Qualcomm Inc. – A Deep Dive into its future and investment thesis

Is Qualcomm a good buy today? Let's find out!

In June, I already argued that Qualcomm shares were a bargain. The company's share price remained under pressure due to Wall Street concerns over its exposure to Apple and emerging threats in the Chinese handset market. In addition, the semiconductor industry continued to struggle under export restrictions and poor cyclical demand, leading to a rather attractive buying opportunity at just 15x earnings for a business expected to grow revenue and EPS at respectable rates.

However, since then, shares have given up another 18% after last week’s 5% sell-off, even as management delivered solid quarterly results earlier this month, beating consensus expectations, and was able to issue bullish long-term guidance for its IoT, automotive, and PC segments, highlighting the business is successfully moving away from its dependence on Apple and the handset market, albeit slowly.

In other words, it is about time we revisit the Qualcomm investment case, taking a close look at its recent financial performance and investor day guidance and commentary.

Not familiar with Qualcomm yet? Don’t worry; most of it will become clear throughout this article!

This is a deep dive into the future of Qualcomm and its investment thesis.

Let’s delve in!

Qualcomm and its struggles to convince investors

For those unfamiliar with Qualcomm Incorporated, it is a leading global semiconductor design company mostly known for its wireless communications chips and smartphone processors under the Snapdragon brand. The company is the leading global supplier of 5G and RF-modem chips (including the sole supplier for Apple’s iPhones) and the #2 supplier of chipsets for Android smartphones.

Over the years, this has made it a critical force behind mobile innovation, playing a foundational role in advancing 3G, 4G, and 5G cellular technologies. Qualcomm's Snapdragon processors are widely recognized as the core of many smartphones, tablets, and other connected devices, offering cutting-edge performance in areas such as AI, graphics, and energy efficiency.

Meanwhile, in recent years, the company has expanded its reach into automotive, Internet of Things (IoT), and networking solutions, positioning itself at the forefront of connectivity and digital transformation across various industries.

In other words, when it comes to wireless technologies, Qualcomm is the go-to for most businesses globally. Over the years, it has become a real industry stalwart with a $170+ billion market cap.

However, despite its leading positions and continued success in innovating and fighting off competition, Qualcomm has never really been a Wall Street darling – quite the opposite. Even as everyone was buying semiconductor shares over the last decade, resulting in the SOXX ETF gaining more than 500%, Qualcomm shares returned only 117%, well underperforming peers and the 186% return from the S&P500.

Furthermore, whereas the sector median forward P/E is close to 25x due to the industry's high growth, Qualcomm shares currently trade at just a 14x multiple, with a PEG of just above 1.

In other words, Wall Street values Qualcomm nowhere near most of its peers, and this is for several reasons. First, the company derives most of its revenues from the handset or smartphone industry, which isn’t really a fast-growing semiconductor vertical and a highly competitive one.

This industry is very mature and growing slowly, and Qualcomm faces tough competition, especially in China, where it derives some 62% of its revenues. Besides, this exposure to China is also some pretty heavy exposure that investors don’t really like.

On top of this, the company also has significant exposure to Apple as the supplier of connectivity chips for its iPhones. Analysts estimate that Qualcomm derives 15-20% of its revenues and profits from Apple alone, which is heavy exposure to a single customer. However, the worst part is that Apple is actively looking to get rid of Qualcomm and produce these chips in-house, putting this revenue at risk.

So far, Apple has been unsuccessful in producing a similar quality in-house product and recently renewed its contract with Qualcomm until the end of 2027. However, the future risk remains significant.

All of this doesn’t make Qualcomm the most compelling pick, and it explains its discount. However, I would argue that now isn’t the time to stop reading and put Qualcomm shares aside.

You see, Qualcomm management realizes all this all too well, which is why it has been working on diversifying its revenue stream for years now, focusing on high-growth areas such as automotive, IoT, and most recently, the AI PC processor market, and with quite some success.

In recent years, it has grown into the leading supplier of advanced automotive and IoT chips and has made a strong and better-than-expected entry into the PC processor market in recent months.

