Meta & Amazon – Only one is a buy after earnings

In this post, we dive into the Q4 earnings reports of both Amazon and Meta, discussing their financial performance and recent developments.

Author note: We very much hope you enjoy this earnings review. We have much more content coming up later this week as we take a close look at the Uber, Infineon, and Enphase quarterly results, with an analysis of these all coming out later this week.

Stay tuned, and make sure to subscribe if you haven’t done so already!

Meta Platforms, Inc. – Q4 results positively surprise investors in multiple ways

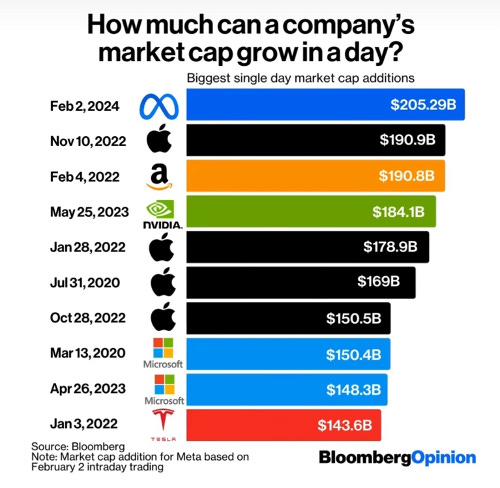

Meta released its Q4 earnings report last week and once more managed to blow away the Wall Street consensus and surprise investors and analysts alike with its performance. Q4 results came in far ahead of our expectations and those of Wall Street analysts as we all continue to consistently underestimate Mark Zuckerberg and Co. As a result, the company made history by adding a staggering $205 billion to its market cap as shares were up 20% following the release.

In my latest coverage of the company in October (On Seeking Alpha, to be found here), I rated shares a buy as I continued to see a lot of upside potential for Meta, even as shares had already run up significantly from a 2022 low, driven by a strong recovery ahead in the advertising market, plenty of growth levers for management to pull, and the incredible cash flows it continued to produce. For those interested in the growth opportunities still ahead of it, I recommend checking out that article.

However, right now, I want to review the incredible earnings delivered by Meta in Q4, management’s commentary and outlook, and what this means for our financial projections.

And well, it sure means something, as Meta’s Q4 results were impressive. The company reported a quarterly revenue of $40.11 billion, which is up a very impressive 24.7% YoY and 3% above our expectations.

