Monday.com Ltd. – A Deep Dive into a Rule of 50 SaaS leader

In this post, we dive deep into Monday.com, a rare rule of 50 company and one of the most innovative SaaS companies out there. With its exceptional Work OS platform, the company is poised for growth.

At InvestInsights, we always look for new opportunities and explore companies that have not been on our radar before. Today, our lens shifts towards Monday.com, a rising star in the realm of work operating systems. As the digital landscape evolves rapidly, businesses worldwide seek streamlined solutions to enhance productivity and collaboration. Monday.com emerges as a compelling contender in this arena, offering a versatile platform designed to revolutionize how teams organize, track, and manage their work processes.

Monday.com, aka Monday, is a company you will have most likely never heard of before. And that makes a lot of sense! The company is another high-quality SaaS company, founded in 2012, with a market cap of just over $10 billion and only 1854 employees. However, the company has rapidly emerged as a fierce competitor for established peers, with its work OS seeing rapid adoption.

The company already has over 225,000 customers in over 200 countries and over 200 industries, giving it a truly global reach despite its relatively small size. Throwing at it some more compelling stats, its Work OS platform is used by over 2 million paying users monthly; it has an amazing balance sheet with over $1 billion in cash, no debt, and positive FCF; and the company is an impressive and rare (especially today) rule of 50 company.

Usually known as the rule of 40, the rule of 50 indicates that the company has a combined revenue growth rate and FCF margin that adds up to at least 60%. The rule tells us that a company manages its growth effectively while maintaining profitability. In this case, we can safely say that Monday is not only growing rapidly but does so with solid profitability. On top of this, the company is still led by its co-founders, who are leading the company as co-CEOs with 17% insider ownership, according to Seeking Alpha.

Overall, Monday.com is definitely an interesting company and stock.

The Monday.com platform is exceptional and unique

Starting with the basics, Monday.com (the platform) is a low code-no code Work OS platform that allows organizations and users to build work management tools to fit their needs with incredible customizability. It offers access to this platform through subscription-based and seat-based pricing, making its cash flows somewhat predictable and high margin.

Monday originally started as a work collaboration tool in 2014 but has expanded over time into many other enterprise software verticals, including CRM, human resources, and software development. Today, Monday.com offers a dynamic and versatile platform designed to streamline teamwork and project management processes for businesses of all sizes and industries. At its core, Monday.com revolves around customizable workflows, allowing customers to create tailored workspaces that suit their specific needs and preferences, streamlining business processes.

In addition to its core project management functionalities, Monday.com offers specialized solutions tailored to specific industries and use cases. These include features for marketing teams, IT departments, HR professionals, and more, catering to the unique needs and workflows of different business functions. It offers this comprehensive suite of enterprise software solutions under three banners:

Monday CRM (Customer Relationships Management) helps enterprises and businesses track leads and customers, manage the sales pipeline, and close deals.

Monday Dev is the company’s software development tool, which helps software teams plan and track their sprints, manage their backlogs, collaborate on code, and deploy their applications.

Monday Work Management allows users to plan and track their projects, set deadlines, assign tasks and resources, monitor progress, and track metrics.

Of course, the company has many more apps and features than outlined and explained here, but it all falls under these three banners. Overall, Monday.com serves as a comprehensive solution for project management, enabling teams to work more efficiently, collaborate effectively, and achieve their goals with greater ease and clarity.

With this platform, Monday offers an alternative to rigid-of-the-shelf solutions designed for SMBs with little customizability and complex enterprise software with huge implementation and maintenance costs. Across the board, the company operates with incredible flexibility, whether it is pricing, development, innovation, or user customizability, making it superior to alternatives.

For example, it offers extensive integrations with popular tools and apps, such as Google Drive, Slack, and Trello, enhancing productivity by consolidating workflows and minimizing the need to switch between multiple platforms; it is highly adaptable and scalable, supporting hundreds of use cases; allows customers to adapt the software to their own preferences, not limiting them to certain templates; and is incredibly customizable and flexible in terms of platform usage and pricing.

As a result, the platform has seen insane adoption over recent years, growing its customer numbers at a 26% CAGR over the last five years, which includes the very difficult operating environment in 2023, where many SaaS peers saw a significant slowdown. Monday’s platform is simply several steps ahead of the competition and is adored by users.

Highlighting this, according to Cloudwards, Monday.com is the best project management platform across the board. From Forbes, the Monday.com platform receives a staggering 4.9/5 compared to a 4.6/5 for Asana.

