Mondelez International, Inc. – Well positioned for ongoing success

In this post, we review our investment case on Mondelez following its Q4 results and the CAGNY conference.

Over the last several weeks, Mondelez released its Q4 and FY23 results and highlighted its strategic priorities at the annual CAGNY conference. Positively, following these announcements and management’s commentary, we reaffirm our enthusiasm for the company and continue to view the shares as one of the most promising in the consumer staples space. However, we do acknowledge the threat of GLP-1 weight loss drugs to the company’s key markets and deem the shares richly valued.

Before we get into the two recent presentations by management, let’s quickly explain this company to those unfamiliar with it. Mondelez is one of the leading companies in the consumer staples space, focusing on convenience food categories like Chocolate, Biscuits, and baked snacks through a diverse array of globally recognized multi-billion-dollar brands alongside an extensive collection of local and regional gems that thrive in their respective markets. It owns leading and popular brands like Belvita, Chips Ahoy, Grenade, Lu, Milka, Oreo, Prince, and many more.

Through these incredible brands, the company can drive annual revenue of $36 billion as of 2023, which has earned it a market cap of just below $100 billion. Now, while this makes it quite a bit smaller than its leading peer, PepsiCo, I do believe Mondelez offers a much more compelling investment proposition driven by its exposure to faster-growing verticals, excellent regional diversification, and terrific management team. As I pointed out in our weekly insight post last Monday, this has allowed the company to drive quite impressive growth far ahead of its consumer goods peers in the previous two years, which was fueled by both volumes and price.

We see no reason for this trend to change, and we view Mondelez as a premier choice within the consumer staples sector, also after its recent Q4 results, which weren’t incredibly well received by the market. However, the problem here wasn’t the Q4 results, as these beat the consensus on both the top and bottom lines.

The company reported revenue of $9.3 billion for the quarter, up 10% YoY. This marked another quarter of double-digit growth for Mondelez, even as it faces several headwinds like continuing inflation, shifting consumer habits, geopolitical challenges, rising cocoa prices, and more. All in all, it was a very decent performance, indeed.

However, some first signs of weakness were visible in the Q4 results as volumes turned negative for the first time in a long time, driven by weakness in its U.S. biscuits business. Overall, volumes were down 0.4% in Q4, driven primarily by North America, with volumes down 5.5%. Luckily, in Europe, the company’s largest region by revenue, volumes remained positive at 3.3%. Positively, pricing gains of 10.2% offset the volume weakness.

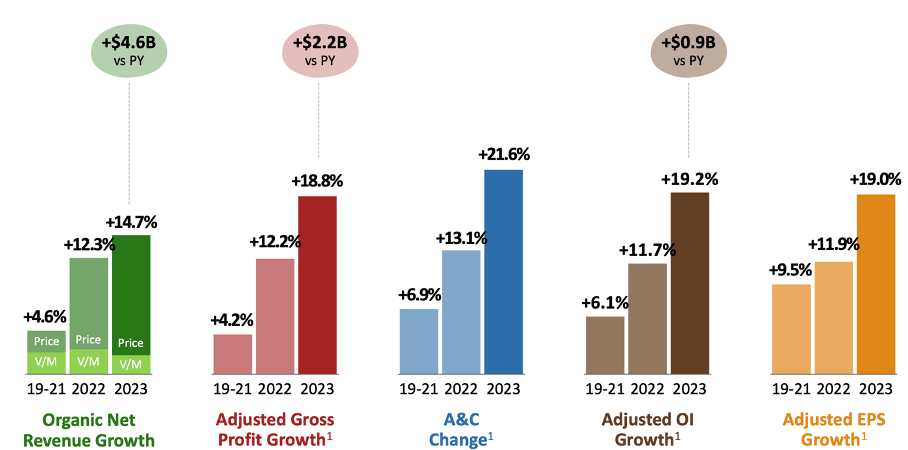

Including these solid Q4 results, Mondelez reported very impressive FY23 results, delivering double-digit top-line growth driven by pricing and resilient volumes. Over the full year, volumes were up 1.3%, with pricing contributing an additional 13.4%. This highlights that consumers kept buying the company’s products despite significant price increases, demonstrating resilience. This resulted in Mondelez reporting organic revenue growth of 14.7% for FY23.

