Weekly Insight #1 - Markets get off to the worst start since 2016

In this first-ever InvestInsights newsletter, we dissect and discuss the most important economic and company-specific headlines of week 1, 2024, dominated by economic data and analyst downgrades.

What to expect

The first week of 2024 marked the worst start since 2016, with the Nasdaq plummeting by 3.25%, breaking a nine-week winning streak for major averages.

Caution prevails as investors shift focus from technology to value opportunities, anticipating heightened market volatility in Q1.

Uncertainty looms following December's Fed meeting minutes, hinting at potential rate cuts in 2024 and emphasizing the crucial role of upcoming inflation data.

Despite strong job growth, a tight labor market contradicts expectations of a rate cut, leading to cautious sentiments and potential downside in the stock market.

Corporate Headlines:

ASML faces export restrictions impacting its FY24 outlook, BYD surpasses Tesla in Q4 EV deliveries, Apple receives downgrades and potential antitrust lawsuit, Walgreens cuts dividend, Carrefour removes PepsiCo products, and Mobileye's weak Q4 results raise concerns about semiconductor demand weakness.

Q4 earnings season kicks off this Friday with big banks and airlines.

Weekly market performance

It is safe to say that the financial markets didn’t have the easiest start to the year, marking the first trading day on Tuesday as the worst day for the Nasdaq since October and the entire first week being the worst start of the year since 2016.

All three major U.S. averages broke a nine-week winning streak, with the Nasdaq suffering the most significant decline at 3.25%, while the S&P 500 and Dow dropped 1.52% and 0.59%, respectively. For the Nasdaq, it was the worst week since September.

The drawdown across the board was mainly related to macroeconomic data that came out during the week, largely pointing to a tight labor market and weakness in other places, suggesting the Fed might need to keep rates elevated for longer. In addition, the markets had to release some tension following the end-of-year rally in November and December.

So, is this dip a buying opportunity for investors or not? Well, no, we don’t think so. As will become visible throughout this newsletter, there are plenty of reasons to start being more skeptical toward stocks and for investors to be cautious.

While the slight dip this week might make some technology stocks look more attractive, the Nasdaq and S&P500 both remain expensive and as the likelihood of the Fed keeping rates flat in February increases, including fewer cuts throughout the year, we see more downside from this point forward, with the markets almost certainly staying extremely volatile throughout Q1.

Following the strong performance of stocks in November and December, we see little upside in Q1 as economic data does not trend in favor of the Fed cutting rates. At Rijnberk InvestInsight, we have shifted our focus from picking up technology stocks to value opportunities, which underperformed the markets in 2023.

Investor Steve Eisman warned of this on Tuesday in an interview with CNBC: “Long term, I’m still very bullish. But near term, I just worry that everybody is coming into the year feeling too good.” He continued by saying, “It’s just that everybody is coming into the year so bullish that if there are any disappointments, you know, what’s going to hold the market up?”

This is precisely what we saw throughout this week and what will continue throughout the month and potentially Q1 unless macroeconomic data improves (or deteriorates, depending on how you look at it), allowing the Fed to lower rates. However, Eisman notes that fewer rate hikes than expected in 2024 could emerge as a negative short-term catalyst, and we can already see this take form.

However, the FY24 outlook remains largely positive, even as the Fed were to keep rates higher for a longer time. Throughout the week, multiple Wall Street banks reaffirmed their expectations for FY24. Oppenheimer analysts suggest that a pause in the market rally would be reasonable after the Q4 rally but remain optimistic. They anticipate further upside in stocks throughout the year, supported by fundamental improvements. Based on the expectation for a second year of the bull cycle underway, the asset management firm sees the S&P 500 as “conservatively undervalued below 5,400”.

Wedbush also maintained a positive view on 2024, specifically toward tech stocks. The analysts continue to believe in the power of AI to elevate tech stocks, concluding that “the Street is still significantly underestimating how quickly this AI monetization cycle is playing out among enterprises in the field.” Their research showed that “use cases lead to the pot of gold at the end of the rainbow. 50%+ of all enterprises we have recently surveyed see 20+ use cases for Generative AI, and 80%+ of all enterprises see 10+ use cases including data analysis, marketing content creation, document editing/summarization, and many more.” As a result, Wedbush’s bull case for the Nasdaq assumes 25% gains in 2024, which translates into it rallying to hit $20,000 by the end of the year.

