Qualcomm Incorporated – The Q1 report is a mixed bag but we remain bullish

In this post, we review Qualcomm's fiscal Q1 results and provide our medium-term financial estimates for the company in order to determine whether they are attractively valued.

Qualcomm shares have accumulated over 30% since I last covered these in November on Seeking Alpha as a rebound in smartphone chip sales was around the corner, and investors seem to finally realize the company’s potential in AI technologies as it released generative AI functionalities for both smartphones and cars.

We have been pounding the table on Qualcomm for over a year as shares traded between $100 and $120 per share, and these now trade at $143 per share, which is nothing but justified. In our view, Qualcomm remains one of the primary beneficiaries of the rise of AI as the company has many ways to leverage this new technology, which will also help it diversify its revenue stream.

Ultimately, the bull case for Qualcomm is relatively easy to see. Yet, investors consistently underestimate the company and tend to focus on the negative sides, like its dependence on smartphones and Apple as a customer. Yet, they fail to see the revenue potential and incredible progress the company has made with AI, IoT, automotive, and PC CPUs.

Furthermore, it remains a leader in crucial technologies and smartphone chipsets while having shown the ability to penetrate new markets as well. I stick by my earlier view and urge investors to take a closer look at Qualcomm before throwing it to the side based on the much-discussed “risks.”

The Q1 results

However, right now, I want to focus on the Q1 results and management’s guidance and commentary. Qualcomm shares fell by around 4% yesterday after it reported really quite decent and optimistic fiscal Q1 results. Crucially, both the Q1 results and guidance topped the consensus. So, why did shares fall by 4% anyway?

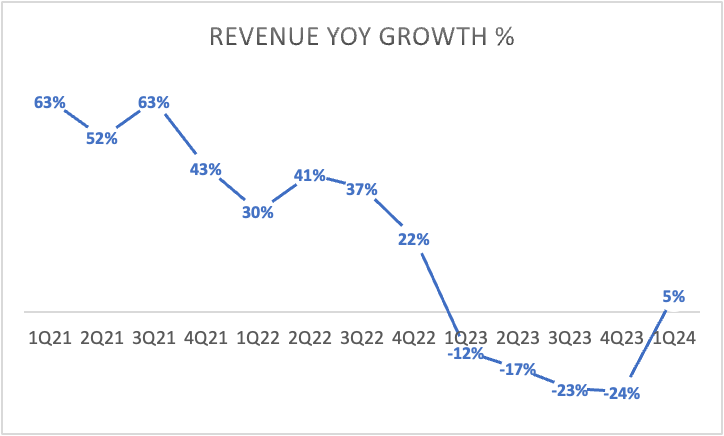

The issue was hidden in management’s guidance and commentary, but before we get into that, let’s review the Q1 results, which were solid. Qualcomm reported revenue of $9.92 billion, up 5% YoY, which is a significant improvement from the 24% revenue decline reported in fiscal Q4. Clearly, the company is seeing an improvement in demand and is lapping the negative quarters from last year. We should expect this to persist and potentially improve throughout the year.

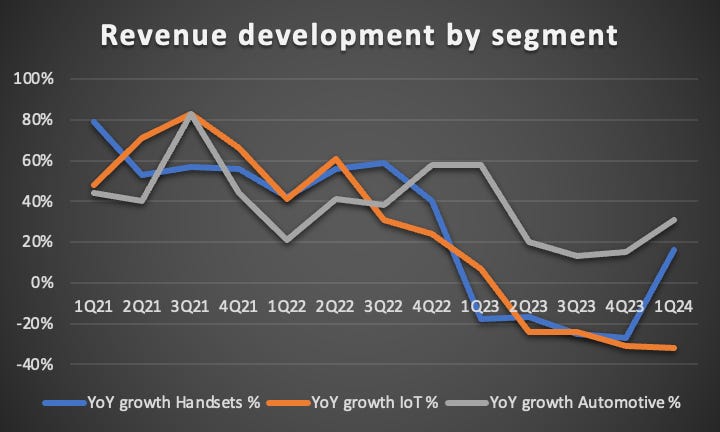

By segment, the strongest recovery was visible in handset revenue, which improved from a negative 27% in Q4 to 16% growth YoY in Q1, which is impressive and driven by a rebound in the handset industry and some critical smartphone releases over the last several months, including the Samsung S24 line.

In automotive, the company also saw accelerating demand, with growth coming in at 31% YoY to a record high of $598 million in revenue. This is an acceleration from 15% growth in Q4 and shows what we already expected, which is that Qualcomm is not feeling any of the pain from higher chip inventory levels at car OEMs.

The IoT segment was the only one that continued to face macroeconomic and demand headwinds and is still down 31% YoY. However, across the board, we can see that demand for Qualcomm’s products is accelerating again, which is a big positive.

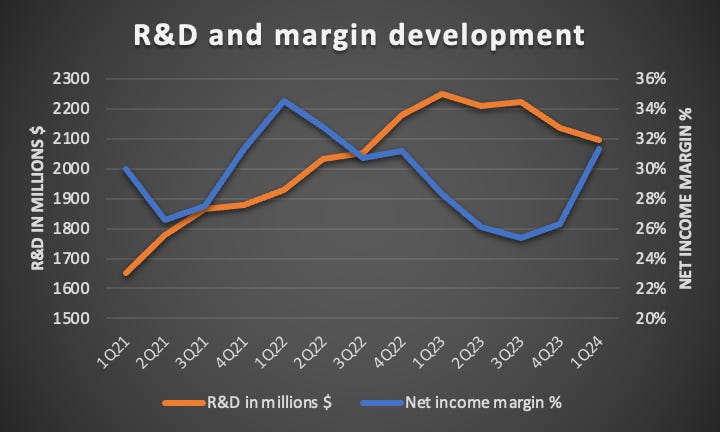

This rebound in demand is also reflected in the bottom line performance, where Qualcomm achieved some significant margin improvements. Most importantly, the net income margin rebounded very strongly to 31.3%, up 300 bps YoY and an even more impressive 500 bps sequentially, leading to EPS growth of 16% to $2.75 per share. This was helped by a 5% sequential decrease in operating expenses as a result of management’s accelerated implementation of cost actions, which it had laid out in previous calls. This included a YoY and sequential decline in R&D investments in the single digits.

