I can’t say I expected to say this before 2022, but Nike, the global apparel and shoe giant and leader, has made a fall from grace. Shares of one of the most valuable and well-recognized brands (who doesn’t know the famous ‘swoosh’) have lost a staggering 57% of their value from a late 2022 high of $178 to a share price today of only $76.

Nike shares are also down a whopping 29% YTD, significantly underperforming the S&P500’s 26% gain, as well as the 15% gain by close footwear peer adidas and even apparel peer Lululemon’s 25% loss.

And, honestly, for good reasons. Nike has been struggling to stay relevant due to a lack of innovation and wrong strategic calls by an unfit management team. As a result, the company has seen organic sales decline and inventories rise to unhealthy levels, forcing it to be overly promotional.

In other words, not a lot has gone well for Nike in recent years, leading to market share losses to smaller competitors and worsening financials. In response, Nike shares still trade close to a multi-year low today.

Positively, the company is working on a turnaround under a new CEO—a true Nike veteran—who is looking to address the strategic mistakes of recent years. Also, fundamentally, Nike isn’t in such bad shape. The company is still by far the largest player in the apparel and footwear markets, even after some market share losses, continues to have a mighty brand ranked 14th most valuable globally, and has plenty of levers to pull to drive growth under the right strategy.

I must say, I am quite optimistic about Nike’s turnaround chances, especially under its new CEO.

Interestingly, Bill Ackman also seems confident in Nike’s turnaround, pouring money into the business. The super investor grew his Nike position by more than 400% last quarter, making it his sixth-largest position, accounting for 11% of his $12 billion fund.

Therefore, it is about time we examined Nike again, reviewed its recent struggles, and discussed management’s plans to revitalize the business.

The company also reported its fiscal Q2 results recently and saw shares trade flat during the following trading session and ever since. Nike’s brand-new CEO quickly tempered initial turnaround optimism, claiming a turnaround would take time and money, scaring investors a bit.

However, as the title of this article already proclaims, I am quite confident and optimistic about Nike’s long-term potential. Ultimately, this is the world’s leading apparel and footwear brand and one of the strongest brands globally. Even though the company doesn’t operate in very exciting and slow-growing markets, there is still plenty to like here!

Let’s delve into all the recent developments and the fiscal Q2 results to get a better sense of where the company is at, before moving to my updated financial projections and target price.

Let’s delve in!

Nike has suffered due to poor strategic calls

First, let me highlight what has gone wrong for Nike in recent years, causing its shares to lose over half their value.

You see, Nike’s recent struggles and subsequent market share losses are the result of apparent mistakes by management over recent years. Multiple factors have contributed here.

For starters, during the COVID-19 pandemic, Nike reduced its new product pipeline and relied more heavily on its perennial top sellers, such as the Dunk, Air Jordan 1, and Air Force 1 models. However, after a couple of years, this lack of innovation and newness came back to haunt the business, as consumers became bored and were no longer attracted to buying new products.

In addition, over the last decade, but more significantly after COVID-19 hit in 2020, Nike had focused on increasing its DTC (direct-to-consumer) sales through its own Nike stores and Nike.com website, as this translates into better product control and margins. In response, the company removed its products from many of its trusty brick-and-mortar retailers, expecting to recapture all this demand through its own channels.

Yeah… that didn’t go so well.

This trend now seems to be reversing, with Nike once again working closely with many retailers such as Foot Locker and JD Sports. In recent quarters, Nike seems to have realized that it can’t live without these wholesalers for multiple reasons.

For starters, ultimately, many people still value the buying experience in-store, something Nike has been offering far less with its own physical store footprint quite limited. In addition, no presence in physical stores has simply made the brand less visible. Consumers just don’t get in touch with its products as often, which you can imagine isn’t a great strategy for a fashion brand.

This has almost certainly contributed to Nike’s market share losses in recent years. It has simply been selling fewer products because it couldn’t capture all this wholesale demand through its own channels. This forced it to be far more promotional, hurting margins, sales, and brand image.

And this is all still hurting the business today. The company still lacks innovation and newness in its product line, which is why it is still struggling to stay relevant, failing to excite consumers.

