SAP SE - An Undisruptible Business with a Stellar Outlook (Deep Dive)

SAP is a brilliant investment for the decade (or two) ahead, driven by its massive moat, brilliant business model, and rapid growth. Let me tell you all about it!

Looking to diversify your portfolio away from U.S. stocks might not be such a bad idea right now, amid political volatility in the U.S., economic concerns, and worsening global trade relations. Meanwhile, while U.S. stocks trade at extremely high valuations, European stocks are trading 30-40% lower on average, a valuation gap that hasn’t been this wide since the 1970s.

Considering economic conditions, European stocks appear poised to outperform their U.S. peers, with an outlook that doesn’t seem overly optimistic.

Personally, I am starting to quite like this European setup; yet, my portfolio still heavily leans toward the U.S., which is why I have been searching for the best European stocks to own for the decade ahead, with the potential to deliver superior returns.

SAP has quickly moved to the top of my list in recent weeks. To be honest, I had never really looked at the company, considering it is perceived as a boring legacy software player. This kept it under my radar. Yet, I couldn’t have been more wrong. This German giant has, in recent years, reinvented itself, transitioning from a traditional, slow-growing legacy software provider to a dynamic and fast-growing cloud business with a very promising outlook.

This transition hasn’t gone unnoticed by Wall Street either, with shares up more than 50% over the last 12 months and up 18% YTD. As a result, SAP has gradually become Europe’s largest company by market capitalization, surpassing Novo Nordisk, LVMH, and ASML over recent months. While each of these has faced headwinds, SAP has steadily continued to improve its business, accelerating growth and positioning itself brilliantly for solid growth in the decade ahead.

SAP seems poised to maintain its title as Europe’s largest company – let me tell you all you need to know about it from an investor’s point of view, ranging from its business model and moat to its recent performance, financials, and outlook.

Is SAP among the best European investment opportunities for the decade ahead? Is it a good buy today?

Let’s delve in!

This is all you need to know about Europe’s largest company!

Business model and fundamentals

So, what is SAP?

SAP SE is a global leader in enterprise (back-office) application software, headquartered in Walldorf, Germany. Founded in 1972, the company has grown into one of the world’s largest software providers, helping over 300,000 organizations across 180 countries and numerous industries streamline their operations through integrated business solutions.

SAP is best known for its Enterprise Resource Planning (ERP) systems, which compete with Oracle's offerings, enabling companies to manage business processes such as finance, supply chain, procurement, human resources, and customer relationship management in a unified environment. These systems are deeply embedded in large enterprises and have long been delivered through traditional, on-premise software models. SAP operated on a license-and-maintenance model, selling perpetual software licenses and charging annual support fees. But that model is being phased out.

In recent years, SAP has undergone a major strategic shift, transforming from a legacy software vendor into a cloud-first enterprise platform. Central to this evolution is the SAP S/4HANA platform, which delivers real-time data processing and analytics capabilities in a modern, cloud-native environment. SAP has also expanded its portfolio into areas such as artificial intelligence, machine learning, data management, and business network collaboration, supporting end-to-end digital transformation across various industries.

This transition has led to a corresponding shift toward a subscription-based revenue model. As of 2025, cloud revenues represent well over 50% of total revenue, driven by growing adoption of SAP S/4HANA Cloud and the broader Cloud ERP suite. That share is still rising, as more customers migrate to SAP’s cloud offerings. The result is a business model with greater revenue visibility and recurring income, comparable to that of leading SaaS peers such as Adobe and ServiceNow.

Here is the revenue split by product type:

Cloud Subscriptions and Support now account for roughly 60% to 65% of total revenue. This includes cloud ERP (S/4HANA Cloud), SuccessFactors (HCM), Ariba, Concur, Business Technology Platform, and RISE with SAP.

Software Support for On-Premise Solutions makes up about 25% to 30% of revenue. This refers to the recurring maintenance and support associated with legacy license customers, which is gradually declining as cloud adoption increases.

