The last time I examined Oracle ORCL 0.00%↑ closely was in September 2023, following the company’s Q1 results. Back then, I viewed the shares as attractive at a price of $111, but these have since underperformed the market slightly, returning 15% against the S&P’s 17%. Furthermore, its share price performance is far below that of peers like Microsoft, Amazon, and even SAP.

However, earlier this month, Oracle reported excellent Q3 results, and shares jumped over 10% on the good news. Oracle has turned its business around in recent years and is now positioned for sustainable long-term growth, driven by the revolution in AI and cloud computing.

For those unfamiliar with the company, let’s quickly discuss it, although a lot will become apparent throughout this earnings review.

Oracle Corporation is a global technology company renowned for its comprehensive range of database software, cloud engineering, and enterprise software products and services. With its headquarters situated in Redwood City, California, Oracle has expanded its reach worldwide, boasting a presence in over 175 countries and over 340,000 customers.

Oracle's flagship product since 1977, the Oracle Database, is widely regarded as one of the most robust and reliable database management systems available, offering unparalleled scalability, security, and performance. In addition to its core database offerings, Oracle provides a diverse portfolio of enterprise software solutions, including customer relationship management (CRM), enterprise resource planning (ERP), human capital management (HCM), and supply chain management (SCM) software.

However, these are very mature industries offering little growth potential for Oracle. In response, the company has been on an acquisition spree, acquiring 150 companies over ten years for a total of $110 billion. The latest of these was Cerner for $28.3 billion. These M&A activities massively increased the company’s debt burden, but they still only allowed it to grow revenue at a meager CAGR of 1.35% from 2012 to 2022.

Luckily, it recognized the shift to the cloud several years ago, and the company has been making significant investments in developing its cloud infrastructure and services, driving accelerating growth. The Oracle Cloud platform today encompasses a comprehensive suite of infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS) offerings, enabling organizations to leverage the power of cloud technology to drive innovation, agility, and cost efficiency, and to access Oracle’s legacy enterprise software offering through its cloud technology.

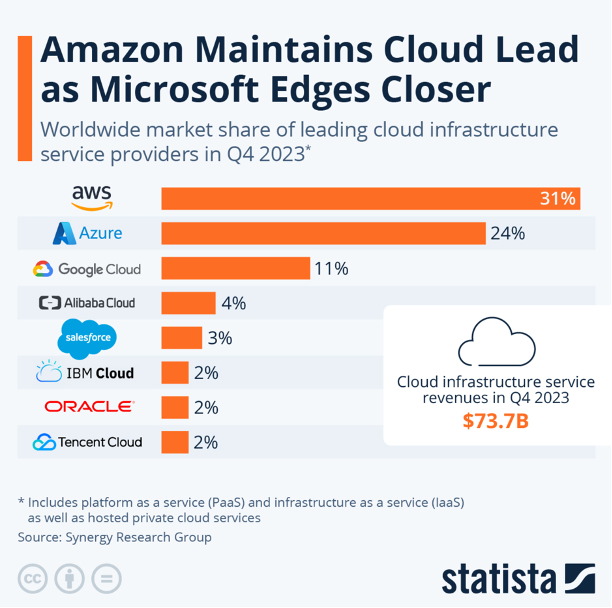

Oracle has been rapidly migrating enterprise software customers to the cloud and has been scaling its infrastructure. Through these innovations and investments, the company is able to capture a 2% market share in the global cloud industry today.

As a result, the company is in a much more compelling position today than five years ago, with accelerating growth, expanding margins, and a much more compelling collection of operations. Let’s dive into its Q3 results.

