Investor's Dilemma: Lam Research Shines Amid Risks, but is the Price Right?

Despite a commendable track record and strategic industry alignment, caution is advised as overbought shares present a demanding valuation, urging investors to await a more favorable entry price.

(Note that this article can be truncated in an email. By clicking "View entire message" you can view the entire post. Alternatively, you can view this post in the Substack app)

Article Thesis

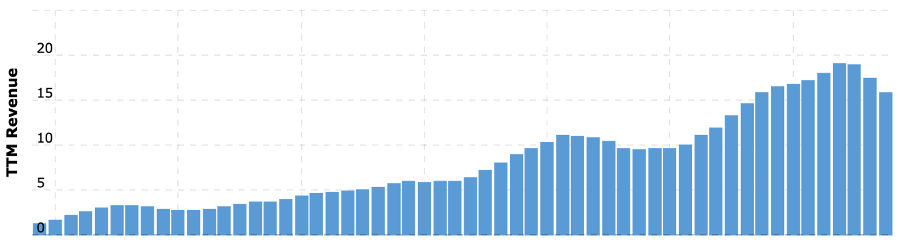

Lam Research LRCX 0.00%↑ has proven to be an outstanding investment over the last decade, with a commendable revenue growth CAGR of 15.6%. Despite facing the cyclicality inherent in the semiconductor industry, Lam's ability to navigate through these cycles has been exceptional, showcasing its resilience and consistent growth. The company's strategic focus on crucial semiconductor processes like deposition, etch, and clean solutions has solidified its market leadership, holding a 15% market share in the semiconductor equipment industry.

Lam's positioning in critical semiconductor processes aligns well with the anticipated industry growth, set to rebound and thrive in the medium term. Factors such as increased demand for semiconductors driven by advanced technologies and the semiconductor equipment market's projected CAGR of 7.9% through 2030 further support Lam's optimistic outlook.

The recent fiscal Q1 earnings report reflects both positives and challenges. While Lam beat Wall Street expectations, weakness in the NAND market and unexpected challenges in the foundry/logic market impacted overall revenue. The company, however, maintains a solid margin profile, with a resilient gross margin of 47%, reflecting prudent cost management.

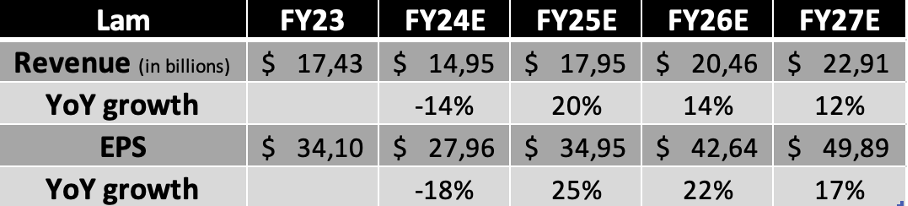

However, despite the company’s strong fundamentals and our expectation for low to mid-teens revenue growth and high-teens EPS growth in the medium term, shares seem slightly overbought today following the end-of-year rally.

Therefore, we don’t believe the current risk/reward profile is attractive enough. We are staying on the sidelines for now and will look for the shares to drop closer to the $710 range before considering initiating a position in order to be better positioned for market-beating returns from this incredible compounder.

Lam has been an excellent investment over the last decade.

Lam has been one of the best investments over the last decade, and not without reason. It has grown revenues at a CAGR of 15.6%, even after the dip in fiscal FY23, making it one of the fastest growers in the semiconductor equipment industry. Meanwhile, with $17.3 billion in revenue, an installed base of 90,000, and great global exposure with 14 primary locations globally, the company is by no measure small.

Furthermore, it managed to deliver this growth despite the industry’s cyclicality and Lam’s significant exposure to this, as highlighted in recent quarters. Yet, while cyclicality is all over the company’s financials (just look at the revenue development below), it has shown an excellent ability for incredible growth through these semiconductor cycles.

