Salesforce, Inc. – The sell-off presents an opportunity. I am buying.

Let's dive into Salesforce, one of the largest software companies in the world. After shares sold off after the Q1 result, we are looking at a prime opportunity to buy.

Salesforce CRM 0.00%↑ reported earnings on Wednesday, May 29th, and a lot has already been said about the results. Shares fell by close to 20% on Thursday before taking back roughly 7.5% on Friday. As a result, shares ended the week down 13%, bringing the YTD total loss to 8% and the gain over the last 12 months to just 17.5%. This stands in sharp contrast to a 26% gain for the SPY and even bigger gains for many of its technology peers.

There is no way around it – Salesforce has been underperforming over the last year or so. While there are clear reasons explaining the underperformance, the company remains an undisputed leader and very much a promising growth stock in CRM and AI. Therefore, the big question is whether this underperformance was fully justified and if this might be a prime opportunity to pick up some shares in this technology and AI leader.

To answer this question, let’s take a look at the latest results, analyze some trends, and discuss its prospects.

Salesforce is, without a doubt, one of the most impressive software businesses

As always, as this is the first time I am covering Salesforce here on Substack, let me first give you a short introduction to the company for those not so familiar with its operations.

Let me start by saying this is one of the most impressive and amazing technology companies, which is precisely why it has been on my watchlist for a long time. The company is not only a technology leader but also leads the incredibly lucrative CRM market and is one of the most exciting AI opportunities. The company dominates and is a leading innovator in enterprise software.

Salesforce is a pioneering force in the CRM and cloud computing industries. It offers a comprehensive suite of products designed to enhance customer relationships, drive business growth, and improve operational efficiency.

Founded in 1999, Salesforce has grown to become one of the most influential companies in the technology sector. The company revolutionized the software industry with its innovative approach to delivering enterprise applications over the Internet, a concept now known as Software as a Service (SaaS). Yes, Salesforce was among the first!

Today, Salesforce operates on a unique business model focusing on a subscription-based revenue structure. This model has contributed to the company's consistent revenue growth and financial stability. Just consider the following:

Salesforce’s vast global customer base now exceeds 150,000

Revenue growth CAGR of 23% since 2016

EPS growth CAGR of 35% since 2016

GAAP operating margin has improved from 4% in FY19 to 14.4% in FY24

ROE of 9.3, ahead of the median of 3.2

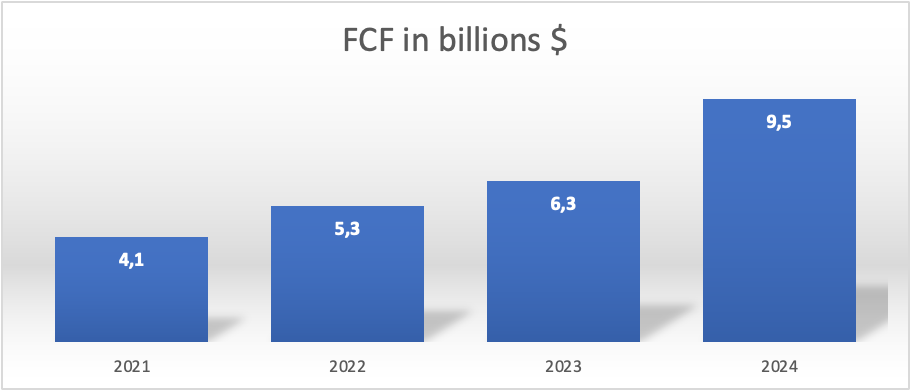

FCF margin of 27% - generating close to $10 billion in FCF.

At the core of Salesforce's operations is its comprehensive CRM platform, which enables businesses to manage and analyze customer interactions and data throughout the customer lifecycle. This platform is designed to improve customer relationships, drive sales growth, and enhance customer service efficiency. The company's flagship product, Sales Cloud, is a highly sophisticated sales automation tool that provides sales teams with real-time data, analytics, and insights to streamline their sales processes and enhance productivity.

Sales Cloud today is still one of the company’s largest products in terms of revenue, accounting for roughly 22% of revenue, and Salesforce is the undisputed leader in CRM for the 10th consecutive year.

According to IDC, Salesforce holds a market share of 22.1%, far ahead of Microsoft’s 5.7%. This is up 230 bps since 2020, which indicates that despite its already demanding market position, Salesforce is still able to keep gaining share, mostly at the cost of legacy providers such as SAP and Oracle, which can’t keep up with Salesforce’s pace of innovation.

