Market Insight - Why we continue to avoid Boeing following last Friday's incident

Boeing Faces Escalating Reliability Challenges: The latest 737 Max-9 Incident Raises Alarms Amid Lingering Quality Control Concerns.

Boeing once again faces reliability issues - Avoid

Boeing shares once more took a hit in the first couple of days this week after an Alaska Airlines Boeing 737 Max-9 had its so-called door plug blown out mid-flight, an issue which could have been fatal if it happened at a higher altitude or with people sitting next to the door plug. Luckily, there were no casualties in this instance.

Following the accident, the FAA temporarily grounded 171 Boeing 737 Max-9 planes globally, requiring fresh inspections and safety checks before the plane can return to service, which is a massive blow to Boeing and its customers.

This is not the first reliability issue Boeing has faced in recent years. The company was once known for its incredible reliability and has a long history in the aerospace industry. Boeing's reputation for reliability was particularly strong in the mid to late 20th century with the success of iconic aircraft like the Boeing 707, 727, 737, and 747.

However, the issues the company faced in December 2018 and April 2019 with two crashes of its 737 max-8 planes completely obliterated its fame for reliability, with hundreds of people killed due to a structural flaw in the company’s flight control software and other components. (For a fascinating documentary on this issue, check out “Downfall: The case against Boeing” on Netflix)

From March 2019, the 737 Max-8 was grounded for a total of 20 months, which cost Boeing over $20 billion. CNN reported the cost split as follows:

“Boeing has detailed about $20 billion in direct costs from the grounding: $8.6 billion in compensation to customers for having their planes grounded, $5 billion for unusual costs of production, and $6.3 billion for increased costs of the 737 Max program.”

These issues not only significantly impacted Boeing financially but also its reputation. Considering this recent history of Boeing’s reliability issues, this week’s investor panic, resulting in a 9% drop in the company’s share price in just two trading days, is entirely understandable. Considering shares were up almost 40% from an October low, I am surprised shares are not down more considerably.

Since the grounding and significant damages incurred from the 737 Max-8 grounding, Boeing has been working hard to shake off the financial and reputational damage. However, with its production process, priorities, and quality control still seemingly not in order, apart from possible financial damages, the company will likely be back in the crosshairs of regulators and further damage its reputation.

But crucially, what is the size of this new reliability issue, and what could it mean for Boeing?

Well, early on Monday, analysts from Citi prematurely concluded that Boeing should see no long-term impact from the grounding of the planes. The analysts claimed that since the plane has been in production since 2015, the malfunction is likely an isolated incident. This would limit the impact on Boeing.

However, later that day, both Alaska and United Airlines already announced that they had found loose bolts on multiple 737 Max-9 planes during inspections, confirming that this could be another widespread production issue.

Positively, in contrast to the long time of denial and silence of Boeing management with the 2018 and 2019 crashes, Boeing CEO Dave Calhoun was quick to admit the company’s mistake on Tuesday, “acknowledging the planemaker made a mistake and telling staff it would work with regulators to make sure it can never happen again."

While we are glad Boeing learned from its prior mistakes and is open and transparent with its customers and shareholders, this also confirms our belief that Boeing does not have its manufacturing lines and quality control in order, which is the main reason we have stayed away from the shares all these years. While the current CEO was brought in to restore the company’s reputation, “many of the core criticisms around production and the reliability of its suppliers have lingered,” as The New York Times reported.

Furthermore, according to Russ Mould, investment director at AJ Bell, “there are naturally questions being asked about the quality checks and whether Boeing is trying to do too much too fast,” as he questions Boeing’s quality control as the company seems to be still too focused on catching up with Airbus. Simply put, the company most likely once again dropped the ball on reliability to push out more planes.

Mould adds that “Boeing’s management will be under considerable pressure from the regulators and customers to explain what’s going on, which means considerable headwinds ahead for the business. It’s no wonder investors have raced to sell the shares as the risks to the investment case have just shot up.”

In our view, Boeing is in no way an investment option as long as these problems linger and the company does not get its priorities on quality control in order. The new reliability issues once more confirm that Boeing continues to struggle with execution challenges as it tries to find a balance between keeping costs under control and catching up to Airbus while maintaining high safety standards.

Furthermore, these reliability concerns will likely limit the upside for Boeing shares, as confirmed by Morgan Stanley analysts. Ronald Epstein, an analyst at Bank of America, wrote that they believe that these latest issues will also result in greater regulatory scrutiny, which most likely will slow the certification process around newer Max 7s and Max 10s. He also added that “this could temporarily impact 737 Max-9 deliveries, depending on what the F.A.A. and N.T.S.B. as well as foreign regulators conclude.”

Meanwhile, Boeing has now likely also used the last credit it had with investors and customers and can’t afford any more mistakes if it wants to stay in the fight with Airbus. Tim Clark, the CEO of Emirates, a major plane buyer, told Bloomberg, "They’ve [Boeing] had quality control problems for a long time now, and this is just another manifestation of that,” expressing very little confidence in the plane builder.

All in all, these latest issues likely have caused significantly lower customer confidence in the company, which could impact order intake numbers in upcoming quarters or even years, putting Boeing further behind Airbus, which is executing much better. This could lead to depressed growth.