The IoT chip market is projected to grow at a 14% CAGR through the end of the decade.

The automotive SoC market is projected to grow at a 10% CAGR through the end of the decade.

The AI PC market is projected to grow at a 29% CAGR through the end of the decade.

As a result, the Qualcomm of today is far better positioned than it was 5-10 years ago to drive impressive sustained growth, with dependence on Apple and the handset market decreasing.

As investors and Wall Street continue to worry about the competition in China and the exposure to Apple, I believe many ignore the positives here. While I most certainly acknowledge the risks, they seem fully priced in at current prices and projections, and I view Qualcomm as a rather compelling investment at current multiples, with relatively little downside risk and plenty of room to prove the critics wrong and outperform against conservative long-term growth estimates by Wall Street.

During its most recent investor event, Qualcomm solidified these beliefs, confirming it’s on the right path and issuing bullish long-term guidance for its high-growth segments and diversification.

Let’s delve into the details and review the company’s most recent financial performance to make up the balance and set financial projections and a target price.

Is now the right time to buy Qualcomm shares? Let’s find out!

Qualcomm delivers strong fiscal Q4 results.

Let’s start with Qualcomm’s most recent financial results, announced earlier this month on November 6th, and getting right into it; Qualcomm impressed! The company beat the consensus on top and bottom lines as it delivered revenue and EPS above the high end of its own guidance and saw a continued recovery in all its end markets and segments.

The company reported total revenue of $10.2 billion, an 18% year-over-year increase. This highlights a continued revenue recovery after this dropped into negative territory in 2023 amid poor consumer demand impacting electronics sales. With over 90% exposure to consumer electronics and industrial end-markets, this hit Qualcomm rather hard, as visible below.

Positively, growth has been recovering in 2024 and continues its upward trajectory so far, recovering gradually.

This recovery was visible across each of the company’s operating segments, with IoT revenues rebounding aggressively after prolonged weakness, the automotive segment remaining remarkably strong, and handset revenue gradually improving as well.

Handset revenue last quarter was $6.1 billion, which is in line with expectations and reflecting a recovery in Android smartphones globally, with particular strength in China.

IoT revenues came in at $1.7 billion, up 24% YoY, and as said before, recovering aggressively thanks to the continued success of smart glasses, industrial demand rebounding, and channel inventory finally having normalized, which means Qualcomm is no longer forced to undership market demand, which led to multiple quarters of double-digit declines in fiscal 2023.

However, the most impressive performance continues to come from Qualcomm’s automotive segment, which hasn’t seen revenue growth drop into negative territory at all in recent years and has bounced back aggressively from mid-teens growth at the end of 2023 to a staggering 68% YoY revenue growth in the most recent quarter.

Q3 automotive revenues hit $899 million, up 68% YoY and 11% sequentially, driven by the continued content increase in new vehicle launches. Notably, this growth in automotive revenues is even more impressive considering the headwinds the automotive industry is currently struggling significantly with lackluster demand and lower global shipments, which doesn’t seem to impact Qualcomm at all.

Management was asked about this resilience and gave the following answer:

“As we said before, I think you should look at our revenue and auto less sensitive to what happens in the market, much more related to new models that are being launching with Qualcomm technology and it's reflecting a shifting share. So, as we gain share and new models get launched, you started to see that show up in our financials and that's the reason we continue to have growth both sequentially and year-over-year.”

Impressive!

Moving to the bottom line performance, there is also little to complain about, with the business performing well. Qualcomm has shown a remarkable ability to improve margins in recent years, growing revenues at a 15% CAGR since fiscal 2019. R&D has grown at a CAGR of just 8%, and SG&A at just a 2% CAGR.

Last quarter was no different, with margins quickly recovering from 2023 lows. Qualcomm reported a net income of just over $3 billion, up 33% YoY and reflecting a net income margin increase of 330 bps YoY, hitting 29.6%.

This resulted in an EPS of $2.69, up 33% YoY.

These improving margins allowed Qualcomm to report a record FCF for fiscal FY24 of $11.2 billion, allowing it to handsomely reward investors and strengthen its balance sheet.

