Oracle’s 36% Rally is Built on Hope, Not Fundamentals

Investors are cheering Oracle’s AI cloud momentum, but they overlook the massive red flags - the reported numbers don’t tell the whole story.

What can justify a 36% jump in share price for a $670 billion market cap business? In other words, how do you justify a $240 billion increase in business value?

Well, Oracle managed to do so last Tuesday, when it released its fiscal Q1 earnings report, which sent Wall Street into a frenzy. While the headline numbers themselves in the earnings report didn’t impress, the underlying demand Oracle is seeing for its superior cloud infrastructure, designed for AI inferencing, is mind-blowing, as reflected by RPO numbers that are out of this world, growing over 300% YoY to $455 billion – future revenue that is.

And management’s guidance reflects it. Following the extreme demand the company experienced last quarter and the number of long-term, multi-billion-dollar infrastructure contracts it signed, management issued extremely bullish 2030 guidance that was significantly ahead of even the most optimistic consensus estimates.

That is how you justify a $240 billion market cap pop – it’s hard to argue against when examining the numbers and considering the apparent role Oracle is set to play in the future of AI. By now, I believe we can safely say that Oracle will be the leading cloud provider for AI, not AWS, Azure, or GCP —a claim I have been making for well over a year now.

Oracle’s infrastructure is simply superior in every way: in design, cost, speed, and functionality. The numbers now fully reflect this.

Wall Street and investors are finally realizing this now as well, as evidenced by last Tuesday's 36% surge in shares, which propelled Oracle to become the 10th most valuable U.S. business, with the company not far from joining the exclusive $1 trillion club.

And yet, I am also skeptical. I will argue that it’s not all plain sailing, as there are serious risks and concerns that Wall Street seems to be overlooking in the Oracle bull case, most notably the extreme customer concentration and the substantial capital expenditure required to meet customer needs, which leads to significant execution risk.

In fact, one might argue that Oracle’s reported numbers are highly misleading and management isn’t entirely transparent on the structure of the multi-billion-dollar deals signed.

Anyway, following last week, it’s definitely time to revisit my Oracle investment thesis. So, let’s go over the numbers and developments and make up the balance before updating medium-term financial projections and reconsidering valuation.

Are Oracle shares still a good long-term buy?

Notably, after Tuesday’s pop, shares have lost some momentum, pulling back some 10% from those newly set all-time highs, ending the week up “just” 23%. So, is it time to take profits and sit on the sidelines, or is the 10% pullback an opportunity to buy?

Let’s find out!

Welcome to InvestInsights — an independent equity research publication rooted in long-term, buy-and-hold investing, publishing actionable stock/equity research reports weekly!

📈 You’re reading my latest exclusive stock analysis. If you like this analysis, make sure to like & subscribe to receive much more like this!

If you’d like full access to all my exclusive analysis & portfolio access (14% CAGR since 2022), consider becoming a paid subscriber!

Oracle sees cloud demand explode.

Interestingly, Oracle’s actual fiscal Q1 financial results were far from impressive. In fact, the company missed both top and bottom-line consensus estimates with its headline numbers, saw margins contract, and FCF turn negative.

However, Wall Street didn’t seem to care about the short-term headline numbers amid the positive long-term demand developments reported by Oracle and the great underlying traction. The following quote from CEO Safra Catz covers it pretty well:

“Oracle has become the go-to place for AI workloads.”

Let me explain this from the basics, without getting too technical.

You see, Oracle has carved out a unique niche in cloud computing by zeroing in on high-performance, mission-critical workloads and embracing a hybrid multi-cloud strategy. This focus has positioned it exceptionally well for the AI era.

One of Oracle’s key differentiators is its infrastructure design. Because the company entered the cloud market later than AWS, Azure, and Google Cloud, it was able to avoid the legacy bottlenecks of first-generation platforms. Oracle Cloud Infrastructure (OCI) was built on a flat, high-bandwidth, non-blocking network that allows traffic to move directly between servers without unnecessary hops. The result is consistently lower latency, higher throughput, and predictable performance at scale.

These technical advantages matter. OCI delivers latency measured in microseconds rather than milliseconds, exceptionally high IOPS for storage, and compute and networking that typically run 20–50% cheaper than AWS.

