L'Oréal S.A. – This is a true SWAN (A Deep Dive)

A Deep Dive into this beauty/luxury conglomerate!

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

It’s during these turbulent times that we are once more shown the value of reliable, steady, and low-risk investments, which we can rely on when fear and panic rule on Wall Street.

These kinds of all-weather investments/stocks are often referred to as a SWAN, which in the investment context stands for a “Sleep Well At Night” investment. This practically refers to an investment that allows you to sleep well at night without concerns over performance or risk. These tend to be the kind of investments that provide steady, low-volatility returns, allowing the investor to feel confident and worry-free, even during turbulent market conditions.

However, these stocks aren’t abundant or easy to find, let alone trading at favorable multiples. These unique and ultra-high-quality businesses most often trade at high multiples at all times—unsurprisingly. I mean, reliability and steady compounding with very limited risk will always come at a premium.

It is pretty much any investor’s dream. As you can imagine, these tend to be the highest-quality businesses out there. These investments typically emphasize capital preservation, strong fundamentals, and predictable cash flows.

To be awarded the title of a SWAN stock, a company needs to fit several criteria.

First and foremost, it typically has a strong, durable business model—something that’s easy to understand and hard to disrupt. Think of companies with competitive advantages like brand strength, pricing power, or dominant market share.

It also shows consistent and reliable earnings growth. You want to see a track record of profitability and growth across economic cycles, not just during the good times.

A SWAN stock usually has low debt or at least a very manageable debt profile, which reduces financial risk when the economy slows down.

These companies aren’t usually flashy or chasing aggressive growth; instead, they focus on long-term value creation and risk management. All of this contributes to a smoother ride, even when markets get bumpy.

A company matching all these criteria?

Yes! That’s French multinational and cosmetics and beauty giant, L’Oréal.

L’Oreal has an exceptionally durable business model with a lot of brand equity and pricing power. Names like Lancôme, Kiehl’s, and L’Oréal Paris carry trust and prestige, which helps maintain margins even in a competitive environment

L’Oréal has a century-long track record and is a global leader in the beauty and personal care industry—a sector that tends to be resilient through economic cycles. People don’t stop buying shampoo, skincare products, or makeup entirely in recessions, and L’Oréal’s portfolio of brands spans both luxury and mass-market segments, which gives it balance and flexibility.

As a result, it has demonstrated remarkably consistent earnings growth over decades, navigating recessions, currency fluctuations, and even the COVID-19 pandemic with relative resilience. Its revenue base is diversified across product categories—makeup, skincare, haircare, and fragrance—and it’s increasingly leaning into digital and e-commerce, which continues to support growth and stability.

Also, financially, L’Oréal has a strong balance sheet, consistent free cash flow, and a history of increasing its dividend. It doesn’t rely heavily on debt, which gives it stability in times of uncertainty. Plus, it invests heavily in R&D and innovation, ensuring it stays relevant and competitive without compromising its conservative financial profile. Finally, its corporate governance is generally seen as solid, with a long-term focus and disciplined capital allocation.

So yes, while it may not be the fastest-growing or most interesting business out there, L’Oréal fits the mold of a SWAN stock—it offers stability, resilience, and dependable long-term performance that lets investors sleep easy.

As a result, the company has consistently earned a premium multiple, which, combined with its steadily compounding earnings, has allowed it to be an amazing investment over both the last 10 and 20 years, averaging a 15.3% and 12.1% return CAGR, respectively.

Crucially, going forward, I don’t expect this to change, with the beauty industry still as strong and promising as ever and L’Oréal still dominating and taking market share. Therefore, I remain optimistic about its future and view it as one of the best SWAN investments out there.

Meanwhile, shares have struggled over the last year, losing 14% of their value, while L’Oreal has shown no fundamental weakness. As a result, the valuation multiples have come down considerably, and we might just be looking at a very attractive entry point for investors right now.

Therefore, now is the perfect time to take a really close look at this business.

In today’s Deep Dive, I will provide a very detailed look at this French beauty giant, going over its business model, fundamentals, financial health, recent performance, and outlook.

Without further ado, let’s find out all there is to know about this business!

This is L’Oréal!