As of the end of its fiscal Q4, Qualcomm held a total cash position of $13.3 billion against similar levels of long-term debt, leaving it in a healthy financial position, earning it an A credit rating.

This healthy financial position and great FCF generation allowed management to keep rewarding shareholders nicely in Q4, returning a total of $2.2 billion consisting of $1.3 billion in stock repurchases and $947 million in dividends.

Qualcomm shares currently yield a sweet 2.2%, roughly in line with their 5-year average yield and 46% above the sector median. Meanwhile, the company has grown its dividend at a respectable rate for 20 straight years, but we’re still only looking at a payout ratio of 32%, leaving it well covered and with plenty of room for further growth in the years ahead.

However, investors shouldn’t expect much dividend growth in the years ahead, as the company is very committed to maintaining a flexible cost profile and executing its diversification strategy. As a result, as of its investor day, management aims to grow its dividend only in the low to mid-single digits, which still isn’t too bad considering its decent starting yield and payout consistency.

On that note, let’s delve deeper into the company’s future by taking a look at its investor event commentary.

But first, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe and if you like our content and if you want to show even more appreciation for our work, please consider upgrading to paid (only $5 monthly).

In addition to all the free stuff, this also gets you access to the occasional premium analyses and full insight into my personal portfolio!

Qualcomm’s Investor event shows promise

Earlier this week, Qualcomm held its investor event, providing more detailed commentary on the company’s technology progress and growth targets/expectations. The event didn’t disappoint, as Qualcomm issued bullish guidance and set optimistic growth targets for its automotive and IoT segments, pointing to ongoing revenue diversification and a move away from dependence on Apple and handsets.

You see, while there is a lot not to like about Qualcomm, as clearly pointed out earlier, one thing no one can complain about is Qualcomm’s ability to innovate and successfully enter new markets with incredible success.

As a result, the company now sees its TAM swell to $900 billion by 2030, growing double digits, thanks to exposure and a leading position in the handset, automotive, and IoT (inc. PCs) markets, providing it with a positive growth backdrop for the years to come.

Handsets

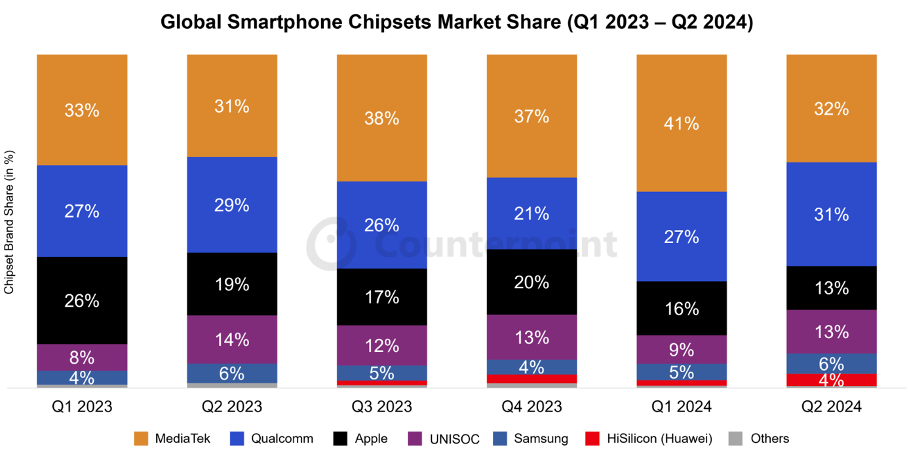

When it comes to handsets, Qualcomm continues to dominate the Android smartphone market today, along with MediaTek, claiming a 30%+ market share. This share is roughly stable over the longer run, with quarterly fluctuations induced by smartphone release timing.

However, in the high-end smartphone range, Qualcomm is doing quite a bit better as its latest generation Snapdragon chipsets have allowed it to retake the performance crown in Android phones, setting the highest benchmark scores and being one of the first to enable on-device AI models.

