Lam Research Corp. – I have just tripled my position in this brilliant compounder

Lam is one of the best-managed businesses you'll find. Yet, despite a blinding outlook and dominant market position, it is now being discounted for no valid reason. Time to back up the truck!

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

Lam Research, the third largest provider of semiconductor manufacturing equipment to the likes of TSM, Intel, Samsung, and GlobalFoundries, is one of my favorite long-term picks in the highly promising semiconductor industry and, therefore, a decent-sized position in my personal portfolio.

Since 2013, when it merged with Novellus, Lam has grown revenues at a CAGR of 14%, even after the recent cyclical dip in revenues, driven by strong underlying industry growth and constant market share gains. However, even more impressive, the company grew its EPS at a CAGR of 24%, which is incredible and fueled by consistently expanding margins and management significantly lowering the share count.

Meanwhile, despite its $17 billion revenue run-rate, industry-leading margins, installed base of 96,000, and market cap of $96 billion, the company still has a lot of room to grow.

In the words of management, “The best is yet to come for Lam.” Initial investments have yet to pay off, the AI revolution is driving more opportunities, and management is executing perfectly, even after its 44-year history still managing the business like it’s a start-up.

Regarding the bullish thesis here, Lam is poised to benefit massively from the secular growth expected for the semiconductor industry through its leading position in several crucial semiconductor manufacturing processes—Deposition, Etching, and Wafer Cleaning—each of which is expected to outgrow the sector due to its growing importance as semiconductors become increasingly complicated.

This alone should result in a pretty great outlook through the end of the decade, with Lam management confident it will continue to outgrow the underlying WFE industry, now pointing to low to mid-double-digit revenue growth and a high-teens EPS CAGR through 2028. That alone is already pretty great.

However, on top of that, the company has an excellent management team that is extremely capable, pays a nice and rapidly growing dividend, and consistently delivers industry-leading margins and cash flows that allow it to maintain a healthy balance sheet and its technological edge through considerable R&D investments. In fact, in recent years, Lam has been steadily growing its market share in each of its leading technologies.

As a result, I view it as one of the most promising and best-positioned businesses in the semiconductor sector, poised for significant growth amid strong underlying industry growth, great execution, and consistent market share gains.

I was already bullish on Lam for these exact reasons back in October 2024, but recent events in February have only added to my conviction.

Back in late January, Lam Research released an impressive quarterly earnings report that blew past expectations. A few weeks later, in mid-February, it held its investor day, which led to additional optimism as management was very optimistic and issued very bullish long-term guidance as the business is firing on all cylinders in a rapidly growing market.

Therefore, the subsequent 23% gain was much deserved, especially since Lam shares had previously traded at absolute bargain levels, which I alluded to back in October 2024.

However, amid broader market pressures, Lam shares have given up all those YTD gains in the span of about two weeks, falling 18% and are now trading back at similar levels to the start of the year. Furthermore, this leaves Lam shares once again trading 35% below the July 2024 all-time high and at absolute bargain valuation levels.

For reference, at a current share price of around $73 per share, we are looking at just a 19x forward earnings multiple and PEG of roughly 1x, which is extremely hard to explain looking at Lam’s fundamentals and all that I have just pointed out.

Ultimately, Lam is just poised for another great decade, and I believe current multiples do it no justice, not at all pricing in its terrific growth outlook and management’s perfect execution and track record.

Honestly, I believe Wall Street is sleeping on this one amid near-term uncertainties, which is exactly why it might just be one of my highest-conviction investments!

Anyway, today, I want to discuss the company’s excellent quarterly results and its Investor Day, updating my thesis, financial projections, and target price!

Let’s start by going over the December quarter results before getting to the Investor Day takeaways.

Fiscal Q2 results + Highlights

December quarter (fiscal Q2) revenue was $4.38 billion, up 16% YoY and beating the consensus by $70 million

WFE spending in 2024 finished in line with expectations at $90 billion.

Lam delivered an excellent quarterly report, with revenue, gross margin, operating margin, and EPS all beating both management’s and Wall Street’s expectations. The company continued on its recovery after a very challenging 2023 amid a cyclical demand dip, especially in the semiconductor memory market.

With Lam having more exposure to memory than most of its peers, it was impacted quite heavily, as visualized below.

Positively, this same graph also shows a strong recovery in 2024, as demand for Lam’s top-notch manufacturing equipment recovered swiftly, driven by system revenues for both DRAM and Foundry Logic reaching record highs, slightly offset by prolonged weakness in the NAND market. However, the net results remained solid, with Lam still growing its installed base to roughly 96,000, up 7% YoY.