Oracle reported decent Q3 results

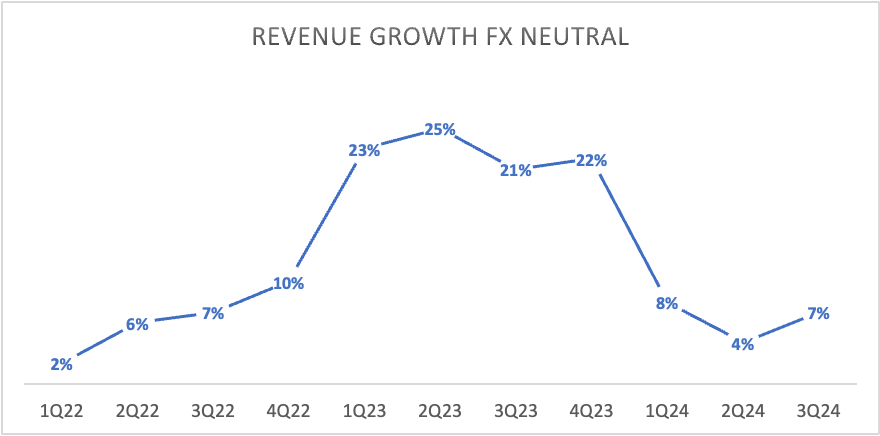

Oracle reported Q3 results earlier this month and managed to report financials that were roughly in line with the Wall Street consensus. The company saw its top line expand by 7% YoY (or 9% excluding Cerner) to $13.3 billion for the quarter. This solid performance shows that top-line growth is accelerating again after this slowed down over recent quarters.

The main driver of this growth continued to be cloud revenue, which was up 24% YoY to $5.1 billion, including Cerner, which continues to be a drag on top-line growth as Oracle is working on integrating the company into its tech stack and operations, holding back growth.

Nevertheless, 24% growth is still great, especially as it is starting to account for a larger part of revenue. Furthermore, within the cloud segment, the company continues to perform strongly with its cloud infrastructure operations through OCI (Oracle Cloud Infrastructure), which is the company’s alternative to Amazon’s AWS and Microsoft’s Azure.

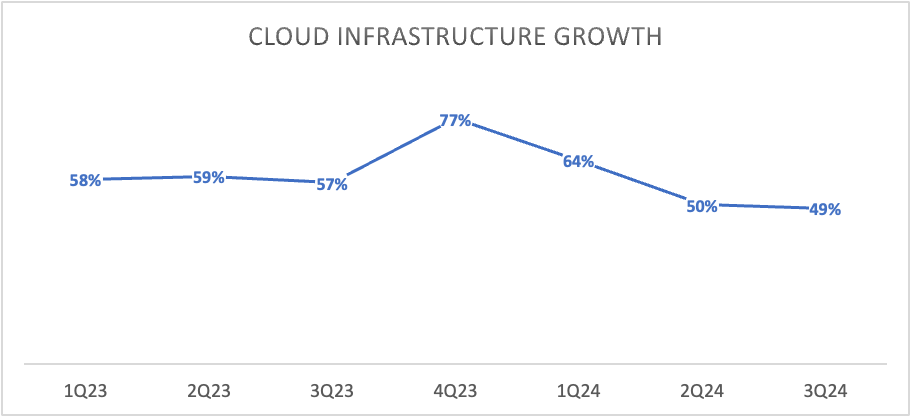

OCI revenue grew by 49% YoY in Q3 to $1.8 billion, roughly in line with the growth reported in Q2. Furthermore, this shows the cloud platform is growing much faster than its larger peers, although not in dollar terms due to its rather small size.

Still, the segment is a great growth driver for Oracle and is seeing massive demand. The segment today is the largest driver of revenue, and management expects growth to remain impressive going forward as it continues to scale rapidly and is currently experiencing supply constraints instead of demand constraints, indicating demand is higher than computing capacity. OCI consumption revenue was up 62% in Q3 but could have been even higher.

While Oracle was initially slow to adopt cloud technology, explaining why it's far behind its peers in size, it has come a long way since and has claimed a solid position in the cloud computing and AI industry, mainly only trailing Microsoft, Amazon, and Alphabet.

In fact, the company’s OCI (Oracle Cloud Infrastructure) is #4 in terms of market share in high-performance cloud computing, while performance-wise, it might even be higher. Just consider that Nvidia has picked OCI for its generative AI training and cloud computing, and for good reasons.

Technology-wise, the platform is superior to many peers while offering far better pricing, decades of experience in handling mission-critical workloads at an enterprise scale, maintaining the highest data security standards, offering significant AI functionalities through a close partnership with Nvidia, and the platform’s incredible flexibility.