AI is giving Qualcomm a new edge in computing and on-device functionality. It is leading the market for AI-enabled smartphone processors, which could benefit it in the medium term.

Because of its top-performing chips, Qualcomm generates five times more premium-tier smartphone revenue than its closest competitor, Mediatek. Mediatek tends to focus on the lower end of the industry, while Qualcomm dominates in the high-end arena.

Nevertheless, ultimately, it is no secret that the handset market is far from exciting and isn’t likely to be a big revenue growth driver for Qualcomm, even as the company performs well and stays ahead of the competition.

The industry is still only expected to grow low to mid-single digits, and for Qualcomm, this is likely to translate into mid-single-digit growth through the end of the decade, according to Qualcomm management. This is mainly as anticipated and not spurring a lot of enthusiasm.

Ultimately, the handset market, accounting for 75% of Qualcomm’s revenues, is not the real reason to invest in Qualcomm. It is rather negative due to slow growth and overexposure to Apple and China.

Automotive

However, the company's automotive segment is a much more exciting area of the business and definitely spurring enthusiasm. Here, management is very bullish, and Qualcomm is doing exceptionally well.

Today, Qualcomm is the industry leader in automotive high-end semiconductors, ahead of Nvidia. Thanks to its complete offering, which includes everything from simple car connectivity, safety features, and assisted driving to full ADAS platform features enabling autonomous driving and robotaxis, Qualcomm is the market leader.

The company currently has a $45 billion automotive design win pipeline, with one-third of this being driven by ADAS systems. This is up from $30 billion in 2022, and most of this future revenue will come from Europe and the U.S., which I am quite pleased with.

This competitive positioning and complete offering positions Qualcomm extremely favorable to fully benefit from the expected growth in automotive semiconductor revenue, which is still expected to boom through the end of the decade driven by the digitalization of cars for connectivity, safety, comfort, and ADAS purposes.

According to Qualcomm, which collaborates with most OEMs, this should lead to its automotive TAM doubling from $50 billion in 2024 to $100 billion by 2029. This growth is mostly driven by digital cockpit and ADAS functionalities, reflecting a 15% CAGR.

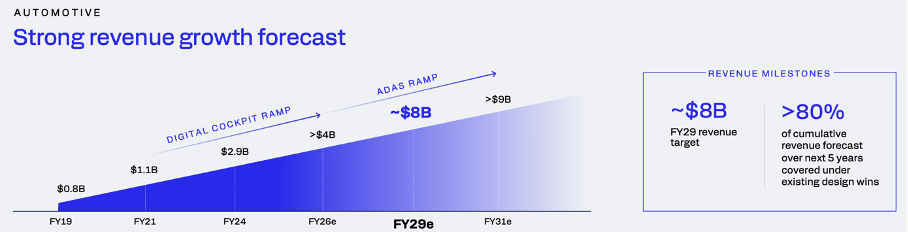

However, driven by continued market share gains, design wins, and exposure to faster-growing verticals, management is confident it will be able to outpace this underlying industry growth. It points to automotive revenue growth at a CAGR of 22.5%, which will reach $8 billion by 2029 and $9 billion by fiscal FY31.

Notably, its design win pipeline currently fully covers a staggering 80% of this expected revenue through 2029, giving management excellent revenue visibility and reliability.

In other words, automotive will remain a significant growth driver for Qualcomm well into the next decade.

PC Processors

After acquiring world-class CPU and technology design company Nuvia in 2021, founded by previous Apple engineers, for a total of $1.4 billion, Qualcomm launched its first ARM-based PC processor earlier this year and has impressed.

You see, up until this point, ARM-based processors in Windows had seen little success. Within Windows, the products had always struggled with compatibility and performance compared to the traditional X86 technology products from Intel and AMD.

However, Qualcomm seems to have broken this trend, launching impressive products that have seen acceptable compatibility so far and that have blown competitors out of the water with great benchmark results, fully optimizing the more advanced ARM technology.

In performance per watt, Qualcomm now leads the PC industry, outperforming both industry leaders, AMD and Intel. This means Qualcomm’s chipset is more energy efficient, which comes with a bunch of performance gains like better thermal management and better battery life.