For databases, HPC, and AI training or inference workloads—where performance and cost efficiency go hand in hand—this combination is highly compelling. That’s why Nvidia, OpenAI, Cohere, xAI, and even Meta (for its Llama models) run workloads on OCI.

As Larry Ellison put it:

“Several world-class AI companies have chosen Oracle to build large-scale GPU-centric data centers to train their AI models. That's because Oracle builds gigawatt-scale data centers that are faster and more cost-efficient at training AI models than anyone else in the world.”

Training, however, is just the beginning of the AI journey. Training an AI model is like teaching a student from scratch: it involves feeding the system vast amounts of data, adjusting its internal weights through trial and error, and repeating this process until it learns patterns. This stage is extremely compute-intensive and requires clusters of thousands of GPUs to run for months.

Inference is different. Once the model is trained, inference is the process of putting it to work—making predictions, generating text, interpreting images, or answering questions. The model isn’t learning anymore; it’s applying what it already knows. While each inference task is less computationally demanding than training, the scale of usage—millions or billions of inferences daily—still requires immense infrastructure.

Ellison believes this is where the true revolution lies. As he put it:

“In fact, the AI inferencing market will be much, much larger than the AI training market. AI inferencing will be used to run robotic factories, robotic cars, robotic greenhouses, biomolecular simulations for drug design, interpreting medical diagnostic images and laboratory results, automating laboratories, placing bets in financial markets, automating legal processes, automating financial processes, automating sales processes… AI is going to automatically write the computer programs that will then automate your sales processes and your legal processes and everything else and in your factories and so on. Think about it. AI inferencing, it's AI inferencing that will change everything.”

This perspective highlights why Oracle’s positioning matters. Training drives the headlines today, but inference will define the market tomorrow. With its flat network, bare-metal servers, GPU clusters, and high-performance storage, Oracle has designed OCI to handle both phases effectively—supporting the massive compute requirements of training and the low-latency, cost-efficient needs of inference at scale.

Beyond performance, Oracle has also built flexibility into its model. Its hybrid offerings, such as Cloud@Customer and Dedicated Region, enable enterprises to run Oracle Cloud services within their own data centers, thereby satisfying compliance and residency requirements. Meanwhile, multi-cloud partnerships with Microsoft, AWS, and Google enable customers to combine Oracle’s strengths in database and enterprise software with the broader ecosystems of other providers.

In effect, Oracle isn’t trying to beat AWS or Azure at their own game. Instead, it has built a cloud designed for the most demanding workloads—databases, HPC, AI training, and increasingly, AI inference—while giving enterprises the flexibility to modernize at their own pace.

In a world where performance, latency, and cost efficiency matter more than ever, and where inference may become the dominant workload of the AI era, that strategy is a powerful advantage.

The result? Oracle is experiencing remarkable and improving traction in its cloud operations today and is witnessing incredible long-term demand, as it continues to sign multi-billion-dollar cloud infrastructure deals and rapidly grows its RPO to unprecedented levels.

Let me lay out the numbers that drove the insane investor enthusiasm.

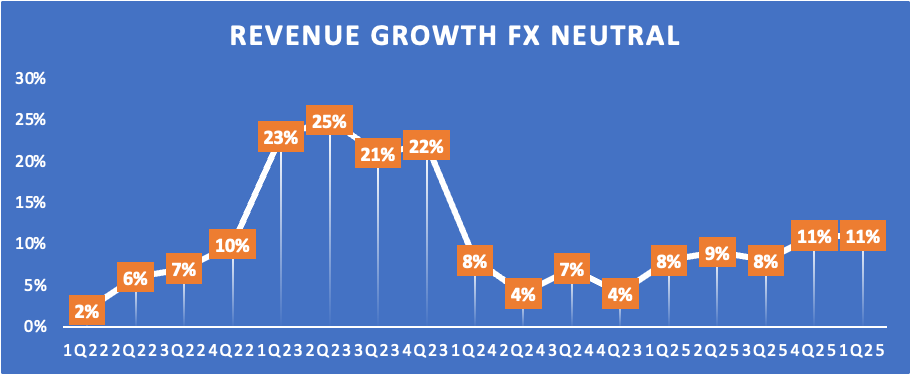

For starters, the company reported strong cloud revenue growth in its fiscal Q1, with revenue comprised from both application software and infrastructure growing 27% to $7.2 billion, now accounting for 48% of group revenue.