Overall, so far so good. The company is seeing improving demand, and margins are recovering. On top of this, management’s guidance also exceeded expectations as it guides revenue to be between $8.9 billion and $9.7 billion, which is roughly flat YoY at the midpoint.

This might seem a little disappointing, considering growth was positive in Q1, but this has a lot to do with seasonality and smartphone releases. Furthermore, EPS is projected to be between $2.20 and $2.40, which reflects a 9% YoY improvement as margins should recover YoY.

However, what led to some disappointment was management’s guidance for the smartphone industry to be flat to slightly up YoY in 2024, whereas a more significant recovery was expected. Meanwhile, Qualcomm expects handset revenue to be down 6% sequentially in Q2 and to remain flat in Q3, which leaves little room for positivity and disappointed investors and analysts alike, leading to the share price decline.

On top of this, the fact that Huawei has re-entered the 5G smartphone market and plans to sell these chips to other Chinese handset OEMs as well is seen as a big risk for Qualcomm as it could lead to market share losses in this massive market. I discussed this in-depth in my earlier coverage on Seeking Alpha, and I stated that it could cost Qualcomm up to 50-60 million units compared with 2023. In terms of revenue, this translates into multiple billions of handset revenue losses. Positively, in 2024, this is expected to be at least partially offset by the rebound in handset demand, but this is most likely a big reason why Qualcomm’s handset guidance remains depressed. It is also quite a big long-term risk.

On a more positive note, Qualcomm did announce a new multiyear deal with Samsung to keep using its Snapdragon platform. This comes after Qualcomm already extended its license agreement and partnership with Apple through 2027 and the renewed long-term agreements it announced with two significant Chinese smartphone OEMs. Meanwhile, the company also continues to work on extending two additional agreements with large OEMs whose agreements are set to expire in 2025.

Also, the company is getting ready to launch its first PC chipset in the Snapdragon X Elite in mid-2024, with which it will penetrate another massive market. This is what management said about it during the earnings call:

“We expect Snapdragon X Elite to set the industry benchmark for on-device gen AI and copilot experiences in addition to leading performance and battery life for next-generation Windows PCs.”

This is another multi-billion opportunity for Qualcomm, though I would be careful with awarding any value to it at this point as its success remains a big question mark. What is much more concrete, however, is the company’s potential in automotive, where it has seen great traction with its Snapdragon Digital Chassis.

As I explained earlier this month, Qualcomm has seen its automotive segment grow rapidly over recent years and already has 350 million cars on the road carrying its Snapdragon Digital Chassis. It is leading the industry right now. Meanwhile, the company continues to guide $4 billion in automotive revenue by 2026, which will grow to over $9 billion by the end of the decade. Therefore, automotive will remain a significant growth driver for the company.

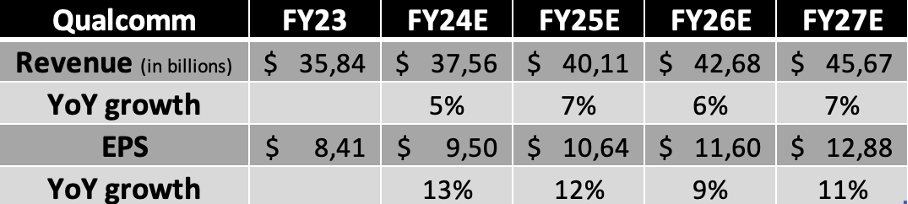

As a result of these positive developments, I continue to be bullish on Qualcomm despite the rising threat from Huawei in the Chinese handset market. As I predicted this impact in my earlier coverage, I didn’t expect a massive rebound in 2024. Now, handset guidance seems to come in even lower than I expected, but automotive demand should easily offset this. Therefore, I increase my FY24 financial projections after the Q1 results and management’s guidance.

Based on these estimates, shares now trade at 15x this year’s earnings, a 15% discount to the 5-year average. Furthermore, The forward PEG ratio now sits at 1.3x, which is still rather healthy. Clearly, the company isn’t as discounted as it used to be, but shares arguably remain attractive.

While I do not expect these to easily return to historical multiples due to an increased risk profile due to the factors discussed above, I believe a 16x multiple is more than fair when considering the company’s global technology leadership and growth expectations. I believe this correctly incorporates the increased risks as well.

Based on this multiple and my FY25 EPS projection, I arrive at a target price of $170, which should translate into annual returns of just over 10% annually or 12.5% when including the company’s sustainable and well-covered dividend yield of 2.2%.

Therefore, I continue to believe Qualcomm shares should be able to keep outperforming global indices, even without any success in the PC CPU market. Therefore, there is also definitely some additional upside to be found here.

As a result, we remain buy-rated on Qualcomm.

Thank you for reading this post. Enjoyed it? Please leave a like to let us know!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

Please make sure to like, restack, and share this post to increase our reach and support our work. Thank you!

Not subscribed yet? What are you waiting for?!

Disclosure: I/we do have a beneficial long position in the shares of QCOM, either through stock ownership, options, or other derivatives. This article expresses my own opinions and we are not receiving any sort of compensation for it.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.