Unsurprisingly, this has opened the door for newer, smaller, and more nifty and innovative competitors to pick up this demand, such as Hoka and On Running, which both have been taking market share from Nike and are rapidly gaining in popularity.

For reference, since the pandemic, Hoka and On have seen their market share in footwear triple, filling in for demand missed by Nike and adidas. At the same time, Nike has seen its market share drop by a few percentage points from a 2019 level of 23.4%, well ahead of any competitors, to around 20-21% in 2024, which is a rather significant loss.

Clearly, Nike and adidas can’t drop the ball any longer and keep relying on old favorites. There might be some consumer fatigue.

As a result, Nike’s global market share (for sneakers and apparel) dropped from 17.1% in 2022 to 16.4% in 2024.

Now, this is all far from great, and management in recent years has definitely dropped the ball on most fronts, but let’s not all overreact to the situation here. While things most certainly need to change here, the damage done in recent years is not beyond recovery, and Nike remains by far the largest footwear and apparel company by market share globally.

For reference, its 16.4% market share is still well ahead of #2 adidas, with a 9% market share or #3 and #4 Anta (3.7%) and Puma (3%).

Nike’s moat, brand, and size are still unequaled in the industry, giving it a significant edge and a strong foundation for turning the business around. In terms of revenues, Nike is about two times the size of its largest competitors, giving it significant budget advantages in R&D, marketing, and distribution.

Also, Nike’s brand power remains significant. Nike still claims the number 14 spot on Interbrand’s most valuable brand list, with a value of $45 billion. And it does well across all age categories, including teenagers. Nike remains the No. 1 brand for all teens in both apparel (34% share) and footwear (59% share), and although this is down somewhat from prior years, it is miles ahead of #2 adidas, taking just a 7% share.

So, clearly, Nike’s brand remains as strong as ever, and a successful turnaround is not that far-fetched.

Nike, under Elliott Hill, is on the right way to realize a successful turnaround

So, what is management’s plan?

To address all these issues and get back to its core mission and strategy that has made it so successful for so many years. This quote from the earnings call says it all:

“We [will] create innovative and coveted products, tell emotional, inspiring stories through our brand, and execute in a way that grows the entire marketplace, digital and physical, wholesale and NIKE direct.”

Exactly everything Nike has missed over recent years. It seems like management has identified exactly those issues I alluded to before, and new CEO Elliott Hill is very open about what has gone wrong. He embraces it, looking for a way to solve each of these issues and move forward.

And Nike plans on doing this under a new CEO – a true Nike veteran. You see, after a tremendous 14 years under Mark Parker as CEO, Nike appointed a new CEO in 2020, John Donahoe, an outsider. John Donahoe had a solid CV with leadership functions at tech companies like eBay, PayPal, and ServiceNow, and with this technology experience, he was appointed to turn Nike into a semi-tech business, rapidly growing and transforming its digital infrastructure.

This worked great during the COVID-19 crisis, with Nike’s digital and direct channels exploding as physical stores closed globally. Subsequently, Donohoe was convinced consumers would never return to traditional shopping—he couldn’t have been more wrong.

Meanwhile, this CEO choice led to Nike being managed as a technology company, moving away from its core identity, which had made it so successful in the previous decade, and losing its consumer—and sports-centered focus.

Bloomberg described Donahoe as 'The Man Who Made Nike Uncool,’ and by now, we all know how that has worked out.

Therefore, Nike is heading in a different direction. Elliott Hill took over as Nike CEO two months ago, though he is everything but new to the business. This is a real Nike veteran.

Elliott started at Nike in 1988 as an apparel sales representative intern. Over the years, he worked his way up into management functions before retiring in 2020, having worked all those years within the Nike organization.

Whereas in most situations, a board and investors prefer an outsider when looking for a new CEO, this wouldn’t work for Nike. This company needs a return to its core identity, which has made it one of the most visible and globally loved brands. No better way to do this than to go with a guy who knows every part of the business thanks to a 32-year stint with the business.