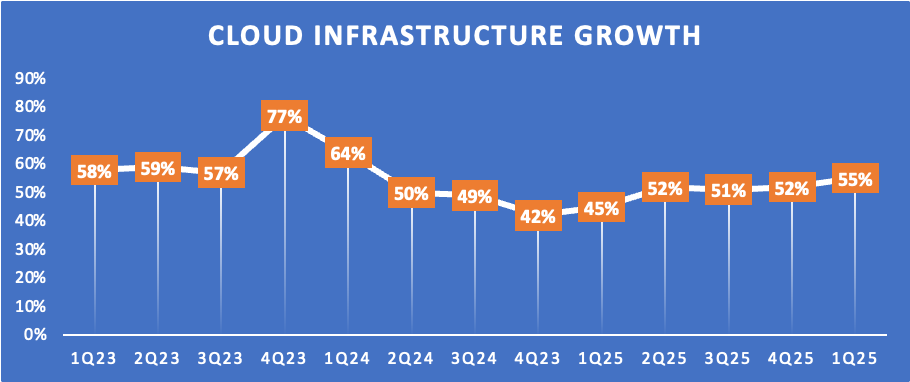

Included in this is Oracle’s infrastructure cloud revenue, which came in at $3.3 billion in Q1, up 54% YoY, despite lapping 46% growth in the same quarter last year. Furthermore, this represents an acceleration from prior quarters, up from 52% in Q1, and marks the best infrastructure revenue growth reported by Oracle in two years.

Clearly, Oracle is seeing strong and even improving traction in its infrastructure business, as perfectly highlighted by 57% growth in OCI consumption revenue, aided by the fact that Oracle is getting more capacity online. Nevertheless, management indicates that Oracle continues to be capacity-constrained, as “demand continues to dramatically outstrip supply,” as management quotes. This shows that there is definitely a significant amount of upside for Oracle, held back only by capacity limitations.

Meanwhile, in applications, growth also remains strong. Cloud database service revenues were up 32% YoY, now sitting at an annualized revenue of $2.8 billion, and multi-cloud database revenue, which is revenue generated through database subscriptions used outside of OCI, was up a whopping 1,529% in Q1.

Additionally, cloud application revenue reached $3.8 billion, representing a 10% increase, driven by a 16% growth in strategic back-office application revenue.

However, that still leaves us with the real highlight of the quarter, which was RPO. During the quarter, Oracle signed significant cloud contracts with AI leaders, including OpenAI, xAI, Meta, NVIDIA, and AMD, amid exploding demand.

As a result, Oracle reported a total end-of-Q1 RPO of $455 billion, which is up 359% YoY and up a mind-blowing $317 billion from the end of fiscal Q4, which suggests Oracle signed long-term contracts worth $317 billion in Q1 alone, driven by 500% growth in cloud RPO, on top of last year’s 83% growth.

This indeed suggests that Oracle is seeing unprecedented demand for its cloud infrastructure from these leading AI providers, which fuels an impressive outlook for the years ahead. And traction isn’t abating either, with management guiding for another multi-billion-dollar deal to be signed soon, bringing RPO to over $500 billion, which is absolutely incredible and far ahead of even the wildest Wall Street consensus.

In short, Oracle’s Q1 results may have been mixed at first glance, but the sheer scale of RPO growth completely reframes the narrative. No other cloud vendor has reported contract momentum of this magnitude, and Oracle’s partnerships with the world’s most influential AI players position it uniquely for the decade ahead. If management can execute on this unprecedented backlog, Oracle is no longer just catching up in the cloud—it could be on the verge of leapfrogging competitors. Oracle is truly the fourth cloud provider now.

Now, to round up Oracle’s Q1 results, to this excellent cloud revenue, we can add $5.7 billion in “legacy” software revenue and just under $2 billion in other revenue, which together were roughly flat YoY, and Oracle reported a total Q1 revenue of $14.9 billion, up 11% YoY but $110 million shy of consensus estimates.