Today, central to SAP’s offering is its SAP S/4HANA cloud-based ERP platform. It is built on SAP’s in-memory database, HANA, which allows for much faster data processing and analytics compared to traditional systems. Unlike SAP’s older on-premise ERP software, S/4HANA is available both on-premise and in the cloud, and it's a central part of SAP’s shift toward more agile, integrated, and cloud-based enterprise solutions.

According to Gartner and IDC, SAP S/4HANA is recognized as a leader in both service-centric and product-centric cloud ERP categories. Analysts cite its end-to-end process integration, embedded AI, scalable architecture, and “clean-core” extensibility as key strengths that enable it to compete directly with Oracle in the enterprise cloud ERP space.

That said, SAP still trails Oracle in terms of cloud ERP market share. A key reason is timing. Oracle began its cloud transformation early, investing aggressively in the 2010s to build a native cloud infrastructure and promote its Fusion Cloud ERP and NetSuite platforms. This gave Oracle a head start in securing cloud-native ERP customers.

SAP, by contrast, initially focused on moving its legacy on-premise ERP systems into hosted environments, rather than building a true cloud-native offering. It wasn’t until the launch of S/4HANA in 2015—and more decisively, the introduction of RISE with SAP in 2021—that the company fully committed to a cloud-first strategy. Even then, S/4HANA Cloud started out more as a hybrid and private-cloud solution, evolving only gradually into a competitive public-cloud ERP offering.

This slower start allowed Oracle to gain meaningful ground while SAP was still pivoting. However, in recent years, SAP has closed much of the gap through sustained investment and product refinement. While Oracle continues to benefit from its broad cloud infrastructure and database strengths, SAP has stayed laser-focused on optimizing its back-office IT stack and deepening its core enterprise software capabilities.

Importantly, SAP brings decades of domain expertise in verticals like manufacturing, automotive, pharmaceuticals, energy, and heavy industry segments, where it continues to win large, complex deals. In many cases, its solutions are still regarded as more robust and better suited for global enterprises navigating complex regulations and intricate workflows.

Moreover, with over 300,000 customers, SAP retains a vast, embedded user base. Migrating these organizations to the cloud is an ongoing challenge, but one that offers a long runway for growth. Once migrated, customers tend to stay, highlighting the strength of SAP’s ecosystem and the stickiness of its platform.

However, market share data reveals the true story of whether SAP is gaining traction. Has its cloud shift actually translated into competitive gains, or is Oracle still pulling ahead?

According to IDC, based on 2024 numbers, SAP remains the global leader in enterprise application software. SAP delivered the strongest growth in 2024, outpacing Oracle. Meanwhile, Gartner confirms the same for the global ERP market – SAP is the leader when we include both on-premises and cloud offerings, which is a crucial stat.

In fact, its market share appears relatively stable as well, having gained slightly in recent years due to its superior cloud growth. However, in cloud ERP, SAP is still trailing Oracle’s 20.6% market share, albeit slowly closing the gap as it is growing faster.

Ultimately, looking at SAP’s offering and its successful move to the cloud with a technologically advanced platform, it’s clear the company is no longer playing catch-up—it’s competing. While Oracle benefited from an earlier start, SAP’s deep specialization in enterprise back-office IT, its stronghold in complex global industries, and its growing cloud momentum have kept it firmly in the leadership tier.

With a stable market share in ERP, a fast-growing cloud business, and a massive, loyal customer base that is steadily migrating to the cloud, SAP is now well-positioned to not only defend its ground but gradually expand it. As digital transformation accelerates across industries and the need for integrated, intelligent business operations grows, SAP’s role as a mission-critical enterprise partner should only become more central.

In short, the company’s strategic evolution and sharpened focus on cloud-based enterprise software suggest SAP is well placed to drive sustainable growth and remain a dominant force in global back-office IT for years to come.

SAP’s fundamentals as a mission-critical software provider remain strong, and its sharpened focus on cloud enterprise solutions positions it well to not only hold its own against Oracle but to steadily gain ground.

Does SAP have a moat?

Yes, SAP has a strong and durable moat, with little risk of disruption.

