While Lululemon Athletica LULU 0.00%↑ might not be the best-known brand out there, especially outside of North America, it is one of the rising names in apparel/sportswear and one of the brands and companies I am most enthusiastic about, both as a consumer and an investor.

In my view, Lululemon remains one of the most exciting companies. It has a massive growth runway through expansion in all verticals, industry-leading margins and exceptional profitability, and a sublime management team and growth strategy. In my opinion, this company is a must-own, and I believe the most recent sell-off following the Q4 results presents investors with a tremendous opportunity to add to an existing position or initiate one.

For those unfamiliar with the company, Lululemon Athletica Inc. is a prominent Canadian athletic apparel retailer with a global presence, renowned for its high-quality yoga-inspired clothing and accessories. Established in 1998 by Chip Wilson in Vancouver, British Columbia, the company swiftly rose to prominence by blending performance, style, and innovation in its product offerings.

Their product line includes yoga pants, sports bras, running gear, outerwear, other sports-specific apparel, and everyday clothing, all meticulously designed to provide both functionality and aesthetic appeal. This is where Lululemon excels and differentiates itself from the competition – premium products and craftsmanship.

No competitor, including Nike or Adidas, can match Lululemon's product quality and material innovation. Lululemon consistently innovates with its materials and fibers, bringing best-in-class quality products to market with optimum functionality and aesthetic appeal. I personally swear by their shorts… Nike can’t match it.

Consequently, Lululemon aims at the higher-income consumer, and its products are quite expensive. For example, its shorts are generally 50-100% more expensive than those of Nike. However, this has made it extremely popular among higher-income individuals who don’t mind spending extra for higher-quality products.

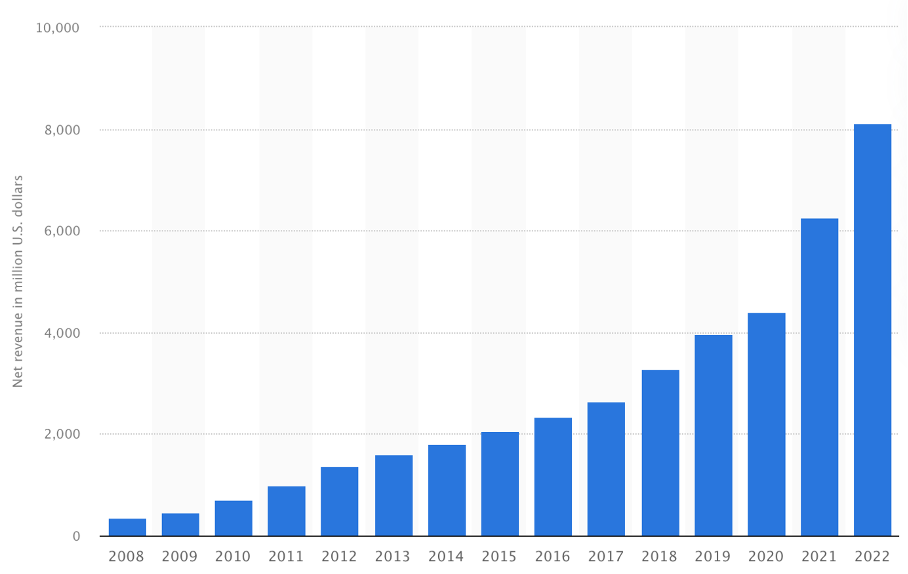

Furthermore, the brand is also gaining popularity among younger generations, thanks to its yoga-inspired brand profile and entry-level luxury profile. As of a 2022 survey, the brand was the second most opulent among Gen Z, only falling behind Nike but climbing the ladder rapidly. This positions it favorably for growth and the future. Its distinct brand profile and growing popularity are the reason that it has been able to grow revenues at a rapid CAGR of close to 20% over the last decade.

Meanwhile, this differentiation from competitors means it remains exceptionally well positioned for continued growth, with its brand awareness still rather low, especially outside of North America. For reference, 53% of the company’s physical stores are located in the U.S. and 64% in North America, followed by China at around 20%.

