Lowe’s Companies, Inc. – A true SWAN stock, one I would love to own (Deep Dive)

Lowe’s is one of the rare companies deserving the SWAN (Sleep Well At Night) stock title, highlighting its insane quality. At the right price, this is a company I would love to own.

Have you ever heard of a SWAN stock? These are typically seen as the highest-quality businesses available and are most definitely the ones you want to own in your portfolio. I certainly do.

A SWAN stock, or a "Sleep Well At Night" stock, is a business that is considered very safe, stable, and reliable, allowing investors to "sleep well at night" without worrying about significant losses or volatility, ideally also giving solid returns.

Typically, these include large, blue-chip companies in industries like consumer staples, utilities, or healthcare, which tend to be more resilient during economic downturns but also slower growing.

So, while SWAN stocks may not outperform the market in a bull run, they often provide a smoother ride with less downside risk, making them attractive for long-term, conservative investors looking for true compounders and businesses with terrific longevity.

In other words, these are the kind of stocks you can buy and never look back, and you’ll be completely fine – their business isn’t going anywhere, and you can count on steady dividend payments and share price returns.

Pretty compelling, right?

You can aspire to outperformance and high growth all you want through unprofitable small caps and software businesses, but nothing beats a compounder you can hold for decades without worrying for a single day about its longevity, financial health, or growth prospects.

Of course, such stocks/investments don’t exist, but a SWAN can come pretty damn close, and since most don’t have the stomach to deal with volatility and uncertainty accompanying high growth, it is probably more profitable to invest in a slow-growing SWAN as well. Oh, and most likely better for your mental health.

Anyway, a SWAN company is typically characterized by:

Strong Financials: These companies have solid balance sheets, consistent revenue and profit growth, and low debt levels.

Stable Dividends: They often provide regular and reliable dividend payments, which appeal to income-focused investors.

Low Volatility: SWAN stocks usually exhibit low price volatility, making them less susceptible to market swings.

Reputation and Longevity: They are often well-established companies with a long track record of success and strong market positions.

Obviously, this is what investors tend to love, and having a few of these businesses in which your capital is “safe” and compounding nicely over time in your portfolio is preferred. In fact, many of these SWANs tend to outperform, primarily due to their excellent quality.

One of the companies matching most of these criteria and sitting high up on my watchlist due to its sheer quality and longevity is Lowe’s Companies, the second-largest home improvement retailer in the U.S.

Lowe’s has turned out to be a brilliant investment over the last decade, with returns from this “boring” business blowing past that of the S&P 500 and leaving many “growth darlings” in its tracks. Over the last ten years, Lowe’s shares have appreciated over 360%, and over the last five years, investors were rewarded with a 120% gain, and that is without incorporating any dividends.

Quite sublime indeed, especially considering the slow growth of the home improvement market and the relatively dull nature of this business.

However, so far this year, Lowe’s hasn’t been quite as strong, with sales and profits falling and its shares underperforming, returning just 10% against an 18% return from the S&P 500.

So, where does that all leave us today? In this Deep Dive, I want to introduce you to this brilliant business and SWAN, discussing its fundamentals, underlying market, financials, recent performance, and prospects.

Is it worth buying Lowe’s shares today, or should you wait for a better entry point? Let’s find out!

Are you here for the first time? Then go ahead and check out all our previous [FREE] content as well, like our recent coverage of adidas, Lululemon, and Uber! You can find it all through the button below! (and, of course, subscribe;))

“Rijnberk InvestInsights is a publication for investors and those looking for easy-to-read and in-depth stock analysis!

We provide your weekly dose of investment ideas, analyses, and updates on some of the most exciting and best opportunities in the financial markets.”

Lowe’s is a brilliant business – A true SWAN.

Lowe's Companies, Inc., commonly known as Lowe's, is a well-established American retail company specializing in home improvement products and services. Lowe's operates a vast network of stores across the United States. The company offers a wide range of products, including hardware, tools, building materials, appliances, and home décor items, catering to both DIY enthusiasts and professional contractors. In addition to its extensive product offerings, Lowe's provides various services such as installation, maintenance, and repair, helping customers with all aspects of home improvement projects.

Founded in 1946 in North Wilkesboro, North Carolina, the company has grown into one of the largest and most recognized home improvement retailers in the world, operating 1,746 home improvement stores and outlets in the United States.

While maybe not as well-known as its larger peer, Home Depot, which easily has twice the brand value and annual revenue of Lowe’s, it has been able to compete quite well in recent years. Today, the company captures roughly 12% of the market, compared to 17% for Home Depot. This market share for Lowe’s has been stable over recent years.