In my opinion, this is exactly what Nike needs. Elliott intends to once more lead Nike as a fashion and sports icon, revitalizing its wholesale partnerships and returning the brand to what it was 5 years ago. Here is what he said during the earnings call:

“When I retired in 2020 after 32 years, I continued to stay in touch with many of my teammates and cheered them on from the sidelines. Why? Because I have an irrational love for this company. I know NIKE inside and out, take pride in what the brand stands for, and want to see the company succeed. And in a moment where our team, brand, and business are being challenged, my singular focus is to help get us back on track to get back to winning.”

Elliott already seems to have correctly identified and acknowledged these recent weaknesses and has a plan to revitalize the business. Here is how new CEO Elliot Hill started his first earnings call last week:

“We, the entire NIKE team, feel the sense of urgency here.”

During the earnings call, Elliott confirmed that he wants Nike back to being Nike again, leveraging what has made the brand so great over recent decades.

As I said before, the company still owns three iconic brands and many more product lines, has a dominant roster of athletes, teams, and leagues, a deep catalog of products at every price point, and an integrated marketplace and global infrastructure with a presence in 190 countries.

The foundation here really is excellent, and Elliott intends to maximize each of these assets, starting by addressing the failed Nike Direct strategy.

During last week’s earnings call, Elliott was very open about the very wrong choice of prioritizing Nike Direct in recent years and breaking longstanding partnerships with wholesalers around the world, which, together with a lack of innovation, has impacted the health of its marketplace and its ability to sell products.

As Elliott points out, Nike has become far too promotional. Its digital platforms deliver roughly a 50/50 split of full-price sales to promotional sales, which is poor. This is extremely unhealthy, hurting margins and impacting the brand’s premium appeal.

Therefore, going forward, management will focus promotions during traditional retail moments, not at the consistent levels we are seeing today. Crucial to realizing this is a renewed relationship with wholesale partners worldwide.

Elliott plans to revitalize most of these partnerships and regain trust, with Foot Locker and JD Sports, for example. He plans to give these partners once again access to the best products and the breadth and depth they need. Here is what Elliott added:

“We'll do more than just sell in our products. We'll actively support mutually profitable sell-through. Simply put, we will win when our partners win.”

Nike will once more manage a consumer-led vision, putting its best products right in the path of the consumer, no matter how they choose to shop, increasing the visibility and availability of the Nike brand and its products.

Nike is really going all in on wholesale again, and I can only say I love this approach. This is the first big step to tackling its problems.

In addition, Elliott confirmed that Nike has lost its obsession with sports, a big part of its identity and appeal to consumers. For example, in recent years, Nike has become more focused on signing the most important celebrities/influencers to its brand, losing its connection to athletes and sports.

Positively, management intends to turn this around and intends to put its athletes at the center of every decision going forward. Here is another quote from the earnings call:

“We will get back to leveraging deep athlete insights to accelerate innovation, design, product creation, and storytelling. Sport is what authenticates our brand.”

This includes a renewed focus and bold and creative marketing leveraging its athletes and unique sports moments enabled by Nike. In recent months, Nike has been on top of this already, signing new long-term deals with the NBA and the WNBA, the Brazil Football Confederation, FC Barcelona, and last week, a new deal with the NFL through 2038.

Here is another telling quote:

“We drive growth through sports most iconic partners. Their athletes are the creative fuel for our brand. The power our innovation agenda, our brand voice and our revenue. Inspiring the consumer includes being part of the active communities who run, train and compete locally. It's about showing up and building relationships every day with athletes and influencers.”

These quotes tell me that Elliott has an extremely thorough understanding of Nike and its meaning. In my opinion, he is addressing exactly those areas where Nike has failed in previous years. Again, there is nothing wrong with the foundation here, but its strategy had moved in the wrong direction. It just needs some correcting, and that is exactly what Elliott intends to do.

Management is committing to a multiyear cycle of innovation, refreshing its product line-up and reattracting consumer interest. This also includes a major restructuring under a new CEO, including the layoff of 1,600 employees or 2% of its workforce, as it looks for significant efficiency gains of up to $2 billion in cumulative cost savings over the next three years.