On that bullish note, let’s look at this week’s economic headlines.

Not subscribed yet? Make sure to do this now! Also, please share this newsletter to spread the word and grow our community!

This week’s economic news

A breakdown and analysis of last week’s most important and impactful economic and macroeconomic headlines.

Fed minutes give us mixed feelings – be cautious

On Wednesday, the December fed meeting minutes were released and not well received by the market. The minutes showed that Federal Reserve officials in December concluded that interest rate cuts are likely throughout 2024, though they provided little insight into when that may occur and stressed that there remains a high level of uncertainty - the meeting notes gave very little clarity into when or if this will happen.

In December, the Federal Reserve decided to keep rates steady at 5.25% and 5.5% and is said to be aiming for a 0.75% reduction in 2024 as baseline projections warrant a lower target range for the federal funds rate. Furthermore, the dot plot showed the expectation for cuts over the coming three years to “bring the overnight borrowing rate back down near the long-run range of 2%,” according to CNBC.

Supply chain factors, which were an important driver of inflations, seem to be easing quickly, and Federal Reserve officials cited progress in bringing the labor market better into balance, although still not where they want it to be.

As indicated before, uncertainty remains high, and several Fed members said: “It might be necessary to keep the fund rate at an elevated level if inflation doesn’t cooperate, and others noted the potential for additional hikes depending on how conditions evolve.”

Safe to say, nothing is certain at this point, and upcoming inflation data might be even more important than we have seen in recent months. This is due to Fed funds futures pointing to a total of six 25 bps cuts this year, which, going by the recent minutes, might be too optimistic.

Therefore, we currently expect quite some volatility ahead as markets will likely respond aggressively to upcoming inflation data. While a 25 bps cut is priced in for February, this definitely is no certainty, and we currently believe the Fed is most likely to keep rates steady in February unless inflation data comes in below the current consensus. This could lead to some more near-term downside for stocks.

US job reports are trending in the wrong direction

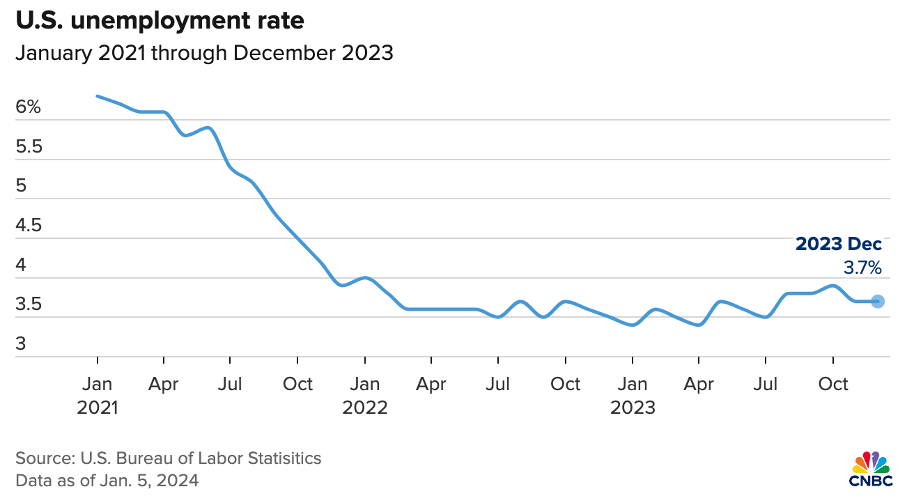

Looking at the macroeconomic data that has come out in the first week of the year, it is safe to say that falling markets and rising rates are no surprise. As for the U.S., a number of job reports came out through the week, and this all pointed to a still very tight labor market, something the Fed will not be all too happy about, and that might inspire officials to keep rates steady in February.

The December ADP report highlighted a resilient US jobs market with private payrolls increasing by 164,000, stronger than the 130,000 consensus. According to ADP’s chief economist, Nela Richardson, “We’re returning to a labor market that’s very much aligned with pre-pandemic hiring. ” Furthermore, “while wages didn’t drive the recent bout of inflation, now that pay growth has retreated, any risk of a wage-price spiral has all but disappeared.”