The semiconductor industry experiences periodic fluctuations in demand due to various factors, including macroeconomic conditions, technological advancements, and end-market demand for electronic devices. The demand for semiconductor equipment, such as the products offered by Lam Research, is closely tied to the overall health of the global semiconductor market as it fully depends on the investments made by semiconductor manufacturers like Taiwan Semiconductor TSM 0.00%↑, Intel INTC 0.00%↑, and Samsung.

On top of this cyclicality, it is also worth noting that Lam is slightly more cyclical compared to some of its peers, but this is due to the company having more exposure to the memory market, whereas peers are more weighted toward logic/foundry. However, as highlighted by the company’s growth numbers, this should not be of concern to investors as the company has shown an excellent ability to grow through the cycles and outgrow its more stable peers.

Moreover, over the same 10-year period, the company grew its EPS at a CAGR of 38.4%, which is incredible and fueled by consistently expanding margins and management significantly lowering the share count. Management has lowered the share count by 22% over the last decade through significant share repurchases.

Yet, even more impressive is the GAAP operating margin, which has expanded from 5.6% in 2013 to 28.4% in 2023, highlighting incredible margin expansion coming from cost efficiencies and size benefits. Remarkably, the company has been able to consistently expand margins even as it kept growing investments in R&D at a double-digit rate as well. As of the most recent fiscal year, the company spends a significant $1.7 billion in R&D annually, translating into approximately 10% of revenue to maintain its technological edge.

Considering all these factors, it should be no surprise that Lam has been one of the best-performing semiconductor stocks over the last decade, with returns of 1352%.

Now, I can already tell you that the company today still seems far from done growing and is poised for strong continued growth in the medium term as it still has plenty of growth levers. That is why it remains an attractive investment option, even after the incredible growth we have witnessed over the last decade. However, before we get to that, we first need to understand this business better. Therefore, let’s take a step back to look at the company’s fundamentals and operations.

Lam Research is a market leader in critical semiconductor manufacturing processes.

Lam Research Corporation, headquartered in Fremont, California, is a leading global provider of semiconductor equipment and services. Established in 1980, the company has evolved into a key player in the semiconductor manufacturing industry. Lam Research specializes in designing, manufacturing, and servicing wafer processing equipment used in the fabrication of integrated circuits.

The company's comprehensive product portfolio includes deposition, etch, and clean solutions that play a critical role in the semiconductor manufacturing process. Lam Research is recognized for its innovative technologies, which enable the production of smaller, faster, and more efficient semiconductor devices. As the semiconductor industry continues to advance, Lam Research remains at the forefront, providing solutions that address the evolving needs of semiconductor manufacturers.

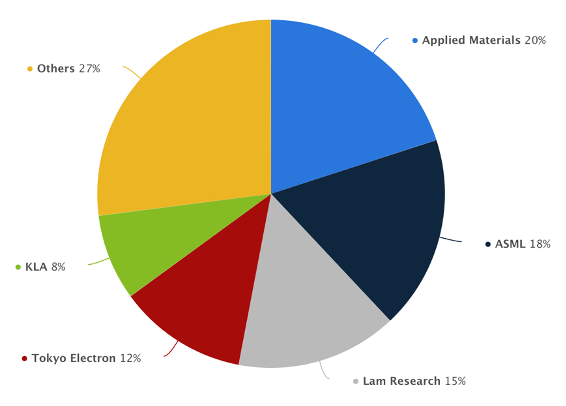

In fact, today, nearly every advanced chip is built with Lam technology, and the company holds a very decent 15% market share in the semiconductor equipment market, only trailing ASML ASML 0.00%↑ and Applied Materials AMAT 0.00%↑. However, it is essential to understand that the $80 billion semiconductor equipment market is a highly complicated and diverse industry in which every company specializes in particular processes. As a result, it is worth noting that Lam does not compete with its larger peers and is, in fact, a market leader in its respective markets.

The fact that the company is responsible for the manufacturing of nearly every semiconductor and is an important player in the industry is the result of the company’s focus on the three key semiconductor processes, which are deposition, etch, and clean solutions. Lam Research focuses on providing equipment and solutions for these various critical processes in semiconductor fabrication.