Indeed, change won’t happen overnight. Product innovation and development, especially, could take some years to materialize fully, which could lead to some sales sluggishness in the coming period as the company goes through a transition period.

As claimed by the new CEO, this transition and reorganization will take time and money, but management is willing to take this near-term (margin) pain, focusing on the long-term view. Management is focused on the long-term health of the brand and business, as well as long-term shareholder value.

Considering the fundamentals and nature of the problems, I am quite confident and willing to take some short-term pain.

On that note, let’s delve into the financials and recent performance.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe and if you like our content and if you want to show even more appreciation for our work, please consider upgrading to paid (only $5 monthly).

In addition to all the free stuff, this also gets you access to even more premium analyses (3 per month), full access to my own outperforming portfolio, immediate trade alerts, and a full overview of all my price targets and rating, and even more!

Nike shows weakness all over the place in Q2

Nike reported its fiscal second-quarter results last Thursday and beat the consensus estimates, even as its results continued to show broad weakness. While financial results largely met management’s expectations, headwinds remained significant, and global store traffic was below expectations.

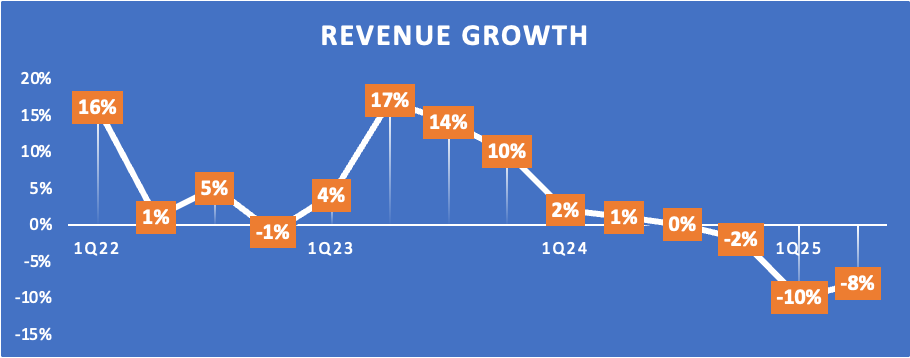

Nike reported total Q2 revenues of $12.35 billion, beating the consensus by a solid $240 million but also down 8% YoY, reflecting ongoing traffic headwinds and the effect of management’s actions outlined earlier. Particularly in September and October, Nike reported very low traffic numbers before turning positive in November, thanks to a successful holiday season.

Nevertheless, Nike struggled over the quarter as it faced demand headwinds from lower consumer spending, which was witnessed industry-wide. It also continues to lack innovation and newness, resulting in disappointing traffic, especially through its digital channels. Management’s efforts to reduce inventory and restructuring efforts also don’t help here.

Headwinds still seem to mount for Nike.

As a result, Nike Direct revenue was down 14% YoY, driven by a 21% decline in digital revenues and a 2% decline in revenues from Nike stores. On top of this, wholesale revenues were also down 4% due to a weak consumer.

Meanwhile, due to lower traffic and sales, inventory remained flat year over year and higher than preferred. Partner inventory did decline, but Nike Direct inventories are still too high due to poor traffic.

Top line weakness was also driven by all regions, with North America revenue down 8% YoY, driven by a 15% decline in Nike Direct revenue and a 1% decline for wholesale. In the EMEA, Nike didn’t perform much better, with revenue down 10% YoY, driven by a 20% decline in Direct revenue and a 4% decline for wholesale. This includes the headwind of a reduction in promotional activity in paid media, which leads to lower traffic, but this should lead to a healthier marketplace over time.

In other words, this is management positioning itself for the years ahead.

Finally, in China, Q2 revenue was down 11% YoY, driven by a 7% decline in Direct revenue and a 15% decline for wholesale. Here, Nike continues to see very poor retail traffic across all channels due to a difficult macroeconomic environment. This also required higher markdown activity to drive sell-through, negatively impacting gross margins.

Ultimately, all of this just shows general weakness across the board as a result of macroeconomic and company-specific headwinds. Nike is struggling and underperforming most peers as a result.

