MercadoLibre Is Crushing It — But I’m Not Buying (Yet)

LatAm’s digital king just crushed Q1 —MELI could easily 3x by 2035, but the current setup isn’t perfect despite my bullish stance.

For quite some time now, LatAm giant MercadoLibre has been near or at the top of my top picks list for long-term investors, simply because it is without any doubt one of the best-positioned companies you’ll ever find, with an insane runway of growth ahead of it.

In fact, I still view MELI as a likely multi-bagger through the end of the decade and a no-brainer for long-term investors, all thanks to its unique and dominant positioning, moat, and brilliant management team.

You see, MercadoLibre is not just any business. The company is the largest in the rapidly emerging but still underdeveloped Latin American region, which is poised for rapid growth and development over the next few decades, particularly in the field of digitalization. For reference, as of today, only about 50% of the Latin American population owns a smartphone, compared to 81% in the United States, leaving a significant opportunity for development.

Notably, MercadoLibre is uniquely positioned as the leader in both e-commerce and FinTech, two industries that are fully benefiting from this move to digital and the rapid economic growth on the continent.

MercadoLibre operates the #1 e-commerce platform in LatAm and has been rapidly expanding it. Today, there are over 100 million unique buyers, and by volume, its market share hovers around 22%, having grown in recent years.

Meanwhile, the industry still has significant growth potential ahead, thanks to e-commerce penetration, which remains at a relatively low 10% on the continent. For example, in the U.S., e-commerce penetration currently stands at 25%. As a result, according to current estimates, the Latin American (LatAm) industry is expected to continue growing at a 22% compound annual growth rate (CAGR) through 2030 as it attempts to catch up.

However, that is not all, as the company also has an impressive FinTech platform called Mercado Pago, which has quickly become one of LatAm's leading digital wallets and payment processors. Following rapid growth and expansion in recent years, Mercado Pago now has over 60 million users, more than double the number it had two years ago.

This has resulted in the company becoming a leading fintech player in LatAm, holding the #1 position in Mexico, Chile, and Argentina, and the #2 position in Brazil. Meanwhile, as of today, cash payments remain the primary payment form, leaving MELI, once again, with an exceptional runway of growth, driven by a secular shift to digital.

As I said, the company is truly uniquely positioned and poised to benefit from secular tailwinds for decades to come. As a result, I see ample room for the company to continue growing at a double-digit rate for at least two more decades, driven by its focus and dominant position in two of the fastest-growing markets in Latin America.

Additionally, as a cherry on top, the company remains (semi-) founder-led, with founder Marcos Galperin serving as chairman of the board. Also, it is growing rapidly, steadily improving profitability, and consistently delivering excellent financial metrics, with a ROE of 34% and a ROIC of 24%.

Yes, to me, MELI is a no-brainer for the decade ahead and just an excellent, well-managed business.

At this rate, I don’t doubt MELI will reach a $1 trillion market cap sometime over the next 10-15 years, leaving plenty of upside from a current $126 billion market cap, which already makes it a giant in the region.

Anyway, last week, this same company released an earnings report that only confirmed my bullish thesis and boosted my confidence. The company delivered excellent growth, accelerating in both its e-commerce and FinTech operations, and continues to drive rapid margin expansion as operating leverage increases. Additionally, underlying, there are nothing but green flags.

After blowing past consensus estimates, MELI shares are now up 12% since the report was released, which is well-deserved, considering the necessary upward revisions to near-term financial estimates as the company continues to outperform expectations.

As a result, shares are now up almost 52% YTD, after rallying some 27% over the last month alone, thanks to improving sentiment and the company’s excellent Q1 report. So, are shares still a good buy today, or is it time to move to the sidelines?

To answer this question, let’s review the Q1 results, breaking them down and putting them into perspective to gain a clear understanding of the business’s performance and its implications for my bullish thesis. Afterward, I will update my financial projections and target price.

Without further ado, let’s delve in!

Q1 results + Highlights

Quite simply, MercadoLibre delivered a brilliant Q1 earnings report that showcases the uniqueness of this business. In Q1, the company exceeded both top and bottom-line estimates by a wide margin, delivering excellent and accelerating growth across the board.

Remarkably, while the 34% revenue CAGR MELI delivered between 2010 and 2020 was already mighty impressive, growth has only accelerated since. From 2021 through 2024 (excluding 2020, which was an exceptional year), MELI achieved a 43% compound annual growth rate (CAGR), and it once again delivered exceptional growth in the first quarter of 2025.

