Salesforce, Inc. – The new leader in AI, but optimism might have been overdone

Are Salesforce shares still a good buy? Let's reassess the situation after Tuesday's Q3 earning report and a sweet 11% share price pop.

Thank you for reading Rijnberk InvestInsights!

For all of you reading this through e-mail, did you know we also have an active subscriber chat [FREE]?

In this chat, we post regular updates throughout the week, like standout news items, with plenty of room for discussion and questions from all of you!

Definitely go check it out, and feel free to ask me anything there! Don’t miss out on these daily subscriber features!

Jumping straight into it, Salesforce reported its fiscal Q3 earnings earlier this week, spurring investor enthusiasm. Shares gained an impressive 11% in the following trading session and ended the week 9% higher, setting new all-time highs with the business reaching a market cap of $346 billion.

Interestingly, we can’t really say impressive financial results drove the jump in share price. Don’t get me wrong, Salesforce delivered very decent numbers and growth across the board, but it in no way was able to blow the consensus out of the water.

In fact, the SaaS giant and AI leader missed the EPS consensus estimate, and even as it raised its FY25 guidance, management’s full-year EPS estimate came in below the Wall Street consensus. In other words, yes, the business is still growing nicely and expanding margin steadily, but there isn’t any room for a positive revision in financial projections.

And yet, shares jumped double digits last week, which is remarkable, to say the least, especially considering Salesforce shares already were in no way cheap after rallying in recent months. I mean, I have seen less expensive shares get sold off on a beat-and-raise quarter in recent weeks as investors have become hard to please.

So, what happened?

Well, AI happened.

Indeed, what we see here is purely the power of imagination and the promise of a bright AI future. For Salesforce, investors don’t seem focused or interested in current results, profits, and near-term guidance but rather the company’s traction and advancements in AI that are supposed to drive future growth for Salesforce. In other words, last week’s jump wasn’t driven by fundamentals but instead, at least mostly, by the promise of AI as the next big growth driver and difference-maker. Even Benioff himself made this clear during the earnings call:

“But as I'm sure everybody knows on the quarter, these numbers are not what we're really excited about at Salesforce. And while the quarter numbers are fantastic, the real excitement is really what is hitting with the technology.”

You see, in recent years, as the AI boom took over Wall Street, Salesforce has emerged as one of the biggest beneficiaries of the rise of this new technology and one of the most significant AI plays for investors.

Salesforce is already the largest supplier of enterprise AI in the world, with 2 trillion Einstein AI transactions per week. This cloud-based service offers advanced data analytics and business intelligence capabilities. It leverages artificial intelligence to provide predictive insights and automate complex tasks.

Meanwhile, thanks to its customer base of over 150,000 enterprise customers, Salesforce derives insane amounts of data, now amounting to 300 petabytes, which allows it to drive incredible accuracy and efficiency in its AI features.

And in recent months, Salesforce has presented even more exciting and promising AI features, putting it further at the forefront of the AI revolution. It might even be one of the most enticing AI opportunities out there.

I must at least admit that Salesforce's management sells the dream to investors very well.

However, this raises questions about whether the current share price and valuation have any fundamental support. Despite a stable fundamental profile, shares have become significantly more expensive over recent months.

Up until this week, the YTD performance from salesforce shares had sat roughly in line with the S&P500 index, returning some 26% to investors. However, after this week’s price jump, it now belongs to the 2024 outperformers. Since my buy call in June, shares have returned a whopping 53%. That is in just six months and well ahead of the 16% gain for the S&P500.

And with the share price up significantly and expectations mostly flat, or even trending down over the last week, shares have become much more expensive since June. Investors seem to be willing to pay a higher premium for this business today, driven by its AI potential and promise.

For reference, back in June, you could pick up shares at just 22x next year’s earnings. Currently, you’ll have to pay a whopping 50% higher multiple at 33x earnings, even as long-term financial estimates have actually remained flat to down slightly.

So, is the higher share price justified? Honestly, I doubt it.

Fundamentally, it is hard to explain current prices, and however much I like this business, this is a worrying trend and not a compelling sight. Yes, Salesforce has a bright future, and AI is likely to drive the next stage of growth, but investor enthusiasm and optimism might have run up too high, exceeding fundamentals and complicating the risk-reward balance at current prices.

As Buffett said, “Be fearful when others are greedy.” This might be the right time to turn fearful.