In Q2, this was no different, with YoY growth of 16% YoY and sequential growth of 5%, even as Lam, like all its peers, experienced headwinds from U.S.-imposed Chinese export restrictions. Positively, so far, Lam isn’t impacted too much by these restrictions, and the loss of business in China was offset by improving demand elsewhere.

As a result, the company derived only 31% of Q2 revenues from China, down from 37% in Q1, showing a rapid decline. At the same time, strong demand from Korea offset this, growing to 25% of revenue, up from 18% in the prior quarter. Furthermore, Taiwan now accounted for 17% of revenue and the U.S. for 9%.

Also worth highlighting once more is Lam’s services segment, which is referred to as CSBG. You see, apart from selling systems, Lam also generates a significant portion of revenue from services like recurring maintenance contracts and upgrades.

Crucially, these are mostly recurring and anti-cyclical revenues. Whether the industry is in a boom or bust period, Lam customers need to keep maintaining and upgrading their machines. As a result, while the company and industry as a whole have gone through three downcycles since 2013, CSBG revenue growth was only negative for a single quarter, which is quite remarkable.

Meanwhile, service revenues are also growing rapidly as Lam’s installed base grows, leading to steadily growing maintenance contracts, while growing semiconductor complexity leads to growing upgrade demand. Especially these upgrades are a great growth driver for Lam. Here’s how management explained the value and why this is a booming business:

“The magic of upgrades is that upgrades enable our customers to cost effectively scale their technology on the Lam equipment that they already have installed in their fabs. It's also the fastest way to get that technology up to the next node because it takes a lot less time for us to perform an upgrade on an existing system than to facilitate and install a new tool.”

Remarkably, thanks to this and the durability of Lam equipment, these machines rarely ever get retired. Tools manufactured by Lam 30 years ago are still in use today, as tools rarely become obsolete, thanks to the power of upgrades and “the fact that semiconductors are used over such a broad array of applications that those tools continue to be used,” as well explained by Lam management.

As a result, the installed base is growing even more rapidly at an average rate of 10% (CAGR).

As a result, CSBG revenues have well outpaced systems revenue growth, growing 5x since 2013 and averaging a 17% CAGR. This makes this quite an incredible segment, which also still has terrific prospects for all these reasons!

In the calendar year 2024, this segment once again exceeded expectations, with revenue growing 11% YoY to $6.6 billion. Meanwhile, in Q2, the segment generated $1.8 billion in revenue, up an impressive 20%, offsetting weakness elsewhere.

Moving to the bottom line, Lam also did really well!

Calendar year gross margin was 48.2%, the highest since the 2013 merger with Novellus.

The Q2 gross margin was 47.5%, flat YoY

The Q2 operating margin was 30.7%, up 70 bps YoY.

While maybe not too impressive at first glance, this margin performance was better-than-expected and really solid, especially considering Lam is still heavily investing in R&D and infrastructure to fuel future growth.

As a result, the gross margin was flat YoY and down 70 bps sequentially, despite impressive top-line growth. This was driven by an unfavorable customer mix. Meanwhile, operating expenses in Q2 were in line with expectations at $735 million, of which 67% was used for R&D, as Lam continues to invest heavily in technology, no matter the cycle.

This resulted in an operating margin of 30.7% in Q2, up 70 bps YoY but down 20 bps from Q1.

While not particularly impressive in Q2, Lam’s longer-term margin trajectory definitely is, with the company having shown a terrific ability to expand margins and improve operating leverage.

For reference, back in 2013, Lam reported an operating margin of around 15%, which grew to a mid-20s percentage in 2019 and over 30% in 2024, showing an 8.3x improvement in operating income dollars.

That is some impressive margin expansion, especially considering Lam consistently invests around 70% of operating expenses on R&D, up from 50% in 2013. So, even as Lam has been growing its R&D investment rate, margins still expanded significantly.

This has also led to improving cash flows, which subsequently allowed Lam to keep rewarding shareholders very handsomely.

In Q2, Lam returned close to $1 billion to shareholders through dividends and share repurchases. In 2024, it allocated 98% of FCF to capital returns totaling $4 billion.

As a result of these margin improvements and share retirements, Lam reported 21% EPS growth in Q2 to $0.91, beating estimates by $0.03.

Ultimately, Lam delivered a very neat quarterly report that simply surpassed expectations.

On that note, let’s delve a little deeper into this business and its prospects by going over the February Investor Day highlights and takeaways!