Furthermore, it delivers a 10% faster CPU performance than the closest competitor and requires 38% less energy at peak performance.

Meanwhile, Qualcomm is already working on its next-generation product, which outperforms the first generation by another 30% in CPU performance and another 57% energy gain, which is tremendous. Clearly, Qualcomm has a lot of innovation to come and is starting to look like a real industry disruptor, with an initial product that is at least comparable with the X86 competition, and, more importantly, its focus on energy efficiency and performance gives it an edge in the next generation of PC computing with AI.

Now, I can imagine many of you don't care about these numbers, and you might wonder how this is relevant to investors. However, I do point this out to highlight how strong Qualcomm’s entry into the PC processor market has been, with impressive initial products.

Meanwhile, Qualcomm has also seen rapid adoption of its ARM-based processors by app developers. The majority of PC programs now work natively with the Qualcomm Snapdragon chipset, which was somewhat of a concern pre-release. Positively, Microsoft and Qualcomm have both been working hard to enable a seamless user experience, which is paying off.

Despite only being launched a few months ago, Qualcomm has already shipped its new range of ARM-based PC processors in 58 different devices, a number that should grow to 100 by 2026, and has been the first and only enabler of Microsoft’s co-pilot+ Windows PCs, which run on-device AI models.

It seems like Qualcomm has quickly become a real competitor in the PC industry, leveraging the AI revolution to its advantage to generate an initial headstart. Initial signs all look really good for Qualcomm, which hasn’t disappointed in the slightest with this release.

As a result of this successful entry and with much innovation to come, management expects its 2029 PC silicon TAM to be $35 billion. This includes the expectation that AI’s presence in PCs will skyrocket to 90% by then and that ARM-based processors will rapidly gain market share thanks to better energy efficiency. Qualcomm expects some 30-50% of this to be non-X86 processor PCs.

Using this data, Qualcomm now targets $4 billion in PC revenues by 2029, from practically zero today.

With this, Qualcomm has entered another promising market with success, further diversifying away from handsets and Apple. This is great news for investors and really impressive.

The Internet of Things (IoT)

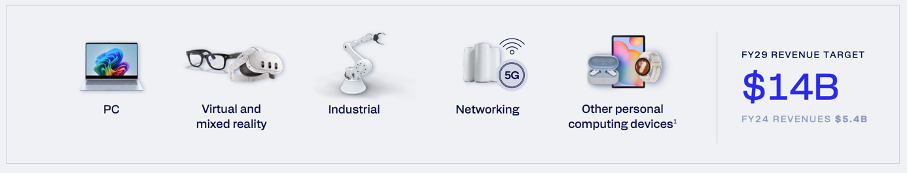

Qualcomm’s IoT segment is incredibly broad, including connectivity, VR/AR, Industrial automation, and PC revenue, all of which have great prospects.

Two of the biggest contributors of revenue in this segment continue to be industrial automation and VR/AR. Starting with the latter, it is worth pointing out that Qualcomm’s chips are the product of choice for most VR/AR players and in most virtual and mixed-reality glasses/headsets. You can find most of its partners and customers below.

Driven by the expected significant growth in VR/AR adoption after the entry of Apple into the market and Meta’s success with its RayBan smart glasses, Qualcomm believes its AR/VR revenues will, too. By 2029, Qualcomm targets $2 billion in AR/VR revenues, with Industrial contributing another $4 billion thanks to a continued push for automation and Qualcomm producing the highest-end wireless technology.

Adding PC revenues to the mix, Qualcomm management now targets a whopping $14 billion in IoT revenues by 2029, reflecting a 21% growth CAGR.

Ultimately, management now believes revenue excl. handsets should continue to grow rapidly at a 22% CAGR through the end of the decade, with revenue from these segments hitting $22 billion by fiscal 2029.

Obviously, this should far outpace expected handset revenues at a mid-single-digit CAGR. As a result, handset revenue is expected to be closer to 50% of revenue from 75% today, according to Qualcomm.