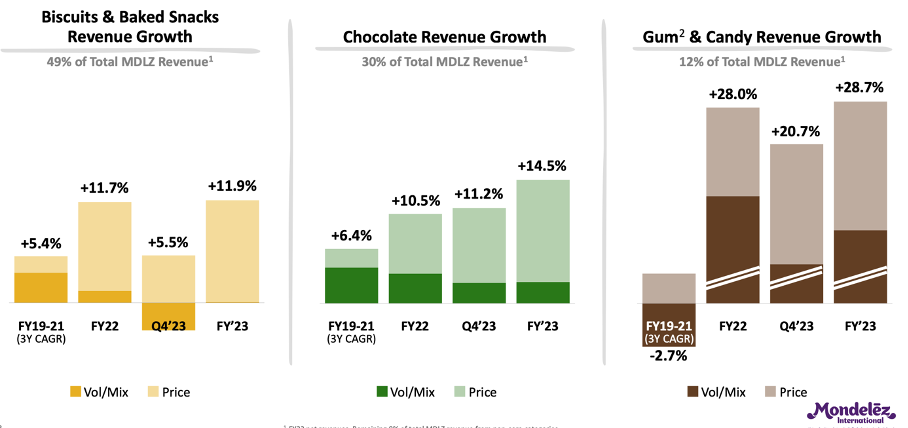

Moreover, growth in both Q4 and FY23 was driven by all regions and product categories, highlighting a resilient performance company-wide. Biscuits grew by 11.9% for the entire year and by 5.5% in Q4, with the latter representing some volume weakness. Meanwhile, the performance in chocolate was slightly better, with this segment generating revenue growth of 14.5% in 2023 and a very resilient 11.2% in Q4, driven by both developed and emerging markets and volume and pricing. For this segment, volumes remained positive at 2.4% in Q4, showing little weakness or deterioration from the 2.5% volume growth reported across 2023.

In the end, both Mondelez’s largest segments delivered very impressive double-digit growth in 2023, now accounting for 80% of revenue. The remaining 20% comes from the company’s Gum and Candy operations, which grew by more than 28% in 2023 and 20% in Q4.

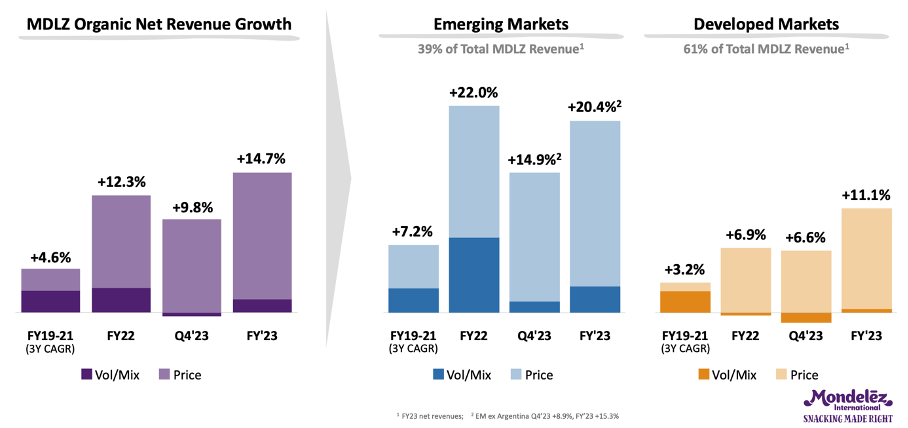

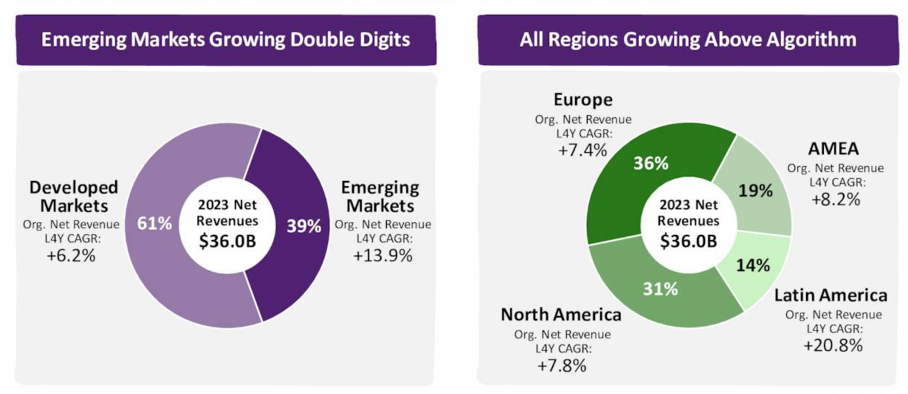

In terms of performance by region, the company continued to report solid growth in both emerging and developed regions. For the entire year, revenue from emerging markets was up 20.4%, outpacing the 11.1% growth reported for developed markets. Growth in both regions did slow down in Q4 to 14.9% and 6.6%, respectively.

