Hi all,

Thank you for reading the monthly update, and welcome to all new subscribers who joined us last month.

For those new to Rijnberk InvestInsights, please note that the portfolio insights later in this post are only for our paid subscribers, hence the paywall. For all our new non-paid subscribers, do not worry! Only our monthly portfolio updates include a paywall, but all our stock analyses and deep dives are free for all!

If you would like full access to the entirety of this post and future portfolio updates, consider subscribing to our paid subscription tier ($4.99 monthly)!

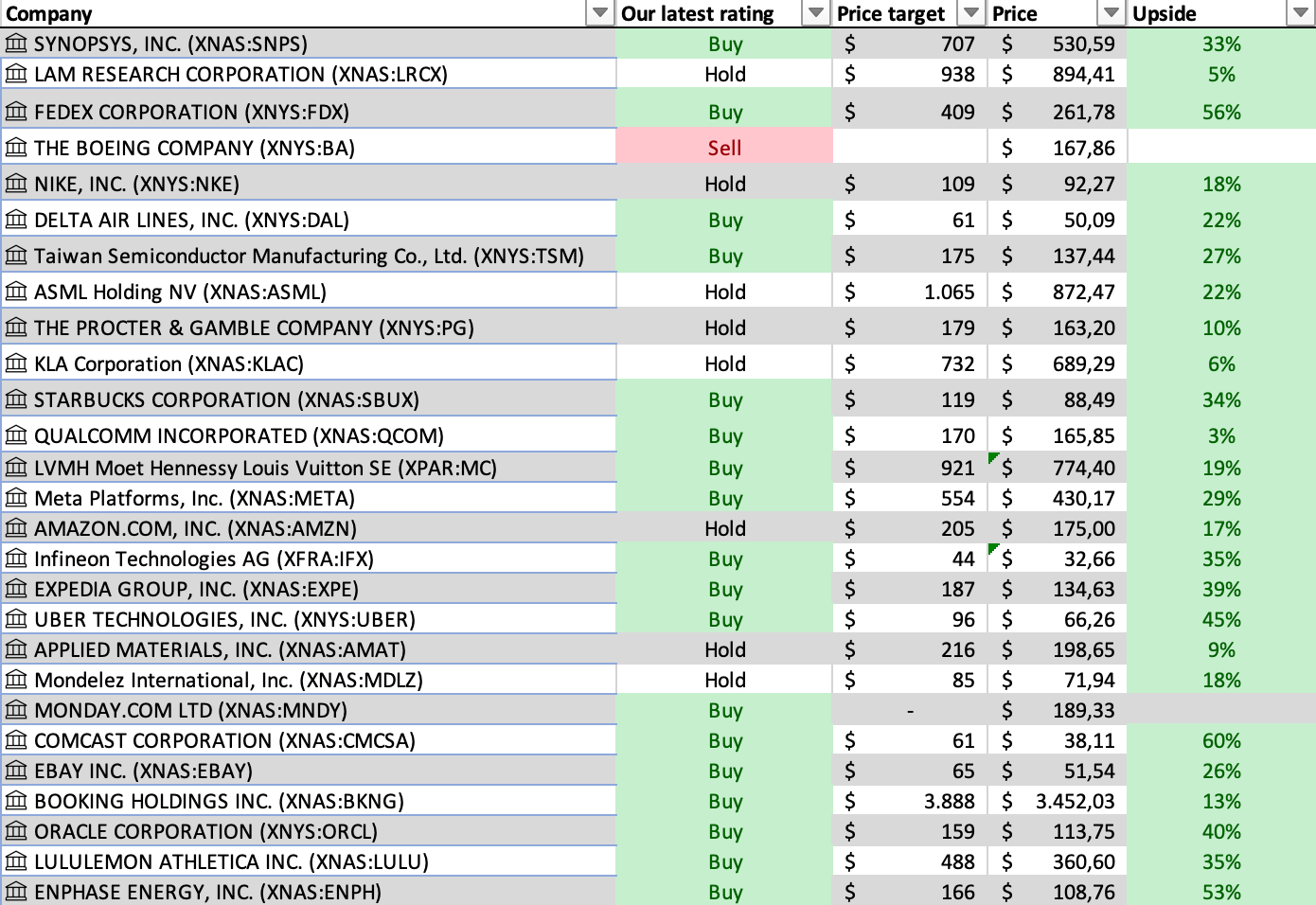

Now, for both our paid and free subs, let me introduce you to a new overview. The graph below shows all of our ratings issued here on Substack, hopefully providing some ideas and inspiration for your portfolio.

Note that some of these ratings can be slightly outdated (most often at most three months), but the remaining upside and price target statistics should help with that. Also, for each of these companies, you can find a complete analysis on our Substack page on either the Substack website or the app.

We will make sure to keep this overview updated monthly to make all our ratings easily accessible.

On that note, let’s move on to the portfolio.

