considering the remaining growth runway for these types of applications, with incredible growth ahead for solar and wind power capacity, the bull case shouldn’t be hard to see, especially with Infineon leading the industry.

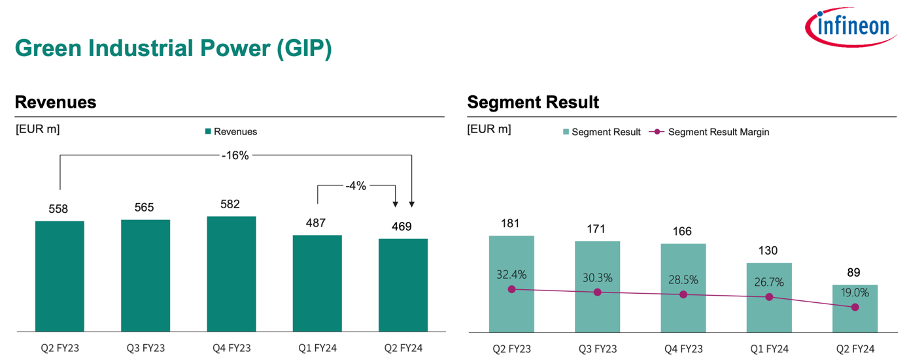

However, due to weakness in industrial and a dip in the solar industry, this segment’s performance is far from great right now. In Q1, revenue declined 16% YoY to €469 million, with the segment now accounting for roughly 13% of revenue. This lackluster performance is further reflected in the segment’s bottom line, with a segment result of only €89 million and a segment margin of 19%, down 13.4 percentage points YoY.

Excess inventories and a challenging industrial operating environment drive the top-line decline. Also, while demand for solar overall remains quite strong (projections for 24% growth and 18% growth for solar and wind installations in 2024, respectively), high inventory levels dampen this. This leads to short-term weakness, but crucially, the long-term bull thesis is still very much intact.

Adding to this bull case is the company’s dominant position and solid progress in Silicon Carbide (SiC) technology, which is one of the fastest-growing verticals of the semiconductor industry, projected to grow at a stellar 23.8% CAGR through 2030.

The technology is superior to silicon and excellently suited for sustainability, electrification, and power semiconductor applications, so the fact that Infineon is also pushing this new technology is promising. For reference, its market share is estimated to be around 30%, which management aims to maintain through 2030.

An important step for Infineon here was its €5 billion investment in building a new state-of-the-art 200-millimeter silicon carbide power fab in Malaysia. This fab should become the largest in the world and potentially allow Infineon to produce over €7 billion worth of silicon carbide semiconductors annually by 2030.

Overall, we believe this leading position in SiC could help Infineon grow its market share and boost its growth. The company is already seeing very strong customer interest in the technology, according to Infineon per the latest earnings call, being “a key enabler of de-carbonization in automotive and industrial applications.”

However, on a slightly negative note, Infineon did report that the current demand environment is more cautious, which is why Infineon expects the ramp curve to be less steep than initially expected, lowering its growth expectation for 2024 from 50% to 20%, with more significant growth in 2025 and 2026.

Positively, management does not expect it to impact its leading market share and remains bullish on the near-term growth prospects. For reference, customers like Ford and SolarEdge have helped it fund the Kulum facilities to ensure capacity in the future, which should tell you something about how strong demand is. This will be a long-term growth driver in these already promising segments.

Power & Sensor Systems and Connected Secure Systems

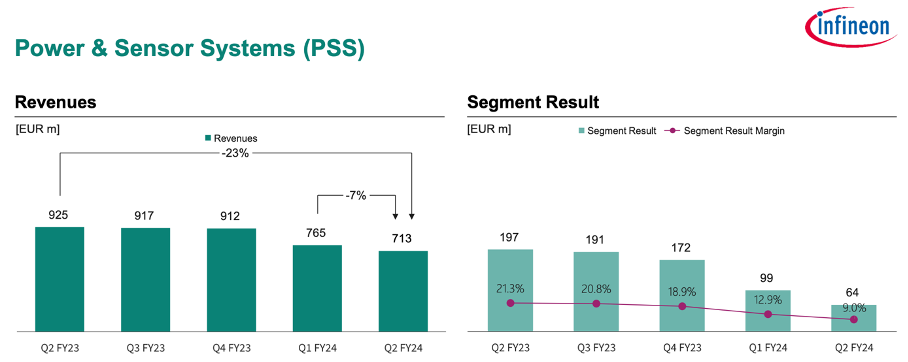

Moving to the final two segments, Power & Sensor systems revenue was down 23% YoY to €730 million. Products for consumer-facing applications remained under pressure due to relatively high inventories and cautious consumer spending. The segment has been trending down for six consecutive quarters, and revenue is now 40% below its 2022 high.