I know I already introduced the company a bit, but let’s start from the beginning, nevertheless.

L’Oréal S.A. is a French multinational cosmetics and beauty company headquartered in Clichy, France. Founded in 1909, it is the world’s largest cosmetics company, known for its extensive portfolio of brands covering skincare, haircare, makeup, fragrance, and professional salon products—pretty much the entire beauty industry.

Over its decade-long history, L’Oreal has managed to grow into the largest player in the beauty and cosmetics sector through rapid expansion and growth, and many blockbuster acquisitions. Similar to luxury conglomerate LVMH, the company constantly acquires high-end, upcoming brands to strengthen and expand its portfolio.

As a result, the company is a true giant today, generating over €43 billion in annual sales, employing a workforce of over 90,000, a market cap over $200 billion, operating across 150 countries, and operating 37 factories located over all continents, but with most located in Europe.

Today, L’Oréal is more of a beauty conglomerate, with terrific global and industry exposure. Furthermore, L’Oreal has by far the best portfolio of brands in the beauty industry (about 40), including an impressive 12 billion-dollar brands (generating more than €1 billion in annual revenue each). This portfolio includes world-renowned brands like L’Oreal Paris, Lancome, Garnier, Maybelline, CeraVe, Vichy, Kiehls, and Yves Saint Laurent.

For reference, L’Oreal Paris alone is good for €7.5 billion annually as of 2024, making it the #1 beauty brand globally. A staggering 1.1 billion consumers use L’Oréal products on a regular basis.

Through this portfolio of well-recognized brands, the company operates across four key divisions. The Consumer Products segment includes widely recognized brands such as L’Oréal Paris, Maybelline, and Garnier, catering to mass-market beauty needs. The Luxe division features high-end brands like Lancôme, Giorgio Armani Beauty, and Kiehl’s, offering premium skincare and fragrances. L’Oréal’s Professional Products division serves salons and hairstylists through brands like L’Oréal Professionnel, Redken, and Kérastase. Meanwhile, the Dermatological Beauty segment focuses on scientifically driven skincare solutions with brands like La Roche-Posay, Vichy, and CeraVe.

Furthermore, the company is exposed to all beauty sectors, including skin care (39% of revenue), makeup (19%), fragrances (14%), and hair (24%).

As a result, unlike smaller competitors focused on niche markets, L’Oréal’s portfolio covers the entire beauty spectrum—from affordable drugstore brands like Maybelline and Garnier to luxury lines like Lancôme and Yves Saint Laurent Beauté. This diversification provides stability during economic downturns and allows the company to capture growth across all consumer segments.

Indeed, through its broad portfolio of brands, the company is able to reach every demographic or racial group out there, giving it a massive addressable market of an estimated 4.2 billion consumers (roughly half the population), of which the company currently counts 1.3 billion among its customer base, a number the company aims to grow to over 2 billion by 2030.

So, yeah, it’s a pretty insane business, to say the least.

However, most importantly, through this brilliant portfolio of brands and its unequaled global reach, L’Oréal has become a dominant force in the beauty industry across both the upper end of the industry and the lower end.

As of 2024, the company’s beauty industry market share is estimated to be roughly 15.4%.

While maybe not as impressive at first sight, this makes L’Oréal an absolutely dominant force in a highly fragmented industry. L’Oréal is unmatched, being almost twice the size of its closest peer and owning a portfolio of very high-end, well-recognized brands. This gives it a massive moat.

You see, similar to the luxury industry, which the beauty industry is very close to in fundamentals, the beauty industry is all about brand power and size advantages.

L’Oreal dominates in every sense of the word and is reaping the benefits, which is what makes it such a brilliant business, a steady performer, and a very low-risk investment.

Crucially, being twice the size of your closest peer gives you a massive competitive advantage, especially in this industry, with L’Oréal having a big edge over the competition in many ways, making it hard for those smaller players to compete, fueling L’Oréal’s consistent market share gains and growing dominance.

Take L’Oréal’s financial firepower, for example. Similar to its revenue, its R&D and advertising budget also tend to be at least 2x the size of its closest peer. In an industry where product innovation and product/brand visibility are key, this gives the company a massive advantage.