Crucially, Fed officials will be closely watching the job reports as the tight labor market and growing wages have a significant impact on inflation. While officials stated that they see the labor market coming better into balance from the huge supply-demand mismatch in recent years, data shows that it remains quite tight.

Initial jobless claims for the last week of December “totaled 202,000, a drop of 18,000 from the previous period and below the Dow Jones estimate for 219,000,” the Labor Department reported. This is the lowest amount since October and goes against the expectations for a softening labor market, further fueling our expectations for the Fed to maintain rates in February.

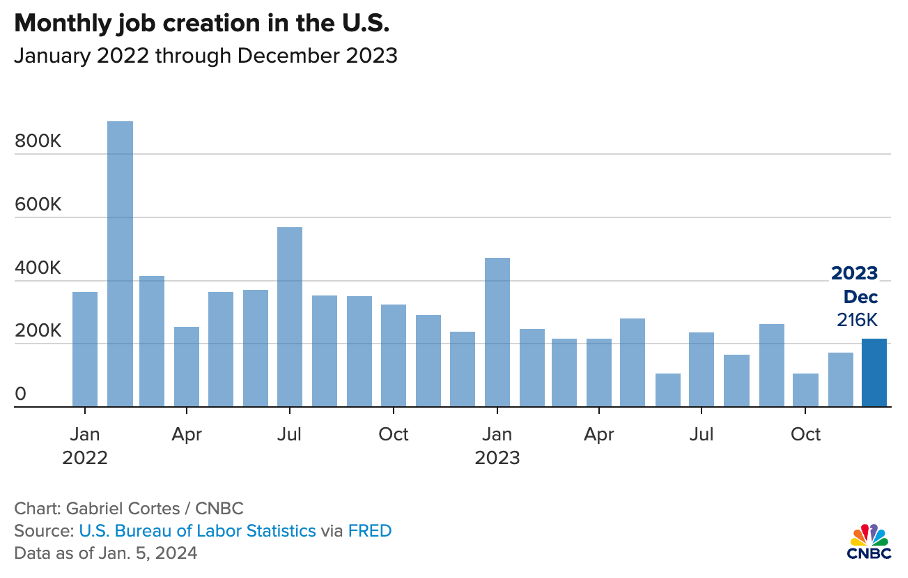

Further contributing to this was the jobs report from the U.S. Bureau of Labor Statistics, which showed employers added 216,000 positions in December. This was up quite significantly from both November and October. This also beat the consensus of 170,000 by a significant margin.

Meanwhile, the unemployment rate was steady at 3.7%, which is still quite low and below the 3.8% consensus. On top of this, the average hourly earnings rose 0.4% in December and were up 4.1% YoY, both higher than the consensus of 0.3% and 3.9%, respectively. This was despite a drop in the average workweek to 34.3 hours.

All this data points in one direction, and it is a strong labor market, whereas the Fed has been looking for some softening. In response to Friday’s data, the Fed funds rate saw the odds for a March rate cut trade lower to about 56%, according to the CME Group.

According to Andrew Patterson, senior international economist at Vanguard. “The decision of when to first cut policy rates remains one for the second half of the year in our view.” At InvestInsights, we share this view and currently expect the Fed to maintain rates in February. “Jobs growth remains as resilient as ever, validating growing skepticism that the economy will be ready for policy rate cuts as early as March,” said Seema Shah, chief global strategist at Principal Asset Management. Clearly, macroeconomic data is not supporting rate cuts in the near future. This could lead to some further downside for stocks.

Global PMIs are mixed

Over the last week, we have seen some manufacturing PMIs come out from across the world. The Chinese manufacturing PMI was down for the third month in a row in December. The result of 49 is weak considering the market forecast, which stood at 49.5 and remains below the threshold of 50. This indicates that manufacturing continues to shrink and points to slowing economic growth.

Meanwhile, the US ISM manufacturing PMI was better than expected despite also staying far below 50. For December, this came in at 47.4, up from 46.7 in November and beating the forecast of 47.1.