For starters, switching costs are extremely high due to deep product integration. SAP’s core ERP systems (like S/4HANA) are deeply embedded in the operations of large enterprises, spanning finance, supply chain, HR, procurement, and compliance. These systems are mission-critical and tightly integrated into customers’ broader IT infrastructure. Replacing or even modifying them involves high switching costs, both technically and organizationally. This “stickiness” is a major source of SAP’s competitive durability.

Customers simply can’t go without it, and switching to an alternative is incredibly complicated and expensive.

Additionally, SAP’s global reach and regulatory coverage are extensive, giving it a significant edge, especially in the current geopolitical climate. SAP supports dozens of languages, currencies, and compliance regimes. This makes it the go-to choice for multinational corporations managing complex operations across borders—a segment where very few vendors can truly compete at the same level.

Smaller competitors simply can’t match Oracle or SAP on this front, leaving little room for disruption.

Finally, there are also mild network effects. SAP has built a vast global ecosystem of implementation partners, consultants, and third-party developers. This network amplifies the value of its platform and creates a kind of network effect: the more companies and consultants that use SAP, the easier it becomes for others to adopt and support it.

So yes, SAP still has a strong moat, grounded in complexity, scale, and integration.

I see no real risk of fundamental disruption for SAP.

Revenue reliability and consistency

In addition to a strong and durable moat, which already makes SAP an attractive investment, the company also offers consistent revenue growth, thanks to its anti-cyclical product offerings. For reference, over the last 15 years, SAP has reported only 10 quarters of negative YoY growth.

What drives this consistency?

First of all, it has a strong moat with very high switching costs. Its ERP and business suite software are mission-critical systems that companies rely on to run finance, supply chain, manufacturing, HR, and more. This means customers are highly reluctant to change vendors, providing SAP with steady, recurring revenue streams.

Second, SAP benefits from a large, diversified global customer base across industries and geographies. This diversification cushions SAP from economic fluctuations in any one sector or region, smoothing out revenue volatility.

EMEA accounts for roughly 45% of revenue

The Americas account for roughly 35%

APJ accounts for roughly 20%.

Additionally, SAP charges customers based on annual contracts, which are often multi-year in duration, ensuring a stable revenue base. Especially with the company’s move to a cloud-based offering, which tends to be subscription-based and recurring, the company’s revenues should only become more reliable, with very little economic or inflationary sensitivity. For reference, 86% of SAP’s revenue today is already subscription-based (and therefore predictable).

This makes SAP an interesting portfolio cornerstone – an investment you can rely on through the cycles.

Organic growth prospects

SAP’s growth numbers over the last decade are nowhere near impressive or compelling. As I mentioned, the company only began to fully invest its resources in cloud architecture from 2021 onward, meaning that over the last decade, it still heavily relied on on-premise software, delivered through a license-and-maintenance model.

Crucially, this is a very mature and slow-growing market, now even in decline. For SAP, it meant only mid-single-digit growth at best. For reference, here are SAP’s growth numbers over the last 10 years:

A revenue CAGR of 5.5%

An EPS CAGR of only 2%

Of course, the recent transition to the cloud is also a factor to consider. SAP’s transition from licensed on-premise software to cloud subscriptions has weighed on top-line momentum in recent years, as traditional license sales declined while recurring cloud revenue grew more gradually. Meanwhile, earnings per share have been impacted by high upfront investments in cloud infrastructure, research and development, and customer migration efforts. These strategic moves compress near-term growth.

So, SAP’s poor growth numbers reflect a lasting dependence on a mature market and the impact of transitioning to the cloud, so it’s safe to say these numbers are nowhere near representative at all of the actual business performance. Yet, it has kept me away from looking deeper into the company for years.

However, with the company now fully focused on the cloud ERP market, with SAP S/4HANA now its primary product, it is addressing a much more compelling market with far greater revenue potential than the legacy ERP market ever had, which is already translating into steadily accelerating sales growth for SAP.

SAP’s renewed addressable market is expanding rapidly in the cloud era. Yes, the generally mature broader ERP market still only offers up mid-single digit growth, even as the cloud subset grows at a 15-20% rate, but with the transition to the cloud, there is a lot of additional value for SAP to cross-sell to increase contract value per customer, giving it a great growth lever.

