Market Review – Disinflation stagnates, and rate cut hopes disappear.

Let's take a close look at the state of the U.S. economy, the disinflation process, and market projections.

We saw this coming from a mile away…

You are not going to tell me that recent hot U.S. inflation data and job reports came as a surprise. They sure do not come as a surprise to us and should not be a surprise to those who have been reading our market reviews in recent months.

In these, I usually discuss some of the economic and market headlines and lay out our views and perspectives. Not much has changed since our last one, or at least not in our view.

Our thorough analysis in recent months has consistently highlighted the market's over-optimism about expected rate cuts. We've been preparing our readers for the likelihood of higher and stickier inflation levels in 2024, which, combined with a resilient labor market, should delay a first-rate cut until at least the second half of the year.

In our last market review post from late March, we pointed to a first cut in September and a total of 50-75 bps of rate cuts in 2024. However, looking at the latest data, we might even have been somewhat overoptimistic with those expectations, which were already far below the market’s expectations at that time.

Even after the Fed turned out to be quite dovish after its last meeting, current economic data does not leave any room for a rate cut any time soon. Yet, crucially, back in March, after the latest Fed meeting, Fed chair Jerome Powell stated that they continue to aim for three rate cuts in 2024 or 75 bps, which boosted investor confidence.

This was quite a surprise. Data in preceding months already showed stabilizing inflation levels above 3% and incredibly strong labor market data, which should have led to a revision of the dot plot.

The Fed did lower its 2025 rate cut expectations, which was a first sign of lesser confidence, in hindsight. Still, their overall views and comments were quite dovish, pointing to solid rate cuts in 2024, which was quite a surprise and has misled the market a bit.

Fast-forward roughly 1.5 months, and macroeconomic data continues to worsen. Inflation levels are rising again, economic growth remains solid, and the labor market barely weakens, simply not allowing the Fed to cut rates any time soon.

This was confirmed by Fed officials increasingly sounding more Hawkish. For example, Atlanta Fed President Raphael Bostic recently said that right now, only a single rate cut is likely in 2024, only occurring by Q4 as disinflation stagnates.

Also, Dallas Fed President Lorie Logan said that reaching the 2% inflation target is getting increasingly more difficult with a lot of uncertainty ahead, making it too early to consider a rate cut. These are her exact words:

“Nevertheless, in light of these risks, I believe it’s much too soon to think about cutting interest rates. I will need to see more of the uncertainty resolved about which economic path we’re on.”

Her words followed those of Minneapolis Fed President Neel Kashkari, who expects no rate cuts at all this year after recent data came out. He even believes rate hikes are still on the table. Fed governor Michelle Bowman shared this opinion, saying that if inflation fails to fall or continues to reverse, rate hikes are still a consideration.

Clearly, sentiment hasn’t improved since the last Fed meeting in March, and for good reasons!

The latest economic data paints a scary picture

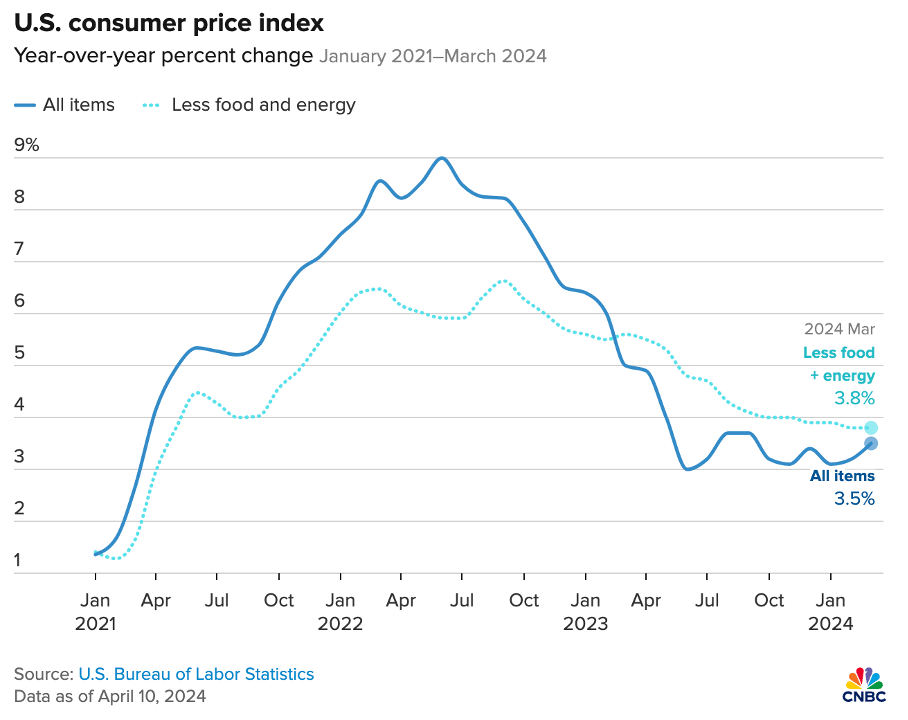

Looking at the latest data, last week’s CPI report jumped out. March CPI came in far hotter than expected, further demolishing any hopes for an early cut. March CPI, “a broad measure of goods and services costs across the economy,” as CNBC described it, was up 0.4% for the month, pushing the 12-month inflation level up 0.3% from February back to 3.5%, nowhere near the Fed’s 2% target and trending in the wrong direction.