In product innovation, L’Oréal excels, with its investments in biotech, AI-driven beauty personalization, and dermatological research giving it a significant competitive edge. Ultimately, consumers want the best products, and L’Oréal delivers, keeping it ahead of the competition.

Apart from this, L’Oréal’s financial edge also shows in its marketing budget, allowing for unparalleled brand visibility through a large number of commercials and big brand ambassadors. Highlighting this, L’Oréal is the 4th largest advertiser in the world, across every industry that is.

Good luck competing with that.

Finally, on the subject of financial power, its vast financial war chest allows it to acquire emerging brands before they become major competitors, further strengthening its position and expanding into promising areas. Take the acquisitions of CeraVe and IT Cosmetics, for example, which have allowed it to tap into high-growth segments, ensuring continued market expansion.

Crucially, the company has a very good acquisition track record. Take CeraVe, for example. When it acquired the brand, it did €140 million in annual sales. Today, 7 years later, it generates more than €1 billion annually.

L’Oreal knows how to identify the right opportunities in the market and leverages its extensive network and top-notch marketing abilities to propel the brand higher in no time.

Now, apart from a big financial advantage, L’Oréal’s size also gives it unmatched economies of scale, for example allowing it to manufacture, distribute, and market products more efficiently than its peers.

Also, L’Oréal operates in over 150 countries with deep-rooted retail relationships, giving it superior access to both emerging and established markets and top access to consumers through e-commerce, luxury retailers, salons, pharmacies, and mass-market stores.

Its brand simply gets the best visibility, which is key.

So, overall, it seems safe to conclude that L’Oréal has a massive edge over the competition and an indestructible moat, which also seems to grow as these exact benefits are what help it expand its market share.

A successful virtuous circle of compounding dominance. Quite a positive backdrop, I would say.

But… there is even more to like about L’Oréal’s fundamental positioning.

The company is also extremely well-diversified geographically. The company derives most of its revenues from Europe, though still only 32%. North America accounts for 27% of revenue, North Asia accounts for 24%, and the remaining emerging markets account for 17%.

That might just be the best diversification I have seen anywhere. This is a truly global company, and no single continent accounts for more than a third of its revenue, which is just brilliant in my eyes. Most importantly, it shows the company isn’t overdependent on a single economy while also deriving a significant portion of revenue from faster-growing (non-Western) regions.

For reference, while only accounting for 17% of 2024 sales, emerging markets accounted for 36% of growth, which is precisely why I like this exposure.

Even its production is nicely geographically diversified, with its 37 manufacturing facilities spread across every continent, though most are located in Europe.

Finally, before moving to the industry dynamics and financials, I want to highlight L’Oréal’s unique ownership structure. Like many luxury businesses, L’Oréal has a somewhat unique ownership structure. In this case, this structure has been positive, as it has allowed for strategic stability and a long-term focus.

You see, L’Oreal is still largely owned by the Bettencourt Meyers Family, which owns 34% of shares. This is followed by Nestle, which owns about 20% but has been reducing its stake.

With the Bettencourt Meyers family and Nestlé as anchor shareholders, L’Oréal benefits from a stable investor base that supports long-term planning rather than short-term performance pressures. The family has absolutely no interest in short-term movements and focuses on long-term value creation. In this case, those parties holding the most voting rights are fully aligned with shareholders, which is perfect.

Of course, with such ownership, there is always some level of concern over governance and succession, but crucially, the company’s board is 50% independent, taking away some of these concerns.

I can only say I like this ownership structure quite a lot.

The Beauty industry is compelling

Alright, so far so good, right? L’Oreal is a brilliant business with a massive moat. There is plenty to like so far. And there is more.

You see, as with any business, the industry in which they operate determines, to a large part, their attractiveness and growth potential. This is another factor that makes L’Oreal so incredibly attractive and a real SWAN, with the company operating in the steadily compounding and resilient beauty industry.

For starters, the beauty industry has grown at a really impressive and steady pace over the last decade, thanks to steadily increasing demand at a mid-single-digit rate, which is nothing to complain about already.

Yet, even more impressively, the graph above shows that the industry has shown barely any weakness, even as the economy has faced tough years over this period. Simply put, beauty products are a necessity, regardless of the state of the economy or consumer health, and they lead to great revenue stability.

