Oracle is Firing on All Cylinders — So Why Did I Sell My Shares?

Oracle’s fiscal Q4 results were incredible, but red flags remain present. Was I right to sell my shares?

Oracle remains one of the leading players in the cloud computing industry and an understated and often underappreciated AI player.

This company is no longer the boring and slow-growing legacy technology business it was for most of the last two decades. Instead, it is now delivering double-digit revenue growth and has turned into one of the more exciting AI beneficiaries.

I have been highlighting Oracle’s cloud potential and edge since March 2023, pointing to its extremely favorable setup and a unique, arguably superior cloud infrastructure approach, giving it a unique edge over its larger, more dominant peers (Azure, AWS, and Google Cloud). Today, the company is reaping the benefits, as the rise of AI computing has now made it the fastest-growing among its peers.

Last week, the company proved this once more, delivering hugely impressive quarterly results and blinding guidance that sent shares soaring over 20% in the next two days to a new all-time high, and, arguably, much deserved. The company just continues to deliver financial results and growth well ahead of expectations as customers remain eager to sign massive cloud infrastructure contracts, and its best-in-class back-office IT systems remain in high demand.

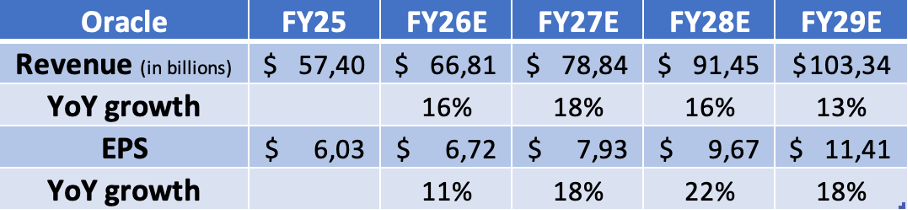

As a result, medium-term expectations and guidance just keep trending in the right direction, with Oracle now estimated to deliver high-teens sales growth and high-teens EPS growth through the end of the decade, which, going by what the company delivers today, is hard to argue against.

Oracle really is firing on all cylinders.

And yet, I don’t own any shares, having sold them in early 2025. Why? Was I still right to sell? Or should investors still consider buying shares despite the all-time high amid recent developments?

Clearly, after last week, it’s time to revisit my Oracle thesis. Let me take you through all the numbers and once again make up the balance!

Oracle is brilliantly positioned, and the Q4 numbers show it

With its fiscal Q4 results, announced last Wednesday, Oracle exceeded consensus estimates and delivered results that surpassed its own guidance. The reason? It’s incredible cloud success, which today is translating into mind-boggling demand.

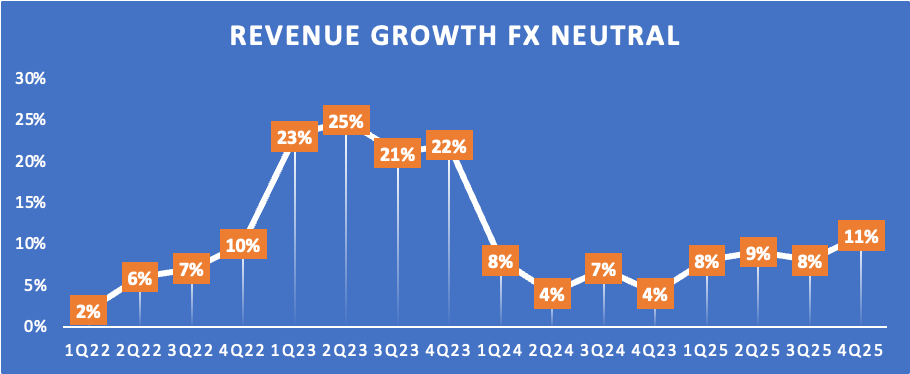

A few years ago, Oracle promised shareholders that growth would accelerate over time as it remained cloud capacity-constrained and would get much more capacity online in the years ahead. Today, we are seeing that turn into reality. Over recent quarters, Oracle has slowly but steadily accelerated its revenue growth, as visible in the graph below, reaching double digits in the latest quarter (growth in 2023 wasn’t representative due to the acquisition of Cerner).