MELI reported a total Q1 revenue of $5.9 billion, up an impressive 37% YoY, which remains stable compared to Q4 and exceptionally resilient, with weakness in one place offset by strength in another. As a result, sales growth has been stable in the mid-to-high thirties, which is quite a remarkable growth rate to maintain.

How many companies can you name that have grown at this rate for so many years, and still show no signs of slowing down? This is exceptional, driven by management’s excellent execution and the strength of the Latin American economies, despite the disruptions elsewhere in the world.

Breaking down this growth by region, we can see that performance was primarily driven by a significant recovery in Argentina. In Q1, macroeconomic conditions in the country improved significantly, with consumer sentiment rising and the rate of inflation declining.

As a result, revenue from Argentina increased by a whopping 125% year-over-year. This strength was able to offset a slowdown in growth in Brazil (20% YoY) and Mexico (26% YoY), although growth here also remained healthy.

Additionally, growth continued to be driven by both the e-commerce and FinTech operations, which are both fully benefiting from the shift to digital. Starting with e-commerce, MELI reported Q1 GMV (Gross Merchandise Volume) of $13.3 billion, up 17% YoY. This indicates continued healthy growth in e-commerce operations, with a notable increase from prior quarters. For reference, it’s the dollar growth that reflects actual segment performance.

Crucially, these numbers indicate that MELI continues to outpace the underlying markets, capturing market share in key markets such as Brazil and Mexico, despite intense competition, which highlights MELI’s winning strategy and competitive edge.

This healthy growth in GMV was driven by continued expansion in the number of unique buyers on the MercadoLibre platform, which increased by 26% year-over-year (YoY) in Q1 to 67 million. Notably, this represents the best growth since Q1 2021, indicating that MELI is not losing any traction; it appears to be improving. This helps the company’s current performance, and it is also a promising sign of its long-term potential.

In addition to this, MELI also continues to see each of these unique platform users purchase more products. The number of items sold per unique buyer increased marginally YoY. As a result, the total number of items sold grew even faster by 28% YoY to 492 million, showing a solid and steady acceleration from prior quarters.

Meanwhile, the third-party take rate remained stable at 21.4%, excluding one-time events. This resulted in e-commerce revenue growth of 32% YoY, slowing down from mid-40s growth in previous quarters, but remaining really strong.

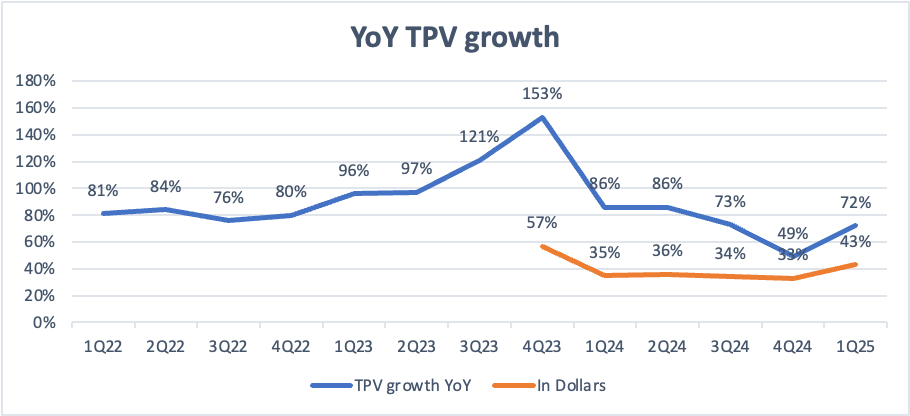

Moving to MELI’s FinTech operations, there is even more to be enthusiastic about. Q1 TPV (Total Payment Volume) was $58.3 billion, up an impressive 43% YoY, which is a sweet growth acceleration compared to previous quarters.

This TPV growth was driven by strong transaction growth of 38% YoY, which benefited from stable monthly active user growth of 31% YoY to 64 million. Remarkably, active user growth remains strong at over 30%, despite the company’s leading position and large existing user base. Once again, this is a very promising long-term sign.

Meanwhile, with a take rate stable at 4.5%, FinTech revenue also increased by 43% YoY, accelerating considerably from 29% growth in Q4.

Moving then to the bottom line, MELI showed healthy improvements in margins amid rapid top-line growth and controlled costs, despite significant investments being made in the business.

Income from operations was up 45% YoY to $763 million, reflecting a 12.9% operating margin, up a solid 70 bps YoY and showing solid progress, as MELI continues to expand margins as operating leverage grows.

In Q1, this performance was helped by the strong recovery in Argentina. The significant improvement against a low base last year helped counterbalance investments and some cost pressures in Brazil and Mexico.