We only saw weakness during COVID-19 when stores closed, leading to lower traffic and sales. Besides, with people obligated to stay inside for most of the time, looking good was maybe less important, I guess. A very unique situation, to say the least.

However, the beauty industry has generally proven to be one of the least economically dependent, least cyclical, and most inflation-resistant.

So, while not a fast grower in any sense, with its mid-single digit growth rarely exceeding 6%, apart from the COVID-recovery years, the amount of stability is precious. Instead, it is a stable compounder. Even during the GFC, the beauty industry maintained positive growth. Consumers simply prioritize beauty expenses.

Meanwhile, the long-term outlook for the industry remains solid. An increasingly wealthy middle class, price growth, and younger generations coming of age are providing plenty of growth consistently. Here is what management said during the most recent earnings call regarding younger demographics:

“Gen Z are the biggest consumer clusters in emerging markets, and their rapidly rising affluence, digital savviness and beauty obsession make them a core target. Second, by 2030, 370 million Gen Z consumers will be over the age of 25, entering a new life stage with more disposable income and a more sophisticated beauty routine. Third, 200 million Gen Alpha consumers will be coming of age in 2030.”

All this provides a tailwind for the beauty industry.

There are also the faster-growing industry vectors, like dermocosmetics. This is a rapidly growing part of the beauty industry as consumers look for healthy and safe skin products. There is also a growing need for skin disorder prevention amid a growing impact from aging, climate change (pollution, exposure to UV rays), and stress. By now, one in four people experience skin disorders, and this number is growing, providing growth for the industry.

Ultimately, driven by all these factors, McKinsey estimates the beauty industry to keep growing at an average 6% CAGR through 2028, with both pricing and volume contributing a low-single-digit percentage.

This provides L’Oréal with a stable and solid underlying market, allowing it to maintain growth.

On that note, let’s delve into recent results and L’Oréal’s financials.

L’Oréal is still firing on all cylinders

L’Oréal released its most recent financial results (Q4) in early February (Q1 and Q3 are only sales updates so I am not counting those) and showed strong 2024 results. The company continues to deliver healthy top-line growth ahead of the underlying market, expanding margins, solid underlying developments, and healthy cash flows.

Starting with the top-line performance, L’Oréal delivered a 2024 like-for-like sales growth of 5.1% to €43.5 billion. This was once again ahead of the beauty market, which grew by 4.5% in 2024, with L’Oréal leveraging its competitive edge.

This growth for the company was driven by 1.4% volume growth and 3.6% value growth, consisting of a 2.1% contribution from pricing and 1.5% from mix. I view this as healthy dynamics in line with long-term averages. Clearly, L’Oréal’s pricing strength allows it to raise prices to offset cost inflation while not suffering from subsequently weak demand.

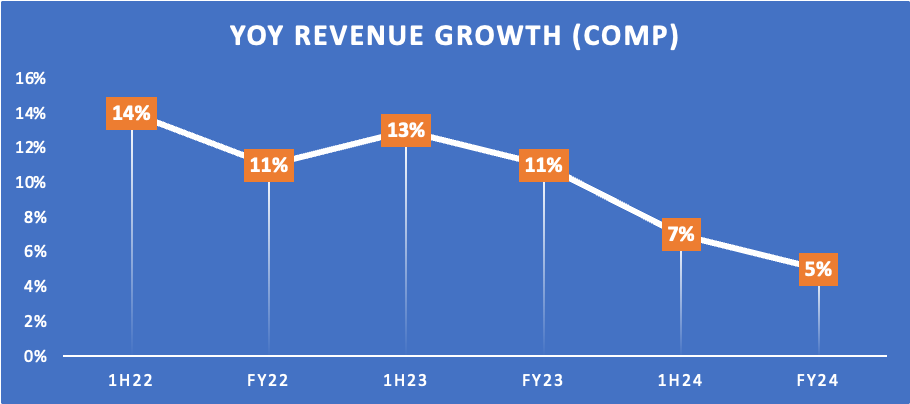

At the same time, while still outpacing the market, we have seen growth for L’Oréal slow down considerably in 2024. In 2022 and 2023, L’Oréal delivered growth in the double digits due to a combination of a dragged-out COVID recovery and decade-high inflation levels leading to stronger pricing growth.