Furthermore, this was above the 0.3% and 3.4% consensus, pushing all major U.S. indices down roughly 1% last Wednesday.

Core CPI, which is more important to the Fed as it excludes volatile food and energy components, also exceeded expectations and grew 0.4% for the month and 4.8% on a 12-month basis. Crucially, shelter costs remain a significant inflation driver, which refuses to slow down against the Fed’s expectations. Shelter cost inflation was 0.4% and 5.7% YoY, which remains substantial, especially when considering this accounts for about a third of core CPI.

With this being the third consecutive strong reading, we can safely say the disinflationary narrative has come to a stop. This not only completely destroys any chance of a June rate cut but can also have long-term consequences on the Fed’s decision-making. This is how Seema Shah, chief global strategist at Principal Asset Management, explained it:

“In fact, even if inflation were to cool next month to a more comfortable reading, there is likely sufficient caution within the Fed now to mean that a July cut may also be a stretch, by which point the US election will begin to intrude with Fed decision making.”

Joseph LaVorgna, chief economist at SMBC Nikko Securities, added the following after the CPI report:

“inflation will remain higher than what is necessary to warrant Fed easing. In this regard, Fed cuts will be pushed out to into the second half of the year and are likely to fall only 50 basis points with risks being tilted in the direction of even less easing.”

We couldn’t agree more with this view.

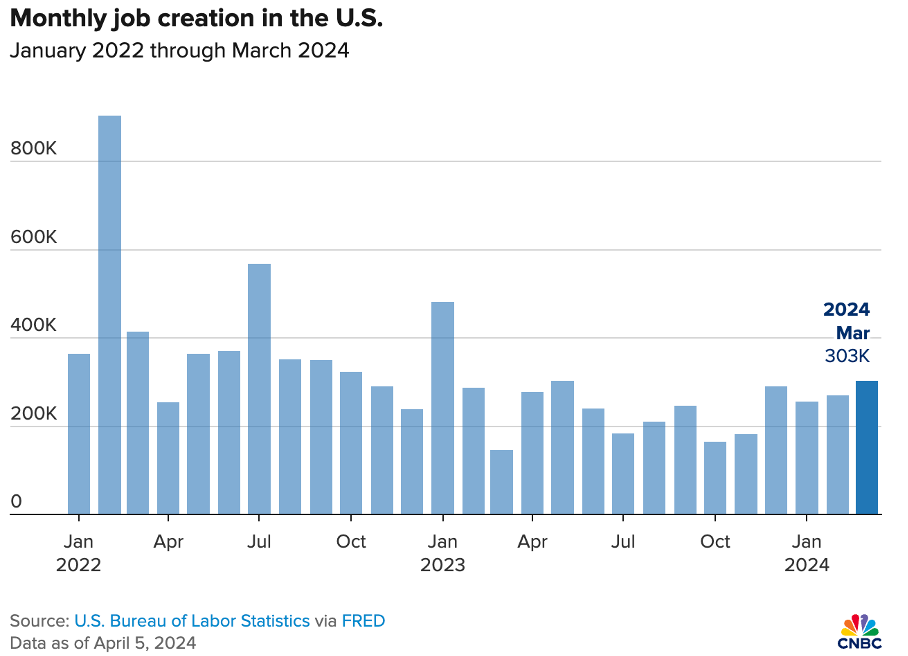

Moving onto another important part of this equation, let’s focus on the labor market, which isn’t developing quite in the direction the Fed wants to see. The latest report from the U.S. Bureau of Labor Statistics showed that in March, employers added 303,000 jobs, the largest gain since January 2023, so in over a year, which suggests the labor market remains in a good place and is showing no weakness.

