Mastercard, Inc. – One of the best stocks to own for the decade ahead (Deep Dive)

This is my Mastercard Deep Dive!

Few businesses are as high-quality as the digital payment processor Mastercard. Over recent decades, the company has solidified its position as a true SWAN (Sleep Well At Night) stock, thanks to its duopoly with Visa in the high-margin and steadily growing digital payment processing (credit and debit cards) market.

I mean, about 25% of all global general-purpose card transactions, whether debit or credit, are conducted through Mastercard-branded cards. This amounts to $9 trillion in annual transaction value, with a whopping 143 billion annual transactions conducted by over 3.3 billion active Mastercard-branded cards.

This successful and critical financial network has given Mastercard a massive and impenetrable moat in the financial industry. It's no surprise that Mastercard is today the 39th most valuable brand globally, just behind Netflix and in front of PayPal, Airbnb, and Gucci.

Mastercard takes a small piece (around 0.3%) of all those transactions it processes. With all those earlier numbers growing by high single digits to mid-double digits and already being more than considerable, Mastercard has been able to deliver impressive financial numbers and growth over the last decade at truly limited risk, thanks to the simple necessity of the Mastercard network, the company’s massive moat, and the steady growth in the underlying industry as digital spending grows.

This business is incredibly difficult to disrupt and will likely still flourish in a few decades. This is probably as good as it gets—a company outperforming in both bull and bear markets. I mean, there is a reason Mastercard and Visa are consistently among the least shorted stocks.

This is a key reason why Visa and Mastercard are solid holdings across most of my portfolios. You just can’t go wrong with either, and, as proven over the last decade, these are steady outperformers. For reference, over the last decade, MA shares have returned 525% compared to a 193% return for the S&P500.

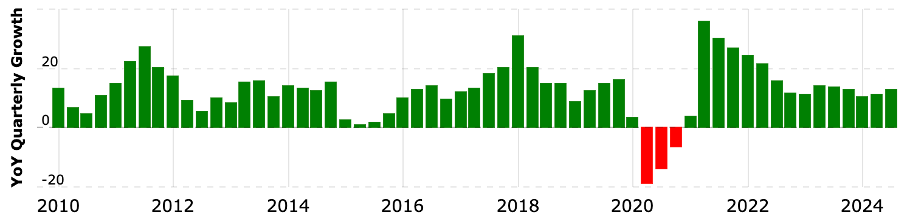

And rightfully so. Mastercard has compounded its revenues at a compelling 12% CAGR over the last decade and 5 years, EPS at an even more impressive 16.5% CAGR, and FCF at an 11% CAGR. However, probably even more remarkable is the fact that Mastercard is able to deliver growth through any cycle and the most challenging conditions. This is highlighted by the fact that Mastercard has only reported negative YoY growth in three quarters since 2010, and this was during the COVID-19 pandemic, as lockdowns made people spend far less.

Nevertheless, the company's consistency is remarkable and a testament to its tremendous business model and moat. Again, this is as good as companies get. Any dip in share price and valuation over the last decade has become a great buying opportunity.

This includes the majority of 2023 and 2024. Even as Mastercard continued to fire on all cylinders and deliver solid growth, shares underperformed the S&P500 in 2024, even after performing better in recent months, returning 25% to shareholders. In fact, for most of 2024, shares traded at quite a discount to their historical multiples, below 30x earnings at moments, mostly due to some concerns over a political crackdown on its moat, which seems to have disappeared again.

This has also led to shares trading closer to their historical multiples again today, with shares trading at roughly 33x earnings. Meanwhile, Mastercard’s outlook remains impressive, and its future is extremely bright.

This raises the question of whether now is still a good time to buy shares after they have gained about 20% over the last six months.

Based on your request, in this post, I will take a deep dive into Mastercard, going over its business fundamentals, finances, recent performance, and growth potential.

So, are MA shares still attractive enough to pick up, or should you wait for a dip in share price? Let’s delve in!

An Introduction to Mastercard, Inc.

Alright, by now, I have already explained what Mastercard is and does in big part. Actually, you probably already were fairly familiar with the company from the start. Therefore, I’ll try to keep this part short and try not to repeat myself!

Let’s start with the basis.