The WFE industry and Lam’s favorable positioning.

That the semiconductor industry has been a brilliant one to invest in over the last decade is nothing new. I mean, the Van Eck semiconductor ETF ($SMH) is up a whopping 650% over the last decade.

This is no surprise considering that semiconductors have grown at 2.9x the rate of global GDP. Meanwhile, the semiconductor equipment industry (WFE industry) has grown even faster, at 1.7x the broader semiconductor industry.

And this isn’t expected to slow down. Looking ahead, the sector's promise remains brilliant. AI is driving tremendous WFE investment as more advanced manufacturing equipment and higher quantities of it are required to satisfy current and expected demand. Lam estimates that for data center expansion alone, WFE spending of roughly $200 billion is required over the next five years.

Simply put, performance requirements in the AI era are driving major technology changes at the leading edge. As a result of this growing complexity, WFE spending per leading-edge wafer has grown roughly 20% over the last 5 years, and with the technology inflections we’re seeing today, the expectation is for this to increase another 50% over the next several years.

Ultimately, the result is considerable expected growth for the WFE or semiconductor equipment industry, which is already a very bullish backdrop for Lam and peers like ASML, KLA, and AMAT.

However, Lam, in particular, is looking incredibly promising, more than most of its peers, as it’s exposed to faster-growing verticals. For reference, Lam’s etch and deposition SAM, driven by the growing demand for 3D architectures and more advanced semiconductors, has grown at 1.2x the rate of WFE in general over recent years.

For reference, WFE spend has grown at an already impressive 11% CAGR since 2013. Yet, Lam has compounded revenues through the cycles at a 14% CAGR, with expanding margins leading to EPS growth at a 24% CAGR.

Most importantly, these trends are expected to persist in the coming years, or rather the coming decade, with Lam management confident it should continue to outpace the semiconductor and WFE industry. The company is perfectly positioned to benefit from the growing complexity of the semiconductor manufacturing process as demand for advanced nodes grows, in part thanks to the earlier-mentioned proliferation of AI.

It is actually quite simple (as far as this industry can be): These more advanced semiconductors, including GPUs and high-bandwidth memory, require newer and more complicated technologies like gate-all-around (GAA) and advanced packaging. Subsequently, these technologies are much more deposition and etch-intensive, driving significant demand growth for Lam’s industry-leading solutions.

For example, driven by a push for more advanced technologies to enable NAND at 500 layers and more, Lam expects its NAND SAM to grow 1.8x by 2028, as these more advanced technologies need more deposition and etch equipment.

Meanwhile, in DRAM, the transition to 3D is taking shape, and Lam is at the forefront thanks to its experience with 3D in NAND, giving it a unique jump start on the competition. As a result, Lam estimates its DRAM SAM will grow 1.7x by 2028.

Finally, similar to DRAM, foundry/logic is also rapidly moving towards 3D structures “like gate-all-around and backside power distribution to achieve greater density scaling but also to improve performance and power efficiency,” according to Lam management. For Lam, this once more creates a compelling SAM expansion story, as, once more, deposition and etch technologies become more important. According to management’s estimates, its SAM here should grow 2x by 2028.

By now, I think the narrative here is pretty clear.

Ultimately, for Lam, this all should lead to a rapidly growing SAM, which, combined with continued market share gains thanks to its best-in-class products and significant push for innovation, should allow it to comfortably outpace the broader WFE industry through the end of the decade and likely well beyond.

In other words, Lam should be able to keep growing its top line at a solid rate through the cycles, likely at a low double-digit CAGR, fueled by secular trends.

This is a pretty terrific backdrop!

And there is even more fueling my bullish thesis!

Expanding margins, excellent returns on investment, and incredible shareholder returns

On top of this incredibly promising top-line development and likely growth outlook, Lam has plenty more going for it. Consider a very capable and experienced management team, expanding margins, rapidly growing cash flows, and amazing amounts of cash returned to shareholders.

As for the management team, Tim Archer, the current CEO, has been with the company since its merger with Novellus in 2013, and he has a brilliant track record. Meanwhile, CFO Doug Bettinger has also been with the company as its CFO since 2013 and also serves as its Executive Vice President.

The duo has led Lam to great success over the last decade and has shown a great understanding of the industry and its dynamics. This is as good a duo as Lam shareholders can wish for.

In particular, management’s capital allocation strategy and execution are as good as you’ll find. Management has always favored investment in R&D and infrastructure, which have fueled market share gains and rapid growth, but has at the same time been able to return massive amounts of cash to shareholders due it operating Lam extremely capital-light and management realizing insane returns on investment.

