Weekly Insight #2 - Wall Street remains too optimistic amid sticky inflation

Markets continue to price in unrealistic and opportunistic interest rate cuts. Meanwhile, recent macroeconomic data points to sticky inflation and a tight labor market.

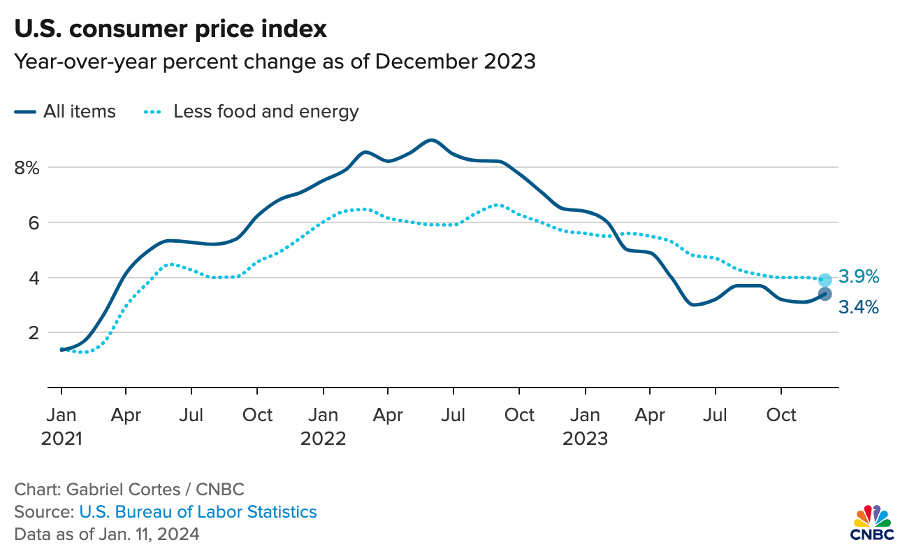

All week long, investors, traders, and analysts alike have had their focus on Thursday’s inflation data to get a better sense of what to expect from this month’s and March’s Fed meeting. We started the year with the market's pricing in a 175 bps cut in interest rates this year. Yet, this conviction had faded over the last two weeks as a robust labor market and sticky inflation data points in another direction, potentially forcing the Fed to keep rates high for longer. This is why this week’s December inflation data was critical.

And crucially, it wasn’t as good as hoped, with inflation levels rising above the consensus estimates and showing a slight uptick. As reported by Seeking Alpha:

“The December CPI data came in at +0.3% M/M versus the +0.2% expected and +0.1% prior levels. Moreover, core CPI, which excludes food and energy, was +0.3% M/M compared to the +0.2% expected and +0.3% prior figures.”

Now, even as inflation came in somewhat hotter than expected, we do not expect this to be enough to destroy the bullish market or cause significant changes in the Fed’s stance, which is why the market closed mostly unchanged.

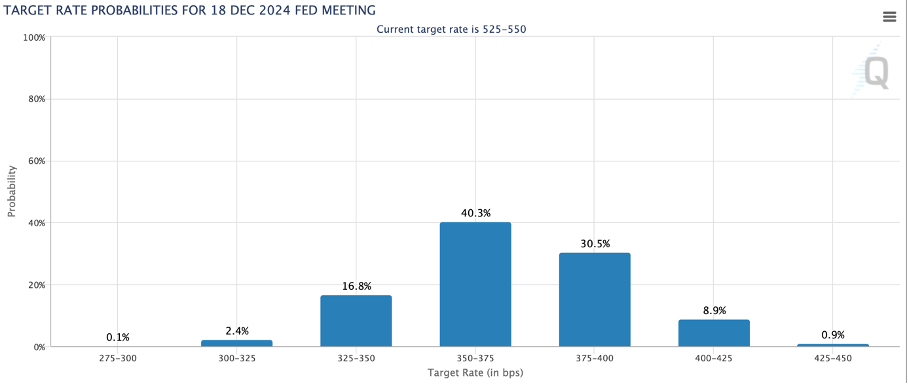

However, it is a warning that we are not there yet, and it further solidifies our belief that we should prepare for a high-interest rates for a longer scenario. With all the data so far from December, we deem it highly unlikely the Fed will lower interest rates in March, and we expect most of the cuts to come in the second half of the year, as we communicated earlier.