For those unfamiliar with these statistics, the U.S. Institute for Supply Management (ISM) Manufacturing Purchasing Managers' Index (PMI) is an economic indicator that provides insights into the health of the manufacturing sector in the United States. The PMI is based on a monthly survey of purchasing managers from various industries, including manufacturing, and it measures changes in production levels, employment, supplier deliveries, inventories, and new orders.

The ISM Manufacturing PMI is reported as a single headline number. A PMI reading above 50 generally indicates an expansion in the manufacturing sector, while a reading below 50 suggests a contraction. The higher the reading above 50, the faster the expansion, and vice versa.

This means that for both China and the U.S., we are currently seeing a contraction in the manufacturing sector. A contraction in the manufacturing sector often signals a broader economic slowdown. Manufacturing is a critical component of economic activity, and a decline in manufacturing can contribute to reduced overall economic growth.

However, more important and potentially even more significant than the earlier reported jobs report from Friday was the December ISM non-manufacturing PMI, which missed the 51 consensus by a mile and fell to 43.3, well into contraction territory. Moreover, these are the levels only seen within times of crisis like COVID-19 and the Great Recession, highlighting how significant this really is. It indicates that a period of economic contraction and potentially a recession is most definitely not out of the question yet.

Eurozone macroeconomic data

While most investors will be focused on the U.S. macroeconomic data, it is also worth highlighting the data from the Eurozone. And crucially, data that came out last Friday pointed to a rebound in inflation from 2.4% in November to 2.9% in December.

However, as Michael Field, European market strategist at Morningstar, pointed out, the rise in headline inflation “is essentially a technicality.” More importantly, core inflation — not including energy, food, alcohol, and tobacco prices — continued to ease in December, falling from 3.6% in November to 3.4% last month. This is the data central bankers will keep a close eye on, so the headline data is unlikely to impact their decision-making. January’s inflation print will be crucial to see if the downtrend continues.

Economic agenda of week #2

Thursday, January 11 → US inflation data from December

Let us know what you think of this week’s economic headlines! We are always open to a valuable discussion.

This week’s business headlines

A breakdown and analysis of last week’s most important and impactful company-specific and industry-changing headlines.

U.S. officials requested ASML to stop shipping DUV machines in Q4

ASML ASML 0.00%↑ shares have not started the year very well. Shares fell by over 5% in the first two trading days of the year on a surprising announcement that it had stopped shipping two types of DUV machines to China. It did this even before its export license was revoked as of January 1st. ASML announced that it impacted only a few Chinese customers and two types of DUV equipment.

That ASML faced export restrictions has already been clear for a while, but the latest of these was supposed to kick in as of January 1st. Yet, the Dutch government revoked some licenses before this date, as reported by ASML.

However, according to sources from Bloomberg, U.S. officials requested ASML to stop shipping some of its semiconductor manufacturing equipment to China even before the start of 2024. This could be the result of the U.S. fearing the rapid semiconductor technology developments made by Huawei, which are said to be made using ASML DUV equipment through SMIC. Potentially, the Biden administration wanted to keep China from being able to scale the manufacturing of these chips.

While ASML stated that the revocation has no meaningful impact on the FY24 outlook, it could not prevent investors from selling the shares in line with the broader semiconductor index. This could be partly due to the fear of Q4 results coming short of the current consensus.

ASML experienced a lot of pulled-forward demand from Chinese customers in H2 as these were looking to avoid the export restrictions in effect as of this year. Exactly how many machine orders ASML canceled is unclear, but we estimate it could impact up to €100 million of revenue.

Despite these developments, we at InvestInsights remain bullish as we continue to see some upside for ASML and its semiconductor equipment peers.

Investors moving investments to China?

On January 2nd, Bloomberg reported a significant shift in investor interest toward Chinese markets. According to its latest Markets Live Pulse survey, almost a third of respondents “say they will increase their China investments over the next 12 months.” This is a significant shift from just 19% in a similar survey in August and 25% in March 2023.

This indicates that for many investors, a drop of 60% is a “signal to buy Chinese stocks,” as reported by Bloomberg. Only 20% still consider cutting their Chinese investments, so it is safe to say that investor sentiment toward China is improving.

With Alibaba BABA 0.00%↑ still trading at depressed levels, now might be the time to pick up some shares. We think the narrative is improving here and are carefully monitoring developments.