To make up the balance and see whether Salesforce shares remain attractive or should indeed be avoided amid higher prices and over-optimism, I want to examine the company’s quarterly results and management commentary closely to see how the business is performing under the hood and how its AI innovations are faring. Subsequently, I will update my financial projections, buying range, and rating.

For those unfamiliar with the business, my June post on Salesforce explores its products, business model, and fundamentals in greater depth. The post can be found at the link below.

Let’s delve in!

Salesforce delivers a solid quarter but falls short of expectations

Salesforce released its fiscal Q3 results last Tuesday, and as I said, the headline numbers were not that impressive. While Salesforce continues to show steady growth and improving margins and cash flows, it only marginally beat the revenue consensus and missed the EPS consensus.

Top line performance – growth stabilizes and looks healthy

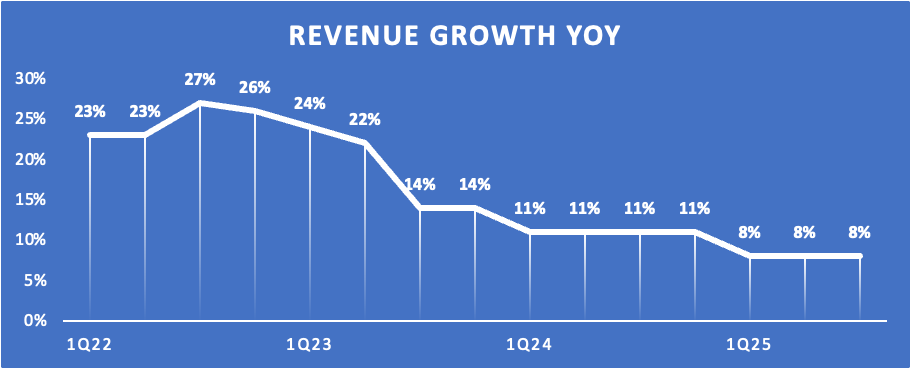

Salesforce reported Q3 revenue of $9.44 billion, up 8% YoY and stable from prior quarters. In recent years, Salesforce has seen its growth slow down rather dramatically from the mid-20s in 2022 to the low-teens in fiscal 2024 and dropping into the single digits in 2025, driven by a touch operating environment with tight IT budgets and the rule of large numbers kicking in for Salesforce.

Positively, growth seems to now have stabilized in the high-single digits, which is positive, and with the demand environment expected to improve in 2025 and 2026, we could actually see growth accelerate a bit again in the quarters ahead.

Focusing on last quarter again, by region, the company continues to see softness in the U.S., where revenue grew only 6% YoY. Positively, in Europe, growth was slightly better at 12% YoY, and in APAC, the company continues to expand its reach, growing revenues at 16% YoY.

Furthermore, Salesforce reported Subscription and support revenue growth of 9% YoY, driven by strong ARPU (Average Revenue Per User) growth and a continued execution of its multi-cloud strategy. The company continues to see great success in its multi-cloud strategy, which aims to increase the value per customer by selling customers not only its CRM/sales cloud system but also its service, marketing, and data clouds.

This cross-selling led to double-digit growth in its Sales and Service Cloud in Q3. Furthermore, the company reported that the top 25 deals averaged more than five clouds each, proving customers are increasingly adopting more of Salesforce’s offerings.

This also led to another quarter of solid RPO growth. RPO represents all future revenue under contract, which grew to $53.1 billion in Q3, up 10% year over year. This indicates that management continues to see solid future demand and is able to sign long-term contracts. Management says demand has stabilized after a tough two years.

Contributing to this is the significant demand for AI.

With the rise of AI and Salesforce’s offering here, Salesforce is seeing increasing success on the multi-cloud front. Salesforce users are eager to access these functionalities and optimize the Salesforce package, driving internal growth.

For reference, in Q3, the company reported that deals greater than $1 million annually, including AI, more than tripled, showing significant demand for the company’s AI offering. The company signed 2,000 deals that included AI functionalities, with more than 200 deals containing the company’s revolutionary Agentforce system, launched mid-October, but more on that in a bit.

It’s these AI deals that are already showing clear signs of growth acceleration, and this is what is driving the bull case. It was this data shared by management that led to the investor enthusiasm we saw in the share price on Wednesday, with shares gaining 11% despite an earnings miss and unimpressive guidance. Investors are seeing AI is seriously gaining traction for Salesforce and is likely to drive another leg of double-digit growth through the end of the decade and potentially well beyond.

I must admit, initial signs are positive.