In addition, the company has been focused on women’s apparel for most of its history and has a lot of market share to gain in the men’s segment, in which it is heavily investing, offering it another growth vertical. This is all part of the company’s Power of Three 2x growth strategy, a 5-year growth plan initiated in 2021, aiming to double its revenue by 2026 to over $12.5 billion.

The strategy focuses on product innovation, which includes introducing new products and expanding its men’s segment (target to double men’s revenue); market expansion, which refers to international expansion (quadruple international revenues); and guest experience, which speaks for itself, really (triple digital sales). So far, the company is on track to outperform its own objectives.

Regarding retail strategy, Lululemon operates through a mix of brick-and-mortar stores and e-commerce channels, allowing customers to conveniently access their products online and offline. The company has strategically expanded its physical footprint globally, with stores in key metropolitan areas and high-traffic locations. As of the end of 2023, the company operated 711 stores globally, mostly in the U.S. Also, note that the company makes no use of wholesale channels but controls all sales in-house.

Lululemon reported solid quarterly results

Lululemon reported Q4/FY23 earnings on March 21. The Q4 results were above management's updated guidance from January and topped the Wall Street consensus on both the top and bottom lines as LULU continues to perform well, taking market share.

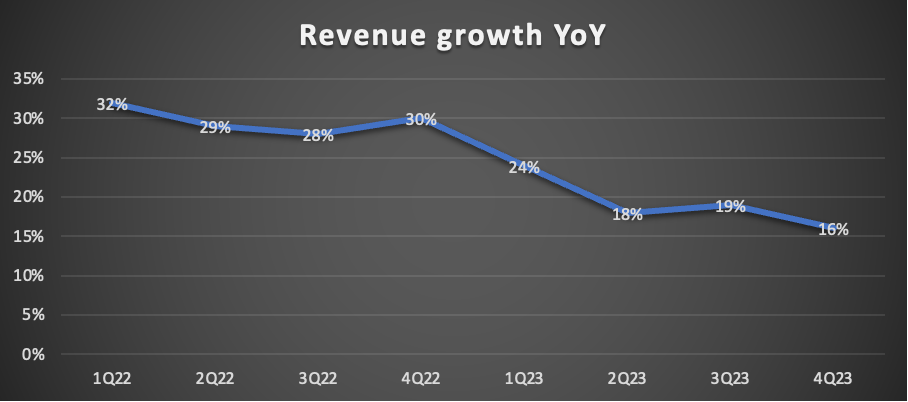

Revenue grew 16% YoY in Q4 to $3.4 billion, far ahead of Nike’s 0.3% growth. This was driven by comparable sales growth of 12% and some price growth to correct for inflation. While growth has been slowing down almost every single quarter over the last two years, this is as expected and should not come as a surprise.

The company has been growing quickly, and as it grows, it is hard to keep reporting growth rates in the 20-30% range, especially in an environment with decade-high interest rates, hot inflation, and depressed consumer spending levels. This growth slowdown was inevitable and should normalize once economic sentiment improves later in 2024 and into 2025, flattening the trend.

Meanwhile, growth in Q4 was driven primarily by regions outside of North America, with China growing by 78% and the rest of the world, including Europe, by 36% YoY. Meanwhile, growth in the U.S. remained steady at 9%, far ahead of the few percentages reported by Nike, and still looking quite solid in a challenging environment.

By channels, store sales grew by 15% YoY, driven by 6% comparable sales growth. This growth was helped by store growth of 8.5% and square footage growth of 15%, as LULU is still very much expanding its global presence. Meanwhile, digital sales still outgrew store sales, growing 17% YoY and now accounting for 52% of revenue. From the start, LULU has been committed to its online channels, which is working out great.

Breaking sales down further, men’s and women’s growth remained solid, growing by 15% and 13%, respectively. I keep being impressed by the growth LULU reports for its women’s segment, which already accounts for the majority of sales. Still, this segment is growing at close to the same rate as the rapidly expanding men’s segment, which speaks to the brand’s appeal.