Meanwhile, the CRM market is also huge due to the software's simple necessity for pretty much every business worldwide. Grand View Research estimates its value at right around $65 billion as of 2023 and believes it should be able to continue growing at a CAGR of 14% through the end of the decade, which is massive.

The research firm believes this will be driven by “trends such as hyper-personalization of customer service, use of AI and automation, and implementation of robust social media customer service can help reduce costs, increase response times, improve customer satisfaction, and increase the adoption of customer relationship management (CRM) platforms across industries.”

This shows that CRM remains a very lucrative market. Salesforce shows it can continue to gain market share with its brilliant cloud platform, and it is poised for continued growth, without a doubt. This is a very favorable setup, and its legacy CRM platform remains a significant growth driver.

However, as visible above, Salesforce's product suite extends beyond the Sales Cloud to include various other clouds tailored to different aspects of business operations, most closely related to CRM. The Service Cloud is another major product offering powerful tools for customer service and support management. It includes features such as case tracking, knowledge base management, and customer self-service portals. Today, this is Salesforce’s largest cloud platform by revenue at 24%.

In addition, the Marketing Cloud provides a comprehensive set of digital marketing tools, enabling businesses to create personalized marketing campaigns, track customer engagement, and analyze marketing performance across multiple channels, where it competes with Adobe. This specific cloud platform accounts for 14% of revenue.

However, possibly the product currently generating the most enthusiasm toward Salesforce is the Data Cloud, also known as Salesforce Einstein AI. This cloud-based service offers advanced data analytics and business intelligence capabilities. It leverages artificial intelligence to provide predictive insights and automate complex tasks.

Einstein AI is designed to further enhance the capabilities and functionalities of CRM and its other related cloud products, adding features like predictive analytics, and personalized customer interactions, as well as automated data entry.

Where Salesforce has a significant advantage over any peer in this area is the significant amount of metadata it has access to through its 150,000 enterprise customers. Just consider that Salesforce manages more than 250 petabytes of data for its customers. That is an insane number!

Salesforce also recently released Einstein Copilot, which allows users to use AI for better decision-making, higher efficiency, and more personalization for customers. It functions on Salesforce’s own metadata as well, meaning it is trained by the data from its customers. This makes it very advanced and accurate regarding outcome prediction and additional insights across its Sales, Service, and Marketing Clouds, adding significant value.

Positively, Salesforce will include Einstein Copilot in the Customer360 package, adding many productivity gains without big customers having to spend separately on AI. This, in turn, massively improves the attractiveness of the Salesforce platform, allowing it to gain share. Simply brilliant!

With this application of AI technologies, Salesforce should be able to distinguish its cloud product further, bringing new features to its entire suite, which will put it further ahead of the competition. It is this kind of functionality that enterprises strive for, as this will literally directly result in significant cost savings across operations for Salesforce customers.

I am incredibly enthusiastic about it, especially as someone who often works with Salesforce software. And I am not alone; the uniqueness and reliability of Data Cloud are already attracting customers to the Salesforce product suite.

Notably, in Q4, already 25% of new deals valued at over $1 million included Data Cloud in the subscription, showing really impressive adoption among new customers, who were probably tempted to join Salesforce for this exact reason, even as many of its latest features are still in beta testing.

The Data Cloud platform is expanding rapidly and is already approaching a $400 million ARR. Now, while this isn’t significant on around $35 billion of annual revenue today, it is still growing at 90% YoY and so could become an important contributor pretty damn quickly.

For reference, global spending on AI software is expected to compound at a CAGR of around 19% through the end of the decade, and with Salesforce as one of the frontrunners in a critical area, I definitely see it as one of the primary beneficiaries.

Data analytics and AI will be massive growth drivers for this enterprise software and cloud leader; I do not doubt it. Salesforce is just exceptionally well-positioned and is already ahead of the pack.

Considering all of this, it should be no surprise that Salesforce is among the cloud leaders with a 3% market share in the industry. Now that it is also one of the leaders in AI, I can easily see it further gaining market share here.

The overall bull case for Salesforce should be pretty clear by now. Thanks to its incredible positioning and drive for innovation, this company should be able to keep growing strongly going forward. Regarding long-term revenue growth, I feel like a low teens CAGR is still the most likely scenario.