However, with the COVID recovery now fully behind us and cost inflation easing off, these top-line growth tailwinds are disappearing, leading to a slowdown to the mid-single digits. This is nothing but a normalization in growth, which was due to happen at some point.

Nevertheless, growth in H2 was softer than expected, driven by a slowdown in the beauty market from 5.5% growth in H1 to 4.5% for the full year, and the shape of this slowdown was sharper than expected. This was particularly driven by weakness in China, where this was expected to stabilize, it didn’t, but more on that in a bit.

Looking ahead, growth is expected to stabilize here in the mid-single digits, where it has been over the last two decades. For reference, L’Oreal has compounded revenues at a stable yet impressive 7.6% CAGR over the last 5 years and 6% CAGR over the last 16 years, registering only a single year of negative YoY growth, which was 2020.

Absolutely brilliant!

All right, shifting focus back to 2024, notably, growth was driven by all end-markets.

Fragrances revenue grew 14% YoY

Hair grew 13% YoY

Make-up grew 5% YoY

Skincare grew 3% YoY

Furthermore, L’Oréal outpaced the market in each one of its operating segments apart from consumer products, where the market delivered 6% YoY growth, while L’Oréal grew revenue by 5.4%, which was driven by retail weakness in China, where L’Oréal’s market share is even bigger (roughly 34%), making this weakness hurt more compared to peers (and yet it performed better overall).

Professional Products grew 5.3% YoY. This was driven by the ongoing boom in premium healthcare.

Consumer Products grew by 5.4%.

Luxe grew 2.7% YoY (excluding China, this segment saw growth of 10% YoY)

Dermatological Beauty grew 9.8% YoY, hitting $7 billion for the first time due to rapidly growing demand.

As for the regional performance, L’Oréal saw strength across the board, apart from North Asia, particularly China. In this region, the company faced a weak skincare market, where the company absolutely dominates, which is precisely why weakness here hit it harder than its peers. For reference, the company has a beauty market share in Asia of over 30%, compared to 15% globally.

As a result, L’Oreal saw its Asian revenues decline by 3.2% YoY, underperforming the underlying market by roughly 120 bps, driven by this weakness in the Chinese market and lower travel retail sales, which fell by 10% in 2024.

Contributing further to the underperformance here was L’Oréal’s choice to reduce channel inventory amid lower demand, which meant the company had to under-ship the market. This means the company shipped fewer products to retailers to reduce their inventories, which led to additional growth pressure. However, as a result, the company entered 2025 with healthy inventory levels across the regions.

Meanwhile, the company showed impressive strength in its larger and more developed markets, outpacing the market. In the U.S., the company grew 50 bps faster than the market, while in Europe, it outpaced the underlying market by 70 bps (despite an already impressive 20%+ market share), which is really impressive in these very mature markets.

In Europe, the company grew sales by 8.2%, driven by growth in all countries. Growth was also solid in North America at 5.5%, while emerging markets grew strongly, now accounting for 16% of revenue and an even higher percentage of growth.

Due to strength across these regions, excluding Asia, L’Oréal’s 2024 revenue grew by an impressive 8% YoY.

Moving to the bottom line, there is even more to like for investors. Over the last decade and recent years, L’Oréal has shown an amazing ability to expand its margins, and these are absolutely best in class.

For starters, over the last 5 years, L’Oréal has realized 120 bps of gross margin expansion, which has led to gross profit growing even faster than revenue, averaging an 8.1% CAGR.

In 2024, the gross margin hit an all-time high of 74.2%, up 50 bps on a comp. basis, despite a considerable currency headwind, which was offset by price and mix and cost efficiencies. This resulted in a 2024 gross profit of €32.3 billion, up 6% YoY.

Further down the line, this also resulted in a solid operating margin, which expanded by 40 bps YoY on a comparable basis and came in above 20% for the first time ever. Driven by 140 bps of expansion over the last 5 years, the operating profit has grown at an even faster 9.4% CAGR.