Overall, the company delivered excellent and industry-leading growth in Q4, leading to FY23 revenue growth of 19% YoY to $9.6 billion, putting it ahead of schedule with regard to its growth strategy. Honestly, growing revenue by 19% in this environment is quite the performance.

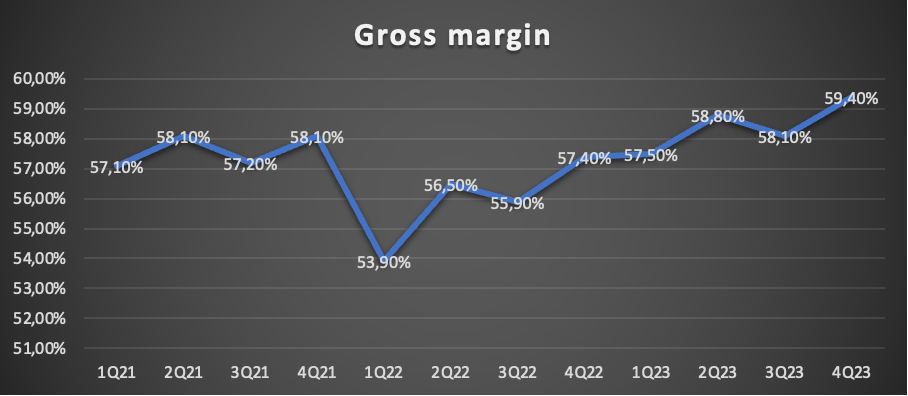

Moving to the bottom line, the company delivered financials that were just as impressive. Gross profit was $1.9 billion in Q4, translating into a gross margin of 59.4%, up 200 bps YoY, which is an excellent performance. This is a record-high gross margin for LULU and far ahead of management’s expectations. The majority of this revenue gain was driven by a higher product margin “driven primarily by lower air and ocean freight costs, as well as lower air freight usage,” according to management per the earnings call.

LULU has consistently improved its gross margin over recent years as its operating leverage grows. This has propelled margins to industry-leading highs, far ahead of industry leader Nike, which reported a gross margin of 44.4%. This is primarily due to LULU’s focus on higher-end apparel and consumers, as well as its excellent cost structure.

However, the gross margin improvement wasn’t entirely reflected further down the line. This was primarily due to SG&A expenses in Q4 coming in around $990 million, up 23% YoY, rising to 30.9% of revenue, which is up 190 bps YoY.

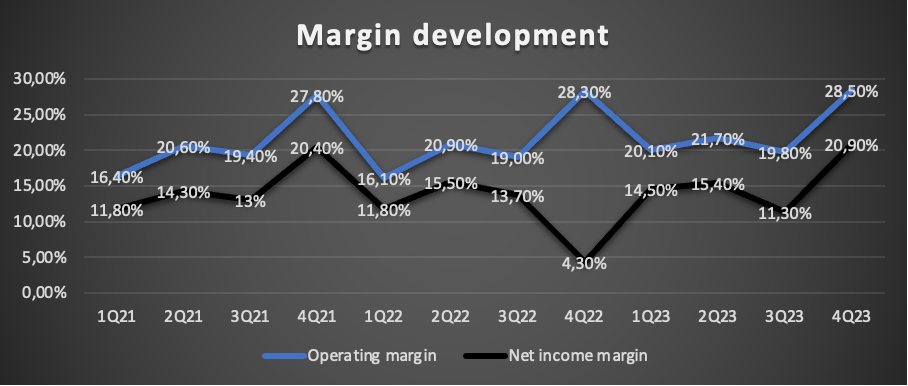

As a result, operating income came in at $914 million, representing an operating margin of 28.5%, up just 20 bps YoY but still reaching an ATH. This led to a net income of $669 million, reflecting a net income margin of 20.9%, up 50 bps from 2 years ago (4Q22 was remarkably low due to one-offs). This resulted in an EPS of $5.29, up 20% YoY, which is nothing short of impressive.

