Qualcomm Incorporated – Don't underestimate its prospects

In this post, we take a look at Qualcomm and its most recent financial results.

I have been publicly bullish on Qualcomm QCOM 0.00%↑ since the end of 2021 and have repeated my buy calls on Seeking Alpha throughout the last couple of years as shares frequently traded around the $100 mark at depressed valuations. Today, after gaining over 9% post-earnings last week, shares now trade at close to $180 after gaining 55% over the last 12 months.

Notably, it was these bullish posts on Qualcomm on which I most often received the most comments, and they were rarely positive. Few investors or readers seemed to see a future for this company and were fixated on the risks that overshadowed an otherwise very high-quality business. Granted, it isn’t the best pick in the industry looking at fundamentals, but anything can turn out to be a tremendous investment at the right valuation.

Qualcomm is one of those companies that consistently trades at a discount to peers due to these exact, consistently lingering (perceived) risks and fears despite its solid moat, high quality, and management working hard on diversifying the business to lower these risks.

The risks we are speaking of here are excessive exposure to Apple, often estimated to account for around 20% of revenue and earnings, and its big dependence on the slow-growing and increasingly competitive smartphone industry. In my last post on Qualcomm here on Substack, I pointed out that competition, particularly in China from Huawei, is a growing risk, but I’ll get more into this subject later.

However, it is essential to know that Qualcomm is not the company it was one decade ago. Its growth track record, which is far from impressive, can be deceiving and, above all, is no indication of the future.

Yes, the company remains the leading supplier of Android chipsets through its Snapdragon product line. It is also the leading supplier of 5G modem chips, most notably to Apple. Still, it has significantly diversified into other sectors within the semiconductor industry and made significant technological strides. Today, it has an industry-leading IoT and Automotive segment and is planning on entering the PC market with a strong-looking ARM-based chip later this year. Arguably, looking at technological progress and innovation, Qualcomm is among the best.

Furthermore, last year, it inked a new deal with Apple to supply RF modems for the iPhone until at least 2027, as Apple remains unable to create a similar-quality alternative in-house. This secured a significant recurring revenue stream, giving it more time to diversify away from Apple. Also, it has been acting very quickly on the emerging AI boom, with AI-focused smartphone chipsets and a partnership with Meta.

Overall, we believe the company is in a pretty good place today. We are confident in its longer-term outlook, even as it remains one of the more uncertain semiconductor investment opportunities.

The big question today is whether shares remain priced attractively enough to offset these risks after making significant gains over the last two years. Let’s examine the company's Q2 results, announced earlier this week, to see where it is at, update our financial projections, and examine its valuation.

Qualcomm performed well across the board in Q2

As mentioned briefly at the start of this post, Qualcomm reported earnings earlier this week, which were well received by investors as shares gained over 9% in the following session.

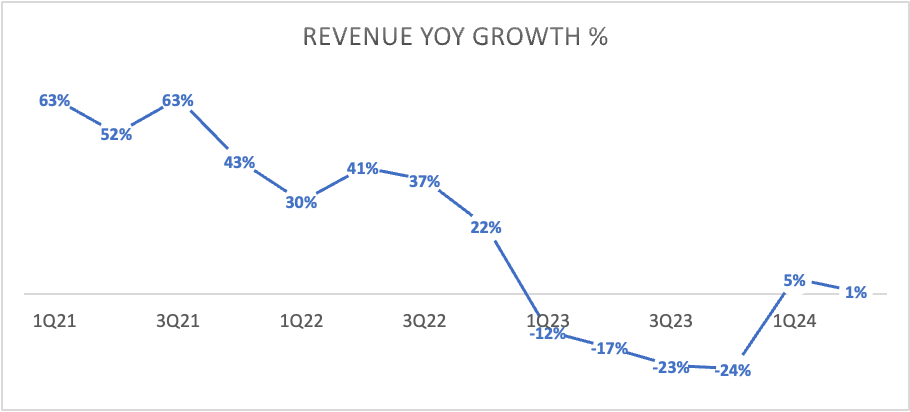

Qualcomm reported revenue of $9.39 billion, up 1% YoY, which is quite an improvement from a 17% decline in the same quarter last year, though down from 5% growth in Q1. This also beat the consensus by a very slim margin, but a beat nevertheless.