It is the latter that is most exciting, in our view. The platform offers exceptional flexibility, not just in terms of data usage but also through a focus on multi-cloud offerings. The company isn’t fixated on locking in customers within its cloud infrastructure but supports and even encourages multi-cloud options. Crucially, its highly regarded Oracle database is available on OCI, AWS, and Azure, giving database customers multiple cloud opportunities. This is what I wrote regarding this prior on Seeking Alpha:

“While Oracle believes its cloud offerings are better than competitors, they know few customers go all-in on a specific environment and prefer to use multiple cloud vendors. Instead of relying on a single cloud provider, a multi-cloud strategy allows an organization to leverage the strengths and capabilities of multiple providers while also mitigating the risks associated with relying on a single provider.”

By doing this, the company believes it is better positioned to gain customers and retain most of its enterprise software and data customers, which count to over 430,000. It is just an excellent strategy that sets it apart and positions is favorably. No wonder the company is capacity constraint.

Moving on from its cloud infrastructure, or OCI, cloud revenue mentioned before also includes SaaS revenues, which refers to the company’s cloud enterprise software packages, including Fusion Cloud ERP and NetSuite Cloud ERP. For reference, these are the company’s cloud variants of its legacy enterprise software packages, including CRM, ERP, HCM, and SCM software.

This segment's revenue grew 14% in Q3 to $3.3 billion, driven by 18% growth in Fusion and 21% growth in NetSuite revenues. The company continues to migrate customers to the cloud and these SaaS variants, which now have a $7.4 billion annualized revenue run rate, up 18% YoY.

Furthermore, database subscription revenue was up 5%, driven by cloud database growth of 34%, again the result of customer migrations. Growth is expected to persist here, driven by these migrations. Positively, this is also expected to boost OCI growth as Oracle is able to convert many of its enterprise software customers to become overall cloud customers, increasing value per client.

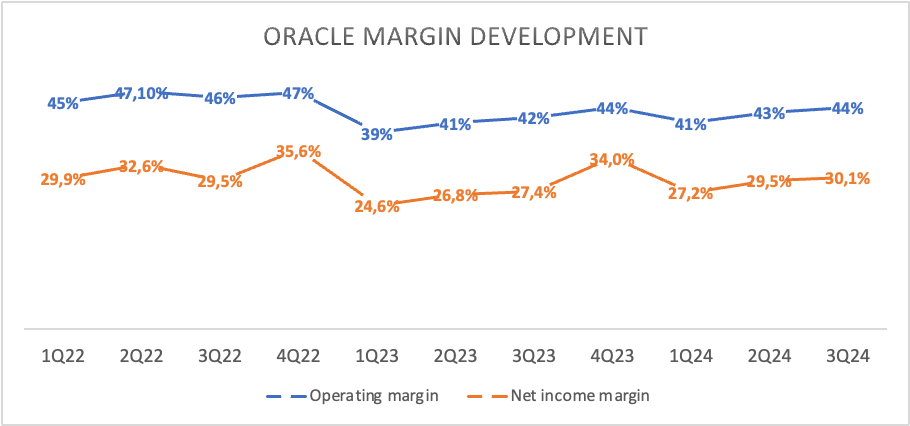

Overall, the company’s top line looks solid, with cloud operations driving growth. This is also reflected in the bottom line, where Oracle has consistently expanded its margins over recent quarters despite continuing to make significant cloud investments.

The cloud services and license support gross margin, which is most important to monitor, improved to 77%, driven by improving margins in OCI as new capacity was filled. This led to gross dollar growth of 8% for cloud services and license support in Q3, slightly outpacing revenue growth.

Management is still very much committed to building out its data center capacity, and as a result, the gross margin is expected to keep increasing in the coming quarters and years as these new cloud regions fill up.

Looking further down the line, Oracle reported an operating income of $5.8 billion, up 12% YoY, as the operating margin improved by around 200 bps to 44%. This margin improvement was driven by efficiencies in operating expenses, which continue to trend down as a percentage of revenue.

Oracle has been able to expand margins solidly in recent years after these fell slightly from 2022 highs due to increased investments in cloud and generative AI and the Cerner acquisition, which also is a slight drag on margins. Still, the progress here is looking good.

Positively, Oracle expects gross margin improvements and growing economies of scale in the cloud and Cerner to allow it to continue growing its operating income and operating margin.