In the semiconductor deposition market, Lam Research produces equipment for the deposition process. Deposition is a critical step in the semiconductor manufacturing process, involving the addition of thin layers of materials onto a semiconductor wafer. These thin films are essential for creating various components and structures within integrated circuits (ICs). Lam is one of the industry leaders in this semiconductor equipment vertical but faces significant competition.

In contrast, the company is the clear market leader in etching, even commanding a 100% market share in the NAND etching market. Etching is the process of removing material from semiconductor wafers to create patterns and features. Lam Research's etching equipment is designed to remove material from the wafer surface precisely, which is another critical process in everyday semiconductor manufacturing.

Finally, the cleaning process is essential for maintaining the purity of the semiconductor wafers. Lam Research provides products for wafer cleaning, ensuring that contaminants are removed and the wafers are prepared for subsequent processing steps. The company has seen substantial growth in its wafer-cleaning equipment segment, driven by its cutting-edge technologies and strong customer relationships, resulting in a 25% market share today.

Lam is exceptionally well-positioned to benefit from underlying industry growth

The company also has a promising growth outlook through its leading market positions in these critical semiconductor processes. For starters, the semiconductor equipment market, valued at $80 billion after a dip in 2023, is expected to rebound in 2024 and grow strongly in the medium term. Grand View Research points to a 7.9% CAGR through 2030. However, New Street analysts are slightly more bullish and believe the new demand cycle could propel the value of this industry to $150 billion by 2028-2030, representing a CAGR of between 9-14%, potentially outpacing the overall semiconductor industry.

Demand for semiconductors will skyrocket in the next upcycle, driven by advanced technologies like cloud, 5G, IoT, and electric/connected vehicles. In addition, individuals are ready to spend more on advanced gadgets to improve their living standards and electronic product experience. This is expected to propel the entire semiconductor industry to a market value exceeding $1 trillion by the end of the decade.

Adding to this the increasing complexity of semiconductor manufacturing, significant factory expansion required, and the search to minimize costs, reduce mass production times, and improve final product value, it is not hard to see how the semiconductor equipment industry could indeed see great growth through the end of the decade.

Therefore, we remain very much bullish on the semiconductor equipment sector, including Lam peers ASML, KLA KLAC 0.00%↑, and AMAT. The projected industry growth and growing demand should easily support high single-digit to low-double-digit growth for each of these.

Meanwhile, with its exposure to three crucial processes, Lam is actually well positioned to outgrow the general semiconductor equipment industry as its focus areas are projected to grow meaningfully stronger due to their growing importance. In addition, the company should see revenue rebound strongly in upcoming years following a dip in 2023, propelling its revenue growth potential.

The deposition market will most likely grow at a low-teens CAGR through the end of the decade, driven by faster-growing areas of this market like Atomic layer deposition and thin layer deposition. More specifically, growth in the industry is driven by growth in semiconductor demand for solar solutions, medical devices, and the expanding LED electronics market, specific end-products for which deposition is a more crucial process. Considering this projected growth and Lam’s strong market share, it should be able to grow deposition revenues by the low to mid-teens from the low base in 2023.

Meanwhile, the semiconductor etching market is projected to keep growing at a 7.6% CAGR through the end of the decade. According to Lam itself, this growth is primarily driven by the strengthening of secular tailwinds such as AI, 5G, and IoT. In addition, the complexity of manufacturing advanced semiconductor devices continues to increase rapidly, leading to a rise in capacity across all market segments. This drives growing demand for etching equipment as well.

For Lam in particular, growth in etching equipment sales could end up even slightly higher from a low 2023 level, with the company holding a commanding market share of 100% in NAND etching, a market projected to reach a size of $2 billion by 2027 or growing at a CAGR of over 40%. Therefore, assuming Lam at least holds on to the majority of this market share, which seems likely, it should be able to grow etching revenues at double digits as well, most likely in the low to mid-teens.