This was mainly the result of strong Android smartphone demand, particularly in China, helped by a number of flagship Android smartphone releases powered by Qualcomm’s Snapdragon 8 Gen 3 chip.

Handset revenue came in at $6.2 billion, up 1% YoY. As handsets or smartphones continue to account for 66% of total revenue, the rebound in this industry was an important driver of Qualcomm’s solid Q2 performance.

In addition, Qualcomm continued to see impressive momentum in automotive, with revenues here again coming in at record levels as growth in the segment is accelerating again after bottoming in the second half of last year. Growth in the segment slowed down to the mid-teens but is now accelerating strongly again, growing by 35% in the most recent quarter.

With this growth, the segment continues to outpace the broader automotive chip market, as Qualcomm continues to see significant design wins and gains market share in this very promising industry.

Finally, IoT revenues showed a 9% uptick sequentially but continue to recover much slower than the other two segments. IoT revenue came in at $1.2 billion and was still down 11% YoY.

On the bottom line, the company also performed well, with the net income margin coming in at 29.4%, gaining 330 bps YoY, despite management also accelerating its R&D investments again. For reference, R&D spending in Q2 was only marginally below record levels.

This strong net income margin gain, resulting from improved top-line levels and strong cost management, translated into EPS growth of 13% to $2.44, beating the consensus by $0.12 or 5%.

These improved cash flows also allowed management to strengthen the balance sheet further, growing its cash position by $800 million to $9.2 billion since the start of its fiscal year in September, against a long-term debt position of $14.5 billion, flat from September.

Meanwhile, management also continued to return cash to shareholders. In Q2, Qualcomm returned $1.6 billion through share repurchases and dividends.

Qualcomm has always been one of the best for shareholders among peers. Over the last decade, it has lowered its share count by 34.6% through significant repurchases and, in the meantime, has grown its dividend for 20 straight years.

Shares now yield a respectable 2%, which sits roughly 20% above the sector median. The yield is based on a conservative 34% payout ratio, meaning investors don’t need to worry about sustainability.

Now, the growth of this dividend hasn’t been tremendous in recent years. Still, considering its low payout ratio and the projected earnings growth, investors can expect Qualcomm to keep growing it steadily at mid to high single digits for the foreseeable future while locking in a very solid 2% yield in this relative growth stock. Not bad at all, if you ask me.

Across the board, Qualcomm management continues to execute just perfectly. Management is doing everything it can to steer this company in the right direction and is able to maintain cash flows relatively well, even in a challenging operating environment.

I am really quite impressed by this management team and Qualcomm’s development in recent years. It bodes well for the future as it continues to be underestimated.

Qualcomm is very well-positioned for the future

Now, these quarterly results are all looking pretty good. However, this is not what we believe investors should be focused on. In our view, management’s commentary on technological and product development during the earnings call gives us a much better idea of future growth, which is much more important to us investors.

What lies in the future eventually decides the success of the investment and looking at current developments, the future is looking promising, but risks can’t be overlooked either.

Qualcomm is leading the on-device AI revolution

Most notably, Qualcomm is the frontrunner in enabling on-device or on-edge AI. What this means is that Qualcomm is one of the first to enable GenAI to run on-device instead of through a load of data centers elsewhere, making the functionalities much more accessible and privacy much better.

Over recent months, Qualcomm has already been rolling out its Snapdragon 8 Gen 3 with on-device AI capabilities, for example, featured in Samsung’s flagship devices.

Furthermore, this push for on-device AI is not just limited to smartphones. Qualcomm is enabling this for a range of applications and devices, from next-generation PCs and vehicles to robotics and networking. The sky really is the limit here, and Qualcomm’s lead in this area puts it at the forefront of this revolution.

Building on this advantage, Qualcomm also recently launched its AI Hub, a “gateway for developers to enable at-scale commercialization of on-device AI applications,” as management explains it. With this, Qualcomm is using a critical page from Nvidia’s successful playbook to build a development platform that matches specifically with Qualcomm chips, which will now become the industry benchmark for on-device AI development.