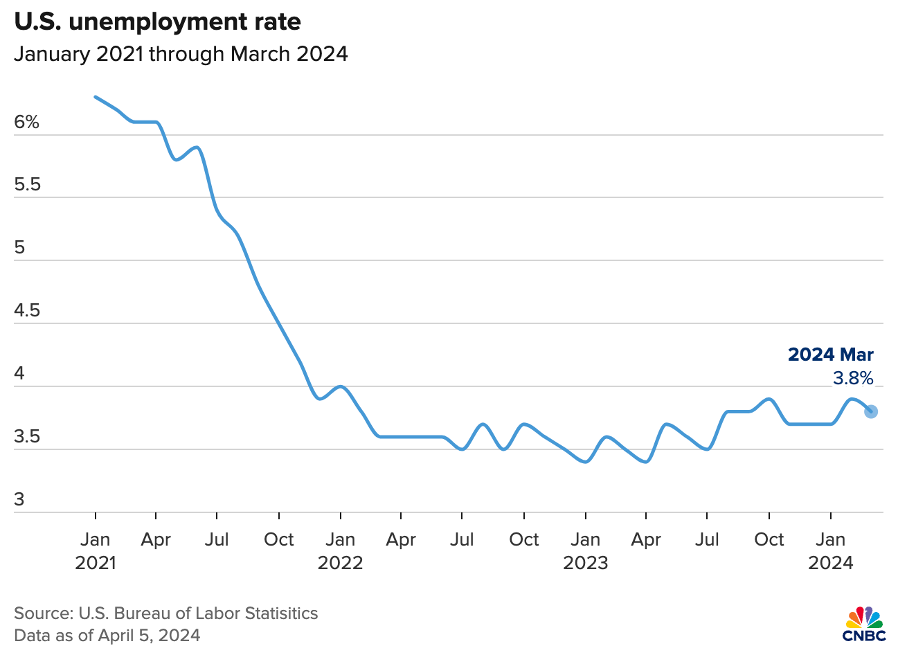

This number was far ahead of the Dow Jones estimate for 200,000 and the revised 270,000 added in February. This also led to a drop in the unemployment rate to 3.8% from 3.9% in February, which isn’t great when it comes to interest rate cuts.

Why? Well, rising unemployment is one of the critical indicators of economic distress. When more people are out of work, it typically signals a slowdown in economic activity, decreased consumer spending, and overall economic contraction, which would favor disinflation and force the Fed to cut rates.

However, with recent labor statistics showing a resilient market, this isn’t quite working out yet, and these tight market conditions even push employers to make attractive offers to new hires to bring these in and fill up roles, further adding to wage growth and, therefore, inflation.

Unemployment has now been below the 4% mark for two years straight, which is a historically low mark. According to Nick Bunker, economic research director for North America at job site Indeed, “The labor market is settling into a sweet spot, and there’s open road ahead of it as well.”

Yeah… this isn’t great, but it does support healthy economic growth despite high-interest rates. According to the Atlanta Fed, GDP is projected to grow at a 2.5% rate in the first quarter, which is really solid considering the circumstances. As long as this remains healthy, the markets will not be in too much trouble either.

There is no positive conclusion here

Alright, let’s call it what it is: we are in for a “no landing” scenario in which inflation is sticky, the labor market resilient, and economic growth is slowing but avoiding a recession for the time being.

Simply put, rates aren’t coming down any time soon, based on the latest data, which is something we have been saying since the start of the year. This will be a drag on stocks and economic growth heading into 2025 and will create uncertainty.