You see, as customers transition to the cloud, the revenue potential per customer for SAP is much greater, allowing it to grow beyond the broader ERP market. SAP is capitalizing on the surge in digital transformation and automation, embedding AI and machine learning to enhance efficiency and provide advanced analytics. These capabilities are offered through additional cloud modules, which customers are eager to utilize. Here’s where this additional contract value comes from:

Cloud contracts bundle more services: hosting, upgrades, security, support, and business continuity—all priced into a subscription.

SAP often shifts customers to broader, integrated cloud suites rather than a simple like-for-like replacement.

Customers gain new capabilities (AI, automation, analytics, collaboration tools), allowing SAP to upsell and cross-sell.

To expand further on the third point, SAP’s platforms increasingly embed AI capabilities, exemplified by tools like the Joule Copilot, which enhance business processes.

Recently, SAP also launched SAP Business Data Cloud, which unifies and governs all of a customer’s data, including both SAP and non-SAP data, as well as structured and unstructured data. To quote management, “It builds a strong semantical layer with the context, connections, and meaning of data.” In addition to bringing data together, Business Data Cloud will also form a pillar for high-performing end-to-end AI agents, similar to Salesforce’s Agentforce, which, when executed well, could prove to be a massive growth driver for SAP as adoption and usability of these features grows.

It's these added layers of software and functionality that drive up contract value and drive growth. As a result of these factors, just the transition to the cloud for its existing user base is generating great value and accelerating overall growth.

Meanwhile, SAP isn’t just migrating its legacy base—it’s also adding new cloud-native customers, especially small and midsize enterprises (SMEs) that never used SAP’s on-premise products before, but are attracted to its best-in-class cloud ERP offering. For reference, its move to the cloud makes SAP’s addressable customer base about 2-3x larger by estimate, which is why SAP management sees room to 5x its existing customer base, based on its current TAM, giving it considerable room for growth.

So, yes, SAP is replacing one revenue stream with another (legacy license-and-maintenance with cloud), but because the cloud stream is larger per customer, more recurring, and growing through upsell and new logos, the result is faster top-line growth overall—even during the transition. That’s why SAP’s cloud shift is not just defensive, but actually a growth accelerator with room to last for at least another decade.

Considering SAP’s technologically strong platform, its ability to capture market share, a moat that ensures little risk of disruption, and the secular growth drivers of the transition to the cloud combined with SAP’s push into AI integration and data analytics, I see plenty of room for the company to maintain low-double-digit sales growth beyond 2030, which it should be able to maintain through the cycles.

That really is a brilliant outlook and one that is quite de-risked as well, not reliant on acquisitions or economic health.

Management team

Finally, before we move on to SAP’s finances and recent performance, I would like to briefly highlight its current leadership.

First of all, insider ownership is negligible. Additionally, there have been very few transactions over recent months, although a small insider purchase by a board member occurred in May at around $240 per share.

More importantly, SAP has an experienced CEO at the helm with Christian Klein, who serves as both CEO and Chairman. Klein joined SAP as an intern and has risen through the ranks over nearly two decades, bringing deep operational knowledge and a clear vision for SAP’s future. Under his leadership, SAP has accelerated its cloud strategy, focusing heavily on S/4HANA Cloud and the RISE with SAP offering, while strengthening the company’s Business Technology Platform since taking over in 2019.

Under Klein, SAP has made all the right moves. I like his vision and approach a lot. It is definitely worth listening in on one of his earnings calls.

Alright, by now, I believe we have a pretty good understanding of SAP and its prospects.

SAP has successfully transformed into a cloud-first enterprise software leader. With strong fundamentals, a sticky customer base, and accelerating growth from cloud migration and AI integration, it’s now well-positioned for sustainable, long-term performance, with likely low-double-digit sales growth beyond 2030.

I must admit that the company appears quite compelling from a fundamental perspective and has executed its strategy effectively over the last four to five years.

On that note, let’s delve into its recent performance and finances before we get to the final outlook, valuation, and conclusion.