Through this, it further strengthens its moat and extends its lead. As AI is rapidly becoming an important part of our daily lives, Qualcomm is well-positioned to enable this and benefit from it.

Qualcomm continues to gain share in the rapidly growing automotive market

Another exciting area for Qualcomm remains automotive, where it is also the undisputed leader, fighting the likes of Nvidia. Its Snapdragon Digital Chassis, the company’s automotive platform, continues to be the leading option in the automotive industry, and it is used by the likes of Stellantis, Toyota, Mercedes, and Volkswagen.

Highlighting its leading position is a massive design win pipeline, which has grown to around $45 billion, up from $30 billion in September 2022. This shows Qualcomm is outgrowing the addressable market and continues to gain market share, putting it well on track to meet its revenue goals.

For its fiscal FY26, management continues to expect to generate $4 billion in automotive revenues, representing a compounded growth rate of 29%, making it a much more significant growth driver. Meanwhile, the overall automotive chip market is expected to continue growing strongly through the end of the decade at a projected CAGR of 11%.

Positively, Qualcomm focuses on faster-growing areas of this market, like autonomous driving and connectivity. As a result of this and thanks to its growing leadership position, I expect this segment to remain a significant growth driver far into the future. I certainly don’t expect growth here to slow down any time soon.

Crucially, with $4 billion in revenue projected for FY26 and Qualcomm likely under-promising here, we believe this segment could account for roughly 10% of revenue by FY26, making it a much more significant contributor.

Qualcomm is entering the PC market, and it looks promising

On top of this, in these coming months, the first PCs with Qualcomm CPUs will also be released.

With these chips, Qualcomm is bringing competition to AMD and Intel’s X86 processors with its ARM-based chipset. According to the Verge and the earliest readings, Qualcomm could match the performance of Apple’s M3, Intel’s Core Ultra 9, and AMD’s Ryzen 9 in daily tasks while excelling in AI.

These PC chips will carry next-generation on-device AI capabilities, and, according to Qualcomm, its CPU will be the global leader in on-device performance and power efficiency for the Windows ecosystem and will be positioned to compete immediately.

However, this is where the situation gets more challenging, and analysts are careful. See, while Apple has proven that an ARM-based SoC can destroy the likes of AMD and Intel on battery life, power consumption, heat, and performance, Microsoft has so far been unable to create a competitive option through the ARM architecture and whether Qualcomm has done so remains somewhat of a question mark.

Also, historically, there have been issues between Windows and ARM chips in implementation and software, so there are challenges to overcome here. However, according to Windows and Microsoft itself, the software should be fully ready for an ARM CPU, so I am excited to see how Qualcomm will do.

Management still claims it can beat Apple, Intel, and AMD in terms of performance, power efficiency, and battery life.

Suppose Qualcomm can deliver on these statements and promises. In that case, it is looking at a multi-billion opportunity, even if it can only gain a few percentages of market share. It most certainly is a great opportunity for Qualcomm, and while it is still too early for investors to award any value to this venture, there is a lot of potential there.

Consider that the PC CPU market is expected to reach a size of over $120 billion by 2030, growing at a 4.5% CAGR.

Positive reviews and performance benchmarks later this year could be a positive catalyst for the shares. We’ll be monitoring these closely.

Qualcomm is also doing well in its more traditional businesses

Meanwhile, Qualcomm also continues to strengthen its moat through significant technological progress in other areas. One of these areas is cellular modems, where Qualcomm is already one of the leaders but has set a new performance benchmark with its recently announced Snapdragon X80, the world's most advanced 5G modem RF system designed for the next era of 5G.

This technological leap puts Qualcomm further ahead of the competition and positions it to benefit from the continued push toward 5G and growth in connected devices. For reference, this is quite a fast-growing market with a projected growth CAGR of 12.5% through 2032. Quite promising, for sure.

Furthermore, the company is also seeing good momentum in XR (falling under IoT) through augmented and virtual reality growth. For example, the Meta Ray-Ban glasses run on Qualcomm’s Snapdragon AR1 Gen 1 platform and are gaining traction.