The slowdown in developed markets was driven primarily by the U.S., where Q4 growth slowed down to just 1.9% compared to 9.5% for the entire year. This was driven by a volume decline as a result of softening the U.S. biscuit category and tight inventory management in advance of Q1 pricing, according to management. Meanwhile, Europe still grew by an impressive 11.6% in Q4 and 14.5% in FY23, driven by strength in the chocolate category.

Finally, Latin America, the company’s leading emerging markets region, grew revenues by 34.8% in FY23 and 28.6% in Q4, driven by strong volumes and exceptional pricing, driven by staggering inflation in Argentina. Ex Argentina, growth in Latin America was a more normalized 18.1% in 2023 and 9.2% in Q4. Still, with volume growth of almost 4% in FY23 and over 2% in Q4, the segment continues to outperform as Mondelez is expanding in these countries.

Following the outperformance in FY23, emerging markets now account for 39% of revenue, with developed markets accounting for 61%, which is an excellent mix of stability and riskier growth. It is one of the reasons we are particularly bullish on Mondelez – the company clearly focuses on emerging markets, where it is performing excellently and which is driving significant growth. For reference, these regions have grown at a CAGR of 13% over the last five years, far ahead of developed markets. This exposure positions it favorably to keep outgrowing its peers.

Moving back to the financial results, this strong top-line performance also allowed it to report record cash flows and profits, with it reporting a gross profit of $13.33 billion, up $2.2 billion or 18.8% YoY. The gross margin improved by 30 bps YoY to 37.5%, which led to an improvement of 10 bps in the operating margin to 15.9% and 15.3% in operating income. Ultimately, this drove EPS up by 19% YoY to $3.19 for FY23, which already includes a $0.11 negative impact from the sale of its developed markets gum business.

Overall, Mondelez delivered truly impressive FY23 results, showcasing incredible resiliency and outperforming peers. Just consider that, according to management, the company gained market share in 65% of its revenue base in 2023, beating its competitors across the board, while it already leads the chocolate and biscuits categories.

Mondelez highlights its strategic priorities

As we said at the start of this post, we do not expect this change anytime soon and believe that Mondelez’s excellent strategy and focused management team will allow it to keep outperforming and take market share. In 2018, the company outlined a new strategy, and we can safely say this has paid off handsomely so far, with the company delivering industry-beating and accelerating growth.

Mondelez management has shown an excellent ability to understand market dynamics and steer the company in the right direction. It has successfully implemented a forward-thinking approach, focusing on biscuits and chocolate, two high-growth product categories within the snacks industry, supporting its normalized revenue growth goal of 3-5%, which it has consistently outperformed. It is also well on track to meet strategic targets with these two key segments almost accounting for its targeted 90% of revenue. I believe this quote from management says it all – they are confident in their strategy:

“We are playing in the right categories, and we are playing to win.”

For some background, as stated multiple times before, Mondelez is now entirely focused on the snacks industry, specifically its two key categories - chocolate and biscuits - which are incredibly promising categories within snacks and consumer staples. During the CAGNY conference, Mondelez management pointed out some exciting data, including the fact that 88% of consumers snack, a percentage that is even higher among Gen X and millennials at 94%. Incredibly promising data, indeed!

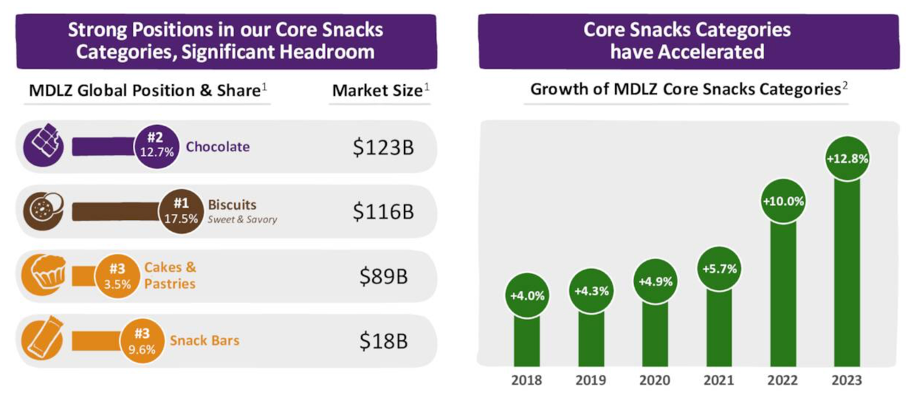

Moreover, Mondelez management pointed out that research shows that “66% of consumers consistently make room for snacks in their grocery budgets even though they are more conscious of rising prices, ” something that has been clearly visible over the last year as Mondelez was able to outperform many peers in the consumer staples sector. Overall, this data points to snacks being a relatively resilient sector in an already highly resilient industry. Ultimately, Mondelez believes this should allow its focus categories to grow consistently by mid-single digits.