Finally, according to Global Market Insights, the outlook for the wafer cleaning equipment market also remains strong, with a projected CAGR of 11.5% through 2032. This industry’s growth drivers are similar to those of the other two markets discussed above, with the ongoing trend to smaller and more complex semiconductors leading to higher cleanliness requirements. Simply put, as semiconductors become smaller, the process becomes more complicated, including the cleaning of the wafers, increasing demand for Lam’s cleaning solutions. This should drive mid-teens growth for Lam as it is well-positioned to gain more share in this market.

Overall, I expect each of Lam’s focus processes to keep growing by double digits, leading to an overall revenue CAGR of 10-14% for Lam through fiscal 2027, helped by the low revenue base in 2023 and the expected upcycle in upcoming years. In the long term, “Lam's growth story is strong and underpinned by the fact that etch and deposition are fundamental enablers of higher performance, more scalable semiconductor device architectures,” according to management. This is how management described in its Q1 earnings call:

“Scaling and complexity challenges are driving multiple inflections towards 3D architectures and, in turn, greater etch and deposition intensity.”

The recent fiscal Q1 earnings report shows positives and negatives

Lam released its fiscal Q1 earnings report on October 18 and managed to beat the Wall Street consensus on the top and bottom lines, driven by strong execution. Meanwhile, WFE spending in the calendar year 2023 has turned out somewhat stronger than management anticipated as it increased its guidance to a market value of $80 billion for the entire industry from a previous $70 billion. However, there has not been much change in Lam’s product categories, meaning its revenue guidance has remained unchanged, mainly due to continued weakness in the memory market.

Lam continues to face weakness in the NAND market as customers adjusted spending levels down and “further lowered utilization to drive a faster path to supply-demand balance,” according to management. Positively, these have recently indicated that trends are stabilizing, potentially indicating a bottom in the cycle.

Meanwhile, DRAM spending is already showing some slight room for positivity as trends in high bandwidth memory-related demand are improving. However, Lam is at the same time also experiencing some unexpected weakness in the foundry/logic market due to weakness in both leading edge and non-China based mature node investments. This means that overall, the demand environment is aligned with management’s expectations and remains somewhat depressed.

This resulted in Q1 revenue of $3.48 billion, which was still down 31.4% YoY but up 9% sequentially. This means that a real recovery still remains elusive, as highlighted by the fact that the YoY decline is still in line with what we saw last quarter.

Memory now accounted for 38% of revenue, up from 27% in the prior quarter following the slight dip in logic/foundry and uptick in DRAM, which was up to 23% of revenue, compared to just 9% in fiscal Q4. For reference, Foundry accounted for 36% of revenue in Q1, down from 47% in the prior quarter. Finally, logic and other accounted for 26% of revenue, flat sequentially.

In addition to these equipment revenues, the company also reports customer support business group revenues (by peers referred to as “service revenues”), which was $1.4 billion in Q1, accounting for 40% of total revenue. This was somewhat more resilient in Q1, down 25%, as customers consistently need their machines serviced, even if production is down. However, the decline was still significant as the lower utilization of customers resulted in significantly decreased demand for upgrades and services. Like equipment revenues, the company’s service revenues are also somewhat more volatile compared to peers (most peers, even though revenue was down YoY, continued to report positive service revenue growth). This once more confirmed that Lam is much more sensitive to the economic cycle than its peers, resulting in a somewhat higher risk/reward profile.