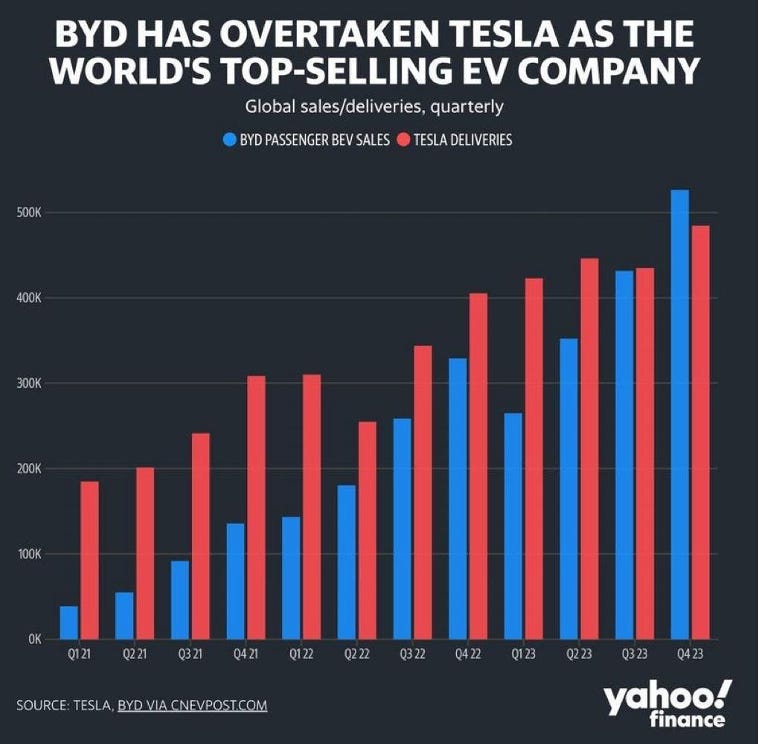

EV deliveries – BYD overtaking Tesla

Chinese electric vehicle manufacturer BYD reported selling over 3 million vehicles in 2023, following a strong Q4 in which it outsold Tesla for the first time ever. BYD reported shipments of 526,000, comfortably above Tesla’s TSLA 0.00%↑ 484,000. The company had been closing in for many years and has finally overtaken Tesla regarding deliveries.

Shipments in 2023 were up 61.9% for BYD, which is staggering and fueled by strong adoption in China and successful expansion in Europe. This led to overseas sales in December tripling from the previous year. The majority of shipments were BEVs.

Meanwhile, Tesla grew 2023 shipments by 38% YoY, down slightly from 40% growth in 2022, but still very impressive. Tesla beat the consensus estimates with deliveries in Q4. Also, crucially, Tesla did begin shipping the new Cybertruck model in December in small numbers.

Notably, following the Q4 delivery report, Deutsche Bank analysts reiterated their buy rating on Tesla with a $260 price target. However, this did include the continued expectation for significant downside risk to expectations as Tesla faces a number of challenges in 2024, including “pricing pressures, the potential impact of Cybertruck margins, and an elevated tax rate in China,” as reported by Investing.com.

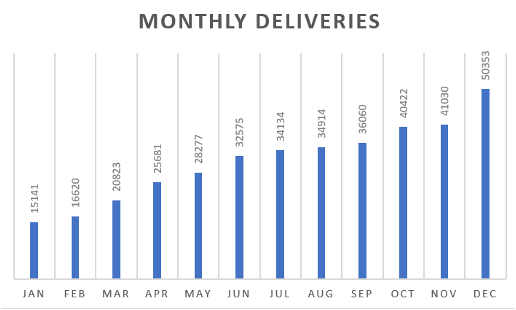

Meanwhile, two smaller Chinese car manufacturers also reported their December deliveries – Nio NIO 0.00%↑ and Li Auto LI 0.00%↑ – which also looked solid. Starting with Li Auto, the OEM reported record-breaking results of 50,353 deliveries, marking the ninth consecutive record quarter for the company. This brought Q4 deliveries to 131,805, easily beating the consensus. In 2023, the company now delivered 376,030, up 182% YoY.

