Mondelez International, Inc. – The best Defensive stock pick today

After underperforming YTD amid high cocoa prices, this has now become a deep-value opportunity with annual returns (CAGR) potentially exceeding 17%.

Thank you for reading Rijnberk InvestInsights!

For all of you reading this through e-mail, did you know we also have an active subscriber chat [FREE]?

In this chat, we post regular daily updates and standout news items with plenty of room for discussion and questions from all of you! Here, you’ll also find my coverage of ASML’s most recent investor day event, including an updated target price and much more!

Definitely go check it out, and feel free to ask me anything there! Don’t miss out on these daily subscriber features!

After underperforming both the S&P500 and its peers significantly YTD (down 10% YTD) due to inflationary pressures hurting the business, Mondelez MDLZ 0.00%↑ shares have now ended up in deep value territory and, in my opinion, now present one of the most compelling value and defensive opportunities out there.

It has been a while since I last discussed Mondelez International Inc., a true consumer staples giant with several $1+ billion chocolate and biscuit brands under its umbrella. Since my last post on February 28 of this year, shares have lost another 13% of their value, well short of the 16% gain for the S&P500, but also falling short of peers like P&G, General Mills, and Hershey’s.

However, my investment thesis remains mostly unchanged. I will continue to argue that Mondelez offers a much more compelling long-term investment proposition than most consumer staples peers. This is due to its exposure to faster-growing industry verticals, excellent regional diversification, and a terrific management team.

For those unfamiliar with it, Mondelez is one of the leading companies in the consumer staples space, focusing on convenience food categories like Chocolate, Biscuits, and baked snacks through a diverse array of globally recognized multi-billion-dollar brands alongside an extensive collection of local and regional gems that thrive in their respective markets. It owns leading and popular brands like Belvita, Chips Ahoy, Grenade, Lu, Milka, Oreo, Prince, and many more.

Through these brands, it is the #2 player in the global Chocolate industry (13% market share), only trailing MARS but gaining market share. This industry is expected to keep compounding rather strongly at a 5.6% CAGR through 2030, making it one of the fastest-growing verticals in the snacks and beverage industry.

Furthermore, Mondelez is also the #1 player in biscuits (18% market share), well ahead of any peers and once again gaining market share consistently. This is another market expected to grow nicely through the end of the decade, with a projected CAGR of 4.9%.

Obviously, Mondelez's strong market position and exposure to faster-growing markets, combined with its excellent execution and consistent market share gains, make It an interesting long-term compounder and investment.

Ultimately, I still view Mondelez as a premier choice within the consumer staples sector, especially after this year’s underperformance has made shares considerably less expensive, now trading at a 10-15% discount to historical multiples and a considerable discount to peers.

While financial markets are dominated by bulls who invest in high-growth tech stocks, the AI promise, and Crypto, I love to buy shares in defensive leaders trading at a discount.

In this area, Mondelez is my top pick.

In the remainder of this post, I will dive deeper into the business and its recent performance and health, putting things into perspective and updating my projections and target price.

Let’s delve in!

Mondelez impresses despite significant headwinds

Mondelez reported its most recent financial results a few weeks ago, on October 29, and impressed investors and analysts as results sailed past the consensus. Management also reaffirmed their FY24 guidance, even as inflationary pressures remain very much present.

You see, the inflationary supercycle we have experienced in recent years has hit chocolate producers like Hershey and Mondelez especially hard. Cocoa prices surged to a high of above $11,000 early this year, up 341% from January 2022 levels. This forced Mondelez to raise prices significantly in recent years.

Today, cocoa prices still remain 233% above pre-inflationary levels at $8,315. As a result, while price increases are behind most businesses in this sector as inflation eases, Mondelez is still forced to raise prices to maintain margins and counter higher expenses. This is hurting volumes as consumers are only willing to accept higher prices up to a point.

Unsurprisingly, this has remained a pain point for Mondelez in recent quarters, putting pressure on its results and share price.

Positively, things have slowly trended in the right direction in recent quarters, with price pressure and subsequent increases easing and the consumer remaining relatively attached to Mondelez products, even as cocoa prices remain high.