On a full-year basis, the operating margin expanded by 110 bps, and EPS grew by an impressive 27% YoY. Cash flows across the board grew strongly in 2023, and this also allowed the company to meaningfully strengthen its balance sheet, growing its cash balance by over $1 billion to $2.24 billion against total debt of $1.4 billion, leaving it in a healthy net cash position. This is after the company started repurchasing shares in 2023, buying back $550 million worth of shares. This leaves it with $1.2 billion left under its current authorization.

Overall, the result highlights that the company continues to perform well, even as growth slows down somewhat and it faces a more challenging consumer spending environment. After a solid performance in the first two years, it remains on track to outperform its growth targets set at the start of 2022.

For reference, revenue has grown at a CAGR of 24%, fueled by a 44% CAGR internationally and market share gains across the board. Gross margins have expanded by 120 bps, and EPS has grown at a 28% CAGR. Impressive indeed!

Meanwhile, according to management, the company is still very much in the early innings of its growth story, and we couldn’t agree more. Just consider that brand awareness in the U.S. is still only just over 30%, while internationally, this sits below 10% in most regions.

Looking at its Power of Three x2 growth strategy, the company has made significant strides in terms of product innovation. In February, it launched its first shoes designed for men, which is an important step in the right direction and shows that it is still very much innovating and penetrating new markets.

The company has little presence in footwear but has a massive opportunity. It approaches the industry in the same way it does with apparel—by focusing on high quality and product innovation. Since it has proven successful with this strategy, I am optimistic about its chances, especially in sports categories where it has a strong presence, like Golf and Tennis. Therefore, I expect footwear to be a great growth driver over time.

Meanwhile, Management also indicated that it expects to introduce the most innovation in a single year in 2024 in the men’s segment. In addition to introducing a men' s-specific shoe, management will also release new fabrics and a refreshed line of Pace Breaker shorts, which have proven very popular. LULU’s product innovation remains one of its key competitive advantages, and I am bullish on any new product releases.

Then, there is market expansion, where the company has also been doing well. As indicated before, the company has continued to significantly expand its global store footprint, especially internationally. For 2024, it expects to grow its store count by another 35-40 stores, with at least 30 located outside North America. For reference, in terms of revenue, international still only accounts for 21%, and driven by this expansion, international growth should remain strong in 2024, even in the face of consumer weakness. Over time, management wants to grow this percentage to over half of revenues.

However, much more interesting are the company’s efforts in growing its brand awareness, where it has had a successful year. As mentioned before and reiterated by management during the earnings call, LULU still has very low brand awareness worldwide, leaving it with a massive runway for growth through simple marketing.

A big move on this front is the company’s deal with the Canadian Olympic Committee and the Canadian Paralympic Committee, which means LULU will be the kit sponsor of the Canadian teams during the coming Summer Olympics, giving the brand a lot of exposure.

Through these kinds of marketing efforts, management was already able to grow brand awareness in key markets in 2023, including the U.S., which went from 25% to 31%, and China, where this grew from 9% to 13%. Still, this is extremely low, leaving it with plenty of growth potential by simply introducing its brand to consumers.

Regarding the customer experience, management reported solid growth in premium members, up to 17 million after one year, which is quite impressive. Through its membership program, LULU offers members exclusives like early access to sales or new products. Management aims to increase brand engagement, buying frequency, and overall spending through this program, which are important growth drivers. Therefore, the solid adoption of the membership is quite promising and important.

Fundamentally, management continues to steer the company in the right direction, which bodes well for its long-term growth outlook. However, the outlook might not be as positive in the short term.

Outlook & Valuation

Now, this is where the story gets a bit less optimistic. While the company has grown quite strongly in 2023, management acknowledged that it has been feeling the shift in U.S. consumer spending behavior so far in 2024, starting the year quite slowly.