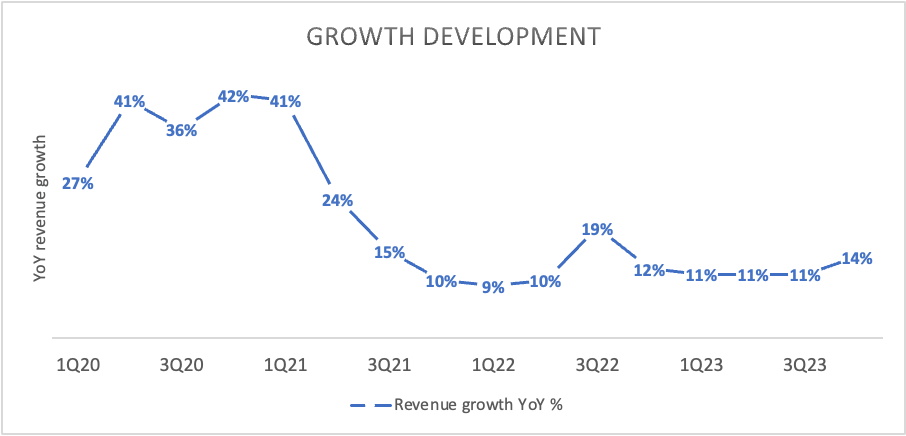

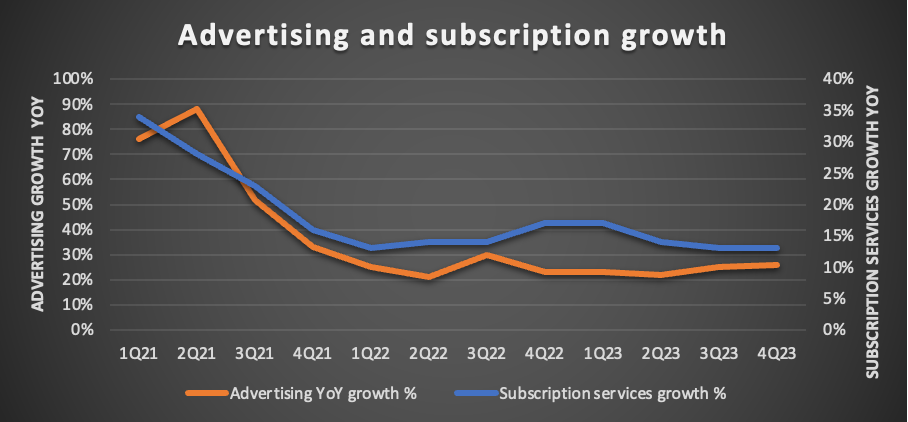

As the graph above highlights, Meta is now in full recovery mode after the digital advertising industry dipped slightly in 2022. However, the operating environment for Meta is improving, leading to a 21% growth in ad impressions in Q4 and a 2% growth in price per ad, with the latter being a meaningful improvement from a full-year decrease of 9%. This indicates that demand for Meta’s advertising spots is rapidly improving, which should continue to drive significant growth in 2024.

Though, even as price per ad remained under pressure in 2023, Meta reported revenue of $134.9 billion, up 16% YoY. A big part of this was driven by 28% growth in ad impressions, driven by the success of reels on Instagram, which has seen incredible adoption and has now turned into a profitable operation as monetization has improved. On top of this, Threads is also off to a solid start, with over 130 million monthly actives.

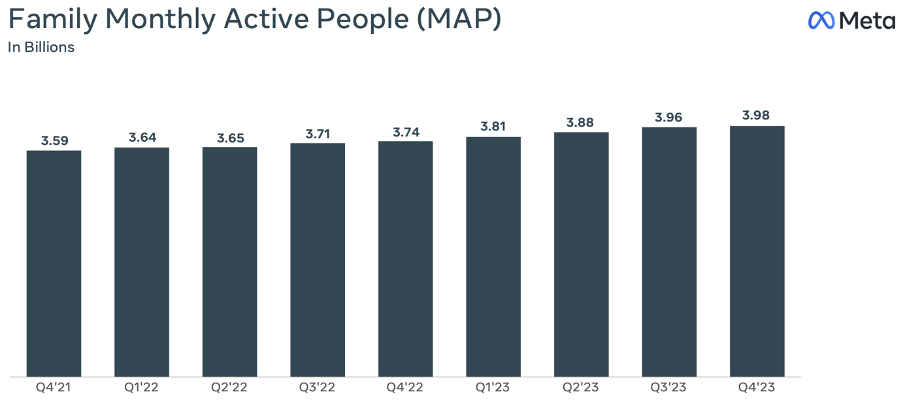

This also led to solid growth in active users. The company continues to keep growing the number of active users among its Family of Apps, with monthly active users growing by 6% YoY in Q4 to almost 4 billion. And this was not just driven by new additions such as Threads and Reels, as even Facebook continued to grow monthly actives by 3% YoY.

Anyways, the fact that Meta was still able to grow its users by 6% from a base of just below 4 billion is really all you need to consider to understand how well this company is executing, how strong its foothold in the social media industry is, how well it is able to introduce new features and platforms (look at reels and Threads), and how valuable the company is to advertisers as a result.

Meta’s apps now account for a staggering 42% of daily social media spend by the adult population through its Facebook and Instagram platforms, gaining it a 20% market share in the U.S. digital advertising industry and a 75% market share in the social media advertising industry. Obviously, with over 4 billion active users, the company should be on the priority list of any advertiser.

This in itself is already a massive reason to remain bullish on Meta’s growth potential. According to Oberlo, the digital advertising market is projected to reach a value of $667.6 billion in 2024 and reach a market size of $870.9 billion by 2027, growing at a CAGR of 9.25%. To put this in context for Meta, if the company can hold onto its market share of around 20%, even in the face of competition from Amazon, this would result in ad revenue of $174.18 billion by 2027.