In my opinion, this makes the business much more attractive and better positioned for long-term sustained growth and success. With its investor event, Qualcomm confirmed it is on the right path and is improving its revenue profile.

I am pleased with this fundamental progress and better positioning as a shareholder!

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

Just two more things: The ARM dispute and a potential Intel acquisition

Before heading into the Outlook & Valuation portion of this post, there are two more important developments to discuss and point out for existing and potential investors.

First of all, there is the significant license agreement dispute between Qualcomm and ARM that will be fought out in court next month, with potentially significant yet unlikely consequences. Let me explain!

Qualcomm and Arm have a close-to-symbiotic relationship. Qualcomm uses ARM IP in most of its chips, and as a result, Qualcomm is likely ARM’s largest customer.

However, in December, the companies will face each other in court.

The issue started when Qualcomm acquired Nuvia back in 2021, the acquisition that laid the foundation for Qualcomm’s recent entry into the PC processor market.

At the time, Nuvia had its own license agreement with ARM, and Qualcomm argues that after the acquisition, it automatically acquired the rights to use Nuvia CPU designs that incorporate Arm IP without ARM’s permission.

However, ARM argues that its architecture license with Nuvia was not transferable without Arm’s permission, which should have led to a renegotiation of the license, most likely at better financial terms for ARM.

As a result, ARM sued Qualcomm in 2022 for breach of contract in an effort to force Qualcomm to pay a higher licensing fee, while Qualcomm still believes it stands in its own right.

So, what could happen in a worst-case scenario? Well, if ARM wins, Qualcomm would have to pay up, which would hurt the future margins of its PC processor sales. If it refuses, it will probably lose the ARM IP in its entirety, forcing it to pull these PC products off the market, which would have seriously bad implications for Qualcomm’s PC prospects.

Definitely not great, and considering what’s at stake here, it’s highly unlikely Qualcomm won’t pay if necessary.

At the same time, it is also worth pointing out Qualcomm is close to being a specialist in litigation, having faced its fair share of lawsuits in the past and with a lot of success. Fun fact: the company even came out on top after a multiyear legal battle with Apple, and it is one of the few companies that Apple has lost to in a licensing dispute.

Of course, ARM knows this, and it is also putting a lot of potential revenue on the line here, coming from its largest customer.

Nevertheless, adding fuel to the fire in recent weeks, ARM has issued a 60-day notice informing Qualcomm that Arm would cancel its license to use Arm’s chip architecture in its entirety, putting at risk most of Qualcomm’s products.

Now, let’s not make it bigger than it really is: this is a power move and nothing more. As I said, ARM has nothing to gain from this and is putting a double-digit percentage of its revenue at risk. There is no chance of the company actually following through with this.

Eventually, it is in the best interest of both parties to settle, negotiating a new license on better terms for ARM and terms Qualcomm can also accept. I deem this the most likely outcome of the entire dispute, with a breakthrough possibly coming before the mid-December court event.

Ultimately, while far from great, I do not view the situation as threatening to Qualcomm; it is mostly noise. Yes, I believe news terms will be negotiated, which can hurt Qualcomm's margins a bit, but this won’t be reflected in its financials.

And then there are the Intel acquisition rumors I want to address.

In recent months, amid Intel’s continued struggles to remain competitive, rumors emerged of a potential Intel acquisition by Qualcomm. The company would likely target not the entirety of the business but only its product business or even only the PC part of the operation. The goal likely is strengthening its position and capabilities in the PC processor market.

Qualcomm is reportedly also pretty serious about its considerations. It has already contacted U.S. and Chinese regulators to discuss a potential acquisition.

However, I just immediately want to cut this subject short: a deal is unlikely due to regulatory issues, and I don’t view it as a good move for Qualcomm to acquire a struggling business. Whereas U.S. regulators probably won’t be a problem due to the promise of a more powerful U.S. chip business, Chinese regulators are highly unlikely to give the green light.

Of course, from Qualcomm’s perspective, the promise of a business owning over 60% of the PC and smartphone processor market is compelling. However, I still struggle to see the risk-reward potential of such an acquisition.