These gains are driven by tight cost control, though management is most certainly not holding back on brand investments to fuel its future growth. At all times, the company invests incredible amounts of cash into its operation, particularly into branding through marketing, which includes everything from the commercials you see on TV to its high-end brand ambassadors.

As of 2024, the company invests over €14 billion annually in these efforts, which explains the big difference between the gross and operating margin. This number consistently grows pretty much in line with revenue. As shown below, marketing costs as a percentage of revenue have been fairly stable over recent years at a low thirties percentage.

The same can be said about SG&A, which L’Oréal tightly manages, allowing for these consistent minor margin gains.

As a result of these steadily improving margins and the well-managed cost profile, L’Oréal has been able to deliver solid EPS growth at a 10% CAGR over the last 6 years. In 2024, EPS grew 7.3% YoY to €12.66.

As for some final financial numbers, the company ended the year with a healthy balance sheet, with a net debt of €4.4 billion or €2.5 billion, excluding the financial lease debt. This translates into a healthy gearing ratio of 13.4% and financial leverage of 0.4x EBITDA of over €10 billion in 2024.

This is a very healthy and well-managed balance sheet for a company such as L’Oréal, which earns a pristine AA credit rating from S&P Global.

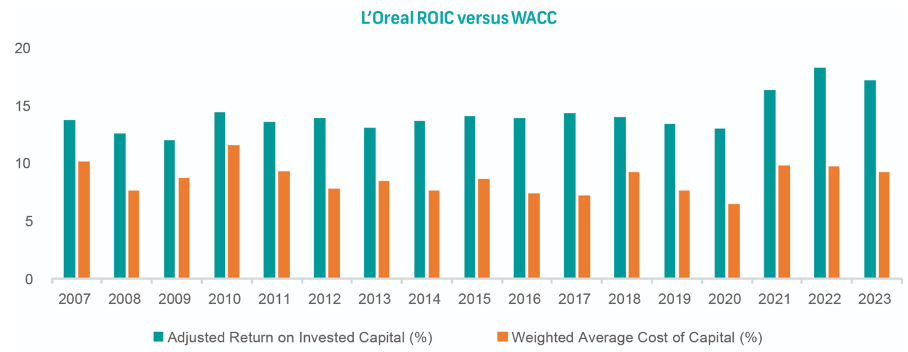

Also, in terms of reinvestment, L’Oréal has consistently performed well, averaging a healthy ROIC of 13%. In any given year, this sits comfortably above its WACC, showing good value creation.

These healthy financials also allow it to pay a sweet dividend, currently yielding 2.1%, which is absolutely nothing to complain about. Meanwhile, the dividend is also growing nicely, having grown at a 10% CAGR over the last 6 years, and analysts project an 8% CAGR through the end of the decade.

This bullish expectation is driven by a healthy payout ratio in the mid-50s and a solid EPS outlook, leaving plenty of room for EPS growth.

Pretty brilliant overall, right?

Let’s move to the outlook!

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe if you like our content! Want to receive even more of our investment insights and show even more appreciation? Please consider upgrading to our paid tier (only $7.50 monthly or just $70 annually).

In addition to all the free stuff, this also gets you access to even more premium analyses (a total of 3 per month), full access to my own (outperforming) portfolio, immediate trade alerts in the subscriber chat, and a full overview of all my price targets and rating, and even more!

Outlook & Valuation

As has already become quite obvious in this article so far, L’Oréal still has a bright future, thanks to the steady compounding of the underlying industry at a mid-single-digit rate and the company extremely well positioned to outgrow this industry driven by continuous market share gain thanks to its massive competitive edge and moat.

For reference, even in its most saturated market, L’Oréal still sees room to grow and expand further, growing its market share. Also, driven by this and industry growth, L’Oréal believes its reach should grow from 1.3 billion customers today to 2 billion by 2030. Finally, acquisitions should also contribute to growth.