However, there is reason to believe Meta’s revenue and digital advertising market share could grow even faster as the social media advertising market is projected to grow at an even faster 12.5% CAGR through 2028 after it is expected to grow by 14.1% in 2024, driven by the increasing importance and popularity of social media and influencers.

If Meta were to grow slightly below this projected growth rate at, say, 11% annually, this would translate into even more impressive revenue levels of over $200 billion by 2027. Now, while this is all slightly speculative and should be taken with a grain of salt, it perfectly illustrates the growth Meta still has ahead of it through its legacy social media advertising business, which is insane from current levels.

On top of this, the company also has plenty of other growth levers. Now, I am not going in-depth on any of these right now, but I would like to highlight some points that management talked about during the earnings call about AI.

One thing is for sure: Meta should be considered as a massive beneficiary of the AI revolution. Not only has the company been successfully leveraging AI for close to a decade to improve its ad targeting, but it is also one of the largest in computing capacity. The company aims to host the most advanced AI products and services, and while its approach is very different from that of Google, Amazon, and Microsoft, Meta has big plans and has the infrastructure in place.

By the end of 2024, Meta expects to have about 350,000 Nvidia H100 GPUs operational in its datacenters, and including other GPUs like those from AMD, Meta will have around 600,000 H100 and equivalents operational.

Leveraging this computing power, last fall, the company launched a range of AI services, including an AI assistant, AI Studio, Business AI, and the RayBan Meta smart glasses, clearly making itself visible in the realm of AI. Meanwhile, the company is already working on its next GenAI model with Llama 3, which is currently training, and according to Zuckerberg, it is looking very good.

Meanwhile, Meta’s use cases for AI also reach further than assistants and the Metaverse as the company also leverages its new AI functionalities and power to continuously improve its Family of Apps and ad business, which Meta management believes will eventually hold the potential to change the way people engage with its services in the future and further increase the value of its advertisements within these apps. For reference, at the end of 2023, Meta was testing over 20 GenAI features within its Family of Apps.

Clearly, we can expect a lot from Meta regarding AI functionalities and products in the future, which holds great growth potential.