The improved operating margin and efficiencies also led to an expansion of its net income margin by 270 bps, driving net income up 18% YoY to $4 billion, leading to an EPS of $1.41, up 16% YoY. Similarly to the operating margin, the net income margin is expected to keep expanding in coming quarters and years, driving faster EPS growth compared to revenue.

Finally, over the last 12 months, Oracle has reported FCF growth of 68% to $12.3 billion as the company benefits from its cloud investments. This helps the company improve its rather ugly balance sheet and allows it to keep returning cash to shareholders.

As of the latest report, Oracle has a total cash position of $9.5 billion against long-term debt of $82.5 billion, which is far from pretty. Much of this is the result of the company’s acquisition spree over the last decade, with Cerner certainly adding quite a bit in recent years. As a result, debt levels are still quite elevated and cash levels rather low.

Still, the company is improving its balance sheet as FCF grows. Since May 2023, the company has lowered debt by $4 billion while keeping its cash levels roughly flat and still returning cash to shareholders. We should expect the company to keep this up.

While this will mean repurchases will remain rather low, I believe the balance sheet should definitely be the priority for management as this currently limits their financial flexibility. In Q3, repurchases were limited to just $450 million, which I would have, in all honesty, preferred to have gone to debt repayment.

Furthermore, the company does still pay a decent dividend, currently costing them $4.4 billion annually, which is well covered by FCF. Shares currently yield 1.24% on a payout ratio of just 29%, which is looking good. The company has grown the dividend at a CAGR of 16% over the last five years and has raised it for nine consecutive years, which sounds great and quite promising.

I definitely believe Oracle will remain a solid dividend growth investment, considering its growth potential, although growth may be somewhat subdued in the coming years as management focuses on lowering its debt.

Cerner is one of the more promising acquisitions.

Before we head to the valuation and outlook, I want to quickly highlight Cerner, which Oracle acquired in 2021 for $27 billion. So far, I have not really mentioned the company, but I am quite enthusiastic about its combination with the Oracle infrastructure. While the acquisition has weighed negatively on the financials and growth due to its need to be integrated into the company, it is looking very promising.

For reference, this is what I wrote about Cerner before:

“Cerner is a global healthcare information technology company that specializes in developing and providing software solutions for healthcare providers. The company's products and services are designed to help healthcare organizations improve the quality of patient care, reduce costs, and increase efficiency. Cerner is one of the largest healthcare IT companies in the world, with more than 29,000 employees and a presence in over 35 countries. The company's clients include some of the largest healthcare providers in the United States, as well as numerous international clients.”

As I said, Oracle paid $27 billion for this company in 2021 to get exposure to the rapidly growing IT healthcare sector post-COVID. Digital healthcare is seeing increasing adoption globally, and Cerner is well positioned to benefit, especially integrated into the Oracle tech stack. Just how important this is was explained during the latest earnings call:

“The best example of this is in Healthcare, where Oracle did not just add a bit of AI around the edges of the existing applications.

Instead, we developed completely new applications using our Apex Application Generator and our Autonomous Database. These all new applications use generative AI throughout the application. The best example is in Healthcare where our new Ambulatory Clinic System is being delivered to customers this Q4. This completely new application features a voice interface called the Clinical Digital Assistant. The Clinical Digital Assistant listens to a doctor's consultations with a patient and automatically generates prescriptions, Doctor's orders, doctor's notes, then automatically updates the patient's electronic health records.”

Oracle believes it can leverage its decades of experience and massive customer base to expand Cerner’s operations globally, growing its addressable market and revenue potential. As for where the potential for Cerner’s platform lies, this is what Ellison said a couple of earnings calls ago:

“Our goals are ambitious: fully automate clinical trials to shorten the time it takes to deliver lifesaving new drugs to patients, enable doctors to easily access better information leading to better patient outcomes, and provide public health professionals with an early warning system that locates and identifies new pathogens in time to prevent the next pandemic. The scale of this opportunity is unprecedented—and so is the responsibility that goes along with it.”

Overall, Cerner within Oracle seems well-positioned to benefit from the connected healthcare industry, which is expected to grow at a CAGR of 27% through 2030. Oracle is clearly well-positioned for growth, owning one of the leading platforms in this industry, and Cerner could turn out to be a great growth driver. For now, Cerner is only a small contributor to Oracle's revenue, adding under $2 billion, but in the long term, it is quite promising.