Positively, management is seeing a bottom and a slight recovery in the running quarter. However, management still doesn’t expect a significant near-term recovery due to a persistently weak macro backdrop.

Meanwhile, there is plenty to be bullish about in the medium to long term, with Infineon expecting to significantly benefit from the AI boom. This is thanks to Infineon’s leadership in power semiconductors, as AI processors require significantly more advanced power management than traditional CPUs. As a result, Infineon claims power systems with best-in-class energy efficiency bring tangible benefits in terms of cost of ownership, motherboard space, and CO2 footprint. This is what management said regarding its capabilities here and the opportunity it sees:

“Capabilities like digital power control chip embedding, the mastery of silicon, silicon carbide and gallium nitride power technologies, and in particular the novel vertical power supply architecture gives us a clear differentiation from others in the market. This has already translated into design wins across AI processor makers, notably with the three most important ones as well as hyperscale data center players. With mid-double digit growth rates, we expect this business to reach a billion Euros over the next couple of years.”

This most certainly sounds promising and is something to keep an eye on, especially as this industry should recover as we head into 2025.

Finally, Connected Secure systems revenue was €371 million in Q2, down 33% YoY but with a clear bottom forming as revenue was up 2% sequentially. Infineon indicates that demand for IoT and smart card products appears to stabilize, and the pace of channel inventory correction is slowing down.

Continued sequential improvements are expected as inventories in IoT and security markets should come down, and management expects a moderate demand recovery in the second half of the calendar year as a result.

Longer-term, there is also plenty to be bullish on for this segment as Infineon is well positioned to benefit from the immense structural growth opportunity of Edge AI.

In fact, the total AI opportunity for Infineon is pretty understated, but management now projects AI-related revenue to be a low triple-digit million amount in FY24. Of course, this can be as low as €100 million or below 1% of total revenue, but this is expected to grow at a CAGR of over 50% through the end of the decade.

Even if this is only €100 million today and compounds at the bottom of management’s guided range at 50%, this means that by 2029, AI would be an almost €1 billion business, from pretty much zero in 2023. Definitely impressive.

On that note, let’s move to the outlook!

Outlook & Valuation

Probably the biggest setback in the Q2 earnings report was the guidance cut from Infineon management. According to management, the guidance cut they made earlier to account for the expected cyclical weakness wasn’t deep enough, which is somewhat disappointing, but at the same time also not overly surprising or important.

For once, Wall Street seemed to agree. Whereas many other companies saw their stock price tumble on the slightest guidance miss, Infineon's shares gained almost 20% on a significant guidance cut. Yeah… markets are still unpredictable as hell… probably more than ever.

But if you ask me, it was the right response. This single down year means absolutely nothing for the investment thesis, and the guidance cut is fully the result of cyclical weakness while the company continues to gain market share in promising end-markets.

Especially with shares trading at bottom valuations, more downside was impossible, and so Wall Street decided to focus on the positives, of which, as discussed, there were plenty in the Q1 report and in management’s commentary.

Regarding guidance, management has lowered its FY24 revenue projection to €15.1 billion, plus or minus €400 million, down from €16 billion. According to management, it has now fully de-risked the outlook, indicating that management is being somewhat conservative. Guidance accounts for only very modest seasonality in the second half, which tends to be stronger.

The €900 million removed from the prior outlook relates, roughly 50%, to lower automotive growth, the other half to lackluster industrial growth, and a more gradual recovery in consumer computing and communications.

For the full fiscal year, management now expects automotive growth to be in the low-to-mid single digits. This reflects a stable number of cars produced in 2024, but inventory corrections to offset growth in EVs, which remains especially strong in China.

In the long term, the company remains exceptionally well positioned to benefit fully from its leading position in automotive and incredible market position in China, where EV penetration is up 600 bps YoY. As explained before, growth in EVs will remain a significant tailwind.

In contrast to positive growth in automotive, all other segments are expected to remain in negative territory this fiscal year, with a low teens decline for GIP, high teens for PSS, and low twenties for CSS.

As for the bottom line, management indicates that it will continue to undership end-market demand to bring down inventories. This will lead to an annual idle cost of more than €800 million, up slightly from previous expectations. This will cut into 2024 margins, though these should remain relatively resilient with a gross margin in the low 40s.