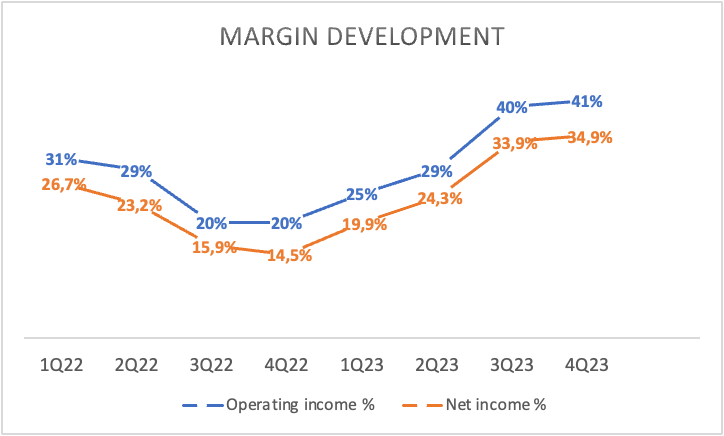

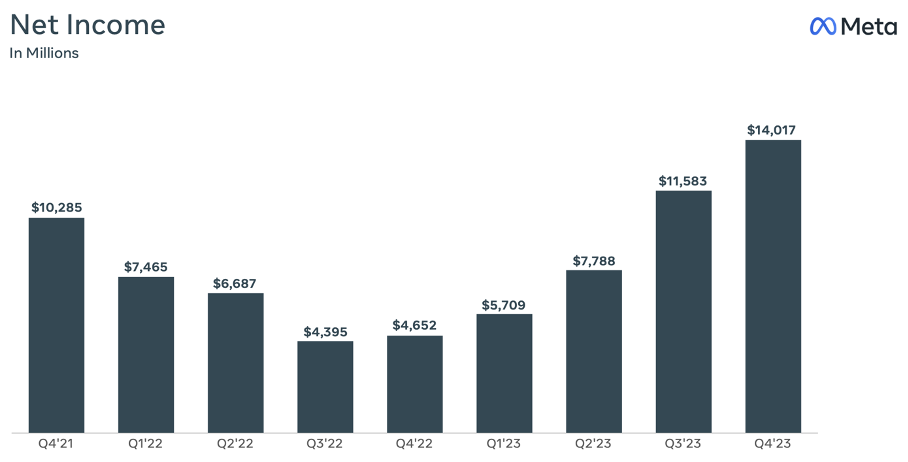

Now, while this is all plenty to get excited about, I want to shift our focus back to the financial results, as the actual highlight of 2023 was the company’s bottom-line performance. At the start of the year, Zuckerberg called 2023 the year of efficiency, and boy, did he deliver.

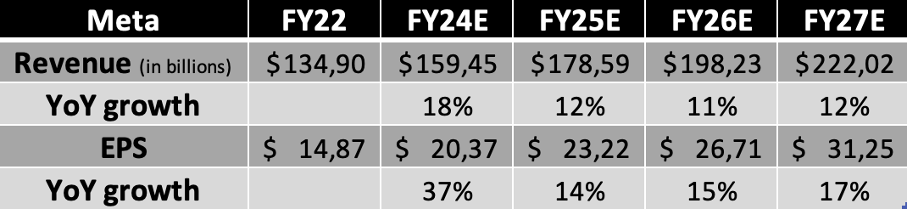

The operating margin in FY23 improved by 10 percentage points to 35% from an FY22 level of 25%, which led to 62% growth in operating income to $46.8 billion. This also led to a significant improvement in the net income margin from 19.9% last year to 29% in FY23, or EPS of $14.87, which is up 73% YoY.

A big part of this was driven by the company significantly cutting its costs, with operating expenses up just 1% in FY23 but down 8% in Q4 to $23.7 billion, even as R&D expenses still increased by 8%. In Q4, marketing and sales costs were down 29% YoY, and G&A decreased by 26%, which was helped by a 22% decrease in employees to 67,300.

This led to a 41% operating margin in Q4 and an operating income of $16.4 billion, which is impressive at the very least. The operating margin in Q4 was up a staggering 21 percentage points. Furthermore, net income in Q4 came in at $14 billion or EPS of $5.33.

Not entirely surprising, while the company was well able to cut costs and improve margins, far better than we expected, the Reality Labs segment continued to bleed cash as the segment reported an operating loss of $4.6 billion in Q4 and a massive $16 billion in 2023, which is quite a bit worse compared to $13.7 billion in operating losses in 2022.

I remain pretty skeptical of the Reality Labs segment, but management has at least been able to cut back operating expenses growth compared to previous years, and the efficiency gains in other areas are able to offset these losses. However, management did confirm that it will continue to invest in these areas.

Luckily, Meta is still a cash flow machine as it generated $11.5 billion in FCF in Q4, bringing the FY23 total to $43 billion, reflecting both the Reality Labs losses and another $1.6 billion in income tax payments deferred from prior quarters of 2023. As a result, the company strengthened its balance sheet further, which now holds $65.4 billion in total cash against just $18.4 billion in debt, leaving it in tremendous financial health.

This brings us to the (probably) highlight of the earnings report as the excellent financial health of the company and cash flow generation ability have allowed it to introduce its first-ever dividend payment, to be paid on March 26.

The company announced it will be paying a quarterly dividend of $0.50, which translates into a dividend yield of around 0.43%. This is far from bad, considering this is the company’s first-ever dividend payment. Undoubtedly, this will make the company a top pick among dividend growth investors.

On top of this dividend, the company also announced a new buyback authorization of $50 billion, so it is safe to say investors are in for plenty of returns. This comes on top of the $30.9 billion still remaining under the prior authorized program, bringing the total to $80.9 billion or just below 7% of the current market cap, likely to be completed over the next 3-4 years.

Again, in terms of capital returns, investors have little to complain about.

Finally, the Q1 outlook from management also looked solid and was above Wall Street expectations. Management now guides Q1 revenue to be in the range of $34.5-37 billion vs. $33.87 billion consensus prior to the release, which points to 31% growth at the midpoint. Furthermore, management also said that it expects 2024 total expenses to be in the range of $94 billion to $99 billion or up 9.4% at the midpoint, which should indicate further margin improvements.