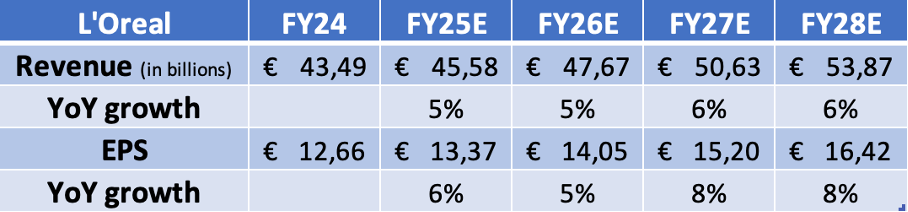

All things considered, it seems fair to assume that L’Oréal will grow its sales at a high end of a mid-single-digit rate, likely between 5% and 7%, and to do so pretty consistently.

Meanwhile, the expectation is for the company to keep steadily expanding its margins, driven by growing operating leverage and cost efficiencies. Operating margin expansion at a 30 bps/year rate, similar to the last 5 years, seems more than realistic, potentially even somewhat conservative. This should bring operating income and EPS growth closer to a high-single-digit CAGR of roughly 7-9%.

Looking a bit more short-term, L’Oréal guides for beauty industry growth in line with 2024, likely coming in between 4% and 4.5%. However, as always, L’Oréal is confident it will outgrow this. Growth should accelerate throughout the year as L’Oréal deploys its strong innovation pipeline, which is looking stronger than ever before, with many product launches coming in 2025. This is expected to pay off throughout the year.

Now, L’Oréal doesn’t provide more detailed information than this, but this likely points to another solid year for the company, with growth likely in line with the longer-term projection at roughly 5-6%.

Ultimately, all things considered and all assumptions made, I project the following financial results over the next four years. This already assumes some impact from tariffs and an economic slowdown in 2025 and 2026. I expect this to put some mild pressure on results in the near term.

In terms of valuation, L’Oréal shares are actually looking the most attractive they have in years, both fundamentally and compared to peers. Based on the projections above, L’Oréal shares now trade at a forward P/E of roughly 28x. Now, I know this might seem like quite a hefty price to pay for EPS growth of just 8-9% at best, but it actually is rather affordable compared to the premium this business has historically been awarded.

You see, this level of consistency, resilience, and quality never comes cheap. A true SWAN like this will always trade at hefty multiples due to the solid growth, very low risk, and low volatility one gets in return. This is pretty much the dream investment for most.

This is reflected in L’Oréal’s average forward P/E over the last 5 years of 35x, which puts it in a similar bracket to the likes of Costco and Hermes in terms of premium multiples.

Another thing all these highly favored stocks have in common is that buying them at a discount to historical multiples almost always results in brilliant long-term returns, as these tend to quickly return to the mean.

Indeed, I believe we are looking at a solid opportunity right here. At 28x this year’s EPS projection, I view L’Oréal shares as attractive and well worth the premium.

For reference, assuming shares will eventually return to a 30x long-term multiple, which I still believe this business is easily worth once sentiment improves and the company once more shows it is a brilliant investment in a downturn, I calculate an end-of-2027 target price of €456 per share. From a current share price of €374, this translates into potential returns of 9% annually (CAGR), which are decent returns coming from an anti-cyclical defensive cornerstone.

In other words, assuming L’Oréal still deserves its massive premium valuation, of which I see no reason it wouldn’t, with the company looking as strong as ever, shares are looking mildly attractive today, with a solid risk-reward profile.

At these prices, shares could turn out to be a solid buy. Though, if shares would show some more weakness and drop below €350 again, I believe this offers even better long-term return potential.

Ultimately, I rate L’Oréal a mild buy at these levels, while I am ideally aiming for a bit more weakness. However, one way or another, this is a company whose shares I would love to own.

Hello Daan

I enjoyed this one as well and got some insight on the company , that to be honest , hasn't come to my attention.

It seems that this company is the best in class in their sector.

It seems that by far from peers they execute the best in their business.

I have also took a look to their biggest direct competitors Shisheido and Estee lauder and it seems obvious who owns this market 😀.

My humble opinion, they own their market, they execute great , I would prefer some more margin of safety on their share price (really the dip around 330 early April was a nice opportunity)

Thank you for the time and effort on this one !

Kostis

Amazing investment case into a truly high quality company! I really want to do a deep dive into the business one day. I particularly like the fact that they drive significant innovation throughout their entire value chain, especially in natural ingredients (which are also great businesses to own imo) which benefits everyone!