Another valuable data point is that snacking is very brand-focused, with 76% of consumers indicating that they are loyal to their snacking brands, once more benefitting Mondelez with its incredibly popular and well-established multi-billion dollar brands. Just consider that its largest brands – Oreo, Milka, and Cadbury - already achieved more than $10 billion in annual revenues in 2023.

As a result, Mondelez already holds a very close number 2 position in the global chocolate industry with a 13% market share and a very strong number one position in biscuits with a 17.5% market share. Considering this and its incredible brand strength, we can safely assume Mondelez will grow in line or slightly faster than the underlying industry.

Meanwhile, it also holds solid positions in smaller but faster-growing categories like cakes and pastries, where it is number two with a 3.5% market share, and the snack bar market, where it holds nearly 10% of the market. Considering this and the fact that the company has solid exposure to emerging regions, has exposure to faster-growing markets, and is focused on M&A opportunities to accelerate growth further, it should be clear why we are quite bullish on Mondelez’s growth potential.

In terms of M&A, management stated that it has a simple and straightforward approach:

“We look for growth opportunities that address key portfolio gaps in our core categories and adjacencies, as well as strategic geographies. We drive value through strong integration and by leveraging our global footprint distribution strength, marketing expertise, and financial discipline.”

Finally, management also remains committed to significantly investing in the business with the goal of investing half of its gross profits into the business, which fuels local-first commercial execution and increased investment in its brands and talent. Management strongly believes this is incremental in delivering attractive, sustainable top and bottom-line growth.

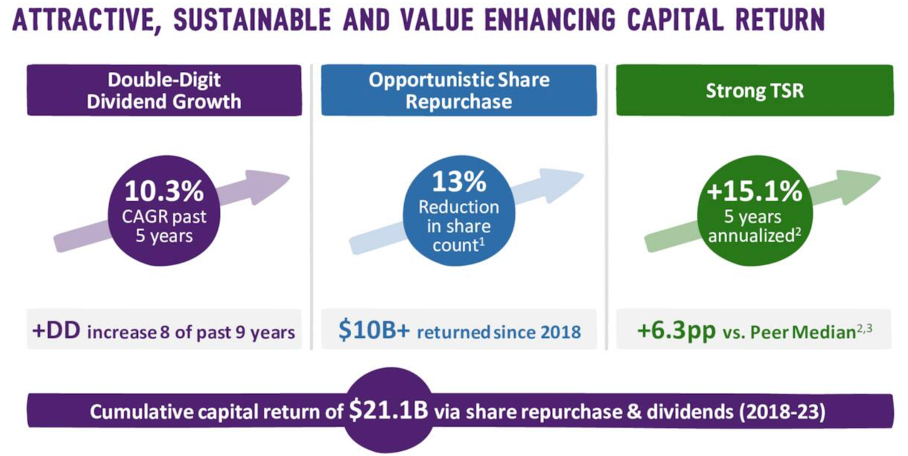

Ultimately, we continue to view revenue growth of 4-7% and basic EPS growth of 7-9% in the medium term as a reliable growth estimate. Now, this might not sound like the most exciting return prospect from an investor’s standpoint. However, this company and management team are also incredibly shareholder-friendly. Just consider that it has returned over $20 billion over the last five years, which includes over $10 billion in share repurchases, retiring approximately 18% of outstanding shares.

During the CAGNY conference, management once more reiterated that it remains fully committed to returning cash to shareholders and to consistently growing its attractive dividends at a pace similar to or slightly above its adjusted earnings growth, which should indicate that the dividend should continue to grow at high-single digits at the very least.

Shares currently yield 2.3% after management has grown this by double digits in eight out of the last nine years. It has now grown the dividend for ten straight years and still only pays out below 50% of its earnings, making the dividend well protected. All in all, it is quite an attractive proposition.

There is only a single real point of concern here

Now, before we get into the shorter-term outlook and valuation, we first want to briefly discuss one of the key concerns, which relates to the rapid adoption of GLP-1 weight loss drugs, which are said to impact food and beverage consumption. In our post on Monday, we wrote that research shows that GLP-1 drugs cut grocery bills by 9%. Categories impacted the most include “snacks, pastries, and ice cream, while yogurt, fish, and vegetable snacks are most positively impacted,” according to Morgan Stanley analysts.