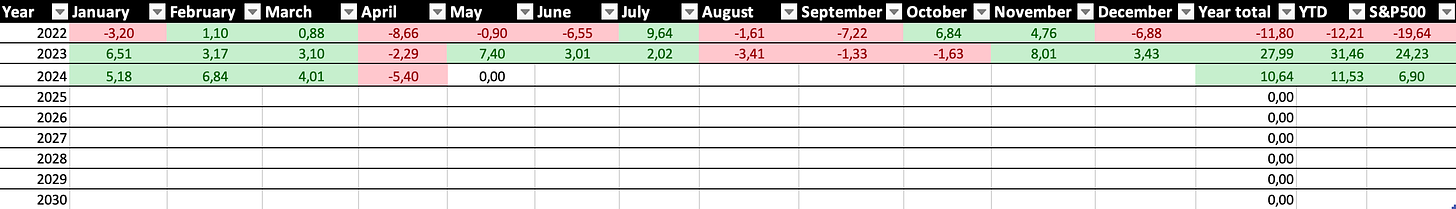

We can safely say that the fun has ended in the financial markets. A five-month run of positive returns ended as the S&P500 ended April down roughly 4.2% and the technology-heavy Nasdaq fell by 5%.

Our portfolio didn’t do much better, losing 5.4%, though this is partly the result of a significant reorganization we announced in our last monthly update. We have been moving our funds around quite a bit over the last month after more than halving the available funds in February for a big transaction outside of investing. Poorly received earnings from Meta and ASML and overall poor sentiment toward semiconductor stocks also did us no favors.

However, on a YTD basis, the portfolio has performed significantly better than the S&P500, returning 11.5% in the first four months, against a 6.9% return from the benchmark, and it did so with a low-risk profile.

Furthermore, the portfolio is now pretty much complete, with almost all funds allocated and a full focus on buy-and-hold investing. We expect to add three more stocks in May to complete the portfolio for now.

We believe this portfolio should continue our track record of outperformance in both bull and bear markets in the long run while maintaining a low-risk profile and a healthy flow of growing dividends. We are very happy with the current balance.

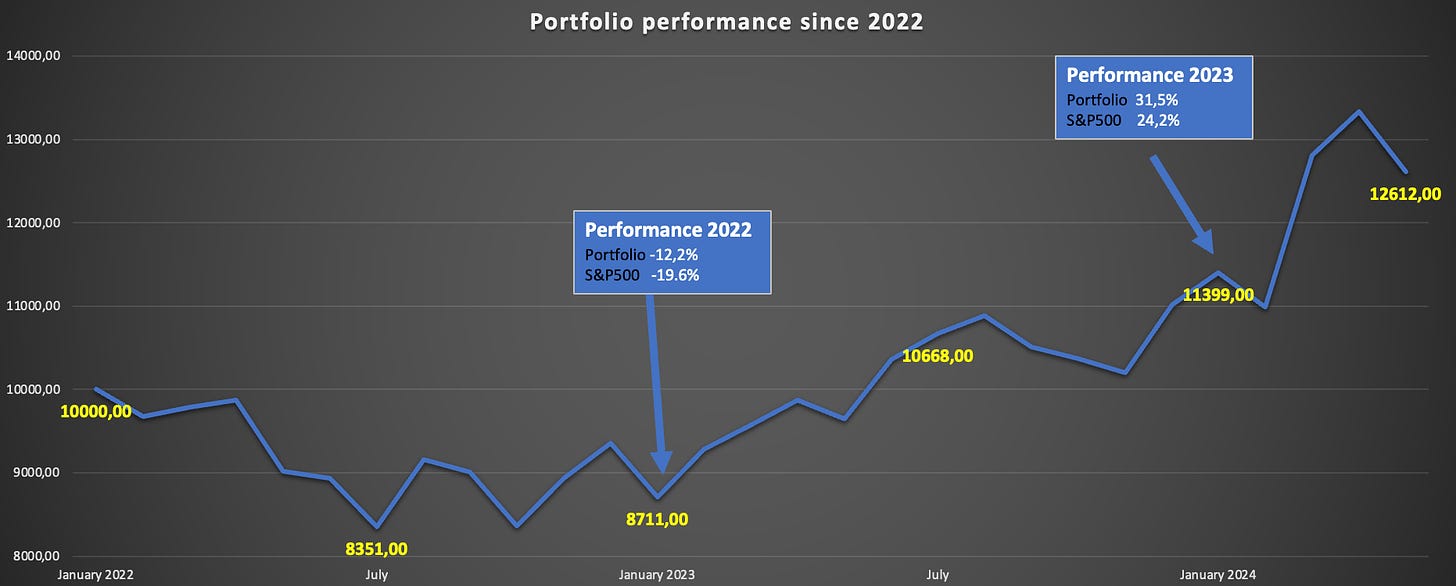

For reference, our portfolio, in different forms, has outperformed the S&P500 by a significant margin since the start of 2022. Our portfolio has gained 26.1% since, compared to a 5.7% gain for the S&P500 and 33.4% gain for the Nasdaq.

We monitor and highlight this performance in the graph below with a hypothetical $10,000 investment, now valued at $12,612.

Here is the performance by month.

As of May 1st, this is what our 29-stock portfolio looks like. We have chosen each of these carefully and plan to hold them for as long as our investment thesis is intact. Ideally, we hope never to sell a share.