However, Wall Street might be underestimating it due to short-term enterprise spending headwinds, which are plaguing the company and can be largely blamed for the sell-off overreaction following the Q1 results.

On that note, let’s take a closer look at the fiscal Q1 results and underlying trends.

Growth continues to slow in Q1, but consider the narrative

Salesforce released its Q1 fiscal FY25 earnings on May 29, and as have mentioned multiple times by now, shares got completely slaughtered in the following trading session as Wall Street wasn’t at all pleased with the continued slowdown in top-line growth Salesforce is projecting.

For its fiscal Q1, however, Salesforce did manage to perform roughly in line with the consensus, reporting revenue of $9.13 billion. This represented a solid 11% increase in revenue YoY, which was in line with prior quarters.

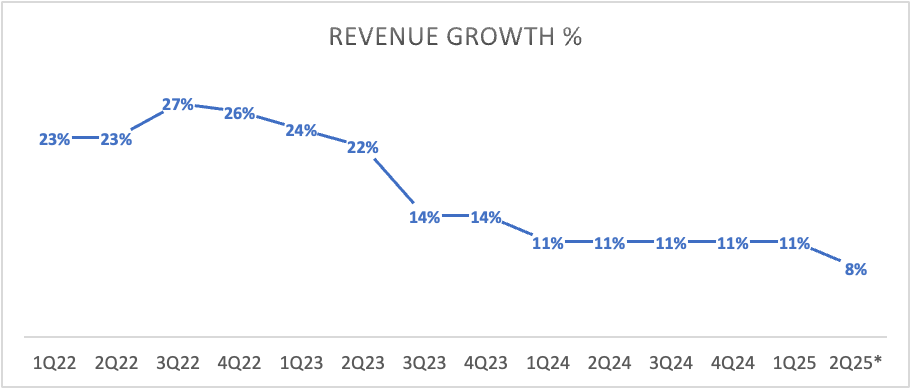

Salesforce’s top-line growth isn’t what it once was. The company is increasingly dealing with the rule of large numbers and has been facing a more challenging operating environment over recent years, with enterprises less willing to spend. As a result, growth has slowed down from 20-30% to the low teens in recent quarters, which is clearly visible above.

We can see growth has stabilized in the low teens since late fiscal 2023, but management is now projecting it to slow further in the current quarter, dropping in the single digits. This has created some panic among investors and concerns about Salesforce’s future growth prospects.

However, while expectations were for revenue growth to remain more resilient in the short term, investors should pay attention to the reasoning here. During the earnings call, management indicated that it continues to see measured buying behavior among its customers and saw stronger bookings from Q4 moderate again in Q1. Enterprises and smaller businesses simply remain careful in their spending behavior as the direction in which the economy is headed is very much uncertain.

It's these dynamics that are currently hurting Salesforce and are pressing down on its growth numbers. However, as I clearly laid out in the prior section of this analysis, the company has plenty of growth ahead of it, so really, I wouldn’t be too worried here. Cyclicality isn’t anything new, and as a more mature company, Salesforce isn’t immune.

Apart from the disappointing revenue guidance, many people also zoomed in on RPO and cRPO, which confirmed the downtrend in revenue growth numbers. For those unfamiliar with it, RPO represents the total value of contracted revenue that a company has yet to recognize. It includes both billed and unbilled amounts and is a key metric for understanding future revenue streams, particularly in subscription-based or contract-based businesses.

However, by the end of Q1, RPO stood at $53.9 billion (up 15% YoY ), while cPRO (current RPO) came in at $26.4 billion, up just 10% YoY and clearly reflecting the measured buying behavior pointed out by management. While cRPO still sits at respectable levels, it has been slowing down significantly over recent quarters, as visible below.

You see, while a temporary fluctuation in cRPO might not be a cause for concern, a sustained slowdown can signal underlying issues that may impact the company's ability to grow and generate revenue in the future. It signals potential challenges in securing new business, maintaining existing customer relationships, and achieving revenue targets.

In other words, this can be seen as quite a big red flag and was a leading reason for the sell-off.

Yet, once again, it is important to consider the underlying circumstances. The cautious buying behavior Salesforce management is witnessing is leading to elongated deal cycles, deal compression, and high levels of budget scrutiny. In other words, it results in businesses being less willing to sign long-term contracts of high value with the likes of Salesforce. Unsurprisingly, this impacts Salesforce’s RPO.