I know 12% might not sound impressive, but the industry remains very much fragmented and has a total worth approaching $1 trillion, so 12% is pretty impressive, actually. This solid position in the industry has allowed it to grow its revenues steadily over the last decade.

Revenue has grown at a 5% CAGR over the last decade. This is a very decent performance and roughly in line with the underlying market. However, it also isn’t mind-blowing or really grabbing your attention, I bet.

Positively, profit growth has been far more impressive, having grown at a blinding 20% CAGR over the last decade.

Furthermore, the company also has a brilliant dividend track record, sitting in the sublime dividend kings bracket. Lowe’s has grown its dividend for a staggering 60 straight years!

Meanwhile, its dividend remains exceptionally well covered by its cash flows, with a payout ratio of 37%. Investors also get a very decent 1.9% yield, and growth has been impressive in recent years as well, with the dividend having grown at a 17.5% CAGR.

I mean, this is pretty damn close to a perfect dividend-paying business.

On top of this, Lowe’s has also been buying back its shares at a blinding rate over the last decade. It has lowered its share count by a whopping 43% over the last decade, which has been a massive growth driver of EPS and the biggest reason this has grown as quickly as it did. Limited margin improvement and 5% sales growth certainly didn’t do the trick. Simply lowering the share count did!

However, not all is positive. What I very much dislike here is the fact that Lowe’s has been consistently funding these buybacks with debt, as it easily surpassed FCF in recent years.

As a result, the company has been forced to take on much more debt, growing its debt burden from $13.5 billion pre-covid (2019) to a whopping $34.2 billion in the most recent quarter. That is more than double in the span of 5 years!

Alright, its cash position has also increased from just $500 million to $4.4 billion, but an end-of-Q2 net debt of $29.8 billion is still more than double the $13 billion from 2019.

The reason? The almost $38 billion Lowe’s has returned to shareholders through repurchases from the end of 2019 through January 2024. FCF in that same period? Not even $34 billion.

I am a big fan of share repurchases as good execution leads to high share value and EPS growth, which has supported most of the outperformance by Lowe’s shares over the last decade, but I absolutely don’t support this being funded by debt as it limits its future financial flexibility. It is just a massive burden.

This is one of the biggest negatives you’ll find in Lowe’s investment case.

The positive is, however, that Lowe’s seems to have at least put one step back in recent quarters and years, slowing repurchases as cash flows struggled and strengthening its balance sheet. For reference, at the start of 2024, Lowe’s held a net debt of $34 billion, so the company has made significant steps in just over six months, which I am glad to see.

You see, Lowe’s has pretty strong cash flows, even as its business is struggling somewhat today, so I do not see the current debt burden as a massive problem. In the end, the company still has an excellent BBB+ credit rating from S&P, ROCE of over 40%, and ROIC of over 30%, and seems to have its debt well under control.

However, I don’t think the company can afford to keep buying back shares at a similar rate as in recent years, which will impact EPS growth going forward. I am not expecting double-digit growth to remain a constant occurrence for Lowe’s. The same can be said about dividend growth.

It is probably best to assume growth to normalize, but that doesn’t mean Lowe’s isn’t still a compelling investment. As clearly laid out above, this company is of insane quality.

Indeed, this blue chip in the steadily growing U.S. home improvement market, which is an industry known for its longevity, matches close to all the criteria for a SWAN business.

On that note, let’s delve into the home improvement industry to determine Lowe’s near and medium-term prospects before diving into the financials!

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Many of its features are free. (Note: this is an affiliate link)

The Home Improvement industry is a compelling compounder with insane longevity

The home improvement market is a fascinating one, but above all, a compelling one due to its longevity, sustained growth, and relative resilience. Don’t get me wrong, the industry is most definitely somewhat cyclical as it depends on mortgage rates, disposable income levels, the health of the housing market, and the state of the economy in general.

However, there is plenty to offset this, leading to the industry growing at a very respectable rate through the cycles helped by cyclical growth drivers, leading to consistent mid-single-digit industry growth.

One of the primary drivers of growth is the increasing trend of homeowners investing in their properties, whether through renovations, upgrades, or essential repairs. This trend is fueled by a combination of rising home values, the desire for personalization, and the need to adapt living spaces to changing lifestyles, such as the shift toward remote work in recent years.