SAP is firing on all cylinders

SAP released its most recent quarterly results in April and delivered excellent numbers, accelerating sales growth and recovering margins, even as market uncertainty remains high. As a result, management remained confident in its 2025 and medium-term outlook, driven by its resilient business model, excellent market position, and the rapid progress in its cloud transformation.

SAP reported total Q1 revenue of €9 billion, up 11% YoY, showing the expected growth acceleration further into the double digits. As shown below, SAP has been delivering strong results over 2023 and 2024, with growth slowly accelerating, as SAP’s improving and expanding cloud portfolio delivers results. This trajectory is expected to persist, as SAP continues to migrate existing customers to higher-value contracts and sees an improvement in customer acquisition numbers. This ramp-up is expected to remain gradual, as it has been so far.

Most importantly, cloud revenue growth remained very strong in Q1, showing no weakness at all, despite SAP’s cloud business becoming larger in size. Q1 cloud revenue came in at $5 billion, up 26% YoY. This is roughly stable compared to recent quarters and remains in the mid-20s range, with a slow acceleration.

Fueling growth here is a strong performance by SAP’s cloud ERP suite, for which revenue grew by 33% in Q1. Cloud ERP accounts for 85% of total cloud revenue and continues to be a healthy growth driver.

Even more impressive than this is the growth SAP realizes in its cloud backlog, which now stands at $18.2 billion, which, together with a highly reliable recurring revenue base, fuels growth for years to come.

SAP’s cloud backlog was up 29% in Q1, stable from recent quarters, and also showing a gradual acceleration in growth as adoption of SAP’s cloud offering accelerates.

These are truly strong and promising developments that show no weakness, only improvement, despite management acknowledging some transactional challenges due to macroeconomic headwinds. As we see in the broader IT market, enterprises are somewhat cautious with their IT spending amid an uncertain macro environment, but SAP doesn’t seem to suffer too much, as its cloud backlog growth remains strong.

I expect this to accelerate further once macro conditions improve.

On the other end of the equation, software license revenue continues to decline as users migrate to cloud-based products. Positively, these revenues were surprisingly resilient in Q1, declining by “only” 10% YoY.

Moving to the bottom line results, SAP is starting to show some improvement after years of profit and cash flow weakness. Amid a multi-year investment cycle to ramp up its cloud infrastructure and offerings, the company experienced considerable profit and cash flow weakness over recent years. However, this pace of investment is now easing, and top-line growth is accelerating, leading to rapid improvements, though SAP should have considerable profit growth ahead of it.

In Q1, these developments resulted in a solid improvement in gross margin. SAP’s gross margin was 73.3%, up 160 bps YoY, driven by a 260 bps improvement in the cloud gross margin, as size benefits are starting to kick in. As visible below, SAP has shown excellent gross margin expansion over recent years, with room for further upside thanks to improving operating leverage as cloud operations grow.

Further down the line, these improvements are even more apparent. Q1 operating profit jumped from a negative number last year to a positive €2.3 billion, reflecting a much-improved operating margin of 25.9%, which reflects a much-improved cost profile driven by operational efficiencies.

In part, these are driven by AI integrations. For example, using SAP’s own Joule for Consultants AI assistant, internal consultants save up to 90 minutes per day through automated tasks. Using this same assistant, developers can be 30% more productive.

According to management, it is already reaping the operational results. Additionally, management sees significant room for improvement in its sales and marketing department and believes it can maintain a measured approach to R&D while still doubling down on innovation.

Given these kinds of efficiency gains or room for improvement, management targets to limit operating cost growth to 80-90% of revenue growth in the coming years, indicating an aim for constant margin expansion. This should allow for double-digit operating profit growth through the end of the decade.

Ultimately, these operational and margin improvements in Q1 led to a 36% YoY jump in FCF to €3.6 billion.