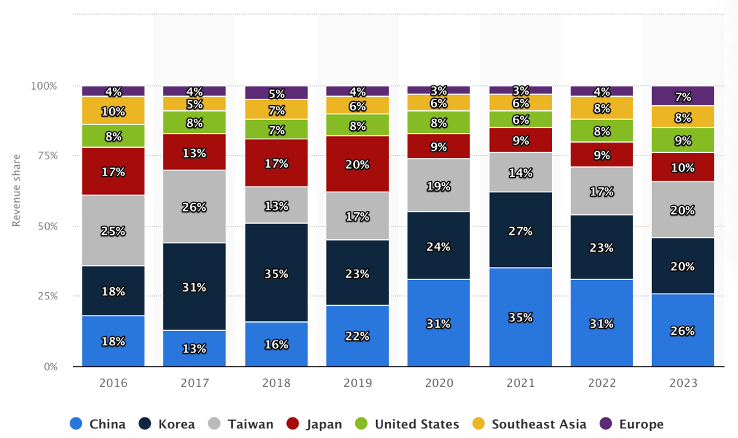

Looking at revenue by region, one thing that pops out in the Q1 financial data is the significant revenue contribution from China at 48% of revenue. However, it is worth noting that this is an elevated level, up from 26% in FY23. This is primarily the result of significant orders coming from domestic Chinese customers in response to U.S. export restrictions kicking in as of January 2023. While these do not overly impact Lam, it is a beneficiary of the Chinese order spree. Lam can fully benefit from this pushed-forward demand as orders and deliveries to other regions are down, which results in these elevated levels. Management expects this strength to persist in the December quarter and ease in the quarters that follow. Positively, the improving demand environment should mean that easing Chinese demand will be offset by other regions.

In addition to China, assuming the more normalized FY23 levels shown above, the company derives most of its revenues from Korea at 20% of revenue, Taiwan at 20%, and Japan at 10%. As a result, the company derives roughly 84% of its revenues from Asia. Of course, this should not come as a surprise as most semiconductor manufacturing facilities remain located in Asia, including major manufacturers like Samsung, TSM, GlobalFoundries, and many more. Therefore, we don’t believe this should be a reason for concern for investors. While the exposure to Asia is far from ideal, this is no different from most semiconductor equipment manufacturers. Yet, for investors avoiding Asian exposure, Lam is a clear avoid.

Lam’s margin profile and balance sheet remain rock-solid

Moving to the bottom line, there is more room for positivity as Lam performs exceptionally well with the gross margin, operating margin, and EPS above the high end of management’s guidance in fiscal Q1. The gross margin improved by 220 bps sequentially and 190 bps YoY, which is remarkable considering the weak top line. The outperformance was partly driven by a favorable customer mix. However, more importantly, management has been working on improving the cost structure over recent quarters and is on track to improve the gross margin by one percentage point by the end of 2023 compared to the start of the year.

Moreover, this also allowed for a resilient operating margin performance, with this coming in at 30.1%, up 280 bps sequentially but down 320 bps YoY, primarily due to operating expenses growing 6% YoY despite the top-line decline. The higher operating expenses were largely the result of a 13.4% increase in R&D investments as management continues to prioritize investments in technological development.

Overall, this margin profile is still very respectable, and considering the severity of the sales and demand weakness, margins are holding up really well. For reference, historically, the margin is not that far from the average but has simply retracted from recent year highs. Furthermore, margins should recover once demand bounces back and revenue returns to growth.

It is worth noting, though, that a rapid recovery in the margin profile is not expected as management has already communicated that it intends to accelerate growth in R&D investments in upcoming years to be able to fully benefit from the renewed upcycle in the semiconductor industry. This, combined with the revenue mix benefits easing, will remain a slight drag on the margins. Still, the company should be able to expand its margin to new highs in upcoming years, and these expanding margins should drive even more impressive growth in EPS (of course, again from low levels), with EPS growth likely to sit in the high-teens percentages.

In Q1, Lam reported EPS of $6.85, down 34% YoY as a result of the lower revenue base and slightly depressed margins. Lam repurchased approximately $830 million worth of shares in Q1, and combined with $230 million worth of dividends, management returned over $1 billion to shareholders in the quarter. This means management returned 120% of FCF in the quarter, which slightly drove down the cash position on the balance sheet to $5.2 billion. Still, considering slightly below $5 billion in debt, the company still holds a net cash position of $0.2 billion, leaving the company in a very healthy financial position with plenty of cash to keep investing through the down cycle.

As highlighted by the most recent quarter, management also regularly uses its significant cash generation and position to reward shareholders. The company pays a respectable dividend yielding 1% but based on a conservative payout ratio of just 23.5%. Moreover, management remains committed to sustainably and consistently growing its dividend in the future after nine consecutive increases since 2014.