Also, considering more than 50 percent of the homes in the U.S. have been built before 1980, homeowners are likely to continue investing to make these to their liking and livable.

In relation to this, during COVID-19 and coming out of the pandemic, there has been a significant boost in interest in DIY projects, which is expected to persist. This is also amplified by the proliferation of online resources and tutorials that empower consumers to undertake their own home improvements.

So, in terms of the bigger picture here, in the long haul, I most definitely view the home improvement market as a compelling investment, especially for those more value-oriented. Going forward, the industry is expected to grow at a 5.2% CAGR through 2032, which is in line with the growth we have witnessed over the last decade.

And in terms of longevity, investors also haven’t got anything to worry about. I bet people will still be building, renovating, or improving houses in 100 years’ time.

However, I already touched on the impact of economic and consumer health, the industry has been struggling in recent years, also reflected in the financials of both Lowe’s and Home Depot, which can be attributed to both a struggling U.S. economy and cautious consumer spending and the industry dealing with some pulled-forward demand during COVID-19. You see, the industry grew rapidly during the pandemic as people suddenly had a lot of time and money to spend on their homes during lockdowns.

Of course, this was great for the industry and Lowe’s, whose revenues reached an all-time high in 2020, growing 24% YoY(!) and another all-time high in 2021 and 2022.

However, this has obviously resulted in quite a bit of pulled-forward demand as many people have spent a lot on their homes in recent years, which means that today’s demand is less significant. Now, I wouldn’t say this is a massive drawdown for the industry, but it isn’t helping in a time of economic uncertainty and insanely high mortgage rates.

You see, due to these mortgage rates, currently around 6%, people are moving less often than they typically do, which has resulted in housing turnover sitting near the lowest levels since the mid-1990s. This isn’t great for home improvement demand and for Lowe’s.

For 2023, this resulted in the market shrinking by 1.8%, which impacted Lowe’s. And this weakness continues to linger today, clearly reflected in Lowe’s financials, which I’ll highlight in a bit.

Positively, the industry’s outlook does seem to be slowly improving, with a more optimistic view for the second half of 2024. Especially the expected rate cuts should positively impact the industry. While mortgage rates will continue to hover around the 6% range, these are expected to move lower later in 2024 and into 2025, which should positively impact the industry.

Also, the near-term growth drivers, like continuously appreciating home prices, disposable income outgrowing inflation, people still working from home, and the aging housing stock, remain in place. Even as the economy struggles and consumer spending is down, people will need to repair and improve their homes.

Interestingly enough, home improvement is both a discretionary and necessary item. This also means the drawdown in the industry is never too significant. For example, while the industry didn’t grow during the GFC in 2007-2010, growth also didn’t turn really negative.

So, making up the balance, it is worth pointing out that the industry is expected to keep compounding at a stable mid-single-digit CAGR for the foreseeable future, which is great. Yet, near-term uncertainty persists, although with an improving outlook.

All in all, there is plenty to be enthusiastic about despite short-term weakness.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. We try to keep all our analysis free for all of you to enjoy and benefit from!

Want to support our work a little bit more and show your appreciation? Consider upgrading to paid (only $5 monthly).

This allows me to push out even more content and gets you premium access to:

My personal portfolio, which has consistently outperformed the market.

My monthly ‘Top Buys’ list.

The InvestInsights Weekly Update, containing all my personal transactions, a market update, and some actionable investment ideas (coming soon!).

Lowe’s finances reflect industry weakness.

Moving to the finances of Lowe’s, it reported Q2 earnings halfway through last month and delivered a mixed report. As will be clear by now, Lowe’s is dealing with a challenging operating environment with a particular weakness in the DIY part of the market, which is exactly the part to which Lowe’s has by far the most exposure.

This demand weakness, originating from cautious consumer spending in the U.S., is clearly reflected in its financials, with the company missing the Q2 revenue consensus by 2% or $370 million and it cutting its FY24 outlook. Obviously, this isn’t quite what investors were hoping for, but it also didn’t come as a massive surprise.

On a positive note, Lowe’s did outperform in terms of profits, with EPS surpassing the consensus by 3%.

Getting into more detail, Lowe’s reported second-quarter sales of $23.6 billion, with comparable sales down 5.1% YoY, with positive growth in Pro and online sales offset by softness in DIY demand.

Coming out of the pandemic, growth for Lowe’s normalized quite quickly to the low-single digits in 2022 before entering negative territory in 2023 and so far in 2024 as consumer spending weakness kicked in and interest rates skyrocketed.