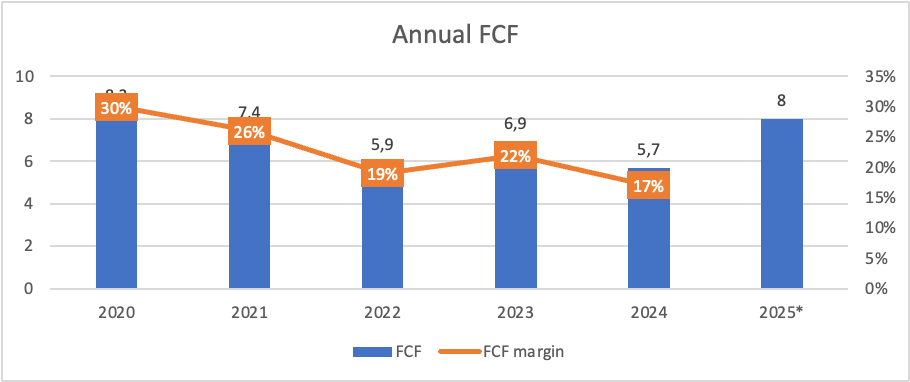

In recent years, SAP has experienced some weakness in FCF due to the earlier-mentioned heightened investments in its cloud transition, as shown below.

This cloud transformation required substantial upfront spending on infrastructure, product development, sales and marketing, and customer migration programs, which temporarily increases operating expenses and capital outlays, reducing near-term cash flow.

Additionally, cloud business models generate revenue more gradually through subscription and consumption fees rather than large upfront license sales, which means cash inflows from new deals are spread over time. This shift impacts the timing and magnitude of cash collections, resulting in lower free cash flow in the short to medium term.

This was as expected and no reason for concern.

Positively, this trend should reverse in 2025, with management estimating to deliver €8 billion in FCF, its best result since 2020.

Additionally, despite some cash flow weakness in recent years, management has remained committed to improving its balance sheet, which has shown significant improvements over the same period. The company has steadily reduced its debt load from €14.2 billion in January 2021 to €8.1 billion today, improving from a net debt position of €2.7 billion to a net cash position of €4.6 billion.

This leaves SAP in excellent financial health, especially amid the expectation for rapidly improving cash flows.

This excellent balance sheet, combined with rapidly growing cash flows, also ensures that SAP’s dividend remains well covered. Shares currently yield 0.94% and are well supported by FCF, even after growing this for 15 straight years. For reference, SAP pays approximately €3 billion in dividends annually, indicating a 2025 FCF payout ratio of well below 50%. This suggests that the dividend is well-supported and has room for growth.

Finally, SAP also delivers healthy reinvestment metrics, making good use of its cash flows and profits.

Here are its ROE and ROIC numbers over recent years:

ROE

2020: 18%

2021: 14%

2022: 6%

2023: 14%

2024: 7%

TTM: 13%

ROIC

2020-2021: 8-9%

2022: 8%

2023: 10%

2024: 9%

TTM: 10%

Alright, these aren’t the most impressive numbers at first glance, I will admit. However, there are some factors to consider here. You see, SAP’s declining Return on Equity (ROE) and modest Return on Invested Capital (ROIC) are primarily the result of its strategic shift from a high-margin on-premise license model to a cloud subscription model. While this shift creates long-term growth potential, it depresses profitability and capital efficiency in the near term.

As SAP has ramped up investments in cloud infrastructure, AI capabilities, R&D, and customer migration programs (like RISE with SAP), near-term profitability has been under pressure. At the same time, revenue from new cloud contracts is recognized gradually over time, not upfront, which lowers reported earnings.

This is exactly why we can see a slight improvement over the last 12 months, as profitability improves and initial investments begin to pay off.

Ultimately, many of SAP’s strategic bets—such as AI integration, platform expansion (Business Technology Platform), and industry-specific solutions—are long-cycle plays. The return on these investments has yet to fully materialize, which is holding back the ROIC. Therefore, I expect these numbers to gradually improve over the years ahead. I wouldn’t place too much value on these at this time.

On that note, let’s finally get to the outlook and valuation part of this analysis.

Before we move on, just a quick word…

Want more out of your subscription?

InvestInsights PRO - $7.50/month ($70/annually)

An additional 2-5 premium stock analysis monthly.

Full insight into my own portfolio (15% return CAGR since 2022).

Monthly portfolio updates + Instant transaction alerts (Fully transparent)

A complete overview of all my target prices and ratings (Excel file).