Meanwhile, it also receives a remarkable 4.7/5 on G2.com out of over 10,000 reviews and is ranked the best project management platform by Tech.co, receiving the highest score out of the ten major providers with a 4.7/5. According to the reviewers, “Deciding whether a specific software program is right for your team isn't always easy, especially if you're a small business without much of a software budget. However, you'll feel instantly more organized with monday.com thanks to the software's clean and tidy interface.”

By Gartner, the company is named a leader in collaborative work management. The platform ranked #1 in 5 out of 7 use cases. Also, Gartner named Monday as a leader in adaptive project management and reporting. And yet, despite all of this, the company is slightly cheaper than most of its peers, and it offers more pricing plans, making it much easier for businesses to pick a plan that works for them.

What more needs to be said, right? Considering everything mentioned above, it is no surprise that this company is growing rapidly in a digitalizing world where collaboration is becoming more important by the day.

A top player in the CWM industry and innovation leader

The company holds a solid position in the highly fragmented and relatively underdeveloped work management industry with its Work OS platform and many enterprise software features. With its distinguished platform, Monday is uniquely positioned within the industry and has been the fastest-growing CWM company.

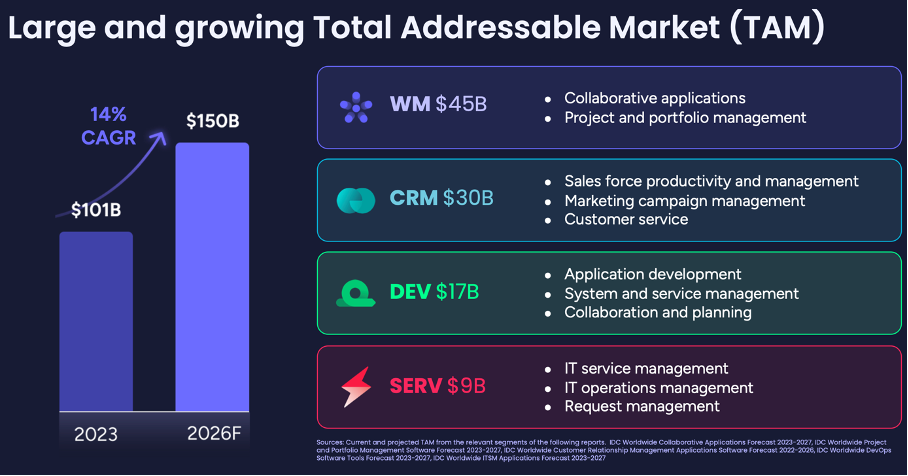

This market has been heating up in recent years as more and more organizations and enterprises look for ways to enhance their productivity in a digital and remote working environment. According to Monday’s management, its TAM currently sits at around $101 billion but should continue to grow at a CAGR of 14% to $150 billion by 2026, presenting it with solid underlying growth in its existing markets.

However, Monday’s growth isn’t just limited to growth in the underlying market; the company also still has massive opportunities to introduce new features and take loads of market share.

One of Monday's key growth strategies is innovation and expanding its product offering. Over the last several years, the company has launched several new products every quarter, meaningfully growing its platform and its usefulness to customers.

What allows it to roll out these many features rapidly and consistently is that all Work OS products are built on top of the platform, sharing 80% of the same code. This makes it incredibly easy for developers to build in new features. For reference, the first version of the company’s blockbuster CRM and Dev tools were built by just four and three developers, respectively, which is insane and speaks to the company’s abilities and superior infrastructure.

This is what allows management to drive 69% of ARR growth by bringing new features to the platform, compared to 42% in 2019. As management explains, “Invest once, harvest everywhere: each addition to the platform makes all of our Work OS better.”

The company has so far seen fantastic adoption of these newly introduced functionalities. For reference, the company’s CRM platform has seen growth accelerate rapidly since its launch, growing by 22x within 15 months and growing by 500% in 2022.

Another big growth driver is the company’s ability to capture more market share in this highly fragmented industry, which it can do through the simple fact that its platform is so much better, flexible, more user friendly, and superior to peers.

All these factors have allowed the company to see incredible adoption, growing its customer numbers at a 26% CAGR over the last 5 years. Customers worth over $50k have grown even faster at a CAGR of 132% over the last five years as the company is seeing more and more adoption among larger enterprises.

In the enterprise category, an important growth driver, Monday has seen great success with its land-and-expand strategy, as highlighted by the success of new features and growth in high-value customers. The company is able to rapidly grow its TAM by successfully penetrating enterprises.

Overall, this rapid customer growth has allowed Monday to grow revenue at an even faster CAGR of 75% over the last four years, including factors like new product releases and the acquisition of larger customers.