Management has not only been consistent in its dividend growth but has also grown it rapidly at a 5-year CAGR of 14.4%, including a 16% increase most recently, despite the company working its way through a downcycle. This speaks to management’s commitment to its shareholders. Furthermore, with EPS expected to rebound strongly in the coming years and the payout ratio still conservatively low, we still see plenty of room for dividend growth at a mid-teens CAGR in the medium term.

In addition to this solid and growing dividend, management still has $2.7 billion remaining on its share repurchase plan, which allows it to further lower the share count by 2.6% after retiring 22% of the outstanding shares over the last ten years. Safe to say, Lam appreciates its shareholders, and these are in for significant cash returns ahead, adding to the already attractive shareholder proposition.

Outlook & Valuation

For the final quarter of the calendar year 2023 and the company’s second fiscal quarter, management guides for revenue of $3.7 billion plus or minus $300 million, representing a revenue contraction of around 30%, still showing little to no improvement from prior quarters. Furthermore, the gross margin is expected to remain similarly impressive as in Q1 at 47% plus or minus one percentage point, reflecting a continued favorable customer mix, albeit not quite as favorable as we saw in Q1. This should lead to an operating margin of 29.5% plus or minus one percentage point and earnings per share of $7 plus or minus $0.75.

Looking further forward, management indicates that it remains challenging to call the timing and pace of a WFE recovery, making it hard to point to an inflection point for Lam today. Nevertheless, the company is well-positioned to benefit from both cyclical and structural drivers of demand, and the recovery in memory should allow Lam to recover quickly. As indicated before, Lam should be a prime beneficiary of the next upcycle in the semiconductor industry.

Considering this, management’s guidance, and my in-depth research, we arrive at the following financial projections through FY27. This includes our expectation for a gradual semiconductor industry recovery from mid-2024 and into 2025.

Based on these projections, shares are currently valued at 28x this fiscal year’s earnings, which is a significant premium to WFE peers, with AMAT and KLAC trading at 21x and 24.5x earnings, respectively. Of course, we should consider Lam's superior growth outlook, which is far stronger than that of its peers. In addition, the company remains in excellent financial health and is rewarding investors handsomely, clearly deserving somewhat of a premium.

However, also taking into account the company’s significant sensitivity to the economic cycle, its cyclicality, and considerable exposure to Asia-located customers, we are not quite sure if the current premium is entirely justified, especially when considering that shares currently trade at a 60% premium to the 5-year average and 14% to the sector median.

All things considered, we believe a multiple of 22x, which still sits far above its historical multiples, offers investors a much more attractive risk/reward proposition. However, based on this multiple and our FY26 EPS, we calculate a target price of $938, which, from a current elevated share price of $783, leaves investors with limited annual returns of just 7.5% annualized.

Considering these mediocre projected returns, we view the current risk/reward profile as unattractive. This is despite the company’s incredible growth potential and our bullish view of the company. Shares have run up over 86% in 2023 and 36% since the end of October, which is why we currently view shares as slightly overbought, together with much of the market.

This is why we chose to stay on the sidelines for now and look for shares to drop closer to the $710 range before possibly initiating a position in order to be better positioned for market-beating returns. However, were we to already hold the shares at a more attractive cost basis, we would not consider selling these as Lam has plenty of growth ahead of it.

Thank you for reading this research report. Please note that this particular one was somewhat less extensive than what we aspire to publish on InvestInsights. This report was designed to offer our new subscribers some quick and actionable content.

Make sure to stay tuned for more investment content, including our weekly newsletter and extensive stock and industry research reports. Want to receive our research conveniently in your email and stay updated on new content? Subscribe using the button below.

Also, please share this completely free content with your friends and family!

Disclosure: We have no stock, option, or similar derivative position in any of the companies and stocks mentioned. This article expresses our own opinions and we are not receiving any sort of compensation for it.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor. This is no financial advice or recommendation and is for informative purposes only.