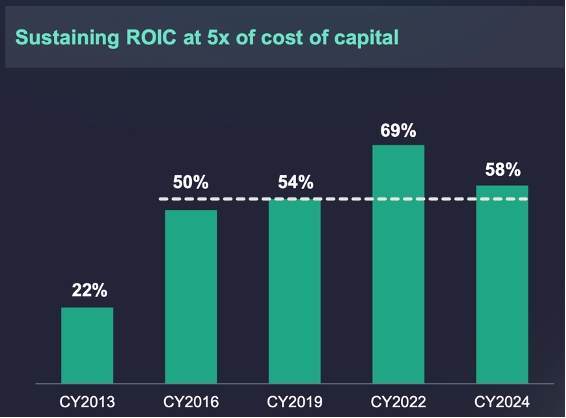

Since 2019, Lam has consistently delivered an ROIC at least 5x the cost of capital, with an ROIC above 50% since 2016. Those are absolutely mind-blowing and unequaled numbers.

Meanwhile, management also operated a pretty CapEx-light business, with only 4% to 5% of revenue reinvested in CapEx. Yet, by investing in all the right areas at the right times, it has still been able to gain market share consistently.

At the bottom line, this great approach and execution have led to rapidly improving margins and excellent cash flows. For reference, back in 2013, Lam reported an operating margin of around 15%, which grew to a mid-20s percentage in 2019 and over 30% in 2024, showing an 8.3x improvement in operating income dollars and leading to EPS growth at a 24% CAGR since 2013.

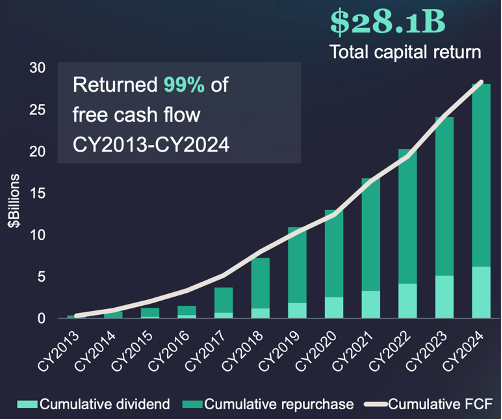

Furthermore, Lam has consistently reported an excellent FCF margin of between 20-25%, allowing it to generate between $3 billion and $5 billion in FCF over recent years. And thanks to its capital-light model and healthy balance sheet, a whopping 99% of this FCF has been returned directly to shareholders.

Since 2013, Lam has returned a whopping $28 billion to shareholders, consisting of $6 billion in dividends and $22 billion in repurchases. As a result, since 2013, Lam has retired a staggering 65% of its outstanding shares, adding $6.50 in cumulative EPS through share count reductions alone.

On top of this, Lam has now grown its dividend for 10 straight years, now yielding a very decent 1.2% based on a conservative 25% payout ratio. Furthermore, with a 5-year CAGR of 14%, the dividend is growing rapidly as well, making Lam a very attractive dividend growth investment.

So, we have a great and proven management team, a capital-light business model, an extremely strong capital allocation track record (ROIC of 50%+), healthy and growing cash flows, and 99% of FCF returned directly to shareholders, leading to rapidly growing dividend and roughly 3% of share being retired in any given year.

That is just incredible.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe if you like our content! Want to receive even more of our investment insights and show even more appreciation? Please consider upgrading to our paid tier (only $7.50 monthly or just $70 annually).

In addition to all the free stuff, this also gets you access to even more premium analyses (a total of 3 per month), full access to my own (outperforming) portfolio, immediate trade alerts in the subscriber chat, and a full overview of all my price targets and rating, and even more!

Outlook & Valuation

Unsurprisingly, everything just discussed leads to a great short- and long-term outlook for Lam, with the company well positioned to keep growing its top line at a double-digit CAGR and a combination of expanding margins and buybacks leading to even faster EPS growth through the end of the decade.

However, let’s start with the short-term outlook, which is also better than anticipated. You see, in late 2024, most investment bank analysts cut their WFE spending estimates for 2025. However, in mid-January, TSM, the largest manufacturer of semiconductors with a 50%+ market share, announced a 2025 CapEx of between $38 billion and $42 billion, a whopping 19% higher than what analysts guided for. This immediately offset any fears of poor 2025 WFE spend.