We already noted before that the social media advertising market is expected to grow by 14.5% in 2024, and we expect Meta to beat this in 2024 as advertisers will prefer to use Meta’s proven platforms over less effective alternatives in the current treacherous environment which should lead to high-teens revenue growth. Meanwhile, margins should continue to grow as management continues to manage costs, which is why we now project revenue growth of 18.2% and EPS growth of 37%. This is visible in our financial estimates below.

Following my buy rating on the shares in October, quite a few readers and investors said I was insane for rating Meta stock a buy after a 200%+ gain since the end of 2022. Yet, this turned out to be one of those situations where we should not focus on the share price or recent gains but focus on the underlying business and its potential. Those that deemed Meta shares overbought back in October have missed out on another 40%+ gain over the last three months as shares reached new all-time highs last week.

So, what are we looking at right now? Are shares still attractive, or is now the time to be more careful as growth is fully priced in?

Well, based on our FY24 estimates, shares are still trading at just 22.5x this year’s earnings, which, arguably, is quite cheap for this high-quality business, projected to keep growing revenue and EPS in the double digits, with an incredible global presence and market share, and significant cash flows. Especially with the company now also paying a dividend, we believe it deserves a valuation slightly above its 5-year average of 23x. Therefore, we now award it a 25x multiple, which, based on our FY25 EPS, translates into a 24-month target price of $581 or annual returns of 12.5% from a current share price of $458.

Therefore, even as shares have turned out to be a multi-bagger over the last 1.5 years, we still believe Meta shares remain attractive to shareholders and continue to present significant upside over the next 2-5 years. Of course, buying the shares at their low in 2022 or before the Q4 results would have been better, but don’t be scared away by recent gains. This company still has significant growth potential ahead of it, which is still not fully priced yet, and it remains one of the highest-quality businesses globally.

We remain buy-rated on Meta.

Amazon.com, Inc. – Another impressive quarter, but the upside is limited

While the Amazon Q4 earnings report didn’t quite receive the same reaction from investors as we saw following Meta’s earnings release, Amazon also delivered a very solid quarterly report, which led to shares picking up a few percentages.

Most importantly, the company is seeing pretty much all its financials develop in the right direction as growth accelerated in pretty much every department and profitability rapidly improved, leaving very little for analysts to complain about.

The company reported revenue of $170 billion, which was up 14% YoY as Amazon is another perfect example of a big tech corporation that defies the law of large numbers and continues to drive growth by double digits. Even more, growth accelerated by 300 bps from the prior quarter.

With this revenue, it beat the consensus by a very solid 2.5% and significantly beat our estimates, as Amazon was well able to benefit from a resilient consumer. A big reason for this are the fundamental developments and improvements Amazon is making to improve the customer experience, which includes faster delivery speeds.

It might seem not that meaningful, but as Amazon was able to grow same-day or overnight deliveries by 65% in Q4, it was able to capture many more sales as customers increased the number of occasions that they choose Amazon to fulfill their shopping needs while also using it more often for everyday essentials. This drives very meaningful growth, according to management, and allows it to outgrow the underlying industry.