The impact of AI – Salesforce appears as an AI leader

In addition to the solid AI traction shown by management, the company’s technological progress and promise are also encouraging, further fueling optimism. In a recent event, Salesforce presented Agentforce, the next generation of AI features, enabling so-called “digital labor.”

On this front, Salesforce has come flying out of the gate, quickly becoming the largest supplier of digital labor, with its Agentforce system leading the pack in autonomous AI agents.

So, what is Agentforce, anyway? In straightforward terms, Salesforce’s Agentforce is a more advanced version of the Copilot versions launched recently by Microsoft and Salesforce. Its essential enhancement compared to the copilot systems we know is the ability to create autonomous agents capable of tasks such as summarizing or generating content and taking specific actions.

Unlike traditional chatbots or copilots, these agents can operate independently, retrieving relevant data on demand, creating action plans for any task, and executing tasks without constant human intervention. In other words, it gets pretty close to a kind of digital employee to manage certain tasks, all driven by data.

Agentforce allows organizations to create and manage autonomous agents for tasks across various business departments, such as Sales Agents, Service Agents, Marketing Agents, Commerce Agents, and Platform Agents.

Now, you don’t need to be a genius to see how this is potentially significant to any business or Salesforce customer. These agents can lead to a significant step up in digital automation and far higher productivity against lower workforce costs. These agents work 24/7 to analyze data, make decisions, and take action where necessary.

As Salesforce puts it, these agents are a step up from AI seen as a tooltool to becoming a collaborator. This is what management added:

“Agentforce can seamlessly resolve issues, process transactions, anticipate customer needs, free up humans to focus on the strategic initiatives, and build meaningful relationships.

Agentforce is deflecting service cases and resolving issues, processing, qualifying leads, helping close more deals, creating optimizing marketing campaigns, all at an unprecedented scale 24/7.”

I believe you can see how this excites investors. Salesforce seems to be leading the next step in AI, the step toward massive productivity improvements. For Salesforce, this is a multi-billion-dollar opportunity in the years ahead alone and a massive potential boost to its multi-cloud strategy.

As far as demand goes, Salesforce has gone off to a strong start. Agentforce was only released in the very last week of the quarter, but within that one week, the company had already signed 200 deals and reported incredible demand.

While it might have been overdone, I can definitely see where enthusiasm is coming from. Salesforce genuinely might have transformed itself into a real AI leader.

Bottom line performance – improving margins and cash flows

Alright, before moving to the outlook, let me briefly discuss last quarter’s bottom-line performance.

For Q3, Salesforce reported an operating margin of 33.1%, up 190 bps YoY, as management continues to drive further efficiency and solid top-line growth and is disciplined in its expense management.

As visible below, Salesforce has rapidly improved margins in recent years. Although the pace of improvement has slowed, Salesforce continues to report solid margin gains, which is still impressive.

Meanwhile, on a GAAP basis, the company continues to set new highs as its financial profile improves, and it works to reduce SBC as a percentage of revenue. Last quarter, the GAAP operating margin was a record 20%, and SBC sat at 8.7% of revenue.

SBC was up 70 bps from last year but in line with the previous quarter and down significantly from 2022 and 2023 levels. Management expects to keep bringing down SBC in the years ahead, and against a solid growth backdrop, I am okay with some 8-9% SBC.

It's not great, but it’s acceptable, especially with management offsetting this dilution through share repurchases.

Further down the line, management reported an EPS of $2.41, missing consensus estimates by $0.04. However, we should add that this includes a $0.18 headwind driven by mark-to-market adjustments of strategic investments. Excluding this, the EPS would have been $2.59, well ahead of the consensus.

Furthermore, the company reported rapidly improving cash flows, with a Q3 operating cash flow of $2 billion, up 29% YoY, and an impressive FCF of $1.8 billion, up 30% YoY.

Most of this free cash flow last quarter was used to return cash to shareholders, offsetting dilution fully through repurchases and paying its quarterly dividend. Last quarter, the company returned a total of $1.6 billion to shareholders, including $400 million in dividends.

Salesforce shares currently yield only a meager 0.43%, but considering this is based on a very low payout of only 12% and the company’s growth ahead, I would argue this is a very appealing dividend growth investment, even at this low starting yield.

Finally, management can safely keep returning cash to shareholders as it maintains a healthy balance sheet. It currently holds $12.8 billion in cash and short-term investments against a manageable $11.4 billion in debt, which leaves it in a healthy financial position and earns it an A+ credit rating from S&P Global.