Exclusive access to the PRO subscribers Discord channel

Instant access to earlier premium analysis on, for example, Adobe, Thermo Fisher, Spotify, and The Trade Desk.

Outlook & Valuation

Looking ahead, management remains confident in its 2025 targets. For 2025, management now guides for cloud revenue to be between €21.6 billion and €21.9 billion, reflecting a 26-28% increase YoY. This is expected to drive total revenue up by 10-12%. Furthermore, operating profit should grow by roughly 26% to 30% to €10.3 billion to €10.6 billion, and FCF should be roughly €8 billion.

Even more impressive, management anticipated revenue growth to accelerate through FY27, driven by product innovation, simplification, and the expansion of the sales team. In other words, management guides revenue growth in the low to mid-teens for FY26 and FY27. Beyond that, I expect growth to stabilize in the low double digits through 2030.

Meanwhile, as discussed earlier, operating profits and cash flows are expected to grow even faster, as sales growth is anticipated to outpace cost growth going forward, leading to a particularly promising medium-term outlook.

In fact, SAP aims to become a Rule of 40 company, driven by low-double-digit revenue growth and an FCF margin recovering toward the 30% mark, which would put it in a superior bracket of high-quality companies.

Based on this guidance from management and everything discussed so far, below, you’ll find my financial projections. Personally, I now expect SAP to deliver 11% year-over-year (YoY) sales growth in 2025, with this acceleration continuing through FY27, reaching 16%. Beyond that, I expect growth to remain strong in the low teens range, fueled by SAP’s cloud transition and the addition of new AI-driven modules to increase contract value.

Meanwhile, profit growth is expected to be considerable amid slowing investments and accelerating economic growth- there remains significant room for operating and profit margin expansion. I now anticipate EPS growth after 2025 to remain in the low twenties before falling to the high teens.

You can find my full projections below.

Turning to valuation, it’s clear investors are assigning a hefty multiple to SAP shares. The stock is up 50% over the past twelve months and now trades near all-time highs — just 7% shy, at a current price of €250.

SAP now trades at 41x this year’s expected earnings — a steep premium for a mature large-cap. For further context, the shares are trading at 38x 2025 EV/FCF and a PEG ratio of 1.8x, both well above those of software peers like Oracle and Microsoft.

Can this valuation be justified? To an extent, yes. I believe SAP merits a premium multiple given its strong outlook, competitive moat, and durable business model.

The company is delivering robust growth with an especially promising profit trajectory. Its focus on enterprise applications — rather than cloud infrastructure — sets it apart from Microsoft and Oracle and gives it a strategic edge, in my view. This application-centric positioning reduces exposure to commoditized cloud services and aligns well with long-term structural trends.

SAP also benefits from a long growth runway, expanding product scope, and a large addressable market. Its mission-critical, subscription-based products further enhance visibility and stickiness — a key reason why I see this as a business with staying power well into the next decade.

In short, I like SAP’s fundamentals and competitive positioning, and I view it as a compelling long-term opportunity, particularly as AI begins to reshape enterprise workflows.

Yes, I can see why SAP is slowly becoming an investor favorite – this is an undisruptible business with a great outlook.

That said, valuation matters. And at current levels, I believe the risk-reward skews unfavorably. Even applying a relatively generous 35x medium-term earnings multiple — still above peer averages — I estimate an end-of-2027 price target of €321. That implies an annualized return of roughly 10–11%, which falls short of my 12% minimum target even under optimistic assumptions.

In other words, today’s valuation already bakes in a lot of optimism.

That’s why I’m not a buyer at current levels. But I’d be very interested if shares were to pull back into the €220–€230 range — a level reached as recently as April. At that price, the long-term multiple is more reasonable and offers better downside protection.

If the stock returns to that range, I believe it would represent excellent value for long-term investors seeking exposure to a resilient, fast-growing European software leader.

This German giant absolutely deserves a spot on your watchlist.

I remember when SAP was called a Dinosaur with no growth. Guess I should have bought then.

Nice article! SAP is clearly an interesting company! Thank you