Further down the line, this resulted in a net income of $494 million, up 44% YoY and reflecting an 8.3% net income margin, up 40 bps YoY.

Finally, FCF was a negative $10 million, reflecting the impact of seasonality, $770 million in FinTech funding, and significant capital expenditures of $256 million, which increased by almost 100% year-over-year. Therefore, this isn’t any sort of concern.

At the same time, these high investments are weighing on MELI’s balance sheet, with a growing debt pile. As of the end of Q1, MELI had a total debt of $7.7 billion, up from $5.3 billion the previous year. At the same time, the company maintains a healthy cash position of $5 billion, up from $4 billion the previous year, leaving it with ample liquidity. A net debt position of $2.8 billion is manageable, as it is fully covered by EBITDA.

Ultimately, MELI remains in excellent financial health, even as investments in the business remain high.

Before we move on, just a quick word…

Want more out of your subscription?

Get exclusive stock picks, premium research, timely earnings breakdowns, direct access to my watchlist, thinking, and full portfolio through InvestInsights PRO — built for serious long-term investors who want an edge.

Deeper dives. Sharper takes. Full insight into my actions.

InvestInsights PRO - $7.50/month ($70/annually)

An additional 3-7x/month premium stock analysis.

Full insight into my own portfolio (15% return CAGR since 2022).

Monthly portfolio updates + Instant transaction alerts (Fully transparent)

A complete overview of all my target prices and ratings (Excel file).

2x/month Rijnberk Picks - The stocks to watch

Instant access to earlier premium analysis on, for example, Adobe, Thermo Fisher, Spotify, and The Trade Desk.

Outlook & Valuation

Following this strong Q1 performance, an upward revision to my FY25 projections is inevitable. Clearly, the Latin American region is holding up relatively well, potentially even benefiting somewhat from weakness in U.S. and Chinese markets. Additionally, the secular drivers that benefit MELI remain in place.

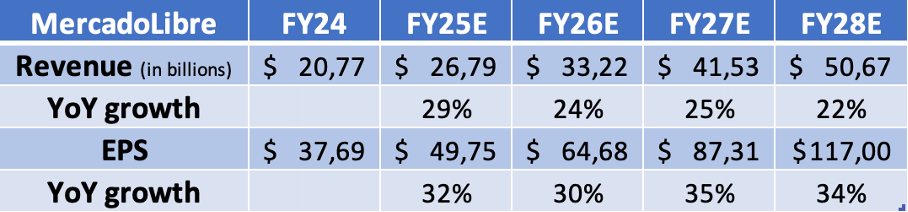

All things considered, I am really bullish on MELI’s prospects for 2025. Therefore, I have slightly increased my FY25 revenue projection and significantly increased my EPS projection. Meanwhile, I have also raised my further medium-term estimates, as MELI continues to outperform all my previous estimates, and underlying growth remains in good health.

There are nothing but green flags to be found and MELI remains one of the best-positioned businesses for the decade ahead.

Below, you can find my revised financial estimates.

With MELI shares up 27% over the last month and 52% YTD, shares haven’t gotten any cheaper, even as I have considerably raised my financial estimates. At a current share price of $ 2,584, MELI shares now trade at 52x FY25 earnings, up from 49x back in February, when I called the shares slightly too expensive.

Yet, the growth outlook has improved considerably. As a result, MELI’s growth-adjusted PEG is actually down slightly from February to 1.6x, which is not too far away from the broader retail industry, and I will definitely argue that MELI has a far brighter future.

In my view, the market is now pricing MELI fairly, although its long-term growth prospects may still not be fully reflected in this valuation.

For now, I will assume a 40x long-term P/E is about fair, considering MELI’s dominant position in two of the most exciting industries in one of the most exciting regions, its massive moat, its incredible runway of growth, and its brilliant medium-term outlook. Additionally, its unique positioning within Latin America largely isolates it from the U.S. tariff pressures and economic weakness.

Therefore, I see no reason to discount MELI at this time. Using this assumed 40x multiple and my FY27 EPS estimate, I calculate an end-of-2027 target price of $3,492. From a current price of $2,584, this means we are looking at potential returns of 12% annually, right in line with my goal.

However, I don’t think this leaves quite enough downside protection in this environment. Amid current uncertainty, no matter how strong my thesis, I prefer to aim for some more downside protection.

Therefore, at current prices, I am not an active buyer of MELI shares. Personally, I am now aiming to buy at a share price below $2,450, ideally below $2,400.

For now, I am Hold rated, though I remain extremely bullish long-term.

Wonderful company and I agree with your analysis. I invested in 2019 thanks to the Motley Fool; I'm a really big fan of their podcast.