Last quarter, Mondelez delivered solid top-line growth that topped consensus estimates. Price increases remained stable, and volumes recovered ahead of expectations. This resulted in revenue of $9.2 billion, and growth ticked up again to 5.4%, topping growth from the previous two quarters.

Unlike most of its peers, especially those with a significant presence in the chocolate industry, Mondelez is seeing a continued consumer uptake as it sees above-average consumer loyalty. This has translated into an uptick in volumes for Mondelez, somewhat surprisingly.

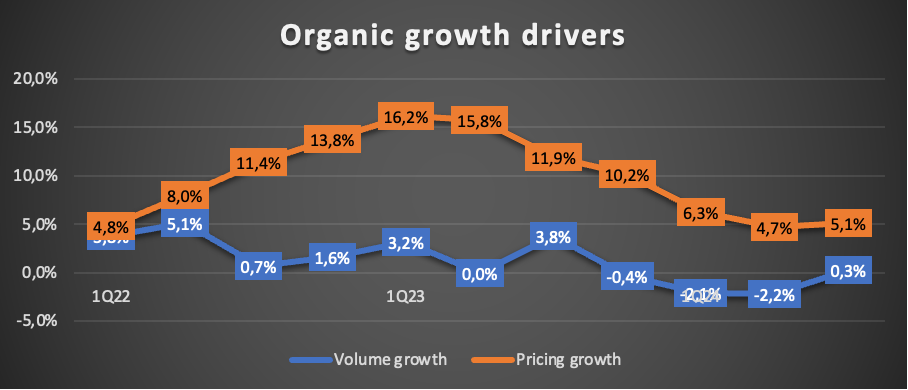

For the quarter, overall volume growth turned positive for the first time in a year at 0.3%, up from a negative 2.2% in Q2. Meanwhile, price growth remained stable from recent quarters at 5.1%, as input cost growth has also flattened.

In North America, volumes started rebounding last quarter after several quarters in which they turned negative due to price increases. Simply put, consumers adapt their buying behavior to prices, so as Mondelez raises prices, it sells fewer products but maintains margins.

However, even as price increases remain above normalized levels, volumes turned positive last quarter, not only in the U.S. but also in Europe, where volumes bounced back strongly after price increases earlier this year. Volume growth was a positive 1% in both regions.

Across the board, Mondelez still outperforms peers, and its trends are already turning the corner. This is helped by the simple fact that its chocolates and biscuits remain everyday indulgences, translating into above-average consumer loyalty.

Driven by these positive volumes, thanks to consumer loyalty and resilience and continued price increases to offset higher input costs, growth in the U.S. and Europe was strong, at 3.7% and 8.1%, respectively.

This translated into mid-single-digit growth in developed markets. Meanwhile, growth also recovered in emerging markets, with growth of mid-single digits despite continued boycotts of Western brands in certain markets, though still with negative margins, not helped by poor consumer sentiment in China.

Looking at the different product segments, chocolate revenues grew 9.2% YoY thanks to strength in developed and emerging markets, even as volumes remained negative at 1.2%. The segment is still facing headwinds from high cocoa costs, which put pressure on volumes and margins, mainly in LatAm, whereas volumes in Europe rebounded strongly.

Meanwhile, biscuit volume growth improved and was roughly flat last quarter. Again, despite continued price raises, Mondelez is seeing impressive brand loyalty, with its two largest U.S. brands, Oreo and Ritz, both gaining market share YTD. Revenue for the biscuits and baked snacks segment grew 3.3% for the quarter, as this segment sees much lower price increases than chocolate.

Moving to the bottom line, the company’s performance was even more impressive as Mondelez was able to offset high cocoa prices thanks to effective coverage strategies.

Gross profit grew by 11.2%, translating into a 40.5% gross margin, up 230 bps YoY. Further down the line, this resulted in an operating margin of 18.9%, up a very solid 220 bps YoY and hitting new multi-year highs. This was driven by the earlier-mentioned solid top-line growth, good pricing execution, and ongoing cost discipline.