Outlook & Valuation

Looking forward, Oracle management is optimistic, especially about its cloud services. The company sees its cloud services improving each quarter, resulting in a strong pipeline and improving win rates. Obviously, the cloud is going to be Oracle's growth driver.

Positively, Oracle sees supply constraint ease in coming quarters as a lot of capacity should become available, which, according to management, should allow revenue growth to accelerate in fiscal FY25. Management expects growth to accelerate further in Q4, but growth in FY25 should be meaningfully higher. Contributing to this is also the fact that Cerner is expected to start growing again next year.

Overall, management sticks to its FY26 financial targets, which include a minimum of $65 billion in revenue, a 45% operating margin, and EPS growth at a CAGR of over 10%. According to the latest comments, these goals might even prove conservative.

Looking more short-term, management now expects to report Q4 revenue, including Cerner, to grow between 4% and 6% YoY (6% to 8% excluding Cerner). This includes the expectation for cloud revenue growth to remain strong, up 22% to 24% due to more capacity coming online. However, EPS growth will be negative due to a big difference in tax rate compared to last year, but this is as expected. This should lead to EPS of between $1.62 and $1.66, down 2% to flat at the midpoint.

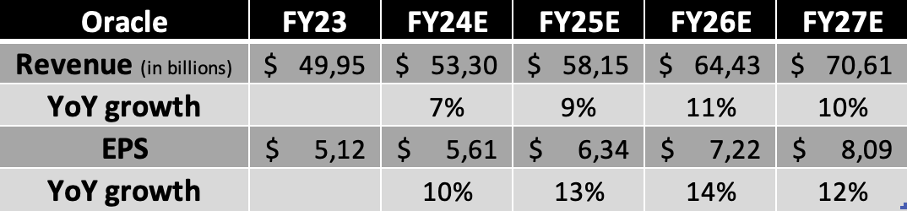

Considering this guidance and everything discussed so far, we are quite bullish on Oracle’s long-term growth potential. The company is very well-positioned in the cloud computing industry and should be able to accelerate top-line growth in the next few years as more capacity comes online and global cloud usage grows. As a result, we now expect Oracle to grow FY24 revenue by 6.7%, accelerating to the low-double digits through its fiscal 2027. Meanwhile, we expect EPS growth to remain a couple of percentage points higher due to continued margin expansion. This results in the following financial projections.

Based on these projections, Oracle shares now trade at just below 23x this year’s earnings, which is a well-deserved 40% premium compared to its 5-year average but still an 8% discount to the sector median and below its cloud peers like Salesforce, Microsoft, Amazon, and Google. Although, we also believe this discount is somewhat justified.

Oracle is not projected to grow as fast as most of these peers and has a significantly worse balance sheet, which does still hurt the investment case. As a result, we believe shares are trading right around fair value. Assuming Oracle can realize the growth projections above, we believe a long-term P/E of 22x is fair for this reinvented business.

Based on this 22x multiple and our FY26 EPS projection, we calculate a medium-term target price of $159, which points to annual returns of just over 10%. Adding to this a dividend of just over 1%, investors buying Oracle shares at current prices of around $128 per share could expect potential annual returns of 11-12%, which should be enough to beat global benchmarks.

As a result, we view Oracle shares as attractive today and rate them a “buy” even after the recent share price jump. This reinvented company is performing well and is well positioned for excellent long-term growth, driven by the cloud and AI revolution.

Let us know your thoughts in the comments! Also, please leave a like if this post was of value to you!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which I hope will be insightful!

Disclosure: I/we do not have a beneficial long position in the shares of ORCL, either through stock ownership, options, or other derivatives. This article expresses my own opinions, and we are not receiving any sort of compensation for it.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.

In my buy side days I use to cover Cerner and for some weird reason loved the blue/green color scheme they use. Totally stole the color palette for my newsletter when I started writing.

Oh, and great write-up :)

Have you considered posting your article to additional sites and linking back to the original here?

You're preparing good articles. They should get more viewers and if you do it that way you should see your followers grow much faster.