We should not forget that the IoT chip market also remains a massive growth opportunity for Qualcomm, and even as the industry is struggling to gain traction today, it is projected to keep growing at a CAGR of close to 15% through the end of the decade, providing Qualcomm with plenty of growth potential.

Making up the balance

We can safely say that Qualcomm has established pretty significant leadership positions in segments beyond handsets, including automotive, XR, and networking, with it also likely benefitting significantly from a push for AI and an entry into the PC processor market.

Developments over the last quarter show that Qualcomm remains one of the most innovative chip companies out there, and this, combined with its leadership positions in these growth areas, makes us confident in its future.

The company is rapidly diversifying, slowly moving away from the slow-growing handset market while maintaining a solid leadership position, while fast growth in other segments and continued innovation in modem technology should offset a potential loss of the Apple modem business. Although, right now, there is nothing that points to Apple being able to build a competitive modem in-house, so any worries here could turn out unjustified.

However, despite all these positive developments, we remain of the opinion that Qualcomm’s long-term outlook remains somewhat clouded by risks and uncertainties.

Most notably, Huawei’s recent emergence in the 5G smartphone market puts pressure on Qualcomm’s Chinese business, which it is very dependent on. Losing market share to Huawei here could significantly impact the business.

In the first few months of this year, Huawei has emerged as the number one brand, growing its market share from 9% last year to 17% so far this year. This is hurting Qualcomm customers like Vivo and Oppo, and therefore also Qualcomm.

This is a significant risk that needs to be considered as it could become a multi-billion dollar headwind for Qualcomm if the Huawei resurgence persists.

Of course, losing Apple in 2027 would also remain a setback, although this is becoming a lower impact every quarter as the Apple part of the business slowly shrinks. Therefore, this does not worry me overly much any longer, especially as there is also a good chance Apple will stick with Qualcomm after all.

On that note, let’s move to the all-important outlook and valuation section.

Outlook & Valuation

After already beating estimates in Q2, management’s guidance also sat above the Wall Street consensus, which caused further optimism and drove the post-earnings price jump.

Qualcomm management has left its yearly handset guidance unchanged at flat to low single-digit growth. For its fiscal Q3, this translates into revenue guidance of $8.8 billion to $9.6 billion, up roughly 10% YoY at the midpoint. EPS is expected to be between $2.15 and $2.35, up 20% at the midpoint, as margins should continue to improve strongly.

Growth is expected to be mainly driven by a continued recovery in the handset market, a sequential improvement in IoT, and continued strong growth in automotive revenues, potentially accelerating further.

Overall, this is pretty strong guidance from management, beating both the expectations from Wall Street and ourselves. As a result, we have increased our FY24 revenue and EPS estimates, as well as our longer-term estimates, due to some positive underlying developments and a faster-than-expected recovery so far. We continue to believe Wall Street is underestimating the company’s prospects.

This has led to the following updated financial projections.

Based on these estimates, Qualcomm shares now trade at roughly 18x this year’s earnings, a 5% premium to its 5-year average and a 22% discount to the sector median. Both of these premiums are justified up to a point.

First of all, Qualcomm today looks much better than it did over most of the last five years, with growth projections looking better and risks easing a bit. Therefore, a higher multiple is justified, especially considering its promising growth outlook.

However, Qualcomm remains one of the higher-risk semiconductor investments, explaining its discount to the sector median.

Overall, I think we can safely say Qualcomm is trading roughly around fair value. While it might deserve to trade at a multiple closer to 20x earnings, it is better to stay somewhat conservative with this one and keep a decent margin of safety.

Therefore, we take an 18x multiple as fair value and calculate an FY26 target price of $224, leaving investors with returns of roughly 9.4% annually, which, combined with its 2% yield, should allow it to deliver double-digit returns from a current share price of $179.

As a result, we maintain our buy rating on the shares and continue to view Qualcomm as a promising investment. While the company certainly is facing above-average risks, it also has plenty of opportunities to outperform thanks to management’s strong push into new sectors and markets.

Therefore, we remain bullish.

Let us know your thoughts in the comments! Also, please leave a like if this post was of value to you!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

Fun read but also very informative

Excellent read sir 👏👏