As visible above, Oracle delivered 11% YoY growth in its fiscal Q4, delivering total revenue of $15.9 billion, surpassing consensus estimates by $300 million or a solid 2% beat. This brought fiscal FY25 revenue to a total of $57.4 billion, up 9% YoY, as Oracle delivered its best financial results in over a decade.

As alluded to before, the driver of this growth were Oracle’s cloud services, which now account for 77% of total revenue and which as a whole were up 12% YoY in fiscal FY25 to $44 billion.

Now, I know, this number (12%) might not seem overly impressive, considering the growth its larger peers still manage to deliver with their cloud operations. However, for Oracle, this number also included its legacy and much slower-growing license support business. If we look at Oracle’s pure-play cloud operations, it seems much more impressive.

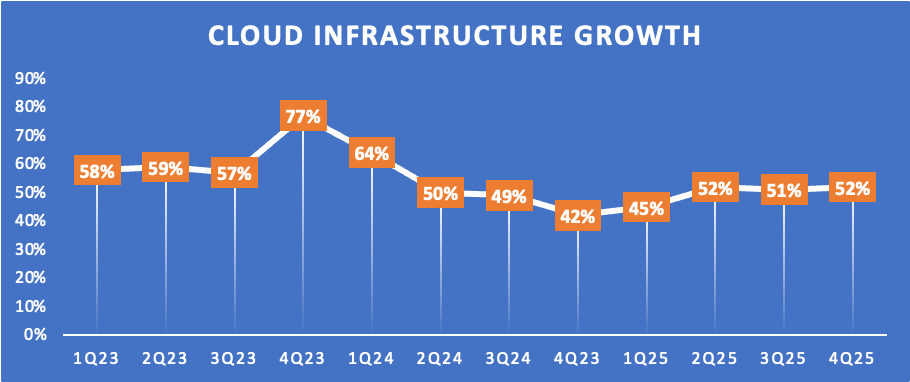

Oracle’s fiscal FY25 IaaS or cloud infrastructure revenue was up 51% YoY to $10.2 billion, driven by 59% higher consumption revenue, and accelerating.

Fiscal FY25 SaaS revenue was up 10% to $14.3 billion.

Looking at Q4, these combined pure-play cloud operations (SaaS + IaaS) delivered 27% YoY growth to $6.7 billion.

SaaS accounted for $3.7 billion of this, up 11% YoY. SaaS includes Oracle’s strategic back-office applications, such as ERP, financials, EPM, HCM, supply chain, and manufacturing. For decades, Oracle has dominated (together with SAP) the enterprise back-office IT market, with a commanding market share. However, over the last decade, Oracle has been gradually migrating its legacy back-office IT customers to the cloud ahead of its peers, resulting in strong booking results and higher renewal rates. As a result, Oracle continues to dominate this industry with a low-twenties percentage market share, and it continues to deliver strong growth and market share gains.

As of last quarter, these strategic back-office SaaS applications generate annualized revenue of $9.3 billion, up a whopping 20% YoY. Now, we should consider that this includes a huge number of migrations, so the growth appears more impressive than it actually is. A large piece of this is taken away elsewhere in Oracle’s operations.

Still, this is strong growth Oracle is showing, also suggesting some market share gains, in large part thanks to its cloud-first and multi-cloud approach, leading to higher customer satisfaction, greater renewal rates, and business wins.

Oracle remains the strategic back-office IT leader, and in the AI era, it appears to be expanding its leadership.

However, while this is a great business, the real driver of my bullishness toward Oracle are its cloud infrastructure operations, which are just brilliant.

You see, over the years, Oracle has carved out its own niche in cloud computing, focusing on high-performance, mission-critical workloads and a hybrid multi-cloud strategy, which has positioned it perfectly today. Let me explain!

For one, Oracle is one of the few cloud providers with a deep integration with Nvidia (DGX Cloud partnership). There’s a reason why Nvidia is a large Oracle customer itself. Additionally, Oracle Cloud Infrastructure (OCI) was built later than AWS, Azure, and Google Cloud, allowing them to design a more modern, flat network architecture, which has given it a number of performance advantages:

Lower latency.

High IOPS (input/output operations per second).