Mastercard Inc. is a global technology company in the payments industry. It operates in about 210 countries and specializes in facilitating electronic payments and providing a wide range of financial services. Headquartered in Purchase, New York, Mastercard connects consumers, financial institutions, merchants, governments, and businesses worldwide through its secure and efficient network.

The company’s core business involves processing payment transactions, including authorization, clearing, and settlement, primarily through its credit, debit, and prepaid card products.

Its network processes more than 143 billion transactions annually (as of 2023), conducted by over 3.3 billion Mastercard-branded debit and credit cards from hundreds of financial institutions globally, amounting to $9 trillion in annual transaction value. (I know, I said I wouldn’t repeat myself, but these numbers are just mind-blowing)

Mastercard operates a payments monopoly

Through this tremendous payment network and its many customers and partners, the company operates a very powerful duopoly with Visa, accounting for 90% of all digital payment processing outside of China.

Both in debit and credit card transactions, Visa and Mastercard dominate. For reference, Mastercard captures about 24% of all global credit card transactions and 25% of U.S. volume. Mastercard’s global credit card transactions market share has been mostly stable at 24%, while Visa’s has been trending down from 50% in 2017 to only 34% in 2024, mostly due to the rapid rise of UnionPay in China. Meanwhile, Mastercard has been gaining market share in the U.S. and Europe, offsetting these China headwinds.

Furthermore, Visa accounts for 37% of all credit cards in circulation, while Mastercard accounts for 32%. Meanwhile, in the U.S., Visa and Mastercard dominate the debit card market, handling 60% and 25% of all debit transactions, respectively. In Europe, Mastercard has a similar lead over Visa.

A powerful duopoly, indeed.

Meanwhile, there is also no lack of growth in this market. For reference, Mastercard has grown its payment volume by more than 50% since 2020, and going forward, we can safely assume this growth in payment volume and transactions will remain significant and a great source of growth for Mastercard.

Mastercard management believes 95% of its revenue growth through the end of the decade will be driven by growth in the underlying market thanks to the continued shift to digital. For reference, while many of us might already conduct most of our day-to-day transactions digitally, globally, still a significant portion of transactions is conducted through cash.

And I am not just talking about less developed regions. Even in Europe, roughly 52% of transactions are still cash, leaving the digital payment processing industry with a significant runway for growth as it steadily moves toward digital.

As a result, the total digital transaction value globally is expected to grow at a CAGR of about 16% through 2029, offering Mastercard a strong growth driver as one of the primary players in the industry.

Meanwhile, the remaining 5% of Mastercard’s growth will be driven by its sustained market share gains, which will be driven by rapidly growing acceptance and partnership wins. For reference, Mastercard has grown from 75 million merchant locations in 2020 to over 150 million in 2024. As a result, it has been gaining market share across all categories, including credit, debit, prepaid, and commercial, driving additional growth ahead of peers.

Not too shabby, right?

Indeed, through its massive moat, dominant market position, and excellent execution, Mastercard is expected to fully benefit from this underlying industry growth. With every bit of additional digital volume, Mastercard will take a very small piece, likely growing its transaction revenues at a low-to-mid-teens CAGR through the end of the decade.

Pretty brilliant.

Value-added services are the real growth driver

However, while the company’s payment processing revenues are great and compounding nicely, this isn’t even the most exciting part of the Mastercard investment thesis.

The biggest driver of my high conviction for Mastercard is its value-added services segment. In addition to its payment processing services, Mastercard offers a variety of value-added products designed to complement its core payment processing business. These services encompass fraud detection and prevention tools, cybersecurity solutions, and authentication technologies that enhance the security and trustworthiness of payment transactions, as well as data analytics and insights services, which provide clients with actionable intelligence on consumer behavior, market trends, and operational efficiency.

Especially this last one, in the age where data is the new gold, is an extremely exciting and fast-growing opportunity for Mastercard.

You see, through the many transactions processed through the Mastercard platform, the company derives heaps of valuable data that allow it to provide clients with unique and highly accurate perspectives on consumer behavior, spending patterns, and market trends, which are critical for strategic decision-making to businesses, financial institutions, and governments.

The value lies in the granularity and breadth of the insights. For reference, Mastercard sits on 15 petabytes of payment data. Furthermore, Mastercard’s network spans across industries and geographies, giving it access to data that can highlight regional differences, seasonal trends, and emerging market opportunities. By analyzing this data, clients can identify growth opportunities, refine marketing strategies, optimize pricing, and improve customer segmentation.