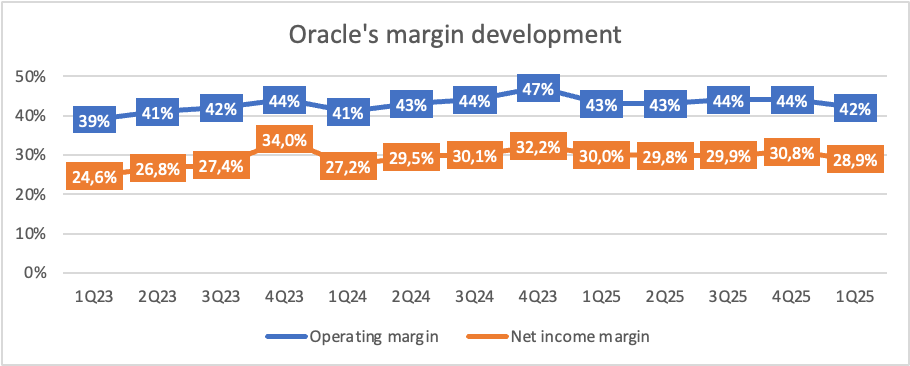

Moving to the bottom line, Oracle reported an operating income of $6.2 billion, up 7% YoY, growing slower than revenue as Oracle’s operating margin contracted. For reference, operating costs increased by 14%, driven by higher restructuring costs and a 39% rise in cloud costs. As a result, costs outpaced revenue growth, putting pressure on the operating margin, which contracted 100 bps YoY.

Notably, management remains committed to operating margin expansion in fiscal year 2026, amid the internal adoption of AI, which is expected to result in mid-teens operating income growth.

Finally, Oracle reported an EPS of $1.47, up 6% YoY through a combination of higher revenue and lower margins, as the net income margin also contracted by 110 bps YoY. This included a $0.03 headwind from a higher tax rate.

But I also have some serious concerns…

Obviously, this was an excellent quarter for Oracle. Yes, headline numbers missed expectations, but cloud demand and subsequently RPO reached incredible levels, fueling incredible optimism for not just its revenue and growth potential for the years ahead but also way beyond, as Oracle is now broadly viewed as the prime cloud infrastructure beneficiary in the AI era, which drives an optimistic outlook well into the next decade.

I mean, it’s hard to deny with $455 billion in total RPO and 500% YoY cloud RPO growth. It’s unheard of, even giving Nvidia-level vibes.

And yet, I am not over the moon or as optimistic as everyone on Wall Street currently seems to be. Yes, as I just did, I acknowledge the “great” results, but I also have serious concerns and don’t believe everything is as good as it looks.

For one, there is the viability of its outlook, the quality of its RPO, and the incredible customer concentration.

You see, Oracle’s reported $455 billion in RPO looks extraordinary on paper, but the assumptions behind it warrant scrutiny. For example, there is the assumed incredible customer concentration, as reports suggest that the massive driver of Oracle’s RPO in Q1 was primarily a whopping $300 billion deal signed with OpenAI, in relation to project Stargate, which would mean this customer alone accounts for 66% of total RPO, which isn’t ideal, especially considering the state of this one customer.

Reportedly, Oracle will provide OpenAI with 4.5 gigawatts of capacity over the next five years for “up to” $300 billion. It’s worth putting some focus on the “up to” in that sentence, because where is OpenAI getting $300 billion from, or going to pay roughly $60 billion a year for computing capacity, given it only generates only ~$12 billion in annual revenue today, remains far from profitability, and faces enormous uncertainty around the pace of AI adoption and the broader economic cycle.

In other words, it is highly unlikely this is a fixed contact. I believe it to be full of escape clauses, usage contingencies, or phased commitments. Otherwise, the math simply doesn’t add up – once again, consider the “up to” in the report. I deem it likely that the committed number is much lower – this seems like overcommitment with a lot of optionality built in.

Yes, if OpenAI scales as optimistically projected (management has reportedly targeted $125 billion in revenue by 2029), that demand might materialize - it might. But if adoption slows, if financing dries up, or if competitive dynamics shift (I mean, OpenAI’s competition is intense), Oracle could be left with costly capacity commitments.