Therefore, even though I do not expect the latest Boeing 737 Max-9 issue to result in significant direct financial damages from repairs and groundings, as the issue seems to be less complicated than in 2019, I am much more worried about the long-term confidence and regulatory scrutiny impact, which could continue to pressure financial growth and bottom line improvements.

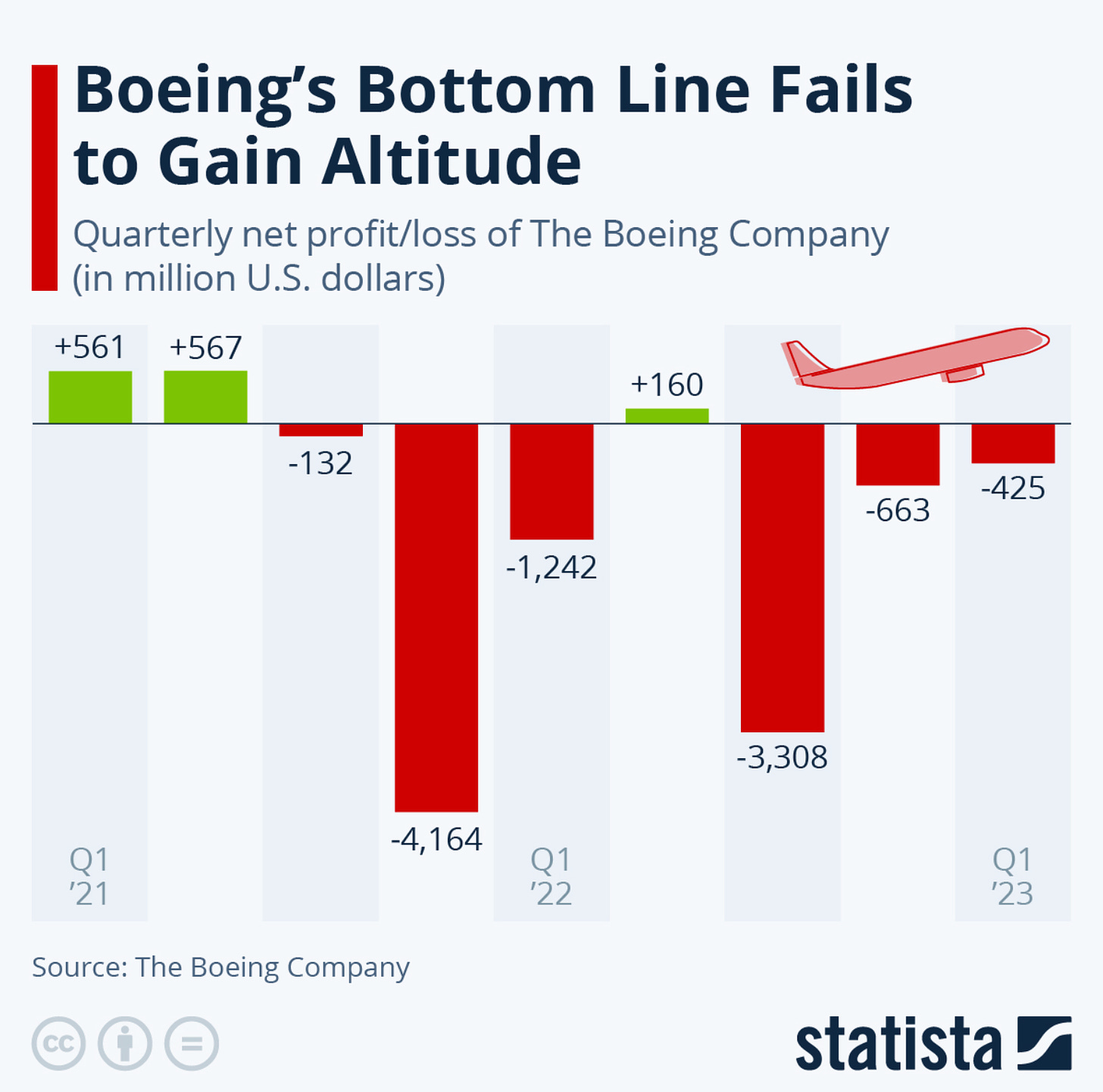

Meanwhile, the company also remains in a treacherous financial position. It has a significant $47.1 billion of debt on the balance sheet, against just $6.8 billion in cash. Meanwhile, the company has also struggled to report a profit in recent years and quarters, both in terms of FCF and net income. Therefore, the company does not have a lot of room to play with.

Overall, we continue to view Boeing as an obvious stock to avoid. The new CEO has been unable to solve the quality control and reliability issues, and while the direct financial damages should not be severe and planes should be back in the air soon, the long-term reputational damage and highly likely regulatory scrutiny in the product certification process could very well turn out to be a significant drag on the company, both in terms of growth and costs, which will indirectly put continued pressure on its bottom line.

Therefore, we are bearish on the company’s long-term prospects and expect it to lose more ground to Airbus in the upcoming years.

Thank you for reading this newsletter. Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which I hope will be insightful!

Please make sure to like, restack, and share this post to increase our reach and support our work. Thank you!

Not subscribed yet? What are you waiting for?!

Disclosure: We have no stock, option, or similar derivative position in any of the companies and stocks mentioned. This article expresses our own opinions and we are not receiving any sort of compensation for it.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.