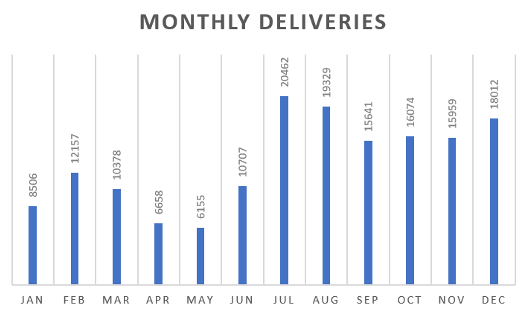

Nio also posted solid results with total car deliveries in December of 18,012, up 13.9% YoY. This brought the Q4 total to 50,045, up 25% YoY. For 2023, deliveries were up 30.7% to just over 160,000 cars. Clearly, Chinese car OEMs are seeing solid growth numbers across the board.

Apple facing analyst downgrades

Apple AAPL 0.00%↑ – the world’s largest company by market cap with a significant weighting of close to 7% in the SPY ETF SPY 0.00%↑ – has started the year not all too well, with shares down over 5% after just two days of trading. These losses were mainly the result of multiple Wall Street analysts voicing their doubts and negative views on the company’s 2023.

Barclays downgraded Apple to underweight as the Wall Street bank is worried about a prolonged period of weak results and its current multiple not being sustainable as a result. The analysts now guide for a low-single-digit decline in revenue and EPS in the March quarter. In response, the analysts set a target price at $160, far below a current share price in the mid-80s.

It is worth noting, though, that Barclays has historically been quite skeptical of Apple compared to most investment banks and institutions, so we recommend not awarding too much value to this single-sell rating. Historically, Apple has shown to be able to outperform its estimates. We view Barclays’ current stance as overly negative.

While we believe the current multiple is rich and Apple could see headwinds remain for longer, this could limit the upside for the time being but is most certainly, in our view, no reason to sell.

Meanwhile, Piper Sandler also downgraded Apple to neutral, “citing concerns about iPhone inventory levels and a perceived peak in unit sales growth rates.” Nevertheless, the firm maintained its $205 price target but saw challenges in 2024 from China and currency headwinds.

And that is not all as on Friday, the news surfaced that “the U.S. Department of Justice is preparing an antitrust lawsuit against the iPhone maker, which could be filed as soon as this year,” as reported by CNBC. The lawsuit is said to target some of the exclusivities of the iPhone, like the compatibility with the Apple Watch, the iMessage service, and potentially even Apple Pay.

Continued power struggle at Disney

The power struggle between Disney DIS 0.00%↑ CEO Bob Iger and activist investor Nelson Peltz has been ongoing for a few months now as Peltz’s Trian Fund Management “owns roughly $3B worth of Disney's common stock, has been highly critical of Iger and the company’s trajectory.” Just last month, Trian nominated Peltz and Disney CFO James Rasulo to join Disney's board.

In response to devastating reports written by Nelson Peltz on the address of Bob Iger and his management team and the recent move to nominate Peltz and Disney CFO James Rasulo to join Disney's board, “The Walt Disney Company and activist investor ValueAct Capital Management L.P. said Wednesday they have entered a confidentiality agreement, as reported by MarketWatch. This means “ValueAct will support the board’s recommended slate of nominees for election to the board at the 2024 annual meeting” in an effort to fight back against Trian’s effort.

On top of this, Iger has found backing from activist hedge fund Blackwells Capital, which will nominate three directors to Disney’s board in support of Bob Iger, further strengthening his power over Trian’s.

Clearly, this matter is still far from over, and we will let you know of any developments.

Sofi receives downgrade – Stock slides 13% on Tuesday.

Sofi SOFI 0.00%↑ received a downgrade on Tuesday from KBW analysts to a sell and fell 13% in response. Even though the shares clawed back some percentages in the following trading days, the analysts highlighted several valid concerns.

While the analysts were not overly negative, they pointed to the “re-underwriting of its model, which slightly reduced estimates, leaving the U.S. materially below consensus." On top of this, shares have rallied 45% since the Q3 results, taking them to a significant premium. The analysts stated that “anytime a growth stock is trading at premium valuations with 15-20% downside potential to consensus EBITDA, we believe a more cautious stance is appropriate.”