However, I would also argue that these numbers should be put into perspective. You see, as I explained before, the company reported insane growth during the COVID-19 pandemic due to pulled-forward demand. However, so far, even amid current weakness, the company is still expected to deliver FY24 revenue easily $10 billion above pre-COVID levels or roughly 15% higher, which is quite remarkable considering the underlying dynamics.

In other words, there was never any chance of the company keeping up its normal mid-single-digit growth rate coming out of the pandemic, with demand at some point having to normalize. Considering this, the numbers above don’t look too shabby, and management is executing quite well, focusing on investing in growth opportunities and managing its expenses.

Also, we can see sales have likely bottomed already, with growth rates improving in recent quarters and the industry expected to rebound and return to growth in 2025, driven by lower interest rates. Therefore, I expect growth to improve throughout the remainder of 2024 as well.

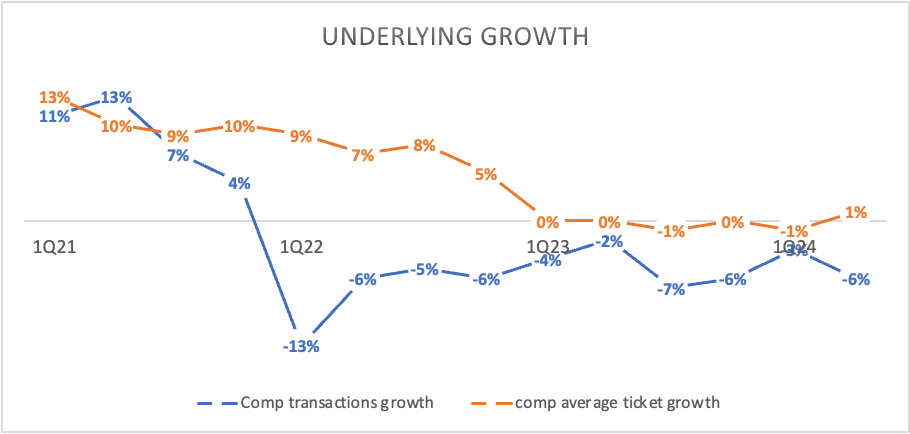

Meanwhile, in terms of the Q2 numbers, it is worth pointing out that the total number of transactions saw particular weakness, down 5.9% YoY, primarily due to lower DIY spend. On the other hand, average ticket size was up 1%, helped by Pro, and still a positive impact from inflation, although this is normalizing.

In prior quarters, inflation turned out as a solid tailwind as higher prices and average ticket sizes helped offset transaction weakness, as highlighted below. However, both have been normalizing in recent quarters, with customers returning and making more purchases, but this is offset by normalizing prices. Moving forward, I expect comp average ticket growth to remain in current territory and comp transactions to return to growth as we enter 2025.

Standouts last quarter were both the Pro segment and digital sales. The Pro segment did grow solidly by mid-single digits, thanks to management’s continued efforts in capturing market share here, and online sales also delivered positive comps.

Over the years, Lowe's has focused on enhancing the customer experience through digital transformation and innovation, including developing a robust online platform and mobile app, which has been boosting growth, especially among younger generations.

As of fiscal FY23, online still only accounted for 11% of total sales, leaving Lowe’s with plenty of room to boost its online presence. The company is actively expanding its delivery availability, expanding same-day delivery options, and partnering with Uber, Doordash, and Instacart to extend its reach into both urban and suburban areas, boosting incremental sales.

This omnichannel strategy is definitely paying off for Lowe’s and will help it grow far into the future.

However, even more exciting is the company’s growth opportunity in the Pro segment. The company has been investing heavily in better aiming its product catalog and stores to attract Pro customers. It has also invested heavily in updating its CRM tools and partnership programs to better service this customer base.

You see, as of FY23, Pro still only accounted for 25% of total sales for Lowe’s, with 75% coming from far more economically sensitive DIY customers. For comparison, Home Depot derives over 50% of its sales from Pro’s.

Positively, Lowe’s has seen great traction in recent years, taking market share and growing its Pro sales at a double-digit rate consistently. Even today, Pro sales remain positive, outgrowing its larger peer.

Going forward, Lowe’s continues to aim for Pro sales to grow 2x as fast as its DIY segment, as it hopes to gain market share, and looking at developments in recent years, I do expect Pro to remain a growth driver for Lowe’s.

Furthermore, as do-it-yourself (DIY) customers are pulling back on both spending and projects, the pro segment represents a much steadier business for home improvement retailers, so as this grows as a percentage of total revenue for Lowe’s, this will positively impact economic sensitivity as well.