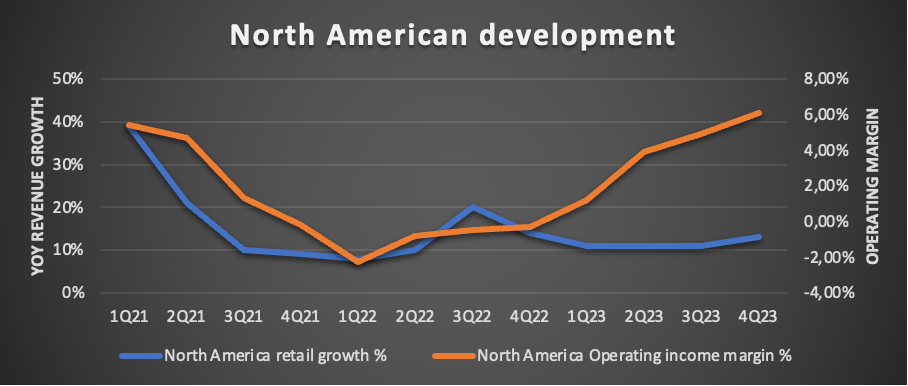

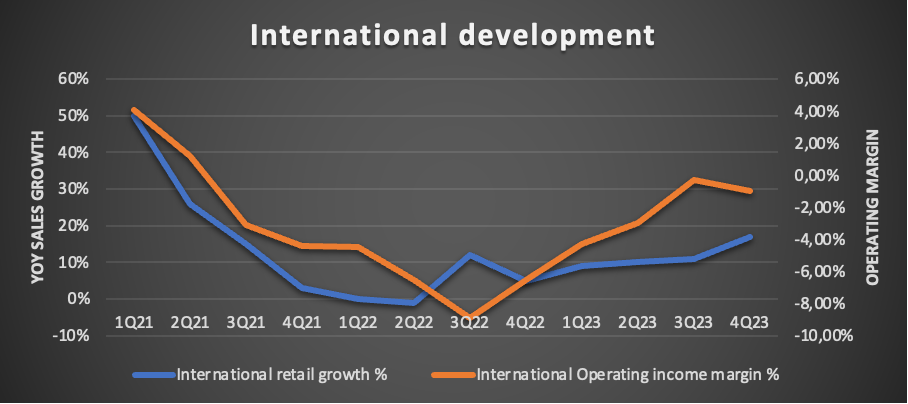

As a result, the North American retail segment crossed the $100 billion quarterly level for the first time ever as it grew by 13% YoY to $105.5 billion, which is also a 200 bps acceleration from the previous quarter. Meanwhile, the international segment grew by a faster 17% YoY, although excluding FX tailwinds, this was a more moderate but still impressive 13%, to $40.2 billion.

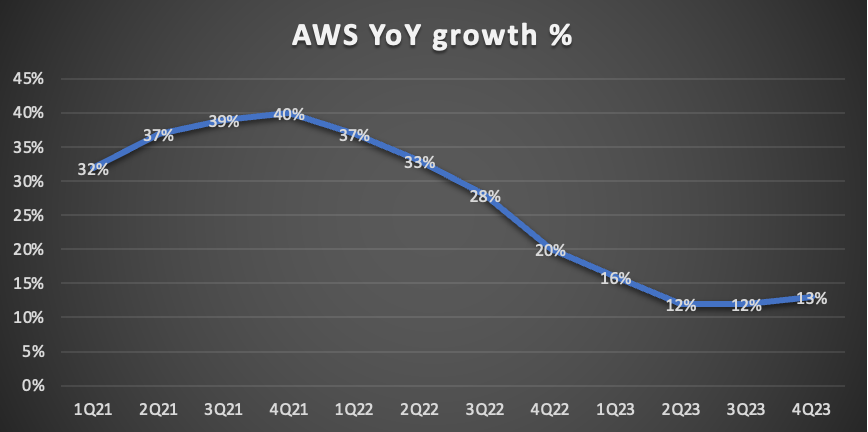

Growth in the company’s cloud segment – AWS – also accelerated from prior quarters as Amazon is seeing customers shift their focus back to bringing new workloads to the cloud as cost optimizations by the customers, which was the leading reason for the AWS growth slowdown over recent years, is easing. This allowed it to accelerate growth by 100 bps from the prior quarter to 13% YoY and $24.2 billion in revenue. Management added to this that it continues to have a strong customer pipeline as these are renewing faster and for larger commitments as the importance of the cloud grows.

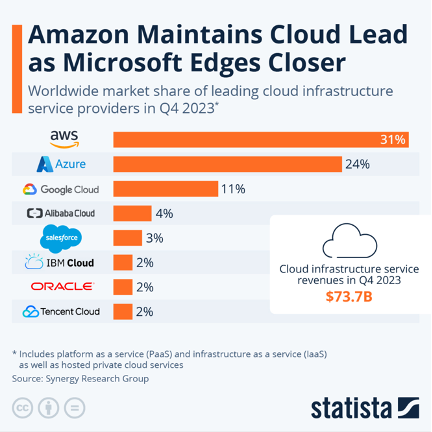

However, despite this, AWS has been losing market share over recent quarters to fierce competitor Microsoft, which has raised the question of whether Microsoft might be eating Amazon’s lunch and is taking away its customers. I have recently been discussing this dynamic with some cloud engineers in an effort to figure out how high switching costs really are for companies as, right now, Microsoft seems to have a stronger cloud offering, although this is up for discussion.