This means KBW analysts see more room for downside than possibility for upside, which resulted in a more careful stance, even as SOFI might achieve profitability in Q4.

Walgreens reports Q1 and cuts dividend

Walgreens WBA 0.00%↑ shares fell 5% on Thursday after the company reported decent Q1 results but also cut its dividend in half. Starting with the elephant in the room, Walgreens cut its dividend, which yielded 7%, to 25 cents per share from 48 cents per share, resulting in a new yield of 3.9% based on Thursday’s closing price. This ended 48 years of consecutive increases.

According to management, the cut is important to “strengthen [its] long-term balance sheet and cash position,” which makes a lot of sense to us. Yes, for dividend investors who were there for the 7% yield alone, this is definitely bad, and it is safe to assume 90% of the outflow today comes from these investors. However, we believe Walgreens has become more attractive to investors after this dividend cut. It gives management a lot of additional financial room to invest in the business, turn the ship around, and accelerate growth. In the end, this is the most shareholder-friendly thing to do, as CEO Tim Wentworth put it.

This was the first quarter in which CEO Tim Wentworth officially led the company, and he is clearly determined to steer the ship around. Walgreens was one of the most significant large-cap underperformers in 2023, with shares down 30% as the company grappled with weakening demand for Covid products, low pharmacy reimbursement rates, increased pressure from online retailers, labor unrest among pharmacy staff in the fall, an uneven push into health care and a challenging macroeconomic environment, as reported by CNBC.

The company is making significant investments in transforming from a major drugstore chain to a large healthcare company through substantial investments and making better use of its incredible nationwide presence.

As for the Q1 result, Walgreens topped the consensus on revenue and EPS:

EPS: 66 cents per share adjusted vs. 61 cents expected

Revenue: $36.71 billion vs. $34.86 billion expected

Walgreens expects 2024 to remain challenging, partly due to lower market growth in prescriptions and lower sale and leaseback contributions. In addition, weak consumer spending will impact US retail sales in H1 before improving in H2. Nevertheless, long-term Walgreens could be a remarkable turnaround opportunity.

Let us know what you think in the comments!

Carrefour removes PepsiCo products from the shelves

Carrefour, one of the largest supermarket chains in France, Europe, and South America, is telling customers in four European countries that it will no longer sell products from snacks and beverage giant PepsiCo PEP 0.00%↑.

This includes brands like Pepsi, Lay’s, and 7up, as they have become too costly, and Carrefour will no longer accept recent significant price increases. Staggeringly, PepsiCo has now raised prices for seven consecutive quarters by double digits and has openly admitted to having shrunk packaging sizes simultaneously.

While this might still sound like only a small impact, and you might have never even heard of Carrefour, it impacts more than 9,000 stores across four countries or about two-thirds of the retailer's global footprint. Crucially, these are very important regions for PepsiCo as well and could very well cost the company tens of millions of dollars if it takes time to resolve.

Interviews conducted by Reuters show that Carrefour customers cheered the move. Shopper Edith Carpentier told Reuters she thinks “there will be lots of products left on the shelves because they have become too expensive, and they are all things we can avoid buying."

Carrefour has been one of the most aggressive retailers fighting food and beverage inflation by global giants. One year ago, the company even started a specific campaign against this by sticking warnings on products that have shrunk in size but cost more. Carrefour is determined to offer its shoppers the best value, highlighted by its focus on store brand products.

Meanwhile, the impact for PepsiCo is likely to be small, although we do not expect this issue with Carrefour to be resolved any time soon. The company has been negotiating prices for months, ending with Carrefour dragging the products from the shelves. Nevertheless, we stay bullish on PepsiCo, especially with the company having most of its price increases behind it now. We expect these controversies to be manageable for the company.

Weak Q4 results from Mobileye worry investors in semiconductors

Mobileye MBLY 0.00%↑ reported preliminary Q4 results last Thursday, and shares fell 25% in response to the following trading session. While this might not sound like the most notable news of the week – in the end, Mobileye only has a market cap of slightly over $30 billion – the results send shivers down the spines of many investors in semiconductor stocks.