Finally, FCF net of acquisitions and investments in front-end buildings in Germany and Thailand is expected to come in at around €1.6 billion. However, the reported FCF will be roughly around €0, down from a previous €200 due to slightly lower profitability.

For its fiscal Q3, management now expects to report revenue growth of around 5% sequentially to roughly €3.8 billion, which is still down 7% YoY but shows an improving trend.

Finally, looking at the medium to long-term outlook, Infineon remains an excellent investment opportunity as ever. Even amid current weakness, management continues to see plenty of opportunities to strengthen its competitiveness sustainably and expects to keep gaining share.

This supports its longer-term guidance, which aims to grow revenues at a CAGR of over 10% through the cycles, a segment result margin of over 25%, and an adjusted FCF margin of 10-15%, which is just excellent overall.

Notably, top-line growth should be driven by every single one of its segments growing by double digits. Also, growth will be driven by Infineon’s 5 focus areas, which account for 60% of revenue as of FY23 – E-Mobility, Renewables, ADAS, AI/data center, and IoT.

In addition, helping Infineon in terms of financial flexibility and technological advancements is the fact that it produces the majority of its chips in-house, with facilities worldwide but concentrated in Germany, where the company is also benefitting from government incentives.

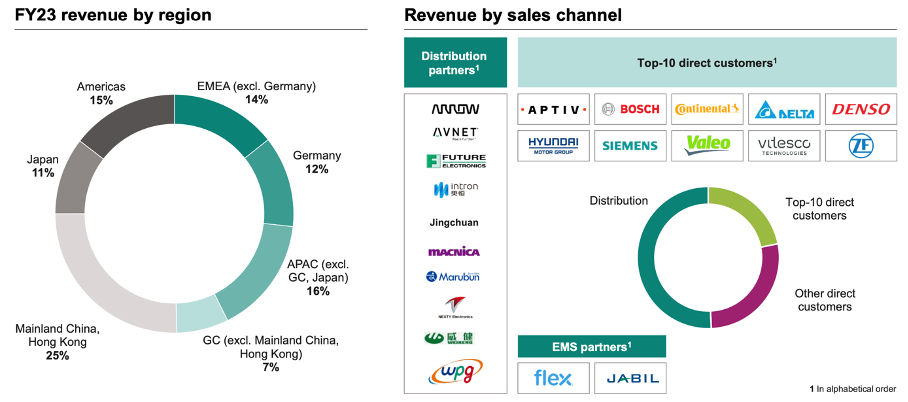

Finally, it is worth pointing out that Infineon also looks very good from a geographical diversification perspective. In contrast to many of its semiconductor peers, it does not rely overly much on China, which is great for risk management. Also, its top 10 customers account for less than 20% of revenue.

Across the board, I continue to adore this company and its long-term prospects. Let’s just say I remain very much bullish.

Yet, considering management’s updated guidance, I will have to cut my near-term projections while also boosting my longer-term expectations, accounting for a shift in the recovery expectation and continued market share gains.

This results in the following financial projections, reflecting a €1 billion cut in the revenue estimate and another 14% EPS cut for FY24.

Based on these projections and the 20% share price jump last week, Infineon shares now trade at roughly 22x this fiscal year’s earnings, which is quite an improvement from the 16x at which shares traded one quarter ago. This reflects the improvement in share price and lower EPS projections.

However, while shares are most definitely not as attractively priced as before, these continue to trade at multiples below their 5-year average and at a 5% discount to the sector median. Also, on a PEG basis, shares trade at a PEG of just 1x, which is an almost 50% discount to the sector median.

What we are seeing right now is simply normalizing valuation levels as investors finally shift their focus to this company’s promising future. In fact, we believe shares are still slightly undervalued. Considering its growth potential and extremely strong positioning, I argue that shares deserve to trade at a multiple of at least 20x, which would translate into an end-of-fiscal FY26 target price of €51, representing potential returns of only just below 14% annually, which should comfortably beat the market.

Even when we assume an even more conservative 18x multiple, investors are in for annual returns of just below 10% or closer to 10.5%, including the dividend. This highlights that shares remain attractively priced.

Therefore, we maintain our buy rating. Infineon remains a key holding in our portfolio.

Let us know your thoughts in the comments! Also, please leave a like if this post was of value to you!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

It will be helpful if you can compare Infineon to On Semiconductor.

The case is not really a “no brainer” at the moment. The automotive market is quite down right now and EV automotive is clearly taking a hit. I would favor STmicro vs Infineon. STmicro could be interesting in case of a strong launch for AI smartphone this year.