And common, while we may have been expecting an improvement in enterprise IT spending, the current economic picture simply doesn’t allow it. While this is a setback, the most important takeaway here should be that there is no indication that Salesforce is losing market share whatsoever, so this is no company-specific issue but rather an industry-wide cyclical headwind.

Meanwhile, as discussed, the long-term outlook for the enterprise software industry and for Salesforce remains promising, so stop focusing on the headline numbers and instead look deeper! It is these moments of unreasonable selling that offer opportunities for retail investors to look at the bigger picture!

Pointing out some positives from the results, Salesforce continues to grow worldwide, with 11% growth in the Americas, 9% in EMEA, and 21% in APAC. Also, management pointed out that Data Cloud adoption remained solid, with this included in 25% of new $1 million-plus deals in Q1, similar to Q4.

The bottom-line performance remains reason for optimism

Another contributor to the top-line growth slowdown but also a reason for optimism is the significant strategy shift Salesforce has realized in recent years, going from a focus on growth to a focus on profitability.

The shift in focus has resulted in significant GAAP and non-GAAP margin gains in a relatively short time span. For reference, the GAAP operating margin has improved from 4% in FY19 to 14.4% in FY24, while the non-GAAP operating margin has expanded by a whopping 12 percentage points since the Q1 fiscal FY22 – that is just 12 quarters.

One of the most important drivers for these improvements has been a significant reduction in SG&A expenses as a percentage of sales, indicating Salesforce has become a much more efficient business now, finally benefitting from its economies of scale. Positively, it still has plenty of room for further improvements as it continues to grow mostly organically.

In Q1, Salesforce reported a non-GAAP operating margin of 32.1%, up a very impressive 450 bps YoY, even as top-line growth continued to slow down. This allowed it to generate an operating cash flow of $6.25 billion, up 39% YoY.

EPS came in at $2.44, beating the consensus by $0.07 and growing a stellar 44% YoY. FCF also grew strongly, coming in at $6.1 billion for the quarter, up 43% YoY. Clearly, Salesforce is still rapidly improving its bottom line and cash flows.

For reference, FCF has grown at a 32% CAGR over the last three years, visualized below. Salesforce is becoming a real cash flow machine with a 27% FCF margin as of fiscal 2024.

This has allowed it to maintain a healthy balance sheet with $10 billion in cash and $8.4 billion in long-term debt.

Yet, while this all looks tremendous, there is a slight negative we can’t pass on, and this is SBC or stock-based compensation, which has always been a massive negative for Salesforce shareholders. You see, even as of the most recent quarter, there was an almost 14 percentage point difference between the GAAP and non-GAAP operating margin, mainly attributed to SBC, amounting to 8.2% of revenue, which is more than significant.

Salesforce has significantly diluted its shareholders over the last decade, growing its share count by 61%, which is far from great.

Positively, as part of the strategy shift, Salesforce is committed to cutting down on its SBC expenses in an effort to improve shareholder value, which is, of course, great. And we can already clearly see the results of this.

SBC dollars reached a peak in mid-fiscal 2023 and have since trended down or at least not increased. More notably, SBC, as a percentage of revenue, has trended down nicely from a peak of almost 12% to closer to 8% in Q1.

This progress is also reflected in the share count, which has decreased for five consecutive quarters for the first time in Salesforce’s history. This is thanks to management’s share buyback efforts. In Q1 alone, Salesforce spend $2.1 billion on share repurchases, bringing the total since the inception of the capital return program to more than $14 billion.

This is great for investors as it increases shareholder value. While Salesforce still has a lot of work to do here, it is certainly taking steps in the right direction. To me, these efforts to cut down on SBC and buy back shares meaningfully improve the investment case.

However, the dividend Salesforce introduced earlier this year probably excites me the most in this area. While shares yield only 0.68%, Salesforce’s growth profile and rapidly growing cash flows make it one of the most exciting dividend growth investments in today’s market.

We are currently looking at a payout ratio of only 16% based on projected fiscal 2025 earnings and only 16% based on FY24 FCF. This means Salesforce’s cash flows easily cover the dividend, leaving it with plenty of room to grow it by double digits for many years.

Again, Salesforce is one of the most promising dividend growth investments out there!