As a result, management now guides Q1 revenue between $2.18 billion and $2.2 billion, representing growth of 9-10%, a slowdown from the 16% growth reported last quarter, reflecting the challenging market dynamics in the U.S.

Furthermore, management guides for a flat gross margin of around 57.5% and SG&A as a percentage of revenue to increase by 130-140 bps YoY, driven by increasing marketing investments. As a result of growth here, the operating margin is expected to decline by 130-140 bps YoY. However, this will likely normalize in Q2 through Q4 as SG&A growth eases. This also results in limited EPS growth to an estimated $2.35 to $2.40, up just 4% YoY in Q1.

For FY24, management now guides for revenue growth of 11-12% to roughly $10.75 billion, which is quite a slowdown from 2023 in terms of top-line growth, reflecting a worsening operating environment in the U.S. but an improvement in H2.

Gross margin is expected to be flat across the year, and SG&A is only expected to grow by 10 bps as a percentage of revenue for the full year. Finally, EPS is expected to be between $14 and $14.20, reflecting growth of 10.4% at the midpoint, slightly below top-line growth. This reflects a slight margin decline on the bottom line due to little to no gross margin expansion and growing costs.

However, it is important to note that LULU management has a history of guiding quite conservatively, positioning it for raise-and-beat quarters. For reference, the company has beaten top and bottom line estimates in every single quarter since Q1 2020.

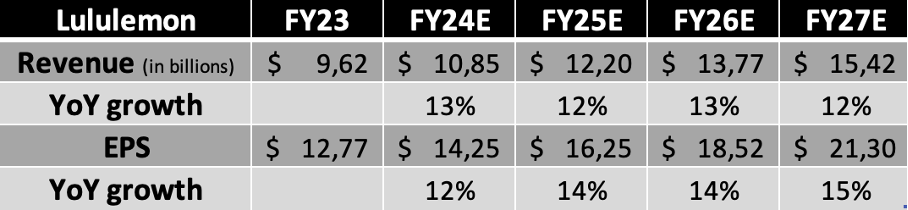

I don’t believe this year will be any different. Therefore, I anticipate FY24 revenue growing by 12.8% and EPS growing by a slightly lower 11.6%, which is above the Wall Street consensus, although only marginally. Check out our full financial projections below.

Based on these estimates, shares now trade at just over 27x this year’s earnings, which is in no way cheap in the current economic environment. For reference, Nike trades right around 23-24x times earnings. However, the company is also in a unique position where it is able to keep growing quite strongly right now, while larger and more mature peers like Nike or Adidas are very much struggling.

Furthermore, the company has a massive growth runway ahead of it and is by far the best positioned in the industry. It is just a sublime company with excellent management and healthy, industry-leading financials.

Therefore, I am happy to pay a premium for this company. It has incredible potential to become a stellar long-term compounder, and I believe investors should grab the recent sell-off opportunity with both hands to add this company to their portfolio or add to an existing position.

Looking at its long-term potential, we believe a 30x earnings multiple is quite fair. Based on this multiple and our FY25 EPS projection, we calculate a target price of $488, right around Wall Street’s $480 price target, and positioning investors for returns exceeding 11% annually.

Therefore, as will be clear by now, we put a “buy” rating on the shares. We believe the sell-off presents investors with an opportunity and have added shares to our position for this exact reason. This company hardly ever trades at a discount.

However, we do add to this that there could be some further downside in the coming weeks as sentiment toward this industry is quite negative. However, timing the market is a foolish game, which is why we added shares the second these entered our buy window.

Let us know what you think of Lululemon shares below!

Let us know your thoughts in the comments! Also, please leave a like if this post was of value to you!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

Really good article, I believe LULU is on the growing stage and has a lot of room to grow !!

I think the price now is a little bit overvalue but in the right price it is a really good stock to own for the long term.

I currently holding Nike so I wouldn’t add this one to my portfolio since they are in the same industry, but it is for sure I good stock to own.

Thanks for sharing 👊🏻

These deep dives just keep getting better man!!