Anyway, I wanted to find out how strong Amazon’s moat really is as it seems to be losing share in the cloud computing industry, with data from Statista showing Amazon held a market share of 34% one year ago, and this has fallen to 31% as of the most recent quarter, while Microsoft has been rapidly gaining market share.

However, I don’t believe this now is a reason for concern. Yes, competition is absolutely heating up, and we can safely say Amazon’s AWS won’t be able to hold onto its current market share of above 30% as Microsoft is able to capture more new customers.

Yet, it is also worth noting that existing AWS customers are unlikely to switch cloud providers as the infrastructure, switching, and personal costs and efforts are immense, as pointed out by some cloud engineers and managers I talked to. Therefore, we can safely say Amazon’s moat is rather strong, and there is no reason to believe Microsoft will take away its customers and quickly overtake it in terms of market share.

Overall, we believe a safe estimate would be for AWS to continue losing some market share over the next few years, ending the decade with a market share of around 25-27%, which should allow it to keep growing AWS revenue by the low to mid-teens.

Another important growth driver for Amazon in Q4 and FY23 was advertising revenue, for which growth also accelerated in Q4 by 100 bps to 26%, which continues to outperform industry giants such as Alphabet and Meta. This was driven primarily by sponsored products as Amazon is improving its machine learning algorithms to improve ad targeting, increasing the value of these ads to advertisers.

Advertising is becoming increasingly more meaningful for Amazon at $14.6 billion in revenue in Q4 and we very much believe advertising is one of the largest bull case drivers here, both in terms of revenue growth as well as margin expansion.

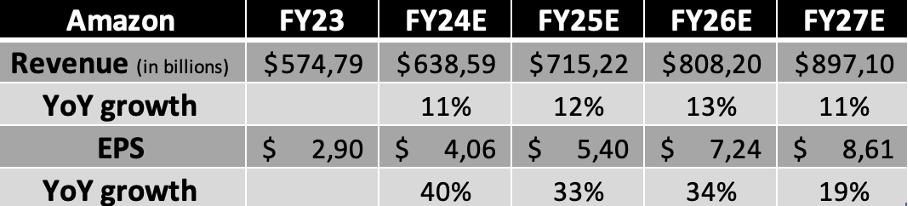

Ultimately, this very solid Q4 performance brought the FY23 revenue total to a staggering $574.8 billion, up 12% YoY. Meanwhile, operating income tripled to $36.9 billion, and TTM FCF was $35.5 billion, up from a negative level in FY22. Yes, in addition to driving impressive and resilient revenue growth, Amazon has also proven to investors and analysts that it is well able to drive solid profits if it chooses to.

Amazon also performed strongly in terms of profitability again in Q4, as operating income came in above expectations and guidance, driven by significant efficiency gains and higher-than-expected revenue. The company reported an operating income of $13.2 billion in Q4, which is up 383% YoY as the operating margin improved from 1.8% to 7.8%.

A big part of these efficiency gains is thanks to the company’s regionalization efforts, which have brought transportation distances down, leading to a decrease in the cost to serve. As a result, the operating margin for the North American retail operations improved by 120 bps sequentially and 640 bps YoY to 6.1% or $6.5 billion in operating income. This now marks seven consecutive quarters of straight margin improvements or a total improvement of 800 bps.

Meanwhile, operating income from the international operations remained negative with a loss of $419 million, which in terms of margin is still a YoY improvement of 550 bps, although also a 70 bps drop from the prior quarter.

Nevertheless, this shows us how significant the cash flow potential for Amazon is in its retail operations. For a long time, the retail operations were seen as a drag on profitability due to the thin margins and lack of overall profitability, but at this point, the actual cash flow dollars are not that far from those generated by the much more profitable AWS segment.