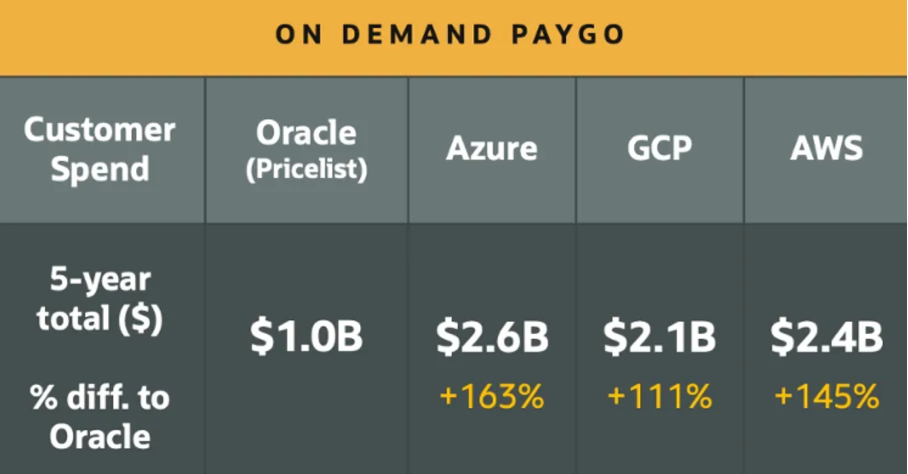

A far lower computing cost, which translates into far lower prices, as shown below. In any situation, running on OCI is at least 20-50% cheaper than AWS.

Do you know where this combination of better performance and lower prices is perfectly suited for? Databases, AI training, and inference and HPC workloads. This is precisely what customers with database-heavy and compute-heavy needs, where microseconds of latency matter, look for. And this just so happens to be booming right now amid the AI revolution.

It’s these reasons exactly why Oracle has become the favored choice for AI workloads and non-GPU cloud infrastructure services for customers of all sizes. This includes absolute industry leaders such as OpenAI, xAI, Nvidia, Cohere, and Meta, which has recently been added to this list as it will train and run its large-scale Llama models on OCI (Oracle Cloud Infrastructure).

Oracle’s infrastructure is built for AI, and it’s reaping the results.

Furthermore, since it began building its cloud infrastructure, Oracle has been a strong advocate of hybrid and multi-cloud setups, and this remains a significant benefit today, as it is shaping up to be the future, aligning with the way most large enterprises envision their cloud setup. Here’s what you need to know.

First, let’s start with hybrid cloud. This means a company uses a mix of public cloud and private infrastructure together. For example, a bank might run certain sensitive workloads on its own servers (on-premise) because of regulatory, security, or latency reasons, while using a public cloud provider like Oracle Cloud or AWS for less sensitive applications, AI workloads, or customer-facing web services. The key point is that workloads can move across both environments or interact with each other seamlessly. Hybrid allows companies to modernize without having to fully abandon their existing, often very complex, IT infrastructure.

Now, multi-cloud means using more than one public cloud provider. Instead of being locked into a single vendor, an enterprise can spread its workloads across multiple cloud vendors, such as AWS, Azure, and Google Cloud. Multi-cloud provides companies with flexibility, better negotiating leverage, redundancy, and enables them to optimize for performance, cost, or compliance across different geographies.

When you combine both — hybrid multi-cloud — this approach enables large companies to manage risk, meet regulatory requirements, avoid vendor lock-in, and optimize IT costs and performance. No surprise it’s becoming the preferred way to use cloud computing.

This is where Oracle comes in. By offering cloud services that deeply integrate with on-premise Oracle systems, Oracle allows these companies to incrementally modernize their operations without rewriting everything from scratch or exposing themselves to regulatory and operational risks. Oracle's Cloud@Customer and Dedicated Region solutions enable companies to run Oracle Cloud services within their own data centers, preserving data residency and regulatory compliance while providing access to modern cloud capabilities. This hybrid approach reduces friction and makes Oracle an easy partner for these mission-critical workloads.

At the same time, Oracle’s multi-cloud partnerships — with Microsoft, AWS, and Google — let customers blend Oracle’s strengths in database and enterprise software with the broader ecosystem strengths of other clouds. This cooperative approach reduces the fear of vendor lock-in, allowing enterprises to select the best tool for each task while maintaining Oracle at the center of their most valuable data and applications.