I hope you can see the value in their services and insight, which has been driving significant growth for Mastercard outside of its legacy business. Today, these service revenues amount to $11 billion annually or about 38% of revenue, up from 35% in 2020.

Crucially, while its transaction revenues are somewhat exposed to the economic health and very much to consumer spending, these service revenues aren’t, adding a great deal of diversification, especially since the majority of these service revenues are recurring and subscription-based. In other words, service revenues create diversification and differentiation.

Furthermore, due to the high value of the insight and other services, these revenues have been growing rapidly as well. Service revenues have compounded at an impressive 18% CAGR over the last 5 years, with 85% of these revenues being recurring.

Meanwhile, Mastercard's revenue opportunity and growth runway remain significant. According to management, it now has a TAM of $490 billion and a SAM of $165 billion, with the largest portion of this coming from business and market insight and cybersecurity. This means Mastercard still only captures about 7% of its current TAM, leaving it with a lot of room to keep growing through rapid TAM expansion as it grows its offering and deepening penetration of its SAM.

This is a large and growing revenue opportunity and a very compelling growth driver. Given the current numbers, I would be surprised if value-added services revenue growth slowed to below the high teens. As shown below, growth has been pretty consistent in the high teens over recent years.

Innovation is key for Mastercard

Finally, I want to allude to Mastercard’s consistently high level of innovation and ambition, which will ensure its moat remains strong, market share gains continue, and it fights off emerging competition from wallets and other payment processors.

Most importantly, the company aims to eliminate manual entry of card numbers and passwords for online shopping by 2030, which should massively improve digital checkout and security.

Mastercard plans to move to a tokenization and on-card biometrics system. This system will eliminate the need to enter 16-digit card numbers or passwords, thanks to seamless authentication across devices and websites, and ensure personal data stays on the device.

Tokenization replaces the sensitive card information with a unique digital identifier called a "token." This token acts as a stand-in for the card details, ensuring that the actual information remains protected and is not exposed during the payment process. For example, mobile wallets like Apple Pay and Google Pay rely on tokens to enable card-free transactions. When you tap your phone to pay, the mobile wallet uses a token instead of your card number to process the transaction.

This means that from a cybersecurity standpoint, the only thing that can happen is the interception of the token, which is designed explicitly for this transaction. Nothing else can be done with it. Today, your card details can be intercepted and misused in several ways. Therefore, this process will make the whole payment process significantly more secure than traditional methods of storing and sharing card details.

To put into perspective how important this is, Mastercard points out that fraud rates are seven times higher online than in stores, as criminals exploit exposed card numbers, causing headaches for consumers, merchants, and financial institutions.

Therefore, the need for such a ‘safer’ system is high, and if Mastercard remains ahead of the competition, it is likely to keep gaining market share. In recent years, this kind of innovation has already been helping the company beat the competition. In 2021, the company was the first payments network to formally phase out the magnetic stripe in favor of newer and more secure technologies, pleasing financial institutions and leading to customer wins.

Mastercard still seems to be on the right track here, favoring investments in innovation, something I love to see.

Ultimately, it is safe to say Mastercard is an insanely high-quality business with many compelling factors and growth drivers that should allow it to keep delivering impressive growth well into the next decade.

I hope you can see why I adore this business.

On that note, let’s delve into the financial and recent performance by diving into its latest Q3 results.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe and if you like our content and if you want to show even more appreciation for our work, please consider upgrading to paid (only $5 monthly).

In addition to all the free stuff, this also gets you access to even more premium analyses (3 per month), full access to my own outperforming portfolio, immediate trade alerts, and a full overview of all my price targets and rating, and even more!

Another perfect quarter for Mastercard

Mastercard reported its latest financial results on October 31st and managed to beat both top- and bottom-line consensus estimates. Top-line growth remained largely stable and resilient, even accelerating from prior quarters, thanks to resilient consumer spending and improving macro conditions globally.

As management pointed out, underlying consumer spending strength remained, the U.S. labor market remained strong, and inflation levels continued to moderate globally. Meanwhile, Mastercard’s secular growth drivers remain active. The shift toward digital continues, as reflected by growth in both spending and transactions. The company continues to grow its TAM through commercial and new payment flows, market share gains, and value-added services and solutions.