On the bottom line, the story is not much different. Nike reported a 100 bps decline in its gross margin last quarter to 43.6%, hitting the lowest level in 1.5 years. In fiscal FY23, Nike saw its gross margin recover nicely, as decade-high inflation in the previous year put significant pressure on margins due to higher input and shipping costs.

However, this seems to have ended abruptly last quarter, as higher markdowns on Nike Direct, wholesale discounts to liquidate excess inventory, and channel mix headwinds all put pressure on Nike’s gross margin, which is likely to trend down further in the quarters ahead.

This led to a 10% decline in gross profit to $5.4 billion.

Further down the line, SG&A expenses were down 3% on a reported basis. This was due to lower wage-related expenses and timing shifts in other demand-creation expenses, partially offset by higher investments in sports marketing. However, due to revenue declining quicker, actual SG&A as a percentage of revenue was up 140 bps, putting further pressure on margins.

Ultimately, this led to a 26% decline in net income to $1.2 billion, reflecting a 9.4% net income margin, stable from last quarter but down a very significant 240 bps YoY. This translated into an EPS of $0.78, down 24% YoY but also beating the consensus by $0.15.

These depressed cash flows in recent quarters have also had a negative impact on Nike’s balance sheet, which has also worsened. Nike ended last quarter with total cash, short-term investments, and equivalents of $9.8 billion and a total debt of $12 billion, leaving the company in a net debt position. it still receives an AA- credit rating from S&P Global.

Now, I would say this is far from worrying. The company is relatively healthy, with plenty of cash and a manageable debt pile, leaving it with plenty of room to invest, even as cash flows might trend down further. Also, while this might change this fiscal year and in the year ahead, Nike’s FCF in recent years has been healthy, between $4 billion and $6 billion annually, which is plenty to fulfill its obligations.

This includes paying a pretty sweet dividend. After its share price decline in recent years, Nike shares now yield 2.1% based on a conservative payout ratio of 43%, which means that even at today’s depressed profit levels, investors won’t need to worry about dividend safety here.

Meanwhile, Nike has grown its dividend at an 11% CAGR over the last five years and for 12 straight years, with this year’s raise coming in at 8%. This is compelling, at the very least, especially considering the EPS growth Nike likely has ahead of it.

I would say Nike remains a very compelling dividend growth stock with a sweet starting yield.

Overall, in terms of financial health, Nike still looks healthy, even amid recent struggles.

Outlook & Valuation

Probably the most important piece of this article is this section. Ultimately, what happens in the years ahead will determine whether Nike is a good investment. So, what can we expect?

Well, the picture is mixed and uncertain.

Driven by management’s efforts to refocus the business and correct recent mistakes, management expects a few more quarters with sluggishness across the board, declining profits, and sales growth weakness.

For example, Nike is currently moving to a full-price model for Nike Digital, reducing the percentage of promotional activity and regaining its image as a premium brand. While critical and great in the long run, this will impact short-term traffic and require Nike to liquidate excess inventory through less profitable channels (wholesale), impacting near-term estimates.

With these efforts, management is working hard to create a healthier marketplace and position itself to sell seasonal novelty and innovation for fall and holiday 25. In other words, Nike will take some short-term pain to reposition itself for late-2025 and clear shelf space for new products that should regain consumer interest.

This means that, at the very least, its fiscal 3Q25, 4Q25, and 1Q26 will all be under pressure from these short-term headwinds before we can see a growth recovery, potentially, in the second half of its fiscal FY26 or toward late calendar year 2025.

This is how management put it:

“But over the near-term, the net effect of these actions will result in lower revenue, additional gross margin pressure, and higher demand creation expenses, with a greater headwind to the fourth quarter compared to the third quarter.”

For fiscal Q3, this all translates into management’s expectation for a low double-digit revenue decline and a 300-350 bps gross margin decline to around 41.5%, a multi-year low. Management will continue to work on keeping expenses down, but amid declining revenues, the bottom line is expected to suffer further, with EPS likely to decline well over 50% year over year.

However, this near-term pain should also translate into a recovery by late 2025, when management expects a return to positive top-line growth.