Just brilliant. Oracle isn’t trying to beat AWS, Azure, or Google at their own game. Instead, it’s carving out a niche where its legacy strengths in enterprise data and mission-critical systems can transition smoothly into the cloud era.

Long story short, Oracle offers a superior (faster and cheaper) cloud infrastructure for high-performance, mission-critical workloads (most notably AI applications), and has a unique approach to its cloud setup for enterprise customers, which gives it another edge.

You see why I like Oracle as a compelling AI and cloud play? I continue to view Oracle’s offering and approach as superior for the next stage of cloud computing, which is why I like its prospects.

And its current numbers fully reflect its success. IaaS (cloud infrastructure) revenue was up 52% YoY in Q4 to $3 billion, despite lapping 42% growth of last year. This was driven by 31% growth in database services and 62% growth in OCI consumption revenue, as demand remains incredible and continues to outstrip supply. Indeed, Oracle’s infrastructure remains capacity constraint.

Infrastructure cloud services now have an annualized revenue of almost $12 billion.

However, even more important and telling of the company’s success and the incredible demand it sees are its RPO numbers. Last quarter, RPO once again grew by 41% YoY, adding $8 billion sequentially and bringing the total to $138 billion, which is incredible.

This shows customers are incredibly eager to sign long-term deals with Oracle to ensure capacity availability once more becomes available. This is a clear sign of future growth and intense demand today.

For reference, cloud RPO grew by 56% YoY, despite lapping 80% growth last year, and this now represents 80% of its total RPO, of which only 33% can be realized in the next 12 months due to many of these contracts being long-term, realized over the number of years, and Oracle simply not having enough cloud capacity to satisfy demand.

Like I said, it’s firing on all cylinders and has a very bright future, but more on that later.

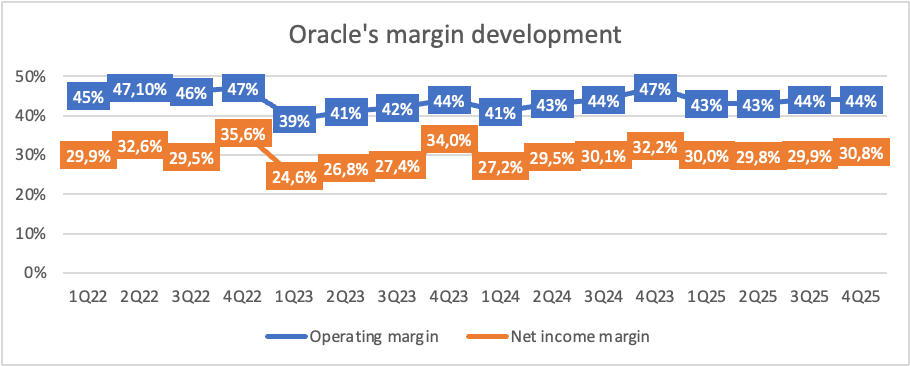

Alongside impressive top-line growth, Oracle’s margins and bottom-line profile also look good, although high capex requirements are clearly reflected in the numbers.

Oracle reported an operating income of $7 billion, up only 4% YoY, as the operating margin contracted by 300 bps YoY. Similarly, the net income margin declined by 140 bps year-over-year, driven by higher costs. For reference, cloud services costs were up 33% YoY and R&D was up 19% YoY, both outpacing total revenue growth.

This was as expected. Oracle is heavily investing in the years ahead, so some margin pressure was unavoidable.

As for the full fiscal year results, operating cash flow was up 12% YoY to $20.8 billion, and FCF came in negative at -$400 million, as Q4 FCF was a negative $2.9 billion. This negative FCF was driven by $9.1 billion in Capex in Q4, or almost 60% of revenue. Fiscal FY25 Capex was $21.2 billion as a result, which is remarkably high.

According to management, the vast majority of these investments are being allocated to revenue-generating equipment for data centers, rather than land or buildings, so the ROI should be considerable.

However, the insane amounts of CapEx aren’t ideal in the near term, considering Oracle lacks the balance sheet health to take the blow. The company now holds a total cash position of $11.2 billion, roughly flat YoY. However, this comes with a staggering $104 billion in debt, which is up approximately $10 billion year-over-year (YoY) due to these massive capital expenditures and the $4.7 billion Oracle still spends on dividends annually, which together well exceed the generated free cash flow (FCF).