These factors lead Bank of America analysts to believe the company should be able to keep growing revenues at a CAGR of 30% through 2026. This is based on several specific factors, including “the potential for monday.com to surpass consensus estimates, continue gaining market share, offer value at its current price compared to peers, and leverage its expansion into the enterprise market and new product launches to drive long-term growth.” So, pretty much all factors discussed so far.

According to the analysts and Gartner vendor evaluations, Monday’s platform is exceptionally well-positioned to keep gaining market share and beat the competition. “With improvements in the platform's scalability on the horizon, analysts expect a significant increase in enterprise deployments, which should boost average revenue per user (ARPU), seat expansion, user retention, margins, and market efficiency,” as reported by Investing.com.

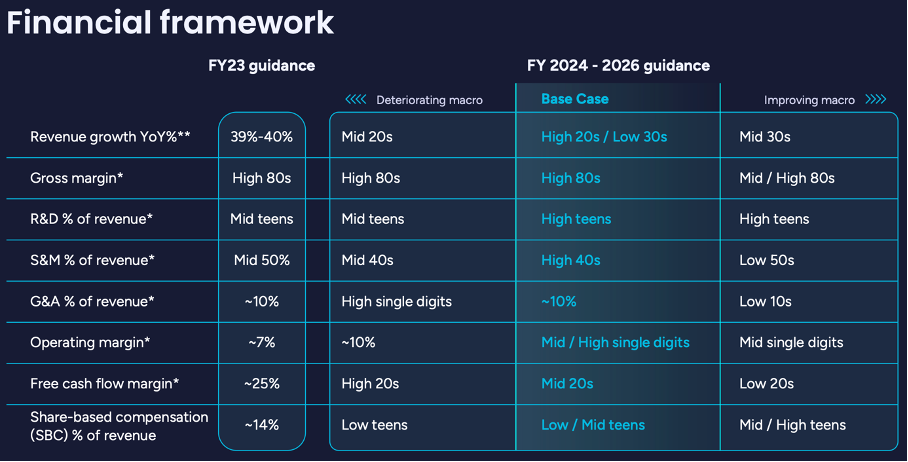

As for Monday’s own growth expectations, management laid out three scenarios based on the recovery of the macroenvironment, with the base case guiding for growth roughly in line with that of Bank of America analysts around the 30% mark. In a more optimistic scenario, management believes mid-30s growth is possible, while a more challenging operating environment could hold back growth in the mid-20s. Meanwhile, the gross margin is expected to remain in the high 80s percentages in any scenario, while the operating margin should advance to the high-teens.

Ultimately, we can safely assume, no matter the macroeconomic environment, that this company has a very bright future through its exceptional Work OS platform, with growth likely to sit around the 30% mark for the foreseeable future, which, in combination with 25% FCF margins and a net dollar retention rate of 110%, puts it in a very elite group of companies.

We are very much bullish on its future.

Most recent financials look just good

The company’s most recent financial results also look excellent. On February 12, the company released its Q4/FY23 earnings report, beating the consensus with strong results and resilient YoY growth. Overall, 2023 was another incredible year for Monday, even in the face of economic and geopolitical pressures. The company continues to exceed expectations.

The company reported Q4 revenue of $202.6 million, up 35% YoY. While this was a slowdown from the previous quarters, it was still a very impressive performance. For FY23, the company reported a total revenue of $729.7 million, up 41% YoY, driven by strong customer acquisition and expansion. The company performed particularly well among enterprise customers.

In terms of ARR (Annual Recurring Revenue), all trends are improving with, for example, enterprises rapidly becoming a larger share of ARR, more contracts becoming annual instead of monthly, and contract sizes growing rapidly.

Meanwhile, the net dollar retention rate dropped in Q4 to 110% from 120% one year ago, which management refers to as normalization. However, how these numbers move going forward is critical to monitor. Obviously, the company is facing a lot of headwinds right now, and it isn’t immune to all of these, so a slowdown at some point was inevitable.

At the current time, I am urged to believe we should see a flattening at this point and improving data from H2 going forward, with the net retention rate stabilizing around 110-115%, which would be excellent still.

On the bottom line, the company is also doing well, with a gross margin of 90% and a non-GAAP operating margin of 7% in 2023, hitting an even more substantial 10% in Q4. On a GAAP basis, the company remains unprofitable, though, with a GAAP operating margin of a negative 1% in Q4, which is still a substantial improvement from the negative 7% reported in the same quarter one year earlier. The discrepancy between the GAAP and non-GAAP results is mainly due to stock-based compensation accounting for 11% of revenue in Q4. While far from great, the company has also been improving itself on this front, bringing SBC down YoY in Q4 as it accounted for 16% of revenue one year ago.