As a result of these dynamics, Mastercard reported net revenue growth of 13% on a reported basis, slightly accelerating from the previous two quarters but remaining in the low to mid-teens range—which is excellent! Furthermore, this growth was driven by its payment network and value-added services.

Starting with its payment network, GDV (Gross Dollar Volume), or the actual volumes going through the Mastercard network, grew 10% year over year, which is mostly stable compared to the rest of 2024. In the U.S., GDV was up 7% YoY, driven by 6% growth in credit and 8% growth in debit.

Outside of the U.S., growth was slightly stronger, with GDV up 12% YoY, driven by 10% growth in credit and 14% growth in debit. In addition, higher margin cross-border volumes were up 17% YoY, reflecting continued strong growth in both travel and non-travel-related cross-border spending.

This was all driven by 11% year-over-year transaction growth, enabled by 6% growth in the number of Mastercard and Maestro-branded cards issued, which now stands at 3.4 billion. Notably, in recent years, Mastercard has consistently delivered impressive growth in issued cards, growing its moat and presence.

This is driven by continued market share gains, and deal wins with partners around the globe. To give you some examples of last quarter, Mastercard announced new partnerships with Paysend, Leap Financial, and Felix Pago in Latin America, a new co-brand card and loyalty program deal with Brussels Airlines in Belgium, an extended credit and debit agreement with BNP Paribas (Europe’s second-largest bank), and the renewal and expansion of its partnership with Doha Bank.

Ultimately, these factors discussed above led to an 11% growth in payment network revenues.

However, growth was even more impressive in value-added services revenues, with these up 18% YoY, driven by strong demand for consulting and marketing services, the scaling of its fraud and security offering, and the identity and authentication solutions, as well as pricing. Growth here remains impressive in the high single digits.

Before moving to the bottom-line performance, I want to quickly point out Mastercard’s excellent revenue diversification geographically. Mastercard derives 34% of its revenues from the U.S., 33% from Europe, 24% from APMEA, and the final 9% from LatAm, which is pretty sublime.

Also, due to faster-growing and emerging regions, dependence on Western and developed regions is dropping, having fallen from 70% in 2020 to 67% in 2024.

On that note, let’s move to the bottom-line performance and details.

Mastercard reported a 12% increase in operating expenses, driven by growth in G&A and marketing expenses. However, this still sat comfortably below net revenue growth, leading to some solid margin expansion.

Operating income grew 15% YoY as the operating margin expanded 50 bps YoY to an impressive 59.3%. Over recent years, Mastercard has seen its margins trend up nicely, as reflected below, though these remain well below Visa’s mid-60s operating margin, highlighting the room for further expansion Mastercard has ahead of it as it grows.

Further down the line, this operating margin gain led to a 13% increase in net income and a 16% growth in EPS, as share buybacks added $0.08 to EPS. Q3 EPS of $3.89 beat the consensus by a solid $0.14.

Mastercard also excels in terms of shareholder rewards. Since its 2006 IPO, management has returned a whopping $83 billion to shareholders through repurchases and dividends.

Similar to last quarter, Mastercard has consistently lowered its share count over the last almost two decades, increasing shareholder value, which is reflected in additional EPS growth. For reference, from the end of 2010, Mastercard retired 30% of its outstanding shares.

Last quarter alone, the company repurchased $2.9 billion worth of shares and an additional $1 billion through the first month of the current quarter. Those are impressive numbers, and management shows no signs of slowing down. Last quarter, the Mastercard board authorized another buyback program of up to $12 billion, coming on top of its remaining $3.9 billion authorization, potentially retiring another 4% of shares in the three years ahead.

This is not a bad use of capital for a cash-flow machine and high-moat business like Mastercard. For reference, Mastercard generates about $12 billion in FCF annually, growing at a double-digit rate. Most of this money is now returned to shareholders.

Historically, Mastercard has definitely proven it knows how to use all this cash. Mastercard consistently delivers an exceptional return on capital employed (ROCE), currently sitting at 58%, almost double that of Visa, and highlighting the company's efficiency in utilizing its capital and generating profit.