The balance sheet impact of these investments is obvious. Honestly, I am not sure what to think of this. A company needing this much debt to fund its medium-to-long-term investments and dividend isn’t one I tend to consider worth investing in, no matter my enthusiasm for its fundamentals.

Moreover, Oracle now anticipates CapEx to come in even higher in fiscal 2026, guiding for over $25 billion, which will continue to be a significant drag on FCF, and even more years of elevated CapEx aren’t out of the question. And then we still need to see all these investments pay off. Is Oracle overestimating demand and overspending right now? That could really hurt ROI and financial health. Yes, there is the incredible RPO, but this is no guarantee that demand will last.

I don’t like this approach, and Oracle’s financial position today is straight up poor. At this rate, the company will take many years to return to healthier debt levels. For me, and I bet for many of you, this is a massive red flag and in many situations, a no-go.

This is a significant financial burden and a negative consequence.

Don’t get me wrong, I understand management has to make these investments to fuel its long-term growth ambitions. However, for investors, I believe this kind of debt/investment situation needs to be avoided due to the long-term risk and financial drag it could become.

So, why did I sell all my shares earlier this year?

Apart from the financial health situation just discussed, which is a massive reason I no longer own Oracle shares, there is more to be aware of.

Clearly, Oracle is doing extremely well, and it’s not hard to imagine why expectations are high through at least the end of the decade. The company’s positioning and technological edge are phenomenal.

Yet, I sold my shares in early 2025 due to several additional structural concerns regarding long-term demand and potentially unjustified, inflated expectations, which are common to all large cloud providers but could impact Oracle more significantly.

I believe there are two questions anyone should ask themselves here:

Is Oracle protected against cloud and AI commoditization in due time?

Could current investments in AI fall off a cliff as applications take time to develop and consumer adoption is slow? In other words, how big is the risk of demand for Oracle’s OCI falling given the sudden speed of investments? Overspending today could lead to a drop in demand later.

Let me address each.

First, there is the risk of commoditization of both cloud computing and AI, which is almost a certainty. Cloud compute (raw CPU, GPU, storage, bandwidth) is already showing signs of commoditization. The big hyperscalers compete heavily on price, scale, and availability. Over time, as infrastructure becomes more standardized and efficient, prices for raw compute and storage will continue to fall. That hurts anyone whose main business is selling pure compute, and Oracle’s IaaS business is exactly that. OCI’s current advantage lies in its niche workloads: high-performance, database-intensive, hybrid-sensitive environments. However, as hyperscalers enhance their own database offerings, reduce networking costs, and expand hybrid solutions, Oracle may face margin compression on its infrastructure layer.

In other words, while I am enthusiastic about its approach and technical edge, which are yielding brilliant results today, I doubt that this will remain a strong and lasting advantage over time. I don’t see enough of a long-term moat here – no durable business model. If margins fall, Oracle will struggle to earn back its massive investments.

Now to AI. Today, AI feels differentiated because access to GPUs is scarce, model training is still relatively technical, and many enterprises are only just beginning to experiment. But fast forward a few years: open-source models will get better (we already saw the first signs of this earlier in 2025), more compact, and cheaper to fine-tune; foundation models may become more of a utility; and cloud providers will sell inference at thinner margins. Oracle is aggressively building massive GPU clusters to compete now, but it’s unlikely to win a price war against AWS or Azure if inference commoditizes and training becomes less capital-intensive.

Again, no durable business model, in my opinion. All this massive demand we see today might benefit Oracle for the next few years, but I expect a sharp drop in demand once a certain level is reached. By this time, Oracle will struggle to recoup all its investments and maintain its margins.

Ultimately, I believe the real value will be in the application layer of cloud computing and AI, not in these infrastructure providers, which is exactly why I sold my shares.

Am I too pessimistic? Potentially.

Before we move on, just a quick word…

Want more out of your subscription?

InvestInsights PRO - $7.50/month ($70/annually)

An additional 2-5 premium stock analysis monthly.

Full insight into my own portfolio (15% return CAGR since 2022).

Monthly portfolio updates + Instant transaction alerts (Fully transparent)

A complete overview of all my target prices and ratings (Excel file).