Outlook & Valuation

That brings us to the outlook. As we pointed out earlier in this post, this company should be able to keep growing strongly going forward thanks to its incredible positioning and drive for innovation. In terms of long-term revenue growth, a low-teens CAGR is still the most likely scenario.

As for earnings, growth will undoubtedly be even greater. Looking at the current margin expansion trajectory, we might see it hit a temporary ceiling by the end of this year and into fiscal FY26. However, as top-line growth and customer demand should tick up in the following years, I do see even more margin expansion for Salesforce and, therefore, significant EPS growth as well. In the medium to long term, I see a mid to high teens CAGR as still achievable.

Yet, in the short term, the economic and demand headwinds will be a drag. For fiscal Q2, management now expects growth to drop into the single digits, guiding for revenue of $9.2 billion to $9.25 billion, up 7% to 8% YoY. cPRO is also expected to keep slowing down to 9% YoY.

Meanwhile, growth is also expected to normalize on the bottom line as Salesforce starts lapping more comparable quarters. As a result, EPS is expected to grow by roughly 11% in Q2 to $2.34 to $2.36.

Obviously, this isn’t the greatest guidance, especially as it also came in below the Wall Street consensus.

Positively, management did maintain its FY25 revenue guidance of $37.7 billion to $38 billion, representing growth of 8% to 9% YoY. It also maintained the margin guidance, pointing to a FY25 operating margin of 32.5%, up 200 bps YoY. The GAAP operating margin is expected to come in at 20%, up 550 bps.

This translates into a non-GAAP EPS of $9.86 to $9.94, up around 20% at the midpoint of the guided range, and FCF growth of 23% to 26% to roughly $11.8 billion, which is very solid.

Overall, short-term guidance is mixed, with investors focusing on the negatives – unsurprisingly. However, long-term Salesforce remains as promising as before, with plenty of room for growth. We currently project the following financial results through fiscal FY28.

Based on these projections, Salesforce shares now trade at around 23.5x this year’s earnings, which is far from the premium they used to trade on and arguably deserve. To be precise, this is a 50% discount to the 5-year average. On a PEG basis, a current 1.15 is also looking relatively cheap at a 40% discount to the sector median and a 50% discount to its own 5-year average.

Of course, at least partially, the current discount to its averages is warranted, with growth continuously slowing down and the operating environment not showing much improvement. Obviously, the short-term outlook isn’t as good as I have gotten used to for Salesforce, which has resulted in the current discount.

However, in the long term, there is nothing that indicates any reason for concern. Salesforce remains one of the best-positioned large-cap SaaS companies on Wall Street and truly is best-in-class. I am confident in its future!

Therefore, I view the current discount as an opportunity for long-term investors. While there is no reasonable situation in which its valuation multiples return to recent averages, an earnings multiple closer to 28x seems more than fair for this business.

Even if we use a more de-risked 26x multiple on my FY27 EPS projection, we end up with a three-year target price of $338, which represents potential returns of close to 13% annually, which should be more than enough to beat global benchmarks.

Therefore, I view Salesforce shares as undervalued. The recent sell-off was an overreaction to near-term industry-wide headwinds, while the Salesforce investment thesis remains fully intact. This has created an opportunity, which I am taking with both hands, initiating a position in Salesforce at an average price of $234.

What I should finally point out is that a small red flag has been the significant selling of shares by CEO Marc Benioff over the last year and a couple of months. Across Salesforce executives, insider transactions are at a net negative of $7 million over the last 12 months, with 439 sells and only 6 buy transactions. Benioff accounted for over half of this value.

While this is important to monitor, I am willing to look through it as I see a clear case for Salesforce, even though this is a stain and should not be overlooked. Positively, Benioff still is the largest individual shareholder, with 3.3% direct ownership and another 1% owned through the Marc Benioff Fund LLC. This shows the CEO remains heavily invested in the company.

For now, it is not changing my stance toward the company.

Let us know your thoughts in the comments! Also, please leave a like if this post was of value to you!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

Benioff has been selling all the time for years. Easy to do when you spend lavishly on SBC. A big red flag is Salesforce again talking about M&A. They said a year ago they won't pursue m&a any more after the value destruction they've done in the past following the activist investors

From the headline and the beginning of the article, I expected to only see the bull case. But I kept reading and got to the risks and the bear case as well. Nice job on presenting the good and bad points to Salesforce!