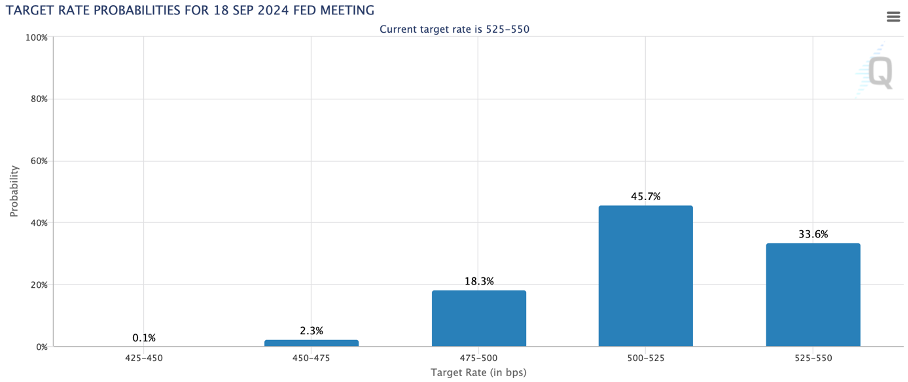

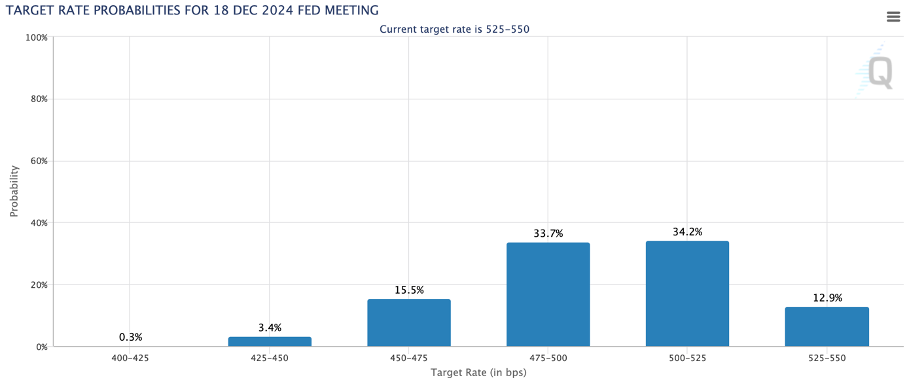

Positively, the market has also realized this by now. According to the latest numbers from CME Group, investors now price in a first cut to be realized by September and only 25-50 bps of cuts in 2024, which is a much more realistic scenario and stands in sharp contrast with the 175 bps expected at the start of the year. The market seems to have come to its senses, at least up to a point.

This should somewhat limit future volatility and extreme reactions to macroeconomic data. However, there is still plenty of downside if inflation, jobs, and GDP data keep coming in strong. Especially the next interest rate decision from the Fed can cause some panic as it will most likely present a new dot plot with a much less optimistic outlook. Just how bad this will be will depend on the coming months, but obviously, there is no more room for a dovish stance here.

However, at this point, a September rate cut and a total of 25-50 bps in 2024 remain the most likely scenario. We will keep monitoring incoming data and commentary from the Fed going forward.

Global markets remain resilient

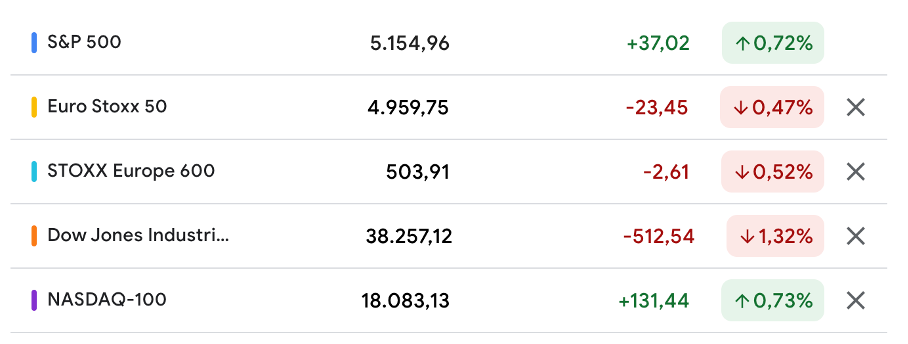

Meanwhile, Wall Street bank analysts continue to upgrade their S&P500 price targets for 2024, and global indices continue to make gains, although not as much as we saw in the first two months. Over the last month, the American and European indices have seen minimal gains and quite some losses. The best performer was the Nasdaq-100, up only 0.7%, and the underperformer was the Dow, down 1.3%.

No gains anywhere close to those we have seen in the first two months of the year and a much-needed cooldown period, although still no dip in any way. Markets continue to trend up and set new highs, driven by factors like strong corporate earnings, a strong economy, and the potential catalyst coming from AI.

Even in the face of sticky inflation, high-interest rates, and potentially slowing economic growth, there is also plenty to be optimistic about. However, whether this is going to remain strong enough to push markets up further is a big question mark.

In our view, markets remain quite heated today, especially those in the U.S. From this point out, we continue to see little upside, potentially even over a 12+ month time frame, though that will heavily depend on the direction the U.S. economy goes in terms of growth and when we will see interest rate cuts by the Fed. We remain cautious.

Meanwhile, Wall Street analysts seem to have a completely different opinion, as most of them are raising their 2024 S&P 500 price target. Among those was HSBC, which raised its price target to 5,400 after the strong Q1 performance and some upside to earnings estimates, an opinion we do not share.

Wells Fargo also raised its price target to 5,535, while Goldman Sachs maintained its 5,200 target but indicated it sees a bull case for levels potentially exceeding 6,000 by the end of the year.

Taking into account these latest revisions, Wall Street's midpoint now is right around the 5,300 mark, compared to our base target of 5,100 and bull case of 5,200 set in January and a current level of right around 5,150. So, even when considering these upgrades based on bullish narratives, the upside is limited for the remainder of this year.

Yet, of course, the financial markets are an unpredictable mechanism that regularly surprises us, so don’t award too much value to these price targets. Generally, Wall Street ends up being completely wrong…

Some other (similar) publications to check out

In closing of this post, we would like to give you all a couple of suggestions for Substack publications publishing similar content to ours, which we read regularly. Make sure to check these out!

Quality Stocks - by

StreetSmarts - by

Thank you for reading this newsletter. Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

Please make sure to like, restack, and share this post to increase our reach and support our work. Thank you!

Disclosure: No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.

Well written man. Another wave of inflation incoming for sure.

Well written article. I am still doubtful about multiple rate cuts this year…