Exclusive access to the PRO subscribers Discord channel

Instant access to earlier premium analysis on, for example, Adobe, Thermo Fisher, Spotify, and The Trade Desk.

Outlook & Valuation

Alright then, that brings us to the outlook, and management couldn’t have been more bullish. Following the strength in demand it sees for both its cloud applications and infrastructure, Oracle raised its guidance for fiscal FY26, now expecting revenue to grow by 16% YoY to over $67 billion, which was well ahead of expectations, fueling investor enthusiasm.

Moreover, cloud revenue is expected to grow by at least 40% in constant currency, representing a considerable acceleration from the 26% growth delivered in fiscal 2025. This growth is driven by rapid expansion in infrastructure revenue, which is now a larger part of total cloud revenues.

Notably, infrastructure revenue is now anticipated to grow by a whopping 70% in fiscal 2026, up from 51% in 2025. The same demand driving growth here should also boost RPO growth by an expected 100% (!). No, but seriously, Oracle expects RPO to double to over $260 billion over the next 12 months, which should be enough for Oracle to exceed its 2029 revenue guidance of $104 billion, according to management.

In other words, despite its already massive and growing size, Oracle is managing to accelerate growth across the board, which is really impressive.

So, what does this mean for my financial estimates? Clearly, Oracle is performing at an exceptionally high level, experiencing extraordinary demand for its cloud services. As a result, 2026 is likely to be a record year. I now anticipate considerably higher results for Oracle in fiscal 2026, with growth coming in far stronger than I expected before.

Meanwhile, looking at current RPO levels and growth expectations over the next 12 months, I believe Oracle has enough fuel/demand to deliver very strong results through 2029, though I now anticipate a slight drop-off in demand toward the end of the decade, resulting in a growth deceleration. I expect growth to peak in fiscal FY27.

Despite my slight skepticism, there is no denying Oracle is well-positioned to deliver really strong growth numbers in the years ahead.

At the same time, very high investments and rising operational costs will continue to put pressure on margins over the next two years. From fiscal FY28, I anticipate cost growth to stabilize and margins to improve gradually, leading to faster EPS growth. Again, this is considerably better than my previous expectations, driven by higher revenue estimates.

So, with these updated estimates and Oracle shares at new all-time highs, where does that leave us, valuation-wise? Oracle shares closed trading yesterday at a share price of $215 per share, which translates into a FWD P/E of 32x, which is in no way cheap and much more in line with its cloud peers, although this also seems more than deserved right now.

On a growth-adjusted PEG basis, we are now looking at a 1.9x multiple, which isn’t too bad at all, and there could very well be some room for upside to the estimates above. On a growth-adjusted basis, Oracle shares are trading at a similar multiple to 6 months ago, which I deemed just slightly too expensive. Additionally, we are looking at an EV/EBITDA of roughly 26x, which I also deem slightly elevated.

All in all, I definitely believe Oracle deserves to trade at a healthy premium. The company is experiencing exceptional growth and demand for its cloud services, which translates into a very strong medium-term outlook. At the same time, there are clearly longer-term risks to consider as well as the company’s very poor balance sheet, and after last week’s pop, shares look slightly overbought.

For reference, I believe awarding Oracle a 28x long-term earnings multiple is rich enough, considering its strong outlook, poor financial health, and the longer-term risks I pointed out. Using this multiple and my fiscal FY28 earnings estimate, I calculate a three-year price target of $271. From a current share price of $215, this represents annualized returns of only 9% (including dividends), which simply doesn’t represent a compelling risk-reward any longer.

Therefore, I don’t believe Oracle shares are worth considering right now.

So, ultimately, do I regret selling my shares?

Well, obviously, I would have rather sold at these levels… but other than that, my reasons stay intact. I remain confident in my decision to sell my Oracle shares at a modest profit. This is not a company I look to own for a longer period, as I don’t favor its business model amid expectations for cloud and AI commoditization. Only if shares drop below $170 - $180, the risk-reward might be favorable enough to consider picking up some shares in case I am wrong.

I believe Oracle remains a risky long-term pick, especially at these levels.

Thanks for the writeup!

i get the uneasy feeling that at peak shareprice and debt, we see weird things like a ceo departure and 80yr old founder exiting\expiring.

'just a coincidence' people would say.