Ultimately, I expect both the push into digital and the Pro segment to boost sales growth for Lowe’s, potentially allowing it to outgrow the underlying industry.

Now, finally, let me take you through the bottom-line numbers. In the most recent quarter, Lowe’s reported a gross margin of 33.5%, down 20 bps YoY, mainly due to continued supply chain investments. The gross margin has been mostly stable for the last couple of years, hovering in the 32-34% range due to factors like higher input costs and growth-oriented investments cancelling out margin gains from efficiency improvements and cost management.

Further down the line, this is much of the same. The operating margin in Q2 was down 110 bps YoY due to steady operating costs but a declining top line. Positively, once the underlying environment improves, I expect Lowe’s to quickly improve its margin again to a range of 15% to 17%, with further gain possible in the year ahead as it grows its Pro share and online business.

In the end, for Q2, the declining margins led to a 10% decline in EPS to $4.10, but again, the trend is improving here, with a bottom likely behind it. Once top-line growth and margins improve, so will EPS.

Meanwhile, Lowe’s FCF actually remained pretty respectable at $2.7 billion in Q2, which for once actually fully covered shareholder returns of $1.6 billion, allowing it to strengthen the balance sheet.

Outlook & Valuation

Turning to this year’s guidance, Lowe’s management was forced to cut its expectations for this year due to a lot of growth and rate cut uncertainty. As a result, management projects sales in the range of $82.7 billion to $83.2 billion, with comparable sales down 3.5% to 4%.

Furthermore, the operating margin is now expected to come in between 12.4% and 12.5%, down roughly 90 bps YoY. This should translate into an EPS of $11.70 to $11.90, down roughly 10% YoY.

Looking ahead, while the recent performance by Lowe’s wasn’t great, the narrative is improving, and the company should return to growth in 2025, after which I expect it to perform roughly in line with the underlying industry, growing its sales by low-to-mid-single digits.

Meanwhile, recovering margins and continued buybacks (although much slower) will drive up EPS to the high teens in the medium term and potentially into double-digit territory in a more optimistic scenario where the company manages to gain more market share and the economy doesn’t worsen much further.

This leads to the following growth expectations.

Based on the projections above, Lowe’s shares are currently trading at roughly 20.5x this year’s earnings and 19x next year’s earnings, which is quite a premium to its historical averages. Over the last five years, which includes a high growth period, shares traded at an average P/E of 17.5x, making today’s multiple a roughly 15% premium despite somewhat uncertain prospects. Also, this is a 32% premium to the sector average.

Looking at its current PEG, the situation doesn’t change, with a 2.2x PEG ratio sitting 10% ahead of its 5-year average. However, on a TTM P/E/ basis, shares don’t seem that expensive, trading at 20x earnings compared to a 6-year average of 22.6x.

Nevertheless, my conclusion remains that shares are trading at a premium today, which I have some trouble explaining. Alright, its larger peer, Home Depot, does trade at an even more demanding premium of 23x next year’s earnings with very similar growth prospects, so from that perspective, this might just be Lowe’s closing in on Home Depot, but I still think today’s price is demanding, even for a high-quality business such as Lowe’s.

Don’t get me wrong here; the title of this analysis is true. I really want to hold Lowe’s in my portfolio. This company is a solid compounder with incredible longevity in its key business and with solid growth prospects.

However, with growth not expected to match that of the last decade, so won’t the returns for investors, and from that perspective, no matter its quality, I am not eager to buy at current levels.

Per indication, let’s use 20x earnings as a fair value multiple based on current prospects. This is somewhat ahead of its historical averages and not too far away from its current multiple, but Lowe’s is closing in on Home Depot with a higher Pro share of revenue, so a multiple closer to that of its closest and larger peer seems justified.

Using this multiple and my FY26 EPS estimate, which is slightly ahead of the Wall Street consensus, I end up with an end-of-2026 target price of $284, which translates into annual returns of only 6% or 8%, including dividends.

Indeed, this doesn’t offer a really favorable risk-reward at this time. Ideally, I would like to pick up shares below $230 per share as this would translate into annual returns exceeding 10%, making it a much more compelling investment and potential outperformer.

Therefore, I rate shares a hold for now, eyeing a small dip in the share price before starting a position in this SWAN stock.

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

Great post about this interesting company! But I must say that I prefer Home Depot.

Would you say Lowe’s is stronger among professional customers compared to Home Depot?