This raises serious concerns about the quality of the RPO reported by Oracle and whether management is being transparent about the quality and nature of this RPO.

Also, note that under ASC 606, Oracle can only count enforceable and collectible contracted obligations, but that doesn’t make them ironclad. RPO includes deferred revenue (payments received but not yet recognized) and contracted but unbilled amounts (signed commitments to consume services in the future). Both categories are real, but both carry execution risk: whether Oracle delivers on time, whether customers actually consume contracted capacity, and whether payments flow as expected.

These numbers aren’t set in stone. And, one way or another, even if the OpenAI deal is viable, the customer concentration is immense.

In that light, Oracle’s staggering RPO growth is both its crown jewel and its biggest question mark. The numbers are headline-grabbing and may reflect genuine momentum with the world’s most influential AI players. However, investors should temper their excitement with caution: RPO isn’t the same as revenue; its timing is uncertain, and its concentration around one customer magnifies execution risk. Whether this backlog ultimately proves transformative or a mirage will depend on OpenAI’s trajectory and Oracle’s ability to turn contractual hype into durable, cash-generating growth.

I am cautious.

And that’s not all; I also have concerns about Oracle’s future profits and cash flows, and subsequently its financial health, which are closely tied to my prior point.

You see, to meet demand, Oracle needs to rapidly expand its cloud infrastructure capacity, and this requires extreme levels of CapEx, all of which must be invested upfront, with the resulting revenue only realized later. In other words, Oracle needs to anticipate demand and invest in advance.

Take the 4.5 GW of capacity related to the OpenAI deal and the Stargate project. Building out this capacity alone will require roughly $180 billion to $225 billion in capital expenditures (CapEx), according to Wall Street estimates.

That’s an extraordinary commitment, especially when the revenue tied to those investments may not fully materialize, or at least not on the expected schedule.

This mismatch between upfront spending and uncertain future revenues is a double-edged sword. If AI adoption scales at the most optimistic pace and OpenAI and peers meet their growth targets, Oracle could emerge as the critical cloud infrastructure provider of the AI era, unlocking decades of growth and cash flow.

However, suppose OpenAI underdelivers, renegotiates, or fails to utilize contracted capacity. In that case, Oracle will be left with substantial sunk costs and limited flexibility, all while bearing the burden of debt and depreciation from the build-out.

We can already see that these upfront investments weigh on its financial health today. TTM FCF is now -$5.9 billion, while Q1 FCF was -$362 million, due to $27.4 billion and $8.5 billion in CapEx, respectively. Meanwhile, for the current fiscal year, Oracle expects CapEx to be around $35 billion, growing strongly YoY.

And while negative cash flows aren’t good for any business, they are especially painful for Oracle, considering its extremely poor balance sheet. For reference, Oracle ended the quarter with $11 billion in cash and a substantial $105 billion in debt, resulting in a net debt of $94 billion, which is growing.

And amid these extremely high CapEx investments, I don’t expect Oracle’s FCF to turn meaningfully positive anytime soon, which means it will continue to fuel investments through debt. Meanwhile, in the 2 years ahead, it has several debt maturities ($4.6B and $5.2B, respectively). As such, the company may need to raise as much as $20 billion over the next two fiscal years to fuel its operations.

As a shareholder, I really don’t like this approach. With negative free cash flow, a stretched balance sheet, and looming debt maturities, Oracle is effectively betting its financial health on the AI boom materializing exactly as projected. If it pays off, Oracle could solidify its position as a long-term winner; if not, the consequences for shareholders could be severe.

Wall Street and investors are ignoring these negatives and risks amid explosive RPO numbers, and shares are being priced accordingly. Meanwhile, I would like to encourage caution.

Want more out of your subscription? Even more content like this weekly?

Consider InvestInsights PRO - $7.50/month ($70/annually)

This gets you:

A guaranteed 6+ stock analyses every month (roughly 2-4 paid-exclusive).

Full insight into my own portfolio (14% return CAGR since 2022).

Instant transaction alerts anytime I make a move (Fully transparent).

A complete overview of all my target prices and ratings (online available).

You will get immediate access to these recent analyses of Netflix, American Express, PayPal, Uber, and Meta!