Also, this would be a massive financial acquisition for Qualcomm. Intel’s product business is valued at about $130 billion to $140 billion, compared to Qualcomm’s current market cap of around $190 billion.

Could Qualcomm emerge as a stronger force in the industry? Potentially, yes. However, considering the significant risk involved, I am not sure this plan is a good one, even if approved.

Ultimately, I believe a deal here is highly unlikely and not the best approach for Qualcomm.

Outlook & Valuation

Alright, with all that out of the way, let’s turn to guidance, although much of it has been discussed already.

Starting with the short-term, management now guides for fiscal Q1 revenue of between $10.5 billion and $11.3 billion, reflecting YoY growth of 16% at the midpoint, and EPS of $2.85 to $3.05, up 25% at the midpoint.

This includes the expectation for handset revenue growth in the mid-single digits as growth normalizes a bit, IoT growth of over 20% YoY, and automotive revenue growth of 50%.

Across the board, this guidance was slightly above consensus estimates, as Qualcomm continues to see improving demand, which translates into bullish guidance.

Longer-term, the outlook for Qualcomm also remains pretty good. Of course, there is still the significant risk of losing a big piece of revenue from Apple beyond 2027. Still, Qualcomm is successfully executing its diversification strategy, and the decreasing percentage of revenue coming from handsets and Apple lowers the risk involved.

Also, it is worth pointing out Qualcomm is not a high-growth business, with the majority of revenues still coming from the slower-growing handset business. Nevertheless, I am confident Qualcomm will be able to deliver high-single-digit revenue growth through 2030, even when incorporating a gradual loss of Apple revenue from 2027 onward. A quicker loss of Apple revenue and market share losses in the Chinese handset market could put this under some pressure and result in mid-single-digit growth in a more pessimistic scenario.

Positively, continued margin gains should allow it to grow profits, cash flows, and EPS at a slightly more impressive pace of high-single to low-double digits, especially as the company expands margins in its IoT and Automotive segments.

Ultimately, I now expect the following financial results from Qualcomm through fiscal FY28, which are slightly below my prior expectations.

Positively, after losing some 23% of their value over the last six months, Qualcomm shares have come quite a bit cheaper, with mostly steady financial projections. Using the numbers above, Qualcomm shares now trade at just below 14x earnings, which, considering its growth prospects, isn’t expensive at all. However, Qualcomm shares have consistently traded at a discount to peers in recent years due to its much-discussed exposure to Apple, China, and the handset market, which makes sense.

Still, a 14x multiple looks a bit ridiculous to me. This is another 17% discount to the 5-year average and a whopping 45% discount to the sector median. Furthermore, with a PEG of 1.5x, shares still don’t look expensive at all.

I definitely agree Qualcomm should trade at a discount to incorporate potential risks to account for this downside, but after the price reset in recent months, this is now more than priced in and a little overdone, in my opinion.

Per illustration, using a fairer 17x multiple, more in line with the 5-year average and my FY27 EPS projection, I calculate an end-of-fiscal FY27 target price of $231 per share. This translates into potential annual returns (CAGR) of some 14% or 16% when including dividends, more than enough to likely beat most global benchmarks.

In other words, at current de-risked prices and medium-term estimates (already accounting for Apple revenue losses), Qualcomm can become a great longer-term investment with a favorable risk-reward profile.

Therefore, despite all the noise, I still deem Qualcomm shares attractive enough to keep buying.

For all of you reading this through e-mail, did you know we also have an active subscriber chat [FREE]?

In this chat, we post regular daily updates and standout news items with plenty of room for discussion and questions from all of you! Here, you’ll also find my coverage of ASML’s most recent investor day event, including an updated target price and much more!

Definitely go check it out, and feel free to ask me anything there! Don’t miss out on these daily subscriber features!

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

Great article, but It was a quick no from me when I saw that 62% of revenue comes from China! China is cutting out Western producers left and right, + the geopolitical risk is too high.

Great article. Great analysis. Keep killing it bud 💪