The company has rapidly improved profitability consistently over recent years, improving the non-GAAP operating margin from a negative 91% in 2019 to 7% in 2023. Positively, the company has not needed to lay off employees to achieve this kind of profitability improvement but has continued to rapidly grow its headcount to drive long-term growth.

On top of this, the company is also not slowing down its investments in other areas, with R&D expenses in Q4 sitting at $33.3 million or 16% of revenue, in line with last year. Management plans to keep increasing these investments for the foreseeable future as management is obviously still working tirelessly on building out its product suite and scaling its OS both horizontally and vertically.

Finally, EPS in Q4 came in at $0.65 in Q4, up 48% YoY and bringing the full year 2023 total to $1.85, up from a negative $0.73 to $1.85.

These solidly improving margins, driven by rapid top-line growth, also allowed the company to improve its FCF margin in Q4 by 700 bps YoY to 27%. For FY23, the margin was up a staggering 26 percentage points to 28%, which is absolutely fantastic for a rapidly growing company like Monday.

This allowed it to generate over $200 million in FCF in 2023 and maintain a tremendous balance sheet with $1.12 billion of cash and no debt.

Apart from a somewhat weak net retention rate due to macroeconomic pressures, I have yet to find significant weaknesses in the company’s financials.

MNDY stock valuation & outlook

In terms of the 2024 outlook, investors were slightly disappointed in management’s guidance as it came in only in line with expectations. Clearly, the company is increasingly facing macroeconomic headwinds, weighing on its growth and finances. As a result, the 2024 guidance is relatively less impressive, although I believe, set into perspective, it is still rather impressive.

Management now guides for revenue of $207 million to $211 million, representing growth of 28-30% YoY, slowing down from 35% in Q4. Regarding profitability, management guides for an operating income of $8 million to $12 million on an operating margin of 4-6%, also down from the prior quarter but up YoY. Meanwhile, the FCF margin should still remain solid in the 27% to 29% range.

For 2024, this results in management now guiding for revenue in the range of $926 million to $932 million, representing growth of 27% to 28% YoY, down from 41% in 2024, but representing the challenging operating environment with a slight uptick in H2. Meanwhile, the combination of slowing growth and management continuing to ramp up hiring and R&D investments will weigh on profitability. Therefore, management guides for an operating income of 6-7% for the full year and an FCF margin to fall to around the 22% mark.

Obviously, this isn’t great, but we should remember that this slowdown will only be temporary. The expectation is for growth to improve in H2 and accelerate further in 2025. This growth acceleration should also benefit the margin development as top-line growth should once more outpace cost growth.

All in all, we now expect the company to report revenue growth of 27.6% in 2024, accelerating to over 30% for 2025 and 2026. This will then also benefit profitability after a dip in 2024. We expect EPS growth of just 8% in 2024 but a rebound to 36% and 42% in 2025 and 2026, respectively. We certainly shouldn’t underestimate the ability of this company to accelerate growth after a dip in 2024.

Based on these financial projections above, this means Monday shares now trade at a whopping 108x this year’s earnings. However, this might not be as expensive on a relative basis as it seems. According to analysts from Bank of America, the company trades at a 37% discount to its rule of 50 software peers based on enterprise value to 2024 revenue estimates. Analysts from Jefferies agree with this as they stated that Monday shares’ valuation is attractive compared to high-growth software peers, thanks to this significant discount.

So, yes, shares do trade at quite a premium, but it arguably deserves it, considering the sheer quality of the company, its product, and its financials. It is a rare rule of 50 SaaS stocks with an excellent balance sheet and an incredibly promising growth outlook.

Considering the discount shares trade on compared to peers and the fact shares have underperformed many peers on a 12-month and YTD basis, shares could be perceived as attractive at current prices. However, this will highly depend on your risk profile and preferences.

We, for one, have the shares high on our watchlist and are urged to add a few to our portfolio. We believe this is one of the highest-quality picks in the enterprise software space, and this company could be an excellent long-term hold. Yes, we acknowledge the share price is rich and would, therefore, start a position small and add on any weakness.

We rate shares a careful buy for investors with a higher risk profile. One thing is for sure: this company is exceptional.

Please let us know your thoughts in the comments! Also, please leave a like if this post was of value to you!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which I hope will be insightful!

Disclosure: I/we do have a beneficial long position in the shares of MNDY, either through stock ownership, options, or other derivatives. This article expresses my own opinions, and we are not receiving any sort of compensation for it.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.

Very well written. Tons of value in here 👏