No lack of financial health here, especially amid rapidly growing cash flows.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe and if you like our content and if you want to show even more appreciation for our work, please consider upgrading to paid (only $5 monthly).

In addition to all the free stuff, this also gets you access to the occasional premium analyses and full insight into my personal portfolio!

Outlook & Valuation

Before looking at the longer-term expectations, which, thanks to AI, are the optimism driver here, let’s first examine management’s less impressive short-term guidance.

After delivering solid Q3 results, Salesforce management raised its fiscal FY25 guidance, although still only in line with the current Wall Street consensus, even falling short with its profit outlook. For its fiscal FY25, management now guides for revenue of between $37.8 billion and $38 billion, representing growth of roughly between 8% and 9% and comparing favorably to a $37.86 billion consensus.

Margin-wise, management guides for an operating margin of 32.9%, up a sweet 240 bps YoY. This should result in a non-GAAP EPS of $9.98 to $10.03, falling short of a $10.11 consensus but sitting nicely ahead of my $9.92 estimate from six months back. Finally, FCF growth should come in at 26% to 28%, reflecting continued cash flow improvements.

Now, looking a bit longer-term, we can safely say the backdrop for Salesforce hasn’t been worsening. The company is developing rapidly on the AI front and has seen impressive initial adoption, potentially, maybe even likely, providing it with another leg of growth in the year ahead, with its other clouds no longer consistently growing double digits.

For fiscal FY26, the recovery of demand thanks to growing IT budgets will likely start providing a tailwind to the Salesforce business, likely leading to a mild growth acceleration. This includes the assumption of only very minor Agentforce revenues, as scaling and adoption will likely take some time. I currently anticipate the real boost coming from Agentforce only to really appear in 2027, at which point it could be scaling quickly.

Therefore, for fiscal FY27 and beyond, I have turned a bit more optimistic, although cautious at the same time. You see, the AI promise is big here, but it is in the very early stages, so let’s not get too carried away. Yes, Agentforce can be a multi-billion dollar opportunity, and I am mildly confident it will be, but I am not yet fully pricing this into my financial estimates.

Nevertheless, the outlook here isn’t at all bad. I expect Salesforce to return to double-digit growth in fiscal FY26 and growth to accelerate toward the end of the decade, thanks to the impact of AI. Meanwhile, continued margin gains should allow Salesforce to grow EPS at a rate closer to the mid-teens, resulting in a really promising outlook. You’ll find my full estimates below.

Do take into consideration that I am slightly more optimistic than the Wall Street average with these estimates.

So, where does that leave us valuation-wise?

Well, as I said at the start of this article, Salesforce shares have become significantly more expensive after last week’s share price pop and outperformance over the last six months. They are not just a bit more expensive but rather 50% more expensive than they were in June, which is only partly supported by higher financial projections.

As a result, Salesforce shares now trade at 32x my fiscal FY26 EPS estimate and a PEG of 2x, multiples similar to those of Microsoft, for example. This is quite a hefty price to pay for a growth story that has yet to materialize.

You see, back in June, I really liked the valuation and risk-reward balance. However, the shares are now significantly more expensive despite mostly flat medium-term financial projections, and people are betting on the company’s success in leveraging the AI revolution. Thus, this risk-reward balance has worsened considerably.

While I see how shares deserve to trade at more of a premium after 6 months of positive development and are still not insanely expensive, I believe this is not the time to jump into the hype.

As I said earlier, yes, Salesforce has a bright future, and AI is likely to drive the next stage of growth. Still, it seems like investor enthusiasm and optimism might have run up too high, exceeding fundamentals and complicating the risk-reward balance at current prices.

As a result, I move to a Hold rating from a previous Buy and sit on the sidelines for now, waiting for a normalization in valuation or a higher conviction in its AI-driven future.

For reference, even when awarding the business a hefty premium multiple of 32x, which can be somewhat warranted by mid-teens EPS growth estimates with further upside, I calculate an end-of-2027 target price of only $414, representing potential annual returns (CAGR) of only 6.3%. This is nowhere near enough to outperform global benchmarks and represents a poor risk-reward profile.

Therefore, I argue now is not the time to buy Salesforce shares, even amid a compelling AI promise. Personally, I would only consider shares below or closer to a price of $300 per share.

Be patient, don’t FOMO.

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

Great breakdown of Salesforce's AI hype vs. fundamentals.

Great article. I agree that the the valuation is a bit high, there are better opportunities around. I also don't like Benioff. I think he overpaid both for slack and tableau. He doesn't have a good eye for M&A.