In fact, the outlook for the industry is looking rather good suddenly (as I already anticipated in October). Lam now foresees WFE spending growth of roughly 11% in 2025 to $100 billion, which is quite a positive outlook and was well ahead of expectations, driven by fears over Chinese restrictions and questionable AI demand. Turns out those fears were ungrounded.

Most importantly, Lam is confident it should outpace this underlying growth in 2025, driven by all factors just discussed, translating into the following guidance for fiscal Q3:

Revenue to be $4.65 billion, plus or minus $300 million, pointing to 23% YoY growth at the midpoint.

The gross margin is to be 48%, plus or minus 1 percentage point, down 70 bps at the midpoints.

The operating margin is to be around 32%, plus or minus 1 percentage point, up 170 bps YoY.

EPS to be $1, plus or minus $0.10, suggesting 28% YoY growth.

This is excellent short-term guidance, well ahead of consensus estimates, and showing a further top-line recovery amid improving demand, solid operating margin expansion, and EPS growth.

However, even more optimistic is the medium-term guidance that management issued during its Investor Day.

For the calendar year 2028, Lam management now guides for revenue to be between $25 billion and $27 billion, suggesting a midpoint revenue CAGR of an impressive 12.5% over the next four years. As explained earlier, this optimistic guidance is driven by the growing intensity of etch and deposition systems, and Lam anticipating further market share gains

Furthermore, improved operating leverage, a better cost structure, improved localization of the supply chain, and lower logistics spending should allow Lam to further grow its gross margin to roughly 50%, suggesting another 180 bps of gross margin expansion by 2028.

Driven by this improvement and slower cost growth, management anticipates a further 390 bps of operating margin expansion over the next four years, likely reaching a 34% to 35% operating margin. This margin expansion, combined with the expectation for continued share repurchases, leads to 2028 EPS guidance of between $6 and $7, which translates into an EPS CAGR over the next four years of 18%, based on the midpoint of guidance, which is pretty incredible.

Oh, yes, management also expects to deliver a 2028 FCF margin of 30%, suggesting roughly $8 billion in annual FCF, double that of the calendar year 2024 (25% FCF margin).

Also, beyond 2028, Lam management sees room to further grow and expand each of these metrics as the industry grows toward $1 trillion.

Ultimately, this is just an incredible outlook, allowing me to raise my own expectations through 2028, as shown below.

Yes, this is a really great outlook and way up from my earlier expectations, as Lam continues to outperform estimates and benefit from its fundamentally favorable positioning.

However, this excellent outlook and Lam’s great business fundamentals are not reflected in current valuation levels, with broader market pressures leading to Lam shares giving up all the much-deserved gains that came after its very bullish Investor Day.

As a result, Lam shares are now up only 2% YTD and still down 25% over the last 12 months, trading at what I believe to be really affordable prices.

At a current share price of around $73 per share, Lam shares now trade at just 19.5x earnings, which is a small discount to its 5-year average and the semiconductor equipment sector, which it is expected to outperform. As a result, adjusted for growth expectations, Lam shares now trade at a PEG of just 0.9x, a whopping 58% discount to its 5-year average and 43% discount to the sector median. For reference, a PEG below 1 is seen as true value territory.

This very clearly shows that these excellent growth expectations are nowhere near priced into Lam shares right now, leaving considerable room for upside. For example, even if we value Lam at a PEG similar to the sector median, which can be easily justified, it should currently be trading at a share price closer to $99 per share, or a P/E of 26x, much better reflecting the extremely favorable fundamentals and stellar growth outlook.

Furthermore, using a long-term 22x earnings multiple, which seems fair here, I calculate an end-of-fiscal year 2027 target price of $111, suggesting potential returns of 16% annually (CAGR), which is based on my conservative estimates at the low end of management’s 2028 guidance.

In other words, I believe we’re looking at an excellent risk-reward profile, with a base case scenario likely resulting in annual gains exceeding 15%, which should well outpace global benchmarks.

For these exact reasons, I still deem Lam an excellent buy, and I have tripled my position in the company over recent weeks.

Below $80 per share, Lam remains a no-brainer to me.

Very informative. Thanks, Daan! Which one do I sell to make room for LRCX: AMD, TSM or ASML? Or do I trim them up a little and snuck it in? :)

Amazing article Daan! Never would have heard of Lam, grateful that you brought this opportunity to our attention 💪

Just one Q — wouldn’t it be a better strategy to invest FCFs into the business than to pay out dividends / undertake share repurchases? With that kind of firepower, why not look at acquisitions / expanding into newer business lines?