Meanwhile, management confirmed during the earnings call that it continues to see plenty of other opportunities in its operations to further lower the cost to serve. Management now focuses on its fulfillment architecture and inventory placement for 2024 as areas to drive further operating efficiencies, which should lead to much more margin improvement and growing cash flows from the retail segments.

We continue to believe this should, in fact, be one of the primary reasons for investors to be bullish on Amazon. Just consider that even a 100 bps margin improvement in the company’s retail operations based on current revenue levels would generate an additional $1.5 billion in operating income, highlighting the significant cash flow potential remaining for Amazon.

Yet, while the company works on improving margins in these segments, it can still count on its AWS segment to drive solid and reliable cash flows, generating an operating income of $7.2 billion in Q4, an increase of $2 billion YoY. This represents an operating margin of 29.6%, up 500 bps YoY, driven by a headcount reduction.

These operating margin improvements led to a net income of $10.6 billion, which represents a net income margin of 6.3%, which is a significant improvement from the 1.9% reported in Q4 of last year. This translated into an EPS of $1. Though, we should add that net income was helped by a pre-tax valuation loss of $0.1 billion compared to a pre-tax valuation loss of $2.3 billion from the investment in Rivian in the fourth quarter of 2022.

That then finally brings us to the Q1 outlook and our expectations for 2024. Most importantly, management now guides for revenue to be between $138.0 billion and $143.5 billion, representing YoY growth of between 8% and 13%. Furthermore, the operating income is expected to sit between $8 billion and $12 billion, representing an operating margin of 7.1% at the midpoint. This includes a $900 million one-off benefit.

Now, considering the macro backdrop and expected economic slowdown in 2024, we remain somewhat conservative in our financial estimates, even as management surprised with very strong Q4 results. We now project some weakness in the retail operations to occur with the Q2 results, although partially offset by growth in advertising, which should allow the North American and International segment to keep growing by high-single digits to just over 10%. Meanwhile, growth in AWS should continue to accelerate slightly to the 14-15% range as demand grows.

In terms of margins, we expect another year of significant improvements, now projecting an FY24 operating margin of 8.2%, translating into an EPS estimate of $4.06, up 40% YoY.

On top of this, my expectations for FY25 and FY26 are boosted slightly as advertising and AWS growth, in combination with a steady performance in retail, should allow Amazon to keep growing by double digits in the medium term. Meanwhile, my margin expectations remain the same, and I expect the operating margin to come in at 9.8% by FY25 (which is slightly conservative still). This should translate into an operating income of $76 billion and a net income of $60.77 billion or an EPS of $5.40.

Based on these expectations, shares now trade at 41.6x this year’s earnings, which is in no way cheap, especially considering current interest rate levels and the expectation for economic growth to slow down. However, Amazon still has plenty going for it and has proven to be able to grow through treacherous conditions before. Meanwhile, profitability is rapidly improving and management has got plans in place to stay on this course.

As a result, we remain quite bullish on Amazon, and as visible above, the company has plenty of growth ahead of it in our view. As a result, we continue to believe that Amazon’s premium multiples are justified. At a forward PEG of 1.66x, which takes into account future growth, shares are arguably not that expensive.

For now, we award Amazon a medium-term multiple of 38x, which we believe, combined without slightly conservative estimates, should lead to a favorable risk-reward situation. Based on this multiple and our FY25 EPS projection, we now put a target price of $205 on the shares, which translates into potential annual returns of just over 10%, which does not warrant a Buy rating for now.

At this point, we believe Amazon shares are fully priced and we believe, despite our bullish view of the company, that the current share price does not leave investors with enough upside to offset the risks.

Therefore, we put a hold rating on the shares for now. While we are happy to hold the shares in our portfolio, we are no active buyers at current levels and will look for the share price to fall below $162 before adding to our position.

Thank you for reading this post. Enjoyed it? Please leave a like to let us know!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which I hope will be insightful!

Please make sure to like, restack, and share this post to increase our reach and support our work. Thank you!

Not subscribed yet? What are you waiting for?!

Disclosure: I/we do have a beneficial long position in the shares of AMZN and META, either through stock ownership, options, or other derivatives. This article expresses my own opinions and we are not receiving any sort of compensation for it.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.