The company also pays a rapidly growing dividend. Though the yield is a not-so-compelling 0.58%, Mastercard's dividend growth is very consistent. It has grown its dividend for 13 straight years and at a 15% CAGR over the last 5 years.

Furthermore, this still reflects an extremely low payout ratio of just 19%, with dividend obligations of only $2.2 to $2.4 billion annually, easily covered by FCF. As a result, the dividend is not only extremely safe, but Mastercard is also one of the most compelling dividend growth stocks you’ll find. Definitely a great bonus for an already very compelling investment case.

Finally, regarding financial health, there is also nothing to complain about. Mastercard holds $11.5 billion in total cash against total debt of $18.4 billion, leaving it in a healthy position, earning it an A+ credit rating.

Outlook & Valuation

So, what can we expect from this terrific business going forward?

During its recent investor event, Mastercard updated its medium-term guidance. Management now expects revenue to grow at a low to mid-double-digit rate through 2027 and EPS to grow at a mid-teens percentage, reflecting an operating margin target of at least 55%. This is pretty much in line with recent quarters.

Based on underlying industry and company-specific trends in recent years and current projections, I have no reason to question management's projections. Therefore, I also guide for low-teens revenue growth and mid-teens EPS growth through 2027, as visualized below.

In terms of valuation, it won’t be surprising that Mastercard has historically consistently traded at a hefty premium, along with Visa. However, due to Mastercard’s slightly faster growth, it even trades at a premium to its close peer.

Using the projections above, Mastercard now trades at 36.5x this year’s earnings and 32x next year’s earnings, which is a hefty price to pay for any mature business. However, at the same time, considering the sheer quality of Mastercard, its business model, moat, cash flows, and pretty impressive growth outlook, I will argue this is not at all that bad.

This is a business that can continue to compound revenue and earnings well into the next decade without any issues, and it definitely deserves a premium.

To put things in perspective, Mastercard's current P/E multiple is roughly 2% below its 5-year average of 37.5x. This multiple translates into a PEG of 2.1, which is about in line with its historical average. Overall, I will argue that Mastercard currently trades around fair value.

Does that make it a buy today? It sits right on the edge for me.

For perspective, I would prefer to use a slight discount on Mastercard’s average multiple, which has historically proven to be a great time to buy. Therefore, I will use a long-term multiple of 35x, which, combined with my FY26 EPS projection, translates into an end-of-2026 target price of $666.

From a current share price of $521, this reflects potential annual returns (CAGR) of 12%, including dividends, which puts it right on the edge of buying territory.

However, personally, I would prefer a bit more of a margin of safety before pulling the trigger, especially after the outperformance over the last 6 months. Therefore, I am aiming for a share price of closer to $510, which would put annual returns by current projections closer to 14%, with a better margin of safety.

Ultimately, for now, I am hold-rated on this brilliant compounder. However, as I have always done with Mastercard, I will buy additional shares on any weakness, as I firmly believe it is a top buy for the decade ahead.

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

Excellent detailed look at one of the world's best businesses. My key takeaways from your analysis:

- strong moat of scale, special knowledge and enormous customer base

- dominant player in Europe, number two in US

- 58% return on capital employed (!!!)

- revenue and earnings growth sustainable at 10% and up

- token technology by 2030 should cut fraud losses in online transactions by at least two thirds

- data insights business has huge potential and is growing nicely

- commendable record of returning free cash flow to shareholders

- dividend increases every year, averaging 15%

- has retired 30% of shares since 2010 and could retire another 4% in 2025

- since 2006 IPO, has returned $83 billion to shareholders

- expensive at current price but a no-brainer long term buy and hold if there is price weakness that is not justified by events

- 58% return on capital is an invitation to upstarts to compete for MasterCard's business. There are a lot of Fintech firms interested in taking this business. Affirm, Nu, Dave, Mercado Libre and so on. Any of those could find the formula that lets them eat MasterCard (and Visa) from below by disruption. Some of them are diligently looking for exactly that formula.

Mastercard is a fantastic business but they'll need to stay sharp to keep it.

Mastercard is certainly a very good company, but I see the financial sector in a state of upheaval. many rigid structures at the big tankers do not allow a quick adaptation to market conditions and such a company prefers to follow well-trodden paths rather than new ones. mastercard will have to defend its competitive advantage with a lot of cash at great expense. that's my view.