So, what is a realistic expectation in the medium term?

I now anticipate significant weakness to persist in fiscal FY25 and to result in a double-digit revenue decline and EPS to decline close to 50% YoY. However, driven by management’s efforts, such as more aggressive marketing and increased innovation and newness toward the end of 2025, as well as a strengthening consumer thanks to lower interest rates, I anticipate Nike to deliver positive growth again for its fiscal FY26, accelerating further into FY27 and stabilizing in FY28.

However, I wouldn’t expect Nike to start delivering double-digit top-line growth anytime soon, if ever. Ultimately, the company operates in a mature and slow-growing market with an already impressive global reach and limited room to expand.

For reference, both the sports apparel and footwear market are expected to grow at a CAGR of around 4% through the end of the decade, so with Nike’s market share, we can expect it to deliver mid to high single-digit sales growth at best.

Though, Nike has never been a really high-growth business; instead, it is a very reliable and steady grower. Over the last 20 years, Nike has averaged a revenue CAGR of just over 7%, definitely not setting the world on fire. At the same time, over these 20 years, Nike has only reported three years with negative YoY growth, which was the result of the GFC between 2007-2010 and the COVID-19 pandemic in 2020. Apart from those, Nike has been impressive!

Therefore, I would say there is no need for high growth to drive a compelling bull case here, especially from today’s low basis. It certainly isn’t a reason to ignore this business and stock.

Much more compelling, however, is the room for margin expansion once headwinds ease and top-line growth turns positive again. From today’s multi-year low margins, Nike has plenty of room to report margin expansion, potentially driving really impressive EPS growth.

Currently, I expect Nike to deliver a big profit bump in its fiscal FY26, helped by revenue turning positive and reorganization efforts leading to efficiency gains, leading to EPS growth of some 24%, by current estimates. In the years that follow, I expect EPS growth to remain in the high-teens to low-twenties.

Overall, this translates into the following growth projections, which I would say don’t look too bad.

Based on these projections, Nike shares now trade for roughly 37x this year’s depressed earnings, which sounds a lot worse than it is. For reference, it trades at 30x my FY26 EPS consensus, which looks a lot more realistic compared to its 35x historical average.

Furthermore, this translates into a PEG of 1.6x, which really isn’t that expensive, sitting in line with the sector median and far from its 2.8x 5-year average.

In other words, shares seem fairly valued, considering the promising medium-term outlook. Still, it is quite a hefty multiple to pay, but due to Nike’s incredible brand value and its demanding market position, it has arguably always deserved this premium.

At the same time, I don’t believe Nike deserves the premium it has traded on over the last decade, even though growth projections for the years ahead look good. There is still a high level of uncertainty in these projections. Ultimately, a turnaround has yet to be realized here, and this uncertainty does warrant somewhat of a discount, even for a business of this quality.

Ultimately, weighing off both its growth prospects assuming a successful turnaround, which I deem likely, and this subsequent uncertainty, I believe shares are trading around fair value today.

For example, using a 30x long-term multiple and my current FY27 EPS consensus, which leaves plenty of room for upside, I calculate a May 2027 target price of $97 per share. This translates into potential annual returns (CAGR) of roughly 10% or closer to 12%, including dividends.

So, does that make shares a good buy today?

Weighing off the risk-reward balance here, for me, it is right on the edge right now. However, I am quite confident in Nike’s ability, under Elliott, to realize a successful turnaround in the coming years, making me willing to take a bit more risk, mostly because there could very well be additional upside to current estimates.

Management definitely seems to be on the right track right now to bring Nike back to its former glory and dominance.

Therefore, below $78 per share, I would be comfortable carefully buying more Nike shares or initiating a position if you don’t own them yet. However, I will also leave some room to buy even more shares if prices drop further. At a share price closer to or below $72, I would start adding more aggressively.

For now, I am cautiously Buy-rated.

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

I want to see a solid uptrend before I do anything

Great thesis, find no fault. To account for dividends-cash returned tonshare holders-NKE is even cheaper when ysingbthe dividend adjusted PEG ratio.