The company slightly revised its FY23 outlook, narrowing the revenue range and increasing operating income guidance. Moreover, guidance for Q4 still sat largely above the consensus. So why the 25% drop, and why is this a negative indicator for the chip industry?

Well, the real issue was that Mobileye added some commentary for Q1, guiding lower-than-expected volumes in the EyeQ SoC business, which will impact revenue and meaningfully pressure margins to levels significantly below prior quarters. Simply put, Mobileye seems to be facing demand weakness from its automotive customers, resulting in the expectation for a dramatic drop in customer orders in Q1.

Over the last several years, the automotive semiconductor market has been booming in response to the significant shortage of such semiconductors during COVID-19, which plagued many car manufacturers. That’s why many of these stocked-on automotive semiconductors in recent years have driven rapid growth for Mobileye and automotive peers like ON ON 0.00%↑, Infineon $IFX, and STM STM 0.00%↑.

However, this has now resulted in excess inventory at car OEMs, which Mobileye is aware of. Now that supply chain issues have eased, customers are starting to use the vast majority of these semiconductor inventories, meaning they won’t be placing new orders, massively impacting demand.

We are expecting this will not only impact Mobileye but are getting more cautious with its peers, named previously. After the boom in recent years and the significant inventory levels at car OEMs, we are projecting significantly lower automotive semiconductor demand, impacting the likes of Infineon, ON, NXP NXP 0.00%↑, and potentially even Qualcomm QCOM 0.00%↑, Nvidia NVDA 0.00%↑, and Texas Instruments TXN 0.00%↑ to name a few.

We urge investors to become more cautious with these names. While we remain bullish on Infineon, in particular, due to a perceived undervaluation, we are not eager to buy at current times due to increasing uncertainty and the expectation for these shares to fall further in response to disappointing guidance.

Earnings previews week #2

The calendar Q4 earnings reporting period is ready to kick off this week, starting with the first major financials reporting this Friday. Make sure to note the following in your agenda. Of course you will find the highlights in next weeks newsletter as well!

Blackrock BLK 0.00%↑ premarket on Friday, January 12

Delta Airlines DAL 0.00%↑ premarket on Friday, January 12

Bank of America BAC 0.00%↑ premarket on Friday, January 12

Citigroup C 0.00%↑ premarket on Friday, January 12

JPMorgan Chase JPM 0.00%↑ premarket on Friday, January 12

Wells Fargo WFC 0.00%↑ premarket on Friday, January 12

UnitedHealth UNH 0.00%↑ premarket on Friday, January 12

Our Top 10 stock picks of week #1

Picking individual stocks is never an easy feat. While we all aim to outperform the market and achieve the highest returns possible, some with a low or reasonable margin profile and others with significantly more risk, history has proven this to be a hard task. In fact, approximately 90% of retail investors underperform or even lose money in the stock market over the long run.

Of course, there is no shame in that. We must also consider that active equity funds and fund managers mostly underperform the global indices as well. Barron’s explained that, “over the past 10 years, less than 7% of U.S. active equity funds have beaten the market.” Furthermore, CNBC reported that “almost 80% of active fund managers are falling behind the major indexes.” Clearly outperforming the markets is no simple task.

This is why, from next week forward, we will to share our Top 10 highest conviction stock at the moment. These are stocks we are considering buying as we deem these attractive right now. This top 10 will be upgraded each week based on economic and company-specific developments. On top of this, we will also disclose our weekly transactions for optimal transparency.

Stay tuned for this next week and make sure to subscribe to be informed of future releases.

Please do not consider this investment or financial advice. This is for inspirational and informative purposes only and only reflects our own opinions. (Please consider the disclaimer at the bottom of this newsletter.)

We hope to see you again next week! Please leave a comment to share your thoughs and feel free to share this newsletter.

Also, to improve our visibility, please like and restack this post. Thank you!

Disclaimer:

The information provided in this newsletter is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security. The content of this newsletter is based on our analysis and interpretation of market trends, historical data, and other information available at the time of publication.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions. The authors, publishers, and distributors of this newsletter are not responsible for any errors or omissions, or for the results obtained from the use of the information provided herein.

By accessing and reading this newsletter, you acknowledge and agree that you are solely responsible for your own investment decisions.