Our brand new portfolio! (April 7 update)

A close look at our long-term buy-and-hold portfolio

Hi all!

Welcome to our latest model portfolio update, where we will provide insights into our portfolio, strategy, transactions, and motivations.

Please note that the portfolio insights later in this post are only for our paid subscribers, hence the paywall. For all our new non-paid subscribers, do not worry! Only our monthly portfolio updates include a paywall, but all our stock analyses and deep dives are free for all!

If you would like full access to the entirety of this post and future portfolio updates, consider subscribing to our paid subscription tier ($4.99 monthly)!

Since its launch in 2022, our portfolio has consistently outperformed market benchmarks, maintaining a low-to-average risk profile. This success is a testament to our robust and disciplined investment strategy backed by the dedicated research of our team of analysts.

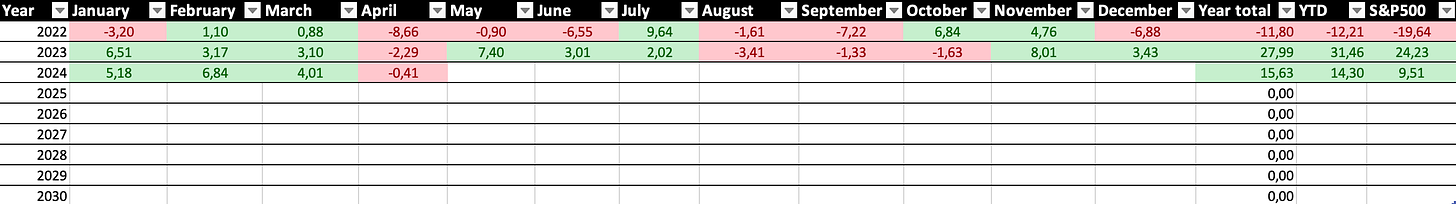

This last quarter was no different, as we once more outperformed global benchmarks. Our portfolio returned just below 15%, outperforming the S&P500 return of around 10%, a performance we are quite pleased about.

Check out our complete performance overview below.

I should note, though, that after purchasing a house in recent weeks, I was forced to cut my portfolio in half and entirely restructure it. So, it is a bit different than it used to be, but it is now entirely aimed at the long term and my retirement in about 35 years (yeah, that’s still a long time to compound). As a result, the investment strategy here really is to buy and hold for as long as my investment thesis remains intact. Ideally, I hope never to sell a share in this portfolio, though that is unlikely.

More about the portfolio structure and the stocks remaining in the portfolio in a bit!

Meanwhile, we have a very clear strategy for which stocks to hold, when to buy, and when to sell. This strategy has helped us outperform the benchmarks since 2020 and should continue to do so going forward.

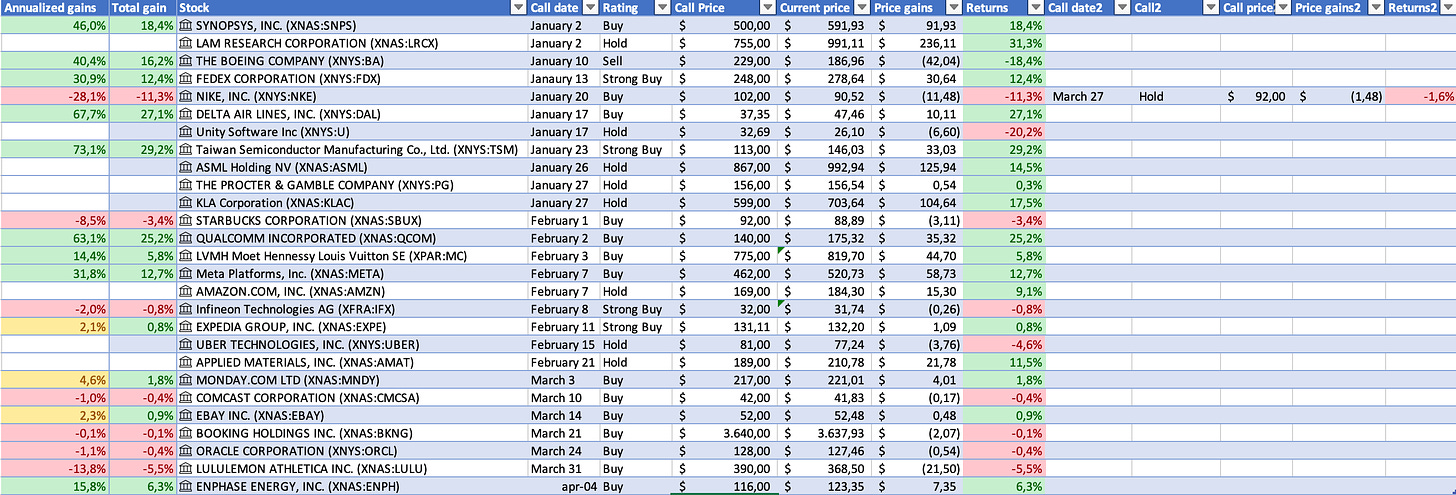

However, before we get to that part, let me also highlight the success of our calls on this platform. While we can not own all stocks we rate a buy or find interesting (I am not looking to own some 500 stocks), our research has shown to result in good returns.

Since we started on this platform in January of this year, our buy calls have averaged a return of 7.9%, including calls we made as recently as last week. Moreover, this translates into annualized returns of just below 20%. Meanwhile, TipRanks points to a historical track record with annual returns of 24.5% and a success rate of 79%, something we are pretty happy about.

We hope to keep providing you with valuable analysis! Check out all our calls on Rijnberk InvestInsights below.

On that note, let’s move on to our strategy, portfolio overview, reasoning, and comments.