These solid margin gains resulted in adjusted EPS growth of 28.6% to $0.99, beating the consensus by $0.14 or 16.5%.

Finally, YTD FCF remains solid at $2.5 billion, which is especially impressive considering that this includes a payment of nearly $400 million in the quarter related to an EU Commission fine. This is still enough to mostly cover shareholder returns.

YTD, Mondelez has returned $1.2 billion through repurchases and another $1.7 billion through dividends.

Shares currently yield close to 3%, a whopping 30% premium to the 5-year average yield and a pretty great starting yield. This is especially impressive considering Mondelez has been growing its dividend at a great rate, averaging a 5-year growth CAGR of 10%.

Meanwhile, the dividend remains well covered by cash flows at a sub-50% payout ratio.

Pretty great, I think.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe and if you like our content and if you want to show even more appreciation for our work, please consider upgrading to paid (only $5 monthly).

In addition to all the free stuff, this also gets you access to the occasional premium analyses and full insight into my personal portfolio!

Outlook & Valuation

With its streamlined portfolio of iconic brands, focused on the core categories of chocolate and biscuits, strong fundamentals, and an advantaged geographic footprint, Mondelez remains well-positioned for long-term growth.

Short-term, management left its 2024 outlook unchanged. 2024 revenue growth should be in line with its long-term targeted algo of 3-5%, and in terms of EPS, management still guides for high-single-digit growth. Not too many surprises there.

Looking ahead to 2025, the focus will once again be on cocoa prices.

Positively, cocoa prices have decreased from all-time highs and signal an eventual normalization. This has been helped by the new crop outlook, which remains positive and has significantly recovered compared to last year. This could potentially ease some of the continued nervousness due to tight physical availability.

Meanwhile, Mondelez continues to employ a flexible hedging structure to manage risk for next year.

Nevertheless, cost management and controlling pricing remain top priorities for Mondelez management. The company tries to minimize volume declines and limit elasticities, thus protecting penetration and frequency of consumption.

However, management indicates it is not looking to make shortcuts that could disrupt its business in the short term. It will not sacrifice key investments or product quality, either, which I believe indicates a confident and capable management team.

Meanwhile, management expects 2025 revenue to be in line with the 3-5% algo, excluding the chocolate segment.

In terms of margins, management anticipates continued pressure, which is likely to lead to negative EPS growth in 2025, again mainly due to cocoa prices, unless these ease above expectations.

Positively, management is more optimistic about 2026. They expect cocoa prices to normalize and the chocolate segment and its margins to rebound significantly.

Ultimately, the big question mark here remains the cocoa prices and trends, as it has a considerable impact on the business. Positively, fundamentally, the business remains well positioned for long-term growth, likely in the mid-single-digits. Meanwhile, expanding margins should allow Mondelez to grow EPS at a rate closer to the high-single digits.

These expectations and dynamics translate into the following financial projections.

After the significant underperformance YTD, as investors dislike the cocoa price uncertainty, one thing is certain: shares have become quite a bit cheaper compared to the last time I covered them.

Using the projections above and a current share price of $64, Mondelez shares now trade at just 18x this year’s earnings, a 14% discount to the 5-year average and a 7% discount to the sector median. Furthermore, looking at the dividend, we are looking at a 30% higher yield.

Therefore, at current prices, I believe Mondelez shares are close to being a deep-value opportunity, trading at quite a discount to peers and its own historical multiples.

Yes, there is still some uncertainty ahead with regard to input costs and struggling volumes, but most indicators are starting to point in the right direction, and I have a lot of confidence in this management team to navigate these headwinds and come out stronger.

Shares have fallen enough now that all these potential headwinds are more than priced in, and considering the long-term growth potential of this business, the risk-reward ratio has become very attractive.

Once headwinds ease, it is only a matter of time before shares return to trading at historical multiples.

For reference, using my FY26 projection and a normalized 22x multiple, which is still a discount to the 5-year average, I calculate an end-of-2026 target price of $87, which translates into potential annual returns (CAGR) of 14% or closer to 17% including dividends.

These are tremendous potential returns for a defensive investment.

Again, I am buying!

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

Great insight as always