Obviously, this is a reason for concern for a global snacks giant like Mondelez. As of today, only around 12.3% of U.S. households have a member using GLP-1s, making the overall impact still rather limited for global food and beverage giants. However, the drugs are expected to continue seeing massive adoption, and clearly, this could significantly impact the consumption of snacks.

However, during the CAGNY conference, Mondelez management indicated that its data showed that “consumers firmly believe snacking plays an important role in active and busy lifestyles,” which is why management is not overly concerned for now. According to management, “more than two-thirds of consumers look for snacks that are portion-controlled, up 5% from last year,” which gives them confidence that snacking remains a great business.

At this point, we are less confident than management seems to be, as data clearly shows that the usage of these weight loss drugs does impact calorie and snack consumption. We will keep a close eye on incoming data and trends impacting Mondelez’s business to better understand what this means for Mondelez. However, for the time being, we believe the impact should be limited, and Mondelez should have plenty of time to adapt its portfolio of products to match a new demand environment.

While this threat could weigh on the valuation multiple and could warrant a slightly lower multiple, we don’t believe it is a reason to stay away from the shares.

MDLZ stock valuation & outlook

In terms of outlook, investors weren’t as happy with Mondelez after its Q4 results. The company has seen volumes deteriorate in every segment and across all regions due to consumers digesting the price increases, which was inevitable. On top of this, Mondelez is also finalizing its pricing initiatives to offset inflation, with this trending down. This puts Mondelez in a tricky in-between position now, with pricing easing and volumes weakening. This is expected to impact the business in 2024, especially with cacao prices at all-time highs and consumers not willing to swallow much higher prices.

As a result, the 2024 outlook isn’t great, although also not much worse than what we already expected. Management now expects 2024 net organic revenue to be at the high end of its long-term algorithm of 3-5%. This includes the assumption that the chocolate business in Europe will keep outperforming and inflation will be in the high single-digit range due to the high cocoa and sugar prices. For EPS, management now points to high single-digit growth and free cash flow of over $3.5 billion, roughly flat to slightly up YoY.

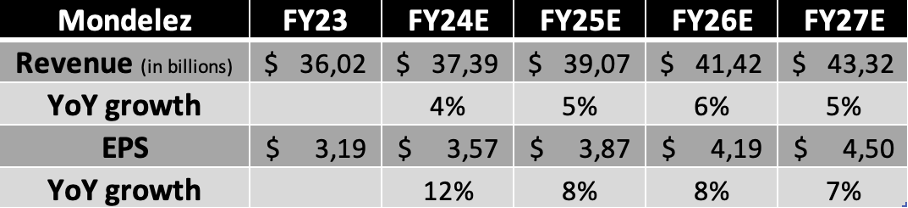

Overall, this is not the most impressive guidance indeed. However, Mondelez management generally guides very conservatively, so we believe these estimates have some upside. Therefore, we now expect revenue growth of 3.8% and EPS growth of 12%, slightly down from our previous expectations. However, we kept our medium-term estimates mostly intact.

Based on these estimates, shares now trade at roughly 20.5x earnings, which is far from expensive and roughly in line with many of its peers, which we believe are less attractive from a long-term growth perspective. Hershey and PepsiCo, which could be perceived as its closest peers, trade at roughly similar valuations, while Coca-Cola trades at a slightly higher valuation

Meanwhile, we remain of the opinion that Mondelez is one of the best positioned among its peers, with leading positions in its respective focus sectors, a clear strategy, an excellent management team, and a very shareholder-friendly approach.

Considering this and the GLP-1 uncertainty, a 22x multiple is fair for this high-quality business, which, based on our 2025 EPS projections, translates into a target price of $85 per share. This means that from a current share price of just above $73, investors can expect annual returns of just below 8% or roughly 10% when including the dividend, putting these right on the edge of a hold/buy rating.

Therefore, at this time, we are no active buyers of Mondelez, but we do continue to view the shares as an excellent hold in any portfolio. The company has significant long-term growth potential and offers excellent stability through more challenging times, as confirmed by management during the CAGNY conference.

We will add to our position on any weakness but do not view shares as attractive enough at the current time and prices of over $73 per share.

Please let us know your thoughts in the comments! Also, please leave a like if this post was of value to you!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which I hope will be insightful!

Disclosure: I/we do have a beneficial long position in the shares of MDLZ, either through stock ownership, options, or other derivatives. This article expresses my own opinions, and we are not receiving any sort of compensation for it.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.