Going by reactions from Fed officials following the December inflation data, as reported by Investing.com, the overall opinion seems to be that it is too early to start thinking about rate cuts, even as inflation has been trending in the right direction. Overall, the inflation data was roughly in line with their expectation, and has not changed their stance, indicating that the most likely scenario right now remains 75-100 bps of rate cuts in 2024, starting in June.

This is also reflected in the FedWatch tool from the CME Group, which now shows that 93.3% expect interest rates to remain unchanged in February. However, this also indicates the market prices in a 25 bps cut in March for 77.7%, which we believe is still too optimistic. Moreover, the market is still pricing in a 175 bps cut in interest rates by the end of 2024, although percentages have come down. Still, this sits far ahead of the Fed’s target of 100 bps in rate cuts in 2024, and this is amid macroeconomic data disappointing ever since. On top of this, JPMorgan Chase CEO Jamie Dimon stated earlier today that “heavy government deficit spending along with a bevy of other factors could cause inflation to be stickier and rates to be higher than the market expects,” according to CNBC.

In our view, the markets remain far too optimistic.

This belief was further solidified by other macroeconomic data coming out over the last week, including the initial jobless claims report, which showed that claims for the week ended January 6 were down 1,000 to 202,000, far below the 209,000 consensus, once more highlighting that the labor market remains solid and quite tight.

On a more positive note, data earlier today showed that wholesale prices unexpectedly fell by 0.1%, while economists surveyed by Dow Jones had been looking for a monthly gain of 0.1%, a positive indicator for inflation.

Furthermore, one scenario that we at least perceive as highly unlikely is another rate hike by the Fed. Even long-term hawk Michelle Bowman recently stated that she believes rate hikes are probably over, as she thinks the Fed has made solid progress in bringing down inflation over the last few months.

However, she also claimed that rate cuts are not appropriate yet. She believes interest rates should be kept at current levels in order to get inflation down to the targeted 2%. She believes rate cuts are no option as long as inflation remains far from the 2% level.

Furthermore, in response to the latest macroeconomic data, UBS currently continues to project a soft landing as the most likely scenario for the U.S. economy. This also means the bank does not expect a recession to occur, fueled by inflation coming down to close to the 2% Fed benchmark in the second half of the year. As a result, UBS currently expects the Fed to cut interest rates by 100 bps in 2024, in line with the projection from the Federal Reserve itself and, in our opinion, a realistic projection.

Meanwhile, according to the World Bank, we are on course for the worst half-a-decade in over 30 years as economic growth is projected to slow down for the third year in a row to 2.4%, according to their latest report. This is now projected to be followed by a slight uptick to 2.7% in 2025, which is still below average.

Problems keep mounting across the board, and even as bullishness on Wall Street and toward stock markets looks great, we are becoming more bearish. It is in times of incredible optimism that we should become more skeptical. With all economic data pointing to a period of slow economic growth and a recession not out of the question, it might be time to be more careful with the S&P500 valued at a premium still.

All in all, we should not forget that we are most likely facing a period of higher interest rates, sticky inflation, slow economic growth, and above-average levels of geopolitical tensions, all weighing down on the market. The World Bank even warned that without a “major course correction, the 2020s will go down as a decade of wasted opportunity.”

Thank you for reading this newsletter. Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which I hope will be insightful!

Please make sure to like, restack, and share this post to increase our reach and support our work. Thank you!

Not subscribed yet? What are you waiting for?!

Disclosure: No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.